Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsWeb 3 Solution To Q2

Web 3 Solution To Q2

Uploaded by

Olivia KhumaloThis document summarizes the tax calculation for an individual with a gross income of R704,000. It shows the individual's salary, other income sources, exemptions and deductions. It then calculates the taxable income after exemptions and deductions are applied. Using the 2023 tax tables, it determines the normal tax liability is R166,204 after taking into account the primary rebate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- 05chap 5 NP Individuals Solutions 2020Document3 pages05chap 5 NP Individuals Solutions 202044v8ct8cdyNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- HW 16.1.24 Personal TaxationDocument8 pagesHW 16.1.24 Personal TaxationhusninanorzainNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- T2A 20542021 Employment IDocument6 pagesT2A 20542021 Employment IChan Chun HaoNo ratings yet

- Tax 3702 Exam Pack 2016Document18 pagesTax 3702 Exam Pack 2016nhlakaniphoNo ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Practice Question Individuals - MEMODocument1 pagePractice Question Individuals - MEMOYonnyNo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- Taxaation 2Document4 pagesTaxaation 2M CNo ratings yet

- Unit 12-Question 12-B Sol (2023)Document2 pagesUnit 12-Question 12-B Sol (2023)shirleygebenga020829No ratings yet

- Unit 12-Question 12-C Sol (2023)Document2 pagesUnit 12-Question 12-C Sol (2023)shirleygebenga020829No ratings yet

- UCC E-Filling SolutionDocument5 pagesUCC E-Filling SolutionSibam BanikNo ratings yet

- Goodwill: (Note 1)Document10 pagesGoodwill: (Note 1)SHi MiNNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- Zaini Zain (BAF2009012) Taxation UpdatedDocument15 pagesZaini Zain (BAF2009012) Taxation UpdatedZaini ZainNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- CAF 2 Autumn 2023Document8 pagesCAF 2 Autumn 2023HareemNo ratings yet

- FR AssDocument10 pagesFR Asssimon mtNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Plagiarism Declaration Form (T-DF)Document12 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- 3rd Quizzer TAX 2nd Sem SY 2019 2020Document4 pages3rd Quizzer TAX 2nd Sem SY 2019 2020Ric John Naquila CabilanNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Chapter 9 Taxation of CorporationsDocument4 pagesChapter 9 Taxation of CorporationsElizabethNo ratings yet

- FS$12134061$BCLACC$466850$3491Document9 pagesFS$12134061$BCLACC$466850$3491CalistaNo ratings yet

- Chapter 5: Pensions Question 5.1-AnswerDocument3 pagesChapter 5: Pensions Question 5.1-AnswerAk AlNo ratings yet

- 2.3 Solutions Module - 2 PDFDocument9 pages2.3 Solutions Module - 2 PDFArpita Artani100% (1)

- Income Taxation 2019 Chapter 13A 13C 14 BanggawanDocument8 pagesIncome Taxation 2019 Chapter 13A 13C 14 BanggawanEricka Einjhel Lachama100% (9)

- CA2 - Question On Taxable Income of A Natural Person MEMODocument5 pagesCA2 - Question On Taxable Income of A Natural Person MEMOYonnyNo ratings yet

- Solution - Mock Exam - 240120 - 142640Document6 pagesSolution - Mock Exam - 240120 - 142640lebiyacNo ratings yet

- Accounting Case - Excel AppendeciesDocument2 pagesAccounting Case - Excel AppendeciesRohan SinghNo ratings yet

- 08chap 8 NP Farming Solutions 2020Document3 pages08chap 8 NP Farming Solutions 202044v8ct8cdyNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Mavesto LTD and Its SubsidiaryDocument4 pagesMavesto LTD and Its SubsidiaryTawanda Tatenda HerbertNo ratings yet

- March16 Q4Document1 pageMarch16 Q4SITI NUR DIANA SELAMATNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- 10 Task PerformanceDocument5 pages10 Task Performancejeffersam31No ratings yet

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandiceNo ratings yet

- Paye 2 2023Document16 pagesPaye 2 2023v8ysqzd9pbNo ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- Tax Practice Assignmenment Edited 2 Ketty Dec 2022Document6 pagesTax Practice Assignmenment Edited 2 Ketty Dec 2022ketty sambaNo ratings yet

- ACCT223 AY 21 22 Mid-Term AnswersDocument5 pagesACCT223 AY 21 22 Mid-Term AnswersLIAW ANN YINo ratings yet

- 2.1 Suggested Solutions Impairment 2020Document12 pages2.1 Suggested Solutions Impairment 2020lameck noah zuluNo ratings yet

- Programme Subject Commerce Semester V Semester Session No. 42 Topic Problems On Taxable Salary Created by Prof Asharani, CDocument6 pagesProgramme Subject Commerce Semester V Semester Session No. 42 Topic Problems On Taxable Salary Created by Prof Asharani, Ctharunm451No ratings yet

- LFPE5800 November 2018 MEMODocument37 pagesLFPE5800 November 2018 MEMOSibongiseniNo ratings yet

- Principles of DeductionsDocument12 pagesPrinciples of DeductionsJUSTINEJADE PEREZNo ratings yet

- Income From Salary Solution ZDocument3 pagesIncome From Salary Solution ZMuhammad FaisalNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- 06chap 6 NP Fringe Benefits Solutions 2020Document2 pages06chap 6 NP Fringe Benefits Solutions 202044v8ct8cdyNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

Web 3 Solution To Q2

Web 3 Solution To Q2

Uploaded by

Olivia Khumalo0 ratings0% found this document useful (0 votes)

2 views1 pageThis document summarizes the tax calculation for an individual with a gross income of R704,000. It shows the individual's salary, other income sources, exemptions and deductions. It then calculates the taxable income after exemptions and deductions are applied. Using the 2023 tax tables, it determines the normal tax liability is R166,204 after taking into account the primary rebate.

Original Description:

Taxation

Original Title

Web 3 Solution to Q2 (1)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the tax calculation for an individual with a gross income of R704,000. It shows the individual's salary, other income sources, exemptions and deductions. It then calculates the taxable income after exemptions and deductions are applied. Using the 2023 tax tables, it determines the normal tax liability is R166,204 after taking into account the primary rebate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

2 views1 pageWeb 3 Solution To Q2

Web 3 Solution To Q2

Uploaded by

Olivia KhumaloThis document summarizes the tax calculation for an individual with a gross income of R704,000. It shows the individual's salary, other income sources, exemptions and deductions. It then calculates the taxable income after exemptions and deductions are applied. Using the 2023 tax tables, it determines the normal tax liability is R166,204 after taking into account the primary rebate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

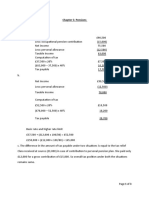

Taxation 2A

Webinar 3-Solution to question 2 (Caselet)

Gross Income R704 000

Salary 500 000

Academic work 140 000

Net rentals (60 000 + 40 000 Megan)/2 50 000

Interest (28 000/2) 14 000

Less: Exemptions (14 000)

Interest exemption-limited to a maximum of R23 800 (14 000)

Income 690 000

Less: Deductions and allowances (18 100)

Cleaning and maintenance (R4 500 x 12) x 10% (5 400)

Assessment rates and utility charges (R72 000 x 10%) (7 200)

Office equipment (R33 000/3 x 6/12) (5 500)

* Taxable income 671 900

Tax payable *(see 2023 tax table) 182 629

170 734 + 39% X (671 900 – 641 401)

170 734 + 39% X (30 499)

170 734 + 11 895

Less: Primary rebate (16 425)

Normal tax liability R166 204

You might also like

- TAX3761 EXAM PACK JPJBLFDocument146 pagesTAX3761 EXAM PACK JPJBLFMonica Deetlefs0% (1)

- 05chap 5 NP Individuals Solutions 2020Document3 pages05chap 5 NP Individuals Solutions 202044v8ct8cdyNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- Salary Solution 97Document4 pagesSalary Solution 97Al SukranNo ratings yet

- E1049217251 12520 1322185717213Document5 pagesE1049217251 12520 1322185717213Sumit PattanaikNo ratings yet

- HW 16.1.24 Personal TaxationDocument8 pagesHW 16.1.24 Personal TaxationhusninanorzainNo ratings yet

- Solution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsDocument7 pagesSolution Lecture 4 Part 2: Financial Statement With Adjustments Question 1 (A) AdjustmentsIsyraf Hatim Mohd TamizamNo ratings yet

- T2A 20542021 Employment IDocument6 pagesT2A 20542021 Employment IChan Chun HaoNo ratings yet

- Tax 3702 Exam Pack 2016Document18 pagesTax 3702 Exam Pack 2016nhlakaniphoNo ratings yet

- MockDocument6 pagesMockWEI QUAN LEENo ratings yet

- Practice Question Individuals - MEMODocument1 pagePractice Question Individuals - MEMOYonnyNo ratings yet

- INCOME TAX AssignmentDocument5 pagesINCOME TAX AssignmentShakib studentNo ratings yet

- Solution Tax667 - Jun 2018Document9 pagesSolution Tax667 - Jun 2018Aiyani NabihahNo ratings yet

- Tax Answerrs and QuestionsDocument33 pagesTax Answerrs and QuestionsoluwafunmilolaabiolaNo ratings yet

- Pre Rev Mock Attempt Answers Nov 21Document3 pagesPre Rev Mock Attempt Answers Nov 21RiyaNo ratings yet

- Taxaation 2Document4 pagesTaxaation 2M CNo ratings yet

- Unit 12-Question 12-B Sol (2023)Document2 pagesUnit 12-Question 12-B Sol (2023)shirleygebenga020829No ratings yet

- Unit 12-Question 12-C Sol (2023)Document2 pagesUnit 12-Question 12-C Sol (2023)shirleygebenga020829No ratings yet

- UCC E-Filling SolutionDocument5 pagesUCC E-Filling SolutionSibam BanikNo ratings yet

- Goodwill: (Note 1)Document10 pagesGoodwill: (Note 1)SHi MiNNo ratings yet

- Final PB87 Sol. MASDocument2 pagesFinal PB87 Sol. MASLJ AggabaoNo ratings yet

- Zaini Zain (BAF2009012) Taxation UpdatedDocument15 pagesZaini Zain (BAF2009012) Taxation UpdatedZaini ZainNo ratings yet

- Test 3 Memo Tax621sDocument2 pagesTest 3 Memo Tax621sMartha EeluNo ratings yet

- CAF 2 Autumn 2023Document8 pagesCAF 2 Autumn 2023HareemNo ratings yet

- FR AssDocument10 pagesFR Asssimon mtNo ratings yet

- STT - Mock - Test - S-24 - Suggested AnswersDocument8 pagesSTT - Mock - Test - S-24 - Suggested AnswersabdullahNo ratings yet

- Plagiarism Declaration Form (T-DF)Document12 pagesPlagiarism Declaration Form (T-DF)Nur HidayahNo ratings yet

- T4Q - TaxationDocument4 pagesT4Q - Taxation吕仙姿No ratings yet

- Individual TAXDocument6 pagesIndividual TAXPushpa ValliNo ratings yet

- Sol. Man. Chapter 9 Income Taxes 2021Document18 pagesSol. Man. Chapter 9 Income Taxes 2021Kim HanbinNo ratings yet

- 3rd Quizzer TAX 2nd Sem SY 2019 2020Document4 pages3rd Quizzer TAX 2nd Sem SY 2019 2020Ric John Naquila CabilanNo ratings yet

- Income Taxes: Problem 1: True or FalseDocument17 pagesIncome Taxes: Problem 1: True or FalseJean Mira AribalNo ratings yet

- Chapter 9 Taxation of CorporationsDocument4 pagesChapter 9 Taxation of CorporationsElizabethNo ratings yet

- FS$12134061$BCLACC$466850$3491Document9 pagesFS$12134061$BCLACC$466850$3491CalistaNo ratings yet

- Chapter 5: Pensions Question 5.1-AnswerDocument3 pagesChapter 5: Pensions Question 5.1-AnswerAk AlNo ratings yet

- 2.3 Solutions Module - 2 PDFDocument9 pages2.3 Solutions Module - 2 PDFArpita Artani100% (1)

- Income Taxation 2019 Chapter 13A 13C 14 BanggawanDocument8 pagesIncome Taxation 2019 Chapter 13A 13C 14 BanggawanEricka Einjhel Lachama100% (9)

- CA2 - Question On Taxable Income of A Natural Person MEMODocument5 pagesCA2 - Question On Taxable Income of A Natural Person MEMOYonnyNo ratings yet

- Solution - Mock Exam - 240120 - 142640Document6 pagesSolution - Mock Exam - 240120 - 142640lebiyacNo ratings yet

- Accounting Case - Excel AppendeciesDocument2 pagesAccounting Case - Excel AppendeciesRohan SinghNo ratings yet

- 08chap 8 NP Farming Solutions 2020Document3 pages08chap 8 NP Farming Solutions 202044v8ct8cdyNo ratings yet

- Sol. Man. - Chapter 9 - Income Taxes - 2021Document18 pagesSol. Man. - Chapter 9 - Income Taxes - 2021Ventilacion, Jayson M.No ratings yet

- Mavesto LTD and Its SubsidiaryDocument4 pagesMavesto LTD and Its SubsidiaryTawanda Tatenda HerbertNo ratings yet

- March16 Q4Document1 pageMarch16 Q4SITI NUR DIANA SELAMATNo ratings yet

- Answers Chapter 9 Income TaxesDocument17 pagesAnswers Chapter 9 Income TaxesJeannamy PanizalesNo ratings yet

- 10 Task PerformanceDocument5 pages10 Task Performancejeffersam31No ratings yet

- Fac2601-2013-6 - Answers PDFDocument9 pagesFac2601-2013-6 - Answers PDFcandiceNo ratings yet

- Paye 2 2023Document16 pagesPaye 2 2023v8ysqzd9pbNo ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet

- Tax Practice Assignmenment Edited 2 Ketty Dec 2022Document6 pagesTax Practice Assignmenment Edited 2 Ketty Dec 2022ketty sambaNo ratings yet

- ACCT223 AY 21 22 Mid-Term AnswersDocument5 pagesACCT223 AY 21 22 Mid-Term AnswersLIAW ANN YINo ratings yet

- 2.1 Suggested Solutions Impairment 2020Document12 pages2.1 Suggested Solutions Impairment 2020lameck noah zuluNo ratings yet

- Programme Subject Commerce Semester V Semester Session No. 42 Topic Problems On Taxable Salary Created by Prof Asharani, CDocument6 pagesProgramme Subject Commerce Semester V Semester Session No. 42 Topic Problems On Taxable Salary Created by Prof Asharani, Ctharunm451No ratings yet

- LFPE5800 November 2018 MEMODocument37 pagesLFPE5800 November 2018 MEMOSibongiseniNo ratings yet

- Principles of DeductionsDocument12 pagesPrinciples of DeductionsJUSTINEJADE PEREZNo ratings yet

- Income From Salary Solution ZDocument3 pagesIncome From Salary Solution ZMuhammad FaisalNo ratings yet

- FAC1601-oct2014 Suggested Sol eDocument7 pagesFAC1601-oct2014 Suggested Sol ePhelane FNo ratings yet

- 06chap 6 NP Fringe Benefits Solutions 2020Document2 pages06chap 6 NP Fringe Benefits Solutions 202044v8ct8cdyNo ratings yet

- A - Mock PSPM Set 1Document5 pagesA - Mock PSPM Set 1IZZAH NUR ATHIRAH BINTI AZLI MoeNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet