Professional Documents

Culture Documents

ACN 2107-3 - Financial Management Midterms - ANCERO - Google Sheets

ACN 2107-3 - Financial Management Midterms - ANCERO - Google Sheets

Uploaded by

HiedelynLlanoCopyright:

Available Formats

You might also like

- Navigating PCI DSS v4.0Document24 pagesNavigating PCI DSS v4.0Ivan DoriNo ratings yet

- Solution Manual For Essentials of Business Statistics Bowerman Oconnell Murphree Orris 5th EditionDocument36 pagesSolution Manual For Essentials of Business Statistics Bowerman Oconnell Murphree Orris 5th Editionjohnathannealy03w100% (31)

- Skullcore Forces and ScenariosDocument14 pagesSkullcore Forces and ScenariosJM100% (2)

- Security Education JSS One First TermDocument6 pagesSecurity Education JSS One First TermAtiku A Yusuf100% (6)

- 1.4.4.aHVA NATURAL HAZARD FixDocument2 pages1.4.4.aHVA NATURAL HAZARD Fixdita mardianiNo ratings yet

- AlamiDocument2 pagesAlamiReborn IncNo ratings yet

- Risk and Return Risk and ReturnDocument18 pagesRisk and Return Risk and Returnhaya khanNo ratings yet

- SOLUCIÓN DESVIACIÓN ESTANDAR CASO PRÁCTICO 3 - EJERCICIOS 1 - 2 - 3 y 4Document34 pagesSOLUCIÓN DESVIACIÓN ESTANDAR CASO PRÁCTICO 3 - EJERCICIOS 1 - 2 - 3 y 4perlefaro1234No ratings yet

- Uji Statistik PungkiDocument11 pagesUji Statistik PungkiAulia Annas MNo ratings yet

- Pew 20114 CDocument3 pagesPew 20114 CsaeedNo ratings yet

- 56.yunita Rochma - 1902012773Document5 pages56.yunita Rochma - 1902012773Yunita ARNo ratings yet

- Tugas1Document9 pagesTugas1Arsya AldeNo ratings yet

- Financial ManagementDocument48 pagesFinancial ManagementMuhammad HamdanNo ratings yet

- CH 05Document48 pagesCH 05Ikram UlhaqNo ratings yet

- Determining Standard Deviation (Risk Measure)Document5 pagesDetermining Standard Deviation (Risk Measure)Arslan RammayNo ratings yet

- Standard Deviation EPS I EPS) XPRDocument3 pagesStandard Deviation EPS I EPS) XPRJP100% (1)

- BJFINDocument3 pagesBJFINShubho DasguptaNo ratings yet

- Superficie2 0Document2 pagesSuperficie2 0Bintou RassoulNo ratings yet

- Risk and Return Financial ManagementDocument45 pagesRisk and Return Financial Managementnanad8No ratings yet

- FO-003 Uncertainty Estimate - 1621923638Document2 pagesFO-003 Uncertainty Estimate - 1621923638swapon kumar shillNo ratings yet

- BF330 FPD 7 2020 2Document58 pagesBF330 FPD 7 2020 2richard kapimpaNo ratings yet

- Ancaman Alam: HVA TemplateDocument1 pageAncaman Alam: HVA TemplateDiah Ayu Wulandari SulistyaningrumNo ratings yet

- Risk and ReturnDocument56 pagesRisk and ReturnMuhammad GhozaliNo ratings yet

- Risk and Return: By: Program Pascasarjana Universitas TerbukaDocument60 pagesRisk and Return: By: Program Pascasarjana Universitas TerbukaBNNP Sultra RehabilitasiNo ratings yet

- Hazard Analysis RSCLDocument12 pagesHazard Analysis RSCLmaya tyasNo ratings yet

- Cut Off JKR - KosongDocument17 pagesCut Off JKR - KosongHadzrie SabriNo ratings yet

- KeuanganDocument6 pagesKeuanganCindy Ariyani UtamiNo ratings yet

- Chapter 2 - Risk - RevisedDocument61 pagesChapter 2 - Risk - RevisedBehailu TesfayeNo ratings yet

- CH 07 Tool Kit - Brigham3CeDocument17 pagesCH 07 Tool Kit - Brigham3CeChad OngNo ratings yet

- Maths Mastery: Solve Problems Knowing Decimal and Percentage EquivalentsDocument7 pagesMaths Mastery: Solve Problems Knowing Decimal and Percentage EquivalentsSharma SunilNo ratings yet

- Lampiran Hasil Uji StatistikDocument12 pagesLampiran Hasil Uji StatistikNadia MailinaNo ratings yet

- 003 Risk - ReturnDocument50 pages003 Risk - ReturnShreya SharmaNo ratings yet

- Cazoom Math. FDP. Fractions Decimals Percentages (B) - AnswersDocument2 pagesCazoom Math. FDP. Fractions Decimals Percentages (B) - Answerspurplebell618No ratings yet

- Jadual 2: Skala 11 Mata (CGPA)Document5 pagesJadual 2: Skala 11 Mata (CGPA)Mazheidy Mat DarusNo ratings yet

- Baru Lampiran Output SPSSDocument7 pagesBaru Lampiran Output SPSSnindy KNo ratings yet

- Chapter 5 - Risk ReturnDocument15 pagesChapter 5 - Risk ReturnAshek AHmedNo ratings yet

- Pci DV 1Document17 pagesPci DV 1suyog goreNo ratings yet

- Supplementary MaterialsDocument7 pagesSupplementary MaterialsCarolina Escobar RodriguezNo ratings yet

- Explore: Case Processing SummaryDocument10 pagesExplore: Case Processing SummaryWahyutianurDuapulluhempataprillNo ratings yet

- Risk and Return Risk and ReturnDocument50 pagesRisk and Return Risk and Returnrose OneubNo ratings yet

- Risk and Return: Centre For Financial Management, BangaloreDocument29 pagesRisk and Return: Centre For Financial Management, BangalorekirishnakanthNo ratings yet

- Nominal Regression OUTPUTDocument3 pagesNominal Regression OUTPUTYora SakiNo ratings yet

- Egg Osmosis Spreadsheet STUDENTSDocument5 pagesEgg Osmosis Spreadsheet STUDENTSNour NassarNo ratings yet

- MI Bab 1 Risk and ReturnDocument6 pagesMI Bab 1 Risk and ReturnBidari DhaifinaNo ratings yet

- 5.1.2.c Hva BencanaDocument15 pages5.1.2.c Hva Bencananurul rahmaniaNo ratings yet

- Assignment 5-1Document6 pagesAssignment 5-1irineNo ratings yet

- Interquantile Min MaxDocument4 pagesInterquantile Min MaxBintou RassoulNo ratings yet

- Hasil SPSSDocument30 pagesHasil SPSSReza Ahmad MadaniNo ratings yet

- HVA BencanaDocument8 pagesHVA BencanapuskesmasberkasNo ratings yet

- Descriptive and VisualDocument26 pagesDescriptive and Visualsai revanthNo ratings yet

- Weibull Continuous Distribution 59Document9 pagesWeibull Continuous Distribution 59Lê HoàngNo ratings yet

- Data Analysis PilotDocument15 pagesData Analysis PilotHarsh kumarNo ratings yet

- Financial Management No. 1Document2 pagesFinancial Management No. 1MiconNo ratings yet

- Lampiran Hasil SPSS Klasifikasi Case Processing SummaryDocument5 pagesLampiran Hasil SPSS Klasifikasi Case Processing SummaryAlfa FebriandaNo ratings yet

- WACCDocument5 pagesWACCWarner Alberto MéridaNo ratings yet

- Excel Drill - CAPM & WACCDocument8 pagesExcel Drill - CAPM & WACCgjlastimozaNo ratings yet

- SS 2 CF RiskAndReturnDocument25 pagesSS 2 CF RiskAndReturnmanish guptaNo ratings yet

- Representation of The Market Mechanism of Income Distribution Using Lorenz Curve. Gini Coefficient.Document8 pagesRepresentation of The Market Mechanism of Income Distribution Using Lorenz Curve. Gini Coefficient.Мария МариничNo ratings yet

- SALBIYATUNDocument8 pagesSALBIYATUNEka NovitaNo ratings yet

- Variable RiskaDocument4 pagesVariable RiskaRiska IndriNo ratings yet

- Explore: Lampiran 5 Hasil Pengolahan SPSSDocument4 pagesExplore: Lampiran 5 Hasil Pengolahan SPSSEsti Tri LestariNo ratings yet

- Capital Budgeting With Risk MGMTDocument15 pagesCapital Budgeting With Risk MGMTAmit JainNo ratings yet

- It App NotesDocument26 pagesIt App NotesHiedelynLlanoNo ratings yet

- HERNANDEZDocument4 pagesHERNANDEZHiedelynLlanoNo ratings yet

- OBE Economic DevelopmentDocument9 pagesOBE Economic DevelopmentHiedelynLlanoNo ratings yet

- Ethics: Gilbert A. ApasDocument9 pagesEthics: Gilbert A. ApasHiedelynLlanoNo ratings yet

- Pfleeger Ch01 Part1Document18 pagesPfleeger Ch01 Part1ealabaseNo ratings yet

- Cryptography Benefits & DrawbacksDocument2 pagesCryptography Benefits & Drawbackstracy keitaNo ratings yet

- Network SecurityDocument5 pagesNetwork SecurityIndrajit Banerjee100% (4)

- Lucara Feb Report MJDocument12 pagesLucara Feb Report MJjmbmokoenaNo ratings yet

- Iso 27002 Compliance GuideDocument23 pagesIso 27002 Compliance Guidepioneers ksaNo ratings yet

- DFO GD MaterialDocument1 pageDFO GD Materialijasnk786No ratings yet

- G31000-QUIZ ALL Correction AllDocument63 pagesG31000-QUIZ ALL Correction AllAlex DaliNo ratings yet

- Burglar Alarms Security Systems BizHouse - UkDocument3 pagesBurglar Alarms Security Systems BizHouse - UkAlex BekeNo ratings yet

- APT: It Is Time To Act: Dr. Eric ColeDocument22 pagesAPT: It Is Time To Act: Dr. Eric ColemegvikNo ratings yet

- 2 Symmetric Cipher Introduction 05-01-2024Document8 pages2 Symmetric Cipher Introduction 05-01-2024sankarperuriNo ratings yet

- BSSW 3 A Disaster Control Group PDFDocument6 pagesBSSW 3 A Disaster Control Group PDFAlyssa Marie CabidogNo ratings yet

- Lesson 7 Biorisk ManagementDocument11 pagesLesson 7 Biorisk ManagementReiford De MesaNo ratings yet

- Fema CertificateDocument1 pageFema Certificateapi-314439695No ratings yet

- Njack Csec - 2022Document35 pagesNjack Csec - 2022Rashad AlamNo ratings yet

- Commitment On Cyber Security and User Privacy TemplateDocument2 pagesCommitment On Cyber Security and User Privacy Templatenureddin eljamlNo ratings yet

- 2019.03.19 Barrie Parkes - A Brief SynopsisDocument3 pages2019.03.19 Barrie Parkes - A Brief SynopsisAlan Pemberton - DCSNo ratings yet

- Threat Intel Roundup - 3 July - 10 JulyDocument13 pagesThreat Intel Roundup - 3 July - 10 JulyAmr M. AminNo ratings yet

- Colonel Alan Brooke Pemberton & Diversified Corporate Services Limited - Fiscal Year Arms Control Impact StatemenDocument879 pagesColonel Alan Brooke Pemberton & Diversified Corporate Services Limited - Fiscal Year Arms Control Impact StatemenAlan Pemberton - DCSNo ratings yet

- Cyber Security Attacks - TorresDocument4 pagesCyber Security Attacks - Torresmark.murasaki.chanNo ratings yet

- Review 1Document18 pagesReview 1Kona Alika Alicer OberesNo ratings yet

- 100 Industrial Security Management QuestionsDocument13 pages100 Industrial Security Management QuestionsJen PaezNo ratings yet

- CyberDocument29 pagesCyberBhanubhakta lamsalNo ratings yet

- The Unified Kill ChainDocument19 pagesThe Unified Kill ChainManuNo ratings yet

- Manajemen Keamanan SiberDocument50 pagesManajemen Keamanan SiberBPR Mandiri DhanasejahteraNo ratings yet

- RomanianationalsecurityDocument27 pagesRomanianationalsecurityddraghici24No ratings yet

- Emergency Response Plane TemplateDocument20 pagesEmergency Response Plane TemplatecppngcphseNo ratings yet

- Law Enforcement/SecurityDocument2 pagesLaw Enforcement/Securityapi-79101262No ratings yet

ACN 2107-3 - Financial Management Midterms - ANCERO - Google Sheets

ACN 2107-3 - Financial Management Midterms - ANCERO - Google Sheets

Uploaded by

HiedelynLlanoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACN 2107-3 - Financial Management Midterms - ANCERO - Google Sheets

ACN 2107-3 - Financial Management Midterms - ANCERO - Google Sheets

Uploaded by

HiedelynLlanoCopyright:

Available Formats

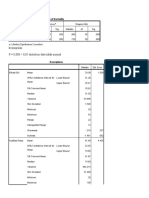

LLANO, HIEDELYN I.

ACN 2107-3 Financial Management Midterms

STRONG TOWER INC. BRIGHT FUTURE CORP.

(Deviation^2) * (Deviation^2) *

Demand Probability Rate of Return Product Deviation Deviation^2 Prob Demand Probability Rate of Return Product Deviation Deviation^2 Prob

Strong 0.25 90% 23% 90.0% 0.8100 0.2025 Strong 0.25 40% 10% 40.0% 0.1600 0.0400

Normal 0.4 40% 16% 40.0% 0.1600 0.0640 Normal 0.4 42% 17% 42.0% 0.1764 0.0706

Weak 0.35 -25% -9% -25.0% 0.0625 0.0219 Weak 0.35 10% 4% 10.0% 0.0100 0.0035

r̂ = 29.75% Σ=variation= 0.2884 r̂ = 30.30% Σ=variation= 0.1141

√variation= 0.5370 √variation= 0.3377

σ% = 53.70% σ% = 33.77%

σ Return - Risk-Free rate σ Return - Risk-Free rate

r̂ σ r̂ σ

53.70% 29.75% - 2% 33.77% 30.30% - 2%

29.75% 44.71% 30.30% 14.93%

Coefficient = 1.50 Sharpe= 0.62 Coefficient = 0.49 Sharpe= 1.90

66 67 68

Risk-free rate + Premium Risk-free rate + (Market Risk Premium)(Beta) Risk-free rate + (Market Risk Premium)(Beta)

3% + 2% 3% + (2%)(1) 3% + (2%)(2)

RRR = 5% 3% + 2% 3% + 4%

RRR = 5% RRR = 7%

68 69

Risk-free rate + (Market Risk Premium)(Beta) Required return w/ beta of 1 - Required return with beta of 0.5 Risk-free rate + (Market Risk Premium)(Beta)

3% + (2%)(2) 5% - 4% = 1% 3% + (2%)(0.5)

3% + 4% 3% + 1%

RRR = 7% RRR = 4%

You might also like

- Navigating PCI DSS v4.0Document24 pagesNavigating PCI DSS v4.0Ivan DoriNo ratings yet

- Solution Manual For Essentials of Business Statistics Bowerman Oconnell Murphree Orris 5th EditionDocument36 pagesSolution Manual For Essentials of Business Statistics Bowerman Oconnell Murphree Orris 5th Editionjohnathannealy03w100% (31)

- Skullcore Forces and ScenariosDocument14 pagesSkullcore Forces and ScenariosJM100% (2)

- Security Education JSS One First TermDocument6 pagesSecurity Education JSS One First TermAtiku A Yusuf100% (6)

- 1.4.4.aHVA NATURAL HAZARD FixDocument2 pages1.4.4.aHVA NATURAL HAZARD Fixdita mardianiNo ratings yet

- AlamiDocument2 pagesAlamiReborn IncNo ratings yet

- Risk and Return Risk and ReturnDocument18 pagesRisk and Return Risk and Returnhaya khanNo ratings yet

- SOLUCIÓN DESVIACIÓN ESTANDAR CASO PRÁCTICO 3 - EJERCICIOS 1 - 2 - 3 y 4Document34 pagesSOLUCIÓN DESVIACIÓN ESTANDAR CASO PRÁCTICO 3 - EJERCICIOS 1 - 2 - 3 y 4perlefaro1234No ratings yet

- Uji Statistik PungkiDocument11 pagesUji Statistik PungkiAulia Annas MNo ratings yet

- Pew 20114 CDocument3 pagesPew 20114 CsaeedNo ratings yet

- 56.yunita Rochma - 1902012773Document5 pages56.yunita Rochma - 1902012773Yunita ARNo ratings yet

- Tugas1Document9 pagesTugas1Arsya AldeNo ratings yet

- Financial ManagementDocument48 pagesFinancial ManagementMuhammad HamdanNo ratings yet

- CH 05Document48 pagesCH 05Ikram UlhaqNo ratings yet

- Determining Standard Deviation (Risk Measure)Document5 pagesDetermining Standard Deviation (Risk Measure)Arslan RammayNo ratings yet

- Standard Deviation EPS I EPS) XPRDocument3 pagesStandard Deviation EPS I EPS) XPRJP100% (1)

- BJFINDocument3 pagesBJFINShubho DasguptaNo ratings yet

- Superficie2 0Document2 pagesSuperficie2 0Bintou RassoulNo ratings yet

- Risk and Return Financial ManagementDocument45 pagesRisk and Return Financial Managementnanad8No ratings yet

- FO-003 Uncertainty Estimate - 1621923638Document2 pagesFO-003 Uncertainty Estimate - 1621923638swapon kumar shillNo ratings yet

- BF330 FPD 7 2020 2Document58 pagesBF330 FPD 7 2020 2richard kapimpaNo ratings yet

- Ancaman Alam: HVA TemplateDocument1 pageAncaman Alam: HVA TemplateDiah Ayu Wulandari SulistyaningrumNo ratings yet

- Risk and ReturnDocument56 pagesRisk and ReturnMuhammad GhozaliNo ratings yet

- Risk and Return: By: Program Pascasarjana Universitas TerbukaDocument60 pagesRisk and Return: By: Program Pascasarjana Universitas TerbukaBNNP Sultra RehabilitasiNo ratings yet

- Hazard Analysis RSCLDocument12 pagesHazard Analysis RSCLmaya tyasNo ratings yet

- Cut Off JKR - KosongDocument17 pagesCut Off JKR - KosongHadzrie SabriNo ratings yet

- KeuanganDocument6 pagesKeuanganCindy Ariyani UtamiNo ratings yet

- Chapter 2 - Risk - RevisedDocument61 pagesChapter 2 - Risk - RevisedBehailu TesfayeNo ratings yet

- CH 07 Tool Kit - Brigham3CeDocument17 pagesCH 07 Tool Kit - Brigham3CeChad OngNo ratings yet

- Maths Mastery: Solve Problems Knowing Decimal and Percentage EquivalentsDocument7 pagesMaths Mastery: Solve Problems Knowing Decimal and Percentage EquivalentsSharma SunilNo ratings yet

- Lampiran Hasil Uji StatistikDocument12 pagesLampiran Hasil Uji StatistikNadia MailinaNo ratings yet

- 003 Risk - ReturnDocument50 pages003 Risk - ReturnShreya SharmaNo ratings yet

- Cazoom Math. FDP. Fractions Decimals Percentages (B) - AnswersDocument2 pagesCazoom Math. FDP. Fractions Decimals Percentages (B) - Answerspurplebell618No ratings yet

- Jadual 2: Skala 11 Mata (CGPA)Document5 pagesJadual 2: Skala 11 Mata (CGPA)Mazheidy Mat DarusNo ratings yet

- Baru Lampiran Output SPSSDocument7 pagesBaru Lampiran Output SPSSnindy KNo ratings yet

- Chapter 5 - Risk ReturnDocument15 pagesChapter 5 - Risk ReturnAshek AHmedNo ratings yet

- Pci DV 1Document17 pagesPci DV 1suyog goreNo ratings yet

- Supplementary MaterialsDocument7 pagesSupplementary MaterialsCarolina Escobar RodriguezNo ratings yet

- Explore: Case Processing SummaryDocument10 pagesExplore: Case Processing SummaryWahyutianurDuapulluhempataprillNo ratings yet

- Risk and Return Risk and ReturnDocument50 pagesRisk and Return Risk and Returnrose OneubNo ratings yet

- Risk and Return: Centre For Financial Management, BangaloreDocument29 pagesRisk and Return: Centre For Financial Management, BangalorekirishnakanthNo ratings yet

- Nominal Regression OUTPUTDocument3 pagesNominal Regression OUTPUTYora SakiNo ratings yet

- Egg Osmosis Spreadsheet STUDENTSDocument5 pagesEgg Osmosis Spreadsheet STUDENTSNour NassarNo ratings yet

- MI Bab 1 Risk and ReturnDocument6 pagesMI Bab 1 Risk and ReturnBidari DhaifinaNo ratings yet

- 5.1.2.c Hva BencanaDocument15 pages5.1.2.c Hva Bencananurul rahmaniaNo ratings yet

- Assignment 5-1Document6 pagesAssignment 5-1irineNo ratings yet

- Interquantile Min MaxDocument4 pagesInterquantile Min MaxBintou RassoulNo ratings yet

- Hasil SPSSDocument30 pagesHasil SPSSReza Ahmad MadaniNo ratings yet

- HVA BencanaDocument8 pagesHVA BencanapuskesmasberkasNo ratings yet

- Descriptive and VisualDocument26 pagesDescriptive and Visualsai revanthNo ratings yet

- Weibull Continuous Distribution 59Document9 pagesWeibull Continuous Distribution 59Lê HoàngNo ratings yet

- Data Analysis PilotDocument15 pagesData Analysis PilotHarsh kumarNo ratings yet

- Financial Management No. 1Document2 pagesFinancial Management No. 1MiconNo ratings yet

- Lampiran Hasil SPSS Klasifikasi Case Processing SummaryDocument5 pagesLampiran Hasil SPSS Klasifikasi Case Processing SummaryAlfa FebriandaNo ratings yet

- WACCDocument5 pagesWACCWarner Alberto MéridaNo ratings yet

- Excel Drill - CAPM & WACCDocument8 pagesExcel Drill - CAPM & WACCgjlastimozaNo ratings yet

- SS 2 CF RiskAndReturnDocument25 pagesSS 2 CF RiskAndReturnmanish guptaNo ratings yet

- Representation of The Market Mechanism of Income Distribution Using Lorenz Curve. Gini Coefficient.Document8 pagesRepresentation of The Market Mechanism of Income Distribution Using Lorenz Curve. Gini Coefficient.Мария МариничNo ratings yet

- SALBIYATUNDocument8 pagesSALBIYATUNEka NovitaNo ratings yet

- Variable RiskaDocument4 pagesVariable RiskaRiska IndriNo ratings yet

- Explore: Lampiran 5 Hasil Pengolahan SPSSDocument4 pagesExplore: Lampiran 5 Hasil Pengolahan SPSSEsti Tri LestariNo ratings yet

- Capital Budgeting With Risk MGMTDocument15 pagesCapital Budgeting With Risk MGMTAmit JainNo ratings yet

- It App NotesDocument26 pagesIt App NotesHiedelynLlanoNo ratings yet

- HERNANDEZDocument4 pagesHERNANDEZHiedelynLlanoNo ratings yet

- OBE Economic DevelopmentDocument9 pagesOBE Economic DevelopmentHiedelynLlanoNo ratings yet

- Ethics: Gilbert A. ApasDocument9 pagesEthics: Gilbert A. ApasHiedelynLlanoNo ratings yet

- Pfleeger Ch01 Part1Document18 pagesPfleeger Ch01 Part1ealabaseNo ratings yet

- Cryptography Benefits & DrawbacksDocument2 pagesCryptography Benefits & Drawbackstracy keitaNo ratings yet

- Network SecurityDocument5 pagesNetwork SecurityIndrajit Banerjee100% (4)

- Lucara Feb Report MJDocument12 pagesLucara Feb Report MJjmbmokoenaNo ratings yet

- Iso 27002 Compliance GuideDocument23 pagesIso 27002 Compliance Guidepioneers ksaNo ratings yet

- DFO GD MaterialDocument1 pageDFO GD Materialijasnk786No ratings yet

- G31000-QUIZ ALL Correction AllDocument63 pagesG31000-QUIZ ALL Correction AllAlex DaliNo ratings yet

- Burglar Alarms Security Systems BizHouse - UkDocument3 pagesBurglar Alarms Security Systems BizHouse - UkAlex BekeNo ratings yet

- APT: It Is Time To Act: Dr. Eric ColeDocument22 pagesAPT: It Is Time To Act: Dr. Eric ColemegvikNo ratings yet

- 2 Symmetric Cipher Introduction 05-01-2024Document8 pages2 Symmetric Cipher Introduction 05-01-2024sankarperuriNo ratings yet

- BSSW 3 A Disaster Control Group PDFDocument6 pagesBSSW 3 A Disaster Control Group PDFAlyssa Marie CabidogNo ratings yet

- Lesson 7 Biorisk ManagementDocument11 pagesLesson 7 Biorisk ManagementReiford De MesaNo ratings yet

- Fema CertificateDocument1 pageFema Certificateapi-314439695No ratings yet

- Njack Csec - 2022Document35 pagesNjack Csec - 2022Rashad AlamNo ratings yet

- Commitment On Cyber Security and User Privacy TemplateDocument2 pagesCommitment On Cyber Security and User Privacy Templatenureddin eljamlNo ratings yet

- 2019.03.19 Barrie Parkes - A Brief SynopsisDocument3 pages2019.03.19 Barrie Parkes - A Brief SynopsisAlan Pemberton - DCSNo ratings yet

- Threat Intel Roundup - 3 July - 10 JulyDocument13 pagesThreat Intel Roundup - 3 July - 10 JulyAmr M. AminNo ratings yet

- Colonel Alan Brooke Pemberton & Diversified Corporate Services Limited - Fiscal Year Arms Control Impact StatemenDocument879 pagesColonel Alan Brooke Pemberton & Diversified Corporate Services Limited - Fiscal Year Arms Control Impact StatemenAlan Pemberton - DCSNo ratings yet

- Cyber Security Attacks - TorresDocument4 pagesCyber Security Attacks - Torresmark.murasaki.chanNo ratings yet

- Review 1Document18 pagesReview 1Kona Alika Alicer OberesNo ratings yet

- 100 Industrial Security Management QuestionsDocument13 pages100 Industrial Security Management QuestionsJen PaezNo ratings yet

- CyberDocument29 pagesCyberBhanubhakta lamsalNo ratings yet

- The Unified Kill ChainDocument19 pagesThe Unified Kill ChainManuNo ratings yet

- Manajemen Keamanan SiberDocument50 pagesManajemen Keamanan SiberBPR Mandiri DhanasejahteraNo ratings yet

- RomanianationalsecurityDocument27 pagesRomanianationalsecurityddraghici24No ratings yet

- Emergency Response Plane TemplateDocument20 pagesEmergency Response Plane TemplatecppngcphseNo ratings yet

- Law Enforcement/SecurityDocument2 pagesLaw Enforcement/Securityapi-79101262No ratings yet