Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

149 viewsS06 e 1 Usha Deep

S06 e 1 Usha Deep

Uploaded by

Vinay SrivastavaThis document provides details on an e-learning course on motor insurance for surveyors. The course consists of 56 lectures across 5 modules covering topics like history of motor insurance, types of motor vehicles and policies, underwriting, claims, analytics, consumer services, international legal scenarios, and compensation assessment. Each lecture lists duration, file size, and description of the session content. The course aims to provide a comprehensive overview of motor insurance concepts and processes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Automotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedFrom EverandAutomotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedRating: 4 out of 5 stars4/5 (3)

- Vibration Basics and Machine Reliability Simplified : A Practical Guide to Vibration AnalysisFrom EverandVibration Basics and Machine Reliability Simplified : A Practical Guide to Vibration AnalysisRating: 4 out of 5 stars4/5 (2)

- Formula Sheet For Open Channel Flow HydraulicsDocument2 pagesFormula Sheet For Open Channel Flow HydraulicsBrett100% (1)

- The Impact of the General Data Protection Regulation (GDPR) on the Online Advertising MarketFrom EverandThe Impact of the General Data Protection Regulation (GDPR) on the Online Advertising MarketNo ratings yet

- IC 72 Motor Insurance PDFDocument597 pagesIC 72 Motor Insurance PDFSaba Ansari77% (13)

- Advanced Driver Assistance SystemsDocument57 pagesAdvanced Driver Assistance SystemsharisNo ratings yet

- Production of Lime: Chemical Engineering DepartmentDocument17 pagesProduction of Lime: Chemical Engineering DepartmentDon Aries EidosNo ratings yet

- Ic 72 - Motor InsuranceDocument2 pagesIc 72 - Motor Insurancepriyarss230% (2)

- Shubham Verma FinalDocument70 pagesShubham Verma FinalVarun ChauhanNo ratings yet

- Report of Justice Rangarajan CommitteeDocument89 pagesReport of Justice Rangarajan CommitteeManav RathoreNo ratings yet

- Jagan Verma FinalDocument70 pagesJagan Verma FinalVarun ChauhanNo ratings yet

- 18au017 SyllabusDocument2 pages18au017 SyllabusRAJA TNo ratings yet

- 6.0 Principles and Practice of Motor Insurance and AssessmentDocument4 pages6.0 Principles and Practice of Motor Insurance and Assessmentkevin muchungaNo ratings yet

- Wa0001.Document40 pagesWa0001.vjpyeojdgwkvqgasioNo ratings yet

- Alagappa Univeristy Risk ManagementDocument236 pagesAlagappa Univeristy Risk ManagementBALACHANDAR TNo ratings yet

- Transport ManagementDocument147 pagesTransport Managementiiftgscm batch2No ratings yet

- Consequences enDocument126 pagesConsequences enC SNo ratings yet

- Recent Trends in Automobile: Sachin ChouhanDocument23 pagesRecent Trends in Automobile: Sachin ChouhanMohd Javed IqbalNo ratings yet

- Auto Mechanics SyllabusDocument55 pagesAuto Mechanics SyllabusBbosa DerrickNo ratings yet

- Consumer Credit Banking ModuleDocument115 pagesConsumer Credit Banking Modulehanif_iswari4288No ratings yet

- 05 ContentsDocument5 pages05 ContentsAkanksha PandeyNo ratings yet

- Pyae Phyo Wai (EMBF - 51)Document48 pagesPyae Phyo Wai (EMBF - 51)htethtethlaingNo ratings yet

- CME-2 Compliance 05-9-2012Document224 pagesCME-2 Compliance 05-9-2012Jeez100% (1)

- 29-04-2022 Report of Committee On Designing of Combi Products For Micro-Insurance SegmentDocument93 pages29-04-2022 Report of Committee On Designing of Combi Products For Micro-Insurance SegmenttusharNo ratings yet

- Syllabus Professional Examination March, 2023 NewDocument41 pagesSyllabus Professional Examination March, 2023 Newrashitekwani5No ratings yet

- Research Report 6Document7 pagesResearch Report 6Siyeon YeungNo ratings yet

- Motor Insurance Products: ObjectiveDocument4 pagesMotor Insurance Products: ObjectiveChazzy f ChazzyNo ratings yet

- Stolyarov Old CASExam5 Study GuideDocument546 pagesStolyarov Old CASExam5 Study GuidePierre HazizaNo ratings yet

- PG - M.com - Finance & Control - 33544 Banking and InsuranceDocument282 pagesPG - M.com - Finance & Control - 33544 Banking and InsuranceShikha Sidar LLM 2021No ratings yet

- TR - RFP - LCS Danısmanlık Hizm - İzmir Okulları DH-06 17.03.2023Document244 pagesTR - RFP - LCS Danısmanlık Hizm - İzmir Okulları DH-06 17.03.2023harendraNo ratings yet

- VAOW Pitch 22112023Document27 pagesVAOW Pitch 22112023sahilNo ratings yet

- A Study On Operation and Claim Procedure of Motor Vehicle InsuranceDocument94 pagesA Study On Operation and Claim Procedure of Motor Vehicle InsuranceRushikesh SonawaneNo ratings yet

- A Study On "Web Based Application For Insurance"Document53 pagesA Study On "Web Based Application For Insurance"aurorashiva1No ratings yet

- Professional Exam Sylabus IIIDocument37 pagesProfessional Exam Sylabus IIIRahul JaiswalNo ratings yet

- CME 3 Broker Dealer 30-4-2015Document235 pagesCME 3 Broker Dealer 30-4-2015Jeez100% (1)

- IJRPR5946Document10 pagesIJRPR5946sm2765568No ratings yet

- VPTP306470000100Document2 pagesVPTP306470000100avi.kadam25No ratings yet

- Motor Third Party Claims ManagementDocument555 pagesMotor Third Party Claims ManagementBhavin Karia67% (3)

- Motor Third Party Liability Insurance in Russia: Gaining Competitive AdvantageDocument28 pagesMotor Third Party Liability Insurance in Russia: Gaining Competitive AdvantagemkhaliliyNo ratings yet

- BA501758VPC5553953 CarInsuranceOnlineDocument2 pagesBA501758VPC5553953 CarInsuranceOnlineSuraj MishraNo ratings yet

- Compensation Under Motor Vehicle Act, 1988Document19 pagesCompensation Under Motor Vehicle Act, 1988Shristi TalukdarNo ratings yet

- Ayyappa SongDocument2 pagesAyyappa Songnagasuryateja.gNo ratings yet

- PIAM & ORS v. COMPETITION COMMISSION (2022)Document39 pagesPIAM & ORS v. COMPETITION COMMISSION (2022)sheronfeddrin00No ratings yet

- 0 PDFDocument136 pages0 PDFTahena Vidal AndradeNo ratings yet

- CS 4E Shigeyuki KawanaDocument13 pagesCS 4E Shigeyuki Kawanadevil philipNo ratings yet

- Vehicle InsuranceDocument11 pagesVehicle InsuranceAbhyank KumarNo ratings yet

- KoodooLLM CaseStudyDocument4 pagesKoodooLLM CaseStudyArpitNo ratings yet

- Operators Guide To Rotating Equipment PDFDocument11 pagesOperators Guide To Rotating Equipment PDFOlusegun Olugbade0% (1)

- Design and Evaluation of A Code-Based Immobilizer System For Vehicle Anti-Theft SecurityDocument8 pagesDesign and Evaluation of A Code-Based Immobilizer System For Vehicle Anti-Theft Securityariel wa lundaNo ratings yet

- Nine Months Certificate Course On Business and Financial LawsDocument10 pagesNine Months Certificate Course On Business and Financial Laws1021210665 158220No ratings yet

- Future Generali India: Insurance Company LimitedDocument2 pagesFuture Generali India: Insurance Company LimitedYash GodseNo ratings yet

- New Trends and Developments in Automotive System EngineeringDocument678 pagesNew Trends and Developments in Automotive System EngineeringJosé RamírezNo ratings yet

- Applicant PIA User Manual - V1.0 PDFDocument136 pagesApplicant PIA User Manual - V1.0 PDFAmit SharmaNo ratings yet

- Applicant PIA User Manual - V1.0 PDFDocument136 pagesApplicant PIA User Manual - V1.0 PDFRajesh PainulyNo ratings yet

- Tata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyDocument2 pagesTata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyRapoluSivaNo ratings yet

- Gitesh Khadu - EMBA14Document100 pagesGitesh Khadu - EMBA14Kamlesh RampalNo ratings yet

- Ijitee Final PaperpublishedDocument10 pagesIjitee Final Paperpublishedydez4No ratings yet

- Intermediary Code: Intermediary Name: Contact:: BR501650 Invictus Insurance Broking PVT LTD 1800-266-0101Document2 pagesIntermediary Code: Intermediary Name: Contact:: BR501650 Invictus Insurance Broking PVT LTD 1800-266-0101KUMARNo ratings yet

- Chapter - 2Document34 pagesChapter - 2NishobithaNo ratings yet

- Important For Direct Tax CA FinalDocument2 pagesImportant For Direct Tax CA FinalJamsheer BslNo ratings yet

- Final Project PDFDocument92 pagesFinal Project PDFyogesh kumbharNo ratings yet

- Control Box CB6S Data Sheet EngDocument8 pagesControl Box CB6S Data Sheet EngThanhNo ratings yet

- RR SMR E3s Case Chapter 5 - Reactor Coolant System and Associated Systems Issue 1 Gda PublicationDocument89 pagesRR SMR E3s Case Chapter 5 - Reactor Coolant System and Associated Systems Issue 1 Gda PublicationMuhammad ImranNo ratings yet

- Troop 99 Dutch CookbookDocument74 pagesTroop 99 Dutch CookbookBobNo ratings yet

- Intro - BiG Airtech A5Document6 pagesIntro - BiG Airtech A5Muflich ArbaNo ratings yet

- 08CLecture - Welding Codes StandardsDocument15 pages08CLecture - Welding Codes StandardsDavid HuamanNo ratings yet

- MT - 01 PCM JM Paper (26.06.2022) 12thDocument22 pagesMT - 01 PCM JM Paper (26.06.2022) 12thAnurag PatelNo ratings yet

- 2021-2023 FO X RFR Tracker - KC NCDDP AFDocument147 pages2021-2023 FO X RFR Tracker - KC NCDDP AFJestoni Gonzales TortolaNo ratings yet

- AssignmentDocument6 pagesAssignmentvikrantNo ratings yet

- Diploma in Palm Oil Milling Technology & Management Semester 1Document15 pagesDiploma in Palm Oil Milling Technology & Management Semester 1Mohd Irham IdrisNo ratings yet

- 06mbdrflkay PDFDocument6 pages06mbdrflkay PDFYanto Sandy TjangNo ratings yet

- Population Genetics TutorialDocument164 pagesPopulation Genetics TutorialMichelle GNo ratings yet

- Learning Disabilities OtDocument48 pagesLearning Disabilities OtReeva de SaNo ratings yet

- OW200 Product Manual With AgarDAS (Released 2013)Document141 pagesOW200 Product Manual With AgarDAS (Released 2013)AndersonNo ratings yet

- Individual Differences and Work BehaviorDocument3 pagesIndividual Differences and Work BehaviorSunny Honey0% (1)

- Programme Chart For Commercial BuildingDocument1 pageProgramme Chart For Commercial Buildinganish kvNo ratings yet

- Cambridge IGCSE: BIOLOGY 0610/61Document12 pagesCambridge IGCSE: BIOLOGY 0610/61Sraboni ChowdhuryNo ratings yet

- Lupus in Women - Informative SpeechDocument13 pagesLupus in Women - Informative Speechkayla leeNo ratings yet

- Task 1 - Three Phase (Ø) Electrical Installation Direct On Line (Dol) Forward Motor ControlDocument4 pagesTask 1 - Three Phase (Ø) Electrical Installation Direct On Line (Dol) Forward Motor Controlmoganraj8munusamyNo ratings yet

- 14 Oct - SDRM - Prof. Nirmalya BDocument2 pages14 Oct - SDRM - Prof. Nirmalya BShivam GuptaNo ratings yet

- Unit 1: Overview of The Strategic Planning ProcessDocument11 pagesUnit 1: Overview of The Strategic Planning ProcessAmeng GosimNo ratings yet

- Pulse Valve 03 BrochureDocument3 pagesPulse Valve 03 BrochurehendraNo ratings yet

- GCU ELM-305 Topic 5 Discussion Question ResponsesDocument3 pagesGCU ELM-305 Topic 5 Discussion Question ResponsesKristin HensleyNo ratings yet

- Incozol 4 TDSDocument1 pageIncozol 4 TDSsriatul2006No ratings yet

- Internet and NetworkingDocument18 pagesInternet and Networkinghussain korirNo ratings yet

- Dairy IndustryDocument4 pagesDairy IndustrySOURAV GOYALNo ratings yet

- Money Time RelationshipsDocument6 pagesMoney Time RelationshipsKevin KoNo ratings yet

- Unit Test - 4 Class-Xii Sub.-Chemistry Time:01:30 Hrs Mm:40Document2 pagesUnit Test - 4 Class-Xii Sub.-Chemistry Time:01:30 Hrs Mm:40Nihar Ranjan NikuNo ratings yet

- Morning Report Saturday, 10 MARCH 2018Document33 pagesMorning Report Saturday, 10 MARCH 2018Efan StiawanNo ratings yet

S06 e 1 Usha Deep

S06 e 1 Usha Deep

Uploaded by

Vinay Srivastava0 ratings0% found this document useful (0 votes)

149 views3 pagesThis document provides details on an e-learning course on motor insurance for surveyors. The course consists of 56 lectures across 5 modules covering topics like history of motor insurance, types of motor vehicles and policies, underwriting, claims, analytics, consumer services, international legal scenarios, and compensation assessment. Each lecture lists duration, file size, and description of the session content. The course aims to provide a comprehensive overview of motor insurance concepts and processes.

Original Description:

surveyor

Original Title

S06e1UshaDeep

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides details on an e-learning course on motor insurance for surveyors. The course consists of 56 lectures across 5 modules covering topics like history of motor insurance, types of motor vehicles and policies, underwriting, claims, analytics, consumer services, international legal scenarios, and compensation assessment. Each lecture lists duration, file size, and description of the session content. The course aims to provide a comprehensive overview of motor insurance concepts and processes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

149 views3 pagesS06 e 1 Usha Deep

S06 e 1 Usha Deep

Uploaded by

Vinay SrivastavaThis document provides details on an e-learning course on motor insurance for surveyors. The course consists of 56 lectures across 5 modules covering topics like history of motor insurance, types of motor vehicles and policies, underwriting, claims, analytics, consumer services, international legal scenarios, and compensation assessment. Each lecture lists duration, file size, and description of the session content. The course aims to provide a comprehensive overview of motor insurance concepts and processes.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

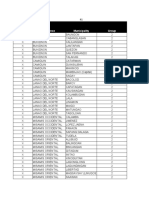

Usha Deep Academy of Insurance

e-Learning for Surveyors / III, Mumbai Examinations

Subject: S-06 / IC-72: Motor Insurance

Part-1: Own Damage Insurance

Lecture Duration File-Size Description

No. (Minutes) (MB)

Module-1: Chapter:1 and 2 (Lectures-1 to 5; Time-3 Hours; Data-0.85 GB)

1 50 90 Chapter-1: Session-1: History of Motor Insurance, APPLICABILITY OF BASIC

PRINCIPLES OF INSURANCE, PRINCIPLE OF UTMOST GOOD FAITH

(UBERRIMAE FIDES)

2 90 138 Chapter-1: Session-2: PRINCIPLE OF INSURABLE INTEREST, PRINCIPLE OF

INDEMNITY, DOCTRINE OF SUBROGATION, CONTRIBUTION & PROXIMATE

CAUSE, Legal Aspects of Motor Insurance and The Motor Vehicles

(Amendment) Bill, 2008, Provisions Relating to Third Party Insurance,

Definitions, Registration, Permit & Driving

License Under MV Act 1988

3 70 184 Chapter-1: Session-3: Registration of the vehicle, Licensing of Drivers,

Procedure for Accreditation of Bus Body Builders, The Motor Vehicle

(Amendment) Bill, 2008

4 70 198 Chapter-2: Session-1: MARKETING IN MOTOR INSURANCE: Motor Third

Party Pool

5 85 239 Chapter-2: Session-2: MARKETING IN MOTOR INSURANCE: Knock For Knock

Agreement and some Market Practices, International Issues in Insurance

Markets, Some Market Practices.

Module-2: Chapter: 3 and 4 (Lectures-6 to 15; Time-16 Hours; Data-1.4 GB)

6 52 139 Chapter-3: Session-1: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: Types of Motor Vehicles

7 55 223 Chapter-3: Session-2: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: Motor insurance documents (Proposal Forms, Cover notes,

Certificate of Insurance).

8 80 229 Chapter-3: Session-3: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: Motor insurance documents (Policy Forms, Endorsement,

Renewal Notice), LIABILITY ONLY POLICY

9 52 142 Chapter-3: Session-4: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: SCHEDULE, LIABILITY COVER UNDER PACKAGE POLICIES,

COVERAGE FOR MOTOR PACKAGE POLICIES

10 58 166 Chapter-3: Session-5: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: PROTECTION AND REMOVAL COSTS, Section I (own Damage) of

Two Wheeler Package Policy, Commercial Vehicle Package Policies

11 70 191 Chapter-3: Session-6: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: MOTOR TRADE POLICIES

12 62 174 Chapter-3: Session-7: TYPE OF MOTOR VEHICLES, DOCUMENTS AND

POLICIES: NEW TECHNOLOGIES

13 90 237 Chapter-4: Session-1: UNDERWRITING IN MOTOR INSURANCE: MARKET

PRACTICE OF MOTOR INSURANCE IN INDIA, Guidelines applicable in India

(Up to GR.24).

14 60 150 Chapter-4: Session-2: UNDERWRITING IN MOTOR INSURANCE: Guidelines

applicable in India (Up to GR.25 to GR-49)

Lecture Duration File-Size Description

No. (Minutes) (MB)

15 55 146 Chapter-4: Session-3: UNDERWRITING IN MOTOR INSURANCE: IMT (India

Motor Tariff) Endorsements: 1 to 65.

16 70 197 Chapter-4: Session-4: UNDERWRITING IN MOTOR INSURANCE: Motor Policy

Premium Computation, Amendments Subsequent to Discontinuance of

Tariff, International Practice in Motor Insurance Rating.

17 100 287 Chapter-4: Session-5: UNDERWRITING IN MOTOR INSURANCE:

Underwriting in motor insurance, (Up to Credit Rating)

18 73 198 Chapter-4: Session-6: UNDERWRITING IN MOTOR INSURANCE: The claims

experience, Principles and practice of premium computation, (Up to The

pricing objectives).

19 70 180 Chapter-4: Session-7: UNDERWRITING IN MOTOR INSURANCE: Principles

and practice of premium computation (Motor premium rating, Model wise

Risk assessment), Motor Underwriting.

Module-3: Chapter: 5, 6 and 7 (Lectures-20 to 30; Time-14 Hours; Data-1.8 GB)

20 82 173 Chapter-5: Session-1: MOTOR INSURANCE CLAIMS: Doctrine of cause of

Accident, Motor Insurance Claims Procedures, Claim Documents, The

Survey Report.

21 65 244 Chapter-5: Session-2: MOTOR INSURANCE CLAIMS: Technical aspects of

problems involved in assessment and settlement, Types of Losses (Total

Loss or Constructive Total Loss, Total Loss due to Theft, Recovery and

Assessment on Repair Basis).

22 74 284 Chapter-5: Session-3: MOTOR INSURANCE CLAIMS: Types of Losses (Cash

loss (Net of salvage or cash less) Settlement, Cash loss settlement, Cash less

settlement), Various Causes of Accident.

23 67 200 Chapter-5: Session-4: MOTOR INSURANCE CLAIMS: Surveyor and His role in

Loss Minimization.

24 50 153 Chapter-5: Session-5: MOTOR INSURANCE CLAIMS: Role of Road Safety in

Insurance, Frauds in Motor OD Claims.

25 70 258 Chapter-6: Session-1: IMPORTANCE OF ANALYTICS AND IT INTERVENTION:

IT Intervention and Competition, Importance of Analytics and IT

Intervention, The new Data-Driven Insurer.

26 85 331 Chapter-6: Session-2: IMPORTANCE OF ANALYTICS AND IT INTERVENTION:

Detection of driver under the influence of drug, Need for and Importance of

Statistics

27 95 342 Chapter-6: Session-3: IMPORTANCE OF ANALYTICS AND IT INTERVENTION:

TAC as Data Depository and TAC as National Repository, Future of Auto

Insurance

28 80 261 Chapter-7: Session-1: CONSUMER DELIGHT: Evolution of Quality Service

Concept, Impact of Nationalisation, Objectives of Opening the Insurance

Sector, Basic Elements of Customer Service.

29 50 83 Chapter-7: Session-2: CONSUMER DELIGHT: Regulatory, Statutory, Self and

Internal Commitments In India‘s regulatory regime, Service Gaps in Claims

and Customer Experience Management.

30 50 174 Chapter-7: Session-3: CONSUMER DELIGHT: Need for Insurance

Ombudsman, Creating Value Added Services

Module-4: Chapter: 8 and 9 (Lectures-31 to 42; Time-14 Hours; Data-2.6 GB)

31 70 200 Chapter-8: Session-1: International Legal Scenario in Motor Insurance

Lecture Duration File-Size Description

No. (Minutes) (MB)

32 90 280 Chapter-8: Session-2: Third Party Claims Management in India

33 95 300 Chapter-8: Session-3: Who can claim Compensation?

34 65 200 Chapter-8: Session-4: Jurisdiction of Civil Courts

35 40 138 Chapter-8: Session-5: Alternate Methods of Settlement

36 95 287 Chapter-8: Session-6: Principles of Damages

37 65 200 Chapter-8: Session-7: Defenses available to Insurers

38 65 200 Chapter-8: Session-8: Defenses for Insurance Companies

39 85 248 Chapter-9: Session-1: Procedures and Powers of Claims Tribunals,

Procedure for Filing of Claim

40 60 199 Chapter-9: Session-2: Mis-joinder of necessary party, Out of Court or

Compromise Settlement, Arguments during Proceedings

41 80 270 Chapter-9: Session-3: Procedure for Filing and Defending, Steps to be taken

in Third Party Motor Accident Cases

42 40 138 Chapter-9: Session-4: Steps to be taken in Execution Cases, Stay of

operation of award during the pendency of appeal

Module-5: Chapter: 10, 11 and Annexure A & B (Lectures-43 to 56; Time-16 Hours; Data-3.8 GB)

43 70 236 Chapter-10: Session-1: Assessment of Compensation and Type of Damages

44 70 262 Chapter-10: Session-2: Option to choose Jurisdiction

45 80 294 Chapter-10: Session-3: No Fault Liability, Structured Compensation Method,

Hit-And-Run Motor Accidents, Comparison with Section 166, Just

Compensation

46 75 286 Chapter-10: Session-4: Dictionary meaning of compensation, Definition of

Income, Net income, Some Case Studies for Damages to Non-earning

Members.

47 70 243 Chapter-11: Session-1: Frauds in TP Claims and Frauds in Motor Insurance,

Underwriting Frauds and Issues to be Audited.

48 70 216 Chapter-11: Session-2: Effective investigation to Power to Recall by

Tribunals

49 73 262 Chapter-11: Session-3: Non-motor Cases Fixed as Motor Accidents,

Common Processing Defects.

50 60 206 Chapter-11: Session-4: Receipt of summons to End of Chapter.

51 60 241 Annexure-A: Session-1: Negligence

52 60 250 Annexure-A: Session-2: Negligence

53 70 308 Annexure-A: Session-3: Liability when policy is not in existence

54 70 304 Annexure-A: Session-4: Liability when policy is not in existence

55 70 290 Annexure-B: Session-1: IMPORTANT DECISIONS ON MOTOR VEHICLE ACT

56 100 440 Annexure-B: Session-2: IMPORTANT DECISIONS ON MOTOR VEHICLE ACT

Total 65 Hrs 12 GB

(1 to

56)

You might also like

- Automotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedFrom EverandAutomotive Diagnostic Systems: Understanding OBD-I & OBD-II RevisedRating: 4 out of 5 stars4/5 (3)

- Vibration Basics and Machine Reliability Simplified : A Practical Guide to Vibration AnalysisFrom EverandVibration Basics and Machine Reliability Simplified : A Practical Guide to Vibration AnalysisRating: 4 out of 5 stars4/5 (2)

- Formula Sheet For Open Channel Flow HydraulicsDocument2 pagesFormula Sheet For Open Channel Flow HydraulicsBrett100% (1)

- The Impact of the General Data Protection Regulation (GDPR) on the Online Advertising MarketFrom EverandThe Impact of the General Data Protection Regulation (GDPR) on the Online Advertising MarketNo ratings yet

- IC 72 Motor Insurance PDFDocument597 pagesIC 72 Motor Insurance PDFSaba Ansari77% (13)

- Advanced Driver Assistance SystemsDocument57 pagesAdvanced Driver Assistance SystemsharisNo ratings yet

- Production of Lime: Chemical Engineering DepartmentDocument17 pagesProduction of Lime: Chemical Engineering DepartmentDon Aries EidosNo ratings yet

- Ic 72 - Motor InsuranceDocument2 pagesIc 72 - Motor Insurancepriyarss230% (2)

- Shubham Verma FinalDocument70 pagesShubham Verma FinalVarun ChauhanNo ratings yet

- Report of Justice Rangarajan CommitteeDocument89 pagesReport of Justice Rangarajan CommitteeManav RathoreNo ratings yet

- Jagan Verma FinalDocument70 pagesJagan Verma FinalVarun ChauhanNo ratings yet

- 18au017 SyllabusDocument2 pages18au017 SyllabusRAJA TNo ratings yet

- 6.0 Principles and Practice of Motor Insurance and AssessmentDocument4 pages6.0 Principles and Practice of Motor Insurance and Assessmentkevin muchungaNo ratings yet

- Wa0001.Document40 pagesWa0001.vjpyeojdgwkvqgasioNo ratings yet

- Alagappa Univeristy Risk ManagementDocument236 pagesAlagappa Univeristy Risk ManagementBALACHANDAR TNo ratings yet

- Transport ManagementDocument147 pagesTransport Managementiiftgscm batch2No ratings yet

- Consequences enDocument126 pagesConsequences enC SNo ratings yet

- Recent Trends in Automobile: Sachin ChouhanDocument23 pagesRecent Trends in Automobile: Sachin ChouhanMohd Javed IqbalNo ratings yet

- Auto Mechanics SyllabusDocument55 pagesAuto Mechanics SyllabusBbosa DerrickNo ratings yet

- Consumer Credit Banking ModuleDocument115 pagesConsumer Credit Banking Modulehanif_iswari4288No ratings yet

- 05 ContentsDocument5 pages05 ContentsAkanksha PandeyNo ratings yet

- Pyae Phyo Wai (EMBF - 51)Document48 pagesPyae Phyo Wai (EMBF - 51)htethtethlaingNo ratings yet

- CME-2 Compliance 05-9-2012Document224 pagesCME-2 Compliance 05-9-2012Jeez100% (1)

- 29-04-2022 Report of Committee On Designing of Combi Products For Micro-Insurance SegmentDocument93 pages29-04-2022 Report of Committee On Designing of Combi Products For Micro-Insurance SegmenttusharNo ratings yet

- Syllabus Professional Examination March, 2023 NewDocument41 pagesSyllabus Professional Examination March, 2023 Newrashitekwani5No ratings yet

- Research Report 6Document7 pagesResearch Report 6Siyeon YeungNo ratings yet

- Motor Insurance Products: ObjectiveDocument4 pagesMotor Insurance Products: ObjectiveChazzy f ChazzyNo ratings yet

- Stolyarov Old CASExam5 Study GuideDocument546 pagesStolyarov Old CASExam5 Study GuidePierre HazizaNo ratings yet

- PG - M.com - Finance & Control - 33544 Banking and InsuranceDocument282 pagesPG - M.com - Finance & Control - 33544 Banking and InsuranceShikha Sidar LLM 2021No ratings yet

- TR - RFP - LCS Danısmanlık Hizm - İzmir Okulları DH-06 17.03.2023Document244 pagesTR - RFP - LCS Danısmanlık Hizm - İzmir Okulları DH-06 17.03.2023harendraNo ratings yet

- VAOW Pitch 22112023Document27 pagesVAOW Pitch 22112023sahilNo ratings yet

- A Study On Operation and Claim Procedure of Motor Vehicle InsuranceDocument94 pagesA Study On Operation and Claim Procedure of Motor Vehicle InsuranceRushikesh SonawaneNo ratings yet

- A Study On "Web Based Application For Insurance"Document53 pagesA Study On "Web Based Application For Insurance"aurorashiva1No ratings yet

- Professional Exam Sylabus IIIDocument37 pagesProfessional Exam Sylabus IIIRahul JaiswalNo ratings yet

- CME 3 Broker Dealer 30-4-2015Document235 pagesCME 3 Broker Dealer 30-4-2015Jeez100% (1)

- IJRPR5946Document10 pagesIJRPR5946sm2765568No ratings yet

- VPTP306470000100Document2 pagesVPTP306470000100avi.kadam25No ratings yet

- Motor Third Party Claims ManagementDocument555 pagesMotor Third Party Claims ManagementBhavin Karia67% (3)

- Motor Third Party Liability Insurance in Russia: Gaining Competitive AdvantageDocument28 pagesMotor Third Party Liability Insurance in Russia: Gaining Competitive AdvantagemkhaliliyNo ratings yet

- BA501758VPC5553953 CarInsuranceOnlineDocument2 pagesBA501758VPC5553953 CarInsuranceOnlineSuraj MishraNo ratings yet

- Compensation Under Motor Vehicle Act, 1988Document19 pagesCompensation Under Motor Vehicle Act, 1988Shristi TalukdarNo ratings yet

- Ayyappa SongDocument2 pagesAyyappa Songnagasuryateja.gNo ratings yet

- PIAM & ORS v. COMPETITION COMMISSION (2022)Document39 pagesPIAM & ORS v. COMPETITION COMMISSION (2022)sheronfeddrin00No ratings yet

- 0 PDFDocument136 pages0 PDFTahena Vidal AndradeNo ratings yet

- CS 4E Shigeyuki KawanaDocument13 pagesCS 4E Shigeyuki Kawanadevil philipNo ratings yet

- Vehicle InsuranceDocument11 pagesVehicle InsuranceAbhyank KumarNo ratings yet

- KoodooLLM CaseStudyDocument4 pagesKoodooLLM CaseStudyArpitNo ratings yet

- Operators Guide To Rotating Equipment PDFDocument11 pagesOperators Guide To Rotating Equipment PDFOlusegun Olugbade0% (1)

- Design and Evaluation of A Code-Based Immobilizer System For Vehicle Anti-Theft SecurityDocument8 pagesDesign and Evaluation of A Code-Based Immobilizer System For Vehicle Anti-Theft Securityariel wa lundaNo ratings yet

- Nine Months Certificate Course On Business and Financial LawsDocument10 pagesNine Months Certificate Course On Business and Financial Laws1021210665 158220No ratings yet

- Future Generali India: Insurance Company LimitedDocument2 pagesFuture Generali India: Insurance Company LimitedYash GodseNo ratings yet

- New Trends and Developments in Automotive System EngineeringDocument678 pagesNew Trends and Developments in Automotive System EngineeringJosé RamírezNo ratings yet

- Applicant PIA User Manual - V1.0 PDFDocument136 pagesApplicant PIA User Manual - V1.0 PDFAmit SharmaNo ratings yet

- Applicant PIA User Manual - V1.0 PDFDocument136 pagesApplicant PIA User Manual - V1.0 PDFRajesh PainulyNo ratings yet

- Tata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyDocument2 pagesTata AIG General Insurance Co. LTD.: IRDA Registration No: 108 Two Wheeler Package PolicyRapoluSivaNo ratings yet

- Gitesh Khadu - EMBA14Document100 pagesGitesh Khadu - EMBA14Kamlesh RampalNo ratings yet

- Ijitee Final PaperpublishedDocument10 pagesIjitee Final Paperpublishedydez4No ratings yet

- Intermediary Code: Intermediary Name: Contact:: BR501650 Invictus Insurance Broking PVT LTD 1800-266-0101Document2 pagesIntermediary Code: Intermediary Name: Contact:: BR501650 Invictus Insurance Broking PVT LTD 1800-266-0101KUMARNo ratings yet

- Chapter - 2Document34 pagesChapter - 2NishobithaNo ratings yet

- Important For Direct Tax CA FinalDocument2 pagesImportant For Direct Tax CA FinalJamsheer BslNo ratings yet

- Final Project PDFDocument92 pagesFinal Project PDFyogesh kumbharNo ratings yet

- Control Box CB6S Data Sheet EngDocument8 pagesControl Box CB6S Data Sheet EngThanhNo ratings yet

- RR SMR E3s Case Chapter 5 - Reactor Coolant System and Associated Systems Issue 1 Gda PublicationDocument89 pagesRR SMR E3s Case Chapter 5 - Reactor Coolant System and Associated Systems Issue 1 Gda PublicationMuhammad ImranNo ratings yet

- Troop 99 Dutch CookbookDocument74 pagesTroop 99 Dutch CookbookBobNo ratings yet

- Intro - BiG Airtech A5Document6 pagesIntro - BiG Airtech A5Muflich ArbaNo ratings yet

- 08CLecture - Welding Codes StandardsDocument15 pages08CLecture - Welding Codes StandardsDavid HuamanNo ratings yet

- MT - 01 PCM JM Paper (26.06.2022) 12thDocument22 pagesMT - 01 PCM JM Paper (26.06.2022) 12thAnurag PatelNo ratings yet

- 2021-2023 FO X RFR Tracker - KC NCDDP AFDocument147 pages2021-2023 FO X RFR Tracker - KC NCDDP AFJestoni Gonzales TortolaNo ratings yet

- AssignmentDocument6 pagesAssignmentvikrantNo ratings yet

- Diploma in Palm Oil Milling Technology & Management Semester 1Document15 pagesDiploma in Palm Oil Milling Technology & Management Semester 1Mohd Irham IdrisNo ratings yet

- 06mbdrflkay PDFDocument6 pages06mbdrflkay PDFYanto Sandy TjangNo ratings yet

- Population Genetics TutorialDocument164 pagesPopulation Genetics TutorialMichelle GNo ratings yet

- Learning Disabilities OtDocument48 pagesLearning Disabilities OtReeva de SaNo ratings yet

- OW200 Product Manual With AgarDAS (Released 2013)Document141 pagesOW200 Product Manual With AgarDAS (Released 2013)AndersonNo ratings yet

- Individual Differences and Work BehaviorDocument3 pagesIndividual Differences and Work BehaviorSunny Honey0% (1)

- Programme Chart For Commercial BuildingDocument1 pageProgramme Chart For Commercial Buildinganish kvNo ratings yet

- Cambridge IGCSE: BIOLOGY 0610/61Document12 pagesCambridge IGCSE: BIOLOGY 0610/61Sraboni ChowdhuryNo ratings yet

- Lupus in Women - Informative SpeechDocument13 pagesLupus in Women - Informative Speechkayla leeNo ratings yet

- Task 1 - Three Phase (Ø) Electrical Installation Direct On Line (Dol) Forward Motor ControlDocument4 pagesTask 1 - Three Phase (Ø) Electrical Installation Direct On Line (Dol) Forward Motor Controlmoganraj8munusamyNo ratings yet

- 14 Oct - SDRM - Prof. Nirmalya BDocument2 pages14 Oct - SDRM - Prof. Nirmalya BShivam GuptaNo ratings yet

- Unit 1: Overview of The Strategic Planning ProcessDocument11 pagesUnit 1: Overview of The Strategic Planning ProcessAmeng GosimNo ratings yet

- Pulse Valve 03 BrochureDocument3 pagesPulse Valve 03 BrochurehendraNo ratings yet

- GCU ELM-305 Topic 5 Discussion Question ResponsesDocument3 pagesGCU ELM-305 Topic 5 Discussion Question ResponsesKristin HensleyNo ratings yet

- Incozol 4 TDSDocument1 pageIncozol 4 TDSsriatul2006No ratings yet

- Internet and NetworkingDocument18 pagesInternet and Networkinghussain korirNo ratings yet

- Dairy IndustryDocument4 pagesDairy IndustrySOURAV GOYALNo ratings yet

- Money Time RelationshipsDocument6 pagesMoney Time RelationshipsKevin KoNo ratings yet

- Unit Test - 4 Class-Xii Sub.-Chemistry Time:01:30 Hrs Mm:40Document2 pagesUnit Test - 4 Class-Xii Sub.-Chemistry Time:01:30 Hrs Mm:40Nihar Ranjan NikuNo ratings yet

- Morning Report Saturday, 10 MARCH 2018Document33 pagesMorning Report Saturday, 10 MARCH 2018Efan StiawanNo ratings yet