Professional Documents

Culture Documents

Gen Certificate Mutation

Gen Certificate Mutation

Uploaded by

rathinexusCopyright:

Available Formats

You might also like

- Fear and Loathing in La Liga Barcelona, Real Madrid, and The Worlds Greatest Sports Rivalry (Etc.) (Z-Library)Document481 pagesFear and Loathing in La Liga Barcelona, Real Madrid, and The Worlds Greatest Sports Rivalry (Etc.) (Z-Library)rathinexusNo ratings yet

- Payslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008Document10 pagesPayslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008vntkhatri50% (6)

- LHDN BindDocument4 pagesLHDN BindJohnyReuben0% (2)

- Allotment LetterDocument7 pagesAllotment LetterDharma Tej ReddyNo ratings yet

- Municipal Corporation of DelhiDocument2 pagesMunicipal Corporation of DelhisunilchhindraNo ratings yet

- Doc-20231022-Wa0005 231022 090138Document9 pagesDoc-20231022-Wa0005 231022 090138kumarhealthcare2000No ratings yet

- LGD Jesus Realty & Dev'T. Corp.: Hauling ContractDocument7 pagesLGD Jesus Realty & Dev'T. Corp.: Hauling ContractGonzales CarlNo ratings yet

- Pennar StayDocument2 pagesPennar StayIshita FarsaiyaNo ratings yet

- M - S Singh Group Versus State of U.P. and 2 Others - 2022 (8) TMI 97 - ALLAHABAD HIGH COURTDocument3 pagesM - S Singh Group Versus State of U.P. and 2 Others - 2022 (8) TMI 97 - ALLAHABAD HIGH COURTSrichNo ratings yet

- Messrs Shree Renuka Sugars Ltd. Versus State of GujaratDocument12 pagesMessrs Shree Renuka Sugars Ltd. Versus State of Gujaratrizwanipooja89No ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Allotment LetterDocument7 pagesAllotment LetterJaisimha Reddy ANo ratings yet

- 8 Indemnity Bond in Place of Rectification Deed ANNEX08Document1 page8 Indemnity Bond in Place of Rectification Deed ANNEX08bijenders561No ratings yet

- Legal Department Delhi Vindeswar PaswanDocument1 pageLegal Department Delhi Vindeswar Paswanshivamraj780840No ratings yet

- Alec Rosefsky, Edith Rosefsky, Joseph A. D'Esti and Helen T. D'Esti v. Commissioner of Internal Revenue, 599 F.2d 515, 2d Cir. (1979)Document5 pagesAlec Rosefsky, Edith Rosefsky, Joseph A. D'Esti and Helen T. D'Esti v. Commissioner of Internal Revenue, 599 F.2d 515, 2d Cir. (1979)Scribd Government DocsNo ratings yet

- Capitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationDocument4 pagesCapitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationoldhillbillyNo ratings yet

- Legal Department Delhi Shashi Bhushan KumarDocument1 pageLegal Department Delhi Shashi Bhushan Kumarshivamraj780840100% (1)

- Guest House Agreement v2Document14 pagesGuest House Agreement v2rohitnsaNo ratings yet

- Legal Department Delhi Indradev RayDocument1 pageLegal Department Delhi Indradev Rayshivamraj780840No ratings yet

- Allotment Letters (SAVIOUR Green Isle)Document12 pagesAllotment Letters (SAVIOUR Green Isle)Sonakshi ChauhanNo ratings yet

- PC 921 1Document6 pagesPC 921 1abdullah rahmanNo ratings yet

- Taxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTDocument6 pagesTaxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTmohd.samadNo ratings yet

- Mutation ProcedureDocument7 pagesMutation ProcedureRishi SehdevNo ratings yet

- Allotment LetterDocument7 pagesAllotment LetterPeyush MehtoNo ratings yet

- Business Partnership Agreement: Lamane Infrastructure P - LDocument17 pagesBusiness Partnership Agreement: Lamane Infrastructure P - LNavneet JainNo ratings yet

- CombinedDocument242 pagesCombinedLord AumarNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- PB PTA PATIA 51747 Sanctioned SIGDocument2 pagesPB PTA PATIA 51747 Sanctioned SIGPrabhkirat Singh ChhabraNo ratings yet

- 9 Paz Vs RepublicDocument3 pages9 Paz Vs RepublicElla B.No ratings yet

- J&G Advocates: Solicitors and Legal ConsultantsDocument4 pagesJ&G Advocates: Solicitors and Legal ConsultantsBharat BhushanNo ratings yet

- PC 1033Document7 pagesPC 1033Asadujjaman TuhinNo ratings yet

- Taxation Case DigestDocument4 pagesTaxation Case DigestArden KimNo ratings yet

- KK Enterprises and Ors Vs Municipal Corporation ofD060059COM807225Document13 pagesKK Enterprises and Ors Vs Municipal Corporation ofD060059COM807225vijay.kandpalNo ratings yet

- CD - 81. Allied Banking v. Quezon CityDocument2 pagesCD - 81. Allied Banking v. Quezon CityCzarina CidNo ratings yet

- 5 Indemnity Bond in Lieu of Proof of OwnershipDocument3 pages5 Indemnity Bond in Lieu of Proof of OwnershipDamodar AggarwalNo ratings yet

- 5 Indemnity Bond in Lieu of Proof of OwnershipDocument3 pages5 Indemnity Bond in Lieu of Proof of OwnershipShahbaz MalbariNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDocument3 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNo ratings yet

- P23140-A Short Form AgreementDocument2 pagesP23140-A Short Form Agreementc ysNo ratings yet

- New - Rent Agreement Vardayini Agrememnt - 01!06!22Document4 pagesNew - Rent Agreement Vardayini Agrememnt - 01!06!22Steamhouse InternNo ratings yet

- Ref. Docket No. 7Document3 pagesRef. Docket No. 7Chapter 11 DocketsNo ratings yet

- Rent Agreement 2020Document6 pagesRent Agreement 2020Himalayan MandererNo ratings yet

- Gala Villa 2013Document5 pagesGala Villa 2013sohail2006No ratings yet

- JJDocument7 pagesJJLakhan WankhadeNo ratings yet

- ATS Sample 2024 Arcadia P 3.4 FF Plot No 05Document3 pagesATS Sample 2024 Arcadia P 3.4 FF Plot No 054cslandbaseNo ratings yet

- Agreement Crowdapps Technologies Private LimitedDocument5 pagesAgreement Crowdapps Technologies Private LimitedAnkit JainNo ratings yet

- Fitness by Design Vs CIRDocument4 pagesFitness by Design Vs CIRGavin Reyes CustodioNo ratings yet

- Compensation Agreement: BIL/L&R/CA/V1.1Document9 pagesCompensation Agreement: BIL/L&R/CA/V1.1Chandresh JainNo ratings yet

- 12-12553-jmp Doc 12Document3 pages12-12553-jmp Doc 12oldhillbillyNo ratings yet

- Talento V Escalada, Digital V CantosDocument6 pagesTalento V Escalada, Digital V CantosCAMILLENo ratings yet

- Nunc Pro Tunc To The Petition DateDocument11 pagesNunc Pro Tunc To The Petition DateChapter 11 DocketsNo ratings yet

- FL Leo: Clerk, Distr' Courts Tor The Bankruptcy RTCT of ColumbiaDocument12 pagesFL Leo: Clerk, Distr' Courts Tor The Bankruptcy RTCT of ColumbiavinayNo ratings yet

- A Government of Andhra Pradesh UndertakingDocument7 pagesA Government of Andhra Pradesh UndertakingHelloLand markNo ratings yet

- GSIS - GSIS v. City Treasurer of Manila, December 23, 2009Document7 pagesGSIS - GSIS v. City Treasurer of Manila, December 23, 2009Jyzzer ZjNo ratings yet

- Assam Instruction No. 13 2023 GSTDocument2 pagesAssam Instruction No. 13 2023 GSTCA Kaushik Ranjan GoswamiNo ratings yet

- Rent Agreement Format PDFDocument6 pagesRent Agreement Format PDFSiddharthSharmaNo ratings yet

- Ref. DocketDocument5 pagesRef. DocketChapter 11 DocketsNo ratings yet

- Lease Agreemnet Galleria Basement 4001Document9 pagesLease Agreemnet Galleria Basement 4001vikasNo ratings yet

- No Interest For ITC Availed But Not UtilisedDocument5 pagesNo Interest For ITC Availed But Not Utilisedsvasan32453No ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamFrom EverandBureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- SPKR Mailer 1Document1 pageSPKR Mailer 1rathinexusNo ratings yet

- CBSE/CTET/AUG/2023 Date: 15/09/2023Document2 pagesCBSE/CTET/AUG/2023 Date: 15/09/2023rathinexusNo ratings yet

- 7198 - Emci - 20171220 22 - Legal Environmental Concerns of Cement PlantsDocument38 pages7198 - Emci - 20171220 22 - Legal Environmental Concerns of Cement PlantsrathinexusNo ratings yet

- Thailand Tourist Covering LetterDocument1 pageThailand Tourist Covering Letterrathinexus50% (2)

- 1000 Shorts Tiktok IdeasDocument18 pages1000 Shorts Tiktok Ideasrathinexus100% (2)

- generateDupBill PDFDocument1 pagegenerateDupBill PDFrathinexusNo ratings yet

- Form VDocument1 pageForm VrathinexusNo ratings yet

- Soa 0030300152406Document1 pageSoa 0030300152406Maria Theresa LimosNo ratings yet

- Disbursement Voucher - Check #101-200Document91 pagesDisbursement Voucher - Check #101-200Jessa Mariz Lecias CalimotNo ratings yet

- Sold To:: FC WB 03269940 X2015400 00000014875 0Document2 pagesSold To:: FC WB 03269940 X2015400 00000014875 0RuodNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument5 pagesMobile Services: Your Account Summary This Month'S Chargesgirver meenaNo ratings yet

- Receipt 32Document1 pageReceipt 32Angga DwiNo ratings yet

- Wickliffe Schools Levy HistoryDocument4 pagesWickliffe Schools Levy HistoryThe News-HeraldNo ratings yet

- Prospersure International Pte LTD Swift Copies From Bank of America 04030211Document6 pagesProspersure International Pte LTD Swift Copies From Bank of America 04030211michaelgracias700No ratings yet

- Receipt Purchase PDFDocument2 pagesReceipt Purchase PDFAbishek DharNo ratings yet

- InvoiceDocument1 pageInvoiceSri WatsonNo ratings yet

- Date: Invoice No.: Order ID: Order Status: Payment Method:: Payment Address Shipping AddressDocument1 pageDate: Invoice No.: Order ID: Order Status: Payment Method:: Payment Address Shipping Addresssrikanth2vangaraNo ratings yet

- Mortgage and RRSPDocument2 pagesMortgage and RRSPmetaldwarfNo ratings yet

- Account StatementDocument2 pagesAccount StatementReziir rmcNo ratings yet

- Estimate 1427 - AIRPRO 500LDocument1 pageEstimate 1427 - AIRPRO 500LAgung NgurahNo ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- Taxation On TradersDocument5 pagesTaxation On TradersbalakrishnaNo ratings yet

- 25 Mar - Paris HotelDocument2 pages25 Mar - Paris Hoteljohn surgenNo ratings yet

- E-Ticket Upsrtc Online ReservationDocument1 pageE-Ticket Upsrtc Online ReservationYuvraj SinghNo ratings yet

- LT E-BillDocument3 pagesLT E-Billsandeep khairnarNo ratings yet

- WPR4 Format ADRIKA SINGHDocument2 pagesWPR4 Format ADRIKA SINGHAdrika SinghNo ratings yet

- Signing Date: 19/10/2023 03:18:09 SGT Signed By: Ds CWT India PVT LTD 2Document3 pagesSigning Date: 19/10/2023 03:18:09 SGT Signed By: Ds CWT India PVT LTD 2Himanshu MishraNo ratings yet

- Your BillDocument4 pagesYour Billmanishadash009No ratings yet

- Electricity Bill: Due Date: 11-07-2011Document1 pageElectricity Bill: Due Date: 11-07-2011Anjani GroverNo ratings yet

- Difference Between Tax Avoidance and Tax EvasionDocument3 pagesDifference Between Tax Avoidance and Tax EvasionHay Jirenyaa100% (1)

- Sanjay Sir ShahjahanpurDocument3 pagesSanjay Sir Shahjahanpursinghutkarsh3344No ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMahasri 4thNo ratings yet

- Study of Mobiles WalletsDocument42 pagesStudy of Mobiles WalletsVijay TendolkarNo ratings yet

- 27 09 Taurum SarlDocument2 pages27 09 Taurum Sarls.v.dovzhokNo ratings yet

- Set Off FinalDocument2 pagesSet Off FinalEngr. Md. Ishtiak HossainNo ratings yet

Gen Certificate Mutation

Gen Certificate Mutation

Uploaded by

rathinexusOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gen Certificate Mutation

Gen Certificate Mutation

Uploaded by

rathinexusCopyright:

Available Formats

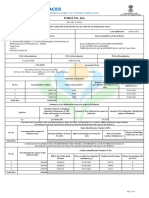

Reg No. 5561 Date. 28.09.

2022

Sh/Smt.

ARUN SURI, NIDHI DHAR

House No. FLAT NO 9553 GF SEC-C PKT-9,Vasant Kunj

Vasant Kunj

New Delhi I

Vasant Kunj (Mahilpalpur) C-5 to C-9/Mahipalpur/Najafgarh Zone/South MCD

Subject : Change of Name of Tax payer(s) in property tax assessment record in the event of transfer or devolution with the

purpose to deposit property Tax/Bldg./Vacant Land Tax in respect of Property No.House No. FLAT NO 9553 GF SEC-C PKT-

9,Vasant Kunj

Dear Sir/Madam,

This change of name is granted in pursuance to the provision of Sectioin 128 of the Delhi Municipal Corporation Act 1957 , as

amended from time to time and is valid only for the person and property specified herein subject to he following condition:-

1. Change of name of person(s) referred to above is being changed only for the limited purpose of payment of property tax

U/s 128 of the DMC Act and in no circumstance, it will confer/devolve any legal title of ownership whatsoever.

2. If any tax liability further arises on this property/premises on account of creation of any additional demand, disposal of

pending proposal(s) u/s 123D/461 of DMC (Amendment) Act, 2003, or due to any calculation mistake(s) etc., the tax liability

shall be payable by you.

3. This order shall not be treated as valid if the property has been constructed on a land belonging to any

Govt.Agency/DDA/MCD of which you are not the lessee/licensee, according to law and if any dispute arises in future.

4. This order has been issued based on the documents filed by the taxpayer. Further, at a later date, in case of any other claimant to the

property or any dispute regarding ownership of the same or if it is found that the documents submitted are suppressed/or not genuine or

any information is concealed there from and this has been executed by suppression of any fact and/or by misrepresentation and /or fraud

etc, if any fact is found otherwise or any of the other claimant comes up with any dispute, this order shall be treated as invalid and the

same will be cancelled without any prior notice. Moreover, the applicant shall also be liable to indemnify the Corporation for the losses,

cost and expenses etc., if suffered by the South Delhi Municipal Corporation in this regard

5. This order cannot be used for any other purpose except for payment of P roperty Tax in the Corporation. In case of its use for any other

purpose, South DMC shall not be responsible and user shall be fully responsible and indemnify South DMC against all costs, damages,

loses, claims etc which Corporation may have to suffer, undergo as a consequence of the use of this order.

Dy. Assessor & Collec tor

Oct 10 , 20 22, 6:11 P M

You might also like

- Fear and Loathing in La Liga Barcelona, Real Madrid, and The Worlds Greatest Sports Rivalry (Etc.) (Z-Library)Document481 pagesFear and Loathing in La Liga Barcelona, Real Madrid, and The Worlds Greatest Sports Rivalry (Etc.) (Z-Library)rathinexusNo ratings yet

- Payslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008Document10 pagesPayslip: Satender Sharma:: Tool Room:: Incharge::: Payslip For May - 2008vntkhatri50% (6)

- LHDN BindDocument4 pagesLHDN BindJohnyReuben0% (2)

- Allotment LetterDocument7 pagesAllotment LetterDharma Tej ReddyNo ratings yet

- Municipal Corporation of DelhiDocument2 pagesMunicipal Corporation of DelhisunilchhindraNo ratings yet

- Doc-20231022-Wa0005 231022 090138Document9 pagesDoc-20231022-Wa0005 231022 090138kumarhealthcare2000No ratings yet

- LGD Jesus Realty & Dev'T. Corp.: Hauling ContractDocument7 pagesLGD Jesus Realty & Dev'T. Corp.: Hauling ContractGonzales CarlNo ratings yet

- Pennar StayDocument2 pagesPennar StayIshita FarsaiyaNo ratings yet

- M - S Singh Group Versus State of U.P. and 2 Others - 2022 (8) TMI 97 - ALLAHABAD HIGH COURTDocument3 pagesM - S Singh Group Versus State of U.P. and 2 Others - 2022 (8) TMI 97 - ALLAHABAD HIGH COURTSrichNo ratings yet

- Messrs Shree Renuka Sugars Ltd. Versus State of GujaratDocument12 pagesMessrs Shree Renuka Sugars Ltd. Versus State of Gujaratrizwanipooja89No ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument4 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Allotment LetterDocument7 pagesAllotment LetterJaisimha Reddy ANo ratings yet

- 8 Indemnity Bond in Place of Rectification Deed ANNEX08Document1 page8 Indemnity Bond in Place of Rectification Deed ANNEX08bijenders561No ratings yet

- Legal Department Delhi Vindeswar PaswanDocument1 pageLegal Department Delhi Vindeswar Paswanshivamraj780840No ratings yet

- Alec Rosefsky, Edith Rosefsky, Joseph A. D'Esti and Helen T. D'Esti v. Commissioner of Internal Revenue, 599 F.2d 515, 2d Cir. (1979)Document5 pagesAlec Rosefsky, Edith Rosefsky, Joseph A. D'Esti and Helen T. D'Esti v. Commissioner of Internal Revenue, 599 F.2d 515, 2d Cir. (1979)Scribd Government DocsNo ratings yet

- Capitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationDocument4 pagesCapitalized Terms Not Otherwise Defined Herein Shall Have The Meanings Ascribed To Such Terms in The ApplicationoldhillbillyNo ratings yet

- Legal Department Delhi Shashi Bhushan KumarDocument1 pageLegal Department Delhi Shashi Bhushan Kumarshivamraj780840100% (1)

- Guest House Agreement v2Document14 pagesGuest House Agreement v2rohitnsaNo ratings yet

- Legal Department Delhi Indradev RayDocument1 pageLegal Department Delhi Indradev Rayshivamraj780840No ratings yet

- Allotment Letters (SAVIOUR Green Isle)Document12 pagesAllotment Letters (SAVIOUR Green Isle)Sonakshi ChauhanNo ratings yet

- PC 921 1Document6 pagesPC 921 1abdullah rahmanNo ratings yet

- Taxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTDocument6 pagesTaxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTmohd.samadNo ratings yet

- Mutation ProcedureDocument7 pagesMutation ProcedureRishi SehdevNo ratings yet

- Allotment LetterDocument7 pagesAllotment LetterPeyush MehtoNo ratings yet

- Business Partnership Agreement: Lamane Infrastructure P - LDocument17 pagesBusiness Partnership Agreement: Lamane Infrastructure P - LNavneet JainNo ratings yet

- CombinedDocument242 pagesCombinedLord AumarNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument5 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- PB PTA PATIA 51747 Sanctioned SIGDocument2 pagesPB PTA PATIA 51747 Sanctioned SIGPrabhkirat Singh ChhabraNo ratings yet

- 9 Paz Vs RepublicDocument3 pages9 Paz Vs RepublicElla B.No ratings yet

- J&G Advocates: Solicitors and Legal ConsultantsDocument4 pagesJ&G Advocates: Solicitors and Legal ConsultantsBharat BhushanNo ratings yet

- PC 1033Document7 pagesPC 1033Asadujjaman TuhinNo ratings yet

- Taxation Case DigestDocument4 pagesTaxation Case DigestArden KimNo ratings yet

- KK Enterprises and Ors Vs Municipal Corporation ofD060059COM807225Document13 pagesKK Enterprises and Ors Vs Municipal Corporation ofD060059COM807225vijay.kandpalNo ratings yet

- CD - 81. Allied Banking v. Quezon CityDocument2 pagesCD - 81. Allied Banking v. Quezon CityCzarina CidNo ratings yet

- 5 Indemnity Bond in Lieu of Proof of OwnershipDocument3 pages5 Indemnity Bond in Lieu of Proof of OwnershipDamodar AggarwalNo ratings yet

- 5 Indemnity Bond in Lieu of Proof of OwnershipDocument3 pages5 Indemnity Bond in Lieu of Proof of OwnershipShahbaz MalbariNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionDocument3 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Same Meanings Ascribed To Them in The MotionoldhillbillyNo ratings yet

- P23140-A Short Form AgreementDocument2 pagesP23140-A Short Form Agreementc ysNo ratings yet

- New - Rent Agreement Vardayini Agrememnt - 01!06!22Document4 pagesNew - Rent Agreement Vardayini Agrememnt - 01!06!22Steamhouse InternNo ratings yet

- Ref. Docket No. 7Document3 pagesRef. Docket No. 7Chapter 11 DocketsNo ratings yet

- Rent Agreement 2020Document6 pagesRent Agreement 2020Himalayan MandererNo ratings yet

- Gala Villa 2013Document5 pagesGala Villa 2013sohail2006No ratings yet

- JJDocument7 pagesJJLakhan WankhadeNo ratings yet

- ATS Sample 2024 Arcadia P 3.4 FF Plot No 05Document3 pagesATS Sample 2024 Arcadia P 3.4 FF Plot No 054cslandbaseNo ratings yet

- Agreement Crowdapps Technologies Private LimitedDocument5 pagesAgreement Crowdapps Technologies Private LimitedAnkit JainNo ratings yet

- Fitness by Design Vs CIRDocument4 pagesFitness by Design Vs CIRGavin Reyes CustodioNo ratings yet

- Compensation Agreement: BIL/L&R/CA/V1.1Document9 pagesCompensation Agreement: BIL/L&R/CA/V1.1Chandresh JainNo ratings yet

- 12-12553-jmp Doc 12Document3 pages12-12553-jmp Doc 12oldhillbillyNo ratings yet

- Talento V Escalada, Digital V CantosDocument6 pagesTalento V Escalada, Digital V CantosCAMILLENo ratings yet

- Nunc Pro Tunc To The Petition DateDocument11 pagesNunc Pro Tunc To The Petition DateChapter 11 DocketsNo ratings yet

- FL Leo: Clerk, Distr' Courts Tor The Bankruptcy RTCT of ColumbiaDocument12 pagesFL Leo: Clerk, Distr' Courts Tor The Bankruptcy RTCT of ColumbiavinayNo ratings yet

- A Government of Andhra Pradesh UndertakingDocument7 pagesA Government of Andhra Pradesh UndertakingHelloLand markNo ratings yet

- GSIS - GSIS v. City Treasurer of Manila, December 23, 2009Document7 pagesGSIS - GSIS v. City Treasurer of Manila, December 23, 2009Jyzzer ZjNo ratings yet

- Assam Instruction No. 13 2023 GSTDocument2 pagesAssam Instruction No. 13 2023 GSTCA Kaushik Ranjan GoswamiNo ratings yet

- Rent Agreement Format PDFDocument6 pagesRent Agreement Format PDFSiddharthSharmaNo ratings yet

- Ref. DocketDocument5 pagesRef. DocketChapter 11 DocketsNo ratings yet

- Lease Agreemnet Galleria Basement 4001Document9 pagesLease Agreemnet Galleria Basement 4001vikasNo ratings yet

- No Interest For ITC Availed But Not UtilisedDocument5 pagesNo Interest For ITC Availed But Not Utilisedsvasan32453No ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Bureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamFrom EverandBureaucrats Disputed Bjp Government Ratification of Andrews Ganj Land ScamNo ratings yet

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersFrom EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNo ratings yet

- SPKR Mailer 1Document1 pageSPKR Mailer 1rathinexusNo ratings yet

- CBSE/CTET/AUG/2023 Date: 15/09/2023Document2 pagesCBSE/CTET/AUG/2023 Date: 15/09/2023rathinexusNo ratings yet

- 7198 - Emci - 20171220 22 - Legal Environmental Concerns of Cement PlantsDocument38 pages7198 - Emci - 20171220 22 - Legal Environmental Concerns of Cement PlantsrathinexusNo ratings yet

- Thailand Tourist Covering LetterDocument1 pageThailand Tourist Covering Letterrathinexus50% (2)

- 1000 Shorts Tiktok IdeasDocument18 pages1000 Shorts Tiktok Ideasrathinexus100% (2)

- generateDupBill PDFDocument1 pagegenerateDupBill PDFrathinexusNo ratings yet

- Form VDocument1 pageForm VrathinexusNo ratings yet

- Soa 0030300152406Document1 pageSoa 0030300152406Maria Theresa LimosNo ratings yet

- Disbursement Voucher - Check #101-200Document91 pagesDisbursement Voucher - Check #101-200Jessa Mariz Lecias CalimotNo ratings yet

- Sold To:: FC WB 03269940 X2015400 00000014875 0Document2 pagesSold To:: FC WB 03269940 X2015400 00000014875 0RuodNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument5 pagesMobile Services: Your Account Summary This Month'S Chargesgirver meenaNo ratings yet

- Receipt 32Document1 pageReceipt 32Angga DwiNo ratings yet

- Wickliffe Schools Levy HistoryDocument4 pagesWickliffe Schools Levy HistoryThe News-HeraldNo ratings yet

- Prospersure International Pte LTD Swift Copies From Bank of America 04030211Document6 pagesProspersure International Pte LTD Swift Copies From Bank of America 04030211michaelgracias700No ratings yet

- Receipt Purchase PDFDocument2 pagesReceipt Purchase PDFAbishek DharNo ratings yet

- InvoiceDocument1 pageInvoiceSri WatsonNo ratings yet

- Date: Invoice No.: Order ID: Order Status: Payment Method:: Payment Address Shipping AddressDocument1 pageDate: Invoice No.: Order ID: Order Status: Payment Method:: Payment Address Shipping Addresssrikanth2vangaraNo ratings yet

- Mortgage and RRSPDocument2 pagesMortgage and RRSPmetaldwarfNo ratings yet

- Account StatementDocument2 pagesAccount StatementReziir rmcNo ratings yet

- Estimate 1427 - AIRPRO 500LDocument1 pageEstimate 1427 - AIRPRO 500LAgung NgurahNo ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- Taxation On TradersDocument5 pagesTaxation On TradersbalakrishnaNo ratings yet

- 25 Mar - Paris HotelDocument2 pages25 Mar - Paris Hoteljohn surgenNo ratings yet

- E-Ticket Upsrtc Online ReservationDocument1 pageE-Ticket Upsrtc Online ReservationYuvraj SinghNo ratings yet

- LT E-BillDocument3 pagesLT E-Billsandeep khairnarNo ratings yet

- WPR4 Format ADRIKA SINGHDocument2 pagesWPR4 Format ADRIKA SINGHAdrika SinghNo ratings yet

- Signing Date: 19/10/2023 03:18:09 SGT Signed By: Ds CWT India PVT LTD 2Document3 pagesSigning Date: 19/10/2023 03:18:09 SGT Signed By: Ds CWT India PVT LTD 2Himanshu MishraNo ratings yet

- Your BillDocument4 pagesYour Billmanishadash009No ratings yet

- Electricity Bill: Due Date: 11-07-2011Document1 pageElectricity Bill: Due Date: 11-07-2011Anjani GroverNo ratings yet

- Difference Between Tax Avoidance and Tax EvasionDocument3 pagesDifference Between Tax Avoidance and Tax EvasionHay Jirenyaa100% (1)

- Sanjay Sir ShahjahanpurDocument3 pagesSanjay Sir Shahjahanpursinghutkarsh3344No ratings yet

- Form No. 16A: From ToDocument3 pagesForm No. 16A: From ToMahasri 4thNo ratings yet

- Study of Mobiles WalletsDocument42 pagesStudy of Mobiles WalletsVijay TendolkarNo ratings yet

- 27 09 Taurum SarlDocument2 pages27 09 Taurum Sarls.v.dovzhokNo ratings yet

- Set Off FinalDocument2 pagesSet Off FinalEngr. Md. Ishtiak HossainNo ratings yet