Professional Documents

Culture Documents

Form TP3 2022 (English Translation)

Form TP3 2022 (English Translation)

Uploaded by

abu sufianOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form TP3 2022 (English Translation)

Form TP3 2022 (English Translation)

Uploaded by

abu sufianCopyright:

Available Formats

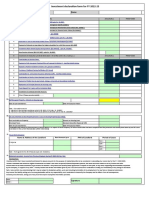

FORM MTD/TP3 (1_2022)

MALAYSIAN INLAND REVENUE BOARD

FORM FOR INFORMATION PERTAINING TO THE EMPLOYMENT WITH PREVIOUS EMPLOYERS

IN THE CURRENT YEAR FOR THE PURPOSE OF MONTHLY TAX DEDUCTION (MTD)

[INCOME TAX (DEDUCTIONS FROM REMUNERATION) RULES 1994]

FORM DETERMINED UNDER SECTION 152, INCOME TAX ACT, 1967 (ITA)

SECTION A: INFORMATION ON EMPLOYER

A1: Name of previous employer 1

A2: Employer number

A3: Name of previous employer 2

A4: Employer number

* (Please use additional sheets for the third and subsequent employer).

SECTION B: INFORMATION ON INDIVIDUAL

B1: Name

B2: Identification number

B3: Passport number

B4: Income tax number

SECTION C: INFORMATION ON REMUNERATION, EMPLOYEES PROVIDENT FUND (EPF), ZAKAT AND MONTHLY TAX DEDUCTION (MTD)

(please state the grand total from the previous employers)

C1: Total gross monthly remuneration and additional remuneration including allowance/ perquisites/ gifts/ benefits subject to tax

C2: Total allowance/ perquisites/ gifts/ benefits exempted from tax

i) Travelling allowance, petrol card or petrol allowance and toll payment for official duties

ii) Child care allowance

iii) Products issued by the employer's business provided free of charge or at a discounted price

iv) Perquisite (whether in cash or otherwise) pursuant to the employee's past achievement award, service excellence award, innovation award or

productivity award or long service award provided that the employee has exercised an employment for more than 10 years with the same employer

v) Other allowance/ perquisites/ gifts/ benefits exempted from tax. Please refer to the Form BE explanatory notes.

C3: Total contribution to EPF or other approved Fund on all remuneration (monthly remuneration and additional remuneration)

C4: Total zakat

C5: Total MTD (not inclusive of CP38)

SECTION D: INFORMATION ON DEDUCTION (please state the grand total from the previous employers)

ANNUAL LIMIT CUMULATIVE DEDUCTION

D1: Medical treatment, special needs and carer expenses incurred for parents Limited to RM5,000

(medical condition certified by medical practitioner); or

D1a: Father relief Subject to criteria as stated under Limited to RM1,500

D1b: Mother relief Section 46(1)(o) of the ITA Limited to RM1,500

D2: Basic suppporting equipment use by a disabled individual, husband/ wife, child and parents Limited to RM6,000

D3: Education fee (Self) Limited to RM7,000

(i) Other than a degree at Masters or Doctorate level - law, accounting, Islamic

finance, technical, vocational, industrial, scientific or information technology; or

(ii) Degree at Masters or Doctorate level - any field or course of study

D4: Medical expenses for serious diseases for individual, husband/ wife and child Limited to RM8,000

D5: Complete medical examination Including Covid-19 testing, purchase of self-test kit or

mental health examination or consulting on individual, husband/ wife and child Limited to RM1,000

D6: Personal Vaccination Expenses on individual/wife and child Limited to RM1,000

D7: Net deposit in Skim Simpanan Pendidikan Nasional Limited to RM8,000

(total deposit in the current year minus total withdrawal in the current year)

D8: Alimony payment to former wife Limited to RM4,000

D9: Life insurance

D8a: Pensionable civil servants Limited to RM7,000

D8b: Category other than pensionable civil servants Limited to RM3,000

D10: Education and medical insurance Limited to RM3,000

D11 Private Retirement Scheme and deferred annuity Limited to RM3,000

D12: Contribution to Social Security Organisation (SOCSO) including EIS contribution Limited to RM350

D13a:Purchase of sports equipment, rental payment or admission fee to sports facilities and competition fees Limited to RM500

D13b:Purchase of reading materials, computer, smart phone, tablet, sports equipment, Limited to RM2,500

gymnasium membership fee and subscription of internet

D14: Breastfeeding equipment (deduction allowed once every 2 years for female tax payers only) Limited to RM1,000

D15: Fees paid to registered childcare centres and kindergartens Limited to RM3,000

D16: Expenses on Domestic tourism (Including accommodation fee at registered premises, entrance fee to

tourist attraction, purchase of domestic travel package through travel agents registered Limited to RM1,000

D17: Expenses on electric vehicle charging facilities Limited to RM2,500

SECTION E: DECLARATION BY EMPLOYEE

I hereby declare that all the information stated in this form is true, correct and complete. If the information given is not true, legal action can be taken

against myself under paragraph 113(1)(b) of the Income Tax Act, 1967.

Date -----------------------------------------------

Day Month Year Signature

NOTE

1 This form must be filled in by employee and a copy must be submitted to the employer without any receipt or supporting document for the purpose of

MTD adjustments.

You might also like

- Borang Tp3 2015 English VersionDocument2 pagesBorang Tp3 2015 English VersionTkc Tan48% (21)

- Volo's Guide To Monsters - 1Document7 pagesVolo's Guide To Monsters - 1Saz100% (1)

- CPAR Fringe Benefit TaxDocument5 pagesCPAR Fringe Benefit TaxNikki75% (4)

- Investment Declaration Form - 2022-2023Document3 pagesInvestment Declaration Form - 2022-2023Bharathi KNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- M012-Consumer Mathematics (Taxation)Document5 pagesM012-Consumer Mathematics (Taxation)Tan Jun YouNo ratings yet

- Fringe Benefits and Fringe Benefit Tax ExercisesDocument3 pagesFringe Benefits and Fringe Benefit Tax Exercisesaj lopezNo ratings yet

- Come Once Again and Love PDFDocument338 pagesCome Once Again and Love PDFdemsNo ratings yet

- Notes PartF 2Document1 pageNotes PartF 2Puvaneswary BalachandrenNo ratings yet

- PBL (Mathematics) - Income Tax Assessment-Poah Zhi XianDocument14 pagesPBL (Mathematics) - Income Tax Assessment-Poah Zhi XianZhi Xian PoahNo ratings yet

- Notes PartF 2 PDFDocument1 pageNotes PartF 2 PDFMohd Nor UzairNo ratings yet

- 93-06 - Fringe Benefit TaxDocument8 pages93-06 - Fringe Benefit TaxJuan Miguel UngsodNo ratings yet

- IRA No. 3 FBTXDocument3 pagesIRA No. 3 FBTXProlen AcantoNo ratings yet

- Lecture-5.Income From Salaries (Sec-21)Document16 pagesLecture-5.Income From Salaries (Sec-21)imdadul haqueNo ratings yet

- Personal Tax Planning 2020Document14 pagesPersonal Tax Planning 2020Faiz RaffNo ratings yet

- Fringe Benefits TaxDocument5 pagesFringe Benefits TaxEnola HeitsgerNo ratings yet

- CPAR FringeDocument6 pagesCPAR FringeMarjorie PagsinuhinNo ratings yet

- ACC4002H Taxation III 2023 April Test FinalDocument6 pagesACC4002H Taxation III 2023 April Test FinalJessica albaNo ratings yet

- Offer Letter: D-278, Near Hanuman MandirDocument3 pagesOffer Letter: D-278, Near Hanuman MandirGhanshyam SinghNo ratings yet

- 92-07 - Gross IncomeDocument10 pages92-07 - Gross IncomeaudreyNo ratings yet

- 11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Document18 pages11 Deductions From Gross Income (Expenses in General, Interest Expense and Taxes)Clarisse PelayoNo ratings yet

- Fringe Benefit DeminimisDocument12 pagesFringe Benefit DeminimisMa. Angelica Celina MoralesNo ratings yet

- PracticeDocument17 pagesPracticeSmarty ShivamNo ratings yet

- Module 3.1 Fringe Benefits and de Minimis BenefitsDocument4 pagesModule 3.1 Fringe Benefits and de Minimis BenefitsGabs SolivenNo ratings yet

- Compensation and Fringe Benefits TaxDocument10 pagesCompensation and Fringe Benefits TaxJane TuazonNo ratings yet

- Tax Reliefs For Year of Assessment 2022 - 230227 - 175314Document6 pagesTax Reliefs For Year of Assessment 2022 - 230227 - 175314Sinex TechyNo ratings yet

- 3-Personal Taxation (Planning Your Tax Strategy)Document21 pages3-Personal Taxation (Planning Your Tax Strategy)Farahliza RosediNo ratings yet

- Taxation Module 3 5Document57 pagesTaxation Module 3 5Ma VyNo ratings yet

- Tax Compliance and Risks Management Overview 15 Feb 2022 (A)Document27 pagesTax Compliance and Risks Management Overview 15 Feb 2022 (A)alex.royer94.arNo ratings yet

- Session 2 - Compensation Income and FBTDocument6 pagesSession 2 - Compensation Income and FBTMitzi WamarNo ratings yet

- Chapter 5 DDR A231Document14 pagesChapter 5 DDR A231Patricia TangNo ratings yet

- Fringe Benefits, de Minimis Benefits, Filing of Income Tax ReturnDocument5 pagesFringe Benefits, de Minimis Benefits, Filing of Income Tax ReturndgdeguzmanNo ratings yet

- FBT FinalDocument28 pagesFBT Finalmendonesmariza2No ratings yet

- 05M Fringe BenefitDocument4 pages05M Fringe BenefitMarko IllustrisimoNo ratings yet

- TAX Treatment For TAX267 and TAX317 Budget 2019Document5 pagesTAX Treatment For TAX267 and TAX317 Budget 2019nonameNo ratings yet

- Compensation Income and Fringe Benefit Tax. ReviewerDocument4 pagesCompensation Income and Fringe Benefit Tax. RevieweryzaNo ratings yet

- FBT de MinimisDocument16 pagesFBT de MinimisJames Daniel VanzuelaNo ratings yet

- Topic 12 - Income Tax PlanningDocument32 pagesTopic 12 - Income Tax PlanningArun GhatanNo ratings yet

- Chapter 4 Ptx1033/Statutory Income From EmploymentDocument14 pagesChapter 4 Ptx1033/Statutory Income From EmploymentNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)No ratings yet

- TRAIN Briefing - Income TaxDocument48 pagesTRAIN Briefing - Income TaxLovely MagdipigNo ratings yet

- Income Tax Declaration Form FY 22 23 AY 23 24Document2 pagesIncome Tax Declaration Form FY 22 23 AY 23 24kishoreNo ratings yet

- PSA 300 RedraftedDocument5 pagesPSA 300 RedraftedKenneth M. GonzalesNo ratings yet

- Pure Compensation IncomeDocument2 pagesPure Compensation Incomechavezcelvia18No ratings yet

- Strictly Personal and ConfidentialDocument1 pageStrictly Personal and ConfidentialMohd ZiaNo ratings yet

- Tax43-013-Compensation IncomeDocument22 pagesTax43-013-Compensation Incomelowi shooNo ratings yet

- Witholding TaxDocument6 pagesWitholding TaxdownloademailNo ratings yet

- Short Quiz 2 Set A With AnswerDocument3 pagesShort Quiz 2 Set A With AnswerJean Pierre IsipNo ratings yet

- Fringe Benefits Tax and de Minimis Benefits: ObjectivesDocument11 pagesFringe Benefits Tax and de Minimis Benefits: ObjectivesChristelle JosonNo ratings yet

- Union Budget 2019: An OverviewDocument8 pagesUnion Budget 2019: An OverviewReuben SalisNo ratings yet

- Continuation of FBT RR 3-1998 Expense AccountDocument5 pagesContinuation of FBT RR 3-1998 Expense AccountALMA MORENANo ratings yet

- Guidance Note FY 20-21 - Submitting Investment ProofDocument11 pagesGuidance Note FY 20-21 - Submitting Investment Proofdeepakraj610No ratings yet

- Withholding Tax - Bureau of Internal Revenue161116Document20 pagesWithholding Tax - Bureau of Internal Revenue161116SandyNo ratings yet

- Presentation On BEL Retired Employees Contributory Health Scheme (Berechs)Document9 pagesPresentation On BEL Retired Employees Contributory Health Scheme (Berechs)lokelooksNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- FABM 2 Module 8 Income TaxationDocument8 pagesFABM 2 Module 8 Income TaxationJOHN PAUL LAGAO50% (2)

- Week 3 Fringe Benefits Part 2 2023Document30 pagesWeek 3 Fringe Benefits Part 2 2023Arellano Rhovic R.No ratings yet

- Module 3.2 - Preferential Taxation Keyworded Lecture NotesDocument8 pagesModule 3.2 - Preferential Taxation Keyworded Lecture NotesGabs SolivenNo ratings yet

- TAX - Gross IncomeDocument7 pagesTAX - Gross IncomeThunder StickNo ratings yet

- Quick Tax Guide 2023-2024Document26 pagesQuick Tax Guide 2023-2024RobertKimtaiNo ratings yet

- Finals - I. Gross Income ProblemsDocument8 pagesFinals - I. Gross Income ProblemsJovince Daño DoceNo ratings yet

- It Chapter 11Document5 pagesIt Chapter 11Rena Jocelle NalzaroNo ratings yet

- Course: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 HourDocument5 pagesCourse: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 Houranis izzatiNo ratings yet

- Ajava 6C 2160707 PDFDocument4 pagesAjava 6C 2160707 PDFanon4819No ratings yet

- G.R. NO. L-5486 Dela Pena vs. HidalgoDocument18 pagesG.R. NO. L-5486 Dela Pena vs. HidalgoSheridan AnaretaNo ratings yet

- Exercise 1 WorkDocument9 pagesExercise 1 Workعبد الكريم المصطفىNo ratings yet

- A Concept Paper About LoveDocument5 pagesA Concept Paper About LoveStephen Rivera100% (1)

- First Certificate Booklet 2Document89 pagesFirst Certificate Booklet 2Alina TeranNo ratings yet

- Fundamentals of Human Resource Management: Decenzo and RobbinsDocument30 pagesFundamentals of Human Resource Management: Decenzo and RobbinsMalik Naseer AwanNo ratings yet

- Chapter 2Document5 pagesChapter 2anon-668822No ratings yet

- Chu Chin Chow - Libretto (Typescript)Document68 pagesChu Chin Chow - Libretto (Typescript)nathan_hale_jrNo ratings yet

- Spsa - Edad 616bDocument18 pagesSpsa - Edad 616bapi-132081358No ratings yet

- Adonis SaturnoDocument6 pagesAdonis SaturnoRaymond G. PanhonNo ratings yet

- DeputationDocument8 pagesDeputationAnand MauryaNo ratings yet

- Project Report Dam Level WarningDocument8 pagesProject Report Dam Level Warningpankaj_yadav007No ratings yet

- Celebrating The Third Place Inspiring Stories About The Great Good Places at The Heart of Our Communities (Oldenburg, Ray) (Z-Library)Document210 pagesCelebrating The Third Place Inspiring Stories About The Great Good Places at The Heart of Our Communities (Oldenburg, Ray) (Z-Library)ferialNo ratings yet

- Mirantis CKA ExamDocument10 pagesMirantis CKA ExamvNo ratings yet

- Pag-Iimahen Sa Batang Katutubo Sa Ilang PDFDocument28 pagesPag-Iimahen Sa Batang Katutubo Sa Ilang PDFLui BrionesNo ratings yet

- Frank Lloyd WrightDocument16 pagesFrank Lloyd WrightKhiZra ShahZadNo ratings yet

- Mark Scheme (Results) : Summer 2018 Pearson Edexcel International GCSE in Further Pure Mathematics (4PM0) Paper 01Document26 pagesMark Scheme (Results) : Summer 2018 Pearson Edexcel International GCSE in Further Pure Mathematics (4PM0) Paper 01Newton JohnNo ratings yet

- Bromberger & Halle 89 - Why Phonology Is DifferentDocument20 pagesBromberger & Halle 89 - Why Phonology Is DifferentamirzetzNo ratings yet

- Review of Related Literature in TagalogDocument5 pagesReview of Related Literature in Tagalogafmzkbysdbblih100% (1)

- Excel Invoicing System TemplateDocument9 pagesExcel Invoicing System TemplateAbu SyeedNo ratings yet

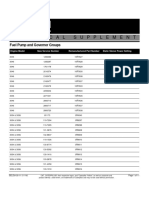

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- (Firm Name:-Ajanta Paint House, Siyana) (GST No.: - 09BSDPP4052K1ZG) (Year 2018-2019)Document3 pages(Firm Name:-Ajanta Paint House, Siyana) (GST No.: - 09BSDPP4052K1ZG) (Year 2018-2019)Vatsal RastogiNo ratings yet

- Q4FY23 HMCL Transcript-230711-085731Document19 pagesQ4FY23 HMCL Transcript-230711-085731vishwesh gautamNo ratings yet

- Following The Cap Figure by Lydia KievenDocument415 pagesFollowing The Cap Figure by Lydia KievenCatherinNo ratings yet

- Members of The Propaganda MovementDocument2 pagesMembers of The Propaganda MovementjhomalynNo ratings yet

- Film - The GuardianDocument1 pageFilm - The GuardianfisoxenekNo ratings yet

- Purposive CommunicationDocument15 pagesPurposive CommunicationJm SalvaniaNo ratings yet

- June 2013 Intake: Programmes OfferedDocument2 pagesJune 2013 Intake: Programmes OfferedThuran NathanNo ratings yet