Professional Documents

Culture Documents

FFS Ep1a

FFS Ep1a

Uploaded by

Navin IndranCopyright:

Available Formats

You might also like

- Planned Preventive Maintenance Schedule Template Excel DownloadDocument2 pagesPlanned Preventive Maintenance Schedule Template Excel Downloadotilia_alexandru_179% (24)

- The Single Family Office BookDocument289 pagesThe Single Family Office BookCode Cloud100% (2)

- Mutual Fund NISM VA Question BankDocument12 pagesMutual Fund NISM VA Question Banksimplypaisa89% (19)

- How To Trade - Book Review - Kenneth L. Grant, Trading RiskDocument3 pagesHow To Trade - Book Review - Kenneth L. Grant, Trading RiskHome Options TradingNo ratings yet

- Overview of The Philippine Financial SystemDocument3 pagesOverview of The Philippine Financial Systemzilla62% (13)

- John T. Reed - The Biggest Mistakes Real Estate Investors MakeDocument4 pagesJohn T. Reed - The Biggest Mistakes Real Estate Investors MakeDenis100% (1)

- Monthly Fund Performance Update Aia International Small Cap FundDocument1 pageMonthly Fund Performance Update Aia International Small Cap FundLam Kah MengNo ratings yet

- Indian Stock Market Decade of Growth 2010 2020 ReportDocument36 pagesIndian Stock Market Decade of Growth 2010 2020 ReportshashanksaranNo ratings yet

- 2017 08 16 - ID Finance Presentation PDFDocument12 pages2017 08 16 - ID Finance Presentation PDFJuan Daniel Garcia VeigaNo ratings yet

- T - Mar 23Document1 pageT - Mar 23coureNo ratings yet

- Investment Approach Through Active Funds: June 2022Document18 pagesInvestment Approach Through Active Funds: June 2022BharatNo ratings yet

- Eet - Mar 23Document2 pagesEet - Mar 23coureNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.07.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.07.15 PDFgeorgevarsasNo ratings yet

- AEOA PMS Factsheet Sep2023Document5 pagesAEOA PMS Factsheet Sep2023nuthan.10986No ratings yet

- Al Ahli Bank of Kuwait - Egypt - MMF - November 2017 - English - Monthly ReportDocument1 pageAl Ahli Bank of Kuwait - Egypt - MMF - November 2017 - English - Monthly ReportSobolNo ratings yet

- Roster Kerja HSE Tofu AgustusDocument4 pagesRoster Kerja HSE Tofu AgustusYusuf NugrohoNo ratings yet

- 95 - Emerging India Portfolio-March2019 - Final Email VersionDocument22 pages95 - Emerging India Portfolio-March2019 - Final Email VersionTarunAnandaniNo ratings yet

- Willingness To Communicate in The Second LanguageDocument6 pagesWillingness To Communicate in The Second LanguageAfifahAbdullahNo ratings yet

- MEF Analysis UI Claims - March 2020Document2 pagesMEF Analysis UI Claims - March 2020Dave AllenNo ratings yet

- 2019-05 Monthly Housing Market OutlookDocument35 pages2019-05 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Dolat Capital Modi Era S Century An AnalysisDocument21 pagesDolat Capital Modi Era S Century An AnalysisRohan ShahNo ratings yet

- Time Sheet - Janaury2018 ShahidDocument56 pagesTime Sheet - Janaury2018 ShahidJunaidNo ratings yet

- Inflation Rates: The Cost of LivingDocument6 pagesInflation Rates: The Cost of LivingAnonymous QKHeLscy2kNo ratings yet

- 2019-04 Monthly Housing Market OutlookDocument35 pages2019-04 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Outlook For The SMSF SectorDocument13 pagesOutlook For The SMSF SectorRomeoNo ratings yet

- Fatigue Management Roster - ProjectDocument1 pageFatigue Management Roster - ProjectNIJESHNo ratings yet

- Atalonia The Difficult Path Towards Independence: Sebastian D. Baglioni Carleton University March 11, 2015Document16 pagesAtalonia The Difficult Path Towards Independence: Sebastian D. Baglioni Carleton University March 11, 2015Haeshan NiyarepolaNo ratings yet

- Roster Off Dep - Plant Per 26 Juni SD 25 JuliDocument1 pageRoster Off Dep - Plant Per 26 Juni SD 25 JuliMuhammad AfdalNo ratings yet

- Indian Stock Market AnalysisDocument36 pagesIndian Stock Market AnalysisTushar GangolyNo ratings yet

- Eclectica Absolute Macro Fund: Manager CommentDocument3 pagesEclectica Absolute Macro Fund: Manager Commentfreemind3682No ratings yet

- Athenian-Shipbrokers-May 2016Document17 pagesAthenian-Shipbrokers-May 2016Nguyen Le Thu HaNo ratings yet

- Weekends Goal Actual: Lancaster Church FaçadeDocument5 pagesWeekends Goal Actual: Lancaster Church FaçadeKristinNo ratings yet

- Tareas Del Salon SeptiembreDocument16 pagesTareas Del Salon Septiembrealan.rojas.huescaNo ratings yet

- Exam Time Table: 2016-2018 Batch (Term III) : # Code Section Course ListDocument1 pageExam Time Table: 2016-2018 Batch (Term III) : # Code Section Course ListKiran MishraNo ratings yet

- B.SC Eng. Academic Calendar - 2022 (Rev. 28-09-2021)Document1 pageB.SC Eng. Academic Calendar - 2022 (Rev. 28-09-2021)chamod kariyawasamNo ratings yet

- Example of Malaysia CCC Inspection Required PeriodDocument1 pageExample of Malaysia CCC Inspection Required PeriodBenson Ng - DCANo ratings yet

- Tracking Financial ConditionsDocument14 pagesTracking Financial ConditionsSathishNo ratings yet

- FE Exam - Study ScheduleDocument23 pagesFE Exam - Study ScheduletjclydesdaleNo ratings yet

- Residential Construction ScheduleDocument2 pagesResidential Construction Schedulefinus marcalNo ratings yet

- B.SC Eng. Academic Calendar - 2022Document1 pageB.SC Eng. Academic Calendar - 2022kalana charukaNo ratings yet

- B.SC Eng. Academic Calendar - 2024Document1 pageB.SC Eng. Academic Calendar - 2024Thilini ApsaraNo ratings yet

- 2019-02 Monthly Housing Market OutlookDocument28 pages2019-02 Monthly Housing Market OutlookC.A.R. Research & Economics0% (1)

- Design Team Plan Schedule Work From Home: Event List NoDocument2 pagesDesign Team Plan Schedule Work From Home: Event List Nobudug19No ratings yet

- Sirgut Tesfaye - VA Employment Work Plan - 27.06.2022. - PROJECT PLANDocument3 pagesSirgut Tesfaye - VA Employment Work Plan - 27.06.2022. - PROJECT PLANSirgut TesfayeNo ratings yet

- Using Big Data To Improve Clinical CareDocument32 pagesUsing Big Data To Improve Clinical CareXiaodong WangNo ratings yet

- Edelweiss Professional Investor Research Diwali Picks 2019 FundamentalDocument7 pagesEdelweiss Professional Investor Research Diwali Picks 2019 FundamentalSandip DasNo ratings yet

- Athenian-Shipbrokers-March 2013Document19 pagesAthenian-Shipbrokers-March 2013Nguyen Le Thu HaNo ratings yet

- 2016 UoM CalanderDocument1 page2016 UoM CalanderKasun WeerasingheNo ratings yet

- B.SC Eng. Academic Calendar - 2025 - 1Document1 pageB.SC Eng. Academic Calendar - 2025 - 1Thilini ApsaraNo ratings yet

- 2021-02 Monthly Housing Market OutlookDocument29 pages2021-02 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- B.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)Document1 pageB.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)IT'S Fake IDNo ratings yet

- B.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)Document1 pageB.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)IT'S Fake IDNo ratings yet

- W99 Lifting Station Work PlanningDocument1 pageW99 Lifting Station Work PlanningAmar AizadNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0005Document11 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0005dicky muharamNo ratings yet

- 2013 - Calendar 1Document1 page2013 - Calendar 1Chanuka WickramasingheNo ratings yet

- Assignment Supply Chain ManagementDocument3 pagesAssignment Supply Chain ManagementEagle FightwearNo ratings yet

- Athenian Shipbrokers - Monthy Report - 13.12.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 13.12.15 PDFgeorgevarsasNo ratings yet

- Goldman Asia Conviction Call Catch-Up 13sep10Document11 pagesGoldman Asia Conviction Call Catch-Up 13sep10tanmartinNo ratings yet

- 2016 - Calendar 1Document1 page2016 - Calendar 1Chanuka WickramasingheNo ratings yet

- Exel For Res10Document4 pagesExel For Res10LiaNo ratings yet

- Athenian Shipbrokers - Monthy Report - 13.11.15 PDFDocument20 pagesAthenian Shipbrokers - Monthy Report - 13.11.15 PDFgeorgevarsas0% (1)

- Equity Debt Strategy For Mar20Document25 pagesEquity Debt Strategy For Mar20Saad KhanNo ratings yet

- Money Market in BangladeshDocument34 pagesMoney Market in Bangladeshjubaida khanamNo ratings yet

- QC LeipoDocument11 pagesQC Leipoanne fornolesNo ratings yet

- Investing YieldnodesDocument33 pagesInvesting YieldnodesVicard GibbingsNo ratings yet

- Zomato LTD.: Investing Key To Compounding Long Term GrowthDocument5 pagesZomato LTD.: Investing Key To Compounding Long Term GrowthAvinash GollaNo ratings yet

- KFC Project CorpDocument14 pagesKFC Project CorpShreyaNo ratings yet

- Macroeconomic PrinciplesDocument128 pagesMacroeconomic PrinciplesTsitsi Abigail100% (2)

- Testbank SolutionsDocument58 pagesTestbank SolutionsAnda MiaNo ratings yet

- Stock MarketDocument11 pagesStock MarketJessamine PanedaNo ratings yet

- Lesson 5 Efficient Securities Market, Accounting Issues, Implications & Economic ConsiderationsDocument28 pagesLesson 5 Efficient Securities Market, Accounting Issues, Implications & Economic ConsiderationsDerek DadzieNo ratings yet

- Financial Summary - : Sakshi Dhar Saurabh NayakDocument12 pagesFinancial Summary - : Sakshi Dhar Saurabh NayakIndra Nag PrasadNo ratings yet

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- JP Morgan FDI PDFDocument6 pagesJP Morgan FDI PDFMohit S MehtaNo ratings yet

- Case Study - Valuation of Ultra Tech CementDocument26 pagesCase Study - Valuation of Ultra Tech CementKoushik BiswasNo ratings yet

- Anti Takeover MeasuresDocument54 pagesAnti Takeover MeasuresParvesh Aghi50% (2)

- Investing Principles - Financial UDocument80 pagesInvesting Principles - Financial UK4NO100% (1)

- Ra 3779: Savings and Loans Association ActDocument12 pagesRa 3779: Savings and Loans Association ActJohn Jay AguilarNo ratings yet

- The ICE U.S. Dollar Index and US Dollar Index Futures ContractsDocument8 pagesThe ICE U.S. Dollar Index and US Dollar Index Futures ContractsDark CygnusNo ratings yet

- Fabm 2-8Document33 pagesFabm 2-8Janine BalcuevaNo ratings yet

- Chapter 5 NotesDocument8 pagesChapter 5 NotesBecca HanNo ratings yet

- Tradimo Cheat SheetDocument1 pageTradimo Cheat SheetChendrean Teofil100% (1)

- Ultimate Trading InformationDocument3 pagesUltimate Trading InformationAnonymous 2HXuAeNo ratings yet

- AS 16 Borrowing CostsDocument16 pagesAS 16 Borrowing CostsRENU PALINo ratings yet

- Case Study IPO Capital Market Alibaba - Deva Fabiola - IBDocument1 pageCase Study IPO Capital Market Alibaba - Deva Fabiola - IBBucin YoungbloodNo ratings yet

- Financial Institutions Instruments and Markets 8th Edition Viney Solutions ManualDocument35 pagesFinancial Institutions Instruments and Markets 8th Edition Viney Solutions Manualchicanerdarterfeyq100% (31)

- Amara Raja Batteries LTD Tirupathi: Narayana Engineering CollegeDocument19 pagesAmara Raja Batteries LTD Tirupathi: Narayana Engineering CollegeBhuvana Analapudi100% (1)

FFS Ep1a

FFS Ep1a

Uploaded by

Navin IndranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FFS Ep1a

FFS Ep1a

Uploaded by

Navin IndranCopyright:

Available Formats

AIA Bhd.

200701032867 (790895-D)

October 2022

MONTHLY FUND PERFORMANCE UPDATE

AIA GLOBAL BALANCED FUND (previously known as AIA Eleven Plus Fund)

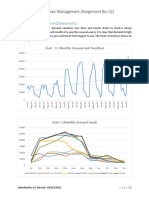

Investment Objective Historical Performance

The primary goal of this Fund is to provide long-term total return (combination of 1.20

capital growth and income) with moderate risk by investing through exposure in AIA Global Balanced Fund

a diversified portfolio of global equities and fixed income securities. It is also 1.00 Benchmark

flexible by allowing investments in newer funds launched in the future. The Fund

adopts a relatively balanced approach towards equities and bond exposure with 0.80

the aim of providing stable growth of your investment. The Fund’s expected

average exposure to equities will be approximately 60% over the long term, 0.60

however this exposure may vary from time to time and can go up to 80%. The

balance is invested in the fixed income or money market instruments. 0.40

0.20

Notice: Please refer to the Fund Fact Sheet for more information about the

Jan-11

Jun-21

Jun-08

Feb-09

Jun-10

Sep-11

May-12

Jan-13

Sep-13

Dec-14

Aug-15

Nov-16

Nov-18

Feb-20

Feb-22

Oct-07

Oct-09

Apr-16

Jul-17

Jul-19

Mar-18

Oct-20

Oct-22

Apr-14

Fund.

Fund Details

Unit NAV (31 Oct 2022) : RM 0.95558 Cumulative Since

1-Mth 6-Mth 1-Year 3-Year 5-Year Inception

Fund Size (31 Oct 2022) : RM 206.242 million Performance

Fund Currency : Ringgit Malaysia Fund~ 3.55% -4.33% -11.67% 6.52% 5.59% 91.12%

Fund Inception : 25 October 2007 Benchmark* 6.18% -1.21% N/A N/A N/A N/A

Offer Price at Inception : RM 0.50 Excess -2.63% -3.12% NA NA NA NA

Fund Management Charge : 1.50% p.a ~ Calculation of past performance is based on NAV-to-NAV. This is strictly the performance of the

investment fund, and not the returns earned on the actual premiums/contributions paid of the

Investment Manager : AIA Bhd. investment-linked product.

Fund Type : Fund of Funds * Prior to fund restructuring effective from January 2022, there was no benchmark available. Post

restructuring the benchmark is 60.0% MSCI World Price Index + 40.0% Barclays Global Aggregate

Basic of Unit Valuation : Net Asset Value Corporate Total Return Index (Source: Bloomberg). Calculation of the benchmark since inception

Frequency of Unit Valuation : Daily performance is based on the date the fund restructuring exercise was completed which is 31 January

2022. Meanwhile, calculation of the Fund’s since inception performance is based on the Fund's

inception date of 25 October 2007.

Underlying Fund Details

Notice: Past performance of the Fund is not an indication of its future performance.

AIA Global Multi-Factor Equity Fund

AIA Diversified Fixed Income Fund

Market Review

Name : AIA Asia Ex Japan Equity Fund

Global equities rebounded in October, ending the month with a 16.7% loss on a Year-to-Date (“YTD”)

AIA Greater China Equity Fund basis. Developed market (“DM”) equities registered strong returns, while emerging markets (“EM”)

AIA India Equity Fund were dragged lower by China. Chinese equities fell sharply as markets grew increasingly anxious

Investment Manager : AIA Investment Management Private Ltd. about the state of China’s economy and the direction of governance and policies following a

reshuffling in President Xi Jinping’s leadership team. Purchasing managers’ indices (“PMI”) for

October indicated that global economic growth continued to slow, pushing the world’s economies

Top Fund Holdings closer to recession. A combination of strong labour markets and the unrelenting rise in inflation kept

most central banks on track for additional interest-rate hikes. However, the Bank of Japan (“BOJ”)

1 AIA Global Multi-Factor Equity Fund 48.84% maintained its ultra-easy policy settings even as core inflation accelerated to an eight-year high and

a slumping Japanese yen (“JPY”) pushed up import costs. Global supply-chain disruptions eased,

2 AIA Diversified Fixed Income Fund 38.38%

although geopolitical tensions heightened as the war in Ukraine escalated and global trade relations

were stressed. The US government published a sweeping set of export controls on advanced

3 AIA Asia Ex Japan Equity Fund 8.89%

computing and semiconductor manufacturing technologies to China, which could amount to the

largest shift in US policy on technology exports to China since the 1990s. The Organization of the

Fund Allocation Petroleum Exporting Countries (“OPEC+”) agreed to its biggest oil production cut since the onset of

the COVID-19 pandemic, slashing output by two million barrels per day. The European Commission

(“EC”) proposed new measures to improve stability in Europe’s gas markets and to mitigate the

Cash & others , 3.89% impact of high prices on households and businesses.

AIA Asia Ex Japan

Equity Fund, 8.89% Strong labour markets and high inflation continued to put pressure on the US Federal Reserve (“Fed”)

over the month. While non-farm payrolls fell short of street estimates, the unemployment rate

dropped to 3.5% while wages continued to rise. The US Job Openings and Labor Turnover Survey

(“JOLTS”) data, on the other hand, showed a sharp drop in job openings which may represent an

early sign that the labour market is beginning to cool. The Consumer Price Index (“CPI”) printed a

surprise to the upside yet again with core inflation notably moving up to 6.6%, a new 40-year high.

The strong advance was led by service inflation which saw strength across all categories including

the shelter, medical, and transportation sectors. The combination of strong labour and inflation data

cemented the market’s view that the Fed would hike rates by 75bps in November and led to a selloff

in rates with the 2Y and 10Y US Treasury (“UST”) yields reaching levels not seen in over 14 years.

Elsewhere the UK Prime Minister, Liz Truss, resigned from office less than two months after

assuming the post and following a chaotic period where her plans for large unfunded tax cuts sparked

market turmoil and forced a total policy reversal. Against this backdrop, the Bloomberg US

Investment Grade Credit Index was unchanged at 147bps, resulting in a monthly excess returns of

53bps. In respect to corporate earnings, with a little over half of S&P 500 companies reporting, 71%

have reported positive earnings per share (“EPS”) surprises while 68% have reported positive

revenue surprises. Thus far, the Year-over-Year (“YoY”) earnings growth rate for the quarter is 2.2%

AIA Diversified Fixed which is below analysts’ estimates and represents the lowest earnings growth rate since 3Q2020. In

AIA Global Multi-Factor the primary market, supply which printed USD104.2 billion was led by financials. As at YTD, the

Income Fund , 38.38%

Equity Fund , 48.84% supply is trailing last year’s issuance by about 14% as heightened rate volatility and high concessions

have made it more difficult for issuers to come to market. Over the month, the best best-performing

sectors were Oil Field Services, Cable Satellite, Food & Beverage, Independent Energy and Refining.

The worst-performing sectors were REITs, Foreign Local Govt, Supermarkets, Packaging and

Supranationals. Amongst rating cohorts, BBB rated bonds fared the best, while A rated bonds fared

the worst.

Lipper Leader Fund for:

Market Outlook

1. Total Return

In view of the bearish view on the equity market, the Fund currently maintains an overweight to lower

2. Consistent Return beta styles, such as Minimum Volatility, High Dividend, Quality and Value with the view that these

factors should outperform the core index under a macro context of weaker growth (or recession) and

Lipper uses a ranking system of 1 to 5. A ranking of 5 means the fund is in the top 20% of Fed tightening. These factors should also be able to provide some downside protection during equity

funds in that category while a ranking of 1 means the fund is in the bottom 20%. sell-off events as well as provide diversification benefits within a portfolio construction context.

Source: www.lipperleaders.com

As for the fixed income market, as we approach the end of the rate hike cycle, we will continue to

adopt a more cautious approach towards credits while positioning for long-term opportunities.

This document is for informational use only. Investments are subject to investment risks including the possible loss of the principal amount invested. The value of the units may

fall as well as rise. Past performance of the fund is not an indication of its future performance. This is not a pure investment product such as unit trust and please evaluate the

options carefully and satisfy that the Investment-Linked Insurance / Takaful plan chosen meets your risk appetite. Please refer to the Fund Fact Sheet for more information

about the fund.

You might also like

- Planned Preventive Maintenance Schedule Template Excel DownloadDocument2 pagesPlanned Preventive Maintenance Schedule Template Excel Downloadotilia_alexandru_179% (24)

- The Single Family Office BookDocument289 pagesThe Single Family Office BookCode Cloud100% (2)

- Mutual Fund NISM VA Question BankDocument12 pagesMutual Fund NISM VA Question Banksimplypaisa89% (19)

- How To Trade - Book Review - Kenneth L. Grant, Trading RiskDocument3 pagesHow To Trade - Book Review - Kenneth L. Grant, Trading RiskHome Options TradingNo ratings yet

- Overview of The Philippine Financial SystemDocument3 pagesOverview of The Philippine Financial Systemzilla62% (13)

- John T. Reed - The Biggest Mistakes Real Estate Investors MakeDocument4 pagesJohn T. Reed - The Biggest Mistakes Real Estate Investors MakeDenis100% (1)

- Monthly Fund Performance Update Aia International Small Cap FundDocument1 pageMonthly Fund Performance Update Aia International Small Cap FundLam Kah MengNo ratings yet

- Indian Stock Market Decade of Growth 2010 2020 ReportDocument36 pagesIndian Stock Market Decade of Growth 2010 2020 ReportshashanksaranNo ratings yet

- 2017 08 16 - ID Finance Presentation PDFDocument12 pages2017 08 16 - ID Finance Presentation PDFJuan Daniel Garcia VeigaNo ratings yet

- T - Mar 23Document1 pageT - Mar 23coureNo ratings yet

- Investment Approach Through Active Funds: June 2022Document18 pagesInvestment Approach Through Active Funds: June 2022BharatNo ratings yet

- Eet - Mar 23Document2 pagesEet - Mar 23coureNo ratings yet

- Athenian Shipbrokers - Monthy Report - 14.07.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 14.07.15 PDFgeorgevarsasNo ratings yet

- AEOA PMS Factsheet Sep2023Document5 pagesAEOA PMS Factsheet Sep2023nuthan.10986No ratings yet

- Al Ahli Bank of Kuwait - Egypt - MMF - November 2017 - English - Monthly ReportDocument1 pageAl Ahli Bank of Kuwait - Egypt - MMF - November 2017 - English - Monthly ReportSobolNo ratings yet

- Roster Kerja HSE Tofu AgustusDocument4 pagesRoster Kerja HSE Tofu AgustusYusuf NugrohoNo ratings yet

- 95 - Emerging India Portfolio-March2019 - Final Email VersionDocument22 pages95 - Emerging India Portfolio-March2019 - Final Email VersionTarunAnandaniNo ratings yet

- Willingness To Communicate in The Second LanguageDocument6 pagesWillingness To Communicate in The Second LanguageAfifahAbdullahNo ratings yet

- MEF Analysis UI Claims - March 2020Document2 pagesMEF Analysis UI Claims - March 2020Dave AllenNo ratings yet

- 2019-05 Monthly Housing Market OutlookDocument35 pages2019-05 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- Dolat Capital Modi Era S Century An AnalysisDocument21 pagesDolat Capital Modi Era S Century An AnalysisRohan ShahNo ratings yet

- Time Sheet - Janaury2018 ShahidDocument56 pagesTime Sheet - Janaury2018 ShahidJunaidNo ratings yet

- Inflation Rates: The Cost of LivingDocument6 pagesInflation Rates: The Cost of LivingAnonymous QKHeLscy2kNo ratings yet

- 2019-04 Monthly Housing Market OutlookDocument35 pages2019-04 Monthly Housing Market OutlookC.A.R. Research & Economics100% (1)

- Outlook For The SMSF SectorDocument13 pagesOutlook For The SMSF SectorRomeoNo ratings yet

- Fatigue Management Roster - ProjectDocument1 pageFatigue Management Roster - ProjectNIJESHNo ratings yet

- Atalonia The Difficult Path Towards Independence: Sebastian D. Baglioni Carleton University March 11, 2015Document16 pagesAtalonia The Difficult Path Towards Independence: Sebastian D. Baglioni Carleton University March 11, 2015Haeshan NiyarepolaNo ratings yet

- Roster Off Dep - Plant Per 26 Juni SD 25 JuliDocument1 pageRoster Off Dep - Plant Per 26 Juni SD 25 JuliMuhammad AfdalNo ratings yet

- Indian Stock Market AnalysisDocument36 pagesIndian Stock Market AnalysisTushar GangolyNo ratings yet

- Eclectica Absolute Macro Fund: Manager CommentDocument3 pagesEclectica Absolute Macro Fund: Manager Commentfreemind3682No ratings yet

- Athenian-Shipbrokers-May 2016Document17 pagesAthenian-Shipbrokers-May 2016Nguyen Le Thu HaNo ratings yet

- Weekends Goal Actual: Lancaster Church FaçadeDocument5 pagesWeekends Goal Actual: Lancaster Church FaçadeKristinNo ratings yet

- Tareas Del Salon SeptiembreDocument16 pagesTareas Del Salon Septiembrealan.rojas.huescaNo ratings yet

- Exam Time Table: 2016-2018 Batch (Term III) : # Code Section Course ListDocument1 pageExam Time Table: 2016-2018 Batch (Term III) : # Code Section Course ListKiran MishraNo ratings yet

- B.SC Eng. Academic Calendar - 2022 (Rev. 28-09-2021)Document1 pageB.SC Eng. Academic Calendar - 2022 (Rev. 28-09-2021)chamod kariyawasamNo ratings yet

- Example of Malaysia CCC Inspection Required PeriodDocument1 pageExample of Malaysia CCC Inspection Required PeriodBenson Ng - DCANo ratings yet

- Tracking Financial ConditionsDocument14 pagesTracking Financial ConditionsSathishNo ratings yet

- FE Exam - Study ScheduleDocument23 pagesFE Exam - Study ScheduletjclydesdaleNo ratings yet

- Residential Construction ScheduleDocument2 pagesResidential Construction Schedulefinus marcalNo ratings yet

- B.SC Eng. Academic Calendar - 2022Document1 pageB.SC Eng. Academic Calendar - 2022kalana charukaNo ratings yet

- B.SC Eng. Academic Calendar - 2024Document1 pageB.SC Eng. Academic Calendar - 2024Thilini ApsaraNo ratings yet

- 2019-02 Monthly Housing Market OutlookDocument28 pages2019-02 Monthly Housing Market OutlookC.A.R. Research & Economics0% (1)

- Design Team Plan Schedule Work From Home: Event List NoDocument2 pagesDesign Team Plan Schedule Work From Home: Event List Nobudug19No ratings yet

- Sirgut Tesfaye - VA Employment Work Plan - 27.06.2022. - PROJECT PLANDocument3 pagesSirgut Tesfaye - VA Employment Work Plan - 27.06.2022. - PROJECT PLANSirgut TesfayeNo ratings yet

- Using Big Data To Improve Clinical CareDocument32 pagesUsing Big Data To Improve Clinical CareXiaodong WangNo ratings yet

- Edelweiss Professional Investor Research Diwali Picks 2019 FundamentalDocument7 pagesEdelweiss Professional Investor Research Diwali Picks 2019 FundamentalSandip DasNo ratings yet

- Athenian-Shipbrokers-March 2013Document19 pagesAthenian-Shipbrokers-March 2013Nguyen Le Thu HaNo ratings yet

- 2016 UoM CalanderDocument1 page2016 UoM CalanderKasun WeerasingheNo ratings yet

- B.SC Eng. Academic Calendar - 2025 - 1Document1 pageB.SC Eng. Academic Calendar - 2025 - 1Thilini ApsaraNo ratings yet

- 2021-02 Monthly Housing Market OutlookDocument29 pages2021-02 Monthly Housing Market OutlookC.A.R. Research & EconomicsNo ratings yet

- B.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)Document1 pageB.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)IT'S Fake IDNo ratings yet

- B.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)Document1 pageB.SC Eng. Academic Calendar - 2021 (Rev. 28-09-2021)IT'S Fake IDNo ratings yet

- W99 Lifting Station Work PlanningDocument1 pageW99 Lifting Station Work PlanningAmar AizadNo ratings yet

- Grain and Feed Update - Bangkok - Thailand - TH2023-0005Document11 pagesGrain and Feed Update - Bangkok - Thailand - TH2023-0005dicky muharamNo ratings yet

- 2013 - Calendar 1Document1 page2013 - Calendar 1Chanuka WickramasingheNo ratings yet

- Assignment Supply Chain ManagementDocument3 pagesAssignment Supply Chain ManagementEagle FightwearNo ratings yet

- Athenian Shipbrokers - Monthy Report - 13.12.15 PDFDocument18 pagesAthenian Shipbrokers - Monthy Report - 13.12.15 PDFgeorgevarsasNo ratings yet

- Goldman Asia Conviction Call Catch-Up 13sep10Document11 pagesGoldman Asia Conviction Call Catch-Up 13sep10tanmartinNo ratings yet

- 2016 - Calendar 1Document1 page2016 - Calendar 1Chanuka WickramasingheNo ratings yet

- Exel For Res10Document4 pagesExel For Res10LiaNo ratings yet

- Athenian Shipbrokers - Monthy Report - 13.11.15 PDFDocument20 pagesAthenian Shipbrokers - Monthy Report - 13.11.15 PDFgeorgevarsas0% (1)

- Equity Debt Strategy For Mar20Document25 pagesEquity Debt Strategy For Mar20Saad KhanNo ratings yet

- Money Market in BangladeshDocument34 pagesMoney Market in Bangladeshjubaida khanamNo ratings yet

- QC LeipoDocument11 pagesQC Leipoanne fornolesNo ratings yet

- Investing YieldnodesDocument33 pagesInvesting YieldnodesVicard GibbingsNo ratings yet

- Zomato LTD.: Investing Key To Compounding Long Term GrowthDocument5 pagesZomato LTD.: Investing Key To Compounding Long Term GrowthAvinash GollaNo ratings yet

- KFC Project CorpDocument14 pagesKFC Project CorpShreyaNo ratings yet

- Macroeconomic PrinciplesDocument128 pagesMacroeconomic PrinciplesTsitsi Abigail100% (2)

- Testbank SolutionsDocument58 pagesTestbank SolutionsAnda MiaNo ratings yet

- Stock MarketDocument11 pagesStock MarketJessamine PanedaNo ratings yet

- Lesson 5 Efficient Securities Market, Accounting Issues, Implications & Economic ConsiderationsDocument28 pagesLesson 5 Efficient Securities Market, Accounting Issues, Implications & Economic ConsiderationsDerek DadzieNo ratings yet

- Financial Summary - : Sakshi Dhar Saurabh NayakDocument12 pagesFinancial Summary - : Sakshi Dhar Saurabh NayakIndra Nag PrasadNo ratings yet

- Income Statement: Quarterly Financials For Toyota Motor Corporation ADSDocument7 pagesIncome Statement: Quarterly Financials For Toyota Motor Corporation ADSneenakm22No ratings yet

- JP Morgan FDI PDFDocument6 pagesJP Morgan FDI PDFMohit S MehtaNo ratings yet

- Case Study - Valuation of Ultra Tech CementDocument26 pagesCase Study - Valuation of Ultra Tech CementKoushik BiswasNo ratings yet

- Anti Takeover MeasuresDocument54 pagesAnti Takeover MeasuresParvesh Aghi50% (2)

- Investing Principles - Financial UDocument80 pagesInvesting Principles - Financial UK4NO100% (1)

- Ra 3779: Savings and Loans Association ActDocument12 pagesRa 3779: Savings and Loans Association ActJohn Jay AguilarNo ratings yet

- The ICE U.S. Dollar Index and US Dollar Index Futures ContractsDocument8 pagesThe ICE U.S. Dollar Index and US Dollar Index Futures ContractsDark CygnusNo ratings yet

- Fabm 2-8Document33 pagesFabm 2-8Janine BalcuevaNo ratings yet

- Chapter 5 NotesDocument8 pagesChapter 5 NotesBecca HanNo ratings yet

- Tradimo Cheat SheetDocument1 pageTradimo Cheat SheetChendrean Teofil100% (1)

- Ultimate Trading InformationDocument3 pagesUltimate Trading InformationAnonymous 2HXuAeNo ratings yet

- AS 16 Borrowing CostsDocument16 pagesAS 16 Borrowing CostsRENU PALINo ratings yet

- Case Study IPO Capital Market Alibaba - Deva Fabiola - IBDocument1 pageCase Study IPO Capital Market Alibaba - Deva Fabiola - IBBucin YoungbloodNo ratings yet

- Financial Institutions Instruments and Markets 8th Edition Viney Solutions ManualDocument35 pagesFinancial Institutions Instruments and Markets 8th Edition Viney Solutions Manualchicanerdarterfeyq100% (31)

- Amara Raja Batteries LTD Tirupathi: Narayana Engineering CollegeDocument19 pagesAmara Raja Batteries LTD Tirupathi: Narayana Engineering CollegeBhuvana Analapudi100% (1)