Professional Documents

Culture Documents

Illustration

Illustration

Uploaded by

NathaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration

Illustration

Uploaded by

NathaCopyright:

Available Formats

15-07-2022

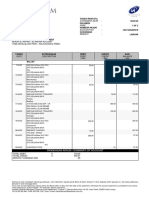

Quote No : qb8ma9b35uwdn,Application No : 1200073867834

Benefit Illustration for HDFC Life Sanchay Plus(Spl)

This Illustration has been produced by HDFC Life Insurance Company Limited to help you understand the benefits of your

HDFC Life Sanchay Plus(Spl)

DETAILS

Name of the Prospect/Policyholder: RAVI PRAKASH GUPTA Proposal No: NA

Age: 38 Name of Product: HDFC Life Sanchay Plus(Spl)

A non-participating non-linked savings

Name of Life Assured: RAVI PRAKASH GUPTA Tag Line:

insurance plan

Age: 38 Unique Identification No: 101N134V13

Policy Term: 15 Years GST Rate: 4.5% for first year

2.25% second year

Premium Paying Term: 5 Years

onwards

Amount of Instalment Premium

Rs.200000

(Without GST):

Mode: Annual

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

"Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers

guaranteed benefits then these will be clearly marked "guaranteed" in the illustration table on this page. If your policy offers variable benefits then the illustrations on this page will

show two different rates of assumed future investment returns, of 8% p.a. and 4% p.a. These assumed rates of return are not guaranteed and they are not the upper or lower limits

of what you might get back, as the value of your policy is dependent on a number of factors including future investment performance."

Policy Details

Policy Option Guaranteed Maturity Sum Assured Rs. 1030000

Guaranteed Payout Sum Assured on Death (at

NA 2410200

Freqency inception of the policy) Rs.

Guaranteed Payout Payout Term

NA NA

Amount (years)

Premium Summary

PP PP Total

Base Plan CI Rider IB Rider PP Rider (PAC) Rider Rider Instalment

(ADC) (CC) Premium

Instalment Premium without GST 2,00,000 0 0 0 0 0 2,00,000

Instalment Premium with First Year GST 2,09,000 0 0 0 0 0 2,09,000

Instalment Premium with GST 2nd Year Onwards 2,04,500 0 0 0 0 0 2,04,500

(Amount in Rupees)

Policy Year Single/ Guaranteed Non Guaranteed

Annualized

Survival Benefits / Other benefits Maturity Benefit Death Benefit Min Special Surrender Value

Premium

Loyalty Additions (if any) Guaranteed

Surrender

Value

1 2,00,000 0 0 0 24,10,200 0 0

2 2,00,000 0 0 0 24,10,200 1,23,600 1,23,600

3 2,00,000 0 0 0 24,10,200 2,16,300 2,16,300

4 2,00,000 0 0 0 24,10,200 4,12,000 4,12,000

5 2,00,000 0 0 0 24,10,200 5,15,000 4,25,184

6 0 0 0 0 25,23,593 5,49,018 5,15,671

7 0 0 0 0 26,36,985 5,83,036 6,19,344

8 0 0 0 0 27,50,378 8,74,553 7,37,567

9 0 0 0 0 28,63,771 9,08,571 8,72,488

10 0 0 0 0 29,77,164 10,97,089 10,26,049

11 0 0 0 0 30,90,556 11,31,107 12,00,670

12 0 0 0 0 32,03,949 11,65,125 13,98,633

13 0 0 0 0 33,17,342 11,99,142 16,22,937

14 0 0 0 0 34,30,734 12,33,160 18,76,854

15 0 0 0 21,74,742 35,44,127 12,67,178 21,63,927

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods & Service Tax.

I , have explained the premiums charges and benefits under the product fully to the I RAVI PRAKASH GUPTA,having received the information with respect to the

prospect / policy holder. above, have understood the above statement before entering into the contract.

Place:

Date: Signature of Agent /Intermediary / Official Date: Signature of Prospect / Policyholder

Note: Kindly note that name of the company has changed from "HDFC Standard Life Insurance Company Limited" to "HDFC Life Insurance Company Limited".

You might also like

- Iraisers 2018Document50 pagesIraisers 2018Donatus Kumah100% (2)

- MIS Assignment On Metlife AlicoDocument20 pagesMIS Assignment On Metlife Alicosalman KomorNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- Illustration Qatkwl5gp3chlDocument2 pagesIllustration Qatkwl5gp3chlRahul DipaliNo ratings yet

- Illustration 5Document2 pagesIllustration 5Phanindra GaddeNo ratings yet

- IllustrationDocument2 pagesIllustrationShashikumar RajkumarNo ratings yet

- Illustration - 2022-03-17T111744.362Document2 pagesIllustration - 2022-03-17T111744.362shubham gaundNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Illustration (13)Document2 pagesIllustration (13)gdrivelink07No ratings yet

- Wa0007.Document2 pagesWa0007.Shashikumar RajkumarNo ratings yet

- IllustrationDocument2 pagesIllustrationashverya agrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- IllustrationDocument2 pagesIllustrationVikas MaheshwariNo ratings yet

- IllustrationDocument2 pagesIllustrationAkash ChauhanNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- Illustration - 2022-08-26T182831.858Document2 pagesIllustration - 2022-08-26T182831.858Soumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationAshfaq hussainNo ratings yet

- IllustrationDocument2 pagesIllustrationVamsi Krishna BNo ratings yet

- IllustrationDocument2 pagesIllustrationsukh37949No ratings yet

- IllustrationDocument2 pagesIllustrationNeerja M GuhathakurtaNo ratings yet

- IllustrationDocument2 pagesIllustrationCHANDRAKANT RANANo ratings yet

- Wa0009.Document2 pagesWa0009.Dhana sekarNo ratings yet

- Illustration - 2022-08-26T182737.117Document2 pagesIllustration - 2022-08-26T182737.117Soumen BeraNo ratings yet

- Illustration - 2024-01-04T213945.722Document2 pagesIllustration - 2024-01-04T213945.722Rishavdar ClassNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- IllustrationDocument2 pagesIllustrationsarthakNo ratings yet

- Sanchy Plus - Long Term Income 1 LDocument2 pagesSanchy Plus - Long Term Income 1 LVen NatNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- IllustrationDocument2 pagesIllustrationMayank guptaNo ratings yet

- Illustration qc5j2kr0ld6j3Document2 pagesIllustration qc5j2kr0ld6j3santhoshkumar.selvaraj01No ratings yet

- IllustrationDocument2 pagesIllustrationestrade1112No ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- IllustrationDocument2 pagesIllustrationVivek SinghalNo ratings yet

- IllustrationDocument2 pagesIllustrationvyasmusicNo ratings yet

- IllustrationDocument2 pagesIllustrationdeepakzynNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- IllustrationDocument2 pagesIllustrationSoumen BeraNo ratings yet

- IllustrationDocument2 pagesIllustrationamitkumar.nayek28101989No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- IllustrationDocument2 pagesIllustrationdeepakzynNo ratings yet

- Illustration 8Document2 pagesIllustration 8deepakzynNo ratings yet

- IllustrationDocument2 pagesIllustrationdeepakzynNo ratings yet

- IllustrationDocument2 pagesIllustrationdeepakzynNo ratings yet

- IllustrationDocument2 pagesIllustrationbalaghatjobsNo ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Illustration Qbuh70x89xxnnDocument2 pagesIllustration Qbuh70x89xxnnKiran JohnNo ratings yet

- HDFC Life Guaranteed Income Insurance ( 8 - 16 )Document2 pagesHDFC Life Guaranteed Income Insurance ( 8 - 16 )AbhishekNo ratings yet

- Illustration Qc0n0t6y4j58fDocument3 pagesIllustration Qc0n0t6y4j58fNavneet PandeyNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument2 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- IllustrationDocument2 pagesIllustrationnikhilraoNo ratings yet

- IllustrationDocument2 pagesIllustrationSharma RaviNo ratings yet

- Illustration Qbf3d3k7xr0p2Document2 pagesIllustration Qbf3d3k7xr0p2Akshay ChaudhryNo ratings yet

- Miscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Nondepository Credit Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- G8UtmTcJQi6FLZk3CXIu A - Activity Template - Stakeholder Analysis and Power GridDocument5 pagesG8UtmTcJQi6FLZk3CXIu A - Activity Template - Stakeholder Analysis and Power GridNathaNo ratings yet

- Digital TransformationDocument9 pagesDigital TransformationNathaNo ratings yet

- RM VargasDocument4 pagesRM VargasNathaNo ratings yet

- IllustrationDocument2 pagesIllustrationNathaNo ratings yet

- Please Read CarefullyDocument3 pagesPlease Read CarefullyNathaNo ratings yet

- Senior Technical LeadDocument10 pagesSenior Technical LeadNathaNo ratings yet

- Annual Accounts HDFC PENSION MANAGEMENT COMPANY LIMITEDDocument8 pagesAnnual Accounts HDFC PENSION MANAGEMENT COMPANY LIMITEDNathaNo ratings yet

- UPPC Portal RegistrationAndLoginInstructionsEnDocument6 pagesUPPC Portal RegistrationAndLoginInstructionsEnNathaNo ratings yet

- Risk Management PlanDocument3 pagesRisk Management PlanNathaNo ratings yet

- Introduction To Course 2Document205 pagesIntroduction To Course 2Natha100% (1)

- Google Project ManagementDocument117 pagesGoogle Project ManagementNatha100% (2)

- Google Project Management2Document59 pagesGoogle Project Management2NathaNo ratings yet

- Google Project Management1Document53 pagesGoogle Project Management1NathaNo ratings yet

- Bajaj Allianz Cash Assure: A Non-Linked Participating Money-Back Life Insurance PlanDocument10 pagesBajaj Allianz Cash Assure: A Non-Linked Participating Money-Back Life Insurance PlanNathaNo ratings yet

- Activity Template - Project CharterDocument3 pagesActivity Template - Project CharterNathaNo ratings yet

- Nomination and Remuneration Policy - FinalDocument15 pagesNomination and Remuneration Policy - FinalNathaNo ratings yet

- Standard Operating Procedure (Sop) : Protean Egov Technologies LimitedDocument36 pagesStandard Operating Procedure (Sop) : Protean Egov Technologies LimitedNathaNo ratings yet

- Affin BancatakafulDocument7 pagesAffin BancatakafulAli NajhanNo ratings yet

- Ows Int Unit by Unit Wordlist EngDocument61 pagesOws Int Unit by Unit Wordlist EngsnadminNo ratings yet

- English Wheat LeafletDocument2 pagesEnglish Wheat LeafletVasantha NaikNo ratings yet

- Economic Evaluation Applied To Wind Energy ProjectsDocument12 pagesEconomic Evaluation Applied To Wind Energy ProjectsminlwintheinNo ratings yet

- Quantitative Problems Chapter 21Document10 pagesQuantitative Problems Chapter 21deathplayer932353100% (1)

- Span Margin CalculationDocument6 pagesSpan Margin Calculationsantanu80No ratings yet

- PG - COL - ADU - DAY - UOP - Smit Dilipbhai - Kalathiya - 2022-08-16Document4 pagesPG - COL - ADU - DAY - UOP - Smit Dilipbhai - Kalathiya - 2022-08-16Ayushi SavaniNo ratings yet

- Conceptual Frame WorkDocument62 pagesConceptual Frame WorkKavyaNo ratings yet

- VA Loans Guidebook Ebook SummaryDocument8 pagesVA Loans Guidebook Ebook Summaryangel montanez100% (1)

- China Banking Corp V CIRDocument2 pagesChina Banking Corp V CIRWayne Michael NoveraNo ratings yet

- Financial Management 3B LAO FinalDocument7 pagesFinancial Management 3B LAO Final221103909No ratings yet

- Estatement-202304 20230511111017Document2 pagesEstatement-202304 20230511111017SITI DZULAIHANo ratings yet

- The Blockchain RevolutionDocument27 pagesThe Blockchain RevolutionAlaa' Deen ManasraNo ratings yet

- Financial Assistance Schemes by SidbiDocument5 pagesFinancial Assistance Schemes by SidbiDiscov SinghNo ratings yet

- BIPPDocument2 pagesBIPPPrince Hadhey VaganzaNo ratings yet

- Sample AssignmentDocument31 pagesSample Assignmentits2kool50% (2)

- PHD Thesis Topics in Accounting PDFDocument8 pagesPHD Thesis Topics in Accounting PDFqpftgehig100% (1)

- Location of New Undertaking & Types of ActivityDocument46 pagesLocation of New Undertaking & Types of ActivityKanika KambojNo ratings yet

- IIFL Internship ReportDocument33 pagesIIFL Internship ReportSURAJ TALEKAR100% (2)

- Signature CardDocument1 pageSignature CardAKASHNo ratings yet

- DTLDocument5 pagesDTLBharat Natti RawatNo ratings yet

- Abstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orDocument9 pagesAbstract: Reverse Mortgage Is A Relatively New Financial Product Which Allows Senior Citizens To Keep Their House orArunabh ChoudhuryNo ratings yet

- Government Accounting Rules, 1990 (2019-Edition) : Prepared by Deepak Kumar Rahi, AAO (LAD/Patna)Document16 pagesGovernment Accounting Rules, 1990 (2019-Edition) : Prepared by Deepak Kumar Rahi, AAO (LAD/Patna)ARAVIND K100% (2)

- A Case Study On Commodities Trading-Investment and SpeculationDocument95 pagesA Case Study On Commodities Trading-Investment and SpeculationNishant Sharma100% (1)

- ABM+2 Learning+Material+No.+4Document3 pagesABM+2 Learning+Material+No.+4Gelesabeth GarciaNo ratings yet

- Presentasi Kel5 - InovasiDocument21 pagesPresentasi Kel5 - Inovasid0r@emon100% (1)

- Theory of MergersDocument37 pagesTheory of MergersJoyal JosephNo ratings yet

- Agreement Personal LoanDocument8 pagesAgreement Personal LoanAnkush KotakNo ratings yet