Professional Documents

Culture Documents

Unit Operator

Unit Operator

Uploaded by

JimmyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit Operator

Unit Operator

Uploaded by

JimmyCopyright:

Available Formats

Press Release

RCCPL Private Limited

July 05, 2022

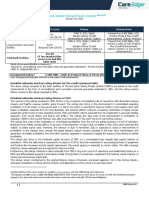

Ratings

Amount

Facilities/Instruments Rating1 Rating Action

(₹ crore)

1,205.38 CARE AA; Stable

Long-term bank facilities Reaffirmed

(Reduced from 1,442.26) (Double A; Outlook: Stable)

Revised from CARE AA

241.70 CARE AA; Stable (CE); Stable [Double A

Long-term bank facilities

(Reduced from 275.30) (Double A; Outlook: Stable) (Credit Enhancement);

Outlook: Stable]

CARE AA; Stable / CARE A1+

Long-term/Short-term bank 1,020.00

(Double A; Outlook: Stable/ Reaffirmed

facilities (Enhanced from 800.00)

A One Plus)

2,467.08

(₹Two thousand four

Total bank facilities

hundred sixty-seven crore

and eight lakh only)

Details of instruments/facilities in Annexure-1.

Detailed rationale and key rating drivers

The ratings assigned to the bank facilities of RCCPL Private Limited (RCCPL) continue to take into account the strategic

importance of the company for its parent entity, Birla Corporation Limited (BCL), with more than half of the profit before

interest, lease rentals, depreciation and taxation (PBILDT) of the group (refers to BCL – Consolidated) being derived from

RCCPL, which is further expected to increase in the subsequent years with the recent commissioning of the plant at Mukutban,

Maharashtra. The ratings also factor in the continued strength derived by way of implied support and financial linkages with

BCL, common finance and marketing function, selling under a common brand, 100% management control from the parent

company with experienced management and operational team with long and satisfactory track record, its multi-region presence

with strong brand recall and strong distribution network, majority sales from blended cement division, operational efficiency

along with availability of sizeable mineral reserves and captive power plants, cost optimisation offered by split units and

proximity of the project to various raw material sources, newly set up plants with updated technology resulting in high

operational efficiency, comfortable liquidity position and eligibility for various incentives which results in cost advantages.

However, the ratings continue to be constrained by volatility in input and finished goods prices and cyclicality of the cement

industry, which leads to variability in the profitability.

Rating sensitivities

Positive factors – Factors that could lead to positive rating action/upgrade:

• Improvement in the credit profile of BCL (parent).

• Significant improvement in RCCPL’s operating performance and financial flexibility.

Negative factors – Factors that could lead to negative rating action/downgrade:

• Deterioration in the credit profile of BCL.

• Significant deterioration in RCCPL’s operating performance.

Detailed description of the key rating drivers

Key rating strengths

Experienced management and operational team with long and satisfactory track record and diversified

operations: Incorporated in August 2007, RCCPL is engaged in the manufacturing of cement with an installed capacity of

around 10 MTPA which is around 50% of the group’s capacity of around 20 MTPA. In August 2016, BCL acquired entire

shareholding of RCCPL from Reliance Infrastructure Limited (RIL). Subsequently, RCCPL became a wholly-owned subsidiary of

BCL, an entity with more than 10 decades of operational experience. RCCPL sold around 6 MT cement in FY22 (refers to the

period April 1 to March 31) out of 14.2 MT sold by BCL (Consolidated) and the contribution from RCCPL is expected to increase

further with operationalisation of 3.89 MTPA Mukutban plant. RCCPL is strategically important to BCL, as it strengthens the

latter’s market presence in central India, and provides entry into premium cement segments and access to limestone mining

licences for future growth of the group in different regions.

RCCPL, after being taken over by BCL, has almost the same management as BCL. Furthermore, healthy cash and liquid

investment at group level provides financial flexibility and supports liquidity position of the group.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

CARE Ratings Ltd.

1

Press Release

Multi-region presence with strong distribution network and strong brand recall: RCCPL, along with BCL, has

significant presence in Central (Madhya Pradesh) and Northern regions (Uttar Pradesh and Rajasthan) of the country. With

operationalisation of 3.89 MTPA plant at Mukutban, Maharashtra, in April 2022, the company’s capacity has increased to around

10 MTPA and it has also forayed into the western region.. The group sells through a common network of around 250 sales

promoters, more than 9,500 dealers, and more than 24,000 sub-dealers. Approximately 80% of the company’s sales in FY22

were generated from Trade channels and the rest from non-trade channels. On a combined basis, the plants cover an average

radius of approximately 300 kms. The group sells its products under well-established brands, viz., MP Birla Perfect Plus, MP Birla

Samrat, MP Birla Samrat Advanced, MP Birla Chetak, MP Birla Unique, MP Birla Ultimate, MP Birla Ultimate Ultra, etc.

Majority sales from blended cement: The Group manufactures both blended (Pozzolona Portland Cement PPC, PSC, PCC –

91 % contribution of overall sales in FY22) and OPC. Furthermore, the Group is considering expanding its premium brands like

‘M.P Birla Perfect Plus’, M.P Birla Unique Cement, M.P Birla Ultimate, M.P Birla Ultimate Ultra, M.P Birla Samrat advance’, which

command premium prices. Recently, the group has launched a super-premium brand Rakshah. The group has increased the

share of premium brands in its total sales to 51 % in FY22 from 30% in FY19, which has positively impacted its profitability

margins.

Operational efficiency with availability of sizeable mineral reserve and captive power plant and robust operating

performance: RCCPL has waste heat recovery system (WHRS) and solar power capacities of around 12.25 MW and around 22

MW, respectively. After operationalisation of Mukutban plant, RCCPL will also has Captive Power Plant (thermal) capacity of

40MW. The company met around 27% of its total power requirement in FY22 (22% in FY21) through captive sources thereby

bringing economies to power cost of the company. Furthermore, the group has captive limestone mines across the country with

estimated limestone reserves of more than 300 MT and another around 100 MT non-operational (for which process of seeking

approvals is in progress). The group sources around 85% of its limestone requirements from its captive mines. Furthermore,

RCCPL has a captive coal mine at Sial Ghogri, Madhya Pradesh, with an extractable reserve of 5.69 MMT providing cost benefit

to the company for its fuel requirements. The production of coal from Sial Ghogri improved to around 2 lakh tons in FY22 from

1.85 lakh tons in FY21.

Cost optimisation offered by split units of the project and proximity of the project to various raw material

sources: RCCPL has its operational units spread across Madhya Pradesh, Uttar Pradesh and Maharashtra. Out of the four units

(Maihar [MP], Kundanganj [UP], Butibori and Mukutban [Maharashtra]), the units at Maihar and Mukutban are integrated

facilities, whereas in other two places, the company is operating grinding facilities near the user markets to save upon the cost

of logistics. Limestone requirements of the unit at Maihar are met through Sadhera and Salaiya mines, while the company has

received approval for development of Persoda mines for Mukutban plant. Major clinker requirements of the two grinding units

are met from the Maihar unit. Furthermore, other raw materials are also located near the project sites which in turn enables the

entity to optimise its cost.

RCCPL’s newly set up plants with updated technology ensures optimum efficiency in operations: RCCPL’s operating

units were commissioned in 2014. The plants are of latest technology, which in turn ensures optimum efficiency in terms of

operations. The same is evident from low power requirement per tonne of production of cement of 67 kw/ton as compared to

industry average of 75-80 kw/ton.

Comfortable financial risk profile, albeit high leverage: The capacity utilisation (CU) of RCCPL increased y-o-y to 108%

in FY22 from 92% in FY21, supported by boost in demand after easing of COVID-19-related restrictions, resulting in increase in

revenue to ₹3,140 crore from ₹2,830 crore. However, the PBILDT margin decreased to 20% from 26% due to increase in

power & fuel and freight expenses. Industry-wide there has been sharp increase in fuel, raw material, and packaging costs

during the year owing to a significant increase in commodity prices. Due to an increase in fuel prices along with prices of pet

coke and coal (both domestic and imported), total distribution cost in FY22 has also risen. The impact on the profitability is

expected to continue even in FY23 due to prolonged and unabated cost pressures. CARE Ratings Limited (CARE Ratings),

however, believes that various cost-saving initiatives taken by the company (such as waste heat recovery-based and solar

power plants to replace high-cost grid power, increase in clinker capacity and coal extraction from captive mines) would aid

profits.

The overall gearing though improved since FY21, continues to remain on a higher side and stood at 1.90x as on March 31, 2022

(2.13x as on March 31, 2021). The improvement in gearing was on account of accretion of profits coupled with slower-than-

anticipated debt drawdown.

RCCPL’s eligibility for various incentives results in cost advantages: RCCPL’s operating manufacturing units in MP, UP,

Maharashtra have been granted the status of Mega Projects and have been granted special incentives. Incentives categories

include value added tax (VAT) (now substituted with Goods and Service Tax [GST]) /Sales Tax and stamp duty exemption,

capital investment subsidy amongst others. The incentives have the potential to recover the entire investment, which can

provide cost advantages in the future course of operations. In FY22, accrued subsidy benefit was around ₹150 crore, while the

company received only ₹13 crore of subsidies, and subsidy receivable stood at ₹500 crore as on March 31, 2022. The new unit

at Mukutban, is eligible for subsidy of over ₹2,000 crore in a span of 20 years from FY22. Timely receipt of subsidies shall

remain one of the key monitorables as the same should not hamper the cashflows and thereby the liquidity of the group.

CARE Ratings Ltd.

2

Press Release

Key rating weaknesses

Volatility in input and finished goods prices: In addition to raw material (Limestone) costs, power & fuel and freight costs

are the major cost components for the cement industry. During FY22, the PBILDT margin of RCCPL declined to 20% from 26%

in FY21 due to (i) increase in power and fuel expenses, which rose to 16.6% of revenue from 13.9% in FY21, and (ii) increase

in freight expenses which rose to 17.9% of revenue from 16.1%.

Crude oil prices went up at a rate of 74% in FY22. Tracking this, pet-coke has also reported a sharp increase of around 71% y-

o-y. International coal prices soared to USD 294.42/MT (record high) due to Russia-Ukraine war, widening demand-supply gap

leading to diminishing inventories, and Indonesia’s temporary ban on coal exports.

The surge in crude oil prices has raised freight costs significantly, resulting in diesel prices doubling up during FY22.

Furthermore, the price of cement remains susceptible to fluctuation on account of market dynamics. Hence, any adverse

movement in the prices of raw materials or the crude cost without a corresponding movement in the price of the cement can

affect the profitability of the company. However, backward integration and captive power sources partially mitigate the risk of

decrease in profitability. The group has captive limestone mines meeting around 85% % requirement and has also set up

WHRS, CPP (thermal), and solar power plants, to meet substantial portion of its power requirements in future and providing

power at much cheaper rates. The company meets its requirement of coal from its captive mines in Sial Ghogri along with a mix

of purchased indigenous and imported coal/Petcoke. RCCPL has a captive coal mine at Sial Ghogri, Madhya Pradesh, which

catered to around 42% (43% in FY21) of the total coal requirements in FY22 of the company.

Cyclicality of the cement industry: Cement industry is highly cyclical in nature and depends largely on the economic growth

of the country. There is a high degree of correlation between the GDP growth and the growth in cement consumption. Cement

being a cyclical industry goes through phases of ups and downs, and accordingly impacts the unit realisations and profitability.

Industry outlook: Growth in India’s cement sector has seen a strong bounce back in FY22. The year closed with a growth of

20%, reaching an all-time high, after witnessing a decline of 11% in FY21. The jump was on account of the government’s

infrastructure push via various schemes and allocations towards the creation of hard assets and a low base effect. Growth trend

continues in production FY21 created a low base primarily because of the COVID-19 pandemic. This, coupled with pent-up

demand, has led to the reversal in the muted trend in volumes. The 20% production growth in FY22 was driven by the strong

recovery witnessed during H1FY22, which saw a y-o-y growth of 36%. Owing to strong momentum in housing, infrastructure,

and industrial development, the cement industry in India is set to see an upswing in demand in FY23. CARE Ratings believes

the industry is likely to move at high single-digit growth on account of government thrust for infrastructure and strong traction

in capital expenditure. Various initiatives by the government along with several Micro, Small, and Medium Enterprises (MSME)

schemes are set to propel capital expenditure from private players. While demand is likely to remain strong in FY23, headwinds

arising out of rising cost pressure could create some stress on the profitability of cement companies. Resultant price hikes by

cement producers will become evident and might sustain in the near term. However, due to the competitive nature of the

industry, the magnitude of the price hikes driven by cost pressure remains to be seen.

Liquidity: Adequate

RCCPL’s average fund-based utilisation during 12 months ended March 2022 has been around 10%. Liquid

investment/unencumbered cash and bank balance stood at ₹94 crore as on March 31, 2022. The company’s gross cash accruals

(GCA) is expected to be around ₹470 crore in FY23 vis-à-vis debt repayment obligation of ₹291 crore (including ₹75 crore

WCDL and ₹100 crore preference shares). Mukutban plant has already been operationalised RCCPL’s management might defer

capex, esp. those related to sustenance and debottlenecking, if the targeted realisations are not achieved. RCCCPL’s liquidity

also draws comfort from BCL’s string liquidity position. On consolidated level, liquid investment/unencumbered cash and bank

balance stood at more than ₹1,200 crore as on March 31, 2022 (including equity investment of around ₹400 crore).

Consolidated GCA stood at ₹858.95 crore in FY22- vis-à-vis debt repayment obligation of ₹414.98 crore in FY23 (including

repayment of WCDL of ₹210 crore).

Furthermore, RCCPL enjoys additional financial flexibility from being a part of the MP Birla Group. The management has

indicated that though a need is not envisaged in the foreseeable future given BCL’s strong liquidity, group support will be

available, if required.

Analytical approach

Standalone

However, parentage of BCL is factored in, as these companies are engaged in similar line of operation under a common

management, having financial linkage and selling their products under the common brand and marketing team. Apart from the

above, RCCPL’s (a wholly-owned subsidiary of BCL) strategic importance is expected to increase in future with the expectation

of it contributing major share of profits of the consolidated entity on account of completion of Mukutban capex plan in RCCPL.

The rating also factors in the financial flexibility that it enjoys by virtue of being part the M.P Birla group.

CARE Ratings Ltd.

3

Press Release

Applicable criteria

Policy on default recognition

Consolidation

CARE’s Policy on Default Recognition

Factoring Linkages Parent Sub JV Group

Financial Ratios – Non financial Sector

Liquidity Analysis of Non-financial sector entities

Rating Outlook and Credit Watch

Short Term Instruments

Cement

Manufacturing companies

About the company

RCCPL Private Ltd (RCCPL; erstwhile Reliance Cement Company Private Limited) was incorporated in 2007 and is engaged in

the manufacturing of cement with major presence in Madhya Pradesh, Uttar Pradesh and Maharashtra. RCCPL’s aggregate

installed cement capacity is of 9.47 million tonnes per annum (MTPA). The company was initially a wholly-owned subsidiary of

Reliance Infrastructure Limited. However, w.e.f. from August 22, 2016, ‘Birla Corporation Limited’, took over 100% shares of

RCCPL held by RIL to expand its existing operations, market presence and gain synergies as apart from its cement

manufacturing facilities in Rajasthan, BCL, like RCCPL, also has significant operations in Central India.

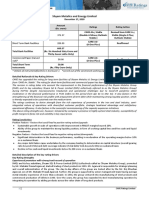

Brief Financials (₹ crore) March 31, 2020 (A) March 31, 2021 (A) March 31, 2022 (P)

Total operating income 2,477.69 2,829.58 3,140.11

PBILDT 669.21 724.43 619.85

PAT 139.22 275.36 217.31

Overall gearing (times) 2.35 2.13 1.90

Interest coverage (times) 3.16 4.12 4.02

A: Audited, P: Provisional

Latest quarter - NA

About the parent

Birla Corporation Limited (BCL), incorporated in August 1919, is currently the flagship company of the M. P. Birla group. The

company is a multi-location cement manufacturing company with an aggregate capacity of 15.6 MTPA as on March 31, 2022

(10 MTPA in BCL and 5.6 in RCCPL). Furthermore, BCL commenced cement production at the 3.89 MT Mukutban plant in April

2022, and with this, the overall capacity is increased and stood at around 20 MTPA.

BCL sells cement under various well-established brands, prominent being ‘Birla Cement Samrat’, ‘Birla Cement Unique’, a

premium Portland Slag Cement, MP Birla Perfect, MP Birla Perfect Plus and ‘Birla Cement Chetak’ with strong presence in

Central and North India. It is also engaged in jute sales. In August 2016, BCL successfully acquired 100% equity stake in RCCPL

Private Limited (RCCPL) (erstwhile Reliance Cement Company Private Limited) at an enterprise value of ₹4,800 crore (including

a debt of ₹2,400 crore) to expand its cement business.

After the death of Priyamvada Birla, wife of Madhav Prasad Birla, in July 2004, BCL was headed by Rajendra Singh Lodha.

Following his death in October 2008, his son, Harsh Vardhan Lodha, took over the charge as the company’s Chairman.

However, the ownership of BCL is under legal dispute, being contested by Harsh Vardhan Lodha and the descendants of the

Birla family. CARE Ratings will continue to monitor the developments in this regard.

Brief Financials (₹ crore) FY20 (A) FY21 (A) FY22 (A)

TOI 6,948.35 6,834.38 7,528.68

PBILDT 1,379.82 1,400.50 1,178.91

PAT 505.18 630.14 398.59

Overall gearing (times) 1.26 1.05 1.03

Interest coverage (times) 3.56 4.73 4.86

A: Audited

Latest quarter - NA

CARE Ratings Ltd.

4

Press Release

Status of non-cooperation with previous CRA:

Not applicable

Any other information:

Not applicable

Rating history for the last three years: Please refer Annexure-2

Covenants of the rated instruments/facilities: Detailed explanation of covenants of the rated instruments/facilities is

given in Annexure-3

Complexity level of various instruments rated for this company: Annexure-4

Annexure-1: Details of instruments/facilities

Size of the

Name of the Date of Coupon Maturity Rating Assigned along

ISIN Issue

Instrument Issuance Rate Date with Rating Outlook

(₹crore)

Dec,

Fund-based - LT-Term Loan - - 1035.38 CARE AA; Stable

2028

LT/ST Fund-based/Non-fund- CARE AA; Stable / CARE

- - - 715.00

based-CC/WCDL/OD/LC/BG A1+

CARE AA; Stable / CARE

Non-fund-based - LT/ ST-BG/LC - - - 305.00

A1+

Aug,

Fund-based - LT-Term Loan - - 241.70 CARE AA; Stable

2028

Dec,

Fund-based - LT-Term Loan - - 170.00 CARE AA; Stable

2028

Annexure-2: Rating history for the last three years

Current Ratings Rating History

Date(s) Date(s) Date(s) Date(s)

Name of the

Sr. and and and and

Instrument/Bank Amount

No. Rating(s) Rating(s) Rating(s) Rating(s)

Facilities Type Outstanding Rating

assigned assigned assigned assigned

(₹crore)

in 2022- in 2021- in 2020- in 2019-

2023 2022 2021 2020

CARE 1)CARE AA; 1)CARE AA- 1)CARE AA-

Fund-based - LT-

1 LT 1035.38 AA; - Stable ; Stable ; Stable

Term Loan

Stable (05-Jul-21) (07-Jul-20) (20-Sep-19)

CARE

LT/ST Fund- 1)CARE AA;

AA; 1)CARE AA- 1)CARE AA-

based/Non-fund- Stable /

2 LT/ST* 715.00 Stable / - ; Stable ; Stable

based- CARE A1+

CARE (07-Jul-20) (20-Sep-19)

CC/WCDL/OD/LC/BG (05-Jul-21)

A1+

CARE

1)CARE AA;

AA;

Non-fund-based - LT/ Stable / 1)CARE A1+ 1)CARE A1+

3 LT/ST* 305.00 Stable / -

ST-BG/LC CARE A1+ (07-Jul-20) (20-Sep-19)

CARE

(05-Jul-21)

A1+

CARE 1)CARE AA 1)CARE AA 1)CARE AA

Fund-based - LT-

4 LT 241.70 AA; - (CE); Stable (CE); Stable (CE); Stable

Term Loan

Stable (05-Jul-21) (07-Jul-20) (20-Sep-19)

CARE 1)CARE AA; 1)CARE AA- 1)CARE AA-

Fund-based - LT-

5 LT 170.00 AA; - Stable ; Stable ; Stable

Term Loan

Stable (05-Jul-21) (07-Jul-20) (20-Sep-19)

*Long term/Short term.

CARE Ratings Ltd.

5

Press Release

Annexure-3: Detailed explanation of the covenants of the rated instruments/facilities

Name of the Instrument Detailed Explanation

A. Financial covenants

I. DSCR Not below 1.15x

II. FACR Not below 1.2x

III. TTL/TNW Not to exceed 3.0x

IV. TOL/TNW Not to exceed 4.0x

B. Non-financial covenants

I. Maintenance of books of accounts The borrower shall maintain proper books of accounts to

accurately reflect its financial condition

II. Material events The borrower shall keep the Bank informed of the happening

of any event which is likely to have an impact on their profit

or business and the remedial steps proposed to be taken.

Annexure-4: Complexity level of various instruments rated for this company

Sr. No. Name of Instrument Complexity Level

1 Fund-based - LT-Term Loan Simple

Annexure-5: Bank lender details for this company

To view the lender wise details of bank facilities please click here

Note on complexity levels of the rated instruments: CARE Ratings has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

CARE Ratings Ltd.

6

Press Release

Contact us

Media contact

Name: Mradul Mishra

Phone: +91-22-6754 3596

E-mail: mradul.mishra@careedge.in

Analyst contact

Name: Ravleen Sethi

Phone: +91-11-4533 3251

E-mail: ravleen.sethi@careedge.in

Relationship contact

Name: Saikat Roy

Phone: +91-98209 98779

E-mail: saikat.roy@careedge.in

About us:

Established in 1993, CARE Ratings is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India, it has been acknowledged as an External Credit Assessment Institution by the RBI. With an equitable

position in the Indian capital market, CARE Ratings provides a wide array of credit rating services that help corporates raise

capital and enable investors to make informed decisions. With an established track record of rating companies over almost

three decades, CARE Ratings follows a robust and transparent rating process that leverages its domain and analytical expertise,

backed by the methodologies congruent with the international best practices. CARE Ratings has played a pivotal role in

developing bank debt and capital market instruments, including commercial papers, corporate bonds and debentures, and

structured credit.

Disclaimer:

The ratings issued by CARE Ratings are opinions on the likelihood of timely payment of the obligations under the rated

instrument and are not recommendations to sanction, renew, disburse, or recall the concerned bank facilities or to buy, sell, or

hold any security. These ratings do not convey suitability or price for the investor. The agency does not constitute an audit on

the rated entity. CARE Ratings has based its ratings/outlook based on information obtained from reliable and credible sources.

CARE Ratings does not, however, guarantee the accuracy, adequacy, or completeness of any information and is not responsible

for any errors or omissions and the results obtained from the use of such information. Most entities whose bank

facilities/instruments are rated by CARE Ratings have paid a credit rating fee, based on the amount and type of bank

facilities/instruments. CARE Ratings or its subsidiaries/associates may also be involved with other commercial transactions with

the entity. In case of partnership/proprietary concerns, the rating/outlook assigned by CARE Ratings is, inter-alia, based on the

capital deployed by the partners/proprietors and the current financial strength of the firm. The ratings/outlook may change in

case of withdrawal of capital, or the unsecured loans brought in by the partners/proprietors in addition to the financial

performance and other relevant factors. CARE Ratings is not responsible for any errors and states that it has no financial liability

whatsoever to the users of the ratings of CARE Ratings. The ratings of CARE Ratings do not factor in any rating-related trigger

clauses as per the terms of the facilities/instruments, which may involve acceleration of payments in case of rating downgrades.

However, if any such clauses are introduced and triggered, the ratings may see volatility and sharp downgrades.

For the detailed Rationale Report and subscription information, please visit www.careedge.in

CARE Ratings Ltd.

7

You might also like

- Sleeping Beauty CaseDocument6 pagesSleeping Beauty CaseAlvaro Andrade Ramírez0% (2)

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- TGV SRAAC LimitedDocument6 pagesTGV SRAAC Limitedjayadeep akasamNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- Press Release Udaipur Cement Works LimitedDocument6 pagesPress Release Udaipur Cement Works Limitedflying400No ratings yet

- Radico Khaitan LimitedDocument6 pagesRadico Khaitan LimitedHarminder Singh BajwaNo ratings yet

- K.P.R. Sugar Mill LimitedDocument7 pagesK.P.R. Sugar Mill LimitedKarthikeyan RK SwamyNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- Thriveni Sainik Mining Private Limited 2023Document8 pagesThriveni Sainik Mining Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- CARE Sunflag 4.01.2024Document9 pagesCARE Sunflag 4.01.2024Swapnil SomkuwarNo ratings yet

- Subros LimitedDocument8 pagesSubros LimitedrajpersonalNo ratings yet

- Jupiter International LimitedDocument6 pagesJupiter International LimitedRahul syalNo ratings yet

- KPR Care Rating Jan 21Document4 pagesKPR Care Rating Jan 21V KeshavdevNo ratings yet

- Tamilnadu Newsprint & Papers LimitedDocument5 pagesTamilnadu Newsprint & Papers LimitedspipsmailNo ratings yet

- Shyam Metalics and Energy Limited-12-17-2020Document7 pagesShyam Metalics and Energy Limited-12-17-2020Parth PatelNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Research Paper - Rashmi Sponge Iron & Power Industries LTDDocument6 pagesResearch Paper - Rashmi Sponge Iron & Power Industries LTDSoumyakanti S. Samanta (Pgdm 09-11, Batch II)No ratings yet

- Press Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionDocument7 pagesPress Release Gravita India Limited: Ratings Facilities Amount (Rs. Crore) Ratings Rating ActionhamsNo ratings yet

- Mahindra & Mahindra LimitedDocument6 pagesMahindra & Mahindra Limitedjerin jNo ratings yet

- IMC LimitedDocument5 pagesIMC LimitedMayank AgarwalNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- The Tata Power Company Limited 202214Document11 pagesThe Tata Power Company Limited 202214pratik567No ratings yet

- Jindal Power Limited: Summary of Rated InstrumentsDocument8 pagesJindal Power Limited: Summary of Rated Instrumentslalit rawatNo ratings yet

- Cleanmax IPP 2 Private LimitedDocument5 pagesCleanmax IPP 2 Private LimitedDhawal VasavadaNo ratings yet

- Kalpataru Power Transmission LimitedDocument8 pagesKalpataru Power Transmission LimitedjayNo ratings yet

- DCM Shriram Limited: Instrument Amount in Rs. Crore Rating ActionDocument4 pagesDCM Shriram Limited: Instrument Amount in Rs. Crore Rating ActiondcoolsamNo ratings yet

- Ganga Rasayanie Private Limited-R-10102019Document7 pagesGanga Rasayanie Private Limited-R-10102019DarshanNo ratings yet

- PR Mahamaya Sponge Iron 8jan24Document9 pagesPR Mahamaya Sponge Iron 8jan24Rohit MotapartiNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Rockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRockman Industries Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionVirender RawatNo ratings yet

- R. K. Marble Private Limited-12!30!2020Document6 pagesR. K. Marble Private Limited-12!30!2020Brajpal JhalaNo ratings yet

- A One Steel Alloys 10may2021Document7 pagesA One Steel Alloys 10may2021L KNo ratings yet

- Amman TRY Sponge and Power Private LimitedDocument4 pagesAmman TRY Sponge and Power Private LimitedKathiresan Mathavi's SonNo ratings yet

- KSB AnalysisDocument7 pagesKSB AnalysisCharles LeeNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- Indotech Transformers LimitedDocument7 pagesIndotech Transformers Limitedpiyush.kundraNo ratings yet

- Bhuwalka and Sons Private LimitedDocument4 pagesBhuwalka and Sons Private LimiteddoctorsabeehNo ratings yet

- Peekay Steel Castings Private Limited-01!09!2019Document5 pagesPeekay Steel Castings Private Limited-01!09!2019GAYATHRI S.RNo ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Rockman Industries Jan 2020 ICRADocument9 pagesRockman Industries Jan 2020 ICRAPuneet367No ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Triveni ICRA March 2024Document9 pagesTriveni ICRA March 2024Puneet367No ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Rane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActionDocument7 pagesRane Engine Valve Limited: Summary of Rated Instruments Instrument Rated Amount (Rs. Crore) Rating ActiontomNo ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Bharat Petroleum Corporation LimitedDocument9 pagesBharat Petroleum Corporation LimitedjagadeeshNo ratings yet

- Bikanervala Foods Private Limited: Summary of Rated InstrumentsDocument7 pagesBikanervala Foods Private Limited: Summary of Rated InstrumentsDarshan ShahNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Shaily Engineering Plastics Limited-09-25-2019Document4 pagesShaily Engineering Plastics Limited-09-25-2019Ashutosh Gupta100% (1)

- Bansal Pathways Habibganj Private LimitedDocument5 pagesBansal Pathways Habibganj Private LimitedKapil PadlakNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Facilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeFrom EverandFacilitating Power Trade in the Greater Mekong Subregion: Establishing and Implementing a Regional Grid CodeNo ratings yet

- F D P A P I S: Sri Guru Gobind Singh College of CommerceDocument2 pagesF D P A P I S: Sri Guru Gobind Singh College of Commercesimranarora2007No ratings yet

- Tire City INCDocument3 pagesTire City INCReetik ParekhNo ratings yet

- TOApayables AnswersDocument14 pagesTOApayables AnswersEunice FulgencioNo ratings yet

- Finfitt Private Limited Internship DataDocument2 pagesFinfitt Private Limited Internship DataGangaprasad KarNo ratings yet

- Class Test Ch-8 - Accounting For Share Capital Time: 30 Mins 10 Marks Multiple Choice QuestionsDocument1 pageClass Test Ch-8 - Accounting For Share Capital Time: 30 Mins 10 Marks Multiple Choice QuestionsMayank Duhalni0% (1)

- Hban 2018 AraDocument180 pagesHban 2018 AraMoinul HasanNo ratings yet

- 1.1SME Loan Proposal Assesment - Kamrul IslamDocument41 pages1.1SME Loan Proposal Assesment - Kamrul IslamDutch Bangla Bank Rosul NagorNo ratings yet

- Chapter 9: The Capital Asset Pricing Model: Problem SetsDocument10 pagesChapter 9: The Capital Asset Pricing Model: Problem SetsnouraNo ratings yet

- Value Creation Private EquityDocument6 pagesValue Creation Private EquityRobes BaimaNo ratings yet

- The Evolution of Marketing ManagementDocument15 pagesThe Evolution of Marketing ManagementMilesNo ratings yet

- Ucp-Cf 09,11-03Document78 pagesUcp-Cf 09,11-03sumaira85No ratings yet

- CHAPTER 5. Merchandising OperationsDocument73 pagesCHAPTER 5. Merchandising OperationsapatinoalvaresNo ratings yet

- A.) Horizontal and Vertical Analysis (Omnibus Bio-Medical Systems Inc)Document7 pagesA.) Horizontal and Vertical Analysis (Omnibus Bio-Medical Systems Inc)Levi Lazareno EugenioNo ratings yet

- SAP Results Analysis For BeginnersDocument21 pagesSAP Results Analysis For BeginnersSUNIL palNo ratings yet

- Cost of Acquisition - IBREL - IIPL DemergerDocument2 pagesCost of Acquisition - IBREL - IIPL DemergerSharad RankhambNo ratings yet

- Simpl Is Cahier Des Charges Edi v18Document42 pagesSimpl Is Cahier Des Charges Edi v18Oussama RamboukNo ratings yet

- Ghi BàiDocument25 pagesGhi BàiYến Nguyễn Hà HảiNo ratings yet

- Due Diligence Studies - Alumina and Bauxite: Light MetalsDocument1 pageDue Diligence Studies - Alumina and Bauxite: Light MetalsEmílio LobatoNo ratings yet

- Group 4 San Miguel Corporation Case AnalysisDocument28 pagesGroup 4 San Miguel Corporation Case Analysislowi shooNo ratings yet

- Stock Management ExamDocument4 pagesStock Management ExamModeste NiyitegekaNo ratings yet

- 4 - Understanding Interest RatesDocument21 pages4 - Understanding Interest RatescihtanbioNo ratings yet

- Case Student QuestionsDocument5 pagesCase Student QuestionsSolmaz Hashemi25% (4)

- 5 Red FlagsDocument6 pages5 Red FlagsMaturant NomaPresNo ratings yet

- FAR PRB Finals Dec 2017Document25 pagesFAR PRB Finals Dec 2017Dale Ponce100% (2)

- Zephyr GlossaryDocument22 pagesZephyr GlossaryMikael TovmasianNo ratings yet

- Chapter 8 Performance Measurement Evaluation Nov2020 1Document113 pagesChapter 8 Performance Measurement Evaluation Nov2020 1Question BankNo ratings yet

- Enhanced 04Document28 pagesEnhanced 04Tanvir Ahmed ChowdhuryNo ratings yet

- 09 Elms Quiz - ArgDocument3 pages09 Elms Quiz - ArgKim Andrew Duane C. RosalesNo ratings yet

- TFCO LapKeu2020 - NewDocument107 pagesTFCO LapKeu2020 - Newmuniya altezaNo ratings yet