Professional Documents

Culture Documents

Epic Makes Progress 311356 NDX

Epic Makes Progress 311356 NDX

Uploaded by

Heberto David Azuara SanchezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Epic Makes Progress 311356 NDX

Epic Makes Progress 311356 NDX

Uploaded by

Heberto David Azuara SanchezCopyright:

Available Formats

Epic Makes Progress With Healthy Planet and Wins

Customer Loyalty

Published 14 November 2017 - ID G00311356 - 24 min read

ARCHIVED This research is provided for historical perspective; portions may not reflect current

conditions.

By Analyst(s): Laura Craft

Initiatives: Healthcare and Life Science Digital Optimization and Modernization

Investing in population health management tools is a top priority

for HDOs. CIO leadership is critical when deciding between the

incumbent megasuite/EHR vendor or a stand-alone solution. CIOs

should use this research to understand Epic's Healthy Planet

population health platform.

Overview

Key Findings

■ Epic has a remarkably loyal customer base. Confidence in Epic's ability to execute on

the Healthy Planet vision and roadmap helps retain customers.

■ Healthy Planet's strengths are the care management and coordination functionality,

closed-looped analytics, and insights that are tightly integrated directly into the

clinician's workflow. The downside is that this appears to work best within an Epic

EHR environment.

■ Clients' chief complaint is the ease of integrating with non-Epic data — driving

several to seek interim solutions.

■ HDOs using Epic most successfully to advance population health programs are

those with more mature population health and analytic programs, mature resources

and strong leadership.

■ Customers desire greater vendor partnership from Epic. They are seeking industry

knowledge and experience to help them drive insights, deliver results and realize

value from the investment.

Gartner, Inc. | G00311356 Page 1 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Recommendations

CIOs responsible for developing the population health management and enterprise

analytics strategy:

■ Press Epic on how it is continuing to address the noted weaknesses, especially

around integration and interoperability. Align the responses with the demands of

your population health program.

■ Conduct an open procurement and evaluate Healthy Planet along with other

population health management solutions. Develop an RFI that will tease out your

HDO's critical differentiators for a population health solution.

■ Perform thorough reference checks by focusing on both the results Healthy Planet

has helped to deliver (e.g., how well has it helped meet the HDO's value-based

contract risk measures) and the challenges that have been encountered. Ask how the

references mitigated the challenges.

Analysis

Population health management (PHM) is one of the top priorities of healthcare delivery

organizations (HDOs). It is a part of almost every senior leadership conversation,

particularly in the U.S., but also globally. PHM is viewed as a best practice for delivering

care, and it is synonymous in the U.S. with the adoption of value-based payment models.

It has become the de facto principle underlying healthcare transformation. Gartner has

been reporting for several years that this is the biggest shift in hospital operations in the

past 60 years. PHM is dependent upon information technology to enable a new set of

capabilities in analytics (e.g., real-time, situational and contextually aware), care

management and coordination, and patient engagement.

Gartner's "Population Health Management Maturity Model, Version 2.0, Lays Out a Future

Path for Healthcare Providers" presents a framework for understanding the role of

technology in supporting population health management. Gartner has found, through its

discussions with clients, that regardless of the vendor, implementing next-generation

analytics and population health management capabilities is tough and requires massive

organizational commitment. Organizational readiness, especially clinical alignment

around the goals, is equally important as the technology partner. Our framework suggests

not only the technology requirements, but the holistic framework customers should press

vendors to partner in.

Gartner, Inc. | G00311356 Page 2 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

The vendor landscape for population health solutions has been a confusing mix. Vendors

jockeying for position have been redefining their solution scopes, upgrading their

platforms (or repositioning based on the hot new term) and often merging or getting

bought. This has resulted in cautious procurement and created tension between a growing

urgency and need for the HDO CIO to get a solution in place, and the available choices.

One factor in this has been the power of the megasuite vendors (such as Allscripts,

athenahealth, Cerner and Epic) and the availability (or lack of) of a viable solution from

them. PHM solutions within the megasuite vendors have matured more slowly than some

of the early entrants into the market — such as Health Catalyst or Philips Wellcentive.

Time will tell whether their lagging pace was prudent in an evolving market or whether the

delay puts them at a strategic disadvantage as others capture market share. There is a

very broad array of stand-alone specialty solutions in the market, as shown in Gartner's

"Market Guide for Healthcare Provider Population Health Management Platforms." In total,

26 vendors are profiled in the Market Guide, and it represents only a fraction of the

saturated market. Buyers are looking for a population health management vendor that

has a solid foundation of data integration, analytics, functionality for care management

and coordination, performance management, and patient engagement (see "Gartner

Population Health Management Framework for Healthcare CIOs").

Gartner differentiates the megasuites from the specialty/stand-alone vendors as follows:

In addition to the EHR, healthcare enterprise megasuite vendors provide core

functionality to meet the business demands of patient access, revenue cycle

management, basic analytics, and reporting across ambulatory and hospital

settings. These products meet most, but not all, of an HDO's software needs (for

example, few include ERP, supply chain function, CRM, advanced analytics,

professional credentialing, or a regulatory training and compliance package as part

of their overall portfolio). We include Allscripts, Cerner, Epic, Meditech and a number

of others in the megasuite category.

Gartner, Inc. | G00311356 Page 3 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Despite the abundance of solutions available, many HDO CIOs have waited to see if their

megasuite vendor's solution would mature and become a viable option. Common thinking

was this would ease integration and workflow challenges, and be more palatable for

clinician adoption (the familiarity of working on a common platform). In general, the

population health management solutions market has suffered from prolonged buying

cycles based on the above and other factors. These include the impact of policy

uncertainty, new budget constraints and fears, and the "lazy loyalists" effect (see

"Healthcare Provider CIOs Should Avoid the Four Major Risks of Megasuite Vendor 'Lazy

Loyalty'"). The wait over the past 12 months has seen significant advancement in the

population health and analytics capabilities offered by the megasuite vendors. Their

solutions have become more competitive as they catch up and provide comparable

functionality as their stand-alone competitors. Product roadmaps have caught up with the

specialty vendors (whose products have also matured), and the question being asked by

CIOs and population health leadership is "Can they meet my population health and

analytic requirements?"

Investment in a population health management solution is a critical decision that will

influence the HDO's operations and clinical delivery for years to come. In essence, since

population health becomes the organizing principle for the HDO, the population health

solution becomes pivotal to the HDO's enterprise architecture. Evaluating the options can

be daunting. The key considerations when preparing to evaluate your megasuite and

specialty vendors are detailed in Note 1.

Epic Population Health Management Capability Overview and Assessment

CIOs can use the information below to help craft their review and assessment of Epic's

Healthy Planet product. The assessment focuses strictly on the features and functions of

Healthy Planet and is not a comparison to other population health management

solutions.

Capability Overview

For the purposes of this deep dive, we are focusing on the Epic Healthy Planet solution.

The product description provided to Gartner by Epic for this solution is as follows:

Healthy Planet is a vendor-neutral population health management and accountable

care platform that collects patient data from a wide range of sources — including

different electronic health records as well as lab, pharmacy, device, satisfaction,

quality, socioeconomic, preadjudicated and adjudicated claims, and cost information

sources — to provide organizations with a central data repository for insight-driven

analysis, reporting and population health management.

Gartner, Inc. | G00311356 Page 4 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Healthy Planet combines analytics with care management, patient and provider

engagement, clinical intervention, virtual care, performance benchmarking and

health information exchange capabilities to identify high-risk patients, connect with

external organizations, engage a patient's entire care team, facilitate more

coordinated care, boost preventive care participation, improve clinical outcomes

across an entire health network, and lower costs.

Healthy Planet is designed to help manage and orchestrate a more collaborative,

value-based care delivery model across the full spectrum of healthcare stakeholders

serving your patients.

Healthy Planet is offered as a locally hosted solution (either as part of a customer's Epic

EHR deployment or as a stand-alone suite) or a vendor-hosted option known as Healthy

Planet Constellation. Regardless of the deployment model, Healthy Planet includes:

■ Chronicles, the healthcare-optimized operational database at the heart of all Epic's

applications

■ Caboodle data warehouse, a flexible and extensible warehouse for Epic, non-Epic

EHR and other data

In addition to loading data to the data warehouse (SQL Server; used most often for

analytics-focused projects), Healthy Planet is an open platform that helps organizations

incorporate data in the formats they need. Options include the following:

■ C-CDA loads via the Care Everywhere interoperability platform bring in patients' and

members' records and other clinical data.

■ HL7 interfaces are used for standards-based exchange with additional systems for

demographics, event notifications, lab data, results and more.

■ X12 837 interfaces bring in preadjudicated claims from independent practices,

billing systems and clearinghouses.

■ The Stargate flat file utility automates receiving, processing, and filing data from

other systems that might not support relevant HL7 or C-CDA exchange capabilities.

Healthy Planet's analytics library includes a metrics framework with:

■ More than 1,400 metrics

Gartner, Inc. | G00311356 Page 5 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

■ Population registries

■ Care gaps

■ Reports/dashboards

■ Cost and utilization analytics

■ Variation analytics

■ Variation and leakage analysis tools, which help identify opportunities for reducing

cost and keeping care in-network

■ Predictive analytics

Epic noted the following as part of its product direction and strategic roadmap:

■ A cognitive computing platform that runs machine learning and advanced analytics

on structured and unstructured data to deliver insights at the point of care

■ Expanded support for behavioral health and social and community care to unify care

professionals across the continuum and support holistic care management outside

the traditional healthcare walls

■ Personalizing medicine through genomics advances, including integrating genomics

in analytics and care management tools to better understand and predict population

health risks

■ Machine learning to help guide care managers and clinicians through workflows

more efficiently and automatically suggest and queue up next steps

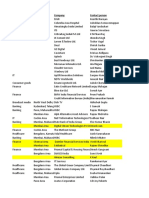

Capability Assessment

The capability assessment is a high-level analysis of strengths, weakness, opportunities

and threats of the Healthy Planet solution (see Figure 1). It is intended to help CIOs better

understand the viability of the solution and formulate the questions to ask Epic when

evaluating its product. The opinions below are based on formal customer interviews

conducted in mid-2017, a roundtable discussion conducted at Gartner's Data and

Analytics Summit in March 2017, various Epic vendor briefings, and Gartner interactions

with clients via inquiry calls.

Gartner, Inc. | G00311356 Page 6 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Figure 1. Healthy Planet SWOT Assessment Summary

Source: Gartner (November 2017)

Epic has a very loyal customer base. Epic customers are happy with Healthy Planet and

are committed to the ongoing development of the roadmap and vision. Customers are

seeing Epic rapidly catch up in areas that had been weaker, such as analytics and data

integration. There is also excitement around new features such as Healthy Planet Link,

which provides an organization the opportunity to share analytics with its partners. As

with any population health management platform, Gartner believes success is not entirely

dependent on the technology platform selected, but also on the organizational leadership

and cultural process changes that are needed to effectively use the capabilities the

product offers. Epic customers also echo this. Lessons learned from early adopters note

the need for strong leadership and governance, strategic direction and a clear roadmap.

Healthy Planet has demonstrated healthy year-over-year growth in customers live on the

platform. The biggest strength of the platform is the population healthcare management

and coordination capabilities being tightly integrated directly into the clinical workflows.

Epic is also providing customers with good technical support and guidance in the arduous

process of integrating claims data into the data warehouse.

The primary weaknesses we note are around non-Epic data integration and analytics.

Some customers are choosing to leverage other industry-leading analytic solutions as an

interim, but are very optimistic that Epic will catch up.

Gartner, Inc. | G00311356 Page 7 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Strengths

■ Care Management and Coordination (Including Registries): Epic's Healthy Planet

care management and coordination functionality stands out as the leading product

strength — particularly when working within an Epic EHR environment. Customers

repeatedly cited the seamless ability for providers to perform population

management activities, view the patient's longitudinal record, and retrieve relevant

data and information within their native workflow. This was noted as a major

contributor to adoption and end-user satisfaction. Customers are highly enthusiastic

about the ability to perform disease management at multiple levels of licenses and

competencies, oversee transitions of care, and track patients across the entire

spectrum. The registries in particular were noted as easy to use and tightly

integrated. Other features of the registries noted by customers as helping to manage

patient populations and risk include:

■ Flexibility to create custom registries

■ Embedded reports, including work lists and risk scores

■ Tools for performing bulk activities or broadcasting, such as ordering and

communications

It's hard to completely isolate Healthy Planet from other Epic tools. Customers also

noted that, through additional capabilities offered by Epic (such as Epic Connect,

Care Everywhere and Happy Together), a solid network of interoperability is created

across providers and patients that creates better provider alignment, as well as

provider/patient alignment. Documentation and data capture standards are also

created across the entire platform, providing for easy clinical use and adoption. This

is, of course, if you stay within the Epic family of products. It was clear from all

customers that Gartner spoke with that the ability to transition the ambulatory

workflow into a population health paradigm works nicely. Care management

workflow is being adopted by all tiers of providers, and there is good relevant insight

provided from the registry reporting.

Gartner, Inc. | G00311356 Page 8 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

■ Clinical, Claims and Internet of Things (IoT) Data Integration: Customers are very

pleased with the facilitation Epic is providing with the arduous task of integrating

clinical and claims data into the Caboodle data warehouse. Integrating claims data

is not an easy process for anyone, and considerable time is spent working with

difficult files and translating them into value. Epic's ability to help accelerate the

process, using standard connectors for government payers, is recognized by

customers as a strength. Claims data from commercial payer is more challenging,

but Epic works directly with the payers to help ease this.

One customer noted that any challenges with the payer data is based entirely on the

data the payers provide — not because of any limitations with Healthy Planet. The

same customer also noted that new data competencies are needed. The

methodologies and concepts needed to develop the data — from loading the data to

transforming it into actionable information — require new skills and thinking, and

new education. Gartner has observed that those doing well don't expect perfection

and fully understand the significance of this task. Epic appears to be a solid partner

in this process.

It's also interesting to note that several customers specifically commented that they

are integrating IoT data and seeing value from it. This is especially important as

population health management strives toward solutions to allow for remote

monitoring of remote devices as care management solutions advance.

■ Customer Service Model: Healthy Planet implementation teams are said to be very

dedicated and committed to their customers, which translates into very high

customer loyalty and satisfaction. Customers find Epic to be a very good partner,

from implementation through support, evolution and upgrades. That the relationship

is routinely referred to as a "partnership" shows that the personalized support model

is not only valued, but relied on and depended on.

Other Strengths Noted

■ MyChart: Epic's MyChart was said to be a great asset for population health

management. This Epic tool has been around long before population health

management and Healthy Planet, but the tight integration now enhances the

customer experience and the provider/patient relationship, and facilitates many

population health management demands. Patient engagement has become an

integrated part of the equation of PHM.

Gartner, Inc. | G00311356 Page 9 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

■ Developer's Certification and Education Program: Customers find Healthy Planet to

be highly flexible and configurable, and the degree of reliance on Epic to do

customizations can be at the discretion of the customer. HDOs can develop the

competency internally if that's the direction the HDO wants to go. Epic provides a

certification and education program that provides developers with what they need to

customize as needed.

■ Vision and Roadmap: Customers like the direction Epic is articulating with Healthy

Planet — which includes deeper and more advanced analytics, as well as additional

data integration points across the network and continuum of care. Customers have

full confidence in Epic's ability to execute on this vision. Even those customers who

were using third-party analytic solutions made it perfectly clear they expected it to be

only a two- to three-year interim solution. In some cases, there were plans in place —

as they were implementing the third-party solution — on how they planned to sunset

the solution once it was no longer needed.

Weaknesses

Epic clients noted the following weaknesses of Healthy Planet:

Gartner, Inc. | G00311356 Page 10 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

■ Data Integration and Analytics: Epic's data integration challenges will limit its

effectiveness. This was repeatedly noted as not complete and not meeting the needs

of rapidly forming clinically integrated networks — of which most HDOs are part of

under some partnership or collaborative. There are two main issues that surfaced,

and they are tightly interdependent:

■ Integration of Non-Epic Clinical Data: Data exchange and integration of non-

native Epic data is simply insufficient. The C-CDA format does not provide the

data in a consumable format. Customers are working with other vendors that

have better data integration capabilities to compensate for this gap. It is

especially apparent with the HDOs that are part of extensive clinically

integrated networks, which have more disparate EHRs to work with and

complex data requirements.

■ Analytics: Just like data integration, many customers are working outside

Healthy Planet. They are using their own enterprise data warehouses or third-

party solutions to integrate and process the data, perform analytic routines and

then bring the results back into Healthy Planet/the Caboodle data warehouse.

They are often using Tableau, which seems to work very nicely with Epic.

Similar to above, many of these clients are those working with fairly large and

sophisticated clinical integrated networks (CINs) with multiple spokes and

hubs. It's not necessarily uncommon or poor strategy to have the primary

analytics environment be a vendor different than the EHR. However, this is

noted as a weakness because customers are specifically using the interim

solution to compensate for what they would prefer to have Epic provide.

In these two areas, customers are expecting more, as they should, from Epic. Without

broader strength in data integration and analytics, Healthy Planet will be hard-

pressed to deliver actual results and ROI beyond Phase 1 deployment. Gartner

expects product maturing of Healthy Planet Link (a web-based portal distributing

analytic dashboards, risk scores and gaps-in-care reports across the CIN) and the

Happy Together framework (bringing together the longitudinal patient record) will

close these gaps.

Gartner, Inc. | G00311356 Page 11 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

■ Population Health Expertise: A surprising number of clients Gartner spoke with

noted that the young implementation teams have limited population health/industry

experience. Although they are excellent at implementing Epic, they have less

experience helping to use the software to change behavior and outcomes. In

fairness, population health is young enough as a discipline for there to be limited

years of experience. However, customers definitely indicated a desire for more

seasoned industry expertise in making sure the potential of the technology is

achieved and in helping to transition to a population health model. This is entirely

consistent with industry rumbles around value and value realization. Several

customers noted that the biggest challenges in implementing population health

platforms are:

■ Getting users to understand the potential

■ Adjusting to all the change that goes with the technology

■ Making sure users are using it in a way that translates into benefits

■ Vendor-Agnostic Platform: It is unclear how well Epic performs as a stand-alone,

vendor-agnostic population health solution, as Gartner did not have the opportunity

to hear from any non-Epic EHR customers using Healthy Planet. Epic has indicated

to Gartner that there are a few non-Epic sites about to either begin implementation or

go live on Healthy Planet. The integration with the Epic EHR and Epic family of

products stands out as a key product strength. Lack of integration with non-Epic

platforms is a key weakness and raises the question of how well this will work in a

non-Epic environment.

Opportunities

Weaknesses can translate into opportunities — opportunities for Epic to enhance its

product, and opportunities for the CIOs (buyers) to press Epic on how it is addressing the

concerns Gartner has noted. Epic can capitalize on its stellar customer relationship and

continue to actively listen and address the concerns. The product roadmap and vision

articulated for Healthy Planet is entirely consistent with feedback we received on gaps,

and the roadmap resonates very nicely with customers. Gartner sees the following as

significant opportunities for Epic to retain customer confidence in Healthy Planet as its

long-term and complete population health solution:

Gartner, Inc. | G00311356 Page 12 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

■ Value Realization: Epic has an opportunity to augment customer service teams to

support true value realization. This includes helping clients navigate the impact of

risk-bearing contracts and the transition from fee-for-service operating models to

population-based models using the tools, data, data integration and analytics that

Healthy Planet offers. Customers specifically noted the need for additional

professional services to help with applying analytics effectively to drive change.

They would love to see Epic become their partner in this piece of the journey as they

realize that:

■ Measures of success are rapidly changing.

■ There are increasingly more stakes on the table and impact of success or

failure is more profound.

■ Achieving success requires massive cultural, organizational and process

reorientation. Epic clients are looking for industry expertise.

With Epic's massive customer base, it should have the industry lens to develop best

practices and critical success factors to guide and coach its clients.

■ Data Integration and Analytics: This has been noted repeatedly throughout this

research, and it is simple. Epic needs to continue focusing resources in this area and

catch up. There is a need for more standard content and reporting, as well as risk-

based analytics. One customer noted that this needs to happen quickly, before they

need to rely permanently on a third-party solution (a noted trend/concern among

Epic clients).

Epic customers want to see more integrated data across the continuum and better

usable integration of non-Epic EHR data. Epic's product roadmap and vision include

broader connections across evolving community care networks, using features like

Care Everywhere. Customers with clinically integrated networks, and even super CINs

expanding the network beyond their own immediate partnerships, are looking for

Epic to deliver augmented integration capabilities sooner rather than later.

Gartner, Inc. | G00311356 Page 13 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Gartner did speak with Epic about the integration and analytics concerns. The

response was that many of the clients we spoke to were very early adopters, which,

indeed had a less mature analytics foundation. Newer implementations come with

better capabilities, and older clients will be supported in the transition. Epic's

response included a commitment to Healthy Planet as "vendor-neutral, and readily

incorporates standards-based-exchanges into both our clinical and analytical tools.

As a result, Healthy Planet can ingest, without additional mapping, the discrete C-

CDA data sent from non-Epic EHRs as long as that EHR abides by governmental

standards for interoperability. The major barrier to interoperability in this case is the

capabilities of the source system. To the extent that critical information lives outside

of interoperable systems, we employ alternative approaches — 837 preadjudicated

claims loads, postadjudicated claims loads, ADT interfaces and HL7 interfaces — to

complete the clinical and financial profile of target populations."

■ Healthy Planet as a Stand-Alone Product: If Epic wants to capitalize on a very active

buying market outside of its own loyal customer base, it needs to do it quickly. There

is currently limited evidence on how well Healthy Planet functions as a stand-alone,

and this will deter buyers because there are plenty of mature, stable and proven

population health management platforms on the market. To compete with non-Epic

sites, Healthy Planet needs a high-profile non-Epic implementation.

Threats

Threats recognize factors that HDO CIOs need to consider about Epic's market position,

stability and ability to deliver.

Epic's biggest threat is itself. Failure to deliver on data integration and a viable stand-

alone solution will continue to perpetuate the isolated universe reputation. Gartner's

perception is that most clients have very homogeneous Epic environments, and that this is

what creates the tight integration and seamless workflows. Other solutions have proven

they can do the same, but with much better integration capabilities of data across all

leading industry EHRs, thus making the data more useful and the analytics more robust.

Competition still rules in the PHM market space, and there are many viable solutions

competing to get critical mass of customers and scale. It is a hotly competitive market

with some very credible population health management solutions that are in direct

competition with Healthy Planet and are growing market share. Although it seems

intuitive, there is actually limited evidence that buying a product native to the EHR is

necessarily less risky and easier to implement than a stand-alone solution.

Gartner, Inc. | G00311356 Page 14 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Conclusion

Gartner finds that Epic's Healthy Planet has matured considerably in the past 18 months.

It is growing its client base (albeit mostly through existing Epic customers), and

customers interviewed were very consistent in their feedback and satisfaction with the

product. There is strong consensus that clinical workflow for population health is intuitive

within the Epic product suite, and consensus that data integration of non-Epic clinical

data still needs some work. The native integration with Epic does seem to be a real

significant benefit, helping to ease the transition to new care delivery models and manage

at-risk populations. Concrete and tangible ROI for population health tools is still hard to

measure, but customers suggest they are achieving targets and seeing value.

The reality is that, whether it is Epic's Healthy Planet or another product, implementing a

population health platform and lifting it to productivity is tough work. And while Gartner

has not seen substantial evidence that there is marked benefit leveraging the PHM from

your EHR (after all, there are several leading PHM tools on the market that work well with

Epic), Healthy Planet is providing customers with an initial set of tools that are getting

good reviews. There is also ample confidence from a very satisfied customer base that

Epic will continue to enhance Healthy Planet features and close gaps.

Evidence

The document is our opinion on the product based on the following sources of

information:

■ Client interviews conducted with Memorial Healthcare System, Oschner Medical

Center, Bon Secours Health System and Novant Health

■ Gartner focus groups at the 2017 Data and Analytics Summit, Grapevine, Texas

■ General client inquiry calls and discussions

Gartner, Inc. | G00311356 Page 15 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Note 1

Evaluation Considerations When Evaluating Your Megasuite

and/or Specialty Vendors for Population Health Management

■ Program Design: No decision on a population health solution should be made until

the HDO has established its population health management program's design and

governance. As detailed in "Gartner Population Health Management Framework for

Healthcare CIOs," program designing and governance include establishing the scope

of the program, establishing policies and processes, and defining driving business

requirements for technology decisions. These conversations are necessary to create

the right requirements and expectations from a technology solution and partner.

■ Data Integration: This is rapidly becoming the most important, and daunting,

element of the population health and overall information architecture. The HDO

needs to have a good handle on source and targets for data and analytics, an

integration mapping of sorts that navigates the path between the many sources of

data and the value creating analytics and applications uses. This is especially

needed across the care management and coordination workflow areas. Have this

data integration picture ready for vendor discussions.

■ Data Governance and Quality: Programs must be established to ensure the integrity

of the data. Data integration and quality issues will be one thing that is certain to

lead to cost overruns, disappointed stakeholders and a load of work that wasn't

expected. The most complex aspect of this is governance and standardization of

data sources across multiple, nonowned, affiliated providers.

■ Change Management: Implementing population health management and the

transition to value-based care is tough. It demands introducing new clinical and care

coordination processes that will disrupt entrenched behaviors, coordinating care

across often disparate affiliates and systems, and engaging the toughest patients

and motivating them to take better care of their health. The change management

challenges are very real. An internal team to manage the change is critical, but

vendors can also be key strategic partners in this process.

■ Outcomes: Tightly tied to program design is having clear project goals and

outcomes. These are very often coupled with the very specific, discrete goals HDOs

have under value-based payment models.

Recommended by the Author

Gartner, Inc. | G00311356 Page 16 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

Some documents may not be available as part of your current Gartner subscription.

An Overview of Healthcare Interoperability and Key Considerations for Upcoming

Challenges

Healthcare Provider CIOs Need to Stay on Course and Procure a Population Health

Solution

Gartner Population Health Management Framework for Healthcare CIOs

Population Health Management Maturity Model, Version 2.0, Lays Out a Future Path for

Healthcare Providers

Market Guide for Healthcare Provider Population Health Management Platforms

© 2022 Gartner, Inc. and/or its affiliates. All rights reserved. Gartner is a registered trademark of

Gartner, Inc. and its affiliates. This publication may not be reproduced or distributed in any form

without Gartner's prior written permission. It consists of the opinions of Gartner's research

organization, which should not be construed as statements of fact. While the information contained in

this publication has been obtained from sources believed to be reliable, Gartner disclaims all warranties

as to the accuracy, completeness or adequacy of such information. Although Gartner research may

address legal and financial issues, Gartner does not provide legal or investment advice and its research

should not be construed or used as such. Your access and use of this publication are governed by

Gartner’s Usage Policy. Gartner prides itself on its reputation for independence and objectivity. Its

research is produced independently by its research organization without input or influence from any

third party. For further information, see "Guiding Principles on Independence and Objectivity."

Gartner, Inc. | G00311356 Page 17 of 17

This research note is restricted to the personal use of heberto.azuarasa@anahuac.mx.

You might also like

- Accenture Life Sciences OverviewDocument20 pagesAccenture Life Sciences OverviewBobAdler50% (2)

- ISM 6404 Module 7Document10 pagesISM 6404 Module 7Noemer OrsolinoNo ratings yet

- Millennium PharmaceuticalsDocument16 pagesMillennium Pharmaceuticalskaushal_bishtNo ratings yet

- CIO Leads - DelDocument41 pagesCIO Leads - DelNithin N Nayak38% (8)

- Enlc 553 Strategic Business ProposalDocument18 pagesEnlc 553 Strategic Business Proposalapi-459703752No ratings yet

- Health Analytics PWCDocument40 pagesHealth Analytics PWCsandeep_prasad17No ratings yet

- Accenture Pharmaceuticals Supply Chain AnalyticsDocument5 pagesAccenture Pharmaceuticals Supply Chain AnalyticsChetan MehtaNo ratings yet

- Guidelines Conducting Stakeholder AnalysisDocument42 pagesGuidelines Conducting Stakeholder AnalysisDavid Sigalingging100% (1)

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument109 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionAnoo IamanidzeNo ratings yet

- Hype Cycle For Healthcare ProviderDocument36 pagesHype Cycle For Healthcare Providershenero1No ratings yet

- Executive InsightDocument77 pagesExecutive InsightWaltSaylorNo ratings yet

- Cortana Analytics in Healthcare White PaperDocument16 pagesCortana Analytics in Healthcare White PaperDeyverson Costa100% (1)

- Outsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessFrom EverandOutsourcing Technology In the Healthcare Industry: In Depth Research to Protect the Security, Technology, and Profitability of Your BusinessNo ratings yet

- Case Study On InnovaccerDocument3 pagesCase Study On InnovaccerAmarnath DixitNo ratings yet

- Deloite Pharma and Connected PatientDocument40 pagesDeloite Pharma and Connected PatientBobAdlerNo ratings yet

- Banner HealthDocument10 pagesBanner HealthPritam DasNo ratings yet

- The Big Unlock: Harnessing Data and Growing Digital Health Businesses in a Value-Based Care EraFrom EverandThe Big Unlock: Harnessing Data and Growing Digital Health Businesses in a Value-Based Care EraNo ratings yet

- DI Health Plan of TomorrowDocument24 pagesDI Health Plan of Tomorrowmaja basketballclubNo ratings yet

- SālsLetterV3 3 PDFDocument8 pagesSālsLetterV3 3 PDFMuhammad Tariq KhanNo ratings yet

- Transforming How Pharma Delivers ValueDocument11 pagesTransforming How Pharma Delivers ValueDr-Mohammed FaridNo ratings yet

- VP Client Services Healthcare in Greater Chicago IL Resume Marybeth ReganDocument5 pagesVP Client Services Healthcare in Greater Chicago IL Resume Marybeth ReganMarybeth ReganNo ratings yet

- Getting The Dose Right: A Digital Prescription For The Pharma IndustryDocument8 pagesGetting The Dose Right: A Digital Prescription For The Pharma IndustryVinita VasanthNo ratings yet

- Case Innova 2022Document17 pagesCase Innova 2022Aashay JainNo ratings yet

- Ethics in Marketing Literature ReviewDocument7 pagesEthics in Marketing Literature Revieweryhlxwgf100% (1)

- The Future of Pharma Is DigitalDocument10 pagesThe Future of Pharma Is DigitalDavid HoffmannNo ratings yet

- Commercial Analytics and It's Defining Role in Pharma MarketingDocument8 pagesCommercial Analytics and It's Defining Role in Pharma MarketingKanika VermaNo ratings yet

- Marketing Research in Health Services Planning: Model: SoughtDocument11 pagesMarketing Research in Health Services Planning: Model: SoughtchokkakNo ratings yet

- HIM Leaders Steer Workforce Through Times of Transformation: For Immediate Release For More Information, Please ContactDocument2 pagesHIM Leaders Steer Workforce Through Times of Transformation: For Immediate Release For More Information, Please ContactUmi Khoirun NNo ratings yet

- Imprortance, Research Methdology, Objectives and Hypothesis: Chapter - IiDocument23 pagesImprortance, Research Methdology, Objectives and Hypothesis: Chapter - Iisacred54No ratings yet

- How Medical Affairs Teams Can Optimize Product Life CycleDocument6 pagesHow Medical Affairs Teams Can Optimize Product Life CycleAmos JacobNo ratings yet

- HIMSS EHR Reporting Program RFI Comment LetterDocument9 pagesHIMSS EHR Reporting Program RFI Comment LetterSpit FireNo ratings yet

- Jvion Award Write Up FinalDocument17 pagesJvion Award Write Up FinalNoo IqNo ratings yet

- Analytics in Healthcare and Online Retail: Business Analytics Group PresentationDocument22 pagesAnalytics in Healthcare and Online Retail: Business Analytics Group PresentationGayathry SureshNo ratings yet

- How Pharma Can Win in A Digital World FinalDocument9 pagesHow Pharma Can Win in A Digital World FinalRaj Kumar JoshiNo ratings yet

- Mobile Health Information Technology and Patient Care A Literature Review and AnalysisDocument4 pagesMobile Health Information Technology and Patient Care A Literature Review and AnalysisafdtfgkbvNo ratings yet

- Business Proposal FinalDocument19 pagesBusiness Proposal Finalapi-408489180No ratings yet

- Roundup of Healthcare Payer Research, 3Q16: AnalysisDocument9 pagesRoundup of Healthcare Payer Research, 3Q16: AnalysisArnabNo ratings yet

- Herrmann Et Al. - 2018 - Digital Transformation and Disruption of The HealtDocument8 pagesHerrmann Et Al. - 2018 - Digital Transformation and Disruption of The HealtRosliana MahardhikaNo ratings yet

- Technology Must Haves For Accountable Care OrganizationsDocument1 pageTechnology Must Haves For Accountable Care OrganizationsiHT²No ratings yet

- Strategy ConsultingDocument5 pagesStrategy Consultinganil reddyNo ratings yet

- Policy Suggestions To Obama Transition TeamDocument3 pagesPolicy Suggestions To Obama Transition Teamhuffpostfund100% (1)

- SAP For Life Sciences For The Pharmaceutical IndustryDocument16 pagesSAP For Life Sciences For The Pharmaceutical IndustryPrathamesh BhingardeNo ratings yet

- 4 AI in HealthcareDocument3 pages4 AI in Healthcaredipannita_roy100% (1)

- Research Paper On Health Care CostsDocument6 pagesResearch Paper On Health Care Costsgw1nm9nb100% (1)

- Ge Healthcare ThesisDocument4 pagesGe Healthcare Thesisfc33r464100% (2)

- Big Data AssignmentDocument9 pagesBig Data AssignmentKingstone JosephNo ratings yet

- OptumDocument12 pagesOptumantonettereynoldsNo ratings yet

- Biopharma Path To Value With Generative AiDocument12 pagesBiopharma Path To Value With Generative AidominiqueNo ratings yet

- BI2 AgendaDocument15 pagesBI2 AgendaPartha MitraNo ratings yet

- Accenture Shaping Future PharmaceuticalDocument7 pagesAccenture Shaping Future Pharmaceuticalvikramhraval1No ratings yet

- Week 2 Summary OldDocument5 pagesWeek 2 Summary OldKharryunna McCloudNo ratings yet

- Pubhealthrep00132 0013Document12 pagesPubhealthrep00132 0013mariano cardinNo ratings yet

- The New Four P of Pharma MarketDocument7 pagesThe New Four P of Pharma MarketRashmi PatilNo ratings yet

- ch1 PDFDocument18 pagesch1 PDFCliffordBeniNo ratings yet

- How Pharma Analytics Is Helping Pharma Companies Stay Ahead in The GameDocument2 pagesHow Pharma Analytics Is Helping Pharma Companies Stay Ahead in The GameRagavendra RagsNo ratings yet

- 1b - McKinsey - How-Pharma-Can-Accelerate-Business-Impact-From-Advanced-Analytics PDFDocument10 pages1b - McKinsey - How-Pharma-Can-Accelerate-Business-Impact-From-Advanced-Analytics PDFDinesh PillaipakkamnattNo ratings yet

- Deepika SharmaDocument19 pagesDeepika Sharmasyyedadnan638875No ratings yet

- Hospital Administration Research PapersDocument6 pagesHospital Administration Research Papersafmcbmoag100% (1)

- Assignment - 2 ISHA JAINDocument4 pagesAssignment - 2 ISHA JAINIsha JainNo ratings yet

- Innovators Will Be Heroes: Shifting The Paradigm From A Focus On Data To Outcomes Through Cloud-Based Digital Health PlatformsDocument12 pagesInnovators Will Be Heroes: Shifting The Paradigm From A Focus On Data To Outcomes Through Cloud-Based Digital Health Platformsrajchanda77No ratings yet

- Five Porter Analysis Excel SheetDocument19 pagesFive Porter Analysis Excel SheetMuhammad WaqarNo ratings yet

- 21 Secrets Every IT Manager MUST KnowDocument72 pages21 Secrets Every IT Manager MUST KnowgscudjoeNo ratings yet

- ASU Digital TransformationDocument12 pagesASU Digital Transformationaseel291aNo ratings yet

- Test Bank For Management Information Systems 6th Edition OzDocument8 pagesTest Bank For Management Information Systems 6th Edition OzAgnes Rhodes100% (40)

- The Soc Hiring HandbookDocument28 pagesThe Soc Hiring HandbookForense OrlandoNo ratings yet

- Ipremier AssignmentDocument4 pagesIpremier AssignmentVedant SachdevaNo ratings yet

- RLW03005USENDocument30 pagesRLW03005USENAlina DanciuNo ratings yet

- Database - CRM UploadDocument24 pagesDatabase - CRM Uploadterraeagle.sophiyaNo ratings yet

- Driving Innovation Through Business Relationship ManagementDocument6 pagesDriving Innovation Through Business Relationship ManagementCognizantNo ratings yet

- Mayuri (27081) SIP Report Symphony SummitAIDocument37 pagesMayuri (27081) SIP Report Symphony SummitAIMayuri KumariNo ratings yet

- 2023 Cio Agenda Midsize Enterprises InfographicDocument1 page2023 Cio Agenda Midsize Enterprises InfographicthauhoNo ratings yet

- 2016cioagenda 151210211845Document25 pages2016cioagenda 151210211845LINKIN_PARK_22No ratings yet

- TRIDENT CIO - SrinivasDuttPallampati PDFDocument3 pagesTRIDENT CIO - SrinivasDuttPallampati PDFKPNo ratings yet

- Data Privacy CompilationDocument239 pagesData Privacy CompilationJan Oliver YaresNo ratings yet

- Project Manager Vs Project CoordDocument5 pagesProject Manager Vs Project CoordAnonymous OuY6oAMggxNo ratings yet

- Beyond-Profit Business Models: Third-Party Funded ModelsDocument11 pagesBeyond-Profit Business Models: Third-Party Funded ModelsSeminarski RadoviNo ratings yet

- Ey Understanding The Cybersecurity PDFDocument7 pagesEy Understanding The Cybersecurity PDFMaya MNo ratings yet

- Aus Gov JobsDocument541 pagesAus Gov JobsdodosawNo ratings yet

- Ebook Mit Cio Generative Ai ReportDocument24 pagesEbook Mit Cio Generative Ai ReportKimie OuYangNo ratings yet

- Anaplan Leaders ProfileDocument11 pagesAnaplan Leaders ProfilepalmkodokNo ratings yet

- The Emerging Role of The CISODocument7 pagesThe Emerging Role of The CISOJuan ParejasNo ratings yet

- CIS 498 Project Deliverable 1 - Project Plan Inception - Complete SolutionDocument2 pagesCIS 498 Project Deliverable 1 - Project Plan Inception - Complete Solutionteacher.theacestud0% (3)

- Volvo It Running It As A Bus 235742Document17 pagesVolvo It Running It As A Bus 235742Juan PerezNo ratings yet

- CIO vs. CTO - What's The Difference - Dream. DevelopDocument3 pagesCIO vs. CTO - What's The Difference - Dream. DevelopJayTeeS6No ratings yet

- CEO CIO Global Project Development in ST Petersburg FL Resume Jon NewsomeDocument9 pagesCEO CIO Global Project Development in ST Petersburg FL Resume Jon NewsomeJonNewsomeNo ratings yet

- In A Centralized Ownership ModelDocument5 pagesIn A Centralized Ownership Modelreader4freeNo ratings yet

- Bangladesh ICT Roadmap (Draft) - 200809Document79 pagesBangladesh ICT Roadmap (Draft) - 200809cleio5No ratings yet

- Gartner Symposium India Cio Guide Ai 2018Document13 pagesGartner Symposium India Cio Guide Ai 2018dhanoj6522No ratings yet

- U.S. Department of Defense Telework PolicyDocument25 pagesU.S. Department of Defense Telework PolicyFedScoop100% (1)