Professional Documents

Culture Documents

Note 4

Note 4

Uploaded by

Naresh Budhaair0 ratings0% found this document useful (0 votes)

6 views1 pageThis document summarizes three accounting scandals:

1) The Global Crossing scandal of 2002 involved accounting fraud, insider trading, and hiding underperforming assets which led to the telecommunications company filing for bankruptcy.

2) The Tyco International scandal of 2002 included overstating profits, hiding illegal activities, and executives taking interest-free loans without informing shareholders.

3) The 1896 Kingston Cotton Mill scandal saw the managing director manipulate the company's stock valuation for many years to inflate reported profits, with the auditor relying on management's documentation.

Original Description:

Original Title

note 4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes three accounting scandals:

1) The Global Crossing scandal of 2002 involved accounting fraud, insider trading, and hiding underperforming assets which led to the telecommunications company filing for bankruptcy.

2) The Tyco International scandal of 2002 included overstating profits, hiding illegal activities, and executives taking interest-free loans without informing shareholders.

3) The 1896 Kingston Cotton Mill scandal saw the managing director manipulate the company's stock valuation for many years to inflate reported profits, with the auditor relying on management's documentation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pageNote 4

Note 4

Uploaded by

Naresh BudhaairThis document summarizes three accounting scandals:

1) The Global Crossing scandal of 2002 involved accounting fraud, insider trading, and hiding underperforming assets which led to the telecommunications company filing for bankruptcy.

2) The Tyco International scandal of 2002 included overstating profits, hiding illegal activities, and executives taking interest-free loans without informing shareholders.

3) The 1896 Kingston Cotton Mill scandal saw the managing director manipulate the company's stock valuation for many years to inflate reported profits, with the auditor relying on management's documentation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

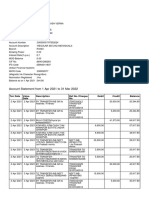

Accoun ng scandals in brief

1. Global crossing scandal

Global Crossing was a telecommunications company founded in 1997

The company began its operations by acquiring existing telecommunications companies and building

networks in various countries.

Connected 27 countries and more than 200 major cities.

It quickly became a major player in the telecommunications industry.

In 1999 Global Crossing: market value balloon to $47 billion out of $450 billion market of

telecommunication industry, despite of course never booking one pro itable year.

Hidden underperforming units & failed deals.

Dot-com bubble burst in 2001, which caused a decline in demand for Global Crossing’s services.

The company was hit by a series of scandals, including accounting fraud, insider trading, and the sale

of underperforming assets. These factors led to the company iling for bankruptcy in 2002.

Dot com bubble burst:

www- world wide web – bug of 19 “99” to 20 “00”, Failure of lots new start-ups in internet &

telecommunication industries, Japan Recession, In lation & interest rate increase- constraint in money

supply.

2. Tyco international scandal

Founded in 1960 by Aurther

R & D service & later start production too & issued IPO

Started working in different sector like electronics, ire & security:- business expanded

Start acquiring small companies & growing rapidly

FS overstated, Overstated pro it, Executives accused of giving interest free loan without

informing shareholders, Hidden illegal activities

Huge loss of 2002

3. Case of Kingston Cotton Mill- 1896

Manipulation by managing director

Value of company’s stock overstated for many years to in late the company’s pro it

Auditor relied on certi icate of stock valuation issued by managers

Led to payment of dividend out of capital

Conclusion of case: “Auditor is a watchdog, not a bloodhound”

Q.N. “Auditor is a watchdog, not a bloodhound” comment

Ans: Hint

Primary objective of audit is to express opinion on inancial statement of entity

Secondary objective of audit is to detect & report misstatement due to fraud or error

Primary responsibility for prevention, detection & correction of misstatement is that of

management & TCWG.

Objective of auditor is not to hunt the misstatement unless there is something arouse

the suspicion regarding to misstatement, also audit may not disclose all misstatement

on FS due to inherent limitations of audit.

Auditor cannot be held liable for non-detection of misstatement if he has conducted

audit with due care as per BPGA.

You might also like

- Accounting Fraud at WorldCom Case Study SolutionDocument8 pagesAccounting Fraud at WorldCom Case Study SolutionKuldip50% (2)

- AF304 - MST - Revision SolutionDocument13 pagesAF304 - MST - Revision SolutionShivneel Naidu67% (3)

- Accounting Scandal of Worldcom ...Document7 pagesAccounting Scandal of Worldcom ...Vikas KambleNo ratings yet

- Worldcom ScamDocument15 pagesWorldcom ScamVishal ZavariNo ratings yet

- Case Study: WorldcomDocument8 pagesCase Study: WorldcomNishant SatamkarNo ratings yet

- Accounting Info - Updated partHDTASTF - RoldanDocument16 pagesAccounting Info - Updated partHDTASTF - RoldanRyan Joseph Agluba DimacaliNo ratings yet

- Fraud ReportDocument5 pagesFraud ReportGiang DuongNo ratings yet

- WORLDCOM SCANDAL Audit PresentationDocument11 pagesWORLDCOM SCANDAL Audit PresentationDeepanshu 241 KhannaNo ratings yet

- World Com Case Solution: Team: Aziz PremjiDocument12 pagesWorld Com Case Solution: Team: Aziz PremjiKumara RajaNo ratings yet

- Worldcom - Executive Summary Company BackgroundDocument4 pagesWorldcom - Executive Summary Company BackgroundYosafat Hasvandro HadiNo ratings yet

- The Rise and Fall of Worldcom: The World'S Largest Accounting FraudDocument14 pagesThe Rise and Fall of Worldcom: The World'S Largest Accounting FraudkanabaramitNo ratings yet

- Joy of Management Assignment: Presentation On: Why Do Business Organizations Exists?Document14 pagesJoy of Management Assignment: Presentation On: Why Do Business Organizations Exists?Harshit KanchanNo ratings yet

- CASE STUDY - WHAT WENT WRONG-WorldComDocument3 pagesCASE STUDY - WHAT WENT WRONG-WorldComMark Jaypee SantiagoNo ratings yet

- WorldCom Case StudyDocument9 pagesWorldCom Case Studyfrazmaker0% (1)

- World Com ScandalDocument7 pagesWorld Com ScandalAddis FikruNo ratings yet

- Worldcom MakalahDocument17 pagesWorldcom MakalahIcha50% (2)

- Corporate Fraud in WorldComDocument2 pagesCorporate Fraud in WorldCombabachabacoNo ratings yet

- Mfa700 ExamDocument5 pagesMfa700 ExamThomas T.R HokoNo ratings yet

- Corporate ScandalsDocument17 pagesCorporate Scandalsjbum93257No ratings yet

- Major Corporate Scandal in India and AbroadDocument8 pagesMajor Corporate Scandal in India and Abroadsourav panda100% (1)

- Worldcom - WACDocument2 pagesWorldcom - WACAlicia Dawn A. OlimbaNo ratings yet

- Case Study WorldComDocument4 pagesCase Study WorldComMuhammad ZubairNo ratings yet

- Worldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryDocument34 pagesWorldcom Inc.: Case Study On The Most Controversial Fraud in U.S. HistoryEira ShaneNo ratings yet

- Famous Corporate ScandalsDocument21 pagesFamous Corporate Scandalsmehakrotra256No ratings yet

- Creative AccountingDocument5 pagesCreative Accountingvikas_nair_2No ratings yet

- Accounting Fraud and Forensic Investigation: An IntroductionDocument19 pagesAccounting Fraud and Forensic Investigation: An IntroductionLO WANYEENo ratings yet

- Worldcom ScamDocument2 pagesWorldcom ScamSHASHANK MAHESHWARINo ratings yet

- Exam Form: Assignment Exam Time: 3 DaysDocument16 pagesExam Form: Assignment Exam Time: 3 DaysTrang DươngNo ratings yet

- Germic I 1Document52 pagesGermic I 1Raejayne IllesesNo ratings yet

- Nayla Damayanti Wordcom BDocument5 pagesNayla Damayanti Wordcom BPutra PutraaaNo ratings yet

- Real Life Accounting FraudsDocument7 pagesReal Life Accounting Fraudsshaurya.somebodyNo ratings yet

- Accounting Fraud at Worldcom: Chao Wan Id: 109597250Document11 pagesAccounting Fraud at Worldcom: Chao Wan Id: 109597250Insatiable LifeNo ratings yet

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- Acc394 Case#1Document14 pagesAcc394 Case#1Najia NasreenNo ratings yet

- Creative Accounting: Goa Institute of ManagementDocument7 pagesCreative Accounting: Goa Institute of Managementnishan01234No ratings yet

- Report On WorldcomDocument153 pagesReport On WorldcomAhber ShahNo ratings yet

- The Lucent Accouting ScandalDocument15 pagesThe Lucent Accouting ScandalBhagwat BalotNo ratings yet

- C3 - Full Report-LibreDocument25 pagesC3 - Full Report-LibrekelerongNo ratings yet

- 2.8 Some Developments in The Audit MarketDocument7 pages2.8 Some Developments in The Audit MarketHervenni ClaraNo ratings yet

- The Accounting Fraud in WorldComDocument12 pagesThe Accounting Fraud in WorldComsyahirah77100% (1)

- Fraudulent Accounting Records and Faithful Image: The Worldcom CaseDocument5 pagesFraudulent Accounting Records and Faithful Image: The Worldcom CaseCharles WelschbilligNo ratings yet

- Two Audit Failure: Presented by Mohi Uddin M.A.M ShahriarDocument19 pagesTwo Audit Failure: Presented by Mohi Uddin M.A.M ShahriarMahiUddinNo ratings yet

- Satyam ScandalDocument10 pagesSatyam ScandalVidushi PuriNo ratings yet

- Dividend-Paying Stock: Lehman BrothersDocument3 pagesDividend-Paying Stock: Lehman BrothersVangie BandoyNo ratings yet

- Satyam AccountsDocument16 pagesSatyam AccountsvrushaliNo ratings yet

- Crs Report For Congress: Worldcom: The Accounting ScandalDocument6 pagesCrs Report For Congress: Worldcom: The Accounting ScandalMarc Eric RedondoNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- WorldCom Accounting ScandalSummaryDocument6 pagesWorldCom Accounting ScandalSummarysamuel debebeNo ratings yet

- PWC Negligence Over Colonial BankDocument8 pagesPWC Negligence Over Colonial BankPurnima Sidhant BabbarNo ratings yet

- World ComDocument15 pagesWorld Commkg750No ratings yet

- WorldcomDocument10 pagesWorldcomRuhul AminNo ratings yet

- Summary of Audit & Assurance Application Level - Self Test With Immediate AnswerDocument72 pagesSummary of Audit & Assurance Application Level - Self Test With Immediate AnswerIQBAL MAHMUDNo ratings yet

- WorldCom CaseDocument9 pagesWorldCom CaseunjustvexationNo ratings yet

- Germic I 1Document61 pagesGermic I 1adrianmenoza1432No ratings yet

- What Went Wrong?Document3 pagesWhat Went Wrong?Sharif HaidariNo ratings yet

- Financial InstitutionsDocument2 pagesFinancial InstitutionsLuCiFeR GamingNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- Invoice Receipt: Orchards Residents AssociationDocument1 pageInvoice Receipt: Orchards Residents Association4mxzfppvfnNo ratings yet

- APGLI Refund Form (Other Than Death Claim)Document3 pagesAPGLI Refund Form (Other Than Death Claim)ch s naiduNo ratings yet

- A Report On E-Products of Indian Overseas BankDocument39 pagesA Report On E-Products of Indian Overseas BankThadoi ThangjamNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument39 pagesFinancial Statement Analysis: K R Subramanyam John J WildGilang W Indrasta0% (1)

- E-Learning KeysDocument142 pagesE-Learning KeysRishabNo ratings yet

- Formula of Time Value of MoneyDocument28 pagesFormula of Time Value of MoneyAyush UpretyNo ratings yet

- Negotiable Instruments Act 1881Document40 pagesNegotiable Instruments Act 1881Tanvir PrantoNo ratings yet

- UBS 2022 Strategy & Outlook - 211110 - 071116Document296 pagesUBS 2022 Strategy & Outlook - 211110 - 071116Huifeng LeeNo ratings yet

- Bond Basics: Yield, Price and Other Confusion - InvestopediaDocument7 pagesBond Basics: Yield, Price and Other Confusion - InvestopediaLouis ForestNo ratings yet

- Deductible ExpenseDocument4 pagesDeductible ExpenseRosemarie CruzNo ratings yet

- EMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Document4 pagesEMBA Financial Accounting Re-Take Spring 2021 - PSR (6-4-2021)Sheraz KhalilNo ratings yet

- Libor Transition A Practical Guide PDFDocument31 pagesLibor Transition A Practical Guide PDFmartaNo ratings yet

- My File NameDocument1 pageMy File NameDimple QueenNo ratings yet

- Taking Shelter From The Inflation Storm: David P. Baskin, President Barry Schwartz, Vice-PresidentDocument12 pagesTaking Shelter From The Inflation Storm: David P. Baskin, President Barry Schwartz, Vice-Presidentttboy39No ratings yet

- Goods Market - The Is CurveDocument4 pagesGoods Market - The Is CurveKatunga MwiyaNo ratings yet

- Resizing Provisions PDFDocument4 pagesResizing Provisions PDFadonisghlNo ratings yet

- Presentataion Money LaunderingDocument34 pagesPresentataion Money LaunderingBirla Kumar100% (1)

- Bank-Reconciliation DemoDocument40 pagesBank-Reconciliation DemoLeteSsieNo ratings yet

- Syc Ausmat Sept Fee Structure 2019Document1 pageSyc Ausmat Sept Fee Structure 2019SeanNo ratings yet

- 201ECN - Revision 01Document11 pages201ECN - Revision 01phuongfeoNo ratings yet

- K1 TNHFHN TRQLZ 1 OBDocument15 pagesK1 TNHFHN TRQLZ 1 OBjai vermaNo ratings yet

- Passing Package PDFDocument10 pagesPassing Package PDFAddds Muhammmed100% (1)

- Principles of Financial Regulation (Introduction)Document23 pagesPrinciples of Financial Regulation (Introduction)陈雨露No ratings yet

- Third Eye CM BrochureDocument22 pagesThird Eye CM Brochureabc testerNo ratings yet

- RR No. 24-2020Document3 pagesRR No. 24-2020Dean Stephen CalisinNo ratings yet

- Real Estate Development Business PlanDocument5 pagesReal Estate Development Business PlanA. FranciscoNo ratings yet

- Chapter 11 Capital Budgeting Cash FlowsDocument33 pagesChapter 11 Capital Budgeting Cash FlowsShahadNo ratings yet

- Futures and ForwardsDocument18 pagesFutures and ForwardsHimanshu PatidarNo ratings yet

- Unibank and Commercial Bank HandoutsDocument4 pagesUnibank and Commercial Bank HandoutsmorningmindsetNo ratings yet

- On September 1 Pat Hopkins Established Ona Cloud Corporation OccDocument1 pageOn September 1 Pat Hopkins Established Ona Cloud Corporation OccLet's Talk With HassanNo ratings yet