Professional Documents

Culture Documents

5.2.1 2021-22 Elec Atul

5.2.1 2021-22 Elec Atul

Uploaded by

Dinesh TiwariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

5.2.1 2021-22 Elec Atul

5.2.1 2021-22 Elec Atul

Uploaded by

Dinesh TiwariCopyright:

Available Formats

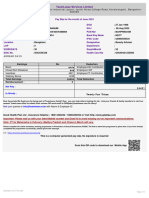

2019-20-25023012

August 27, 2021

Mr.Atul Kumar

R3 A3 H. no. 34A G-Ram Enclave Mohan Garden

New Delhi,Delhi

Pin Code-110059

Offer Letter

Dear Atul,

Congratulations! It is our pleasure to offer you employment with Globiva Services Private

Limited in the position of Associate.

Your Annual CTC will be 150,012 (Rupees One Lakh Fifty Thousand Twelve Only). Your

monthly salary will be paid to you in accordance with our standard payroll procedure.

We would like you to start work on August 27, 2021 Please report to HR department, for

documentation and orientation. If this date is not acceptable, please contact me immediately.

Please sign the enclosed copy of this letter and return it to us by to indicate your August 27,

2021 acceptance of this offer.

We are confident you will be able to make a significant contribution to the success of Globiva

Service Private Limited and look forward to working with you.

Sincerely,

For Globiva Service Private Limited

Authorised Signatory

Globiva Services Private Limited

Registered Office: AIHP Signature, 2nd Floor Plot No 418-419, Udyog Vihar, Phase-IV, Gurugram, Haryana, 122015

• Ph.: 0124-4003847

E-mail : info@globiva.com • www.globiva.com • CIN : U93000HR2017PTC070355

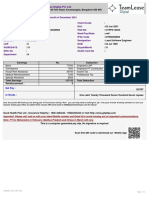

Employee CTC Breakup

Components In INR

Basic Salary 6488

House Rent Allowance 3893

Special Allowance 0

Gross Salary (P.M.) 10381

Employer Provident Fund 844

Employer ESIC 337

Labour Welfare Fund 43

Gratuity 312

Statutory Bonus 584

Total Retirals 2121

Monthly CTC 12501

Annual CTC 150,012

1. All Reimbursement will be paid as per prevailing IT rules and company

policies in effect from time to time.

2. The above compensation will be subject to Income Tax regulations in force

from time to time.

3. The above compensation is subject to deduction towards Medi-claim

Insurance, transport, if/as applicable and any other statutory

deduction/contribution including Professional Tax and LWF.

4. Gratuity to be payable as per the payment of Gratuity Act.

Monthly Take Home Breakup

Components In INR

Basic Salary 6488

House Rent Allowance 3893

Special Allowance 0

Gross Salary (P.M.) 10381

Employee Provident Fund 779

Employee ESIC 78

Employee Labour Welfare Fund 21

Professional Tax 0

Statutory Bonus 584

Monthly Take Home 10088

You might also like

- STATEMENTDocument3 pagesSTATEMENTncrgurukripaNo ratings yet

- Offer Lette - Neeraj NayakDocument3 pagesOffer Lette - Neeraj NayakNeerajNayakNo ratings yet

- PIL Reviewer NachuraDocument71 pagesPIL Reviewer NachuraCarla Domingo88% (8)

- Cand 22270 PDFDocument1 pageCand 22270 PDFraju sallaNo ratings yet

- Pay Advice: Payment SummaryDocument1 pagePay Advice: Payment SummaryankurbbhattNo ratings yet

- CognizantDocument1 pageCognizantVaibhav GhangaleNo ratings yet

- Payslip ModelDocument1 pagePayslip ModelKarthikeyan KarthikeyanNo ratings yet

- Payslip 741557 CIN Oct 2020Document1 pagePayslip 741557 CIN Oct 2020Jatin SethiNo ratings yet

- TSV - Finder's Fee Agreement - SVPDocument11 pagesTSV - Finder's Fee Agreement - SVPKrishna Chandrala100% (1)

- Offer Letter: Globiva Services Private LimitedDocument2 pagesOffer Letter: Globiva Services Private LimitedNiteesh KumarNo ratings yet

- Offerletter Globiva Applicationid 39680 200412611pm 21 4 2023 20 15 20 690 PDFDocument2 pagesOfferletter Globiva Applicationid 39680 200412611pm 21 4 2023 20 15 20 690 PDFavi35997No ratings yet

- Offerletter Globiva Applicationid 30779 090618405am 8 6 2022 9 32 22 327Document2 pagesOfferletter Globiva Applicationid 30779 090618405am 8 6 2022 9 32 22 327Monojit DasNo ratings yet

- Offerletter Globiva ApplicationidDocument2 pagesOfferletter Globiva Applicationidmohd.nasirNo ratings yet

- Apl HR Budget NeDocument136 pagesApl HR Budget NeAnonymous KKCdhUW2CNo ratings yet

- Offer Letter - Pavan Kumar ReddyDocument2 pagesOffer Letter - Pavan Kumar Reddybalajivaddi2697No ratings yet

- Offer Letter - New RutujaDocument2 pagesOffer Letter - New RutujaAvinash JadhavNo ratings yet

- Wartsila Pakistan (PVT.) LTD.: Print Date: February 03, 2023Document1 pageWartsila Pakistan (PVT.) LTD.: Print Date: February 03, 2023umer79rNo ratings yet

- November 2020 - PaySlipDocument1 pageNovember 2020 - PaySlipShikhar GuptaNo ratings yet

- HBDDL 757018 Payslip 03 2020Document1 pageHBDDL 757018 Payslip 03 2020Shikhar GuptaNo ratings yet

- Teamlease Services LimitedDocument1 pageTeamlease Services LimitedMimin khsNo ratings yet

- Cand 22270 PDFDocument1 pageCand 22270 PDFraju sallaNo ratings yet

- Daman Prit SinghDocument3 pagesDaman Prit SinghDaman SinghNo ratings yet

- Durga Padma Sai SatishDocument1 pageDurga Padma Sai SatishBhaskar Siva KumarNo ratings yet

- SEP-2023 PayslipDocument1 pageSEP-2023 PayslipgetlovefromgodNo ratings yet

- Just Dial Joining Salary ChartDocument2 pagesJust Dial Joining Salary ChartPritam SamantaNo ratings yet

- Offer Letter-IntelenetDocument2 pagesOffer Letter-Intelenetkkarthi557No ratings yet

- DocDocument2 pagesDockishan singhNo ratings yet

- Offer Letter SignedDocument4 pagesOffer Letter Signedskrafi340340No ratings yet

- PaySlip Payslip 2024 FEBDocument1 pagePaySlip Payslip 2024 FEBRaj DhulgundeNo ratings yet

- Biplab - PDF Offer LetterDocument3 pagesBiplab - PDF Offer Letterbiplabsuroj48No ratings yet

- Jan 22Document1 pageJan 22kattamurivdkNo ratings yet

- Payslip-APR-2023 PayslipDocument1 pagePayslip-APR-2023 Payslipdammyac10No ratings yet

- Revised Offer Letter - ResolveTechDocument2 pagesRevised Offer Letter - ResolveTechsayali kadNo ratings yet

- 910365compensation Review - FY 18-19 PDFDocument2 pages910365compensation Review - FY 18-19 PDFAbhiman KokateNo ratings yet

- KV Salary SlipDocument1 pageKV Salary Slipsinubishnoi16No ratings yet

- USTS-HR-SR-095 - USTS107-Ashok KumarDocument2 pagesUSTS-HR-SR-095 - USTS107-Ashok KumarriseinspireanimateNo ratings yet

- Offer Letter-Anushka MehraDocument2 pagesOffer Letter-Anushka Mehraanushkamehra121No ratings yet

- Settlement Letter - 100000000468058Document3 pagesSettlement Letter - 100000000468058gajala jamirNo ratings yet

- Problems in Calculus by Ia MaronDocument1 pageProblems in Calculus by Ia MaronOnkar YadavNo ratings yet

- PaySlip Payslip 2464456Document1 pagePaySlip Payslip 2464456mohammedsabit95No ratings yet

- FNF Statement Experience Letter - Pulkit GargDocument6 pagesFNF Statement Experience Letter - Pulkit GargPulkit gargNo ratings yet

- Strictly Private and Confidential Date: 25-Oct-2022 Employee Name: Mounika Nethikunta Employee Code: 35265Document1 pageStrictly Private and Confidential Date: 25-Oct-2022 Employee Name: Mounika Nethikunta Employee Code: 35265Nethikunta MounicaNo ratings yet

- Nishanth Appointment - LetterDocument10 pagesNishanth Appointment - LetterNishanth GowdaNo ratings yet

- 05-09-2024 Saptarshi Paul KolkataDocument2 pages05-09-2024 Saptarshi Paul KolkataSaptarshi PaulNo ratings yet

- Hrishitaa ChopraDocument2 pagesHrishitaa ChopraOuchityaNo ratings yet

- PaySlip Payslip 2023 AUGUSTDocument1 pagePaySlip Payslip 2023 AUGUSTJatinNo ratings yet

- Teamlease Services Limited: Earnings Rs. Deduction RsDocument1 pageTeamlease Services Limited: Earnings Rs. Deduction RschandNo ratings yet

- Teamlease Services Limited: Earnings Rs. Deduction RsDocument1 pageTeamlease Services Limited: Earnings Rs. Deduction RschandNo ratings yet

- Assignment Start Date: Assignment End Date:: Applicability of Notice PeriodDocument2 pagesAssignment Start Date: Assignment End Date:: Applicability of Notice PeriodJohnny JohnnyNo ratings yet

- 6a259f20-e0b3-454d-84d7-b7f3e876c605 (1) (1) (1)Document3 pages6a259f20-e0b3-454d-84d7-b7f3e876c605 (1) (1) (1)UDAYBHAN YADAVNo ratings yet

- Teamlease Services Limited: Earnings Rs. Deduction RsDocument1 pageTeamlease Services Limited: Earnings Rs. Deduction RschandNo ratings yet

- Sanjay Yadav - 1offer LetterDocument2 pagesSanjay Yadav - 1offer LetterSanjay yadavNo ratings yet

- Offer Letter-66e646Document2 pagesOffer Letter-66e646Solanki SahilNo ratings yet

- Oct PayslipDocument2 pagesOct PayslipPriyadharshini RavichandranNo ratings yet

- DocDocument2 pagesDocSourav ChandaNo ratings yet

- Teamlease Services Limited: Pay Slip For The Month of July 2019Document2 pagesTeamlease Services Limited: Pay Slip For The Month of July 2019Avinash Avi RajputNo ratings yet

- Offer Letter Udit TiwariDocument1 pageOffer Letter Udit Tiwarihranjalisharma95No ratings yet

- December 2021 - PaySlipDocument1 pageDecember 2021 - PaySlipMahendra kumarNo ratings yet

- Oct2023 PayslipDocument1 pageOct2023 PayslipTKSVELNo ratings yet

- India Payslip January 2023Document1 pageIndia Payslip January 2023rraji078583No ratings yet

- Twenty-Three Thousand, Seven Hundred: TeamleaseserviceslimitedDocument2 pagesTwenty-Three Thousand, Seven Hundred: TeamleaseserviceslimitedSudhanshu SharmaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Julian Turk ComplaintDocument4 pagesJulian Turk ComplaintABC News PoliticsNo ratings yet

- England and France DevelopDocument16 pagesEngland and France Developapi-662060477No ratings yet

- Javellana vs. LuteroDocument4 pagesJavellana vs. LuteroCMLNo ratings yet

- CHAPTER 15 - Transfer Business TaxDocument9 pagesCHAPTER 15 - Transfer Business TaxKatKat Olarte67% (3)

- Candidate Declaration Form (CDF) For Manappuram Finance Ltd.Document5 pagesCandidate Declaration Form (CDF) For Manappuram Finance Ltd.naagu krish100% (2)

- Proctor v. Saginaw County Board of Comm'rs, No. 349557 (Mich. Ct. App. Jan 6, 2022)Document24 pagesProctor v. Saginaw County Board of Comm'rs, No. 349557 (Mich. Ct. App. Jan 6, 2022)RHTNo ratings yet

- Juta Law Price Index Jan-June 2016 Web 2Document60 pagesJuta Law Price Index Jan-June 2016 Web 2jonas msigala0% (1)

- Kittrich v. Ralph Friedland & Bros.Document5 pagesKittrich v. Ralph Friedland & Bros.PriorSmartNo ratings yet

- Certificate For ML LeagueDocument5 pagesCertificate For ML LeagueMicky Morante100% (2)

- Lecture Notes - Human Rights Lecture Notes - Human RightsDocument62 pagesLecture Notes - Human Rights Lecture Notes - Human RightsSvb CharyNo ratings yet

- Ra 8293 Intellectual Property LawDocument4 pagesRa 8293 Intellectual Property LawAeri UchinagaNo ratings yet

- NUS Students' Union Constitution (Rev Ed 2019 Jul)Document18 pagesNUS Students' Union Constitution (Rev Ed 2019 Jul)TRAN PHUOC MYNo ratings yet

- Criminal Procedure Rule 119Document11 pagesCriminal Procedure Rule 119vn wnstnNo ratings yet

- NSTPDocument34 pagesNSTPFaith Micah Delmendo Abenes50% (10)

- The Bank of The Philippine Islands V Posadas, Jr. Case DigestDocument2 pagesThe Bank of The Philippine Islands V Posadas, Jr. Case Digestmark anthony mansueto100% (1)

- Agan JR V Philippine International Air Terminals PDFDocument21 pagesAgan JR V Philippine International Air Terminals PDFBianca BncNo ratings yet

- Macasiano vs. DioknoDocument6 pagesMacasiano vs. DioknoSherwin Anoba CabutijaNo ratings yet

- Special Power of Attorney FormatDocument2 pagesSpecial Power of Attorney FormatHari KrishnaNo ratings yet

- Waiver, Release and QuitclaimDocument1 pageWaiver, Release and QuitclaimJoyce MadridNo ratings yet

- LRLDocument6 pagesLRLVedant ChoudharyNo ratings yet

- Table of Penalties For Crimes Committed Under The Revised Penal CodeDocument6 pagesTable of Penalties For Crimes Committed Under The Revised Penal CodeElaine Grace R. AntenorNo ratings yet

- ExportDecDoc E6RB000010EDocument2 pagesExportDecDoc E6RB000010ENaj MusorNo ratings yet

- PAF Flight Plan 2028 Hand OutsDocument18 pagesPAF Flight Plan 2028 Hand OutsArtRuszellHensonCastro100% (1)

- Public Law 2021-2022Document36 pagesPublic Law 2021-2022ARDA ALINo ratings yet

- Sobukwe ExhibitionDocument2 pagesSobukwe ExhibitionThandolwetu SipuyeNo ratings yet

- Notification No. G.S.R. 332E Income Tax Dated 03.04.2018Document179 pagesNotification No. G.S.R. 332E Income Tax Dated 03.04.2018kshitijsaxenaNo ratings yet

- Cps Ada Legal NoticeDocument5 pagesCps Ada Legal Noticelankfordterry66No ratings yet

- DTC Agreement Between Ukraine and BelgiumDocument34 pagesDTC Agreement Between Ukraine and BelgiumOECD: Organisation for Economic Co-operation and Development100% (1)