Professional Documents

Culture Documents

Battle Against Inflation Is Not Over Yet

Battle Against Inflation Is Not Over Yet

Uploaded by

Amit GulveOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Battle Against Inflation Is Not Over Yet

Battle Against Inflation Is Not Over Yet

Uploaded by

Amit GulveCopyright:

Available Formats

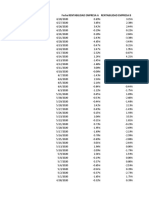

Economic Data Fixed Income Date

Analysis of CPI Feb 2023 Inflation eased mildly: 14 March 2023

Core still remain sticky

CPI eased to 6.4% YoY in February (+0.2% MoM) from 6.5% YoY in January (+0.5% MoM) led by modest

decline in food prices.

Nevertheless, two successive 6% plus headline inflation print is unlikely to provide comfort to the RBI.

RBI’s focus lately has shifted on core inflation, and this metric continues to remain sticky at 6.1% with

internals like housing rentals, household goods and services, education and health maintaining strong

growth on MoM basis.

With domestic inflation above the 6% handle, we see the RBI to hike by 25 bps in April 2023.

Domestic data prints alongside Fed’s actions considering the recent US banking sector woes will likely

determine the course of future hikes.

Feb. 2023 (Prov.) Jan. 2023 (Final) Feb. 2022

(%)

Rural Urban Combine Rural Urban Combine Rural Urban Combine

CPI

6.72 6.10 6.44 6.85 6.00 6.52 6.38 5.75 6.07

Inflation (General)

CFPI 6.60 5.09 5.95 6.65 4.85 6.00 5.81 5.76 5.85

Description Weights MoM YOY

Egg 0.43 -5.71% 4.32%

Vegetables 6.04 -2.53% -11.61%

Oils and fats 3.56 -1.71% -0.49%

Meat and fish 3.61 -1.57% 3.39%

Sugar and Confectionery 1.36 -0.58% 1.26%

Pulses and products 2.38 -0.29% 4.09%

Non-alcoholic beverages 1.26 0.29% 4.37%

Prepared meals, snacks, sweets etc. 5.55 0.52% 7.98%

Spices 2.5 0.53% 20.20%

Cereals and products 9.67 0.75% 16.73%

Milk and products 6.61 0.92% 9.65%

Fruits 2.89 3.28% 6.38%

Food and beverages 45.86 -0.06% 6.26%

Pan, tobacco and intoxicants 2.38 0.40% 3.22%

Clothing 5.58 0.38% 8.67%

Footwear 0.95 0.39% 9.79%

Clothing and footwear 6.53 0.38% 8.79%

Housing 10.07 0.81% 4.83%

Fuel and light 6.84 0.05% 9.90%

Transport and communication 8.59 0.18% 4.46%

Education 4.46 0.23% 5.62%

Recreation and amusement 1.68 0.24% 4.81%

Household goods and services 3.8 0.46% 7.35%

Health 5.89 0.60% 6.50%

Personal care and effects 3.89 0.73% 9.43%

Miscellaneous 28.32 0.41% 6.12%

General Index (All Groups) 100 0.17% 6.44%

1

Economic Data

Analysis of CPI Feb 2023

14 March 2023

Analysis of CPI Feb 2023

This clearly indicates that the expected dis-inflation expected after the 250bps hike in the repo rate by the

RBI has yet not taken shape. Given that retail inflation remains higher than the threshold 6% for the last

two months, it might not be possible for RBI to pause immediately.

The RBI governor had indicated during the last meeting that the real rates are still lower than the pre-

pandemic levels, which might result 25bps increase in the repo rate in April.

Recent developments in the US banking system is unlikely to lead to any snowballing effect on the global

financial and banking systems.

US CPI print tomorrow along with the US Fed’s rate actions on 22 March, 2023 (and any further

developments for the US banking system) will also be critical inputs for the RBI.

CPI Trend-

CPI Trend

9.00%

7.79%

8.00% 7.41%

6.95% 7.04% 7.01% 7.00%

7.00% 6.71% 6.77%

6.52% 6.44%

6.01% 6.07% 5.88% 5.72%

6.00% 5.59%

4.91%

5.00%

4.35% 4.48%

4.00%

3.00%

2.00%

1.00%

0.00%

2

Economic Data

Analysis of CPI Feb 2023

You might also like

- Essentials of Econometrics 4th Edition Gujarati Solutions ManualDocument14 pagesEssentials of Econometrics 4th Edition Gujarati Solutions ManualRobertYangfmspj100% (15)

- Test Bank For Macroeconomics Policy and Practice 2nd Edition Frederic S MishkinDocument25 pagesTest Bank For Macroeconomics Policy and Practice 2nd Edition Frederic S MishkinSuzanne Washington100% (7)

- AS Economics Revision NotesDocument16 pagesAS Economics Revision NotesAlexandru Huțu100% (1)

- Industry ReportDocument77 pagesIndustry ReportabhishakxtNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- Fundsatwork: Investment Returns For January 2021Document4 pagesFundsatwork: Investment Returns For January 2021hong BaaNo ratings yet

- Assignment 2 Muhammad MahatabDocument8 pagesAssignment 2 Muhammad MahatabYash TilakNo ratings yet

- Press Release On MAY 2023 Inflation RateDocument5 pagesPress Release On MAY 2023 Inflation RateJohn Cesar NacionalesNo ratings yet

- SML CML - FMFMDocument2 pagesSML CML - FMFMSaurabh MattaNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- State and Local Sales Tax Rates 2022Document2 pagesState and Local Sales Tax Rates 2022aana rkshNo ratings yet

- India Inflation Rate 1960 - 2022Document3 pagesIndia Inflation Rate 1960 - 2022GouravNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- Uji ProgresDocument19 pagesUji ProgresRAMA PUTRANo ratings yet

- 2021 Regional Nutrition SituationDocument38 pages2021 Regional Nutrition SituationMash JumahariNo ratings yet

- Monthly Economic Watch Jun 2023 1Document22 pagesMonthly Economic Watch Jun 2023 1Dilshan J. NiranjanNo ratings yet

- Total Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixDocument12 pagesTotal Datos 24 Precios Ajustados Fecha Acciones Apple Acciones Baba Acciones Tesla Acciones NetflixLorenaNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- Cpi Press Release June 2019Document2 pagesCpi Press Release June 2019masaud shahNo ratings yet

- CP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIDocument5 pagesCP Comparador de Taxas LCI LCA LFT CDB Poupanca FundosDIeduardolavratiNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- 01-3 Plan Lineal VendedorDocument26 pages01-3 Plan Lineal VendedorJefer AnHe VelezNo ratings yet

- Crecimiento Del Pib Economia Emergentes: TiempoDocument8 pagesCrecimiento Del Pib Economia Emergentes: Tiempodavid hernandezNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Assessment of The Global and Indian Pharmaceuticals Industry - CRISILDocument120 pagesAssessment of The Global and Indian Pharmaceuticals Industry - CRISILblackjack_21No ratings yet

- DDM, RV, OpDocument599 pagesDDM, RV, Opnitish_735No ratings yet

- Group 3 Investments ProjectDocument45 pagesGroup 3 Investments ProjectVathsan VenkatNo ratings yet

- Economics ProjectDocument20 pagesEconomics Projectshe.holmes.2004No ratings yet

- Date Crisil Sunpharma Crisil SunpharmaDocument9 pagesDate Crisil Sunpharma Crisil SunpharmaBerkshire Hathway coldNo ratings yet

- Third Edition Chapter 4Document3 pagesThird Edition Chapter 4walterNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- Long Lasting ResourcesDocument41 pagesLong Lasting ResourcesOsmar ZayasNo ratings yet

- Global Div Inv Grade Income Trust II-IndyMac 2005-AR14!3!31-10Document17 pagesGlobal Div Inv Grade Income Trust II-IndyMac 2005-AR14!3!31-10Barbara J. FordeNo ratings yet

- 4.3 Inflation in BangladeshDocument5 pages4.3 Inflation in BangladeshArju LubnaNo ratings yet

- Ca Manish Chokshi Presence in Capital MarketDocument127 pagesCa Manish Chokshi Presence in Capital Marketthe libyan guyNo ratings yet

- HDFC Bank LTD - Income Statement 11-Sep-2021 21:22Document7 pagesHDFC Bank LTD - Income Statement 11-Sep-2021 21:22Naman KalraNo ratings yet

- Comprador TaxasDocument4 pagesComprador TaxasRenan MartinelliNo ratings yet

- 077 - UBAID DHANSAY Financial Accounting AasgnDocument15 pages077 - UBAID DHANSAY Financial Accounting Aasgniffu rautNo ratings yet

- Fiscal Fact: Updated State and Local Option Sales TaxDocument5 pagesFiscal Fact: Updated State and Local Option Sales TaxNathan MartinNo ratings yet

- BankingDocument5 pagesBankingFahim MkfNo ratings yet

- Mutual Fund Student DataDocument10 pagesMutual Fund Student DataJANHVI HEDANo ratings yet

- Kenya Consumer Price Indices and Inflation Rates April 2024Document3 pagesKenya Consumer Price Indices and Inflation Rates April 2024o.j.dumbo0No ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Macro Bba SEC ADocument15 pagesMacro Bba SEC Aumer farooqNo ratings yet

- Views On Markets and SectorsDocument19 pagesViews On Markets and SectorskundansudNo ratings yet

- Ejercicio 1 AnálisisDocument7 pagesEjercicio 1 AnálisisscawdarkoNo ratings yet

- Q3 2022-FinalDocument71 pagesQ3 2022-FinalcarunsbbhNo ratings yet

- Bankmanagement AssignmentDocument4 pagesBankmanagement AssignmentHasan Motiur RahmanNo ratings yet

- Porcentaje de ObraDocument3 pagesPorcentaje de ObraCesar E. RodriguezNo ratings yet

- 1st and 2nd MNC Slides PresentationDocument22 pages1st and 2nd MNC Slides PresentationNao LupiNo ratings yet

- Ejercicio Sobre Varianza CarteraDocument15 pagesEjercicio Sobre Varianza CarteraDavid AlejandroNo ratings yet

- IDirect Inflation Sept14Document9 pagesIDirect Inflation Sept14nnsriniNo ratings yet

- Target Midcap Portfolio PerformanceDocument1 pageTarget Midcap Portfolio PerformanceAnil Kumar Reddy ChinthaNo ratings yet

- Octavo Semestre: Alto Medio Bajo TotalDocument8 pagesOctavo Semestre: Alto Medio Bajo TotalDreliarz RoqueNo ratings yet

- Absence Effetif 2021 2022 Sur 20Document246 pagesAbsence Effetif 2021 2022 Sur 20Bouzarmine Mohammed El HabibNo ratings yet

- Coca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsDocument6 pagesCoca-Cola Co.: Common-Size Consolidated Balance Sheet: AssetsVibhor Dutt SharmaNo ratings yet

- Rate of Inflation, 1998 - 2010: Year Jan Mar May July Sept Nov AnnualDocument1 pageRate of Inflation, 1998 - 2010: Year Jan Mar May July Sept Nov AnnualM-NCPPCNo ratings yet

- SCHEME - C (Tier-II) - 0Document1 pageSCHEME - C (Tier-II) - 0krishnaNo ratings yet

- India GDP Growth Rate - Historical DataDocument1 pageIndia GDP Growth Rate - Historical DataD FactorNo ratings yet

- CRISIL - Indian Pharmaceutical and CDMO MarketDocument69 pagesCRISIL - Indian Pharmaceutical and CDMO Marketnandhiniravi90100% (1)

- Instant Download PDF ECON MACRO 6th Edition McEachern Test Bank Full ChapterDocument46 pagesInstant Download PDF ECON MACRO 6th Edition McEachern Test Bank Full Chapterlisebotapler100% (5)

- Indicadores Economicos Che Oct. 2014Document1 pageIndicadores Economicos Che Oct. 2014Mari Luz Hermoza MamaniNo ratings yet

- Economic EventsDocument6 pagesEconomic EventsRavel AraújoNo ratings yet

- Multiple Choice For Econ 101 Chapter 1Document50 pagesMultiple Choice For Econ 101 Chapter 1Richard LiNo ratings yet

- Audit Juggernaut So Cant Final Mar 15Document3 pagesAudit Juggernaut So Cant Final Mar 15ss2900No ratings yet

- Explain The Functions of Price in A Market EconomyDocument6 pagesExplain The Functions of Price in A Market Economyhthomas_100% (5)

- Green Paper: 2013 - 2015 Medium Term Expenditure FrameworkDocument43 pagesGreen Paper: 2013 - 2015 Medium Term Expenditure FrameworkChola MukangaNo ratings yet

- CPI ConstructionDocument108 pagesCPI Constructiondookie328No ratings yet

- Two Approaches Toward Fixing Fares For Public Transportation System The Case of West BengalDocument18 pagesTwo Approaches Toward Fixing Fares For Public Transportation System The Case of West BengalAnupam GhoshNo ratings yet

- CBC Book ENDocument638 pagesCBC Book ENgiorgosNo ratings yet

- Academy ForumIAS Prelims Test 10 Dec 22Document197 pagesAcademy ForumIAS Prelims Test 10 Dec 22Shoukath ShaikNo ratings yet

- Economics of Gold Price Movement-Forecasting Analysis Using Macro-Economic, Investor Fear and Investor Behavior FeaturesDocument2 pagesEconomics of Gold Price Movement-Forecasting Analysis Using Macro-Economic, Investor Fear and Investor Behavior FeaturesSpeculation OnlyNo ratings yet

- RG146 Pocket GuideDocument30 pagesRG146 Pocket GuideMentor RG146No ratings yet

- 2024 01 03 Trim Strategy - January EffectDocument8 pages2024 01 03 Trim Strategy - January EffectMuhammad Bagus ArdiwiyatnaNo ratings yet

- Inflation, Unemp and Phillips Curve - CoreDocument51 pagesInflation, Unemp and Phillips Curve - CoreVisheshGuptaNo ratings yet

- CPI - PR - 12 Sept 19Document5 pagesCPI - PR - 12 Sept 19parmeshwar mahatoNo ratings yet

- IKT1102 Problem Set 1 PDFDocument6 pagesIKT1102 Problem Set 1 PDFIulia IonNo ratings yet

- 76082Document171 pages76082al_crespo_2No ratings yet

- Yearly Inflation Rates of PakistanDocument3 pagesYearly Inflation Rates of Pakistanfiyajee100% (1)

- Inflasie Augustus 2014Document10 pagesInflasie Augustus 2014Netwerk24SakeNo ratings yet

- 4 Cpi PDFDocument21 pages4 Cpi PDFNirjon BhowmicNo ratings yet

- Inflation - Group TaskDocument8 pagesInflation - Group TaskSơn TháiNo ratings yet

- Chap 1 - 4 - AnswersDocument31 pagesChap 1 - 4 - AnswersHải Nguyễn VănNo ratings yet

- Macro Assignment No 1 (Zarak Khan CMS 40535)Document8 pagesMacro Assignment No 1 (Zarak Khan CMS 40535)Khan QuettaNo ratings yet

- PS 05 Fama French 1988Document29 pagesPS 05 Fama French 1988Leon LöppertNo ratings yet

- Chemical Engineering Plant Cost Index Ei 201102Document6 pagesChemical Engineering Plant Cost Index Ei 201102Ahmad AlbetarNo ratings yet

- IndexDocument48 pagesIndexAldito MedinaNo ratings yet