Professional Documents

Culture Documents

Civil Affairs Handbook Belgium Section 5

Civil Affairs Handbook Belgium Section 5

Uploaded by

Robert ValeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Civil Affairs Handbook Belgium Section 5

Civil Affairs Handbook Belgium Section 5

Uploaded by

Robert ValeCopyright:

Available Formats

ARMY SERVICE FORCES MANUAL

L~J II11U~

CIVIL AFFAIRS HANDBOOK

BELGIUM

SECTION 5; MONEY AND

BANKING

Disserintion of restricted matter. - The information con-

tained in restricted documents and the essential characteristics of restricted

material may be given to any person known to be in the service of the United

States and to persons of undoubted loyalty and discretion who are cooperating

in Government work, but will not be communicated to the public or to the press

except by authorized military public relations agencies. (See also par. 18b,

AR 380-5, 28 Sep 1942@)

HEADQUARTERS, ARMY SERVICE FORCES,

-- C I 11 3- -- C- II - __ I- --

15 JUNE 1944

ARMY SERVICE FORCES MANUAL M361-5

Civil Affairs

CIVIL AFFAIRS HANDBOOK

BELGIUM

SECTION 5; MONEY AND

BANKING

HEADQUARTERS, ARMY SERVICE FORCES, 15 JUNE 1944

N .. * Dissemination of restricted matter. - The information con-

tained in restricted documents and the essential characteristics of restricted

material may be given to any person known to be in the service of the United

States and to persons of undoubted loyalty and discretion who are cooperating

in Government work, but will not be communicated to the public or to the press

except by authorized military public relations agencies. (See also par. 18b,

AR 380-5, 28 Sep 1942.)

I -- I---~ - ---- pm~--- Is -I - L I

I-I -- -I I - - -I -I I - I -

------ ~--,---- I~,~ --

NUMBERING SYSTEM OF

ARM! SERVICE FORCES MANUALS

The main subject matter of each Ariq' Service Forces Manual is indicated

by consecutive numnbering within the following. categories.

Ml - M99

1100 - 1199

M200

1500

1400

1500

M600

1700

M800

M900

- 1299

- 1599

- 1499

-M1599

1699

1799

- M899

- up

Basic and Advanced Training

Armyr Specialized Training Program and Pre-

Induction Training

Personnel and Morale

Civil Affairs

Supply and Transportation

Fiscal

Procurement and Production

Administration

Miscellaneous

Equipment, -Materiel, Housing and Construction

HEADQUARTERS, ARMY SERVICE FORCES

Washington 25, D. C. 15 June 1944

Army Service Forces Manual M 361-5, Civil Affairs Handbook, Belgium -

Money and Banking has been prepared under the supervision of the Provost

Marshal General and is published for the information and guidance of all

concerned.

[SPX 461 (21 Sep 45).]

By command of Lieutenant General SOMMERVELL:

W. D. STYER

Major General, General Staff Corps,

Chief of Staff. uk

OFFICIAL:

J. A. ULIO,

Major General,

The Adjutant General

This study on Money and Banking in Belgium was prepared for the

MILITARY GOVERNMENT DIVISION, OFFICE OF THE PROVOST MARSHAL GENERAL

by the

BOARD OF GOVERNORS OF THE FEDERAL BESERVE SYSTEM

OFFICERS USING THIS MATERIAL ARE REQUESTED TO MAKE SUGGESTIONS AND

CRITICISMS INDICATING THE REVISIONS OR ADDITIONS WHICH WOULD MAKE THIS

MATERIAL MORE USEFUL FOR THEIR PURPOSES. THESE CRITICISMS SHOULD BE

SENT TO THE CHIEF OF THE LIAISON AND STUDIES BRANCH, MILITARY GOVERNMENT

DIVISION, PMGO, 2807 MUNITIONS BUILDING, WASHINGTON, D. C.

INTRODUCTION

Purposes of he Cil ffair Hadbook.

The basic purposes of civil affairs officers are (1) to assist the

Commanding General by quickly establishing those orderly conditions which

will contribute most effectively to the conduct' of military operations,

(2) to reduce to a minimum the human suffering and the material damage

resulting from disorder, and (3) to create the conditions which will make

it possible for civilian agencies to function effectively.

The preparation of Civil Affairs Handbooks is a part of the effort

to carry out these responsibilities as efficiently and humanely as possible.

The Handbooks do not deal with plans or policies (which will depend upon

changing and unpredictable developments). It should be clearly understood

that they do not iven offciaroj am of action. They are rather

ready reference source books containing the basic factual information needed

for planning and policy making.

ylir'r

CIVIL AFFAIRS D..QQOON

TO P I"G A L 0 UT IN

1. Geographical ard Social Background

2. Government and Administration

5. Legal Affairs

4. Government Finance

5, Money and Banking

6. Natural Resources

7.' Agriculture

8. Industry.. and Commerce

9. Labor

10. Public Works and Utilities

11. Transportation Systems

12. Communications

15. Public Health and Sanitation

14. Public Safety

15. Eaducation

16. Public Welfare

17. Cultural Institutions

This study on Money and Banking in Belgium was prepared for the MILITARY

GOVERNMENT DIVISION, OFFICE OF THE PROVOST MARSHAL GENERAL by the BOARD

OF GOVERNORS OF THE FEDERAL RESERVE SYSTEM.

PROVISIONAL EDITION

::..NORTH'f

SEA

:::

::...

Bruges

G

O Ghent

EAST FLANDERS

0

Brussels

'" ".: "1 BRABANT

HAINAUT

0

Mons

WEST FLANDERS

NAMUR

F R

FROM: PHILIPS'

DRAWN IN THE BRANCH OF RESEARCH AND ANALYSIS, OSS

LITHOGRAPHED IN THE REPRODUCTION BRANCH, OSS

LIMBURG

0

F RA N

O Liege

LIEGE

PROVINCES OF

BELGIUM

o Provincial Capital

Provincial Boundary

0 20 40 60

MILES

0 20 40 60

KILOMETERS

NO. 3258

8 APRIL 1944

ANTWERP

TABLE OF CONTENTS

Page

PART I BACKGROUND INFORMATION

A. Formnetive Stage Before the First World War 1

(Currency, nd central banki ng--Commercial' and

'?mixed" banking-- Other banking and financial

organi zations: Financ ial ho 1lding companies;

Mortgage bankixng; Savings and cooperative . c.redit

institutions; Rural credit cooperatives; Credit

Communal)

B. From the, Firstto the_ Second _ World War 11

(Currency and central banking: The stabilization

of 1926; Renewed difficulties in the 'thirtes--

Comercial and mixed banking until 1.935: Societe

Generale; Banque de Bruxelles; Algemee ie Bank-

vereeniging; The banking crisis--Banking reform

of 1935: Abandonment of mixed banking; Regulation

of banking activities; Control. of security issues;

They Banking Commnission; The reviseurs--Commercial

banking after 1935: Credit Anversois; Cai sse

Generale des Reports et des Depots)

PART II. MONEY AND. CREDIT INSTITUTTONS IN 1939

A. The Mono tary Sys-tem 36

(Notes and coins--Deposit currency)

B. The National Bank

140

(Management--Operations -- Disposition of profits)

C. Commrcial Banks .48

(Three leading banks--Other domostic banking

corporations--Private. banking houses--Colonial

banks--Belgian banks operating abroad--Belgian

participation in foreign banks--Foreign banks in

Belgium)

D. Savings and Cooperative' Credit, Institutions 71

(Caisse Generale d'Epargne--Private caisses

dtepargne--Other cooperative organizations)

E. Mortgage Banking

76

Page

F. Official Credit Institutions 85

(Institut de Ree.compte et de Garantie--Societe

National de Credit a l' Industrie---Office National

du Ducroir -- Office Central de la. Petite ;Epargno--

Loans for Ismall busiress-'Office Central du Credit

Hypothec .ire -- Institut National do Credit Agricole--

The Credit Comaiunal)

G. Financial Companies 93

(Leading "general" financial companies--'Special"

fiinancial companies)

H. Stock iExchanges 105

(Organization--Operations: Thee cash market; The

term market)

I. Insurance companies 110,

(Insurance law -- Life insurance operations--

Leading life companies--Other' insurance branches)

PART III. DEVELOP IENTS SINCE THE INVASION 118

(The invasion crisis and the exile of the National

Bank--German financial exploitatio-- Central banking

and the financing of the tribute--Inflation and prices--

Conmercial, banking--Official credit institutions--S tock

oxchangos--Insurance companies)

Iii ; -- iii - :-

STJ ASMR

Th following report is divided into three principal parts deal-

ing vrdth I, Background Infon'nnation; II, MVoney and Credit Institutions in

1939; and III, Developments Since the Invasion. Part I reviews briefly

the development of currency anld banking institutions in Belgiuaim; &iphasiz-

ing factors necessary for an unrderstadriing of 'the present system and

events which may find a parallel d'uring thy, period follouvaig the present

war. Part II gives a detailed description of the pre-invasionaiZitng

system which, in all of its essential elements, has_ been preserved under

the German occupation., The lack of adequate statistics for the war period

also makes it nece ssaary in many cases to go back to the pre--war years for

full information. Part ITI reriews monetary and banking developments dur-

ing the occupation period., emphasizing the financial consequences of German

exploitation of the country.

Part I

The stage of rapid industrial development which Belgium experienced

before the First World Wir was the formati-v'e period for Belgian-monetary

and banking ins ti-tutions. A central bank, :the BEngue Nationale de Belgicue_,

was established in 1350 with the exclusive right to issule bank notes.

Although the Govemnment was given certain powers over this institution, the

,Bank was forbidden to finance, -the Govremment beyond narrow lmits and in

practice 'concentrated upon' discounting anid rediscoun ing short-term commer-

cial bills. The support which it afforded to the rest of the banking 'system

allo' ed the private banks to play an important role in financing industrial"

expansion. Belgium adhered to a bi-mtallic monetary stndain d before the

First World War although a fall in the world price of silver in the 1g,70' s

had caused the suspension, of free coinage for thi-s motal and had in effect

left Belgium on a gold standard.

Belgiumt's odet and largest banking corporation is the Societe

Generale de Belgigue, -established in 1S22. 'Other banking corporations

appeared on the scene following the revolution in which Belgium gained its

national independence, and following a. series of early banking crises, these

banks entered a period of almest uninterrupted exansion in thewa&sj half

of the nineteenth century. They took a prominent part in financing indus-

trial enterprises not only by loans but also by operations in corporate

securities. Their investnent banking activi ties', including the. holding of

large portfolios of industrial securities, -becoe so important that these

institutions came to be called "mixed" banks rather than commercial "banks.

During the same period Belgium tia building up large foreign investments,

a' pro cess in Which the banks participated on a large scale. A boom in the

early ' seventies marked the appearance of several new banks, including the

Ban cue de. Bruxelles which was subsequently to become the second. largest

banking instituition in the country. By 1913 Belgian banking corporations

(excluding private bankers, etc.) held deposits, of around 3' billion francs

and dominated most lines of Belgian industry by reason of. loans to or

investments in securities of Belgian industrial enterprises.

-iv - _

Other types of financial institutions developed before the. First

World War included financial holdinug companies (financial trusts); mort-

gage banks--many organized for operations abroad--which rrade most of their

loans-on urban real property; and, various savings and cooperative institu-

tions.. A dominat role in the celloction of small savings: was played by

an official institution) the Cirgac s Gel.e dlLXpa7n (Posal Savngs

Bank), founded in 1365., .side from this organization and the National

Bank, the only official credit institution in e~dstence before ,the First

World .War was the Credit Communal, a kind of cooperative association of

provinces and municipalities whi ch issued bonds to finance local government

expenditures.

ith the German invrasion of 3elgiumi in 1914 the o - rtions'

the National Bank 'sore. sum !'4% cni? and the Sociote Generale issued notes to

finance the paynent of tribute to the enemy. In addition large .;amounts of

German marks were put into circulation by the occupation forces. After

the Armistice the German currency was exchanged for motes of the National

Bank, -which thereby .acqu ired large claims on the Government. The c ess

money. supply created in this mar ner laid the basis for a serious inflation

in the post-vvar years which, ' together with some rise in prices during the

-var itself, brought price indexes in Belgium in 1926 to 6 or 7 times their

pre-war level.. The franc was meanwhile depreciating on the international

exchanges amid ridespread spe culation. Finally in October 1926 wMith the

aid of a f'oreign loan, a new monetary unit, the r'

T

elga" (equal to 5 francs),

was established, the gold value of the franc being reduced to nearly one-

seventh of its. pre-war level. Belgium returned to the gold standard on

this basis and built up extensive geld reserves, in the following years as

a result of. a favorable -trade posibion e nd an in.f-Lux of capital funds.

The abandonment of the gold standard by England in September 1931

caused a severe loss to the National Bank on its holdings of sterling funds

and gravely affected the competitive position of Belgium in world markets.

After a. period of attempted domestic deflation,. the pressure on the Belgian

franc in the exchange markets be come so heavy that a devalu tion of th a t

currency proved inescapable. .This wras effected in March 1935, the gold

value of the belga being reduced by 23 per cent. ' Thereafter. the currency

'wa -aintained without exchange control--i.e. on a freely convertible basis--

until ' the--German invasion. There were indeed periods of strain during the

political crises of the late 'thirties but at the time of the invasion

Belgium still retainied a very substantial volume of geld reserves (23.7

billion francs or more tam 800 million dollars).

The successive "rprofits"'' on the National Banka's gold reserves'

resulting' from devaluations of the currency had accrued to the Government

and been used to pay off, gdvernment debt to the Bank, most of which had

thereoby been discharged. With the outbreak of wvar in 1939, howrever, the

central bank again was authorized to extend large emergency credits to the

Government while at the same time a wave of currency hoarding in the country

brought about a marked expansion in the note circulation.

Meanwhile banking institutions had greatly expanded during the

inflation of the t tenties and. had' sufferer from. a severe crisis in the

critical period of U re iearly thir-(G es.. "The first ha lf of thqe e.nties

vas characterized by great .speculativre acivity in industpry and commerce

as v ell as in the foreign exchanges, in which the banks played a leading

role. 'btal deposits with bankirg corporations increased 11 times from

'1913 to 1930 reaching 33 billion francs in the la ter year. ' The mixed

banks continued to give close support to industrial enterprises, and the

big banks iin Brsse ls, ag ressiv ly -expanded their organizations by absorb-

ing smaller banks, especially in the provinces.

With the in.mpa t upon Belgium of the for"_d depression, banking

loans and discounts dropped from over' 30 billion francs at the end of 1930

to 19 billion at the end of 1932. An, acute banking crisis vas then precipi-

tated by the monetary panic in 1934-35 and the ;uithdr. awa l of bank, doposits

for, hoarding purposes or for financing the flight of capital f..rom the

country. The banks were enabled . to surmiive this period only by the liberal

support lent them by the Gove nment and they National Bank. The devaluation

of the currency in March 19:35 put an end, to the crisis but later in the

year a thorough-going refon.. of Belgian banking ,was introduced, la rgely as

a result of lessons learned in the earlier years.

The new banking legisla-tion est ablished gov e~mnent con trol over

banking and the' capital market and divorced investment from commercial

banking. In princinle it became unlawful for any banking corporation to

owan industrial securities, while bank officers weore forbidden =to act as

directors of industrial corporations. In. most cases the mixed banks con-

tinued~ as f'inan cial companies and organized subsidiaries to carry on

straiht coie rcial banking operations. Tlhe new comme rcial banks weore

placed under the supervision of. a Banking Co nmnission and poevision was made

for the issuance of rgulations governing reserve requirements and credit

policies of these institutions. Such regulations wore nevIer act- ally pro-

mulgated, but the Banking Commission nonetheless exercised great influence

in . assuring sound commer cia l banking practices. Security issues, which now

had to . be handled, by th Lfinan cial companies or by private, bankers (not 1iarred

thre crrn by. te-ebenkin g regulations), re also subj ected to close con-

trol by' the Banking Commission.

In the remaining years befoe the Gerxian invasion bank deposits

wore subject to erratic fluctuations wJh ch wore closely rel.dted to the out-

ward and re;turn flows of "hot money" stimulated by the successive political

crises. On the whole,, fron mid-1937 to the end of 1939 deposits declined

from 21 to 13 billion francs, but vvith assistance rendered by the National

Bank, this strain was withstood by ti "banks cxtrernely 'well except in

isolated instances. By the 9nd of 1939 'the; com mercial banks were still in

a reasonably liquid postidn.

Other 'fin cial ins tuti.s folidwed the sanre general pattern of

development' rdiling the inter-ar erod. 'The Cisso One le danpar e

continued t5 be much the most proine nt cello ctor of small savings, especially

since private 'savings and cooperative {ns titutions. suffered severely from

the crisis in the early 'thirties. These institutions were also brought

-vi- -

under' strict .govea-Ment contro after the crisis. T: he late tirties were

marked by a conside rabhle e ipan s n in .the .:number and s cope of official

credit institutions, organized to support variou s. ectors of economic

activity..

Part TI

The circulating medin of the country consisted primarily of bank

notes issued by the National Bank. Subsidiary currency in the fo m of

notes and coins in denominations up to 50 francs was issued by the Belgian

Treasury. Although -Belgium was still on the gold:. standard, no gold coins

were in circulation. In addition demand deposits were held by the pubLic.

mainly with the comnecial banks but also with the National Bank and the

Office des Cheques 'Postaux. The latter office, operating through the post

offices, provided facilities for persons desiring to maintain a deposit for

checking or transfer purposes. In general, however, the volume of demand

deposits was much smaller in relation to note circulation than in Ahglo-

Saxon countries and a much smaller proportion of payments was effected

through banking channels.

The Na-tional Bank was a prive tely-ownied corporation which ma in

tained considerable independence of -action despite the fact that its

Governor was a govonnnent appointee. It was not operated for profit, how-

ever, the Goverment receiving a major shamr of the bank' s earnings. It

had gradually uncrtakoe n bread responsibilities in the administration of

'the whole money end credit system and by force of circumstances had become

intimately concerned with fiscal policy and the Governiment;

t

s finances. It

acted as banker to the State in the sense that it held the Treasury' s

deposits and made end received oayncnts on its behalf. It also extended

credit to the Goveimment in times of stress and was called upon for this

purpose on a large scale during the period from the outbreak of the war to

the German invasion, It held part of the cash reserves of commercial banks

and also received deposits from leading commnercial and industrial firms.

it was required to hold a 40 per cent reserve in geld and foreign exchange

against its notes and other demand liabilities; in practice, after the losses

incurred on. its holdings of sterling in 1931, almost all of the reserves

were held in gold. The bank' s commercial credits were extended by discount-

ing and redis counting _ commercial bills and by makirg loans oi collateral.

gon~isntig of agovo vont' bonds.

Commrcial banksl most of which hadt emerged after the banking

reform of .,1930, were strictly limited in their operations and confined

themselves to what sere, at least nominally, short-trm. operations. How-

ver, . they were accustomed to make loans which were constantly renewed end

wcfhich became in effect long-term comithents, They also held a substantial

security portfolio but this consisted largely of government bonds eligible

as collateral on loans f ru the National Bank.... Their cash reserves wore

maintained at a. reasonably high level as were, their capital and reserves in

relation to deposit liabilities. The. bulk of their deposits were on demand

and at short-term. t at substantial volume of time deposits was also

received.

- vii -

ne bank alone--the Banque de la Societe Gene rale--held. nearly

one--t 3r. of all banking assets in Belgium, and in addition had an :important

affiliate in An twerp, the Banque d' Anvers, The Banque de Bruxelles was the

second largest banik and two others had asse bs exceeding one billion francs,

the Kredietbark operatin.g in Belgium anci the Banqiue Italo-Belge, connected

wi._th the Societe Qeneral.e and operating mainly in South. Amnerica. At the.

end of 1.939 there. were 64 other. Belgian ba.king corporations, 34 private

banking houses, and'9 foreign banks with !:)ranches in Belgium. The private

banking houses included some small firms engaged in commercial banking

operations but the leading houses located in Brussels and Antwerp engaged

in "tfinancial operations" and had an important influence because of their

intimate relations with powerful industrial and financial groups. Belgium

was the domicile of a number of banks operating in the Colony and in foreign

countries, the most important of which, aside from thpe Banque Italo-Belge,.

arras the Banque du Congo Belgo, the bank of issue: for the Congo. In addition

Belgian financial groups had impor tnt participations in foreign banks,

especially in France and in Eastern Europe, whle a few banks in Belgium

were controlled by foreign interests.

Savings and ooerative credit institutions were headed by the

Caisse Generale dt Epargne (Postal Savings Bank) which collected small

savings on passbooks through the post .offices and had a very large volume

of .funds- which it invested mainly in government and other bonds. It also

undertook various other investments in the oublic interest, often placed

through cooperative institutions. THere were a few private savings insti.-

tutions which were subject to strict govern-:-Lent control; there were also

various types of local cooperative institutions of which the rural organiza-

tions--tho caisses agjricols--were the most important.

Mortgage b:ann . was highly- developed in Belgium, especial ly for

loans on urbn resi cientina- property, -which, were also made bey other institu-

tions. An important group of mortgage institutions was engaged in foreign.

operations which often included realty. transactions, land improvement

schemes, etc.

Numrerous offi'cil crei t institutions existed in addition to the

National "-An and the Caisse Generale d

t

Epargno. Those engaged in a great

variety of acti vities covering in general almost every important sector of

economic act vi ty. eHowevr, some o f ti errl we-e'of quite; recent origin and

had not yt developed important operations. 'o committees coordinated

their activrities, one for all official credit institutions and the other

for a group of them serving the Tshall business" field.

Financial companies included those of a general character, most

of which were formed after the 1935 refor. to take over the investment

business of the mixed banks; and special organizations, which acted as

holding companies in particular industrial lines. The gener'al companies

were dominated 'by the Societe. Gnerale do Belgique which controlled the

Banque do , la So ciete Generale and held very extensive interests in Belgian

,.ndstry as w,-,Tell as important colonial and. foreign investments. The next

largest company in this category, although falling far short of the ,Societe

Gencrale, lias "Brufinalt, affiliated with the Ba nque de Bruxelles. Much the

largest of tho special financial companies was HSofinali, which held ide-

spread interests in public utilities, especially in Spain and Latii America.

There were 4 stock exchan es in Belgiu, of which the one in

Brussels was much the most imniportant. The, organization of the stock exchanges

was regulated for the first time in 1935, brokers being given a semi-offic.ial

status and a monopoly for transactions in listed securities. Most of the

transactions on the e::Cchanges were negotiated in the .cash market, i.e. in

principle for imediate settlem nt; 1 "tern

1 1

transactions for settlement on

semi--monthly dates had once been important but were greatly restricted by

the 1935 regulations on speculative activities. Most stock exchange o 1ers

were placed through banks, which shared commissions with the 'brokers.

Insurance companies engaging in life operations were subject to

government supervision but those in non-life lines were governed by no

special regulations. There were ccrtain legal prescriptions for life

insurance company investments but they wore of a very elastic character;

in practice securities and mortgages wore the principal investhment media

By far the largest Belgian life insurer was the Cic. Belge cit Assurances

Oen rales sur la Vie. Foreign com panics had a very important share of the

Belgian life. insurance market. The non-life sector was highly competitive,

there being a very large number of companies in the field: There were some

Belgian reinsurance companies but m ost ' cossions were placed with well--

kno vn British, Swiss, and Gem an reinsurors.

Part III

With the 'Gelman invasion thi Belgian Coverment introduced a

number of emergerincyr wrC measures suspending the convrtibili ter of the cur-

rency, abolishing limitations on central bank loans to the Goverrnnent,

delcaring a banking moratorium, etc. Within three weeks, however, the

Genrans had completed the conquaest of the country and the Belgian Gov ern-

ment had been driven into exile, follo-wed by the National Bank. In July

1940 a new bank of issue wa s set up in Brussels (the Issue Bank) but it

never undertook the function of currency issue since shortly thereafter

the National Bank administration headed by, Governor Janseen returned to

Brussels. Some of the Bank! s officials remained abroad with p rwrer to

administer the Bankt s fo reign assets and in 1941, when Governor Janssen

died, the Belgian governmient-in-exile estabished in London set up a full

administration--in-exile for the National Bankc aMeanwh.ile in occupied

Belgium the National Bank continued to discharge all central banking

functions, using the Issue Bank as an adjunct for perfoning special duties,

especially the management of clearing operations i th Germnany.

Financial developments in Belgium under the occupation have been

dominated by the effects of the tribute excted by 'the Gennan authorities.'

At first this took the fom of the issuance of occupation currency but

this device wi;a.s superseded as 'soon as mo thods for collecting "1occupation

costs" in local currency could be designed. The first payment of this

character is believed to have been made q n August 20, 1940, when the

Issue Bank opened a credit in -favor of the CGeian au-thorities, using funds

supplied by the ''National Bank. The German occupation Curren cy w a s there--

after withdrav: from: circulation by the National, Bsak and. Issue Bank and

is hol. by the latter as a claim on Germany.

-ixi

Belgian payments of "occupation costsa" have greatly exceeded any

legitimate German demands, rising from about 16 billion francs in 1941-.to

an .estimated 22 billion in 1943.- These figures .greatly exceed -total. pre-

war. Belgian goverment expend.i tur es. In' addition, the Issue Bank) , using

funds supplied mainly by the, National Ink, has been forced to finance huge

clearing claims on Germany, arising :for the most part from .Belgian, shipments

of goods to the Reich. By the end of .1943 these clearing claims totaled

nearly 50 billion marks ard the increase inh 1943 exceeded payments of

occupation costs. The total amount of financial tribute exacted in various

forms through the end of 1943 comes to . sme .114 billion francs, aside from

any outright pillage (indludin.g the seizui-e bythe Gemans of 6.7 billion

francs of gold. beonging to the National Bank),

The National Bank has had to finance----through advanced to the

Issue Bank--aJmost .all of the claims on Gexrmany arising fraom. the redemption

of occupation currency and from the clearing operations. A small: portion

has been financed by the Issue Bank out of independent rosourccs, ie..

deposits mainly from Germailan agencies) and funds placed with it by the

Office des Cheques Postaux. In addition, until 1943 the National Bank

had to finance a' substantial portion of the deficit incurred by the Belgian

administrationi in occupied territory, most of which was attributable to the

burden of n ccupation costs". In 1943 the Belgian administration was able

to borrow from the commercial banks and the public an amounit substantially

exceeding its current requiremonts; so that a;, large part of the credits

from the National Bank were repaid. However, including advances to the

Issue Bank, the total amount of credit created by the National Bank for

or on behalf of the State frofi mid-1940 .to the end 9f 1943, was. more. than

54 billion francs. fIts credits to the "private economy" almost disappeared

during this period and there was a net increase in the currency issue of

nearly 50 billion francs

0

From the end of 1939 to the end of 1943, the

amount of currencry in circulation rose approximately 200 per cent while

the publicT s holdings of. demand deposits with commcrcial banks and other

institutions increased in much the sae proportion.

The great expansion of money in the hands of the public has

created great inflationary- pressure on the [price'. level, especially in

view of the acute shortage of consumablo goods. Price inflation .has been

combattcod =with some measure of success by stringent rationing and price

.control measures. ,official prices for rationed goods in the middle 'of 1943

averagoed only ,about double,.. the 'pr- war level. However, black 'market prices

for goods dealt in illicitly have soared to fantastic heights.. Wrgcs 'have

not kept pace even with official prices.i Pears of further depreciation in

the currency- have induced many persons to try to 'convert their- money claims

into Ireal 'values'"; one aspet of this, speculative movement' has been a

great rise in the '..price of equity securities despite poor corporate: earnings

and harsh. restrictions on sto k exchange cbaings. , Notwithstanding the

interral deprecia tion of the. currency, the exchange rates of the Belgian

franc vis-a-vis the Reichsmark and:: other European currencies havc beri

rigidly maintained at the level introduced at the time of the German inva-

sion.

-x -

Commercial banks have operated under strict Genman control and

have lost most of their interests in the rest of Europe to German banks.

However, German banks have not penetrated into the Belgian system. beyond

establishing subsidiaries in Brussels to develop, German-Belgian economic

relations, Commercial banki ng operations have been characterized by a

great expansion of deposits and of loans to the State and a marked falling

off of commercial business. Essentially the commercial banking' process

under the German occupation has been simply to receive, on deposit part of'

the funds pupped into circulation by the central bank and to. rolend these.

funds to the Treasury, mostly through purchases of 'short--tem Treasurye bills,

By the end of 1943 credits to the State constituted nearly 70 per cent of

commercial bank assets as compared vith less than 20 per ce'nt at the end.

of 1939.

The Banque de la Societe Generale has maintained its commanding

lead anong Belgian banks but the other two largest banks, the Banque do

Bruxelles, anid ,the Kredietbank have greatly improved their relative position

at the expense of the smaller banks.

f ery li ttle information is availaole concening the development

of other credit ijnsti tutions during the occupation period.. I mong' the.

official orgni.zations . the Caisse Generale d' Epargne, after losing deposits

through 1941, rocqived small net de posits in 1942 and a large inflow of

funds in 194.3. Tere has. been a very large increase in private deposibts

oith the Office des Cheques Postaux. , The official credit institutions

serving ecial sectors of economic actiityL have found little demand for

normal business loa;? ns, However, seine of then have participated. in projects

for the .reconstruction of war demaage, making leans for this purpose at 16w

interest rates under government guarantee.

As noted above, the sharp rise in share quotations has ;led to

severe rgstrictions on stock exchange- operations. Trnsactions in listed

securities have been forced, to pass through the exchanges in order, to pre-

vent evasion of the controls. The general index of share prices, which

showred sharp fluctuations in 1943, primarily as a result of changing antici-

pations as to the progress of the via r, ended the year about 3-1/2 times

higher than on the eve of the invasion. The abundance of liquid funds

seeking investmlent has caused 'even fixed- interest securities to enjoy

great demand,' even though they, offer no protection a gainst. depreciation

of Thhe currency. The. general :trend of interest rates has therefore been

doinwa rd.

After an. initial period of disruption, life_ insurance sales. have

recovered under the stimulus of monetary inflation and in 'recent years

have greatly surpassed those of pr-wa r years. Nqn-life. insurance, business

has also expanded, especially as a result of the appreciation in the proper-;

values; British reinsurers have been replaced by German' interests and

corporative organizations on the German model have been ester icshed for

'the Belgin- insurance business, largely in order ,to: provide a . channb1 for,

officiol control of insurance activities.

CIZIL AFIYAI 6 NDBOOK

on

B E L G I U M

Section Five

on

M 0 N E Y AND BANKING

PART I

The nineteenth centurf was a period of dynarmic economic expansion

in Belgiiu in wh ichi the leading barks played an outstan ding role

in financing industrial development. The war anrd post-war infla-

tion brought about serious instability of the currency and

encouraged speculative activity in which the banks shared. The

world depression of the eary t thirties finally precipitated a

severe banking crisis in Belgium, which lad to the enactment in

1935 of a. thorough-going banking reforn. Commercial banking was

purged of inves tment banking activities and this and other types

of banking were subje cted to regulation. There wais also a marked

expansion of official credit institutions serving the needs. of

different economic groups.

Now*

PART I. 3 CKC-BIONUD INIMPMA T0_N

A. For ativeStageBe fore the First World War

Currency and Central Banking

WVhdn modern Belgium emerged in 1830 as a result of a national

revolution, the bulk of the currency in the country consisted of French

coins which even under the preceding Lutch regime had been in practice

the frionetary unit of the Southern (or Belgian) provinces of the Kingdom

of the Low Countries. Consequently the Belgian nonetary lawr of 1832

/ copies a~ihmost literally the French law. of 1303. The bimetallic system

wrrith the gold-silver ratio of 1 to 15.5 was introduced; gold was to be

freely coined on the basis of 3,100 francs to one kilogram and silver on

the basis of 200 francs to one kilo gram, both nine--tenths fine. Both

kinds of coins enjoyed unlimited legal tender status. The French ne e of

the monetary unit, the franc, was retained. so that Belgian coins became

faithful duplicates of French coins except for their different design.

This early legislation was concerned only with metallic currency,

bank notes being considered by the government as ordinary credit instru-

ments like bills, promissory notes, etc. Consequently, in principle any

bank was free to issue the., although of course they did not enjoy any

legal ten der capacity. However, the Belgian population distrusted paper

money, having had ill_ experience with the Fro .ch '

T

assignats

t t

, which were

imposed upon the country & ring its annexa:ition to Fran ce and which even-

tually became worthless. As a result, notes issued by institu.tions like

the Societe Generale (the largest bank and indeed the only large corpora-

tion in the country in 1830), and the 'anque do Belgique end other banks

founded after the separation from the Netherlands, did not have a very

extensive circulation. In 1343, following the U"February Revolution'? in

Paris, there was a panic among note holders, as a result of which the banks

had to suspend redemption of their notes in coin. However, the goverment

saved 'the notes from depreciation by giving them legal tender status while

at the sane time imposing limitations on their further issue.

These events, and. earl..ier banking crises, had made it clear that

a ,reform of issue banking was necessary. Consequently, pursuant to. the

Lars of May 5, 1350, the Banque Fa tionlae de Belgigu.e was established as a)

central bank of issue, wwith the exclusive right to issue bank rnotes in

Belgim. The new institution took the form of a private corporation,

subject to government control, with its scope of operations strictly

limited by law. Its original capital of 25 million francs was subscribed

by the two leading banks (Societe Generale and Banque do Belgique), although

they subsequently sold the shares to investors all over the country. ThQ

management of the Bank was entrusted to a Governor appointed by the King

and a Board of hManagers bhosen by the shareholders. here was also a

Board of Censors .(audjtors) chosen by the shareholders to protect their

interests in the administration of the, ank, and a Government Commissioner

who was responsible for continuous supervision of the Bank's operations.

In practice, the -Bank enjoyed almost complete autonomy. Even the Governor,

although appointed by the King, was virtually a representative of the

shareholders, since at least until the 19201 s, he was traditionally chosen

from among the Managers.

-2-

The law established no maximum figure for note circulation, but

required that notes be backed by "'valeurs

1

' (bills) which could' be easily

converted into cash, and that the, Bnk 'aintain a metallic reserve. By

the Bank' s statutes, the amount of this reserve was fixed at one-third of

the Bank' s note and other sight liabilities; the Minister of linance was

authorized to relax this requirement in emergency circu .stances, but he

never had to exercise this powrer before the First World War. Alnost since

its indeption, however, the Bank was allowed to include its holdings of

foreign exchange in this reserve.

The basic law defined in general terms the authorized opnerat ions

of the Bank. Aside from issuing notes, receiving deposits, and performing'

routino banking services, the Bank was authorized. to deal in and make

loans against gold and silver, to discount bills of exchange and other

documents resullting from commercial transactions, to purchase Ttreasuxry

bills within the limits. determined by the statutes, to make short-tenn

advances secured. by bonds issued or guaranteed by the govemment and to

invest in government bonds an amount equal: to its capital and reserves.

The statutes ruled that only commercial bills resulting from genuine busi-

ness transactions, having ro more than one hundred days to run., and bearing

three solvent signatures,) could be discounted. Furthermore , they proidced

that the Treasury bills discounted should also have no more than one hundred

days to run and. that the Thrik could. not hold more than 20 million francs of

such bills in its portfolio. Thus the lun, as reinforced by the statutes,

largely restricted the Bank' s lending activities to the discounting of

short-te m1 self-liquidating. paper, and set up strict barriers. against any

"excessive"I lending to the Stete, whether in di~rect or indirect form. At

the same time, tne nk became the banker of the government in the sense

that it handled all the government' s financ:ial transactions.

By a happy coincidence, the National Bank was founded at the

,beginning of a period 'of great economic expansion in Belgium. It pursued a

vigorous policy, establishing agencies in all the principal cities of the

country, keeping the discount rate as low as possible, and discounting

rather freely the bills presented by cemercja1 houses and banks. In the

early days of the Bank' s existence, commercial banking was still. relatively

undeveloped, particularly in the provi.nces. The Bank therefore sot up in

connection with each of its agencies a "comptoir d' escompte " (discount

office), i.e. an association of a few approved individuals in the local

community--with substantial financial backing--wrhich Vould endorse bills

drawn by merchants and 'manufacturers, thus making then. eligible for discount

with the National Bank.

As a result of thi s vigorous 'credit, expansion, the total note

circulation in Belgium rose rapidly.. WhJnereas before 184 the circulation

of bank notes had not exceeded 20 million francs-, by 1C55 it had risen to

100 million,, by 1900 to over 500 million, and by the eve of the First

World W ar to more than one billion francs. It 'should be noted that in

Belgium, as in other Continental countries, bank notes were the principal'

1 However, bills with ti o signa tures -wore acceptable if secured by collat-

eral or if meeting other requirements as determined by the Board of

Managers of the Bank with aprovaLl of the Miiniste:r of Finance. In prac-

tice, a large proportion of the bills discounted had only two signatures:

that of the drawer and the endorsement of a rank or a lcomptoir d' escompt".

-3-

medum f cr~,lat~o . e pers onsa carried deposit a ccouhbs writh bank s,

especially before the k - st World War. 1wvn iempotrtant indu~strial, an~d

commercial concerns effected~ a large- part ci, their paymnents bymneans of

bank notes, Thus tI e inc 'eas e of the note circulation .fairly represented

the general monetary. e Dans3ion which a ccomlnonied -the rapid growth of

Belgium' s incdustrial and commercial tactivity in the decades before 191/4.

The 1 i etllic standard introduced in. Belgium. on the French model,

and also ad.ered. to by Sw ,itzerland and Italyr, encountered serious dificul-

ties from~ time to time be cauee o f the tendency of the: market prices for gold.Is

l er t e a t f om t e e a'l f x d r t o ,In 1 5 e g u

initiated thr? so -called Lfa tin conetVar y- Union, in -which it was joined by

France, Ita 7., and Switzerland ( Greece sub eqven tl y participa Lted); th~e

members agreed to issue gold; and. silver coins of a. unifoim volight and

fineness which wmould circulate freely. at par in all member countries .

However, a fall in the weorld price of- silver in" the .: lE7O? s threatened to

flood the countries ofa: the 'Union wid-th. silver an d to drain away their, gold

reserves. Accoringly, free bcoinage of sl~i .r was suspended end, although

existing silver coins of 5 franc denomination retained *heir legal tenider

status, the .tonta r stanrdard, w as taci~tly shifte d to agold basis.

Commercial end. fryI xdT .Bankdiq

Bel giumi'' s.; first banking corporation the Societe Generale,J vv

established in l82~ b, Wlilli m I , Kin~g of. the Netherlands, who. was by far

its. mo st imrpo rtamt. sha reholder. Th.e cprtion had an ambitious program

covering all fieolds o '. finean cial activitv, inceluding note issue; however,

its principal opr'at QflS in thbe early, cal!-, are the managcment of landed;

properties .etl stca to it by the .~ :, end . li nc's in go Ve r.c nt se curi-

tie s and foreio - exch.r ne .:. B/ .Terrc. 1. G were were also some private banking

houses in the.eiciel ciis ioZ~c ,ctiwtie. ,:c ,onsiste . mainly in co~rlcct-

ing hills,, m k ing rc iittances. and: dcc fing.!-'. a very : mail s caloe--in go vern-

ment securi-tier.sI, Theydid' some dLscrcnt .ng hi sinescs, oeecra tini~ mainly.wt

their ow n funds but sometimes rcditscouinting wvii th the Societe Gecnce ale.

Somze neWr.ba nkinc corveor tions were establdishe~d during .the first.

d~eca4de .follow--ing the iTevolution,." the most impoertant of which was. :bhc:.Banauo

do Belgique (125). . I.t as.: :s tablisheda with a, capital -of: 20 mill ion francs

part of '-.fhich wras Thi,-ished: by French capitalists, particularly, the;1?thehd~s

of Paris, :who also floated loans on behalf of the. now kingdom. ,The, charter-

of the bank -was very broad; it vas an~thorizod, to i sue notes and to on. ga 9o

in all fields of comjneorcii al and invostLment

banki -,..

A fer.123Q,. Thl gr in jt'i1.w ars.,. alwady manoifes t in the

first quarter of th e century, began tc. cijyeej~o on at an. a cclera ted pace. Many

privatec nter pri s s: -or per-tn e r -?. ap . rerc; c~in (;e irte co.rrat ions , and

fresh capital . e btein:e -by t h i nnO ic :f harce The:. two lea7ding

banks,. Societe Gener ale' end. a guc J!'do 'b.CLg OL C cDw ;Tod a prominent role in..

financing thip x _ e as cn.. In i :1rjnnr c e -t ~c~y . 1 d v ac. as: rmete rs , sui~bs crib-

ing to shares in the . newi ceio'rtj qns anid. s cu!ring .,represents tion on their,

l7ts original sre wams "Scie,ate Generale pour f uvzori e 1' indutlie

nati oaL "q. I n JfjO5 only, .I"L wais brid d t o llbt uieneraled

Del1gicue I.

boards. They also granted extensive loans on current account to the indus-

trial cor ,o rations.: ithi which they 'i'e came affili=ted. They ' ra th er n egle: -

ted discount business in favor of these promoting ventures, but, by puisuing

both cornnecial. and investrarent : banking activities became the first 'repre-

senttives of wh~t later boc~e kneu1~ aLs "m~ixd baking".

eIn

part, the industrial commitments which the baks assumed were

cue to the markedl hesitancy of the public to buy the shares of industrial

undertakings. The -banks tried to organize public issues of industrial

securities, but without nuch success even when they stood. ready to make

loans against the 'collateral of. such securities. They even established

affiliated financial holding companies whose purpose wras to promo te indus-

trial corporations in the hope that shares in such companies would be more

attractive to investors than those of specialized, entorprises with a rela-

tively small capital. This device dig not help, however, because people

distrusted the holding companies . as much as the industrial corporatins.

The result was that banks continued to have a' heavy proprietary interest

:in industry, and early banking crises reflectod the il.liquid nature of

their assots.

In the third quarter of the 19th centary Belgium became, next to

England, the most industrialized country in the world with ' an active capital

market concerned with both domestic and foreign investment. This develop-

ment was encouraged by the government' s obediennc to the principles, of

extreme economic liberalism. There ras no govorn ncnt inter vention in

economic life and. complete liberty prevailed for promoting, issuing, and

dealing in securities of . any kind. ;Indeed by a lawr of 1873 the incorora-

tion of enterprises, which until then had -recuired specific authorization

by the, government became scarcely more than f'oxr ality. While stimulating

the expansion of legitimate business, this extreme liberality also. encouraged

abuses and exposed the public to the activities of unscrupulous company

promoters. Nonetheless, the investing public gradually developed familiar-

ity-with and a taste for industrial securities, and the public flotation of

corporate shares became commonplace. Betwoen 1830 and 1873 there erre 453

incorporations; frem 1873 to the close of the . century more than 4,000; and

in the years 1900-19J4 alone some 4, 400. About 1375 the total amount of

securities issued in Belgium--including

government and municipal bonds--

ws prbaly in thel noihiorhood of 4~ bilion! fracs, in 1900 ~mting

like 8-1/2 - 9 billion, and in 1914 between 15 and 16 billion. Of this

latter 'amount about 5 billion consisted of bonds of pubiic authorities

(mainly government obligations issued for iilding or purchasing railwa"ys),

1-1/2 billiiop o f corporate bonds, and the remaining 3-1/2 - 9 -1/2 billion

of,, shares.

1

J

An important poortion of the share. issuesi were on behalf of "tBelgO-

:foreign" companies organized in Belgium .for operations abroad, especially

in the field of railwayrs, metallurgical, plants, electricity enterprises,

etc.., in other parts of Europe, in Asia, and in South AEmerica. Some of ;

these companies were es tablished-with the collaboration of foreign finan-

cial groups (French,. German, etc.),, and some, even w..,hen entirely controlled

by Belgian bariks and businessrren, sold part of their shares in neighboring

countries, particularly in France. Much of the cxport, of c apital from

lJThose are gross figures, not adjusted for inter-corporate holdings, etc.

Be .gi to foreign countries, which commenced on a large scale as earl y as

th& sixties, flowed abroad through 'c opanies of this type. In addition,

th "arnunt of 'foreign securities proper held by Belgian investors in 1914

has been estimated at 5-7' billion francs: In short, the Belgian capital

market had. numerous' interconne ction~ with those in foreign countries, and

as a consequence Belgian banking organications became prominent in the

field of international finance.

The thriving capital market in Belgium in the last half of the

century provided a very favorable milieu for the development of the banking

system.: Wi~hile before 1850, banking 'as hampered by public distrust. of

paper money and corporate securities, the establishaent of the National

Bank in that year gave a firm foundation to the currency and credit system.

Its 'notes soon gained public confidence and its liberal rediscount policy

encouraged com~ercial banks to expand their loans. During the third quar-

ter of- the century the leading role remained with the So ciete Generale and

the' Banque de Belgique, which both expanded their commercial banking

activities as well as their "financiallt operations. A number, of other

institutions appeared with a similar sphere of operations; these were

usually, formaed at the initiative of private bankers, often with the

cooperation of foreign bankers.

Several new banking corporations were formed during the boom of

the early !seventies, among them the Banque de JBrux-,elles which Was later to

become one of .the: leading -organizations,, second only to the Societe Gonerale.

In 1875-76, however, there was an international crisis 'and an acute fall of

security prices which threw several of the new banks into receivership, and

required others to write off part of their capital. Among the vrictims .of

the crisis was the Banque de Belgique, which had to go into liquidation

because of its excessive commitments in s ecu _a t"ivc railway ventures; no*

losses were incurred, however, by the bankt s depositors.

*In the last decade of the centur-y, a new period' of rapid economic

progress began, which was again accompaied by intense financial expansion.

Many new banks were established., amnnp which ir, cere several relatively largo'

organizations. The crisis of 1900--Ol again : brought banking difficulties,

and again some of the new banks had to write off part of their capital.

On the whole, however, irresponsible banking gaave way to me ro soundly

managed enterprises,. and in 1914, on 'the eve of the First World W ar,

Belgium had a strong banking organi zation rf'oning an important role in,

the economic life of th . counitxr.

By 1914 Belgium had about sixty-seven banking corporations.

Although the movbment of banking amalgamation: had been under way in England,

'France, and Germany for nearly tyro decades it began in Belgium only a few

years before the, war. Indeed nearly all Belgian banks had only. one operat-

ingoffice,, the only .important exception being the Societe Gei erale, which.

had Bighteen affiliated banks, each with oa. few branches. in its respective

region. The Societe Generale group was represented in sixty-one localities.

.The fo'llowing table contains figures' drawAm from a private survey 'shoing

the position of Belgian banking cororations in 1913 with comparative, data

for 18'75 and 1900. The Societe Gonorale, with total assets of 488 million

francs, as by far. the largest bank in Belgium; in addition, there; were,

-6-

about a dozen m

1

edium-sized banks tiith resources in excess of one hundred

million francs each (some of these were affiliated with the Societe

Generale) and, about fifty small banks.lJ

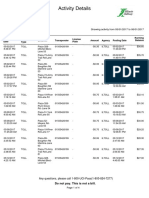

Belgian Banking Corporations"

End o f Year--1375, 1900; and 1913

(illion fran cs),

293

X11 bank- L~ea~ing

Balance sheet item 175 1900 ing cor- corpora-

'Number of banks 46 59 67 13

Assets:

Cash reserves 27. 53 172 110

* Bills 157 312, 777 5'75,

Loans and overdrafts 247 576 1,26 1,090

Securiti es 224 402 7 17 610

Other assets 13? 34 843 40

Th tal 737 1,673 3,302 2,425

Liabilities:

.Deposits (sight or undetermined) 355 893 2,330

hme' depo'si ts' 120 2 5 673 ( 1,830

Capital paid up 248 333 496

Surplus

64 118 235 (

Pro fits

-- 41 63 47

Total 787 1, 67 3502 2,4.25

1/. Excluding savings banks, pri ate bankers, and similar organizations.

I Including bonds issued by some of' the banks, especially those specializ-

ing in mortgage business.

Thus- in 1913 all Belgian banking corporations (excluding sa-vings

..banks, etc.) had some three billion francs of deposits, or around 400 francs

($80) per capita 'as against ;141 in the United States (U.S. figure from

depdsits'in all cormnerciel banks). This disparity reflects not only a

difference in wealth between the two countries but also the more restricted

ulse of bank decosits as compared with bank. notes in Belgium.

Belgian banks' before the war were characterized by a high capital

but low cash ratio. sThe capital and surplus in 1913 of all banks shown in

the table smounted to abut 20 per cent of their total liabilities (in 'the

case of the eighteen leading banks, 23 pci- 'cent), or doulble the convortional

.ratio in 'many other countries. This phenomenon was due.; to the "financial"'

operations of Belgian banks, it }eihg considered that in. principle only a

bank's own resources should be tied up in pennanehb holdings of industrial

securities. On tho other hand, cash rdservcs mnounted to only 7.4 Par

1/._ The re 'were also num;rous 'private banking houses, some of which had an

important role in the :'ield of 1'fin ncial operations "r.

cent of demand deposits (plus 'those of undetermined maturity), anid 5 07:

per 'ent. of all deposits, ratios far lowr thanthose .p evailing' in many

other cotuntries. There were no legalrequirements for cash reseres,. nor

even customary reuirements as in England, and the banks felt it unnece ary

Sto 'keep a high unproductive cash reserve when their commercial po rtfolios

could be' so easily turned into cash by 'resgrt to the rediscount facilities

of the National Bak.

* The table also shows that loans by Belgian banks were much higher

than their discounts, just the reverse of the position in e.g.' French'.

banking. This feature- resulted from tl close ielationships existing in

Belgium between'banks and industrial enterprises. The 'latter received most

of their bank financing in the form of

tt

advances on current account",

comparable in a general) way with overdrafts but usually assured: 'in advance

like a line of credit. It is likely that' many of these adnces did not

-reflect teporari'y (or- seasonal) accommodation. They often, served to increase

the pe rnanent working capital of the borrower,' or to finance the purchase of

industrial equipmenit, until .the debtor corporationwas 'able to issue = new

shares or bonds and pay off s obligation. :In fact,' banks frequen-tly

undertook to' i~iarket new security issues on beh behalf of their 'debtors; often

in association- wii th other banks, in order to provide funds for the repayment

of their loan s

Als& oin the case of securitty portfolios, :Belgan practice differed

from that in 'the Anglo-Saxon countries because of the special relations

between banks and industry. In Belgium the major part of the securitiesin

the banks

t

, portfolios' was composed not of bonds 'held merely for investment

purposes but of shares representing initercests in affiliated enterprises.

In 1913' the portfolio 'of all banking corporations consisted-of about 2Q0

million francs of Belgian industrial shares,, 100 million. of foreign indus-

trial -shares, 75 million of banking shares,. 100' million ,o.f corporation bends.

(Belgian and forei n), and 200-250 mil Lion of government bonds. The .bufl

of these :share holdings were acqire d ii order to estabolish, control over,

or at least a substantial -intrest in,, promising enterprises. Such holdings,

although involving same' ris s,. generally yieldd good dividends. and: also;

brought business to the' bank in the foim of a demand for loans and 'discounts

or fo banking services (issuing, neuw securities, collecting bills, paying

dividends, 'etc.). . Thus many industrial corporations were controlledby

banking interests,, sometimes by one bank but' often' by a banking group The

Societe Generale 'paticularly had a prominent role in coal mining, in the

metallurgical industry,. in electricity enterprises, etc. The degree of

control varied, of course,' according to the aemount of shares held :by. the

bank the importaice of its loans to the company 'concerned, and also. personal

factors. A conspicuous expression of these: connctions was to be 'found in

the numerous directorships held in industrial corpor'ations by bank director

Or off"ibers."

Other Banking and inancial 0r-anizations

Besides the o rganizations . de.votbd to commercial" and investment

banking dealt with in hte preceding section, other oranisations were

developed to" "serve.. various economic a ctivities &nd social needs..

8-

Financial holding companies. Institutions of this type came into

avor in connection with the expansion of Belgian indus try and finance

abro.d, particularly in. the field of railroads, "street railways, and elec-

tricity' companies. - As it was hard to sell to Belgian investors shares of

corporations ape rating.-in little-known. or remote countries, the financing

of such corporations >was entrusted to folding companis rhich ,in turn were

able to market their own securities among the public because they. of ered

diversification of risk" anid a management which inspired confidence.

These companies (often called "trusts financiers" in Belgium) not only

financed the operating companies but also provided" them with various mana-

gerial services such as technical assistance., purchase of .supplies, etc,

In the i8

9

0'

5

many holding companies were established by- Belgian.

banks and financiers, often ith the collaboration of foreign banks (mainly

French or German) in order to finance companies operatinlg street railways

and ele ctricity 'companies. Later other fields (gas, water, rnibber planta-

tions,. etc.) were "invaded by the movemnt, but usually all the operating

companies in a' partocular group ere, engaged in the same type of activity.

Among the financial companies founded before the First World' War, the best

known is the Societe Financiere do Tharisport et d'Bntreprises' Industrielles

(Sofina), which wa's dstablished by an international group. Most .of the

others were reorganized :or merged during. the inter-war period.

From .the outset, there wore strong ties betwccn the banks and

most holding companies. Somc companies wore controlled by one or several

banks, while in other 6ases, friendly relations, not really amounting to a

control, existed. These relationships had their dangers, and some banks

were accused of using' affiliated holding companies as a dumping ground for

securities they could not get rid 'of othrwise . When opcrated in a legiti-

mate manner, however, .the companios' played an importan t and useful role in_

expanding Belgium' s financial and industrial interests in foreign areas.

Mortgage banking. The first mrortgage banks were established as

far back as the 130' s., as affiliates of the two,. ding banks of that time,

but their activities we: 'very limited. lMortgage bank operations became

significant only in the second half of the ,past century, as a result of

the simplification. of 'mortgage 'legislation and expansion of such banks into

the fields of residential building for the midclie classes, loans to indus-

try, and loans abroad; On 'the Continent, the characteristics of a mortgage

bank proper are that it -obtdns funds by issuing .long-term bends aid. that it

grants mortgage loans on real property. which are pby ;dged to, secure its bond

issues. In Belgium, however, some mortgage banks developed the practice of

accepting time deposits and sometimes oven deposits payable' on demand. On

the other hand, many o'f theni departed from their traditional functions by

making loans to and even participating. in industrial corporations. ] .irther-

mere, a special category of mortgage banks appeared toward the end of the .

century' organized for operations abroad *(in South America, Egypt, Canada,

'etc.). Some ware devoted exclusively to mortgage loans, while ethers also

engaged in real estate operations and even other financial, activities.

l The first company of this type was the Societe Generale do Tramways, es-

tablished, in 18'74 by various banks nzdd bankers. It f'inanced and. controlled

Streetcar companies in foreign countries, particularly "in Italy. . In 1882

it was merged with Cia des Chemins 'do fer Economiques, which in its turm

was merged in 1929 with the Electrobol, oie of the strongest holding

companies existing in. Belgium.

Mortgage loans in Belgium were also g ranted by the Postal Savings

Bank (see below),' either upoi residential buildings or on farm' lands; by

insurance companies (generall y combined wih a life insurance_ poli cy),

mainly on residential buildings; and by private investo ra.

Savings and cooperative credit institutions., The first savings

institutions in Belgium were established le ss for the purpose of mobiliz-

ing small savi ngs 'for, productive uses than. i order to foster thrift among

the general public. In the lS201 s, savings offices (cai sses d' epargre)

were established by the local government authorities in some communiities;

almost all of them disappeared 'after 830, however, when such office.s were

established: by the Societe Generale and by other banks. 'Most banks even-

tually set up a "tcaisse d'epargnelt, functioning like a :savings department

of an American bank. Many cooperative organizations also established such

offices, among -hich those in rural sections (the Ucaisses agricole")

became the most important. As early as l865 an official organization w as

established, the Caisse Generale d' Bpar i-ie (Postal Savings Bank) rhichy

operating mainly through the C post offices, collected small savings on pass-

booksl

In order to meet the needs of small traders and. craftsmen not

adequately servred by the commercial benks, opompl s anks (banques popu-

laires) beganr to develop in the second half of the nineteenth century

These institutions, organized on a cooperati wa basis, carried1 the principle

of joint liability very far; some even establ shod unlimited liability of

members for all the debts of the association. While this principle worked

remarkably well in agricultural regions it seems to have contributed to

the failure of the urban ins titutions. About seventy banks of this kind

were established but hardly half a dozen have survived. The urban small.

bourgeoisie proved to be too individualistic for the application of joint

liability; moreover, economic. conditions were too uncertain in the cities,

and there was generally a lack of leadership.

The rur.l credit cooperatives (ti caisses agricoles") had much more

success because of the more c .o-sely-knit character of village society. A

"ccaisse"c of this type was generally established as part of the "agricultural

guild"t,, a wider cooperative organization in the same village providing the

members. with various services such as the purchase of fertilizer and imple-

ments, the marketing of products, the provision of a dairy,, etc. Most

agricultural guilds had a strong religious character, being associated withm

the Catholic church. The local caisses were affiliated. with federations

which operated so-called "central caissesti, regional institutions which,

when the movement started..in the 1S90's, were excected to lend to the local

c isses funds borrowed fromri larger financial organizations (particularly

the Caissc Generao dMEpa~rge) ost of the local caisses, however, soon.

attracted sufficient deposits to become self-supporting, and some even

developed an excess of funds which was deposited with the regional caisses

and used for. leans to local caisses short of funds. On the whole, there-

fore, there was little recourse to the Caisse Generale d'Epargne. On the

l Post offices"also fulfilled some other banking operations, such as

selling money orders and collcoting' bills. Shortly before the First

World War, a system of' postal checking accounts was established.

eve .of the :rst' World Warthere were about :.650 -caisses agricoles, of

which. soiee 300 were affiliated rith the Jerenbon d, the most important

federation in the Flemish part of the country~, 'I e Caisse Centrale du

:oerenbond, although. then holding only same '13 iillion francs of deposits,;

subsequently became one of the strongest financial organizations of ..the

country.

The Credit Communal. Before .the Frst ,World War, there were,

only a few "rpublicf or, "official" credit instituti ons managed in the

general interest, on a non-profit basis. Beside the National 'Bnk and

Postal Savings 'Bank there w1,5s the Credit .cm l founded 'in l860.

Athough established in corporeate form, it was actually a kind of coopera-

tive association-'of pro.vinces and municipalities (in Belgiam called, rcommunesll)r

The Credit made loans to members,. financed by the ' issuunce of its bonids;-

These bond's were serviced from the proceeds of certain taxes, cole cted by

the State for the provinces and communes; the State :reasury remitted such

taxes directly, to. the Credit Communal, which . ,wi tlhhold the amount ,due for

kntrest and amortization on its loans. This practice gave the bondholders

a supplementary guarantee,, and made the bonds of the Credit Communal.

readily marketable: Small communities which could not sell their om

bonds in the market at a reasonable rate- of interest were; the principal

beneficiaries of the opera tions of this intitu tion, In 1914, the Credit:

Communal had bonds, outstan ding i the amount of 3S2 million fran cs.

B. Fr om -the .First to the ,'-Second WTor ld War

Currency and Central Baniking

War and .inflation. At the outbreak of war in l9LL,., there was a

run on the banks and the National Bank was induced to increase its redi.s-

.counts in order to meet the banks? cash requirements. r om July 23 to

August 6, the bank !note circulation rose from 976 to 1295 million francs,

and the private ,current accounts (mainly bankers? deposits) 'at the National

Bank from 67 to 189 million. The bank rate was rais'ed to seven per cent.

On 'August 3, on the eve of the German 'invais'on; a moratorium on deposits was

proclained, 'withdrawals being limited to. 1000 francs, a fortnight. Next-day,

the convertibility' of bank notes was discontinued, and as coins were dis-

appearing from -circulation, notes, in five frcdnc denomination began to be

issued; they were later followed by two- and one franc notes.

One of the first measures taken by. the invader was to deprive the

National Bank of its note issue privileges, as, a punishment for having

evacuated its metallic reserves end printing plates to England.; But an issue

bank was necessary,, not only for ordinary domestic purposes but ,also to finance

the "war contribution" demanded by. the invader. After negotiations between

Germnan authorities and banking leaders (who consulted with political leaders

remaining in. the country), an issue department was set up by the Societe

Generale. Secretly, however, the Societe Generale concluded an agreement

with the National Bank by which the new issue department was to function

entirely:for the account of the latter; in fact, when the armistice arrived,

the National Bank took over 'all liabili tie, and assets of that department.

In addition,, the German authorities proclaimed the German mark as

legal tender on the basis of o'e mark equalling. 1.25 francs (the pre-wad

parity was 1.23). As. a resul.t, there were three kinds of paper currency in

circulation: (1) notes formerly issued by the, National Bank, (2). notes

currently put in circulation by the issue department of the Sociote Generale,

and (3) Genan marks identical with those circulating in Germany itself.

Imirediately after the invasion, the German authorities demanded the

payment of a monthly "war contribution" of ho million francs (later increased

to 50, and eventually to' 60 .million). rn the absenice of a central government

the provinces agreed under pressure to pay..the 'contribution, raising the

necessary funds by issuance of joint bonds ' (bons linter-provinciaux). The

first twelve monthly installments were financed by the issue department of

the Societe Generale, but thereafter commercial banks subscribed to the "inter-

provincial" bonds,' placing part of them with private investors. Notwith-

standing the fact that marks were put in circulation in large volume, and were

used by banks and private investors to pay for the "interprovincial banks" the

German authorities required that a high proportion of the monthly war contri-

bution be paid in francs. The marks, accumulated in the issue department of

the Societe Generale, from which they were taken over by. the German authorities-

against a' credit on the books of the Reichsbank. In effect, an.additional war

contributions was exacted in this manner. On the eve of the armistice, the

liabilities 'of the issue department of the Societe Generale amounted to around

1.9: billi6n francs' (1.5 billion notes and O.h. billion. deposits), while 'thO main

item -of ass'ets (1.2 billion) was represented by "balances abroad, i.e. the

forced dpdsits at the RCichsbank.

- 12 -

At the moment of the armistice, the amount of Bel., ian notes issued

was 2.75 billion (l.25 billion issued by the National Bank and: almost entirely

boardedi, and 1.5 b illi n issued by the Societe Gnerale), besides an unknown

amount of 0erman marks in c rcu~lation. The government decided- to. reedeem all

marks at the exchange rate at which they had been put into circulation (-1 mark-

1.25 francs). The total amount of marks presented.for exchange amounted. to

7.6 billion fr:anz.sLj, of which 1.8 billion were paid by a special issue 'of

treasury bills and. 5.8, billion by a ::loan from the, National Ba~k, Consequently,

after the issue department of the 'Soc ite .Generale had. been tak en over by the

National. Bank and the exchange of marks had. been effected (about, the middle

of 1919), the situation of the central bank was completely d-ifferent from

what it had been in July 191 . The. iabilities of the Nat1onal Bank had, then

amounted to one billion frarcs, covered roughly 'by 400 million f. gold a .nd

foreign exchange and 520 million. of commrer cial 'bills. In 1919., the liab ilities

amounted to 7.2 billion francs' (notes 4.7 billion, aeposits 2.5 billion),',

covered up to 6,3 billion by claims on the government arising from the loan

to redeem marks and the payrmont of the first year's war contribution.

In the following years, until 1926, the { overnment not only re-

fraied from using the credit facil;ties of the central bank but even .repaid

600 million franc's of its debt. Nonetheless, the pressure of the mass of

purchasing power created. during and just after the war, complicated by an