Professional Documents

Culture Documents

Property Valuation For Capital Gain Tax - Taxguru - in

Property Valuation For Capital Gain Tax - Taxguru - in

Uploaded by

Pradeep LohumiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Property Valuation For Capital Gain Tax - Taxguru - in

Property Valuation For Capital Gain Tax - Taxguru - in

Uploaded by

Pradeep LohumiCopyright:

Available Formats

PROPERTY VALUATION FOR CAPITAL GAIN TAX

AUTHOR :CA MANMOHAN JINDAL

https://taxguru.in/income-tax/property-valuation-capital-gain-tax.html

Case Study

I received a case of Property Valuation

Since I am a Registered Valuer –SFA but to serve the customer at one roof , we generally contact our fellow

professionals to facilitate the customer

Silent features of the case are

-The Residential property is inherited to the customer in 1965

-The property is sold in 2021 for Rs 80000.00 ( Notional Value)

-The property purchased in 2021 for Rs 280000.00 ( Notional Value)

-Since the whole amount is invested in another residential property , the Capital Gain is NIL

-Question is that whether the valuation of the property is needed to value, still.

-On enquiry, I am informed that the valuation is required for 01.04.2001 to file the return

During the exercise, what I have learnt – is sharing for you.

Why needed the Valuation

1. Visa – Need Net worth certificate and Property Valuation

2. Bank Loan

3. Capital Gain Tax

4. Dispute in Property

5. Construction

6. Company Property sold / share

7. Inherited property – Property inherited from Father/Mother etc.

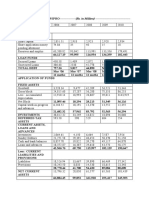

NOTIFIED COST INFLATION INDEX UNDER SECTION 48, EXPLANATION (V)

As per Notification no. 62/2022, dated 14-06-2022 following table should be used for the Cost Inflation Index:-

Sl. No. Financial Year Cost Inflation Index

(1) (2) (3)

1 2001-02 100

2 2002-03 105

3 2003-04 109

4 2004-05 113

5 2005-06 117

6 2006-07 122

7 2007-08 129

8 2008-09 137

9 2009-10 148

10 2010-11 167

11 2011-12 184

12 2012-13 200

13 2013-14 220

14 2014-15 240

15 2015-16 254

16 2016-17 264

17 2017-18 272

18 2018-19 280

19 2019-20 289

20 2020-21 301

21 2021-22 317

22 2022-23 331

Factors for Valuation of Property

1. Location – Corner, Highway, Roadside, Road Length Near Airport or Railway Station, Near Famous

Mandir etc.

2. Lease or Free hold

3. GPA or Registry or Power or Attorney

4. Kuccha or Pucca Makan

5. Use of Property – whether rented or vacant

6. Types of Construction – Marble flooring, Built up area, Floor rise etc.

The list is illustrative only. Other factors may affect the valuation

Points for Valuation

1. Valuer should registered under Income Tax

2. Valuer should be registered with IBBI

3. Fair Market Value- should not be more than the Circle rate of 01.04.2001

4. If no Circle rate that Fair Market value may be any sum subject to the satisfaction of the Authorities

Kindly share on my mail the reply of three question:

1. Whether valuation is compulsory required as on 01.04.2001

2. If we take the valuation as the circle rate , it suffices

3. Customer has suggested that if we take the valuation as on 01.04.2001 as zero then whole the sale

amount is treated as capital gain and exempt from the purchase of another property. But I suggest that it is

not the correct way to deal with. Kindly comment on this also.

You might also like

- Borris 1040 1Document2 pagesBorris 1040 1api-581728153100% (3)

- 2022 Uber 1099-NECDocument2 pages2022 Uber 1099-NECmwgageNo ratings yet

- Accoun1 SpaceDocument25 pagesAccoun1 SpacePerlas Flordeliza100% (1)

- Judith - Slides For IQI RENsDocument35 pagesJudith - Slides For IQI RENsAhmad Saiful Ridzwan JaharuddinNo ratings yet

- Chapter-4d Capital GainsDocument15 pagesChapter-4d Capital GainsBrinda RNo ratings yet

- DT QB - Capital Gain - Cma CA CsDocument29 pagesDT QB - Capital Gain - Cma CA Cslaplovely544No ratings yet

- A. R. Builders & DevelopersDocument5 pagesA. R. Builders & DevelopersdeepakNo ratings yet

- Module 2 - Assessment ActivitiesDocument3 pagesModule 2 - Assessment Activitiesaj dumpNo ratings yet

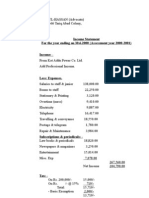

- Income Statement For The Year Ending On 30.6.2000 (Assessment Year 2000-2001)Document8 pagesIncome Statement For The Year Ending On 30.6.2000 (Assessment Year 2000-2001)api-3745637No ratings yet

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFvalsupmNo ratings yet

- Detiland 2023 DocumentDocument3 pagesDetiland 2023 DocumentKWAMESANo ratings yet

- City of Fort St. John - 2022 Annual Tax Sale ReportDocument5 pagesCity of Fort St. John - 2022 Annual Tax Sale ReportAlaskaHighwayNewsNo ratings yet

- 216-2001 (PLG) Settlement of Overdue NCL in Simple InterestDocument4 pages216-2001 (PLG) Settlement of Overdue NCL in Simple InterestArun JerardNo ratings yet

- Credit Evalution: Credit Investigation TypesDocument3 pagesCredit Evalution: Credit Investigation TypesKrizel DANo ratings yet

- 192-4B.21 Assetline Holdings OrugodawattaDocument8 pages192-4B.21 Assetline Holdings OrugodawattaRadeeshaNo ratings yet

- Case Study Tanuj K Khard Rev2Document12 pagesCase Study Tanuj K Khard Rev2TanujNo ratings yet

- ACCO 30053 - Audit of Investments - MARPDocument10 pagesACCO 30053 - Audit of Investments - MARPBanna SplitNo ratings yet

- Valuation of Immovable Property: Professional Practice - IIDocument18 pagesValuation of Immovable Property: Professional Practice - IIMayur KotechaNo ratings yet

- Basic Principle of ValuvationDocument20 pagesBasic Principle of ValuvationEr Chandra BoseNo ratings yet

- DGPM's Letter Dated 22.05.2024Document1 pageDGPM's Letter Dated 22.05.2024ravindrasinghranawat0No ratings yet

- Sample of Valuation Report-1Document11 pagesSample of Valuation Report-1Hamzat100% (1)

- Reliance Call NoticeDocument6 pagesReliance Call NoticeBharatNo ratings yet

- Tendernotice 1Document88 pagesTendernotice 1Gaurav AgarwalNo ratings yet

- Direct Tax (Capital Gain) PDFDocument4 pagesDirect Tax (Capital Gain) PDFSHRIKANT SAHUNo ratings yet

- Direct Tax (Capital Gain)Document4 pagesDirect Tax (Capital Gain)SHRIKANT SAHUNo ratings yet

- Myhomecapital - Business - Plan PresentationDocument27 pagesMyhomecapital - Business - Plan PresentationvkozachenkovaNo ratings yet

- Shopping Complex 9shops Tender Document20221200Document30 pagesShopping Complex 9shops Tender Document20221200BharatiNo ratings yet

- Ife Kemi EditDocument12 pagesIfe Kemi EditIfe OlaworeNo ratings yet

- To Whom So Ever It May ConcernDocument1 pageTo Whom So Ever It May ConcernAnirudha Singh VermaNo ratings yet

- Group AssignmentDocument17 pagesGroup AssignmentKhuetu NguyenhoangNo ratings yet

- Land Sale ProceedsDocument6 pagesLand Sale ProceedsMKMK JilaniNo ratings yet

- Final Channel Partner Empanelment Document For Uploading 1Document45 pagesFinal Channel Partner Empanelment Document For Uploading 1AmeetNo ratings yet

- Accounting ActivityDocument6 pagesAccounting ActivityJanet AnotdeNo ratings yet

- AA Step 8Document11 pagesAA Step 8asNo ratings yet

- Chapter 3 - Income From Capital Gains - NotesDocument65 pagesChapter 3 - Income From Capital Gains - NotesYashSukhwal100% (1)

- Capital Gains - An Overview: Ca Ameet PatelDocument51 pagesCapital Gains - An Overview: Ca Ameet PatelPrasun TiwariNo ratings yet

- Valuation Notes 1Document20 pagesValuation Notes 1DevNo ratings yet

- Tendernotice NIQDocument11 pagesTendernotice NIQB DroidanNo ratings yet

- 2 PPT BCOM 4 SEM INCOME TAX 4C CAPITAL GAINS - PPTXDocument21 pages2 PPT BCOM 4 SEM INCOME TAX 4C CAPITAL GAINS - PPTXvinayprasad RNo ratings yet

- Fundamentals of Project Financial and Investment AnalysisDocument70 pagesFundamentals of Project Financial and Investment AnalysisAmol BagulNo ratings yet

- Requirement 2: Test 2: Computation: Supply The AnswerDocument2 pagesRequirement 2: Test 2: Computation: Supply The AnswercloemrtzNo ratings yet

- 192-6.21 Asstline Holdings AmbalantotaDocument10 pages192-6.21 Asstline Holdings AmbalantotaRadeeshaNo ratings yet

- Choose One Answer To Each QuestionDocument5 pagesChoose One Answer To Each QuestionNguyễn Vũ Phương AnhNo ratings yet

- IIT TenderDocument10 pagesIIT TenderB DroidanNo ratings yet

- Property, Machine and Equipment Valuation Report: Prepared ByDocument19 pagesProperty, Machine and Equipment Valuation Report: Prepared ByKerealem MinyiksewNo ratings yet

- Minutes of The MeetingsDocument2 pagesMinutes of The MeetingsB.VeeraswamyNo ratings yet

- Tax3226N 3247N October 2024 AssignmentDocument10 pagesTax3226N 3247N October 2024 AssignmentKeaTumi Bokang LeagoNo ratings yet

- Dividend Summary As On 26 Dec 2021: Client ID Client Name From Date To Date Portfolio For Asset Class Account SubtypeDocument4 pagesDividend Summary As On 26 Dec 2021: Client ID Client Name From Date To Date Portfolio For Asset Class Account SubtypeCA Nikhil MunjalNo ratings yet

- Chap 002Document100 pagesChap 002Duy AAnhNo ratings yet

- TAX3247N 3226N May 2024 Assignment Question PaperDocument10 pagesTAX3247N 3226N May 2024 Assignment Question PaperfortuinpdNo ratings yet

- E/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Document17 pagesE/o C V/M: (A1) (A2) (A3) (A4) A6) (A7)Krisha Lei SanchezNo ratings yet

- Muthazhagan: From: Sent: To: CC: SubjectDocument11 pagesMuthazhagan: From: Sent: To: CC: SubjectMuthu SaravananNo ratings yet

- Assignment 2: Auction of Securities:: ResourcesDocument6 pagesAssignment 2: Auction of Securities:: ResourcesJapleenNo ratings yet

- Assignment 350 Ikmal DanielDocument37 pagesAssignment 350 Ikmal DanielAIN NATASYANo ratings yet

- OL Accounting P2Document480 pagesOL Accounting P2Luqman KhanNo ratings yet

- Accounting p1 Gr12 Memo Sept 2021 - EnglishDocument9 pagesAccounting p1 Gr12 Memo Sept 2021 - EnglishMpho MaphiriNo ratings yet

- Final Tender - Transaction Auditors.Document7 pagesFinal Tender - Transaction Auditors.Ajay KumarNo ratings yet

- NANDITADocument3 pagesNANDITAscribdarpanNo ratings yet

- Short Quiz 3 Set A With AnswerDocument3 pagesShort Quiz 3 Set A With AnswerJean Pierre Isip100% (1)

- Valuation Report - AWO Filling StationDocument7 pagesValuation Report - AWO Filling StationIbraheem BlazeNo ratings yet

- Case PresentationDocument29 pagesCase PresentationPriya TiwariNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- 1081 Supporting BillDocument2 pages1081 Supporting BillAshirwad BanerjeeNo ratings yet

- InvoiceDocument1 pageInvoicedebashis ghosemohapatraNo ratings yet

- IT-AE-36-G05 - Comprehensive Guide To The ITR12 Return For Individuals - External GuideDocument86 pagesIT-AE-36-G05 - Comprehensive Guide To The ITR12 Return For Individuals - External Guidevivek24200320034197No ratings yet

- Love 07Document11 pagesLove 07Diwaker PandeyNo ratings yet

- SG 2024021401 IV Is 000086632131Document1 pageSG 2024021401 IV Is 000086632131Saleh Abdul RazakNo ratings yet

- SCH XyzDocument1 pageSCH Xyzvikas_ojha54706No ratings yet

- Data ScientistDocument2 pagesData ScientistNandan PatelNo ratings yet

- Lesson 3 TAXATIONDocument14 pagesLesson 3 TAXATIONMarked BrassNo ratings yet

- Income Taxation Chapter 3 4Document23 pagesIncome Taxation Chapter 3 4Janna ClarisseNo ratings yet

- Chapter 3 Introduction To International TaxationDocument19 pagesChapter 3 Introduction To International Taxationrogue.pve1No ratings yet

- Gem Car Repair and Maintenance-Service Manual PDFDocument0 pagesGem Car Repair and Maintenance-Service Manual PDFjscarrilloz100% (1)

- Matla Kriel November Payroll 2022Document2 pagesMatla Kriel November Payroll 2022Tshikani JoyNo ratings yet

- SSDTDocument1 pageSSDTCeejay RosalesNo ratings yet

- Annex "C" Income Payor/Withholding Agent'S Sworn DeclarationDocument2 pagesAnnex "C" Income Payor/Withholding Agent'S Sworn Declarationzairah jean baquilarNo ratings yet

- Sales Register 2017Document69 pagesSales Register 2017Harish BhardwajNo ratings yet

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainNo ratings yet

- True or False: Documentary Stamp TaxDocument6 pagesTrue or False: Documentary Stamp Taxjanelle asiong50% (2)

- Application For Permanent Account Number (Pan) : IndividualsDocument3 pagesApplication For Permanent Account Number (Pan) : IndividualsBharat PangeniNo ratings yet

- Business Taxes ProblemsDocument6 pagesBusiness Taxes ProblemsMendoza KlariseNo ratings yet

- CASE #: 3 TITLE: Fitness by Design, Inc. v. Commissioner of Internal Revenue (CIR), G.R. No. 177982, October 17, TOPIC: Assessing Deficiency TaxesDocument2 pagesCASE #: 3 TITLE: Fitness by Design, Inc. v. Commissioner of Internal Revenue (CIR), G.R. No. 177982, October 17, TOPIC: Assessing Deficiency TaxesRaz Uy BucatcatNo ratings yet

- Gasbill 3429800000 201905 20190604131500Document1 pageGasbill 3429800000 201905 20190604131500Raza Production & FilmsNo ratings yet

- Chapter 7 - National Income DeterminationDocument5 pagesChapter 7 - National Income DeterminationExequielCamisaCruspero100% (1)

- Goods and Services Tax - GSTR 2ADocument6 pagesGoods and Services Tax - GSTR 2ARajesh KumarNo ratings yet

- Sec 195 Gandhidham BR of WIRC of ICAIDocument19 pagesSec 195 Gandhidham BR of WIRC of ICAIरायटर लेखनवालाNo ratings yet

- 2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMDocument1 page2 - 1862473 - Salary - Annexure - 6 - 5 - 2021 12 - 46 - 56 AMMohammad MAAZNo ratings yet

- Soal Kasus AJPDocument5 pagesSoal Kasus AJPmjsjafar12345678No ratings yet

- Chs 5 - 7Document20 pagesChs 5 - 7abigael kebedeNo ratings yet

- CAF2 Workshop (Business Income and STX Questions)Document9 pagesCAF2 Workshop (Business Income and STX Questions)Abdul qadirNo ratings yet