Professional Documents

Culture Documents

Employee Benefits

Employee Benefits

Uploaded by

Paulo Emmanuel SantosOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee Benefits

Employee Benefits

Uploaded by

Paulo Emmanuel SantosCopyright:

Available Formats

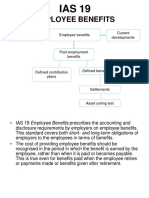

Lesson: Employee Benefits c.

Post Employment Benefits

- all forms of consideration given by an - benefits which are payable after

entity in exchange for services rendered by completion of employment; such as:

employees.

▪ pensions

▪ lump sum retirement pay

a. Short Term Employee Benefits - in exchange for services rendered –

received after employment.

- benefits which are expeced to be settled

wholly within 12 months (except for

termination benefits); includes the

d. Other Long Term Benefits

following:

- benefits that are not under short term

▪ salaries, wages, and social security

benefits, termination benefits, or post

contributions

employment benefits; it is the residual

▪ short-term compensated or paid

definition; includes:

absences

▪ profit sharing and bonuses ▪ sabbatical leave, disability leave,

▪ non-monetary benefits, such as jubilee leave, deferred

medical care, housing, car, and free compensation, maternity leave

or subsidized goods

- in exchange for services rendered –

- in exchange for services rendered – received during employment in a long period

received during employment in a short of time.

period of time.

b. Termination Benefits

- employee benefits provided in exchange

for the termination of an employee’s

employment as a result of either:

▪ entity’s choice to terminate an

employee before normal retirement I. Classifications of Employee Benefits

date

i. In Terms of Contributions:

▪ employee’s decision to accept an

offer of benefit in exchange for the ▪ Non-Contributory – only the

termination employer makes the contributions.

▪ Contributory – the employer and the

- to compensate for the termination –

employee make the contributions.

received after employment.

ii. In Terms of Managing the Funds: - the cost of the company is equal to

actuarial assumptions.

▪ Unfunded – the company is the one

who manages the fund. - e.g., the employer and employee agreed

▪ Funded – the fund is being managed that employee will receive P 100 per year.

by the hired pension fund entity.

A B

Benefit (fixed) 100 100

Return on Funds (-) 90 10

iii. In Terms of the Plan: Contribution (vary) 10 90

▪ Defined Contribution Plan –

contribution is fixed; benefits will II. Projected Benefit Obligation (basis of

vary on the performance of the fund benefit received by employees)

(returns)

▪ Defined Benefit Plan – benefit is - ignore the accumulated benefit obligation,

fixed; contribution will vary on the which considers the current salary of the

performance of the fund (returns) employee.

A. Defined Contribution Plan – the Future Salary XX

contribution by employer is agreed and Certain % X%

fixed; the benefits of employee will vary on Years Employed XX

the return on the fund. Benefit XX

- the employee bears the risk of investment.

- the cost of the company is equal to the III. Benefit Cost (cost less income)

contribution. a. Presented in Statement of Profit or Loss:

- e.g., the employer and employee agreed ▪ Service Cost

that employer will contribute P 100 per year.

- current service cost, past service

A B cost, and gain or loss on settlement of

Contribution (fixed) 100 100 PBO.

Return on Funds (+) 90 10

Benefit (vary) 190 110

i. Current Service Cost – increase in benefit

B. Defined Benefit Plan – the benefit that obligation resulting from services rendered

the employee will receive is agreed and in the current period.

fixed; the contribution wil vary on the return

- the portion of retirement pay that was

on the fund.

earned by the employee because he/she

- the employer bears the risk of investment. rendered services for the current year.

Future Salary 50,000 i. Interest Expense – the amortization of

Certain % x 10% discount – the PBO is measured at present

Earnings Per Year 5,000 value.

ii. Past Service Cost – change in the benefit PBO – beginning XX

obligation resulting from introduction Discount Rate (beg.) X%

and/or curtailment.

Interest Expense XX

- e.g., the company agreed to their employee

to pay retirement pay of P 100 per year of

- discount rate (1st – yield rate of high quality

service; an employee will be introduced

corporate bonds; 2nd – yield rate of

(included) to the plan only when regularized

government issued bonds/treasury bonds)

by the 3rd year.

Year 1 – P 100 not yet incurred (no

obligation) ii. Interest Income – the standard earnings

of investment in the financial market.

Year 2 – P 100 not yet incurred (no

obligation) - this is not the actual income of the

company but only a benchmark in

Year 3 – P 100 (current service) + P 200 for

determining how good the fund was

years rendered in the past (past service)

managed.

iii. Gain or Loss on PBO Settlement – the

Plan Asset – beginning XX

benefit obligation is paid ahead of time than

Discount Rate (beg.) X%

expected date of retirement.

Interest Income XX

- obligation is transferred to financial

institution.

iii. Interest on Effect of Asset Ceiling

- if settled (pain in advance), with gain or

loss; if paid (on time), no gain or loss.

b. Presented in Other Comprehensive

Income:

CA (PV) of BPO Settled XX

Less: Settlement Price (XX) ▪ Remeasurements

Gain or Loss on Settlement XX - actuarial gain or loss on plan asset,

actuarial gain or loss on benefit

obligation, change in effect of asset

▪ Net Interest

ceiling.

- interest expense, interest income,

interest on effect of asset ceiling.

i. Actuarial Gain or Loss on Plan Asset V. Projected Benefit Obligation

Actual Return XX Projected Benefit Obligation

Less: Interest Income X% Actuarial Gain - Beginning Balance

PBO

Actuarial Gain (Loss) XX

Benefits Paid Interest Expense

CA of Benefits Current Service

▪ Actuarial Gain – the excess of actual Settled Cost

earnings over the standard earnings Past Service Cost

Actuarial Loss -

in the financial market. The fund was

PBO

managed properly.

Ending Balance

▪ Actuarial Loss – the excess of

standard earnings over the actual

earnings in the financial market. The VI. Prepaid (Accrued) Benefit

fund was managed poorly.

FVPA, Ending XX

PBO, Ending (XX)

ii. Actuarial Gain or Loss on Benefit Prepaid (Accrued) Benefit XX

Obligation – change in the projected benefit

obligation due to change in statistical - (prepaid benefit) recorded to other non-

estimate. Estimated benefit is based on: current assets in the balance sheet.

a. Demographic – disability, early - (accrued benefit or deficit) recorded to non-

retirement, employee turnover. current liabilities in the balance sheet.

b. Financial – discount rate, future salary,

taxes.

Problem 1: On January 1, 2022, Okubo

▪ Actuarial Gain – change in estimate Company reported the following information

that led to lower benefit obligation. in relation to a defined benefit plan:

▪ Actuarial Loss – change in estimate

that led to higher benefit obligation. Fair Value of Plan Asset

7,000,000

(FVPA)

Projected Benefit

7,500,000

iii. Change in Effect of Asset Ceiling Obligation (PBO)

During the current year, the entity

IV. Plan Asset determined that the current service cost

was P 1,000,000 and the past service cost is

Plan Assets

Beginning Balance Benefits Paid P 400,000. The actual return on plan asset

Contributions Settlement Price during the year was P 840,000. Other related

Actual Return information for the current year:

Ending Balance

Contributions to the Plan 1,200,000 Actuarial Gain – PA 140,000

Benefits Paid to Retirees 1,500,000 Actual Return on PA 840,000

Decrease in PBO due to Interest Income (700,000)

Changes in Actuarial 200,000

Actuarial Gain – PBO 200,000

Assumptions

CA of Defined Benefit Effect of Asset Ceiling 0

500,000

Obligation Settled Net Remeasurement (gain) 340,000

Settlement Price of

400,000

Defined Benefit Obligation

Discount Rate 10% 3. What is the total amount of defined

benefit cost?

1. What amount should be reported in the

income statement for the current year as Service Cost 1,300,000

employee benefit expense?

Net Interest 50,000

Remeasurement (340,000)

Current Service Cost 1,000,000 Defined Benefit Cost 1,010,000

Past Service Cost 400,000

Gain on Settlement (100,000) 4. What is the fair value of plan assets on

Carrying Amount – 500K December 31, 2022?

Settlement Price – 400K

Total Service Cost 1,300,000

Plan Assets

7,000,000 (Beg.) 1,500,000 (Paid B.)

Interest Expense – PBO 750,000 1,200,000 (Contrib.) 400,000 (Settle.)

(7,500,000 x 10%) 840,000 (Act. Ret.)

Interest Income – PA (700,000) 9,040,000 1,900,000

(7,000,000 x 10%) (1,900,000) (1,900,000)

7,140,000 (End.)

Interest Expense – Asset Ceiling 0

Total Net Interest 50,000

Total 1,350,000

(1,300,000 + 50,000)

2. What is the net amount of

“remeasurements” for 2022?

5. What is the projected benefit obligation Current Service Cost 30,000

on December 31, 2022? Past Service Cost 115,000

Benefits Paid 31,000

Contribution to Fund 21,000

Projected Benefit Obligation

200,000 (Act. Gain) 7,500,000 (Beg.)

Plan Assets

1,500,000 (Paid B.) 750,000 (Int. Exp.)

2,100,000 (Beg.) 31,000 (Paid B.)

500,000 (CA of B.) 1,000,000 (Cur SC)

21,000 (Contrib.) 0 (Settle.)

400,000 (Past SC)

? (Act. Ret.)

0 (Act. Loss)

2,431,000 31,000

2,200,000 9,650,000

(31,000) (31,000)

(2,200,000) (2,200,000)

2,400,000 (End.)

7,450,000 (End.)

7. What is the actual return on plan asset?

6. What is the balance of the prepaid or

accrued benefit cost on December 31, 2022? ? = (2,400,000 + 31,000) - (2,100,000 +

21,000)

? = 2,431,000 – 2,121,000

FVPA, Ending 7,140,000

PBO, Ending (7,450,000) ? = 310,000 (actual return on PA)

Prepaid (Accrued) Benefit (310,000)

8. What is the amount of remeasurement of

Problem 2: The Baby Company provided the plan asset?

following information related to a defined

benefit plan for the years ended December

31, 2022: Actual Return on PA 310,000

January 1 December 31 Interest Income (105,000)

FVPA 2,100,000 2,400,000 (2,100,000 x 5%)

PBO 2,200,000 2,500,000 Actuarial Gain – PA 205,000

On January 1, 2022, the discount rate and

expected rate of return are 5% and 7%

respectively. On January 1, 2023, the

discount rate and expected rate of return are

6% and 8% respectively. Other related

information for the year:

9. What is the actuarial loss arising from the Beg. End. Change

increase in projected benefit obligation? Plan Asset XX XX

PBO (XX) (XX)

Surplus (Def) XX XX

Projected Benefit Obligation Asset Ceiling (XX) (XX)

0 (Act. Gain) 2,200,000 (Beg.) Effect XX XX XX

31,000 (Paid B.) 110,000 (Int. Exp.)* Discount % X%

0 (CA of B.) 30,000 (Cur SC) Interest XX (XX)*

115,000 (Past SC) Change XX**

? (Act. Loss)

31,000 2,531,000

* - report to Income Statement (P/L)

(31,000) (31,000)

2,500,000 (End.) ** - report to Other Comprehensive Income

(OCI)

*Interest Expense – PBO = 2,200,000 x 5%

Problem 3: Platon Company’s defined

? = (2,500,000 + 31,000) – (2,200,000 + benefit plan has the following information:

110,000 + 30,000 + 115,000) January 1 December 31

? = 2,531,000 – 2,455,000 FVPA 2,100,000 2,400,000

PBO 2,200,000 2,500,000

? = 76,000 (actuarial loss - PBO) Discount 10% 10%

Asset

1,600,000 2,000,000

Ceiling*

10. What is the net remeasurement gain or

loss on December 31, 2022?

* - present value of available future refunds

and reduction in future contributions.

Actuarial Gain – PA 205,000

Actuarial Loss – PBO (76,000)

Effect of Asset Ceiling 0

Net Remeasurement (gain) 129,000

VII. Asset Ceiling

- the maximum amount of surplus that the

pension fund can manage.

- (effect) the excess fund that can no longer

be managed by the pension fund.

11. In relation to the asset ceiling, the Plan Assets

amount that the entity would recognize in 10,000,000 (Beg.) 2,500,000 (Paid B.)

other comprehensive income for the year 4,000,000 (Contrib.) 500,000 (Settle.)

2020 should be: 1,200,000 (Return)

15,200,000 3,000,000

Beg. End. Change (3,00,000) (3,000,000)

FVPA 10M 12M 2M 12,200,000 (End.)

PBO (8M) (9M) (1M)

Surplus (Def) 2M 3M 1M

Asset Ceiling (1.6M) (2M) (400K) Projected Benefit Obligation

Effect 400K 1M 600K 0 (Act. Gain) 8,000,000 (Beg.)

Discount % 10% 2,500,000 (Paid B.) 800,000 (Int. Exp.)

Interest 40K (40K) 600,000 (CA of B.) 3,000,000 (Cur SC)

500,000 (Past SC)

Change 560K

400,000 (Act. Loss)

3,100,000 12,700,000

40,000 – to Net Interest (P/L) (3,100,000) (3,100,000)

9,600,000 (End.)

560,000 – to Remeasurement (OCI)

Beg. End. Change

Problem 4: Margaret Alarcio Company FVPA 10M 12.2M 2.2M

reported a prepaid benefit cost of P PBO (8M) (9.6M) (1.6M)

1,500,000 on January 1, 2019. The entity Surplus (Def) 2M 2.6M 600K

provided the following information related Asset Ceiling (1.5M) (2M) (500K)

Effect 500K 600K 100K

to a defined benefit plan during the current

Discount % 10%

year:

Interest 50K (50K)

Current Service Cost 3,000,000 Change 50K

Actual Return – PA 1,200,000

Interest Expense – PBO 800,000

Current Service Cost 3,000,000

Settlement Price 500,000

PV of BO Paid 600,000 Past Service Cost 500,000

Interest Income – PA 1,000,000 Gain on Settlement (100,000)

Actuarial Loss – PBO 400,000 Carrying Amount – 600,000

Past Service Cost 500,000 Settlement Price – 500,000

Benefits Paid 2,500,000

Total Service Cost 3,400,000

Contribution to the Plan 4,000,000

PBO – January 1 8,000,000

FVPA – January 1 10,000,000

Asset Ceiling – January 1 1,500,000

Asset Ceiling – December 31 2,000,000

Discount Rate 10%

Interest Expense – PBO 800,000 Interest Expense – PBO 500,000

Interest Income – PA (1,000,000) Interest Income – PA (600,000)

Interest Expense – Asset Ceiling 50,000 Interest Expense – Asset Ceiling 30,000

Total Net Interest (150,000) Total Net Interest (70,000)

Total Benefit Expense (P/L) 3,250,000 Total Benefit Expense (P/L) 830,000

(3,400,000 – 150,000) (900,000 – 70,000)

Actuarial Gain – PA 200,000 Actuarial Gain – PA 300,000

Actual Return on PA 1,200,000 Actual Return on PA 900,000

Interest Income (1,000,000) Interest Income (600,000)

Actuarial Loss – PBO 400,000 Actuarial Gain – PBO 500,000

Effect of Asset Ceiling 50,000 Effect of Asset Ceiling (470,000)

Net Remeasurement (loss) 250,000 Net Remeasurement (gain) 330,000

Total 3,500,000 Total 500,000

(3,400,000 – 150,000 + 250,000) (900,000 – 70,000 – 330,000)

Contribution to the Fund 4,000,000

Less: Benefit Cost (Total) (3,500,000)

Over (Under) Funding 500,000

Beg. End. Change

FVPA 6M 7.9M 1.9M

PBO (5M) (5.9M) (0.9M)

Surplus (Def) 1M 2M 1M

Asset Ceiling (700K) (1.2M) (500K)

Effect 300K 800K 500K

Discount % 10%

Interest 30K (30K)

Change 470K

Current Service Cost 700,000

Past Service Cost 200,000

Gain on Settlement (0)

Total Service Cost 900,000

You might also like

- Summer Revision 29 QuestionsDocument13 pagesSummer Revision 29 Questionsetelka4farkasNo ratings yet

- Case Study: Morton Salt: Chapter 6: Process Selection andDocument22 pagesCase Study: Morton Salt: Chapter 6: Process Selection andPaulo Emmanuel Santos100% (1)

- Notes IAS 19Document18 pagesNotes IAS 19Nasir IqbalNo ratings yet

- Chapter 6 Emplooyee Benefit Part 2Document8 pagesChapter 6 Emplooyee Benefit Part 2maria isabellaNo ratings yet

- Employee Benefits P201Document18 pagesEmployee Benefits P201krisha milloNo ratings yet

- Employee Benefits P201Document17 pagesEmployee Benefits P201krisha milloNo ratings yet

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaNo ratings yet

- Salary PDFDocument14 pagesSalary PDFNITESH SINGHNo ratings yet

- Finacc ReviewerDocument4 pagesFinacc Reviewer200617No ratings yet

- Employee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Document10 pagesEmployee Benefits: PAS 19, PAS 20, PAS 23, and PAS 24 Philippine Accounting Standards 19 (PAS 19)Mica DelaCruzNo ratings yet

- Objectives: Chapter 5 - Employee Benefits - Ias 19Document82 pagesObjectives: Chapter 5 - Employee Benefits - Ias 19Tram NguyenNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsJohn Mark FernandoNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- Dependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)Document3 pagesDependents or Insurance Companies.: Sharing, Paid Annual Leave, Paid Sick Leave, Non Monetary Benefits)Niranjan JainNo ratings yet

- PAS 19 Employee BenefitsDocument62 pagesPAS 19 Employee BenefitsBenj FloresNo ratings yet

- Compensation Income and Fringe BenefitsDocument3 pagesCompensation Income and Fringe BenefitsAbigail VergaraNo ratings yet

- Income Under The Head "Salary"Document15 pagesIncome Under The Head "Salary"NITESH SINGHNo ratings yet

- Pas 19Document5 pagesPas 19elle friasNo ratings yet

- Employee BenefitsDocument3 pagesEmployee BenefitsJAY AUBREY PINEDANo ratings yet

- FR17 - Employee Benefits (Stud) .Document45 pagesFR17 - Employee Benefits (Stud) .duong duongNo ratings yet

- IA2 10 01 Employee Benefits PDFDocument17 pagesIA2 10 01 Employee Benefits PDFAzaria MatiasNo ratings yet

- Lecture Notes - IAS 19Document14 pagesLecture Notes - IAS 19Muhammed NaqiNo ratings yet

- IAS 19 Employment BenefitDocument18 pagesIAS 19 Employment BenefitSrabon BaruaNo ratings yet

- Financial Liabilities SummaryDocument4 pagesFinancial Liabilities SummaryNancy Litera MusicoNo ratings yet

- IAS 19 - SummaryDocument8 pagesIAS 19 - SummaryZubair MalikNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- SBR - Chapter 5Document6 pagesSBR - Chapter 5Jason KumarNo ratings yet

- Chapter 5 Employee Benefit Part 1Document9 pagesChapter 5 Employee Benefit Part 1maria isabellaNo ratings yet

- I. Concept Notes IAS19: Employee BenefitsDocument5 pagesI. Concept Notes IAS19: Employee Benefitsem cortezNo ratings yet

- IA3 - Accounting For Employee BenefitsDocument6 pagesIA3 - Accounting For Employee BenefitsHannah Jane Arevalo LafuenteNo ratings yet

- Short Notes - IAS 19Document7 pagesShort Notes - IAS 19Fakhur Zaman Mujeeb Ur RehmanNo ratings yet

- CFAS NotesDocument27 pagesCFAS NotesMikasa AckermanNo ratings yet

- SN Employee BenefitsDocument6 pagesSN Employee BenefitsKiana FernandezNo ratings yet

- Employee Benefit PlanDocument8 pagesEmployee Benefit PlantinydmpNo ratings yet

- Postemployment BenefitsDocument3 pagesPostemployment BenefitsChristian John PardoNo ratings yet

- Salary and Its TaxationDocument12 pagesSalary and Its TaxationBasit BandayNo ratings yet

- Gross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerDocument9 pagesGross Income: Income Earned Through The Actual, Direct, Personal Effort of The TaxpayerKen RaquinioNo ratings yet

- Ia 3Document3 pagesIa 3Auguste Anthony SisperezNo ratings yet

- Cfas Pas 19Document4 pagesCfas Pas 19Zyribelle Anne JAPSONNo ratings yet

- Ias 19-Employee BenefitsDocument3 pagesIas 19-Employee BenefitsfrondagericaNo ratings yet

- IAS 19 Employee BenefitsDocument32 pagesIAS 19 Employee BenefitsTamirat Eshetu WoldeNo ratings yet

- Add A Little Bit of Body TextDocument4 pagesAdd A Little Bit of Body TextEidel PantaleonNo ratings yet

- IAS 19 NotesDocument16 pagesIAS 19 NotesArsalan AliNo ratings yet

- Lecture # 11: Employee Benefits IAS-19Document3 pagesLecture # 11: Employee Benefits IAS-19ali hassnainNo ratings yet

- Page 1 of 8Document8 pagesPage 1 of 8Aj PotXzs ÜNo ratings yet

- Pas 19 Employee BenefitsDocument14 pagesPas 19 Employee BenefitsKelzarineah FludgeNo ratings yet

- 1ST Summative PPT TheoriesDocument7 pages1ST Summative PPT TheoriesJohn Wallace ChanNo ratings yet

- IAS 19 Employee Benefits StudentDocument40 pagesIAS 19 Employee Benefits StudentYI WEI CHANGNo ratings yet

- Employee BenefitsDocument9 pagesEmployee BenefitstinydmpNo ratings yet

- Is The Higher BetweenDocument4 pagesIs The Higher Betweenleshz zynNo ratings yet

- Ias 19 Employee BenefitsDocument43 pagesIas 19 Employee BenefitsHasan Ali BokhariNo ratings yet

- Business Math Q2Document9 pagesBusiness Math Q2Cezter AbutinNo ratings yet

- FAR.2932 - Employee Benefits.Document6 pagesFAR.2932 - Employee Benefits.Edmark LuspeNo ratings yet

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument5 pagesDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Income Under Head SalariesDocument8 pagesIncome Under Head Salaries887 shivam guptaNo ratings yet

- Salary Part 1Document4 pagesSalary Part 1887 shivam guptaNo ratings yet

- Chapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsDocument50 pagesChapter 4 - Accounting For Other Liabilities: A. Post Employment BenefitsLovely AbadianoNo ratings yet

- Employee Benefit (Ias 19) FinalDocument36 pagesEmployee Benefit (Ias 19) FinalKanbiro OrkaidoNo ratings yet

- Chapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletDocument1 pageChapter 21 - Employee Benefits IFRS (IAS 19) and Then ASPE (Section 3462), Minor Difference Flashcards - QuizletcathNo ratings yet

- Salary PDF New 2Document20 pagesSalary PDF New 2NITESH SINGHNo ratings yet

- Salary PDFDocument12 pagesSalary PDFNITESH SINGHNo ratings yet

- Bahaghari (Social Enterprise Plan)Document51 pagesBahaghari (Social Enterprise Plan)Paulo Emmanuel SantosNo ratings yet

- Advocacy Plan (1A17)Document5 pagesAdvocacy Plan (1A17)Paulo Emmanuel SantosNo ratings yet

- STS Take Home Task 5 (Santos, 1A17) PDFDocument5 pagesSTS Take Home Task 5 (Santos, 1A17) PDFPaulo Emmanuel SantosNo ratings yet

- 1.0 Math in Our WorldDocument43 pages1.0 Math in Our WorldPaulo Emmanuel SantosNo ratings yet

- DCRB RulesDocument127 pagesDCRB RulesAngshuman BhattacharyaNo ratings yet

- PF Form 2Document2 pagesPF Form 2vishal APM jaloreNo ratings yet

- Infographic Fin 533 (2021)Document3 pagesInfographic Fin 533 (2021)Nurul AlyaNo ratings yet

- Superannuation BenefitsDocument49 pagesSuperannuation BenefitsfunshareNo ratings yet

- GNG GN 00252970000228971Document1 pageGNG GN 00252970000228971Ansisa DograNo ratings yet

- Housekeepin G Human Resource IssuesDocument25 pagesHousekeepin G Human Resource IssuesZachary JohannNo ratings yet

- Revision of Pension - Ksebl-2021Document35 pagesRevision of Pension - Ksebl-2021insppcit1No ratings yet

- High School Application Essay SampleDocument7 pagesHigh School Application Essay Samplejwpihacaf100% (2)

- Pension Scheme After 2004 For ChhattisgarhDocument4 pagesPension Scheme After 2004 For ChhattisgarhSaksham SrivastavNo ratings yet

- Optimal Option:: SUNY's Personal Retirement Plan As A Model For Pension ReformDocument32 pagesOptimal Option:: SUNY's Personal Retirement Plan As A Model For Pension ReformJimmyVielkindNo ratings yet

- G.O. Relating To Revised Pay On 7th Pay Commission PDFDocument13 pagesG.O. Relating To Revised Pay On 7th Pay Commission PDFDeepak StallioneNo ratings yet

- 7 Reasons by Ganesan ThiruDocument28 pages7 Reasons by Ganesan ThirupadmaniaNo ratings yet

- MODULE Midterm FAR 3 EmpBenefitsDocument15 pagesMODULE Midterm FAR 3 EmpBenefitsKezNo ratings yet

- NFLPA Benefits BookDocument32 pagesNFLPA Benefits BookJeff NixonNo ratings yet

- In The High Court of Sindh at Karachi: Constitutional Petition No. D - 1497 of 2020Document9 pagesIn The High Court of Sindh at Karachi: Constitutional Petition No. D - 1497 of 2020Salman AhmedNo ratings yet

- Saving HabitDocument10 pagesSaving HabitVienna Corrine Q. AbucejoNo ratings yet

- Santos-Vs-Servier-PhilippinesDocument2 pagesSantos-Vs-Servier-PhilippinesAnonymous V0JQmPJc33% (6)

- 20120524134118688Document118 pages20120524134118688WisconsinOpenRecordsNo ratings yet

- EXCLUSIONSDocument8 pagesEXCLUSIONSMeliodas SamaNo ratings yet

- Om 28323Document4 pagesOm 28323शुभांगी क्षिरसागर पवारNo ratings yet

- 34 - G R - No - 213486-DigestDocument2 pages34 - G R - No - 213486-DigestNaomi InotNo ratings yet

- Edelweiss Retirement Plan Investor PresentationDocument28 pagesEdelweiss Retirement Plan Investor Presentationnarayan.mitNo ratings yet

- Case Study Finance For ManagerDocument1 pageCase Study Finance For ManagerAyazNo ratings yet

- Internship Report On: Askari Bank Limited Hangu Road KohatDocument30 pagesInternship Report On: Askari Bank Limited Hangu Road KohatMuhammad AkmalNo ratings yet

- Contribution Rate Handbook Matrix (TAP Only)Document5,259 pagesContribution Rate Handbook Matrix (TAP Only)Abigail TrevinoNo ratings yet

- 2010 Cercado - v. - UNIPROM - Inc.20180918 5466 1r3ol97 PDFDocument7 pages2010 Cercado - v. - UNIPROM - Inc.20180918 5466 1r3ol97 PDFFrance SanchezNo ratings yet

- Richard Lobo EVP and Head Human Resources - Infosys LimitedDocument9 pagesRichard Lobo EVP and Head Human Resources - Infosys LimitedKunal PatilNo ratings yet

- Review of Family Financial Decision Making - Suggestions For Future Research and Implications For Financial EducationDocument15 pagesReview of Family Financial Decision Making - Suggestions For Future Research and Implications For Financial Educationadek wahyuNo ratings yet

- Plan 189Document1 pagePlan 189Venkatesh BetigeriNo ratings yet