Professional Documents

Culture Documents

An Empirical Assessment of Real Activities Manipulation Measures

An Empirical Assessment of Real Activities Manipulation Measures

Uploaded by

Maher KhasawnehOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

An Empirical Assessment of Real Activities Manipulation Measures

An Empirical Assessment of Real Activities Manipulation Measures

Uploaded by

Maher KhasawnehCopyright:

Available Formats

An Empirical Assessment of Real Activities Manipulation Measures

Subprasiri (Jackie) Siriviriyakul

(Subprasiri.Siriviriyakul@uconn.edu)

University of Connecticut

Current Draft: December 2020

KEYWORDS: real activities manipulation; real earnings management; earnings manipulation;

earnings benchmarks.

JEL CLASSIFICATION: M41 and M1.

I greatly appreciate helpful comments and suggestions from Robert Bloomfield (the editor) and two anonymous

reviewers. This paper is based on my dissertation, and I would like to thank my dissertation committee: Patricia

Dechow (Chair), Richard Sloan, Panos Patatoukas, and Stefano DellaVigna for their comments and continued

guidance. I am particularly grateful to Felicity Jane Barton for her copyediting service. I also thank Sunil Dutta, Yaniv

Konchitchki, Alastair Lawrence, Heemin Lee, Carol Marquardt, Alexander Nezlobin, Sugata Roychowdhury, Xiao-

Jun Zhang, and the seminar participants at the University of California at Berkeley, Drexel University, Pennsylvania

State University, University of Connecticut, Rice University, Rutgers University, Baruch College, and Yale

University. All errors and omissions are my own.

Subprasiri (Jackie) Siriviriyakul, University of Connecticut, School of Business, Stamford, CT 06901.

Electronic copy available at: https://ssrn.com/abstract=2359813

An Empirical Assessment of Real Activities Manipulation Measures

ABSTRACT

I empirically assess the extent to which real earnings management metrics capture

opportunistic behavior versus firms’ fundamental factors such as performance. For the traditional

proxies proposed by Roychowdhury (2006), I find (1) the economic magnitude of the proxies to

be high relative to two relevant benchmarks; (2) they exhibit persistence; and (3) they vary

predictably with performance. These findings suggest that the traditional proxies likely capture

opportunistic behavior but also likely reflect fundamental factors. I also examine several adjusted

proxies based on refinements proposed by subsequent studies. I find that those proposed by Vorst

(2016) and those based on Kothari, Mizik, and Roychowdhury (2016) seem to be the most effective

at attenuating correlation with underlying fundamentals. Additional simulation tests on bias and

power reveal that, between the two adjusted proxies, those based on Kothari et al.’s (2016) are

generally more preferable.

KEYWORDS: real activities manipulation; real earnings management; earnings

manipulation; earnings benchmarks.

JEL CLASSIFICATION: M41 and M1.

Electronic copy available at: https://ssrn.com/abstract=2359813

I. INTRODUCTION

Real activities manipulation or real earnings management (hereafter called “REM”) is the

distortion of reported earnings through managers’ strategic adjustments of a variety of operating

activities. REM and accrual-based earnings management have the common objective of

misleading stakeholders about the underlying performance of a company. However, the

mechanisms through which managers distort earnings are inherently different. While accruals-based

earnings management is achieved through managerial judgment in applying GAAP, REM is achieved

by altering the real activities of the company, not the accounting policies. Evidence suggests that

REM is widely practiced by managers (Graham et al. 2005), with important implications for

scholars and practitioners alike.

In a seminal paper, Roychowdhury (2006) develops an empirical method to detect REM,

focusing on sales manipulation, overproduction, and reduction in discretionary expenses as the

primary ways of engaging in REM. The method relies on the decomposition of the actual level

of an operating activity into a normal component and an abnormal component. Conceptually, the

normal component represents the outcome of managers’ optimal decisions, given the underlying

fundamentals of the company (hereafter called “fundamental factors”). The abnormal component,

conversely, represents a deviation from the optimal. This deviation is the REM proxy for the

activity in question, which is construed as a myopic response by managers intended to distort

reported earnings. The approach led to a voluminous literature on the determinants and

consequences of REM (DeFond 2010).1

1

See, for example, Cohen et al. 2008; Cohen and Zarowin 2010; Taylor and Xu 2010; McInnis and Collins 2011;

Zang 2012; McGuire et al. 2012; Zhao et al. 2012; Wongsunwai 2013; Kim and Park 2014; Alhadab et al. 2015;

Chan, Chen, Chen, and Yu 2015; Cheng, Lee, and Shevlin 2016; Francis, Hasan, and Li 2016; Black, Christensen,

Electronic copy available at: https://ssrn.com/abstract=2359813

Despite the methodological contribution, estimating REM proxies following the spirit of

Roychowdhury (2006) comes with an important shortcoming: both normal and abnormal

components are estimated, not directly observed by the researcher. Thus, the extent to which any

REM proxy capture actual REM is inextricably linked to the extent that the normal component

reflects the fundamental factors. The natural implication is that any research question associating

REM and other constructs is inherently a joint test of two hypotheses: (1) the validity of the

mechanism conjectured by the researcher and (2) the premise that the REM proxy properly

captures the actual REM.

Motivated by this limitation, in this paper I investigate the extent to which

Roychowdhury’s (2006) traditional REM proxies and subsequent refinements capture

opportunistic behavior versus firms’ fundamental factors. Specifically, I empirically assess three

attributes of REM proxies: (1) their economic magnitude, (2) their time-series properties, and (3)

their association with (observable) economic fundamentals.

My first finding is that the magnitudes of the traditional REM proxies are high relative to

the two relevant benchmarks: their actual total levels and their normal levels, while the

magnitudes of the adjusted proxies based on the reversal-based model (Vorst 2016) and the time-

series-adjusted model (Kothari et al. 2016) are reliably lower. This suggests that the two adjusted

proxies are less subject to misspecification errors compared to the traditional proxies.

I perform two analyses with respect to the second attribute, time-series properties: a

Joo, and Schmardebeck 2017; Kim, Kim and Zhou 2017; Bonacchi, Cipollini, and Zarowin 2018; Bereskin, Hsu,

and Rotenberg 2018; Khurana, Pereira, and Zhang 2018.

Electronic copy available at: https://ssrn.com/abstract=2359813

transition matrix and a test for serial correlation. 2 The transition matrix provides more granular

evidence based on REM magnitudes, evidence that is further corroborated in the serial correlation

tests. Specifically, the transition matrices show that the traditional proxies exhibit persistence

(although to a lesser extent than the normal components in some cases), while the adjusted proxies

based on the reversal-based model and the time-series-adjusted model do not. Additional analysis

reveals that the traditional proxies are persistent up to four years into the future (although the

extent varies across the three forms of REM). The serial correlation test shows that the fraction

of firms whose traditional REM proxies exhibit positive serial correlation is relatively high, while

the adjustments from the reversal-based model and time-series-adjusted model reduce the

positive serial correlation for a significant number of firms in my sample. Based on the premise

that underlying REM is transitory, these findings corroborate the use of the two adjusted proxies

in future work.

Finally, I examine how the traditional and adjusted REM proxies vary with firm

performance, namely firms’ income. Scatter plots show that the traditional REM proxies vary

with income, while the adjusted proxies from the reversal-based model and the time-series-

adjusted model do not. The finding suggests that the two adjusted proxies capture actual REM,

since fundamental factors, by nature, co-vary with performance. In addition, since income

summarizes the economic fundamentals of a company, a possible justification for statistical

association between REM proxies and firms’ performance, albeit far from conclusive, is model

misspecification. That is, the presence (absence) of correlation with fundamentals may imply that

the measure captures a higher (lower) degree of fundamental factors.

2

For the transition matrix, I partition observations into REM magnitude quintiles and examine the probabilities that

an observation in a given quintile will stay in the same quintile or move into another quintile in the following year.

Electronic copy available at: https://ssrn.com/abstract=2359813

The prior analyses suggest that the traditional proxies may be misspecified more severely

than the adjusted proxies. However, they might still be more powerful ways of testing for REM.

For example, the measure least correlated with firms’ underlying fundamentals might also have

the least power to detect the underlying REM. To provide insight into this issue, I perform a

simulation test and inject a known amount of REM ranging from 1% to 10% of lagged total assets.

Collectively, the simulation results suggest that the reversal-based proxies are more downward-

biased than the traditional proxies, while the time-series-adjusted proxies are not. In addition,

while the power of the reversal-based proxies depends on whether REM reverts in the subsequent

year, on balance, the power of the time-series-adjusted proxies does not significantly decline over

the traditional proxies. Thus, the time-series-adjusted proxies appear to address misspecification

without sacrificing power and are likely the more preferable choice in most settings.

The paper is subject to the following caveats. First, the paper does not test hypotheses on

the persistence of the underlying REM and assumes that reversal is a natural trait of REM.

Second, it does not test hypotheses on how the incentives to engage in REM vary with

performance. This makes it harder to interpret results when REM proxies vary with performance,

as the variation could be due to either REM incentives or fundamental factors. Finally, the

external validity of the simulation results relies upon how representative the underlying

assumptions are of actual cases of REM.

Despite these caveats, the paper should be helpful to subsequent research in selecting the

appropriate REM proxies. Specifically, to the extent that model misspecification or power is a

concern, this paper highlights the importance of using the time-series-adjusted proxies based on

Kothari et al. (2016).

Electronic copy available at: https://ssrn.com/abstract=2359813

A concurrent paper by Cohen, Pandit, Wasley, and Zach (2020) also examines properties

of commonly used REM measures. Our results complement each other along several dimensions.

First, Cohen et al. (2020) investigate the specification of REM proxies by analyzing the rejection

frequencies of the null hypothesis of no REM in different sample partitions based on past

performance measures. My paper provides an assessment of such empirical proxies through the

lens of their time-series properties and their statistical associations with economic fundamentals.

The differences in scope are ultimately reflected in the econometric techniques employed by the

two papers. While their paper benchmarks traditional proxies with performance-matched REM

proxies, my work incorporates the subsequent economic reversal and the time-series adjustments

to traditional measures.

The remainder of the paper is organized as follows. I discuss the models of traditional and

adjusted REM proxies in Section II, followed by data and sample selection in Section III. I report

the economic magnitudes of REM proxies in Section IV, time-series properties in Section V,

variation with performance in Section VI, and simulation analysis in Section VII, respectively.

Finally, I conclude in Section VIII.

II. MODELS OF TRADITIONAL AND ADJUSTED REM PROXIES

Several empirical proxies for REM have been developed and used by accounting literature.

In this paper, I consider the following six models, all of which are summarized in Appendix A.

2.1 Traditional Proxies

Roychowdhury (2006) constructs three empirical measures for REM, namely (1) abnormal

level of discretionary expenses, (2) abnormal level of cash flows from operations (hereafter called

Electronic copy available at: https://ssrn.com/abstract=2359813

“CFO”) and (3) abnormal level of production costs. The three measures are calculated as residuals

of the industry-year regression models of normal levels of activities as follows:

Discretionary expenses are expressed as a function of lagged sales: 3

,

=𝑘 +𝑘 +𝑘 +𝜀 (1)

, , ,

CFO is expressed as a linear function of sales and change in sales:

∆

=𝑘 +𝑘 +𝑘 +𝑘 +𝜀 (2)

, , , ,

Production costs are a linear function of contemporaneous sales, contemporaneous and

lagged change in sales:

∆ ∆ ,

=𝑘 +𝑘 +𝑘 +𝑘 +𝑘 +𝜀 (3)

, , , , ,

According to Roychowdhury (2006), given a certain level of sales, firms that manage

earnings upwards are likely to have unusually low discretionary expenses, and/or unusually high

production costs. However, the effects on cash flows from operations are mixed. 4

2.2 Non-Linear Model

To address the potential non-linearity in the relation between the optimal level of activity

and firm performance, Cohen et al. (2016) refine Roychowdhury’s (2006) traditional proxies by

adding a squared term of sales in regressions (1) through (3).

3

All variables are deflated by total assets.

4

Specifically, if firms accelerate the timing of sales through price discounts, lenient credit terms, or increased

production, cash flows from operations will be unusually low, while if firms reduce discretionary expenses, cash flows

from operations will be unusually high.

Electronic copy available at: https://ssrn.com/abstract=2359813

2.3 Opportunity-Adjusted Model

To control for firms’ investment opportunity set, Cohen et al. (2016) refine the traditional

proxies by adding firm size (MV), Tobin’s Q (Q), and firm life cycle stages (LIFECYCLE) in

regressions (1) through (3).

2.4 Performance-Matched Model

To control for performance, each firm’s traditional REM proxies are differenced from those

of a matched firm, which is the firm with the closest ROA in the same two-digit SIC industry and

year (Roychowdhury 2006; Cohen et al. 2020). This approach does not require imposing a specific

functional form to the relation between real activity and performance.

Performance-matched REM proxies are analogous to performance-matched discretionary

accruals.5 As such, the performance-matched model is based on the following assumptions: (1) the

effect of performance on real activity is similar for both the treatment firm and its control firm and

(2) REM incentives are not driven by performance.

2.5 Reversal-Based Model

Using the setting of an abnormal cut in discretionary investments, Vorst (2016) argues that

traditional REM proxies include two components: (1) abnormal investment levels driven by

earnings management and (2) abnormal investment levels driven by changes in business dynamics.

The former should reverse, while the latter should not. Therefore, by incorporating a reversal into

the measures (i.e., regressions (1) – (3)), the proxies can be improved. Based on Vorst (2016), I

5

See Dechow, Sloan, and Sweeney 1995; Kothari, Leone, and Wasley 2005; Keung and Shih 2014, etc. for inferences

of performance-matched discretionary accruals.

Electronic copy available at: https://ssrn.com/abstract=2359813

define “reversal-based REM proxies” as equal to the level of traditional REM proxies when there

is a reversal in the subsequent period, i.e., when traditional REM proxies in year t have the opposite

sign from traditional REM proxies in year t+1, and zero otherwise.

An underlying assumption in the reversal-based model is that REM will immediately

exhibit reversal in the following year.6

2.6 Time-Series-Adjusted Model

Kothari et al. (2016) argue that traditional REM proxies suffer from misspecification in

that certain firms are habitually misclassified as exhibiting unusually high (or low) activities due

to growth (or lack thereof), and/or the nature of their operating and business decisions. To resolve

this issue, they suggest extracting firm-specific and year-specific effects that induce model

misspecification.

Rather than trying to exactly replicate the models as they may have appeared in prior

literature, I focus on Kothari et al.’s (2016) general framework to facilitate comparability.

Specifically, I first adjust each variable in the traditional model (regressions (1)-(3)) for firm-

specific effects by taking the difference between the value in that year and that in the previous

year. Using the adjusted values, I then run the industry-year regressions. The residuals from the

regressions are called “time-series-adjusted REM proxies”. There are two key differences between

the adjusted proxies in this paper and those in Kothari et al. (2016). First, Kothari et al. (2016)

examine abnormal cut in R&D and SG&A expenses, while I focus on abnormal discretionary

expenses, abnormal CFO, and abnormal production costs. Second, Kothari et al. (2016) have an

6

In practice, it is possible that a firm faces similar REM incentives in consecutive years. For instance, Huang,

Roychowdhury, and Sletten (2019) report that over 2009-2010, analysts and auditors suspected Green Mountain

Coffee of overproducing inventory over successive periods to under-report their cost of goods sold.

Electronic copy available at: https://ssrn.com/abstract=2359813

additional third step in which they subtract the firm’s mean residuals across all years in the sample

from the firm-year residuals.

The underlying assumption in the time-series-adjusted model is that the one-year-lagged

variables used in the model represent a “normal” level. Therefore, if a firm experiences an unusual

circumstance in the prior year, the resulting time-series-adjusted REM proxies may be more biased

than the traditional proxies.

III. DATA AND SAMPLE SELECTION

All financial data are obtained from Compustat Fundamentals Annual database. The

sample period covers all available data from 1987 to 2001 7. The sample must have sufficient data

available to calculate all three traditional REM proxies. I therefore require non-missing values of

the following variables: CFO, total assets, sales, cost of goods sold, inventory, selling, general and

administrative expenses (SG&A). I exclude firms in regulated industries (SIC codes between 4400

and 5000) and banks and financial institutions (SIC codes between 6000 and 6500). Because the

models for normal discretionary expenses, CFO, and production costs are estimated for every year

and industry, I require at least 15 observations for each industry-year grouping. Extreme

observations are winsorized at 1% and 99%. Imposing all data-availability requirements yields

51,487 firm-year observations over the period 1987-2001, including 44 industries and 8,161

individual firms. Untabulated results reveal that the coefficients from the traditional model and

the mean adjusted R2s are generally consistent with those in Roychowdhury’s (2006) results.

7

The sample period is the same as that in Roychowdhury (2006) to facilitate comparison of model parameters and the

results of empirical tests with the original paper. I obtain qualitatively similar results when I use a longer sample period

from 1987-2012.

10

Electronic copy available at: https://ssrn.com/abstract=2359813

For each of the five adjusted proxies, I further require the sample to have sufficient

additional data available to calculate the adjusted proxies. For example, I require non-missing

values of market value of equity, Tobin’s Q, and lifecycle variables to calculate the opportunity-

adjusted REM proxies; for the performance-matched sample I require observations to have a

matched firm in the same two-digit SIC industry and year with an ROA within 10%, etc.

IV. ECONOMIC MAGNITUDES OF REM PROXIES

I report the economic magnitudes of the traditional and adjusted REM proxies in Table 1.

As these proxies by construction average to zero, I focus on the economic magnitudes of the

extreme quintiles of REM proxies (i.e., Quintile 1 and Quintile 5). I consider REM proxies that

stay in Quintile 1 or Quintile 5 for two consecutive years, to identify cases where the model is

potentially misspecified, and to reduce some of the variance in magnitudes that would be

introduced from considering simply a single year’s REM proxies.

Table 1 reports the descriptive statistics of the various REM proxies in year t.8 I provide

two benchmarks to evaluate the economic magnitudes of REM proxies: the actual total level and

the normal component. The table reports the descriptive statistics of abnormal discretionary

expenses. The results are qualitatively similar across the two quintiles and the two benchmarks.

For instance, in Quintile 1, the median firm’s REM proxy is quite high relative to the actual total

level for the traditional model (175%), non-linear model (173%), opportunity-adjusted model

(137%), and performance-matched model (184%). It drops substantially in reversal-based model

(12%) and time-series-adjusted model (24%).9 The finding is consistent with two alternative

8

I obtain similar results when using year t+1.

9

For the reversal-based model, by construction none of the observations stay in the same extreme quintiles. Therefore,

the table reports the descriptive statistics of observations that are the most persistent in the sample, i.e., (1) those that

11

Electronic copy available at: https://ssrn.com/abstract=2359813

interpretations. On the one hand, the reversal-based model and time-series-adjusted model may

reduce the extent to which the REM proxy captures fundamental factors, thus improving the proxy.

On the other hand, the two adjusted models potentially extract actual REM driven by REM

incentives that are correlated with such fundamental factors, thus reducing the power of the proxy.

I obtain similar results for abnormal CFO and abnormal production costs in untabulated

analysis. Specifically, I find that the magnitudes of the traditional REM proxies are high relative

to their actual total levels and relative to the normal levels. In some cases, the abnormal levels of

activities are more than 100 percent of the actual total levels or the normal levels. However, the

adjusted proxies based on the reversal-based model and the time-series-adjusted model are reliably

lower, suggesting that they are plausibly less subject to misspecification errors compared to the

traditional proxies.

V. PERSISTENCE

I perform two tests to examine the time-series properties of REM proxies. First, I report

the transition matrix of the REM proxies. Second, I report the serial correlation of REM proxies.

The transition matrix provides more granular evidence based on REM magnitudes, while the serial

correlation analysis summarizes the overall persistence of various REM proxies and potentially

reveals other statistical issues with the proxies such as unit root process.

5.1 Transition Matrix

Table 2 presents transition matrices of the three traditional REM proxies and of their

normal components. In each panel, I first form a quintile portfolio based on the magnitude of the

move from Quintile 1 in year t to the lowest quintile available in year t+1 and (2) those that move from Quintile 5 in

year t to the highest quintile available in year t+1.

12

Electronic copy available at: https://ssrn.com/abstract=2359813

variable examined (i.e., either the REM proxy or the normal component) in the current year (year

t) and the subsequent year (year t+1). For brevity, I only report the relative frequencies that firm-

year observations transition from Quintiles 1, 3, and 5 in the current year to Quintiles 1, 3, and 5

in the subsequent year.

Panels A, B and C report the results for abnormal discretionary expenses, abnormal CFO,

and abnormal production costs, respectively. The three panels share a common feature: REM

proxies are, in general, persistent, as most of the observations fall into the main diagonal cells. For

example, Panel A shows that firms in the Quintile 1 of abnormal discretionary expenses in the

current year have a probability of 73.40% to remain in the same quintile in the subsequent year.

However, the three panels show a different feature on the relative persistence of the abnormal and

normal components. Specifically, for abnormal discretionary expenses in Panel A and abnormal

production costs in Panel C, at least one of the extreme quintiles of REM proxies exhibits

persistence that is similar to or greater than the normal component. On the contrary, abnormal CFO

in Panel B is always less persistent than its normal component. Based on the assumption that REM

is transitory in nature, the results suggest that, the traditional proxies for abnormal discretionary

expenses and abnormal production costs plausibly capture a significant portion of fundamental

factors in addition to actual REM.

The transition matrix in Table 2 only examines the transitioning probabilities from a given

year into the following year. To provide additional insight into the traditional REM proxies’ long-

term persistence, I examine the probability of subsequent reversals up to four years in the future.

Table 3 reports the retention percentage (i.e., the percentage of observations that are repeatedly

classified in the same extreme quintiles) up to four years into the future. For instance, Panel A

shows that, of all the firms that are classified in Quintile 1 (Quintile 5) of abnormal discretionary

13

Electronic copy available at: https://ssrn.com/abstract=2359813

expenses in year t, 60% (59%) stay in the same quintile in year t+1; 40% (40%) stay in the same

quintile for three consecutive years; 28% (28%) stay in the same quintile for four consecutive

years; and 20% (20%) stay in the same quintile for five consecutive years. I use two benchmarks

for comparison.

The first benchmark is based on the assumption of economic reversal of actual REM.

Specifically, conditioning on being sorted into a given quintile in year t, an observation has an

equal chance of being sorted into any of the five quintiles in the following year. Accordingly, out

of the 100% of observations in Quintile 1 in year t, the expected retention percentages are 20% in

year t+1, 4% in year t+2; 0.8% in year t+3; and 0.16% in year t+4. Untabulated results reveal that

all of the retention percentages across the three panels are significantly different from this

benchmark, suggesting that the traditional proxies are persistent up to 4 years into the future. 10

The second benchmark is the retention percentages of the normal component. Panel A

shows that abnormal discretionary expenses become as persistent as the normal component in the

long term. Panel B shows that abnormal CFO continues to be significantly less persistent than the

normal component in the long term, while Panel C shows that abnormal production costs in

Quintile 1 (Quintile 5) continue to be significantly more (less) persistent than the normal

component in the long term.

Overall, the results indicate that REM proxies continue to be persistent up to four years

into the future but the extent of persistence depends on the forms of REM. Specifically, abnormal

CFO is less persistent than the normal component, while abnormal discretionary expenses and

10

I also assume that there is full survivorship across the five years, which biases against finding results. This is because

if a firm does not survive (which may be the case for firms that engage in REM activity of extremely large magnitude),

the expected percentages under random transition would even be lower, making the difference even more statistically

significant.

14

Electronic copy available at: https://ssrn.com/abstract=2359813

abnormal production costs have subsamples that are at least as persistent as the normal component

in the long term.

Next, I report the transition matrices of the adjusted REM proxies and of their normal

components in Table 4. For brevity, I only report the results for abnormal discretionary expenses

in the table, but the results show a similar pattern across the three forms of REM. Specifically,

similar to the traditional REM proxies, the adjusted proxies from the non-linear model,

opportunity-adjusted model, and performance-matched model are persistent, as the largest

percentages fall into the main diagonal cells. Unlike the traditional proxies, however, REM proxies

from the reversal-based model and the time-series-adjusted model are not persistent. In fact, the

time-series-adjusted model produces REM proxies that are clearly reversing, since the largest

percentages fall in the off-diagonal cells.

5.2 Serial Correlation

Table 5 reports the results on serial correlation. I require that each firm has a minimum of

8 years of observations without missing values to estimate the firm-level serial correlation. 11,12 The

table reports the summary statistics of the firm-level serial correlation coefficients, as well as

improvements over traditional REM proxies in terms of reduction in percentage of firms whose

REM proxies exhibit positive serial correlation. Finally, the eventual presence of nonstationarity

would prevent us from drawing inferences from the time-series coefficient estimates of REM

11

I thank an anonymous reviewer for suggesting an analysis based on firm-level estimation.

12

The requirement of a minimum of 8 observations are a bit ad-hoc. There is a balance in selecting this threshold as

the smaller number increases the sample but reduces the statistical power of time-series coefficient estimates. I perform

a robustness test by changing the minimum threshold of firm-specific time-series data from 8 years to either 6 years

or 10 years. The results are robust to varying the minimum threshold. In addition, when the minimum threshold is

fixed at 8 years, I find that the results are inferentially similar across the group of firms with 8, 9, … , 14 time-series

observations.

15

Electronic copy available at: https://ssrn.com/abstract=2359813

proxies. To investigate this possibility, I perform the Augmented Dickey-Fuller (ADF) test for the

REM proxies of the cross-section of firms in my sample and report the percentage of firms for

which the ADF test rejects the null hypothesis of unit root process at the 10% significant level.

Table 5 shows that the percentage of firms whose REM proxies (abnormal discretionary

expenses) exhibit positive serial correlation is quite high for the traditional model (82%), the non-

linear model (82%), and the opportunity-adjusted model (81%), while it declines in the

performance-matched model (47%). Importantly, the percentage of firms with positive serial

correlation drops even further in the reversal-based model (2%) and time-series-adjusted model

(23%), suggesting that the two adjusted proxies substantially improve over traditional proxies. In

addition, the table shows that the percentage of firms for which the Augmented Dickey Fuller test

rejects the null hypothesis of unit root process increases significantly under the reversal-based

model (95%) and the time-series-adjusted model (80%). In untabulated analysis, the results show

a similar pattern for abnormal CFO and abnormal production costs. Collectively, the findings

suggest that the two adjusted proxies do not only reduce the positive serial correlation for a

significant number of firms in my sample, but also alleviate the issues with unit root process.

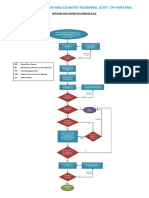

VI. VARIATION WITH PERFORMANCE

I examine how the traditional and adjusted REM proxies vary with firm performance and

report the results in Figure 1. Panel A, Panel B, and Panel C report the results for abnormal

discretionary expenses, abnormal CFO, and abnormal production costs, respectively. For each

panel, I report the results across the six models. For each model, variation of the normal component

with performance is also provided as a benchmark. To create a scatter plot for each REM proxy, I

first partition the sample into percentiles based on income before extraordinary items scaled by

16

Electronic copy available at: https://ssrn.com/abstract=2359813

lagged total assets. Then, I calculate the median value of the REM proxy for each earnings

percentile and produce the scatter plot of the median value of the REM proxies on the median

value of scaled earnings for each earnings percentile portfolio. The scatter plot for the normal

component is created in a similar manner.

I provide the following framework to assist in interpretation of the results of the variation

with performance analysis.13

Case 1: If one observes a variation in REM proxies with performance, possible

interpretations include:

i. REM proxies capture actual REM faithfully and REM incentives co-vary with

performance.

ii. REM proxies reflect both actual REM and fundamental factors, and both REM

incentives and fundamental factors co-vary with performance.

iii. REM proxies do not capture actual REM and are primarily driven by fundamental

factors, which in turn co-vary with performance by definition.

Case 2: If one does NOT observe a variation in REM proxies with performance, possible

interpretations include:

i. REM proxies capture actual REM faithfully and REM incentives do not co-vary

with performance.

13

I thank an anonymous reviewer for suggesting me to add the framework for results interpretation.

17

Electronic copy available at: https://ssrn.com/abstract=2359813

ii. REM proxies reflect both actual REM and fundamental factors, but the covariances

of (1) REM incentives with performance and (2) fundamental factors with

performance offset each other.

Note that fundamental factors, by definition, co-vary with performance. Therefore, it is

unlikely under Case 2 that REM proxies do not capture actual REM at all and are driven only by

fundamental factors. The key difference between Cases 1 and 2 is that under Case 2, all possible

scenarios imply that REM proxies capture actual REM. The above framework highlights the

importance of covariance of REM incentives with performance in drawing inferences.

Figure 1 provides qualitatively similar inferences across the three panels. 14 Specifically,

the figure shows that REM proxies from the traditional model, the non-linear model and the

opportunity-adjusted model vary with performance. In contrast, the adjusted proxies from the

performance-matched model, reversal-based model, and time-series-adjusted model do not vary

with performance, while their normal components do. Based on the above framework, the results

imply that REM proxies from the performance-matched model, reversal-based model, and time-

series-adjusted model do capture actual REM.

VII. SIMULATION ANALYSIS

The analyses conducted so far only address the possibility of misspecification issues.

Importantly, statistical power could be the underlying reason for the associations documented in

14

While the inferences on how the adjusted models affect variation with performance are similar for the three forms

of REM, the traditional REM proxies vary with performance differently across the three forms of REM. Specifically,

abnormal discretionary expenses exhibit a U-curve relationship with performance; abnormal CFO varies positively

with performance; while abnormal production costs vary negatively with performance after the zero earnings

benchmark. It is possible that the traditional proxies for each form of REM may be capturing different underlying

REM incentives. For example, abnormal discretionary expenses may be capturing incentives to avoid reporting losses,

while abnormal production costs may be capturing incentives to manage earnings that are overall correlated negatively

with performance.

18

Electronic copy available at: https://ssrn.com/abstract=2359813

my study. For example, it is possible that the measure least correlated with firms’ underlying

fundamentals also has the least power to detect the underlying REM of firms. To provide insight

into this issue, I perform a simulation analysis by injecting a known quantity of induced REM

into the simulation data. I then report the bias (i.e., the amount of induced REM detected by the

proxy compared with the known amount of induced REM) and the power (i.e., the rejection

frequencies of the null hypothesis of no REM) for each REM proxy.

For tractability, I impose two key assumptions in the simulation analysis. First, I assume

no interactions among the three manipulation methods (i.e., sales manipulation, overproduction,

and abnormal cut in discretionary expenses). 15 Second, I assume that each manipulation method

examined does not significantly affect long-term future real activities. 16 I recognize that the

external validity of the simulation results relies on how representative my assumptions are of

actual cases of REM.

The simulation data are generated from 1,000 random samples. For each sample, 100

observations are randomly selected without replacement. Then, I introduce a known amount of

REM into the underlying activities, ranging from 1% to 10% of lagged total assets. 17,18 Since the

true economic reversal period of REM is unknown, I provide the analysis in two scenarios: (1)

15

In practice, one manipulation method can induce another. For instance, overproducing firms may choose to get rid

of excess inventories through abnormally large discounts, thus engaging in both overproduction and sales

manipulation. As the extent to which one manipulation method drives another may vary across firms and time and is

largely unknown, it is difficult to model the interaction among manipulation methods into the simulation data.

16

For instance, I assume that cutting discretionary expenses in the current period does not significantly affect future

sales.

17

As the effect of sales manipulation on abnormal CFO is partially determined by factors without publicly available

data (such as the percentage of bad debt by customer groups), I do not examine sales manipulation in the simulation.

Rather, I simply focus on the effect of overproduction on abnormal CFO and on abnormal production costs and

examine the effect of cutting discretionary expenses on abnormal discretionary expenses.

18

I focus on income-increasing REM. Thus, for discretionary expenses, the induced REM is “subtracted” from the

original total level of discretionary expenses to arrive at the manipulated level, while for production costs, the induced

REM is “added” to the total level of production costs to arrive at the manipulated level. As I focus on the effect of

abnormal CFO driven by overproduction (and not by cutting discretionary expenses), the induced REM is “subtracted”

from the total level of CFO to arrive at the manipulated level.

19

Electronic copy available at: https://ssrn.com/abstract=2359813

REM does not revert, and (2) REM reverts 100% in the following year. In the second scenario,

the induced REM is fully removed from the underlying activities in the following year. As the

results in the prior sections suggest that the adjusted proxies from the reversal-based model and

time-series-adjusted model seem to be the most effective at attenuating correlation with

underlying fundamentals, in this section, I only report the results for these two adjusted proxies

for parsimony, and use the traditional proxies as a benchmark. 19

The results of the simulations using artificially induced REM are summarized in Figures

2 and 3. Figure 2 presents the results on the bias of the two adjusted REM proxies. Specifically,

each plot presents the average magnitude of REM detected by the REM proxy on the level of

induced REM. In each plot, I use a dashed line to represent the benchmark (i.e., the results of an

unbiased REM proxy). I also include the results of the traditional REM proxies for comparison.

Figure 2 reports the results for abnormal discretionary expenses. It is evident that the reversal-

based model produces REM proxy that is biased downward, but the extent of the bias is attenuated

under the assumption that REM completely reverts in the following year. Unlike the reversal-

based model, however, the result suggests that the time-series-adjusted model does not suffer

from this bias. Untabulated analysis shows qualitatively similar results for abnormal CFO and

abnormal production costs.

Figure 3 provides information regarding the power of the two adjusted REM proxies

relative to the traditional proxies for detecting REM. The figure reports the results for abnormal

discretionary expenses. The figure shows that the reversal-based model is less powerful than

traditional proxies for all levels of induced REM in case of no REM reversals, while it is more

19

In untabulated analysis, the other adjusted proxies derived from the non-linear model, opportunity-adjusted model,

and performance-matched model have qualitatively similar results to the traditional proxies.

20

Electronic copy available at: https://ssrn.com/abstract=2359813

powerful than the traditional proxies in case of complete REM reversals in the following year.

This is likely because the adjusted proxies have lower standard errors, as most observations have

zero values of reversal-based REM proxies. Untabulated results for abnormal CFO and abnormal

production costs show a similar pattern. The figure also shows that the time-series-adjusted model

exhibits more power to detect REM than the traditional model across both scenarios. In

untabulated analysis, I find similar results for abnormal CFO; however, I find that the time-series-

adjusted model for abnormal production costs are slightly less powerful than the traditional

model.

Collectively, the simulation results suggest that reversal-based REM proxies are more

downward-biased than the traditional proxies, while the time-series-adjusted proxies are not. In

addition, while the power of reversal-based proxies depends on whether REM reverts in the

subsequent year, on balance, the time-series-adjusted model does not significantly lose its power

over traditional proxies. Thus, the time-series-adjusted proxies appear to address misspecification

without sacrificing power, and are likely the more preferable choice in most settings.

VIII. CONCLUSION

In this paper, I empirically assess three attributes of REM proxies, namely their economic

magnitudes, time-series properties, and variation with performance. For traditional REM proxies

in Roychowdhury (2006), I find that (1) the magnitude of the abnormal levels of activity are high

relative to their actual total levels and relative to the normal levels; (2) they exhibit persistence;

and (3) they vary predictably with firm performance. I examine five adjusted REM proxies found

in the literature and find that the reversal-based proxies proposed by Vorst (2016) and the time-

series-adjusted proxies based on Kothari et al. (2016) have reliably lower magnitudes, do not

21

Electronic copy available at: https://ssrn.com/abstract=2359813

exhibit persistence, and do no vary with performance. These findings suggest that traditional REM

proxies likely capture actual REM but also likely reflect fundamental factors such as performance,

and that, of all the adjusted proxies examined in this study, those based on Vorst (2016) and

Kothari et al. (2016) seem to be the most effective at attenuating correlation with underlying

fundamentals. The findings also suggest that incorporating reversal and adjusting for firm’s own

time-series potentially improves the specification of the traditional REM proxies.

To provide insight into the statistical power of the two adjusted proxies based on Vorst

(2016) and Kothari et al. (2016), I perform an additional analysis by running a simulation and

injecting a known amount of REM into the underlying activities, ranging from 1% to 10% of

lagged total assets. Collectively, the simulation results suggest that the reversal-based REM

proxies are downward-biased, while the time-series-adjusted proxies are not. In addition, while the

power of the reversal-based proxies depends on whether REM subsequently reverts, on balance,

the power of the time-series-adjusted model does not significantly decline over the traditional

proxies. Thus, the time-series-adjusted proxies appear to address misspecification without

sacrificing power and are likely the more preferable choice in most settings.

The paper is subject to the following caveats. First, the paper does not test the persistence

of actual REM and assumes that reversal is a natural trait for REM. Second, it does not test how

incentives to engage in REM vary with performance. Finally, the external validity of the

simulation relies on how representative the assumptions are of actual cases of REM. Despite these

caveats, this paper is the first to show that the adjusted REM proxies proposed by Vorst (2016)

and those based on Kothari et al. (2016) have very different attributes from the traditional proxies

in terms of their economic magnitudes, time-series properties, and variation with performance.

The paper should be helpful to subsequent researchers when selecting the appropriate REM

22

Electronic copy available at: https://ssrn.com/abstract=2359813

proxies. Specifically, to the extent that their concerns are model misspecification or statistical

power, this paper highlights the importance of using the time-series-adjusted proxies based on

Kothari et al. (2016).

23

Electronic copy available at: https://ssrn.com/abstract=2359813

REFERENCES

Alhadab, M., I. Clacher, and K. Keasey. 2015. Real and accrual earnings management and IPO

failure risk. Accounting and Business Research 45(1): 55-92.

Anthony, J., and K. Ramesh. 1992. Association between accounting performance measures and

stock prices. Journal of Accounting and Economics 15: 203-227.

Bereskin, F.L., P. Hsu, and W. Rotenberg. 2018. The real effects of real earnings management:

Evidence from innovation. Contemporary Accounting Research 35(1): 525-557.

Black, E.L., T.E. Christensen, T.T. Joo, and R. Schmardebeck. 2017. The relation between

earnings management and non-GAAP reporting. Contemporary Accounting Research

34(2): 750-782.

Bonacchi, M., F. Cipollini, and P. Zarowin. 2018. Parents’ use of subsidiaries to “push down”

earnings management: Evidence from Italy. Contemporary Accounting Research 35(3):

1332-1362.

Chan, L. H., K. Chen, T. Chen, and Y. Yu. 2015. Substitution between real and accruals-based

earnings management after voluntary adoption of compensation clawback provisions. The

Accounting Review 90 (1): 147-174.

Cheng, Q., J. Lee, and T. Shevlin. 2016. Internal governance and real earnings management. The

Accounting Review 91(4): 1051-1085.

Cohen, D., A. Dey, and T. Lys. 2008. Real and accrual-based earnings management in the pre-

and post-Sarbanes Oxley periods. The Accounting Review 83: 757-787.

Cohen, D., S. Pandit, C. Wasley, and T. Zach. 2016. Measuring Real Activity Management.

Working paper, University of Texas at Dallas, University of Illinois at Chicago, University

of Rochester, and Ohio State University.

Cohen, D., S. Pandit, C. Wasley, and T. Zach. 2020. Measuring real activity management.

Contemporary Accounting Research 37(2): 1172-1198.

Cohen, D., and P. Zarowin. 2010. Accrual-based and real earnings management activities around

seasoned equity offerings. Journal of Accounting and Economics 50: 2-19.

Dechow, P. M., R. G. Sloan, and A.P. Sweeney. 1995. Detecting earnings management. The

Accounting Review 70: 193-225.

DeFond, M. 2010. Earnings quality research: Advances, challenges and future research. Journal

of Accounting and Economics 50: 402-409.

24

Electronic copy available at: https://ssrn.com/abstract=2359813

Francis, B., I. Hasan, and L. Li. 2016. Abnormal real operations, real earnings management, and

subsequent crashes in stock prices. Review of Quantitative Finance and Accounting 46(2):

217-260.

Graham, J. R., C. R. Harvey, and S. Rajgopal. 2005. The economic implications of corporate

financial reporting. Journal of Accounting and Economics 40: 3-73.

Huang, S., S. Roychowdhury, and E. Sletten. 2019. Does litigation deter or encourage real earnings

management? The Accounting Review (forthcoming).

Keung, E., and M. Shih. 2014. Measuring discretionary accruals: Are ROA-matched models better

than the original Jones-type models? Review of Accounting Studies 19: 736-768.

Khurana, I. K., R. Pereira, and E. Zhang. 2018. Is real earnings smoothing harmful? Evidence from

firm-specific stock price crash risk. Contemporary Accounting Research 35(1): 558-587.

Kim, J., Y. Kim, and J. Zhou. 2017. Languages and earnings management. Journal of Accounting

and Economics 63: 288-306.

Kim, Y., and M. S. Park. 2014. Real activities manipulation and auditors’ client-retention

decisions. The Accounting Review 89: 367-401.

Kothari, S. P., A. J. Leone, and C. E. Wasley. 2005. Performance matched discretionary accrual

measures. Journal of Accounting and Economics 39: 163-197.

Kothari, S. P., N. Mizik, and S. Roychowdhury. 2016. Managing for the moment: The role of

earnings management via real activities versus accruals in SEO valuation. The Accounting

Review 91(2): 559-586.

McGuire, S. T., T. C. Omer, and N. Y. Sharp. 2012. The impact of religion on financial reporting

irregularities. The Accounting Review 87: 645-673.

McInnis, J., and D. W. Collins. 2011. The effect of cash flow forecasts on accrual quality and

benchmark beating. Journal of Accounting and Economics 51: 219-239.

Roychowdhury, S. 2006. Earnings management through real activities manipulation. Journal of

Accounting and Economics 42: 335-370.

Taylor, G. K., and R. Z. Xu. 2010. Consequences of real earnings management on subsequent

operating performance. Research in Accounting Regulation 22: 128-132.

Vorst, P. 2016. Real earnings management and long-term operating performance: The role of

reversals in discretionary investment cuts. The Accounting Review 91(4): 1219-1256.

25

Electronic copy available at: https://ssrn.com/abstract=2359813

Wongsunwai, W. 2013. The effect of external monitoring on accrual-based and real earnings

management: Evidence from venture-backed initial public offerings. Contemporary

Accounting Research 30: 296-324.

Zang, A. Y. 2012. Evidence on the trade-off between real activities manipulation and accrual-

based earnings management. The Accounting Review 87: 675-703.

Zhao, Y., K. H. Chen, Y. Zhang, and M. Davis. 2012. Takeover protection and managerial myopia:

Evidence from real earnings management. Journal of Accounting and Public Policy 31:

109-135.

26

Electronic copy available at: https://ssrn.com/abstract=2359813

APPENDIX A: REM Models and Variable Definitions

Panel A: Discretionary Expenses

Actual Total Level (SC_DISX) = Normal Component + Abnormal Discretionary Expenses

where SC_DISX = Discretionary expenses (the sum of R&D, Advertising, and Selling, General

and Administrative expenses), divided by lagged total assets

Model Abnormal Discretionary Expenses Normal Component

(REM Proxy)

1. Traditional Model AB_DISX = residuals from the NORMAL_DISX

corresponding industry-year regression: = SC_DISX - AB_DISX

,

𝑆𝐶_𝐷𝐼𝑆𝑋 = 𝑘 + 𝑘 +𝑘 +𝜀

, ,

where SALES = Sales revenue;

AT = Total assets.

2. Non-Linear Model AB_DISX_NONL = residuals from the NORMAL_DISX_NONL

corresponding industry-year regression: = SC_DISX - AB_DISX_NONL

,

𝑆𝐶_𝐷𝐼𝑆𝑋 = 𝑘 + 𝑘 +𝑘 +

, ,

,

𝑘 +𝜀

,

3. Opportunity- AB_DISX_IOS = residuals from the NORMAL_DISX_IOS

Adjusted Model corresponding industry-year regression: = SC_DISX - AB_DISX_IOS

,

𝑆𝐶_𝐷𝐼𝑆𝑋 = 𝑘 + 𝑘 +𝑘 +

, ,

𝑘 𝑀𝑉 , + 𝑘 𝑄 , + 𝑘 𝐿𝐼𝐹𝐸𝐶𝑌𝐶𝐿𝐸 , + 𝜀

where MV = the natural logarithm of market

value of equity;

Q = Tobin’s Q;

LIFECYCLE = Firm lifecycle stage

(Anthony and Ramesh 1992).

4. Performance- PM_AB_DISX = the difference between PM_NORMAL_DISX

Matched Model AB_DISX of the treatment firm and that of = SC_DISX - PM_AB_DISX

its match, where matched firm is in the

same 2-digit SIC industry and year with the

closest ROA and whose ROA is within 10%

5. Reversal-Based REV_AB_DISX = the level of AB_DISX REV_NORMAL_DISX

Model when there is a reversal, i.e., when = SC_DISX - REV_AB_DISX

AB_DISX in year t and AB_DISX in year

t+1 have the opposite signs, and zero

otherwise

6. Time-Series- AB_DISX_TS = residuals from the NORMAL_DISX_TS

Adjusted Model traditional model, where each of the = SC_DISX - AB_DISX_TS

variable in the regression is adjusted for by

being differenced from the value in the

previous year

27

Electronic copy available at: https://ssrn.com/abstract=2359813

Panel B: Cash Flows from Operations

Actual Total Level (SC_CFO) = Normal Component + Abnormal CFO

where SC_CFO = Cash flows from operations, divided by lagged total assets

Model Abnormal CFO Normal Component

(REM Proxy)

1. Traditional Model AB_CFO = residuals from the NORMAL_CFO

corresponding industry-year regression: = SC_CFO - AB_CFO

𝑆𝐶_𝐶𝐹𝑂 = 𝑘 + 𝑘 +𝑘 +

, ,

∆

𝑘 +𝜀

,

2. Non-Linear Model AB_CFO_NONL = residuals from the NORMAL_CFO_NONL

corresponding industry-year regression: = SC_CFO - AB_CFO_NONL

𝑆𝐶_𝐶𝐹𝑂 = 𝑘 + 𝑘 +𝑘 +

, ,

∆

𝑘 +𝑘 +𝜀

, ,

3. Opportunity- AB_CFO_IOS = residuals from the NORMAL_CFO_IOS

Adjusted Model corresponding industry-year regression: = SC_CFO - AB_CFO_IOS

𝑆𝐶_𝐶𝐹𝑂 = 𝑘 + 𝑘 +𝑘 +

, ,

∆

𝑘 + 𝑘 𝑀𝑉 , + 𝑘 𝑄 , +

,

𝑘 𝐿𝐼𝐹𝐸𝐶𝑌𝐶𝐿𝐸 , + 𝜀

4. Performance- PM_AB_CFO = the difference between PM_NORMAL_CFO

Matched Model AB_CFO of the treatment firm and that of = SC_CFO - PM_AB_CFO

its match, where matched firm is in the

same 2-digit SIC industry and year with the

closest ROA and whose ROA is within 10%

5. Reversal-Based REV_AB_CFO= the level of AB_CFO REV_NORMAL_CFO

Model when there is a reversal, i.e., when AB_CFO = SC_CFO - REV_AB_CFO

in year t and AB_CFO in year t+1 have the

opposite signs, and zero otherwise

6. Time-Series- AB_CFO_TS = residuals from the NORMAL_CFO_TS

Adjusted Model traditional model, where each of the = SC_CFO - AB_CFO_TS

variable in the regression is adjusted for by

being differenced from the value in the

previous year

28

Electronic copy available at: https://ssrn.com/abstract=2359813

Panel C: Production Costs

Actual Total Level (SC_PROD) = Normal Component + Abnormal Production Costs

where SC_PROD = Production costs (COGS + change in inventory), divided by lagged total

assets

Model Abnormal Production Costs Normal Component

(REM Proxy)

1. Traditional Model AB_PROD = residuals from the NORMAL_PROD

corresponding industry-year regression: = SC_PROD - AB_PROD

𝑆𝐶_𝑃𝑅𝑂𝐷 = 𝑘 + 𝑘 +𝑘 +

, ,

∆ ∆ ,

𝑘 +𝑘 +𝜀

, ,

2. Non-Linear Model AB_PROD_NONL = residuals from the NORMAL_PROD_NONL

corresponding industry-year regression: = SC_PROD -

𝑆𝐶_𝑃𝑅𝑂𝐷 = 𝑘 + 𝑘 +𝑘 + AB_PROD_NONL

, ,

∆ ∆ , ,

𝑘 +𝑘 +𝑘 +

, , ,

𝜀

3. Opportunity- AB_PROD_IOS = residuals from the NORMAL_PROD_IOS

Adjusted Model corresponding industry-year regression: = SC_PROD - AB_PROD_IOS

𝑆𝐶_𝑃𝑅𝑂𝐷 = 𝑘 + 𝑘 +𝑘 +

, ,

∆ ∆ ,

𝑘 +𝑘 + 𝑘 𝑀𝑉 , + 𝑘 𝑄 , +

, ,

𝑘 𝐿𝐼𝐹𝐸𝐶𝑌𝐶𝐿𝐸 , + 𝜀

4. Performance- PM_AB_PROD = the difference between PM_NORMAL_PROD

Matched Model AB_PROD of the treatment firm and that of = SC_PROD - PM_AB_PROD

its match, where matched firm is in the

same 2-digit SIC industry and year with the

closest ROA and whose ROA is within 10%

5. Reversal-Based REV_AB_PROD = the level of AB_PROD REV_NORMAL_PROD

Model when there is a reversal, i.e., when = SC_PROD - REV_AB_PROD

AB_PROD in year t and AB_PROD in year

t+1 have the opposite signs, and zero

otherwise

6. Time-Series- AB_PROD_TS = residuals from the NORMAL_PROD_TS

Adjusted Model traditional model, where each of the = SC_PROD - AB_PROD_TS

variable in the regression is adjusted for by

being differenced from the value in the

previous year

29

Electronic copy available at: https://ssrn.com/abstract=2359813

FIGURE 1: Variation with Performance

Panel A: Abnormal Discretionary Expenses

Traditional Model Non-Linear Model Opportunity-Adjusted Model

1.75 1.75 1.75

1.25 1.25 1.25

0.75 0.75 0.75

0.25 0.25 0.25

-0.25 -2 -1.5 -1 -0.5 0 0.5 1 -0.25 -2 -1.5 -1 -0.5 0 0.5 1 -0.25 -1.5 -1 -0.5 0 0.5 1

Scaled Earnings Scaled Earnings Scaled Earnings

AB_DISX NORMAL_DISX AB_DISX_NONL NORMAL_DISX_NONL AB_DISX_IOS NORMAL_DISX_IOS

Performance-Matched Model Reversal-Based Model Time-Series-Adjusted Model

1.75 1.75 1.75

1.25 1.25 1.25

0.75 0.75 0.75

0.25 0.25 0.25

-0.25 -1.5 -1 -0.5 0 0.5 -0.25 -2 -1.5 -1 -0.5 0 0.5 1 -0.25 -2 -1.5 -1 -0.5 0 0.5 1

Scaled Earnings Scaled Earnings Scaled Earnings

PM_AB_DISX PM_NORMAL_DISX REV_AB_DISX REV_NORMAL_DISX AB_DISX_TS NORMAL_DISX_TS

30

Electronic copy available at: https://ssrn.com/abstract=2359813

Panel B: Abnormal CFO

Traditional Model Non-Linear Model Opportunity-Adjusted Model

0.1 0.1 0.1

-2 -1.5 -1 -0.5 0 0.5 1 -2 -1.5 -1 -0.5 0 0.5 1 -1.5 -1 -0.5 0 0.5 1

-0.4 -0.4 -0.4

-0.9 -0.9 -0.9

Scaled Earnings Scaled Earnings Scaled Earnings

AB_CFO NORMAL_CFO AB_CFO_NONL NORMAL_CFO_NONL AB_CFO_IOS NORMAL_CFO_IOS

Performance-Matched Model Reversal-Based Model Time-Series-Adjusted Model

0.1 0.1 0.1

-1.5 -1 -0.5 0 0.5 -2 -1.5 -1 -0.5 0 0.5 1 -2 -1.5 -1 -0.5 0 0.5 1

-0.4 -0.4 -0.4

-0.9 -0.9 -0.9

Scaled Earnings Scaled Earnings Scaled Earnings

PM_AB_CFO PM_NORMAL_CFO REV_AB_CFO REV_NORMAL_CFO AB_CFO_TS NORMAL_CFO_TS

31

Electronic copy available at: https://ssrn.com/abstract=2359813

Panel C: Abnormal Production Costs

Traditional Model Non-Linear Model Opportunity-Adjusted Model

2 2 2

1.5 1.5 1.5

1 1 1

0.5 0.5 0.5

0 0 0

-0.5 -2 -1.5 -1 -0.5 0 0.5 1 -0.5 -2 -1.5 -1 -0.5 0 0.5 1 -0.5 -1.5 -1 -0.5 0 0.5 1

Scaled Earnings Scaled Earnings Scaled Earnings

AB_PROD NORMAL_PROD AB_PROD_NONL NORMAL_PROD_NONL AB_PROD_IOS NORMAL_PROD_IOS

Performance-Matched Model Reversal-Based Model Time-Series-Adjusted Model

2 2 2

1.5 1.5 1.5

1 1 1

0.5 0.5 0.5

0 0 0

-0.5 -1.5 -1 -0.5 0 0.5 -0.5 -2 -1.5 -1 -0.5 0 0.5 1 -0.5 -2 -1.5 -1 -0.5 0 0.5 1

Scaled Earnings Scaled Earnings Scaled Earnings

PM_AB_PROD PM_NORMAL_PROD REV_AB_PROD REV_NORMAL_PROD AB_PROD_TS NORMAL_PROD_TS

This figure reports the scatter plot of the REM proxies from the traditional and adjusted models against scaled earnings. As a benchmark, the figure also provides the scatter plot of

the normal components against scaled earnings. To plot this graph, the sample is sorted into percentile portfolios based on the magnitude of scaled earnings. Each data point represents

the median abnormal component (REM proxy) or the median normal component against the median scaled earnings for an earnings percentile portfolio. Panel A, B, and C present the

results for discretionary expenses, CFO, and production costs, respectively. Scaled earnings are defined as income before extraordinary items, divided by total assets.

32

Electronic copy available at: https://ssrn.com/abstract=2359813

FIGURE 2: Bias in Traditional and Adjusted REM Proxies

Case 1: No reversal of REM

Reversal-Based Model Time-Series-Adjusted Model

15% 15%

Detected REM

Detected REM

10% 10%

Unbiased Unbiased

5% 5%

AB_DISX AB_DISX

0% REV_AB_DISX 0% AB_DISX_TS

0% 2% 4% 6% 8% 10% 0% 2% 4% 6% 8% 10%

-5% -5%

Induced REM Induced REM

Case 2: Complete reversal of REM in the following year

Reversal-Based Model Time-Series-Adjusted Model

15% 15%

Detected REM

Detected REM

10% 10%

Unbiased Unbiased

5% 5%

AB_DISX AB_DISX

0% REV_AB_DISX 0% AB_DISX_TS

0% 2% 4% 6% 8% 10% 0% 2% 4% 6% 8% 10%

-5% -5%

Induced REM Induced REM

The figure reports the simulation results from tests for bias in REM proxies (abnormal discretionary expenses) derived from the reversal-based model and the time-series-adjusted

model. The simulation data are generated from 1,000 random samples of 100 observations each, all induced with REM ranging from 1% to 10% of total assets. Each plot reports the

magnitude of REM detected by the REM proxy on the level of induced REM. The dash line is a benchmark that represents the results for an unbiased REM proxy. The bias result

from the traditional proxies is also provided for comparison. For each panel, the results are reported for two scenarios. First, REM does not revert. Second, REM reverts 100% in the

following year.

33

Electronic copy available at: https://ssrn.com/abstract=2359813

FIGURE 3: Power Function of Traditional and Adjusted REM Proxies

Case 1: No reversal of REM

Reversal-Based Model Time-Series-Adjusted Model

100% 100%

Rejection Rates

Rejection Rates

80% 80%

60% 60%

40% AB_DISX 40% AB_DISX

20% 20%

REV_AB_DISX AB_DISX_TS

0% 0%

0% 2% 4% 6% 8% 10% 0% 2% 4% 6% 8% 10%

Induced REM Induced REM

Case 2: Complete reversal of REM in the following year

Reversal-Based Model Time-Series-Adjusted Model

100% 100%

Rejection Rates

Rejection Rates

80% 80%

60% 60%

40% AB_DISX 40% AB_DISX

20% 20%

REV_AB_DISX AB_DISX_TS

0% 0%

0% 2% 4% 6% 8% 10% 0% 2% 4% 6% 8% 10%

Induced REM Induced REM

The figure reports the simulation results of power functions of REM proxies (abnormal discretionary expenses) derived from the reversal-based model, and the time-series-adjusted

model. The power function of the traditional proxies is also provided for comparison. The simulation data are generated from 1,000 random samples of 100 observations each, all

induced with REM ranging from 1% to 10% of total assets. Each plot reports the frequency of rejecting the null hypothesis of no REM over the level of induced REM. For each

panel, the results are reported for two scenarios. First, REM does not revert. Second, REM reverts 100% in the following year.

34

Electronic copy available at: https://ssrn.com/abstract=2359813

TABLE 1: Economic Magnitudes of REM Proxies

Quintile 1 in year t to Quintile 5 in year t to

Quintile 1 in year t+1 Quintile 5 in year t+1

Variables Q1 Median Q3 Q1 Median Q3

AB_DISX

AB_DISX -0.406 -0.307 -0.219 0.233 0.360 0.574

|AB_DISX|/|SC_DISX| 112% 175% 280% 35% 44% 55%

|AB_DISX|/|NORMAL_DISX| 53% 64% 74% 55% 80% 121%

AB_DISX_NONL

AB_DISX_NONL -0.407 -0.309 -0.219 0.232 0.356 0.571

|AB_DISX_NONL|/|SC_DISX| 110% 173% 278% 35% 44% 55%

|AB_DISX_NONL|/|NORMAL_DISX_NONL| 52% 63% 74% 55% 79% 120%

AB_DISX_IOS

AB_DISX_IOS -0.364 -0.259 -0.182 0.194 0.288 0.461

|AB_DISX_IOS|/|SC_DISX| 87% 137% 232% 31% 41% 51%

|AB_DISX_IOS|/|NORMAL_DISX_IOS| 47% 58% 70% 46% 68% 104%

PM_AB_DISX

PM_AB_DISX -0.671 -0.461 -0.322 0.349 0.499 0.735

|PM_AB_DISX|/|SC_DISX| 110% 184% 314% 49% 62% 76%

|PM_AB_DISX|/|PM_NORMAL_DISX| 52% 65% 76% 94% 158% 298%

REV_AB_DISX*

REV_AB_DISX -0.097 -0.043 -0.017 0.011 0.021 0.034

|REV_AB_DISX|/|SC_DISX| 5% 12% 28% 3% 4% 9%

|REV_AB_DISX|/|REV_NORMAL_DISX| 5% 11% 22% 3% 4% 10%

AB_DISX_TS

AB_DISX_TS -0.224 -0.119 -0.073 0.067 0.112 0.196

|AB_DISX_TS|/|SC_DISX| 14% 24% 43% 13% 21% 34%

|AB_DISX_TS|/|NORMAL_DISX_TS| 12% 19% 30% 15% 27% 51%

This table reports descriptive statistics of the variables for observations with persistent REM proxies (i.e., those that are classified

repeatedly in the same extreme quintiles (Quintile 1 or Quintile 5) of REM proxies in two consecutive years). The variables reported

include REM proxies (or the abnormal component), the relative magnitude of the REM proxies to the normal component, and the

relative magnitude of REM proxies to the total amount. REM proxies reported include those from the traditional model, non-linear

model, investment-opportunity-set model, performance-matched model, reversal-based model, and time-series-adjusted model,

respectively. REM proxies in the table are abnormal discretionary expenses. All REM models and variable definitions are

summarized in Appendix A.

*For the reversal-based model, none of the observations stay in the same extreme quintiles; therefore, the table reports the

descriptive statistics of the group of observations that are the most persistent available in the sample (i.e., (1) those that move from

Quintile 1 in year t to the lowest quintile available in year t+1 and (2) those that move from Quintile 5 in year t to the highest

quintile available in year t+1).

35

Electronic copy available at: https://ssrn.com/abstract=2359813

TABLE 2: Transition Matrices of Traditional Proxies

Panel A: Abnormal Discretionary Expenses

Year t+1 AB_DISX Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 73.40% 4.10% 1.70% 69.38% 5.66% 0.97%

Q3 4.26% 49.57% 4.15% 5.79% 49.16% 3.08%

Q5 1.54% 5.07% 71.83% 1.21% 2.78% 78.91%

Panel B: Abnormal CFO

Year t+1 AB_CFO Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 47.83% 12.55% 8.29% 69.90% 5.58% 4.93%

Q3 12.85% 28.47% 11.53% 5.69% 37.86% 9.75%

Q5 8.10% 12.43% 48.16% 4.33% 10.81% 55.38%

Panel C: Abnormal Production Costs

Year t+1 AB_PROD Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 69.20% 6.09% 1.97% 69.69% 5.30% 1.85%

Q3 5.80% 40.42% 8.87% 5.93% 45.19% 5.30%

Q5 2.46% 9.27% 60.81% 2.38% 6.43% 67.61%

This table reports transition matrices of the three traditional REM proxies and of the normal components. The sample is sorted into

5 quintile portfolios based on the magnitude of each of the three REM proxies and their normal components. The table presents the

likelihood that a firm-year observation in a given quintile (Q1, Q3, Q5) in year t will transition to Q1, Q3, and Q5 in the subsequent

year (year t +1). Panels A, B, and C present results for abnormal discretionary expenses, abnormal CFO, and abnormal production

costs, respectively. Cells with the highest probability of occurrence for a given state in year t are bolded. REM models and variable

definitions are summarized in Appendix A.

36

Electronic copy available at: https://ssrn.com/abstract=2359813

TABLE 3: Long-Term Persistence of Traditional Proxies

Panel A: Abnormal Discretionary Expenses

Quintile 1 Quintile 5

REM Proxy Benchmark p-value REM Proxy Benchmark p-value

Year Retention % Retention % of diff. Retention % Retention % of diff.

t 100% 100% 100% 100%

t+1 60% 58% 0.014 59% 62% <0.001

t+2 40% 38% 0.087 40% 42% 0.060

t+3 28% 27% 0.260 28% 28% 0.569

t+4 20% 19% 0.637 20% 20% 0.938

Panel B: Abnormal CFO

Quintile 1 Quintile 5

REM Proxy Benchmark p-value REM Proxy Benchmark p-value

Year Retention % Retention % of diff. Retention % Retention % of diff.

t 100% 100% 100% 100%

t+1 38% 54% <0.001 40% 47% <0.001

t+2 18% 33% <0.001 21% 27% <0.001

t+3 9% 21% <0.001 13% 17% 0.002

t+4 5% 14% <0.001 8% 11% 0.019

Panel C: Abnormal Production Costs

Quintile 1 Quintile 5

REM Proxy Benchmark p-value REM Proxy Benchmark p-value

Year Retention % Retention % of diff. Retention % Retention % of diff.

t 100% 100% 100% 100%

t+1 58% 55% 0.008 49% 57% <0.001

t+2 39% 34% <0.001 29% 36% <0.001

t+3 28% 22% <0.001 19% 24% <0.001

t+4 20% 15% <0.001 13% 17% 0.001

This table reports the actual percentage of observations that are classified in the extreme quintiles of REM proxies (Quintile 1 or

Quintile5) in the current year that are consistently classified in the same quintile in the subsequent years up until four years into the

future. The table also reports the retention percentages of the benchmark (i.e., the normal component) and the statistical significance

of the difference. Panels A, B, and C present the results for abnormal discretionary expenses, abnormal CFO, and abnormal

production costs, respectively. REM models and variable definitions are summarized in Appendix A.

37

Electronic copy available at: https://ssrn.com/abstract=2359813

TABLE 4: Transition Matrices of Adjusted REM Proxies

Non-Linear Model

Year t+1 AB_DISX_NONL Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 73.23% 4.16% 1.56% 70.68% 5.36% 0.80%

Q3 4.33% 48.80% 4.58% 5.64% 48.91% 3.00%

Q5 1.47% 5.15% 71.36% 1.12% 2.99% 78.73%

Opportunity-Adjusted Model

Year t+1 AB_DISX_IOS Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 65.53% 6.82% 1.86% 66.00% 7.20% 0.74%

Q3 6.28% 40.99% 5.49% 6.45% 39.34% 6.08%

Q5 1.96% 6.22% 67.82% 1.17% 5.93% 70.37%

Performance-Matched Model

Year t+1 PM_AB_DISX Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 33.64% 19.44% 7.92% 27.81% 20.12% 11.62%

Q3 18.17% 24.76% 12.64% 18.32% 22.85% 15.87%

Q5 7.63% 12.82% 47.89% 11.80% 16.36% 36.59%

Reversal-Based Model

Year t+1 REV_AB_DISX Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 0.00% 56.46% 42.20% 80.22% 2.64% 0.22%

Q3 4.94% 88.86% 5.39% 2.92% 55.11% 2.53%

Q5 32.27% 66.13% 0.00% 0.28% 3.52% 77.28%

Time-Series-Adjusted Model

Year t+1 AB_DISX_TS Benchmark: Normal Component

Year t Q1 Q3 Q5 Q1 Q3 Q5

Q1 18.90% 16.20% 29.32% 72.39% 4.23% 0.46%

Q3 13.07% 26.17% 14.55% 4.34% 50.69% 2.94%

Q5 35.14% 12.68% 20.83% 0.97% 3.59% 77.33%

This table reports transition matrices of adjusted REM proxies and of the normal components. The sample is sorted into 5 quintile

portfolios based on the magnitude of each REM proxy and the normal components. The table presents the likelihood that a firm-year

observation in a given quintile (Q1, Q3, or Q5) in year t will transition to Q1, Q3, and Q5 in the subsequent year (year t+1). REM

proxies in the table are abnormal discretionary expenses. Cells with the highest probability of occurrence for a given state in year

t are bolded. REM models and variable definitions are summarized in Appendix A.

38

Electronic copy available at: https://ssrn.com/abstract=2359813

TABLE 5: Serial correlation

Improvements over

Summary statistics traditional proxies

reduction in reduction in % unit root

Mean Q1 Median Q3 %pos. %pos.&sig. % pos. % pos.&sig. process rejection

AB_DISX 0.342 0.110 0.360 0.593 82% 32% N/A N/A 43%

AB_DISX_NONL 0.340 0.105 0.357 0.592 82% 33% 0% 0% 42%

AB_DISX_IOS 0.302 0.066 0.324 0.546 81% 29% 1% 4% 45%

PM_AB_DISX -0.027 -0.234 -0.021 0.194 47% 3% 35% 29% 63%

REV_AB_DISX -0.146 -0.178 0.000 0.000 2% 0% 80% 32% 95%

AB_DISX_TS -0.232 -0.455 -0.234 -0.025 23% 1% 59% 32% 80%

This table reports the summary statistics of the serial correlation of the traditional and adjusted REM proxies. REM proxies used in the table are abnormal discretionary expenses.

The serial correlation of variable X is the coefficient α1 obtained from the firm-level regression: Xt+1=α0+α1Xt+εt+1. The table also presents the percentage of firm-level coefficients

that are positive and those that are positive and significant, the improvement of the modified proxies over the traditional proxies, and percentage of firms that Augmented Dickey

Fuller test rejects the null hypothesis of unit root process. The sample in both panels includes all firms with available data on Compustat from 1987-2001. REM models and variable

definitions are summarized in Appendix A.

39

Electronic copy available at: https://ssrn.com/abstract=2359813

You might also like

- Collaborative Stewardship: Analytical Approach to Quality of Life in CommunitiesFrom EverandCollaborative Stewardship: Analytical Approach to Quality of Life in CommunitiesNo ratings yet

- Review of Literature of Ratio AnalysisDocument4 pagesReview of Literature of Ratio Analysisrleo_1987198279% (33)

- Dhanya - Final ReadytoprintDocument86 pagesDhanya - Final Readytoprintಡಾ. ರವೀಶ್ ಎನ್ ಎಸ್No ratings yet

- PCC Appointment PDFDocument2 pagesPCC Appointment PDFSri Nithin Kollipara100% (1)

- Sanjit Kumar Roy, Dilip S. Mutum, Bang Nguyen (Eds.) - Services Marketing Cases in Emerging Markets - An Asian Perspective-Springer International Publishing (2017)Document185 pagesSanjit Kumar Roy, Dilip S. Mutum, Bang Nguyen (Eds.) - Services Marketing Cases in Emerging Markets - An Asian Perspective-Springer International Publishing (2017)domiNo ratings yet

- Jacksonville Jaguars Media PlanDocument14 pagesJacksonville Jaguars Media PlanOakenshield1100% (1)

- Cohen 2019 Measuring Real Activity ManagementDocument45 pagesCohen 2019 Measuring Real Activity Managementgustin padwa sariNo ratings yet

- Litreature ReviewDocument3 pagesLitreature ReviewAditi SinghNo ratings yet

- Efectos Del Sistema de Control de Gestión en Conductas Poco ÉticasDocument23 pagesEfectos Del Sistema de Control de Gestión en Conductas Poco Éticascanelon696969No ratings yet

- Effects of The Management Control System in Unethical BehaviorsDocument23 pagesEffects of The Management Control System in Unethical BehaviorsAgatha SekarNo ratings yet

- Managerial Decisions and Long-Term Stock Price PerformanceDocument44 pagesManagerial Decisions and Long-Term Stock Price PerformanceLeszek CzapiewskiNo ratings yet

- Aggressive Real Earnings Management and The Value of Firm Cash HoldingsDocument49 pagesAggressive Real Earnings Management and The Value of Firm Cash HoldingsLiem NguyenNo ratings yet

- RPS 11 Poin 2Document22 pagesRPS 11 Poin 2semessatu26No ratings yet

- 12、Employee Stock Option Exercise and Firm Cost(2019JF)Document42 pages12、Employee Stock Option Exercise and Firm Cost(2019JF)feng zhaoNo ratings yet

- PHD Hina DADocument5 pagesPHD Hina DAhinaNo ratings yet

- Calendar Time PortfolioDocument7 pagesCalendar Time PortfolioLeszek CzapiewskiNo ratings yet

- Mohan RamDocument49 pagesMohan Rammanhhung276894954No ratings yet