Professional Documents

Culture Documents

Serv Let Controller

Serv Let Controller

Uploaded by

AbhishekShuklaCopyright:

Available Formats

You might also like

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Novice HedgeDocument130 pagesNovice HedgeAnujit Kumar100% (6)

- Vanguard Case StudyDocument1 pageVanguard Case Studyvivek mehta100% (1)

- Freeport LNG Liquefaction Project: Macquarie CapitalDocument2 pagesFreeport LNG Liquefaction Project: Macquarie CapitalDaplet ChrisNo ratings yet

- Dobi DobikuDocument27 pagesDobi DobikuMohdTaufikHidayatHamdan100% (2)

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Investment Declaration - Form12BBDocument1 pageInvestment Declaration - Form12BBRiya rashmi DashNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Form12BB 1Document2 pagesForm12BB 1kolhe2377No ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Sample of Form 12BBDocument1 pageSample of Form 12BBphaniranjanNo ratings yet

- Epsf Form12bb 10006980Document2 pagesEpsf Form12bb 10006980Vikas SoniNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form-No 12BDocument4 pagesForm-No 12BtechbhaskarNo ratings yet

- EPSF FORM12BB 10006980 SignedDocument2 pagesEPSF FORM12BB 10006980 SignedVikas SoniNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Form 12BB Investment Declaration 2021 2022Document3 pagesForm 12BB Investment Declaration 2021 2022bs968367No ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Money SavingDocument2 pagesMoney SavingRanga.SathyaNo ratings yet

- Investment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Document2 pagesInvestment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Ranga.SathyaNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form-12BBDocument2 pagesForm-12BBarvindNo ratings yet

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pages"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- Form12BB 22 23Document3 pagesForm12BB 22 23Vipin KumarNo ratings yet

- IT Declaration - Form 12BBDocument4 pagesIT Declaration - Form 12BBmkharb941No ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BBDocument4 pagesForm 12BBAkhilesh PurohitNo ratings yet

- Srimadh BhagavathamDocument2 pagesSrimadh Bhagavathamprabha sureshNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBshrivastavs035No ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Learning Guide: Accounting Department Basic Accounting Works Level IiDocument30 pagesLearning Guide: Accounting Department Basic Accounting Works Level IiKen LatiNo ratings yet

- Joint Venture Accounts Solved ProblemsDocument5 pagesJoint Venture Accounts Solved ProblemsAnonymous duzV27Mx350% (2)

- OFT5UserGuideComplete (120-160)Document41 pagesOFT5UserGuideComplete (120-160)Jan RodenburgNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- 2014 WFE Market HighlightsDocument10 pages2014 WFE Market HighlightsFocsa DorinNo ratings yet

- Lesson Plan Abm Semi DetailedDocument4 pagesLesson Plan Abm Semi DetailedLiza Reyes GarciaNo ratings yet

- Export of Refined Petroleum Product From IndiaDocument36 pagesExport of Refined Petroleum Product From IndiaMadhukant DaniNo ratings yet

- BPCLDocument8 pagesBPCLvipin chahal100% (1)

- 05 - Receivable Financing and Notes ReceivableDocument2 pages05 - Receivable Financing and Notes Receivableralphalonzo100% (3)

- Accounting For Ordinary Share Capital IssueDocument6 pagesAccounting For Ordinary Share Capital Issueraj shahNo ratings yet

- Chart of AccountsDocument9 pagesChart of AccountsMarius PaunNo ratings yet

- Illustration (13) - 1Document3 pagesIllustration (13) - 1prabu80959No ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingKhadar50% (4)

- CostingDocument494 pagesCostingbagi alekhyaNo ratings yet

- Stock Analysis 2019 BseDocument140 pagesStock Analysis 2019 BseNimishKarnNo ratings yet

- Glossary - Technical and Statistical Terms - SUSEPDocument5 pagesGlossary - Technical and Statistical Terms - SUSEPeduardolarasegurodevidaNo ratings yet

- Lecture 02Document31 pagesLecture 02jamshed20No ratings yet

- Lumban Senior High School: "The Home of Future Leaders."Document6 pagesLumban Senior High School: "The Home of Future Leaders."Francesnova B. Dela PeñaNo ratings yet

- Central Government For The Financial Year 2018-2019 PDFDocument511 pagesCentral Government For The Financial Year 2018-2019 PDFAlbert MsandoNo ratings yet

- Rico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To BuyDocument2 pagesRico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To Buyajd.nanthakumarNo ratings yet

- IEPF 2 Capital First 2011 12 July 05 2017Document198 pagesIEPF 2 Capital First 2011 12 July 05 2017Sonam PandeyNo ratings yet

- Notes Keynes Lecture 2019Document2 pagesNotes Keynes Lecture 2019George2001No ratings yet

- 202TC2302-202TC2304 - Đầu tư tài chính - 10g00 - 25.07.2021Document2 pages202TC2302-202TC2304 - Đầu tư tài chính - 10g00 - 25.07.2021Huế ThùyNo ratings yet

- Welcome To The Financial Information System (FIS) An IntroductionDocument23 pagesWelcome To The Financial Information System (FIS) An IntroductionMuneer SainulabdeenNo ratings yet

- 2019 Saln FormDocument2 pages2019 Saln Formchristine joy a. rola100% (1)

Serv Let Controller

Serv Let Controller

Uploaded by

AbhishekShuklaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Serv Let Controller

Serv Let Controller

Uploaded by

AbhishekShuklaCopyright:

Available Formats

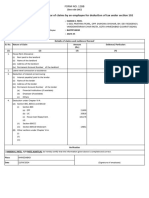

FORM NO.

12BB

(See rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee : ABHISHEK SHUKLA

2. Permanent Account Number of the employee : BMXPA5561J

3. Financial year : 2023-2024

Details of claims and evidence thereof

Sl. No. Nature of claim Amount(Rs.) Evidence / particulars

(1) (2) (3) (4)

House Rent Allowance:

Property No : 1

(i) Rent paid to the landlord Rs.270000

(ii) Name of the landlord Ankita Mishra

1. Rs.270000 Original House Rent Receipts

(iii) Address of the landlord H 68 Fardidabad

(iv) Permanent Account Number of the EVBPM0948D

landlord

Note: Permanent Account Number shall be furnished if the aggregate rent paid

during the previous year exceeds one lakh rupees

Original Travel

2. Leave travel concessions or assistance Rs.0

Receipts/Tickets

Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

Self Occupied Interest of :Rs.-200000

Property 1

Self Occupied Interest of :Rs.

Property 2

Let-OutInterest :Rs.0.0

(ii) Name of the lender

Self Occupied of Property 1 : MOnika Gaur

Self Occupied of Property 2 :

Let-Out :

(iii) Address of the lender Provisional Certificate from

3. Rs.-200000.0 Bank/Financial

Self Occupied of : Mahavir Enclam part 1 Institution/Lender

Property 1

Self Occupied of :

Property 2

Let-Out :

(iv) Permanent Account Number of the lender

Self Occupied of Property 1 : AABCP0471C

Self Occupied of Property 2 :

Let-Out :

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a) 5 Year Time Deposit in Post Office : Rs.10000

(b) Fixed Deposit Scheme (Block Period of 5 yrs) : Rs.50000

(c) Housing Loan - Principal Re-payment : Rs.200000

(d) Mutual Funds : Rs.150000

(e) Life Insurance Premium : Rs.50000

(f) Sukanya Samriddhi Account Deposit Scheme : Rs.50000

(g) Public Provident Fund : Rs.50000

(h) Equity Linked Savings Scheme : Rs.150000

(ii) Section 80CCC :Rs.50000

(iii) Section 80CCD

Rs. 2510000.0 Photocopy of the investment

4.

(a) NPS Tier 1 - Employee Contribution (U/s 80CCD) : Rs.50000.0 proofs

(b) Atal Pension Yojana - Employee Contribution (U/s : Rs.50000.0

80CCD)

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VI-A.

(a) 80DSSCNI - Medical Insurance - Self / Spouse / Children : Rs.100000

(>=60 yrs) - Without Insurance

(b) 80E - Interest on Educational Loan : Rs.500000

(c) 80DSSCI - Medical Insurance - Self / Spouse / Children : Rs.200000

(>=60 yrs) - With Insurance

(d) 80DPI - Medical Insurance for Parents (<60yrs) - With : Rs.400000

Insurance

(e) SEC80DDB - Section 80 DDB benefit for Very Senior : Rs.100000

Citizen

(f) NPS Tier 1 - Employee Contribution (U/s 80CCD1B) : Rs.50000

(g) 80DSI - Medical Insurance - Self / Spouse / Children (<60 : Rs.300000

yrs) - With Insurance

Verification

I, ABHISHEK SHUKLA, son/daughter of Radhey Shyam Shukla. do hereby certify that the information given above is complete and

correct.

Place : GURGAON

Date: 04/05/2023

(Signature of the employee)

Designation : Lead Business Analyst Full Name: ABHISHEK SHUKLA

Note: The information/details above, as required for deduction of tax u/s 192 of the Income Tax Act, has been entered by the employee through an

authorized login on the portal. The information submitted above is deemed to be e-signed by the employee.

You might also like

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- Novice HedgeDocument130 pagesNovice HedgeAnujit Kumar100% (6)

- Vanguard Case StudyDocument1 pageVanguard Case Studyvivek mehta100% (1)

- Freeport LNG Liquefaction Project: Macquarie CapitalDocument2 pagesFreeport LNG Liquefaction Project: Macquarie CapitalDaplet ChrisNo ratings yet

- Dobi DobikuDocument27 pagesDobi DobikuMohdTaufikHidayatHamdan100% (2)

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- LetterDocument2 pagesLettervgNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Form 12 BBSampleDocument2 pagesForm 12 BBSampleAbhishekChauhanNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Investment Declaration - Form12BBDocument1 pageInvestment Declaration - Form12BBRiya rashmi DashNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Form12BB 1Document2 pagesForm12BB 1kolhe2377No ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Sample of Form 12BBDocument1 pageSample of Form 12BBphaniranjanNo ratings yet

- Epsf Form12bb 10006980Document2 pagesEpsf Form12bb 10006980Vikas SoniNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form-No 12BDocument4 pagesForm-No 12BtechbhaskarNo ratings yet

- EPSF FORM12BB 10006980 SignedDocument2 pagesEPSF FORM12BB 10006980 SignedVikas SoniNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Form 12BB Investment Declaration 2021 2022Document3 pagesForm 12BB Investment Declaration 2021 2022bs968367No ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Money SavingDocument2 pagesMoney SavingRanga.SathyaNo ratings yet

- Investment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Document2 pagesInvestment Declaration (Form-12BB) For FY 2020-21 (Old Regime)Ranga.SathyaNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form-12BBDocument2 pagesForm-12BBarvindNo ratings yet

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pages"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBHarsh GandhiNo ratings yet

- Form12BB 22 23Document3 pagesForm12BB 22 23Vipin KumarNo ratings yet

- IT Declaration - Form 12BBDocument4 pagesIT Declaration - Form 12BBmkharb941No ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- SL No. Amount (RS.) Evidence / Particulars Nature of ClaimDocument1 pageSL No. Amount (RS.) Evidence / Particulars Nature of ClaimJayanth vNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BBDocument4 pagesForm 12BBAkhilesh PurohitNo ratings yet

- Srimadh BhagavathamDocument2 pagesSrimadh Bhagavathamprabha sureshNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- Form 12 BBDocument2 pagesForm 12 BBshrivastavs035No ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Document From Rajan®Document5 pagesDocument From Rajan®Anit LuckyNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Learning Guide: Accounting Department Basic Accounting Works Level IiDocument30 pagesLearning Guide: Accounting Department Basic Accounting Works Level IiKen LatiNo ratings yet

- Joint Venture Accounts Solved ProblemsDocument5 pagesJoint Venture Accounts Solved ProblemsAnonymous duzV27Mx350% (2)

- OFT5UserGuideComplete (120-160)Document41 pagesOFT5UserGuideComplete (120-160)Jan RodenburgNo ratings yet

- Accounting Standards and Company Audit AnswersDocument9 pagesAccounting Standards and Company Audit AnswersrinshaNo ratings yet

- 2014 WFE Market HighlightsDocument10 pages2014 WFE Market HighlightsFocsa DorinNo ratings yet

- Lesson Plan Abm Semi DetailedDocument4 pagesLesson Plan Abm Semi DetailedLiza Reyes GarciaNo ratings yet

- Export of Refined Petroleum Product From IndiaDocument36 pagesExport of Refined Petroleum Product From IndiaMadhukant DaniNo ratings yet

- BPCLDocument8 pagesBPCLvipin chahal100% (1)

- 05 - Receivable Financing and Notes ReceivableDocument2 pages05 - Receivable Financing and Notes Receivableralphalonzo100% (3)

- Accounting For Ordinary Share Capital IssueDocument6 pagesAccounting For Ordinary Share Capital Issueraj shahNo ratings yet

- Chart of AccountsDocument9 pagesChart of AccountsMarius PaunNo ratings yet

- Illustration (13) - 1Document3 pagesIllustration (13) - 1prabu80959No ratings yet

- Capital BudgetingDocument12 pagesCapital BudgetingKhadar50% (4)

- CostingDocument494 pagesCostingbagi alekhyaNo ratings yet

- Stock Analysis 2019 BseDocument140 pagesStock Analysis 2019 BseNimishKarnNo ratings yet

- Glossary - Technical and Statistical Terms - SUSEPDocument5 pagesGlossary - Technical and Statistical Terms - SUSEPeduardolarasegurodevidaNo ratings yet

- Lecture 02Document31 pagesLecture 02jamshed20No ratings yet

- Lumban Senior High School: "The Home of Future Leaders."Document6 pagesLumban Senior High School: "The Home of Future Leaders."Francesnova B. Dela PeñaNo ratings yet

- Central Government For The Financial Year 2018-2019 PDFDocument511 pagesCentral Government For The Financial Year 2018-2019 PDFAlbert MsandoNo ratings yet

- Rico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To BuyDocument2 pagesRico Auto Industries: Valuations Become Attractive Post-Correction Upgraded To Buyajd.nanthakumarNo ratings yet

- IEPF 2 Capital First 2011 12 July 05 2017Document198 pagesIEPF 2 Capital First 2011 12 July 05 2017Sonam PandeyNo ratings yet

- Notes Keynes Lecture 2019Document2 pagesNotes Keynes Lecture 2019George2001No ratings yet

- 202TC2302-202TC2304 - Đầu tư tài chính - 10g00 - 25.07.2021Document2 pages202TC2302-202TC2304 - Đầu tư tài chính - 10g00 - 25.07.2021Huế ThùyNo ratings yet

- Welcome To The Financial Information System (FIS) An IntroductionDocument23 pagesWelcome To The Financial Information System (FIS) An IntroductionMuneer SainulabdeenNo ratings yet

- 2019 Saln FormDocument2 pages2019 Saln Formchristine joy a. rola100% (1)