Professional Documents

Culture Documents

Tax Compliance and Tax Remedies

Tax Compliance and Tax Remedies

Uploaded by

Winz Valerie Jose0 ratings0% found this document useful (0 votes)

17 views2 pagesThe document outlines various tax types and deadlines that taxpayers must comply with in the Philippines. It discusses income tax deadlines for individuals and businesses on a quarterly and annual basis. It also details value-added tax periods and deadlines. Non-compliance results in penalties such as a 25% surcharge and 12% annual interest. The document describes the tax assessment process and requirements for a formal demand letter.

Original Description:

Original Title

TAX COMPLIANCE AND TAX REMEDIES

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document outlines various tax types and deadlines that taxpayers must comply with in the Philippines. It discusses income tax deadlines for individuals and businesses on a quarterly and annual basis. It also details value-added tax periods and deadlines. Non-compliance results in penalties such as a 25% surcharge and 12% annual interest. The document describes the tax assessment process and requirements for a formal demand letter.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

17 views2 pagesTax Compliance and Tax Remedies

Tax Compliance and Tax Remedies

Uploaded by

Winz Valerie JoseThe document outlines various tax types and deadlines that taxpayers must comply with in the Philippines. It discusses income tax deadlines for individuals and businesses on a quarterly and annual basis. It also details value-added tax periods and deadlines. Non-compliance results in penalties such as a 25% surcharge and 12% annual interest. The document describes the tax assessment process and requirements for a formal demand letter.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

TAX COMPLIANCE AND TAX REMEDIES

Tax- is an enforced proportional contribution upon persons, properties and/or rights imposed by the

government for public purpose.

Tax Types to be Registered:

Registration Fee (P500) – on or before Jan 31 of the year. BIR Form 0605

Income Tax

Individual

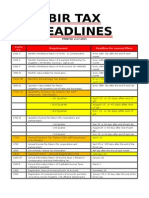

FORM PERIOD DEADLINE

1701Q 1st qtr. May 15

1701Q 2nd qtr. August 15

1707Q 3rd qtr. November 15

1701 Annual April 15 the following year

FORM PERIOD DEADLINE

st

17022Q 1 qtr.

1702Q 2nd qtr. 60 days after end of each qtr.

1702Q 3rd qtr.

1702 Annual 15th day of the 4th month

following the close of the

taxable year

Business Taxes

Percentage Tax – 25th day of the month following the taxable year

FORM PERIOD DEADLINE

st

2551Q 1 qtr. April 25

2551Q 2nd qtr. July 25

2551Q 3rd qtr. October 25

2551Q Annual January 25 the following year

Value-Added Tax

PERIOD DEADLINE FORM

Jan Feb 20 2550M

Feb March 20 2550M

1st Quarter April 25 2550Q

April May 20 2550M

May June 20 2550M

2nd Quarter July 25 2550Q

July August 20 2550M

August September 20 2550M

3rd quarter October 25 2550Q

October November 20 2550M

November December 20 2550M

4th quarter January 25 2550Q

What happen if the taxpayer pays beyond the deadline?

25% Surcharge

12% Interest per Annum under TRAIN Law

Compromise Penalty under RMO No. 7-2015

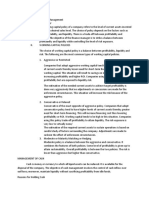

Assesment Process

Stage 4: Formal letter of demand/ Fianl assessment notice (FAN)

Requisites

You might also like

- Ansi Asse A10.8-11Document126 pagesAnsi Asse A10.8-11Jose Abarca100% (1)

- Chapter 11 - Applied ProblemsDocument9 pagesChapter 11 - Applied ProblemsZoha Kamal100% (1)

- JE, GL, TB - Ace BarbershopDocument14 pagesJE, GL, TB - Ace BarbershopJasmine ActaNo ratings yet

- BIR RDO 113 Taxpayers' Compliance Guide 2019Document4 pagesBIR RDO 113 Taxpayers' Compliance Guide 2019Noli Heje de Castro Jr.100% (1)

- Guzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodDocument2 pagesGuzman Cruz Cpas and Co.: Guideline For BIR Tax Deadlines During Enhanced Community Quarantine (ECQ) PeriodGerald SantosNo ratings yet

- Account T24Document1 pageAccount T24Luis Maria CepedaNo ratings yet

- Tax Forms and DeadlinesDocument2 pagesTax Forms and DeadlinesJustine LouiseNo ratings yet

- Bright Sun Production Corporation Bir Forms - Train Law (For Corporations)Document1 pageBright Sun Production Corporation Bir Forms - Train Law (For Corporations)Joyce Hidalgo PreciaNo ratings yet

- Form No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesDocument7 pagesForm No. Requirement Deadline For Manual Filers: BIR Tax DeadlinesromarcambriNo ratings yet

- Form No. Requirement Deadline For Manual FilersDocument1 pageForm No. Requirement Deadline For Manual FilersLhyraNo ratings yet

- SSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineDocument1 pageSSS Philhealth Pag-Ibig 0605 1601-C: Form Type Description DeadlineIvy ValcarcelNo ratings yet

- Bir Tax DeadlinesDocument1 pageBir Tax DeadlinesJomar VillenaNo ratings yet

- BIR Tax DeadlinesDocument2 pagesBIR Tax Deadlinesimports.fcfilesNo ratings yet

- BIR FormsDocument3 pagesBIR FormsLuis JoseNo ratings yet

- BIR Tax Deadlines: Home About Us Services Clientele Contact UsDocument2 pagesBIR Tax Deadlines: Home About Us Services Clientele Contact UsNICKOL NAMOCNo ratings yet

- Module 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsDocument1 pageModule 5. Common Vat Rules On Sale of Goods, Properties and Services - Monthly Declarations and Quarterly Returns Lesson 1-VAT and Tax PeriodsRachelle Mae NagalesNo ratings yet

- New Business Registration (BIR)Document27 pagesNew Business Registration (BIR)CrizziaNo ratings yet

- Briefing MADE EASY-LUCILLEDocument51 pagesBriefing MADE EASY-LUCILLEJames Robert Marquez AlvarezNo ratings yet

- TCS NotesDocument1 pageTCS Notesolympiadas816No ratings yet

- Waiver Extended Date of Prescription Date of Execution Date of Acknowledgment BIR SignatoryDocument10 pagesWaiver Extended Date of Prescription Date of Execution Date of Acknowledgment BIR SignatoryCharish DanaoNo ratings yet

- Bir Tax Deadlines 2015Document2 pagesBir Tax Deadlines 2015Mary Grace BanezNo ratings yet

- Recurring Dates For Statutory CompliancesDocument2 pagesRecurring Dates For Statutory CompliancesDeepika BathinaNo ratings yet

- TRAIN Law - Taxation of Self-Employed IndividualsDocument8 pagesTRAIN Law - Taxation of Self-Employed IndividualsCora EleazarNo ratings yet

- BIR FormsDocument1 pageBIR FormsBSA MaterialsNo ratings yet

- Fre223 Activityjoseph PDFDocument1 pageFre223 Activityjoseph PDFSophia AntonioNo ratings yet

- Tax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesDocument2 pagesTax Returns Description Monthly Quarterly Annual Remarks: Companies Covered: Holding CompaniesArvin GarciaNo ratings yet

- Capital Markets: 2022 SEC Filing Deadlines and Financial Statement Staleness DeadlinesDocument3 pagesCapital Markets: 2022 SEC Filing Deadlines and Financial Statement Staleness DeadlinesHannah Dale Pacheco CardozaNo ratings yet

- BIR Registration & Due Dates-1Document6 pagesBIR Registration & Due Dates-1jessicamarieogbinar37No ratings yet

- Effective Date of Business Registration: 06/24/2020 Replacement of Lost COR: 07/22/2020Document1 pageEffective Date of Business Registration: 06/24/2020 Replacement of Lost COR: 07/22/2020Joseph TordaNo ratings yet

- Sample Acctg CycleDocument27 pagesSample Acctg CycleJonabed PobadoraNo ratings yet

- Compliances Under GST & Income Tax Act-KinexinDocument3 pagesCompliances Under GST & Income Tax Act-KinexinDeepak ChauhanNo ratings yet

- ErrtetDocument9 pagesErrtetSridhar GandikotaNo ratings yet

- All You Need To Know About Maintaining Your BusinessDocument14 pagesAll You Need To Know About Maintaining Your BusinessKrishna SNo ratings yet

- Fee Structure - 2023-24 and 2024-25Document1 pageFee Structure - 2023-24 and 2024-25Smit VithalaniNo ratings yet

- Edusec Demo: 1 Tuition Fees-2015 25000 2 Extra Misc Fees 2000Document1 pageEdusec Demo: 1 Tuition Fees-2015 25000 2 Extra Misc Fees 2000Ahmad Rashed SalimiNo ratings yet

- Our Loan Balance Bro Jessie 2021Document4 pagesOur Loan Balance Bro Jessie 2021JESSIE BAUTISTANo ratings yet

- Bir FormDocument3 pagesBir FormChelsea Anne VidalloNo ratings yet

- Office of The Accountant General (A&E), Tamilnadu Statement of Teachers Provident Fund Accounts For The Year EndedDocument1 pageOffice of The Accountant General (A&E), Tamilnadu Statement of Teachers Provident Fund Accounts For The Year EndedZaith JonNo ratings yet

- Customer Tax ReportDocument1 pageCustomer Tax ReportRana Ahmad AamirNo ratings yet

- Deadlines TaxDocument3 pagesDeadlines TaxLouremie Delos Reyes MalabayabasNo ratings yet

- Rmo 1983Document89 pagesRmo 1983Mary graceNo ratings yet

- 3 Month Deferment Tax Instalment CP204Document1 page3 Month Deferment Tax Instalment CP204Alaya VirjaNo ratings yet

- Value Added Tax: NotesDocument26 pagesValue Added Tax: NotesSamantha AlejandroNo ratings yet

- Reminders - Due DatesDocument7 pagesReminders - Due Datesdhuno teeNo ratings yet

- BaaccenDocument7 pagesBaaccenMa Elizabeth Crosa TolibasNo ratings yet

- 12 Compliance ChartDocument19 pages12 Compliance CharttabrezullakhanNo ratings yet

- Tax FormsDocument4 pagesTax FormsJennie KimNo ratings yet

- VALUE ADDED TAX Value Added Tax, Popularly Known AsDocument6 pagesVALUE ADDED TAX Value Added Tax, Popularly Known AsCAclubindia100% (1)

- Municipality Vs NeesusDocument3 pagesMunicipality Vs NeesusAnsherina FranciscoNo ratings yet

- Capital Markets: 2020 SEC Filing Deadlines and Financial Statement Staleness DatesDocument3 pagesCapital Markets: 2020 SEC Filing Deadlines and Financial Statement Staleness DatesNepean Philippines IncNo ratings yet

- Checklist of Statutory Complience: Name of The Statute Challans & ReturnsDocument2 pagesChecklist of Statutory Complience: Name of The Statute Challans & ReturnsnandhamnkNo ratings yet

- Financial Calendar 2010 - 2011: Month Due DateDocument3 pagesFinancial Calendar 2010 - 2011: Month Due Daterichard_paradise7625No ratings yet

- COVID 19 and Its Tax Implications 20200508 - v1.0Document108 pagesCOVID 19 and Its Tax Implications 20200508 - v1.0Richard CaneteNo ratings yet

- Matrix of Deadlines Extended Due To COVID-19 Situation: Revenue Memorandum Circular (RMC) No. 27-2020Document14 pagesMatrix of Deadlines Extended Due To COVID-19 Situation: Revenue Memorandum Circular (RMC) No. 27-2020Brevin PerezNo ratings yet

- REPUBLIC OF THE PHILIPPINES FROM Rdo 27Document5 pagesREPUBLIC OF THE PHILIPPINES FROM Rdo 27ernestaguilar.valentinoNo ratings yet

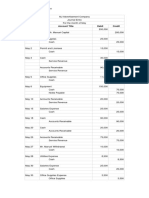

- Refno. Date Account Debit CreditDocument8 pagesRefno. Date Account Debit CreditVenice DatoNo ratings yet

- ASlipDocument1 pageASlipISMAIL IJASNo ratings yet

- Timing Forms Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 10th 10th 10th 31th 31th 25th 25th 15th 15th 30thDocument2 pagesTiming Forms Oct-20 Nov-20 Dec-20 Jan-21 Feb-21 10th 10th 10th 31th 31th 25th 25th 15th 15th 30thdindi genilNo ratings yet

- Account CycleDocument8 pagesAccount CycleAmir ShahzadNo ratings yet

- Checklist of Statutory ComplienceDocument2 pagesChecklist of Statutory CompliencevsyamkumarNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnjoshuaNo ratings yet

- Book 1Document10 pagesBook 1daryl canozaNo ratings yet

- Notes ConstiDocument1 pageNotes ConstiWinz Valerie JoseNo ratings yet

- Working Cap MNGTDocument5 pagesWorking Cap MNGTWinz Valerie JoseNo ratings yet

- Internal Auditing Case StudyDocument2 pagesInternal Auditing Case StudyWinz Valerie JoseNo ratings yet

- Macroeconomics Is The Branch of Economics That Studies The Behavior and Performance of AnDocument11 pagesMacroeconomics Is The Branch of Economics That Studies The Behavior and Performance of AnWinz Valerie JoseNo ratings yet

- Preliminary and General Principles: ST ST ST STDocument36 pagesPreliminary and General Principles: ST ST ST STWilliam Cole Limbu100% (3)

- Za T&C 07.06.2021Document19 pagesZa T&C 07.06.2021Gurey MahomoudNo ratings yet

- Soal Uspbk 2022Document16 pagesSoal Uspbk 2022ZENDI GORLANDZONo ratings yet

- Chapter 7 - Monitoring and Controlling The ProjectDocument41 pagesChapter 7 - Monitoring and Controlling The ProjectAung Khaing MinNo ratings yet

- Numericals On Capital Budgeting TechniquesDocument5 pagesNumericals On Capital Budgeting TechniquesKritikaNo ratings yet

- Southeast University: Mid Term AssignmentDocument7 pagesSoutheast University: Mid Term AssignmentRiyazul IslamNo ratings yet

- HR Building My Personal BrandDocument17 pagesHR Building My Personal BrandDAMNTHEMANNo ratings yet

- Human Resources: A Case Study of Must-Have HR Policies, Hypothetical Cases, Employment Legal Cases and Their Worst-Case AnalysisDocument10 pagesHuman Resources: A Case Study of Must-Have HR Policies, Hypothetical Cases, Employment Legal Cases and Their Worst-Case AnalysisArjun DNo ratings yet

- International Business: Guided by Prof. Nikhil RaoDocument16 pagesInternational Business: Guided by Prof. Nikhil RaoDelrioNo ratings yet

- Cissp 2Document6 pagesCissp 2Ahmed FikreyNo ratings yet

- Final Term DSDocument7 pagesFinal Term DSTaimoor WaraichNo ratings yet

- Rea QuizDocument1 pageRea QuizXandae MempinNo ratings yet

- Projects in Practice CourseksjciworkDocument10 pagesProjects in Practice CourseksjciworkFiveer FreelancerNo ratings yet

- Role of Agricultural Export in Indian EconomyDocument14 pagesRole of Agricultural Export in Indian EconomynandhinislvrjNo ratings yet

- Food Technology Coursework QuestionnaireDocument6 pagesFood Technology Coursework Questionnaireafiwjkfpc100% (2)

- Product Pitch Presentation RubricDocument3 pagesProduct Pitch Presentation RubricAlyson Kate CastillonNo ratings yet

- EFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce DDocument253 pagesEFFICACY OF MERGER AND ACQUISITION IN INDIAN BANKING INDUSTRY - Scholar - Kalaichelvan, Commerce Dcity9848835243 cyberNo ratings yet

- Basic Introduction To Custom - PLL PL/SQL Library FileDocument28 pagesBasic Introduction To Custom - PLL PL/SQL Library FileNakul Venkatraman100% (1)

- Contract of Sale of GoodsDocument2 pagesContract of Sale of GoodsUmair Ali100% (1)

- FYP - Recruitment and Selection FibremarxDocument57 pagesFYP - Recruitment and Selection FibremarxPrateek GoyalNo ratings yet

- Questions - AleenaDocument2 pagesQuestions - AleenaAlina IsrarNo ratings yet

- IQCS-QMSLA-01A Presentation Slides Apr2020 R23 (Protected)Document260 pagesIQCS-QMSLA-01A Presentation Slides Apr2020 R23 (Protected)sharkawyenppaNo ratings yet

- Lspu - Audit Final ExamDocument10 pagesLspu - Audit Final ExamJamie Rose AragonesNo ratings yet

- Interesting Design ServicesDocument21 pagesInteresting Design ServicesMad MateNo ratings yet

- Hilcoe School of Computer Science and Technology: It Research Methods (Cs481)Document15 pagesHilcoe School of Computer Science and Technology: It Research Methods (Cs481)yafet daniel100% (1)

- About Lanka Social VenturesDocument23 pagesAbout Lanka Social VenturesLalith WelamedageNo ratings yet

- DRMG 240Document124 pagesDRMG 240Allen Ashburn100% (1)