Professional Documents

Culture Documents

Forex 1 HW Part 3 - Warm Up

Forex 1 HW Part 3 - Warm Up

Uploaded by

Rajiv ChoudharyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Forex 1 HW Part 3 - Warm Up

Forex 1 HW Part 3 - Warm Up

Uploaded by

Rajiv ChoudharyCopyright:

Available Formats

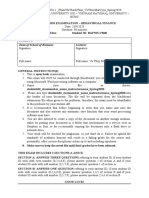

FOREX

Strategic Financial Management

WARM UP

Case Study 3

A US-based foreign portfolio investor (FPI) has invested in the Indian stock market with an

investment of $1 million on January 1, 2022. On December 31, 2022, the FPI wants to convert the

Indian Rupees (INR) back to US Dollars (USD). The following information is available:

1. January 1, 2022: 1 USD = 72.5 INR

2. December 31, 2022: 1 USD = 75.0 INR

3. Nifty 50 Index return: 20%

Question 1:

How much INR does the FPI have on December 31, 2022, after considering the 20% return from the

Nifty 50 Index?

ANSWER:

Rupees invested in India at the beginning of the year = 10,00,000 72.5 =` 7,25,00,000

Return on Nifty = 20%

Value of investment at the end of the year(in rupees) = 7,25,00,000 1.2 =` 8,70,00,000

Question 2:

How many USD does the FPI get after converting the INR back to USD on December 31, 2022?

ANSWER:

After converting this amount back in to dollars he will have 8,70,00,000/75 = $11,60,000 or $1.16

million

Question 3:

How much has the FPI gained or lost due to the movement in currency and stock market

performance?

2 Sanjay Saraf Educational Institute Pvt. Ltd.

Forex-Warm Up

ANSWER:

Return on investment = 11,60,000/10,00,000 = 16%

This return of 16% can be categorized in to

a. Stock component: 20%

b. Currency component: (72.5-75)/75 = -3.33%

c. Cross product:20% of -3.33% = -0.67

Note: alternatively cross product can be directly included in currency component if the question

does not ask for three components.

3 Sanjay Saraf Educational Institute Pvt. Ltd.

You might also like

- AssignmentsDocument5 pagesAssignmentsshikha mittalNo ratings yet

- CWM Level 2 - New MCQ ImpDocument570 pagesCWM Level 2 - New MCQ ImpAyushi ShahNo ratings yet

- East Delta University (EDU) : School of Business AdministrationDocument2 pagesEast Delta University (EDU) : School of Business AdministrationYeasir KaderNo ratings yet

- University of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013Document3 pagesUniversity of Rajasthan: B.B.A (II Sem.) 205 BBA-205 B.B.A. (Second Semester) Exam.,2013GuruKPO0% (1)

- Test Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionDocument11 pagesTest Series: April, 2021 Mock Test Paper 2 Final (New) Course: Group - Ii Paper - 7: Direct Tax Laws and International TaxaxtionRaghavanNo ratings yet

- Reading 1 Rates and Returns - AnswersDocument23 pagesReading 1 Rates and Returns - Answersmenexe9137No ratings yet

- Unit Trust (UT) Sample Questions - Set 2Document13 pagesUnit Trust (UT) Sample Questions - Set 2joshuagohejNo ratings yet

- Pile cp6Document57 pagesPile cp6casarokarNo ratings yet

- CUTE5 - Set 2 ENGLISH Questions & Answers 140610Document12 pagesCUTE5 - Set 2 ENGLISH Questions & Answers 140610Zack ZawaniNo ratings yet

- FCM MCQ 1Document15 pagesFCM MCQ 1capt.athulNo ratings yet

- RTP Group IIIDocument317 pagesRTP Group IIIPricilla RajNo ratings yet

- Investment ManagementDocument19 pagesInvestment ManagementMichael VuhaNo ratings yet

- Institute of Rural Management AnandDocument2 pagesInstitute of Rural Management AnandDharampreet SinghNo ratings yet

- (FR - F7 - Tài liệu ôn thi) Part D - Preparation of financial statementsDocument17 pages(FR - F7 - Tài liệu ôn thi) Part D - Preparation of financial statementsTrúc Diệp KiềuNo ratings yet

- Beginners Guide To Trading and Investment in Sri Lanka 3.0Document16 pagesBeginners Guide To Trading and Investment in Sri Lanka 3.0kajavatan2020No ratings yet

- Master File Fin 722Document34 pagesMaster File Fin 722Shrgeel HussainNo ratings yet

- Chapter 5 Mutual FundsDocument32 pagesChapter 5 Mutual FundsceojiNo ratings yet

- (Template) Construction of Portfolio - TESTDocument4 pages(Template) Construction of Portfolio - TEST41APayoshni ChaudhariNo ratings yet

- Corp Val - Non-DCF Approach (Cir.17.10.2023)Document118 pagesCorp Val - Non-DCF Approach (Cir.17.10.2023)Sonali MoreNo ratings yet

- GeneralMathematics (SHS) Q2 Mod10 MarketIndicesForStocksAndBonds V1Document26 pagesGeneralMathematics (SHS) Q2 Mod10 MarketIndicesForStocksAndBonds V1Rachael OrtizNo ratings yet

- Portfolio MGMT - 2Document2 pagesPortfolio MGMT - 2अंजनी श्रीवास्तव0% (1)

- Jun18l1equ-C01 QaDocument5 pagesJun18l1equ-C01 Qarafav10No ratings yet

- ACC4100-Lesson 3 Self StudyDocument3 pagesACC4100-Lesson 3 Self Studydaljeet singhNo ratings yet

- FM303 2021Document7 pagesFM303 2021Ashley ChandNo ratings yet

- IM FInal Exam Practice Test 3Document13 pagesIM FInal Exam Practice Test 3Ngoc Hoang Ngan NgoNo ratings yet

- ACCT 352 Fall 2022 Midterm BlankDocument12 pagesACCT 352 Fall 2022 Midterm Blankannika.schmunkNo ratings yet

- Exchange Rate Mechanism 27th April 2012Document39 pagesExchange Rate Mechanism 27th April 2012Uzair SupariwalaNo ratings yet

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarNo ratings yet

- RTP Dec 2021 Cap II Group IIDocument106 pagesRTP Dec 2021 Cap II Group IIRoshan KhadkaNo ratings yet

- Paper14 SolutionDocument20 pagesPaper14 Solutionp11No ratings yet

- RRBI Free Mock TestDocument29 pagesRRBI Free Mock TestRisi JayaswalNo ratings yet

- MQP - MBA - Sem2 - Financial Management (DMBA202) PDFDocument4 pagesMQP - MBA - Sem2 - Financial Management (DMBA202) PDFsanjeev misraNo ratings yet

- Forex ArithmeticsDocument3 pagesForex Arithmeticsphenix0723No ratings yet

- Derivatives Practice Exam Q&ADocument15 pagesDerivatives Practice Exam Q&AgjmitchellNo ratings yet

- Sambhram Institute of Technolog3Document1 pageSambhram Institute of Technolog3ravi_nyseNo ratings yet

- St. Paul'S University: DATE: August, 2021 TIME: 8.00am - 8.00am (24 Hours)Document5 pagesSt. Paul'S University: DATE: August, 2021 TIME: 8.00am - 8.00am (24 Hours)DOUGLAS NYONGESANo ratings yet

- Corporate Finance (FIN722) Non-Graded Questions For PracticeDocument3 pagesCorporate Finance (FIN722) Non-Graded Questions For PracticesadafilyasNo ratings yet

- Importanat Questions - Doc (FM)Document5 pagesImportanat Questions - Doc (FM)Ishika Singh ChNo ratings yet

- Derivatives Practice Exam QDocument12 pagesDerivatives Practice Exam QgjmitchellNo ratings yet

- Suggested Answer - Syl16 - Dec2018 - Paper - 14 Final Examination: Suggested Answers To QuestionsDocument17 pagesSuggested Answer - Syl16 - Dec2018 - Paper - 14 Final Examination: Suggested Answers To QuestionsshankarNo ratings yet

- General Mathematics: Quarter 2 - Module 10: Market Indices For Stocks and BondsDocument27 pagesGeneral Mathematics: Quarter 2 - Module 10: Market Indices For Stocks and Bondsshadow girirjekNo ratings yet

- TEST Paper 1 Full TestDocument9 pagesTEST Paper 1 Full Testjohny SahaNo ratings yet

- Risk and Return MidtermDocument31 pagesRisk and Return MidtermyoussefNo ratings yet

- Advisorkhoj HSBC Mutual Fund ArticleDocument9 pagesAdvisorkhoj HSBC Mutual Fund ArticleJitender ChaudharyNo ratings yet

- Bba Sem-6 AssignmentDocument9 pagesBba Sem-6 Assignmentshyam visanaNo ratings yet

- PART I: Short Essays. (35 MARKS) Answers Without Supporting Calculation Will Not Be GradedDocument4 pagesPART I: Short Essays. (35 MARKS) Answers Without Supporting Calculation Will Not Be GradedJannie WaldorfNo ratings yet

- International Financial System - 31082021Document2 pagesInternational Financial System - 31082021rishabh jainNo ratings yet

- Arbitrage ProblemDocument8 pagesArbitrage ProblemShrikantNo ratings yet

- Acts4130 14F A3qsDocument12 pagesActs4130 14F A3qsNurin FaqihahNo ratings yet

- Dean of School of Business LecturerDocument7 pagesDean of School of Business LecturerThạchThảooNo ratings yet

- Soal Mojakoe Uas Ipm Gasal 2019Document4 pagesSoal Mojakoe Uas Ipm Gasal 2019GhithrifNo ratings yet

- Midterm Paper-FMA-Fall 2020Document4 pagesMidterm Paper-FMA-Fall 2020Hamdan SheikhNo ratings yet

- 0708 T2 Midterm AnsDocument17 pages0708 T2 Midterm AnsYudi Kho100% (1)

- CAIIB ABFM Module B Mini Marathon 1Document21 pagesCAIIB ABFM Module B Mini Marathon 1Nandagopal KannanNo ratings yet

- 5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920Document6 pages5 - HI5002 Finance Tutorial Question Assignment T2 20202 Questions-AG 150920ahmerNo ratings yet

- Origination of Formula: R PV X I 1 - (1+i) : FM MIDTERM QUIZ With AnswersDocument11 pagesOrigination of Formula: R PV X I 1 - (1+i) : FM MIDTERM QUIZ With AnswersJanesene SolNo ratings yet

- 313 Practice Exam III 2015 Solution 2Document9 pages313 Practice Exam III 2015 Solution 2Johan JanssonNo ratings yet

- AU FINC 501 MidTerm Exam 2nd Semester2015ss V2Document14 pagesAU FINC 501 MidTerm Exam 2nd Semester2015ss V2Somera Abdul QadirNo ratings yet

- The Exciting World of Indian Mutual FundsFrom EverandThe Exciting World of Indian Mutual FundsRating: 5 out of 5 stars5/5 (1)