Professional Documents

Culture Documents

Correlation Coefficient

Correlation Coefficient

Uploaded by

Dawn Quimat0 ratings0% found this document useful (0 votes)

3 views2 pagesThe document presents correlation analysis results between liquidity and profitability metrics for selected food and beverage companies. It found low correlations between quick ratio and return on asset/equity, and current ratio and return on asset/equity, but the correlations were not statistically significant according to the p-values. While some relationships between the variables were observed, the analysis showed the relationships did not meet the threshold for statistical significance.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document presents correlation analysis results between liquidity and profitability metrics for selected food and beverage companies. It found low correlations between quick ratio and return on asset/equity, and current ratio and return on asset/equity, but the correlations were not statistically significant according to the p-values. While some relationships between the variables were observed, the analysis showed the relationships did not meet the threshold for statistical significance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesCorrelation Coefficient

Correlation Coefficient

Uploaded by

Dawn QuimatThe document presents correlation analysis results between liquidity and profitability metrics for selected food and beverage companies. It found low correlations between quick ratio and return on asset/equity, and current ratio and return on asset/equity, but the correlations were not statistically significant according to the p-values. While some relationships between the variables were observed, the analysis showed the relationships did not meet the threshold for statistical significance.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

Correlation

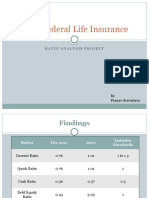

Variables Interpretation p-value Remarks

Coefficient

Quick

0.154 Low correlation 0.671 Not Significant

Return on Ratio

Asset Current

0.362 Low Correlation 0.305 Not Significant

Ratio

Quick

0.255 Low correlation 0.477 Not Significant

Return on Ratio

Equity Current Negligible

0.083 0.820 Not Significant

Ratio Correlation

The result above presents the relationship between liquidity and profitability performance

of selected food and beverages companies listed in the Philippine Stock Exchange.

As revealed in the table, there is no significant relationship between the return on asset

and quick ratio (r =0.154 , p=0.671) as well as current ratio (r =0.362 , p=0.305). Moreover,

there is also no significant relationship between return on equity and quick ratio

(r =0.255 , p=0.477) as well as current ratio (r =0.083 , p=0.820). Although the results have

showed a low correlation between the variables, the p-values suggests that this correlation

coefficients are not significant at 5% level of significance.

SPSS RESULTS

You might also like

- Ratio Analysis of RILDocument10 pagesRatio Analysis of RILadityabaid4No ratings yet

- Statistical Analysis With Software Application Assessment No. 6Document1 pageStatistical Analysis With Software Application Assessment No. 6Maria Kathreena Andrea AdevaNo ratings yet

- VariablesDocument1 pageVariablesKimberly PadiosNo ratings yet

- Name: Yesha Gandhi & Meghana Vansiya Class: MBA (Sem 1) Subject: Accounting For Managers Roll No.Document16 pagesName: Yesha Gandhi & Meghana Vansiya Class: MBA (Sem 1) Subject: Accounting For Managers Roll No.Tapan ShahNo ratings yet

- Results Objective 4Document5 pagesResults Objective 4Kevin MagnoNo ratings yet

- Data AnalysisDocument1 pageData AnalysisFrancis GilbertNo ratings yet

- Correlation Analysis:: Range of Correlation Nature of RelationshipDocument5 pagesCorrelation Analysis:: Range of Correlation Nature of RelationshipLinakar Roy OfficialNo ratings yet

- Maruti Suzuki FM PPT 1Document10 pagesMaruti Suzuki FM PPT 1RohanSharmaNo ratings yet

- Kirukku 4 and 5Document36 pagesKirukku 4 and 5Smart Earn 2020 ONLINENo ratings yet

- AGW 615/3 Advanced Business Statistics: Statistical Analysis ReportDocument10 pagesAGW 615/3 Advanced Business Statistics: Statistical Analysis ReportNida AmriNo ratings yet

- MBA Part A Marking SchemeDocument1 pageMBA Part A Marking SchemeTafsir-i- AliNo ratings yet

- Results Objective 5Document2 pagesResults Objective 5Kevin MagnoNo ratings yet

- Advance Financial Accounting Assignment AliDocument36 pagesAdvance Financial Accounting Assignment AliFarjad AliNo ratings yet

- Big Data AssignmentDocument14 pagesBig Data AssignmentAlen AugustineNo ratings yet

- IDBI Federal Life InsuranceDocument3 pagesIDBI Federal Life InsurancePranav Srivastava0% (1)

- Analisis MratDocument4 pagesAnalisis MratDewi FortunaNo ratings yet

- Ikhsan Uiandra Putra SItorusDocument8 pagesIkhsan Uiandra Putra SItorusIkhsan Uiandra Putra SitorusNo ratings yet

- SSRN 3416918 - Usefulness of Correlation Analysis - 2019 07 09 PDFDocument10 pagesSSRN 3416918 - Usefulness of Correlation Analysis - 2019 07 09 PDFMayank AgarwalNo ratings yet

- Chapter-Iv Analysis of DataDocument9 pagesChapter-Iv Analysis of DataVenket RamanaNo ratings yet

- PDFDocument2 pagesPDFOllid Kline Jayson JNo ratings yet

- 3.4 Research Quality 3.4.1 Reliability TestDocument8 pages3.4 Research Quality 3.4.1 Reliability Testdev hayaNo ratings yet

- Ratio Analysis: A Tool For Analysis and Interpretation of Financial StatementsDocument54 pagesRatio Analysis: A Tool For Analysis and Interpretation of Financial StatementsAjijur RahmanNo ratings yet

- Olat RegressionDocument8 pagesOlat RegressionEloisa EspadillaNo ratings yet

- Eveready Industries India LTDDocument23 pagesEveready Industries India LTDSiddharth ChaudharyNo ratings yet

- Assessment 1Document14 pagesAssessment 1harjaspreetsingh689No ratings yet

- UNIT 2 - Ratio AnalysisDocument16 pagesUNIT 2 - Ratio AnalysisVishika jainNo ratings yet

- Presentation (Data Analysis)Document41 pagesPresentation (Data Analysis)Akinjole ElizabethNo ratings yet

- LevbetaDocument2 pagesLevbetaapi-3763138No ratings yet

- Wipro Ratio AnalysisDocument32 pagesWipro Ratio Analysisvaibhavs_1009No ratings yet

- Ratio Analysis of ACI Ltd.Document29 pagesRatio Analysis of ACI Ltd.Yeasir MalikNo ratings yet

- Descriptive FindingsDocument8 pagesDescriptive FindingsValdi NadhifNo ratings yet

- Assignment Report - Group ADocument31 pagesAssignment Report - Group Akeerthi reddyNo ratings yet

- Chapter 4: Data AnalysisDocument11 pagesChapter 4: Data AnalysissaadNo ratings yet

- Reliability Test: Brand LoyaltyDocument11 pagesReliability Test: Brand LoyaltyHalimah SheikhNo ratings yet

- Finance For ManagersDocument17 pagesFinance For ManagersIkramNo ratings yet

- "Green Procurement: A Tool For Improving Organization Performance in Beverage Industry of Pakistan" Final Year ProjectDocument22 pages"Green Procurement: A Tool For Improving Organization Performance in Beverage Industry of Pakistan" Final Year ProjectHaseeb AhmedNo ratings yet

- I. Liquidity Ratio: SolutionsDocument1 pageI. Liquidity Ratio: SolutionsChristian AribasNo ratings yet

- Correlation & Simple Linear RegressionDocument21 pagesCorrelation & Simple Linear RegressionMeaadNo ratings yet

- Portofolio ManagementDocument1 pagePortofolio ManagementfauziyahNo ratings yet

- FIN5000 Group 10 AssignmentDocument4 pagesFIN5000 Group 10 AssignmentWU YONG / UPMNo ratings yet

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocument5 pagesLiquidity Debt Management Asset Management Profitability Return To InvestorsJayNo ratings yet

- Project Report: A Study On Financial Planning and Forecasting in Honda Motorcompany LimitedDocument11 pagesProject Report: A Study On Financial Planning and Forecasting in Honda Motorcompany LimitedArpita GuptaNo ratings yet

- Note On Financial Ratio FormulaDocument5 pagesNote On Financial Ratio FormulachthakorNo ratings yet

- Note on Financial Ratio FormulaDocument5 pagesNote on Financial Ratio FormulaBISHAL ROYNo ratings yet

- 6.2. MethodologyDocument12 pages6.2. MethodologyAtiaTahiraNo ratings yet

- BetaDocument3 pagesBetavishalNo ratings yet

- Summer Project MBA StudentsDocument18 pagesSummer Project MBA StudentskanksNo ratings yet

- Ratio AnalysisDocument56 pagesRatio Analysisvishi takhar80% (10)

- Regression: SPSS Report 4Document17 pagesRegression: SPSS Report 4sileshiNo ratings yet

- Apple & BXIMCO Pharmaceutical Limited.: Group: AurthohinDocument43 pagesApple & BXIMCO Pharmaceutical Limited.: Group: AurthohinTanbir. Nahid.No ratings yet

- Presentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDDocument12 pagesPresentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDEra ChaudharyNo ratings yet

- Ratio AnalysisDocument33 pagesRatio AnalysisSamNo ratings yet

- Correlation Between The VariablesDocument1 pageCorrelation Between The VariablesSiva gNo ratings yet

- Thesis On Marketing Low Cost BusinessesDocument15 pagesThesis On Marketing Low Cost BusinessesibeNo ratings yet

- Dmart AccountsDocument18 pagesDmart AccountsDrishti KataraNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- Determining The Factors Affecting The Acceptance of Filipinos On The Use of Renewable Energies: A ModelDocument17 pagesDetermining The Factors Affecting The Acceptance of Filipinos On The Use of Renewable Energies: A ModelRFSNo ratings yet