Professional Documents

Culture Documents

Sanghi Industries Limited Vs CCE and ST Rajkot 150CS201724051716293740COM126547

Sanghi Industries Limited Vs CCE and ST Rajkot 150CS201724051716293740COM126547

Uploaded by

Rıtesha DasOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sanghi Industries Limited Vs CCE and ST Rajkot 150CS201724051716293740COM126547

Sanghi Industries Limited Vs CCE and ST Rajkot 150CS201724051716293740COM126547

Uploaded by

Rıtesha DasCopyright:

Available Formats

MANU/CS/0074/2017Equivalent Citation: 2018(361)ELT909(Tri. - Ahmd.

)

IN THE CUSTOMS, EXCISE AND SERVICE TAX APPELLATE TRIBUNAL

WEST ZONAL BENCH, AHMEDABAD

E/237/2010-DB (Arising out of OIO-23-29-COMMR-2009 dated 06/01/2009 passed by

Commissioner of Central Excise-RAJKOT), E/900/2011-DB (Arising out of OIO-37-

50/COMMR/2011 dated 31/03/2011 passed by Commissioner of Central Excise, Customs

and Service Tax-RAJKOT), E/981/2011-DB (Arising out of OIO-37-50/COMMR/2011

dated 31/03/2011 passed by Commissioner of Central Excise, Customs and Service Tax-

RAJKOT), E/982/2011-DB (Arising out of OIA-37-50/COMMR/2011 dated 31/03/2011

passed by Commissioner of Central Excise, Customs and Service Tax-RAJKOT),

E/983/2011-DB (Arising out of OIO-37-50/COMMR/2011 dated 31/03/2011 passed by

Commissioner of Central Excise, Customs and Service Tax-RAJKOT), E/984/2011-DB

(Arising out of OIO-37-50/COMMR/2011 dated 31/03/2011 passed by Commissioner of

Central Excise, Customs and Service Tax-RAJKOT), E/985/2011-DB (Arising out of OIO-

37-50/COMMR/2011 dated 31/03/2011 passed by Commissioner of Central Excise,

Customs and Service Tax-RAJKOT), E/986/2011-DB (Arising out of OIO-37-

50/COMMR/2011 dated 31/03/2011 passed by Commissioner of Central Excise, Customs

and Service Tax-RAJKOT), E/987/2011-DB (Arising out of OIO-37-50/COMMR/2011

dated 31/03/2011 passed by Commissioner of Central Excise, Customs and Service Tax-

RAJKOT), E/988/2011-DB (Arising out of OIO-37-50/COMMR/2011 dated 31/03/2011

passed by Commissioner of Central Excise, Customs and Service Tax-RAJKOT),

E/989/2011-DB (Arising out of OIO-37-50/COMMR/2011 dated 31/03/2011 passed by

Commissioner of Central Excise, Customs and Service Tax-RAJKOT), E/990/2011-DB

(Arising out of OIO-37-50/COMMR/2011 dated 31/03/2011 passed by Commissioner of

Central Excise, Customs and Service Tax-RAJKOT), E/991/2011-DB (Arising out of OIO-

37-50/COMMR/2011 dated 31/03/2011 passed by Commissioner of Central Excise,

Customs and Service Tax-RAJKOT), E/992/2011-DB (Arising out of OIO-37-

50/COMMR/2011 dated 31/03/2011 passed by Commissioner of Central Excise, Customs

and Service Tax-RAJKOT), E/993/2011-DB (Arising out of OIO-37-50/COMMR/2011

dated 31/03/2011 passed by Commissioner of Central Excise, Customs and Service Tax-

RAJKOT) and E/994/2011-DB (Arising out of OIO-37-50/COMMR/2011 dated

31/03/2011 passed by Commissioner of Central Excise, Customs and Service Tax-

RAJKOT) and Order Nos. A/10962-10977/2017

Decided On: 15.05.2017

Appellants: Sanghi Industries Limited

Vs.

Respondent: C.C.E. & S.T., Rajkot

Hon'ble Judges/Coram:

Dr. D.M. Misra, Member (J) and Ashok K. Arya, Member (T)

Counsels:

For Appellant/Petitioner/Plaintiff: R. Nambi Rajan and Anand Nainawati, Advocates

For Respondents/Defendant: Sameer Chitkara, A.R. (Addl. Commissioner)

Case Note:

Excise - Duty demand - Concessional rate - Rule 2A of Standards of Weights &

Measures (Packaged Commodities) Rules, 1977 - Present appeal filed against

orders confirming demand of differential duty on goods sold - Whether

07-06-2023 (Page 1 of 10) www.manupatra.com Symbiosis University

concessional rate of duty as per Notification would not be applicable to sales

made to/for builders, developers, contractors and construction firms,

manufacturers of finished goods, captive consumption - Held, issue was

squarely covered by Tribunal decisions - Sales made to various categories of

buyers are covered under Rule 2A of Rules, 1977 - Such goods are eligible for

benefit of Notification - Impugned orders were modified - Appeal allowed. [4],

[4.6] and[5]

Facts:

SIL/Assessee-manufacturer was engaged in the manufacture of ordinary

Portland Cement falling under Chapter Heading No. 2523 of First Schedule to

Central Excise Tariff Act, 1985. SIL cleared cement in packed form to various

consumers. The Assessee-manufacturer claims that these buyers were

covered by the definition of industrial consumer or institutional consumer

under explanation to Rule 2A Standards of Weights & Measures (Packaged

Commodities) Rules, 1977 and Rule 3(ii) of Packaged Commodities Rules,

2011. The Assessee-manufacturer claimed that in terms of Rule 2A(b) of the

Standards of Weights & Measures (Packaged Commodities) Rules, 1977 and in

terms of Rule 3(ii) of PC Rules in respect of packages of commodities meant

for industrial consumers or institutional consumers, the requirement of

declaring MRP on the packages was not applicable. On all such bags of cement

cleared to the following category of buyers, the Assessee did not declare MRP

and specifically declared as Project Supply Not for Resale.

The Assessee had cleared cement to these buyers on concessional rate of duty

availing the benefit in terms of Sr. No. 1C of the Notification as amended from

time to time. The Assessee claims that the aforesaid entry 1C of the

Notification provides concessional rate of excise duty for cement cleared in

package of 50 kg bags where there is no requirement to declare retail sale

price on such bags. In other words, cement bags of 50 kg cleared to Industrial

or Institutional consumer are eligible for concessional rate of duty. The

Revenue initiated investigation against the Assessee. The Department issued

a total of 21 Show Cause Notices and demanded differential Central Excise

duty by denying the benefit of concessional rate of duty as provided in Sr. No.

1C of Notification as amended during the relevant period.

Seven Show Cause Notices were adjudicated and 14 Show Cause Notices

were adjudicated later on. Both the impugned Orders-in-Original confirmed

the demand of differential duty on the goods sold. Hence, the present appeal.

Held:

Applicability of concessional rate of duty:

(i) The issue was squarely covered by the Tribunal decisions. The sales made

to various categories of buyers are covered under Rule 2A of Rules, 1977 and

such goods are eligible for the benefit of Notification. The impugned orders

were modified. [4],[4.6] and[5]

ORDER

Ashok K. Arya, Member (T)

07-06-2023 (Page 2 of 10) www.manupatra.com Symbiosis University

1 . M/s. Sanghi Industries Ltd. (SIL) has filed two appeals (E/237/2010 and

E/900/2011). Appeal No. E/237/2010 is filed against OIO No. 23-29/Commr/2009, dt.

06.01.2009 and appeal No. E/900/2011 is filed against OIO No. 37-50/Commr/2011, dt.

31.03.2011, both passed by Commissioner of C.Ex. & S. Tax, Rajkot.

1.1 Revenue has also filed 14 Cross Appeals (No. E/981-994/2011) against OIO No.

37-50/Commr/2011, dt. 31.03.2011.

1 .2 As the subject matter in all these appeal cases is common, therefore these are

being decided by this common order.

2. The brief facts are that:-

i) M/s. SIL, an assessee-manufacturer inter alia, is engaged in the manufacture

of ordinary Portland Cement falling under Chapter Heading No. 2523 of First

Schedule to Central Excise Tariff Act, 1985.

ii) M/s. SIL cleared cement in packed form (in 50 kg bags), inter alia, to

various consumers like builders/developers, industrial manufacturers who used

cement for construction or as raw material. The assessee-manufacturer claims

that these buyers are covered by the definition of industrial consumer or

institutional consumer under explanation to Rule 2A Standards of Weights &

Measures (Packaged Commodities) Rules, 1977 and Rule 3(ii) of Packaged

Commodities Rules, 2011.

iii) The assessee-manufacturer M/s. SIL claims that in terms of Rule 2A(b) of

the Standards of Weights & Measures (Packaged Commodities) Rules, 1977 and

in terms of Rule 3(ii) of PC Rules in respect of packages of commodities meant

for industrial consumers or institutional consumers, the requirement of

declaring MRP on the packages is not applicable. On all such bags of cement

cleared to the following category of buyers, the assessee did not declare MRP

and specifically declared as Project Supply Not for Resale:-

a) Social, religious and charitable organizations,

b) Builders, developers, contractors and construction firms,

c) Infrastructural development projects,

d) Government bodies,

e) Manufacturers of finished goods

f) Captive consumption

iv) During the period March 2007 to January 2010, the Assessee had, inter alia,

cleared cement in 50 kg bags to the aforesaid buyers on concessional rate of

duty availing the benefit in terms of Sr. No. 1C of the Notification No. 4/2006-

CE : MANU/EXCT/0008/2006, dt. 01.03.2006 as amended from time to time.

v) The assessee claims that the aforesaid entry 1C of the Notification provides

concessional rate of excise duty for cement cleared in package of 50 kg bags

where there is no requirement to declare retail sale price on such bags. In other

words, cement bags of 50 kg cleared to Industrial or Institutional consumer are

eligible for concessional rate of duty.

07-06-2023 (Page 3 of 10) www.manupatra.com Symbiosis University

vi) The Revenue initiated investigation against the assessee mainly on the

following grounds:-

a) that the exemption was availed by the assessee M/s. SIL by treating

the aforesaid category of buyers as bulk buyers, without categorizing

them as to whether they are industrial or institutional consumers or

not.

b) that majority buyers had consumed the cement cleared by the

appellants for civil construction activities or residential complexes or

for industrial building construction for themselves.

c) that M/s. SIL have violated the statutory provisions of affixing Retail

Sale Price (RSP) on their packaged commodity while clearing cement

with intent to pocket undue profit.

d) that M/s. SIL wrongly cleared cement on payment of concessional

rate of duty in the guise of buyers being institutional consumers or

industrial consumers.

e) that M/s. SIL have intentionally and deliberately misstated the facts

by considering their bulk buyers as institutional consumers which is not

applicable in the present facts and circumstances of the case and

wrongly availed the benefit of concessional rate of duty.

vii) In view of the above, the Department issued a total of 21 Show Cause

Notices during March 2007 to January 2010 and demanded differential Central

Excise duty by denying the benefit of concessional rate of duty as provided in

Sr. No. 1C of Notification No. 4/2006-CE : MANU/EXCT/0008/2006 as amended

during the relevant period.

viii) Seven Show Cause Notices issued for the period March 2007 to November

2008 were adjudicated by OIO No. 23-29/Commr/2009, dt. 11.11.2009 and 14

Show Cause Notices issued for the period December 2008 to January 2010 were

adjudicated by OIO No. 37-50/Commr/2011, dt. 31.03.2011.

ix) Both the aforesaid impugned Orders-in-Original have confirmed the demand

of differential duty on the goods sold to the following categories of buyers:-

a) Social, religious and charitable organizations,

b) Infrastructural development projects,

c) Government bodies,

and dropped the demand of duty on the goods sold to the remaining

categories.

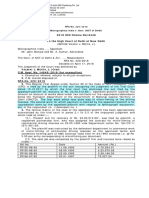

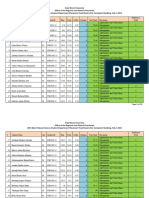

x) The status of the demands raised in the Show Cause Notices pursuant to the

aforesaid impugned Orders-in-Original dt. 11.11.2009 and 31.03.2011 are as

follows:-

OIO No. Demand Demand Department

upheld dropped appealed

OIO No. 23-Rs. Rs. No

07-06-2023 (Page 4 of 10) www.manupatra.com Symbiosis University

OIO No. 23-Rs. Rs. No

29/Commr/2009, 5,06,37,480/- 8,39,57,101/-

dt. 11.11.2009

OIO No. 37-Rs. Rs. Yes

50/Commr/2011, 11,29,12,698/- 5,87,99,884/-

dt. 31.03.2011

xi) To the extent that the demand of duty of Rs. 5,06,37,480/- was confirmed

by the OIO dt. 11.11.2009, the assessee M/s. Sanghi Industries Ltd. (M/s. SIL)

has filed Appeal No. E/237/2010. To the extent that the demand of duty of Rs.

11,29,12,698/- was confirmed by the OIO dt. 31.03.2011, the assessee M/s.

SIL has filed Appeal No. E/900/2011.

xii) For the demand of duty of Rs. 5,87,99,884/- dropped by the OIO dt.

31.03.2011, the Department has filed Appeal Nos. E/981-994/2011.

3. With the background of above facts, both sides i.e. the assessee-manufacturer M/s.

SIL represented by Shri R. Nambirajan, Shri Anand Nainawati, learned Advocates and

the Revenue represented by Shri Sameer Chitkara, the learned A.R. have been heard.

4 . After careful observation of the facts on record and the submissions of both the

sides, it appears that there is no dispute that the assessee-manufacturer is clearing the

goods viz. Cement to various bulk buyers in package form of 50 kg bag with specific

declaration on the bag Not for Resale and goods are not meant for further retail sale

therefrom; but are to be consumed by buyers for their own use. It has been claimed by

the assessee that as per the provisions of Rule 2A(b) of the Standards of Weights &

Measures (Packaged Commodities) Rules, 1977, the goods were cleared to the buyers

which are covered under the category of industrial/institutional buyers mentioned at (a)

and (b) of the explanation to Rule 2A of SWM Rules. The goods were cleared by paying

duty @ Rs. 400 PMT for every consignment meant for institutional and industrial buyers.

4.1 Revenue's stand is that subject supplies/sales, though declared as Not for Resale

are not covered under Rule 2A of SWM Rules, therefore, concessional rate of duty as per

Notification No. 4/2006-CE : MANU/EXCT/0008/2006 Sr. No. 1(b) or 1(c) will not be

applicable to sales made to/for builders, developers, contractors and construction firms,

manufacturers of finished goods, captive consumption.

4 .2 The Department vide the impugned Orders-in-original has denied the benefit of

Notification No. 4/2006-CE : MANU/EXCT/0008/2006 under its Sr. No. 1(C) for the

sales made to following 3 categories of bulk buyers:-

i) Social/Educational, religious and charitable organizations

ii) Infrastructural development projects

iii) Government bodies

i) Social/Educational, religious and charitable organizations:-These

organizations have bought cement for use in construction of buildings,

hospitals, community halls, educational centres etc for providing the services to

the public. It has also been submitted that if above activities/projects are not

considered as service industry, the construction activity undertaken by these

buyers is for production etc and they will be industrial consumers. Considering

these facts, we are of the view that this category of buyers appear to be rightly

covered under the category of institutional consumer.

07-06-2023 (Page 5 of 10) www.manupatra.com Symbiosis University

ii) Infrastructural development projects:-There cannot be two opinions that the

buyers in this category would be covered under the category of institutional

consumer; as infrastructure development projects are integrally linked with the

construction industry, which is in the category of a service industry.

iii) Government bodies:-The facts on record mention that the bulk buyer here is

Gujarat Government's GSCSCL (Gujarat State Civil Supply Corporation Ltd.,)

who is working as a nodal agency for procuring cement for supply to

Government offices/Boards/Corporation for their development and

infrastructure works as per the indent received from the concerned department.

Such supplies to GSCSCL appear to be covered under the category of supplies

to institutional consumers as these are used for construction activity by such

entities of Gujarat Government.

4.3 In case of other three categories of buyers (i) Builders, Developers, Contractors and

Construction Firms which includes category of (ii) Captive consumption and (iii)

Manufacturers of finished goods, the impugned orders allowed the benefit of

Notification No. 4/2006-CE : MANU/EXCT/0008/2006 (supra), with which we agree with

the reasons given therein.

4.4 The present matter is covered by the Tribunal's decisions in the cases of Ambuja

Cement Ltd. Vs. CCE Raipur MANU/CE/0101/2016 : 2017 (1) TMI 1130-CESTAT New

Delhi, Shree Cement Ltd. Vs. CCE Jaipur MANU/CE/0822/2016 : 2016 (12) TMI 25-

CESTAT New Delhi, Prism Cement Ltd. Vs. CCE Bhopal MANU/CE/0427/2016 : 2016

(10) TMI 828 CESTAT New Delhi. In the decision of Shree Cement Ltd., reference has

also been made to the decisions made in the cases of Jayanti Food Processing (P) Ltd.

Vs. CCE, Rajasthan MANU/SC/3474/2007 : 2007 (215) ELT 327 (SC), Swan Sweets Pvt.

Ltd. Vs. CCE Rajkot 2006 (198) ELT 565 (Tri-Mum) as affirmed by Hon'ble Supreme

Court in CCE Rajkot Vs. Makson Confectionary Pvt. Ltd. MANU/SC/0995/2010 : 2010

(259) ELT 5 (SC). The CESTAT in the case of Ambuja Cements Ltd. Vs. CCE Raipur-

MANU/CE/0101/2016 : 2017 (1) TMI 1130 (supra) observes as follows:-

3 . The brief facts are that the appellant is engaged in the manufacture of

Cement and Clinker falling under Chapter Heading 252329 and was clearing the

same, inter alia, to various buyers in 50 kg bags. Such buyers included

manufacturer of excisable items, construction service providers, Government

Department and Charitable institutions/trusts. Some of the cement was also

used for self-consumption and for quality control. During the period of dispute,

Appellant had cleared 62673.633 MT cement by discharging duty liability at the

concessional rate of Rs. 400/- PMT as prescribed under Sl. No. 1C of

Notification No. 4/2006-CE : MANU/EXCT/0008/2006 (as amended). Relevant

part of the Notification is as follows:-

(Table)

S. No.

Chapter or heading or sub-heading or tariff item of the first schedule

Description of excisable goods

Rate

Condition No.

07-06-2023 (Page 6 of 10) www.manupatra.com Symbiosis University

(1)

(2)

(3)

(4)

(5)

1C

252329

All goods, whether or not manufactured in a mini cement plant, not

covered in S. No. 1B, other than those cleared in packaged form:

Explanation for the purpose of Sl. Nos. 1, 1A, 1B and 1C,-

mini cement plant means -

(i)

(ii)

2.

retail sale price means

Provided

Provided

Provided also that where the retail sale price of the goods are not

required to be declared under the Standards of Weights and Measures

(Packaged Commodities) Rule, 1977, and thus not declared, the duty

shall be determined as is in the case of goods cleared in other than

packaged from: Rs. 400 per tone

4. After careful consideration of the facts of the case and the submissions of both the

sides, it appears that the issue is squarely covered by CESTAT decisions in the case of

Grasim Industries Ltd. Vs. Commissioner of Central Excise, Trichi 2008-TIOL-2328-

CESTAT-Mad and Heidelberg Cement (India) Ltd. and M/s. Ultra Tech Cement Ltd. Vs.

CCE Nagpur, Raigad 2014-TIOL-1433 (CESTAT Mum). CESTAT Bombay in the case of

Heidelberg Cement (India) Ltd. and M/s. Ultra Tech Cement Ltd. (supra) in its Paras 5.4

and 5.6 observes as under:-

5.4 There is no dispute that the goods were sold by the appellant directly to

the builders/developers/Ready Mix Concrete (RMC) manufacturers. RMC is an

excisable product and therefore, the sale of cement for manufacture of RMC

would definitely come within the category of sale to industrial consumers. As

regards builders/developers etc., construction activity is a service activity as is

well understood and there is also a Service Tax levy on construction activity.

Therefore, sale to such builders/developers would certainly qualify as sale to

institutional consumers. The argument of the Revenue that since the sale is not

to consumers like transportation, airways, railways, hotels, hospitals and any

07-06-2023 (Page 7 of 10) www.manupatra.com Symbiosis University

other service institution and since the builders/developers have not been

specifically included and, therefore, such sale would not qualify as sale to

institutional consumer is bereft of logic because only certain service providers

have been specifically mentioned therein; others are covered by the expression

like and any other service institution similar to those specifically mentioned.

The institutional consumers mentioned are transportation, hotels and hospitals

which do not form any particular class. Therefore, the principle of ejusdem

generis will not apply. Any service institution would qualify as institutional

consumers.

5.5.

5.6 In the Grasim Industries case (supra), this issue was specifically examined

by this Tribunal & it was held as follows:-

As rightly pointed out by the learned Counsel, as the benefit offered

under the Notification pertains to goods cleared to

industrial/institutional consumers and as this aspect was overlooked by

the Legal Metrology expert as also by the learned Commissioner, the

impugned order is liable to be set aside. The Board's clarification on

the relevant question was wrongly by-passed by the adjudicating

authority. We have found favour with the assessee's case in view of the

clarification issued by the C.B.E. & C., which is to the effect that no

RSP requires to be printed on the goods sold to industrial/institutional

consumers as defined under the rules framed under the Standards of

Weights and Measures Act and that such goods would be covered under

Sl. No. 1B or 1C of Notification No. 4/2006-C.E. :

MANU/EXCT/0008/2006, by virtue of the Second Proviso to the

Explanation to SI. No. 1C of the Notification as amended. The Board's

clarification squarely covers the case in favour of the assessee.

Further, in the case of Mysore Cement Ltd. - 2010 (249) E.L.T. 398,

this Tribunal held that construction industry is a service industry and

benefit claimed by the appellants under the aforesaid Notifications shall

be admissible. The said decision was upheld by the Hon'ble High Court

of Karnataka (supra). Again in the case of India Cement Ltd. -2009-

TIOL-1464-CESTAT-MAD : 2009 (235) E.L.T. 145 (T), it was held that

cement cleared to industrial/institutional consumers in 50 kg bags are

eligible for the benefit of Notification No. 4/2006 :

MANU/EXCT/0008/2006 under Sr. No.1C. Thus it can be seen that this

Tribunal as also the High Court have been consistently holding that

institutional/industrial consumers are eligible for the benefit of

Notification No. 4/2006 : MANU/EXCT/0008/2006 and Notification No.

12/2012.

4.1 As facts are similar to the facts of the decisions quoted above; therefore, following

the decisions in the case of Grasim Industries Ltd. (supra) and Heidelberg Cement

(India) Ltd. and M/s. Ultra Tech Cement Ltd. (supra), the appellant would be eligible for

the benefit of Notification No. 4/2006 : MANU/EXCT/0008/2006 under Sr. No. 1C of the

table annexed to it.

4.5 Further, the Tribunal in the case of M/s. Prism Cement Ltd. Vs. CCE Bhopal (supra)

observes as under:-

07-06-2023 (Page 8 of 10) www.manupatra.com Symbiosis University

3 . The applicability of concessional rate for the cement cleared to builders in

construction industry and educational institution have been subject matter of

decision by this Tribunal. In Heidelberg Cements (India) Ltd. M/s. Ultra Tech

Cement Ltd. Vs. CCE, Nagpur, Raigad 2014 TIOL-1433-CESTAT-MUM, the

Tribunal held that any service institution would qualify as institutional

consumer, builders, developers were held to be eligible for coverage in the said

category. The Tribunal in the case of Grasim Industries Ltd. Vs. CCE, Trichy

2009 (238) ELT 655 (Tri-Che) relied on the Board clarification dt. 12.06.2008

to hold that Government companies, construction companies and other

industrial/institutional consumers were eligible for such concessional rate of

duty. The Tribunal in appellant's own case vide Final Order No. 54122/2014, dt.

13.10.2014 held that when there is no requirement to declaration the RSP on

the package in terms of Packaged Commodities Rules, 1977 the goods should

be treated as if cleared in other than packaged form and the concessional rate

of duty in terms of Entry 1C should be eligible. The Tribunal was deciding the

issue of RSP and the concession under the said Notification for exported

cement.

4 . We find that the original authority found that hospitals, co-operative

societies, temples cannot be considered under the category of institutional or

industrial consumers. We find the reasoning given by the original authority

those schools, educational institutions and hospitals are not service industry in

terms of Rule 2A of the Packaged Commodities Rules, 1977 is not tenable. The

institutional consumer means those consumers who buy cement directly from

the manufacturers for service industry like transportation including airway,

railway, hotel or any other similar service industry. We find that educational

institutions and hospitals are directly buying cement from the assessee-

appellant and rightly eligible for concessional rate of duty as service institution.

Even if it is considered that these institutions do not come under the category

of other similar service industry, as per Rules, the fact remains that the sale to

these institutions are not covered by the definition of retail sale as per Rule

2(q) of the said Rules. Admittedly, the cement without marking of RSP has been

sold by the assessee-appellant directly to these consumers and as such these

transactions does not qualify as retail sale in view of the statutory definition

which requires sale, distribution or delivery of such commodity through retail

sale agency or other instrumentality for consumption by an individual. In the

present case, admittedly, the sale being direct without any intermediary

involved, the criteria for retail sale has not been fulfilled. As such we find

wherever such direct sale is effected the application of Packaged Commodities

Rules, 1977 will not be governed by Rule 3 for enforcement.

5 . In view of the above position, We find that the denial of the concession in

terms of the above said notification for the assessee-appellant on these grounds

is not justifiable.

4.6 From above discussions, and the decisions cited, we are of the considered view that

the sales made to various categories of buyers are covered under Rule 2A of SWM

Rules, 1977 and such goods are eligible for the benefit of Notification No. 4/2006-CE :

MANU/EXCT/0008/2006 (supra).

5. In the result, the impugned Orders No. 23-29/Commr/2009, dt. 06.01.2009 and No.

37-50/Commr/2011, dt. 31.03.2011 are modified to above effect and the appeals filed

by assessee M/s. Sanghi Industries Ltd. are allowed and the appeals filed by the

07-06-2023 (Page 9 of 10) www.manupatra.com Symbiosis University

Revenue are rejected.

(Pronounced in the Court on 15.05.2017).

(Table) This

judgments has been sourced from the court website. The tables in the

judgment may not be aligned.

© Manupatra Information Solutions Pvt. Ltd.

07-06-2023 (Page 10 of 10) www.manupatra.com Symbiosis University

You might also like

- Consumer Court Written Argument On Electricity Supplier DeficiencyDocument10 pagesConsumer Court Written Argument On Electricity Supplier DeficiencySridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್95% (19)

- Tài Liệu Tham Khảo Part 7Document29 pagesTài Liệu Tham Khảo Part 7cdeNo ratings yet

- Open Letter To President Ramaphosa - FinalDocument3 pagesOpen Letter To President Ramaphosa - FinalTiso Blackstar GroupNo ratings yet

- 15-Book-S3 Fluency in Telephone English & Sectoral English - UnlockedDocument103 pages15-Book-S3 Fluency in Telephone English & Sectoral English - UnlockedCESAR REINA100% (3)

- Heidelberg Cement India LTD Vs Commissioner of Cenq140293COM838303Document9 pagesHeidelberg Cement India LTD Vs Commissioner of Cenq140293COM838303Rıtesha DasNo ratings yet

- Ultra Tech Cement LTD Vs CCE and STSuratI 20102022CS202206122217414622COM702359Document8 pagesUltra Tech Cement LTD Vs CCE and STSuratI 20102022CS202206122217414622COM702359Rıtesha DasNo ratings yet

- Caselaw of Balrampur Chini Mills - HCDocument9 pagesCaselaw of Balrampur Chini Mills - HCbmatinvestNo ratings yet

- Ponmani Industries Vs Commissioner of GST and CentCC202312052317515540COM932723Document7 pagesPonmani Industries Vs Commissioner of GST and CentCC202312052317515540COM932723Rıtesha DasNo ratings yet

- Harman Bawa Private LTD Vs CCE and ST ChandigarhI CJ201708121716030729COM590874Document6 pagesHarman Bawa Private LTD Vs CCE and ST ChandigarhI CJ201708121716030729COM590874Rıtesha DasNo ratings yet

- Amazing Cases in Excise DutyDocument74 pagesAmazing Cases in Excise DutyritesscribdNo ratings yet

- Indian Oil Corporation LTDDocument7 pagesIndian Oil Corporation LTDJubin DasNo ratings yet

- Prism Cement Limited Vs CCE Bhopal 28092016 CESTACE201614101615134028COM719728Document4 pagesPrism Cement Limited Vs CCE Bhopal 28092016 CESTACE201614101615134028COM719728Rıtesha DasNo ratings yet

- 2012 2 140 Triblr PDFDocument19 pages2012 2 140 Triblr PDFJoseph EbinNo ratings yet

- 2023 (5) TMI 806 - AT - M - S Ambuja Cements LTD Versus Commissioner of Customs Central Excise..Document13 pages2023 (5) TMI 806 - AT - M - S Ambuja Cements LTD Versus Commissioner of Customs Central Excise..ABHINo ratings yet

- Psi-2007 GRDocument29 pagesPsi-2007 GRapurv1988No ratings yet

- Century Appeal 01 Dated 17.05.2021Document36 pagesCentury Appeal 01 Dated 17.05.2021NM JHANWAR & ASSOCIATESNo ratings yet

- So We Can Create Good Reputation of The Company Rural Market, That's Why There Is Lack of Awareness in PeopleDocument11 pagesSo We Can Create Good Reputation of The Company Rural Market, That's Why There Is Lack of Awareness in PeopleRoshani JoshiNo ratings yet

- IDT CASE LAW & Amendments For May 12 FinalDocument229 pagesIDT CASE LAW & Amendments For May 12 FinalRoopendra PrasadNo ratings yet

- 2017 11 23 LOA ITI LTD Smart MetersDocument108 pages2017 11 23 LOA ITI LTD Smart MetersSumedhGorghateNo ratings yet

- Unit 4Document29 pagesUnit 4arafatNo ratings yet

- Builders - Vs - Cement AssociationDocument3 pagesBuilders - Vs - Cement AssociationJahnavi GopaluniNo ratings yet

- NIT NO - PUR 8.66.IOF/0029 dtd.25/08/2018Document41 pagesNIT NO - PUR 8.66.IOF/0029 dtd.25/08/2018Jaswanth SunkaraNo ratings yet

- Case LawDocument21 pagesCase LawRam SskNo ratings yet

- Central Excise Laws Cases Compilation 2009Document5 pagesCentral Excise Laws Cases Compilation 2009Phani KiranNo ratings yet

- Builders Association of India and Ors Vs Union of D070468COM731175Document26 pagesBuilders Association of India and Ors Vs Union of D070468COM731175Arjun ParasharNo ratings yet

- Jagrriti PlasticDocument12 pagesJagrriti PlasticSatyaKamNo ratings yet

- H and R Johnson India LTD Vs Commissioner of C Ex q140100COM286252Document5 pagesH and R Johnson India LTD Vs Commissioner of C Ex q140100COM286252Rıtesha DasNo ratings yet

- Cerc 1Document53 pagesCerc 1kasturishivaNo ratings yet

- MCGM EoI BiominingDocument8 pagesMCGM EoI BiominingNish PandyaNo ratings yet

- Sec 4 Circular 67 2011 of 30novDocument3 pagesSec 4 Circular 67 2011 of 30novSreenu Garapati VcrcNo ratings yet

- CCL Final Submission Before CESTAT 07062023Document7 pagesCCL Final Submission Before CESTAT 07062023RISHAV KUMARNo ratings yet

- In Re:) Chapter 11) Collins & Aikman Corporation, Et Al.) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesDocument69 pagesIn Re:) Chapter 11) Collins & Aikman Corporation, Et Al.) Case No. 05-55927 (SWR) ) (Jointly Administered) Debtors.) ) (Tax Identification #13-3489233) ) ) Honorable Steven W. RhodesChapter 11 DocketsNo ratings yet

- Saurashtra Cement LTD and Ors Vs Commissioner of CG120578COM947298Document49 pagesSaurashtra Cement LTD and Ors Vs Commissioner of CG120578COM947298HashashinNo ratings yet

- 2011 (23) S.T.R. 400 (Tri. - Del.) : Espn Software (I) (P) Ltd. Commissioner of Service Tax, DelhiDocument5 pages2011 (23) S.T.R. 400 (Tri. - Del.) : Espn Software (I) (P) Ltd. Commissioner of Service Tax, Delhinewguyat77No ratings yet

- Customs: Notification Nos. Date Tariff Non-Tariff Central Excise Tariff Non-TariffDocument15 pagesCustoms: Notification Nos. Date Tariff Non-Tariff Central Excise Tariff Non-TariffsurampudiprasadNo ratings yet

- NDT Tender Document 20180057 1530873125Document29 pagesNDT Tender Document 20180057 1530873125bhimdiptiNo ratings yet

- Finance Bill, 2013Document52 pagesFinance Bill, 2013elinzolaNo ratings yet

- CLB 10 March April 2011Document8 pagesCLB 10 March April 2011amit.a.kekreNo ratings yet

- Maharashtra State Electricity Distribution Co. LTD: Commercial Circular No. 175Document32 pagesMaharashtra State Electricity Distribution Co. LTD: Commercial Circular No. 175Aditya MalviyaNo ratings yet

- 07) LMI On Prevention and Safe Clearing of Ash Build-Up in Boiler Bottom Ash HoppersDocument33 pages07) LMI On Prevention and Safe Clearing of Ash Build-Up in Boiler Bottom Ash Hoppersntpc bgtppNo ratings yet

- Customs, Excise & Service Tax Appellate Tribunal West Zonal Bench at AhmedabadDocument7 pagesCustoms, Excise & Service Tax Appellate Tribunal West Zonal Bench at AhmedabadcustomsrraahmedabadNo ratings yet

- So 197Document39 pagesSo 197manojkumarmurlidharaNo ratings yet

- Socialist Republic of VietnamDocument10 pagesSocialist Republic of VietnamQuỳnh NguyễnNo ratings yet

- Micrographics Vs NCT Delhi 2018 Delhi High CourtDocument7 pagesMicrographics Vs NCT Delhi 2018 Delhi High CourtVidhi SharmaNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument8 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCamille CastilloNo ratings yet

- Regional Bench - Court No.2: (Rajrappa, District - Ramgarh, Pin - 829150.)Document8 pagesRegional Bench - Court No.2: (Rajrappa, District - Ramgarh, Pin - 829150.)RISHAV KUMARNo ratings yet

- Corri 4Document11 pagesCorri 4anubhav.dasNo ratings yet

- Tendernotice - 1 - 2024-05-21T110441.774Document43 pagesTendernotice - 1 - 2024-05-21T110441.774managerNo ratings yet

- Surendra Singh Hada and Ors Vs Arafat PetrochemicaNC20211304211005522COM272178Document18 pagesSurendra Singh Hada and Ors Vs Arafat PetrochemicaNC20211304211005522COM272178Aastha SinghNo ratings yet

- Pallavi Refractories and Ors Vs Singareni Collieris050004COM905152Document6 pagesPallavi Refractories and Ors Vs Singareni Collieris050004COM905152shreesh chadhaNo ratings yet

- Soham Hospital and Medical Foundation Private LimitedDocument11 pagesSoham Hospital and Medical Foundation Private Limitedsaravananece90No ratings yet

- Small Scale Exemption SchemeDocument8 pagesSmall Scale Exemption SchemebakulhariaNo ratings yet

- WilconDocument24 pagesWilconMervin BritanicoNo ratings yet

- MOLEX INDIA PVT LTD Vs CCTDocument4 pagesMOLEX INDIA PVT LTD Vs CCTSHANTANU SINGHNo ratings yet

- Case Study 39Document9 pagesCase Study 39Aditya PrasadNo ratings yet

- White Paper EOIDocument31 pagesWhite Paper EOIAbhishek PantNo ratings yet

- Dr. Satish Chandra, J. (President) and B. Ravichandran, Member (T)Document2 pagesDr. Satish Chandra, J. (President) and B. Ravichandran, Member (T)Bhan WatiNo ratings yet

- Commissioner of Central Excise (Appeals), UTAARPRADESH Under Section 35 (1) of The Central Excise Act, 1944Document11 pagesCommissioner of Central Excise (Appeals), UTAARPRADESH Under Section 35 (1) of The Central Excise Act, 1944Aarav PrakashNo ratings yet

- 04 V605 - Shakambari Overseas Traders - ID-506881Document4 pages04 V605 - Shakambari Overseas Traders - ID-506881Vivek SharmaNo ratings yet

- Tender Dossier - Thermal CyclerDocument19 pagesTender Dossier - Thermal CyclerAndrea DimechNo ratings yet

- 201510161019246000666TCPR - 9th - Amendment - 2015 16.10Document8 pages201510161019246000666TCPR - 9th - Amendment - 2015 16.10swapnilvengNo ratings yet

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Dell International Services India PVT LTD Vs The IIL2022040522170528204COM311728Document30 pagesDell International Services India PVT LTD Vs The IIL2022040522170528204COM311728Rıtesha DasNo ratings yet

- Heidelberg Cement India LTD Vs Commissioner of Cenq140293COM838303Document9 pagesHeidelberg Cement India LTD Vs Commissioner of Cenq140293COM838303Rıtesha DasNo ratings yet

- OIO-KCH-EXCUS-000-COM-01-2021-22, UltraTech Cement Ltd.,23.04.2021Document37 pagesOIO-KCH-EXCUS-000-COM-01-2021-22, UltraTech Cement Ltd.,23.04.2021Rıtesha DasNo ratings yet

- In Re Sri Lakshminarasimha Agro Products 17022023AR20231204231708305COM827281Document11 pagesIn Re Sri Lakshminarasimha Agro Products 17022023AR20231204231708305COM827281Rıtesha DasNo ratings yet

- Dolmen CIty REIT Annual Financial Statments-30-June-2017Document85 pagesDolmen CIty REIT Annual Financial Statments-30-June-2017FURQANNo ratings yet

- ROSARIO FS FinalDocument35 pagesROSARIO FS FinalMELE BOY ROSARIONo ratings yet

- Case StudyDocument5 pagesCase StudyPritamNo ratings yet

- Uganda Telecom Limited CourseworkDocument7 pagesUganda Telecom Limited CourseworkLillian KobusingyeNo ratings yet

- Hyundai Motors: Operations and Sourcing of Hyundai ProductsDocument15 pagesHyundai Motors: Operations and Sourcing of Hyundai ProductsAditya JaiswalNo ratings yet

- Isp542 Group Project Mac 23Document6 pagesIsp542 Group Project Mac 23fudaylNo ratings yet

- Unit Iv: Management OF Small BusinessDocument67 pagesUnit Iv: Management OF Small BusinessanjaliNo ratings yet

- 2015 Batch Natural Science Placement Result Final Feb 3, 2024Document13 pages2015 Batch Natural Science Placement Result Final Feb 3, 2024yohannisyohannis54No ratings yet

- Title Project Proposal On Edible Oil ProDocument29 pagesTitle Project Proposal On Edible Oil ProMedard SottaNo ratings yet

- What Is WIP?: 1. WIP of Cutting Section: Cutting Is Not A Very Complex Process, Generally, LessDocument2 pagesWhat Is WIP?: 1. WIP of Cutting Section: Cutting Is Not A Very Complex Process, Generally, LessMd SunnyNo ratings yet

- FDI Inflows To Automobile IndustryDocument7 pagesFDI Inflows To Automobile Industryomkarvp2002No ratings yet

- 7N8D Rishikesh Haridwar Dehradun Mussoorie AuliDocument13 pages7N8D Rishikesh Haridwar Dehradun Mussoorie AuliRoshanNo ratings yet

- Little Green BookDocument73 pagesLittle Green BookghedjioskNo ratings yet

- Gazette On Revision of Subjects and FunctionsDocument6 pagesGazette On Revision of Subjects and FunctionsAdaderana OnlineNo ratings yet

- Business CulminatingDocument25 pagesBusiness CulminatingHannah AlliNo ratings yet

- Status of Onshore Wind Energy Development in Germany - First Half of 2019 PDFDocument12 pagesStatus of Onshore Wind Energy Development in Germany - First Half of 2019 PDFMilton PintoNo ratings yet

- Directory: Dutch Chamber of Commerce SingaporeDocument51 pagesDirectory: Dutch Chamber of Commerce SingaporeBrian BajajNo ratings yet

- RBI Grade B Phase 1 2023 All Subjects FORMATTED 1Document111 pagesRBI Grade B Phase 1 2023 All Subjects FORMATTED 1choudharyrj2001No ratings yet

- Subsvornado Realty Trust 2020-UnlockedDocument9 pagesSubsvornado Realty Trust 2020-UnlockedastifjNo ratings yet

- 3 Fold - Welding Brochure - MVDocument2 pages3 Fold - Welding Brochure - MVShekhar Pratap SinghNo ratings yet

- Sustainable Cashmere From Mongolia - A Market AssessmentDocument16 pagesSustainable Cashmere From Mongolia - A Market AssessmentЗолоNo ratings yet

- VSLA Linkage With MFDocument46 pagesVSLA Linkage With MFSamuel Dawit RimaNo ratings yet

- Membership Application Form-NewDocument3 pagesMembership Application Form-NewMolla Saidul IslamNo ratings yet

- Chapter 7: International Production Networks (Ipns) and Global Value Chains (GVCS)Document39 pagesChapter 7: International Production Networks (Ipns) and Global Value Chains (GVCS)PARUL SINGH MBA 2019-21 (Delhi)No ratings yet

- On Mukesh AmbaniDocument17 pagesOn Mukesh Ambaniavinashunde70% (2)

- COURSE OUTLINE IN Republic Act 7942Document3 pagesCOURSE OUTLINE IN Republic Act 7942Stella BertilloNo ratings yet

- Wilmar AR2019Document196 pagesWilmar AR2019ViaashNo ratings yet