Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

15 viewsGST Circulars Issued On 6th July - A Summary

GST Circulars Issued On 6th July - A Summary

Uploaded by

Vijaya ChandThe document summarizes 7 circulars issued by the GST council on 6th July 2022. Key highlights include:

1) Reporting requirements for inter-state supplies and reversal of ITC.

2) Fake invoices will attract penal action and registered persons availing ITC on fake invoices will be liable for demand and recovery of ITC.

3) ITC on deemed exports and blocked credits in certain cases.

4) Perquisites provided by employers to employees are not subject to GST.

5) Refund claims under inverted duty structure subject to conditions.

6) Process for re-credit of erroneous refund deposited in electronic cash ledger.

7) Filing of refund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Refund of Unutilised ItcDocument6 pagesRefund of Unutilised ItcgrameshchandraNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Refund in GSTDocument6 pagesRefund in GSTNilesh SoniNo ratings yet

- EY Tax Alert: Executive SummaryDocument6 pagesEY Tax Alert: Executive SummaryAjay SinghNo ratings yet

- Composition Levy SchemeDocument2 pagesComposition Levy SchemeKumariNo ratings yet

- Payment of Tax: FAQ'sDocument23 pagesPayment of Tax: FAQ'smun1barejaNo ratings yet

- Payment of TaxDocument7 pagesPayment of TaxArnav AggarwalNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Tybaf Sem Vi Indirect TaxDocument6 pagesTybaf Sem Vi Indirect TaxAditya DeodharNo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Latest Updates in GSTDocument6 pagesLatest Updates in GSTprathNo ratings yet

- Casual Taxable Person Brochure - 10 November 2022Document2 pagesCasual Taxable Person Brochure - 10 November 2022KumariNo ratings yet

- DRC-03 (4) Applicability and Procedure To Pay Additional TaxDocument3 pagesDRC-03 (4) Applicability and Procedure To Pay Additional Taxevertry27387No ratings yet

- Comparative Analysis Under GST RegimeDocument5 pagesComparative Analysis Under GST RegimeAmita SinwarNo ratings yet

- Section 49Document19 pagesSection 49Shiwang AgrawalNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Assessment and Audit Under GST-DGTPS-New Delhi-19!12!2023-FinalDocument118 pagesAssessment and Audit Under GST-DGTPS-New Delhi-19!12!2023-Finalsanjaypunjabi78No ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument36 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Thematic Audit of GST Refunds SOP 28.06.22Document14 pagesThematic Audit of GST Refunds SOP 28.06.22Sujit Srikantan100% (1)

- Cbic Taxes IndiaDocument2 pagesCbic Taxes IndiaReal PlayerNo ratings yet

- Overview of GSTDocument74 pagesOverview of GSTsunil patelNo ratings yet

- ELP Indirect Tax Newsletter November 2022Document6 pagesELP Indirect Tax Newsletter November 2022ELP LawNo ratings yet

- Priyanka Tungidwar - 21036Document1 pagePriyanka Tungidwar - 21036Anonymous 5l219Y7Iu1No ratings yet

- Pa Tax Brief - November 2019Document10 pagesPa Tax Brief - November 2019Teresita TibayanNo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- Report No. 5 - 22 - Chapter-3-062f0e3be996485.72192939Document30 pagesReport No. 5 - 22 - Chapter-3-062f0e3be996485.72192939srbhgangu123No ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Circular CGST 192Document3 pagesCircular CGST 192Jaipur-B Gr-2No ratings yet

- The Digital Newspaper: Major Recommendations of The 45 GST Council MeetingDocument3 pagesThe Digital Newspaper: Major Recommendations of The 45 GST Council MeetingDevendra AryaNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- AP - 2021 - Departments of Revenue and TransportDocument148 pagesAP - 2021 - Departments of Revenue and Transportmahesh yalamanchiliNo ratings yet

- Input Tax Credit Under GSTDocument52 pagesInput Tax Credit Under GSTkuldeep singhNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- Income Compilation Tax ReviewDocument13 pagesIncome Compilation Tax ReviewJosiebethAzueloNo ratings yet

- Budget 2022 BBDocument30 pagesBudget 2022 BBCA SRD & CONo ratings yet

- GST - Audit OffencesDocument35 pagesGST - Audit OffencesApurva DharNo ratings yet

- Tds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar SahaDocument2 pagesTds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar Sahajkmijkmi597No ratings yet

- Tax Alert: Notable Issues On Personal Income Tax Finalization in 2023Document4 pagesTax Alert: Notable Issues On Personal Income Tax Finalization in 2023K60 Tăng Minh NgọcNo ratings yet

- GST Unit 1 BDocument23 pagesGST Unit 1 BMukul BhatnagarNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismjaipalmeNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- Atlas Consolidated Mining and Development Corporation vs. CIRDocument54 pagesAtlas Consolidated Mining and Development Corporation vs. CIRChristian Adrian CepilloNo ratings yet

- GST TDS Mechanism - 21062017Document3 pagesGST TDS Mechanism - 21062017Deepak WadhwaNo ratings yet

- GST Notices and CompliancesDocument7 pagesGST Notices and CompliancesSubhash VishwakarmaNo ratings yet

- Cir 183 15 2022 CGSTDocument5 pagesCir 183 15 2022 CGSTAmritesh RaiNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Rate_Revision_160719Document1 pageRate_Revision_160719Vijaya ChandNo ratings yet

- Bitumen_160719Document1 pageBitumen_160719Vijaya ChandNo ratings yet

- CTE Col WidthDocument2 pagesCTE Col WidthVijaya ChandNo ratings yet

- Bitumen_160719 (1)Document1 pageBitumen_160719 (1)Vijaya ChandNo ratings yet

- HINCOL_PRICE_2ND_FN_JULY_2019Document1 pageHINCOL_PRICE_2ND_FN_JULY_2019Vijaya ChandNo ratings yet

- Letter of Ministry for Road Safety TrainingDocument3 pagesLetter of Ministry for Road Safety TrainingVijaya ChandNo ratings yet

- lc 12 google mapDocument1 pagelc 12 google mapVijaya ChandNo ratings yet

- Irjet V6i571Document7 pagesIrjet V6i571Vijaya ChandNo ratings yet

- Rate_Revision_16072020Document1 pageRate_Revision_16072020Vijaya ChandNo ratings yet

- LC.7 - LA LetterDocument2 pagesLC.7 - LA LetterVijaya ChandNo ratings yet

- 7587Document2 pages7587Vijaya ChandNo ratings yet

- APR-2012.07.18-Vetting of Sanction Letter by CEDocument1 pageAPR-2012.07.18-Vetting of Sanction Letter by CEVijaya ChandNo ratings yet

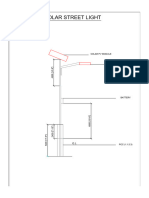

- Streetlight DrawingDocument1 pageStreetlight DrawingVijaya ChandNo ratings yet

- Weak Subgrades CBR 3%Document5 pagesWeak Subgrades CBR 3%Vijaya ChandNo ratings yet

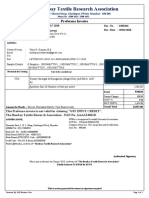

- Labemp e 57 2D 2019Document4 pagesLabemp e 57 2D 2019Vijaya ChandNo ratings yet

- RATE REVISION Wef 16012022Document1 pageRATE REVISION Wef 16012022Vijaya Chand0% (1)

- Rates Wef.1.10.2020Document1 pageRates Wef.1.10.2020Vijaya ChandNo ratings yet

- Feb 2023Document10 pagesFeb 2023Vijaya ChandNo ratings yet

- Exemptionfrom EmdDocument4 pagesExemptionfrom EmdVijaya ChandNo ratings yet

- PRICELIST 16 Jan 2022Document1 pagePRICELIST 16 Jan 2022Vijaya ChandNo ratings yet

- 0 0 20 Jan 2015 1001111871PFR JSW14-01-2015Document51 pages0 0 20 Jan 2015 1001111871PFR JSW14-01-2015Vijaya ChandNo ratings yet

- Bulletin January 2022Document64 pagesBulletin January 2022Vijaya ChandNo ratings yet

- Bitumen Rates Wef.1.10.2020Document1 pageBitumen Rates Wef.1.10.2020Vijaya ChandNo ratings yet

- Go - 23 in Principal Aprroval ThiruthangalDocument2 pagesGo - 23 in Principal Aprroval ThiruthangalVijaya ChandNo ratings yet

- Sales Order - 20180228 - 150322Document1 pageSales Order - 20180228 - 150322Vijaya ChandNo ratings yet

- BPCL FTP 01.03.2022Document1 pageBPCL FTP 01.03.2022Vijaya ChandNo ratings yet

- Par - Ms - 33 - 2018 PDFDocument2 pagesPar - Ms - 33 - 2018 PDFVijaya ChandNo ratings yet

- Par Ms 153 2017Document4 pagesPar Ms 153 2017HRS REGIONAL LAB TANJAVURNo ratings yet

- IEC Download LinkDocument11 pagesIEC Download LinkMultitech InternationalNo ratings yet

- Bcsbi Pictorial BookDocument24 pagesBcsbi Pictorial BookMALAYADRI DUARINo ratings yet

- Electrical Circuit Lab ManualDocument38 pagesElectrical Circuit Lab Manualecessec67% (3)

- Agile TestingDocument5 pagesAgile TestingAman YadavNo ratings yet

- ScheduleDocument2 pagesScheduleJen NevalgaNo ratings yet

- PLC - HMI Lab #4 22W1Document2 pagesPLC - HMI Lab #4 22W1crazyjmprNo ratings yet

- PR m1Document15 pagesPR m1Jazmyn BulusanNo ratings yet

- Working Capital Management: Summer Training Project Report ONDocument102 pagesWorking Capital Management: Summer Training Project Report ONSHASHANKNo ratings yet

- 03 - Literature ReviewDocument9 pages03 - Literature ReviewKhant Wai YanNo ratings yet

- Pre-Lab: Microscopes II: Plant Cells and OsmosisDocument2 pagesPre-Lab: Microscopes II: Plant Cells and Osmosisapi-234540318No ratings yet

- Multi-Component FTIR Emission Monitoring System: Abb Measurement & Analytics - Data SheetDocument16 pagesMulti-Component FTIR Emission Monitoring System: Abb Measurement & Analytics - Data SheetRonaldo JuniorNo ratings yet

- Chapter 3 InternetDocument33 pagesChapter 3 InternetJeanette LynnNo ratings yet

- Western Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterDocument4 pagesWestern Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterMaria Julia DenustaNo ratings yet

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- Steffes 5100 Tech Data SheetDocument4 pagesSteffes 5100 Tech Data SheetcringsredNo ratings yet

- Georgina Smith - Resume 1Document3 pagesGeorgina Smith - Resume 1api-559062488No ratings yet

- Reading Test 1: Questions 1-5 Refer To The Following ArticleDocument14 pagesReading Test 1: Questions 1-5 Refer To The Following ArticletrucNo ratings yet

- Chapter 6Document18 pagesChapter 6Lydelle Mae CabaltejaNo ratings yet

- Binary Vapor Liquid Equilibrium (Vle) Calculator PDFDocument11 pagesBinary Vapor Liquid Equilibrium (Vle) Calculator PDFSalman ZafarNo ratings yet

- YCT Heat Transfer NEET JEE Questions PracticeDocument81 pagesYCT Heat Transfer NEET JEE Questions Practicedrsantanuchakraborty91No ratings yet

- 38 Parasrampuria Synthetics LTD 20 Sot 248Document5 pages38 Parasrampuria Synthetics LTD 20 Sot 248Chanakya ReddyNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument13 pagesSummary of Current Charges (RS) : Talk To Us SMSBrandon FloresNo ratings yet

- Tera Spin PK-1500 Series PK-1600 40 Weighting Arms Jul-2018Document14 pagesTera Spin PK-1500 Series PK-1600 40 Weighting Arms Jul-2018deepakNo ratings yet

- 'Beware of Being Burgoyned.': Marching Toward Monmouth, Delaware River To Freehold, 18 To 27 June 1778Document35 pages'Beware of Being Burgoyned.': Marching Toward Monmouth, Delaware River To Freehold, 18 To 27 June 1778John U. Rees100% (1)

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- The-Impact-On-Load-balancing-In-Cloud-Computing 2020Document5 pagesThe-Impact-On-Load-balancing-In-Cloud-Computing 2020Nikola JovanovicNo ratings yet

- 8DIO Claire Oboe Virtuoso ManualDocument10 pages8DIO Claire Oboe Virtuoso ManualNiskaNo ratings yet

- Vol-37 Let's Eat! MagazineDocument80 pagesVol-37 Let's Eat! MagazineLetseatmagNo ratings yet

- Form Service A40gDocument1 pageForm Service A40gBrando ImanuelNo ratings yet

GST Circulars Issued On 6th July - A Summary

GST Circulars Issued On 6th July - A Summary

Uploaded by

Vijaya Chand0 ratings0% found this document useful (0 votes)

15 views8 pagesThe document summarizes 7 circulars issued by the GST council on 6th July 2022. Key highlights include:

1) Reporting requirements for inter-state supplies and reversal of ITC.

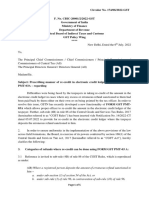

2) Fake invoices will attract penal action and registered persons availing ITC on fake invoices will be liable for demand and recovery of ITC.

3) ITC on deemed exports and blocked credits in certain cases.

4) Perquisites provided by employers to employees are not subject to GST.

5) Refund claims under inverted duty structure subject to conditions.

6) Process for re-credit of erroneous refund deposited in electronic cash ledger.

7) Filing of refund

Original Description:

Original Title

GST circulars issued on 6th July - A summary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document summarizes 7 circulars issued by the GST council on 6th July 2022. Key highlights include:

1) Reporting requirements for inter-state supplies and reversal of ITC.

2) Fake invoices will attract penal action and registered persons availing ITC on fake invoices will be liable for demand and recovery of ITC.

3) ITC on deemed exports and blocked credits in certain cases.

4) Perquisites provided by employers to employees are not subject to GST.

5) Refund claims under inverted duty structure subject to conditions.

6) Process for re-credit of erroneous refund deposited in electronic cash ledger.

7) Filing of refund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views8 pagesGST Circulars Issued On 6th July - A Summary

GST Circulars Issued On 6th July - A Summary

Uploaded by

Vijaya ChandThe document summarizes 7 circulars issued by the GST council on 6th July 2022. Key highlights include:

1) Reporting requirements for inter-state supplies and reversal of ITC.

2) Fake invoices will attract penal action and registered persons availing ITC on fake invoices will be liable for demand and recovery of ITC.

3) ITC on deemed exports and blocked credits in certain cases.

4) Perquisites provided by employers to employees are not subject to GST.

5) Refund claims under inverted duty structure subject to conditions.

6) Process for re-credit of erroneous refund deposited in electronic cash ledger.

7) Filing of refund

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

GST Circulars issued

on 6th July 2022 – A Summary

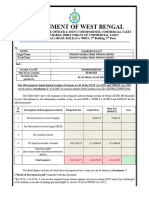

Circular No. Brief Description Brief Summary

Circular-170-02-2022-GST Inter-state supplies to Report such supplies place of supply-wise in Table

unregistered persons 3.2 of GSTR-3B and Table 7B or Table 5 or Table

9/10 of GSTR-1

Inter-state supplies to Report such supplies place of supply-wise in Table

registered persons under 3.2 of GSTR-3B and Table 4A or 4C or 9 of GSTR-1

composition scheme

Correct state of customer to be mentioned in Tax

invoice and Table 3.2 of GSTR-3B

Reversal of ITC To be mentioned in Table 4(B)(1)

ITC not available Due to recipient of intra-state supply is located in

a different state/UT other than place of supply

(or)

on account of limitation of time period to be

reported in Table 4D(2)

Circular No. Brief Description Brief Summary

Circular-171-03-2022-GST Fake invoices Invoices generated without actual supply of

goods or services:

- No tax liability arises

- Registered person liable for penal action u/s

122(1)(ii) of the CGST Act for issuing such tax

invoices

- Registered person availing and utilizing

fraudulent ITC on the basis of fake invoice

shall be liable for the demand and recovery

of said ITC along with penal action

- Any further outward supply by such person –

no tax was required to be paid and liable for

penal action u/s 122 of CGST Act

Circular No. Brief Description Brief Summary

Circular-172-04-2022-GST Deemed Export The ITC of tax paid on deemed export

supplies is not ITC in terms of provisions of

Chapter V of the CGST Act

Blocked Credit Availment of ITC is not barred in case of

leasing, other than leasing of motor

vehicles, vessels and aircrafts

Perquisites provided by Not be subjected to GST

employer to employee in the

course of employment

Utilization of amounts available - Any payment towards output tax,

in the electronic credit ledger whether self-assessed or payable on

account of proceedings can be made

by utilization of amount available in

the electronic credit ledger except for

making payment of tax under RCM.

- Can be used for payment of output tax

only

Utilization of amounts available Amount available may be used for making

in the electronic cash ledger payment towards tax, interest, penalty,

fees or any other amount payable under

GST laws

Circular No. Brief Description Brief Summary

Circular-173-05-2022-GST Claiming refund under inverted Subject to fulfillment of other conditions, refund

duty structure of accumulated input tax credit would be

available where accumulation of input tax credit

is on account of rate of tax on outward supply

being less than the rate of tax on inputs (same

goods) as per concessional notification issued

providing for lower rate of tax

Circular No. Brief Description Brief Summary

Circular-174-06-2022-GST Re-credit in electronic credit - Taxpayer shall deposit the amount of

ledger erroneous refund along with interest and

penalty by debit from electronic cash

ledger using Form GST DRC-03

- Taxpayer shall make written request for

re-credit

- The proper officer shall re-credit an

amount in electronic credit ledger equal

to the refund deposited by the registered

person by passing an order in Form GST

PMT-03A

Circular No. Brief Description Brief Summary

Circular-175-07-2022-GST Refund of unutilized ITC on Manner of filing refund of unutilized ITC on

account of export of account of export of electricity by power

electricity generating units has been prescribed

Circular No. Brief Description Brief Summary

Circular-176-08-2022-GST Omission of Rule 95A and Said rule for refund of taxes paid on inward

Withdrawal of Circular supply of goods at retail outlets at

departure area of international airport has

been omitted w.e.f. 1.7.2019 and Circular

No.106/25/2019-GST dated 29th June, 2019

had been withdrawn

You might also like

- CostAccounting 2016 VanderbeckDocument396 pagesCostAccounting 2016 VanderbeckAngel Kitty Labor88% (32)

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Refund of Unutilised ItcDocument6 pagesRefund of Unutilised ItcgrameshchandraNo ratings yet

- Input Tax Credit MechanismDocument3 pagesInput Tax Credit MechanismRutvik PandyaNo ratings yet

- Refund in GSTDocument6 pagesRefund in GSTNilesh SoniNo ratings yet

- EY Tax Alert: Executive SummaryDocument6 pagesEY Tax Alert: Executive SummaryAjay SinghNo ratings yet

- Composition Levy SchemeDocument2 pagesComposition Levy SchemeKumariNo ratings yet

- Payment of Tax: FAQ'sDocument23 pagesPayment of Tax: FAQ'smun1barejaNo ratings yet

- Payment of TaxDocument7 pagesPayment of TaxArnav AggarwalNo ratings yet

- Overview of Input Tax Credit: CMA Arindam GoswamiDocument4 pagesOverview of Input Tax Credit: CMA Arindam Goswamiharshadaphandge165No ratings yet

- Tybaf Sem Vi Indirect TaxDocument6 pagesTybaf Sem Vi Indirect TaxAditya DeodharNo ratings yet

- E Invoice Under GST - NovDocument2 pagesE Invoice Under GST - NovVishwanath HollaNo ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- GST (Payment of Tax) FinalDocument6 pagesGST (Payment of Tax) FinalDARK KING GamersNo ratings yet

- Attachment 1Document2 pagesAttachment 1khabrilaalNo ratings yet

- Latest Updates in GSTDocument6 pagesLatest Updates in GSTprathNo ratings yet

- Casual Taxable Person Brochure - 10 November 2022Document2 pagesCasual Taxable Person Brochure - 10 November 2022KumariNo ratings yet

- DRC-03 (4) Applicability and Procedure To Pay Additional TaxDocument3 pagesDRC-03 (4) Applicability and Procedure To Pay Additional Taxevertry27387No ratings yet

- Comparative Analysis Under GST RegimeDocument5 pagesComparative Analysis Under GST RegimeAmita SinwarNo ratings yet

- Section 49Document19 pagesSection 49Shiwang AgrawalNo ratings yet

- Qrmp-Scheme NovDocument2 pagesQrmp-Scheme NovVishwanath HollaNo ratings yet

- Assessment and Audit Under GST-DGTPS-New Delhi-19!12!2023-FinalDocument118 pagesAssessment and Audit Under GST-DGTPS-New Delhi-19!12!2023-Finalsanjaypunjabi78No ratings yet

- Amendments For NOV 21: Amendment in 1 Min Series Available On InstagramDocument32 pagesAmendments For NOV 21: Amendment in 1 Min Series Available On InstagramAakriti SinghalNo ratings yet

- Input Tax Credit: Cma Bibhudatta SarangiDocument3 pagesInput Tax Credit: Cma Bibhudatta SarangihanumanthaiahgowdaNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument36 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaManjunathreddy SeshadriNo ratings yet

- Circularno 24 CGSTDocument4 pagesCircularno 24 CGSTHr legaladviserNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- Thematic Audit of GST Refunds SOP 28.06.22Document14 pagesThematic Audit of GST Refunds SOP 28.06.22Sujit Srikantan100% (1)

- Cbic Taxes IndiaDocument2 pagesCbic Taxes IndiaReal PlayerNo ratings yet

- Overview of GSTDocument74 pagesOverview of GSTsunil patelNo ratings yet

- ELP Indirect Tax Newsletter November 2022Document6 pagesELP Indirect Tax Newsletter November 2022ELP LawNo ratings yet

- Priyanka Tungidwar - 21036Document1 pagePriyanka Tungidwar - 21036Anonymous 5l219Y7Iu1No ratings yet

- Pa Tax Brief - November 2019Document10 pagesPa Tax Brief - November 2019Teresita TibayanNo ratings yet

- GSTV70P4 November 27 December 3 (PG 144) SamplechapterDocument2 pagesGSTV70P4 November 27 December 3 (PG 144) SamplechapterSatyakanth SunkaraNo ratings yet

- Report No. 5 - 22 - Chapter-3-062f0e3be996485.72192939Document30 pagesReport No. 5 - 22 - Chapter-3-062f0e3be996485.72192939srbhgangu123No ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- Circular CGST 192Document3 pagesCircular CGST 192Jaipur-B Gr-2No ratings yet

- The Digital Newspaper: Major Recommendations of The 45 GST Council MeetingDocument3 pagesThe Digital Newspaper: Major Recommendations of The 45 GST Council MeetingDevendra AryaNo ratings yet

- New Functionalities Compilation Aug 2022Document3 pagesNew Functionalities Compilation Aug 2022AmanNo ratings yet

- Hc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitDocument3 pagesHc-Allows-Errros in ITC Availment in Tax Head - Rectification-Of-Gstr-3b-After-Expiry-Of-Statutory-Time-LimitychichghareNo ratings yet

- AP - 2021 - Departments of Revenue and TransportDocument148 pagesAP - 2021 - Departments of Revenue and Transportmahesh yalamanchiliNo ratings yet

- Input Tax Credit Under GSTDocument52 pagesInput Tax Credit Under GSTkuldeep singhNo ratings yet

- SOP For ScrutinyDocument5 pagesSOP For Scrutinyacgstdiv4No ratings yet

- Income Compilation Tax ReviewDocument13 pagesIncome Compilation Tax ReviewJosiebethAzueloNo ratings yet

- Budget 2022 BBDocument30 pagesBudget 2022 BBCA SRD & CONo ratings yet

- GST - Audit OffencesDocument35 pagesGST - Audit OffencesApurva DharNo ratings yet

- Tds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar SahaDocument2 pagesTds Under GST Regime - Section 51 of CGST Act: Cma Utpal Kumar Sahajkmijkmi597No ratings yet

- Tax Alert: Notable Issues On Personal Income Tax Finalization in 2023Document4 pagesTax Alert: Notable Issues On Personal Income Tax Finalization in 2023K60 Tăng Minh NgọcNo ratings yet

- GST Unit 1 BDocument23 pagesGST Unit 1 BMukul BhatnagarNo ratings yet

- Reverse Charge MechanismDocument3 pagesReverse Charge MechanismjaipalmeNo ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Step by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?Document7 pagesStep by Step Compliances Under RCM: How Composition Dealer Will Be Affected by RCM?arpit jainNo ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- Atlas Consolidated Mining and Development Corporation vs. CIRDocument54 pagesAtlas Consolidated Mining and Development Corporation vs. CIRChristian Adrian CepilloNo ratings yet

- GST TDS Mechanism - 21062017Document3 pagesGST TDS Mechanism - 21062017Deepak WadhwaNo ratings yet

- GST Notices and CompliancesDocument7 pagesGST Notices and CompliancesSubhash VishwakarmaNo ratings yet

- Cir 183 15 2022 CGSTDocument5 pagesCir 183 15 2022 CGSTAmritesh RaiNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- Rate_Revision_160719Document1 pageRate_Revision_160719Vijaya ChandNo ratings yet

- Bitumen_160719Document1 pageBitumen_160719Vijaya ChandNo ratings yet

- CTE Col WidthDocument2 pagesCTE Col WidthVijaya ChandNo ratings yet

- Bitumen_160719 (1)Document1 pageBitumen_160719 (1)Vijaya ChandNo ratings yet

- HINCOL_PRICE_2ND_FN_JULY_2019Document1 pageHINCOL_PRICE_2ND_FN_JULY_2019Vijaya ChandNo ratings yet

- Letter of Ministry for Road Safety TrainingDocument3 pagesLetter of Ministry for Road Safety TrainingVijaya ChandNo ratings yet

- lc 12 google mapDocument1 pagelc 12 google mapVijaya ChandNo ratings yet

- Irjet V6i571Document7 pagesIrjet V6i571Vijaya ChandNo ratings yet

- Rate_Revision_16072020Document1 pageRate_Revision_16072020Vijaya ChandNo ratings yet

- LC.7 - LA LetterDocument2 pagesLC.7 - LA LetterVijaya ChandNo ratings yet

- 7587Document2 pages7587Vijaya ChandNo ratings yet

- APR-2012.07.18-Vetting of Sanction Letter by CEDocument1 pageAPR-2012.07.18-Vetting of Sanction Letter by CEVijaya ChandNo ratings yet

- Streetlight DrawingDocument1 pageStreetlight DrawingVijaya ChandNo ratings yet

- Weak Subgrades CBR 3%Document5 pagesWeak Subgrades CBR 3%Vijaya ChandNo ratings yet

- Labemp e 57 2D 2019Document4 pagesLabemp e 57 2D 2019Vijaya ChandNo ratings yet

- RATE REVISION Wef 16012022Document1 pageRATE REVISION Wef 16012022Vijaya Chand0% (1)

- Rates Wef.1.10.2020Document1 pageRates Wef.1.10.2020Vijaya ChandNo ratings yet

- Feb 2023Document10 pagesFeb 2023Vijaya ChandNo ratings yet

- Exemptionfrom EmdDocument4 pagesExemptionfrom EmdVijaya ChandNo ratings yet

- PRICELIST 16 Jan 2022Document1 pagePRICELIST 16 Jan 2022Vijaya ChandNo ratings yet

- 0 0 20 Jan 2015 1001111871PFR JSW14-01-2015Document51 pages0 0 20 Jan 2015 1001111871PFR JSW14-01-2015Vijaya ChandNo ratings yet

- Bulletin January 2022Document64 pagesBulletin January 2022Vijaya ChandNo ratings yet

- Bitumen Rates Wef.1.10.2020Document1 pageBitumen Rates Wef.1.10.2020Vijaya ChandNo ratings yet

- Go - 23 in Principal Aprroval ThiruthangalDocument2 pagesGo - 23 in Principal Aprroval ThiruthangalVijaya ChandNo ratings yet

- Sales Order - 20180228 - 150322Document1 pageSales Order - 20180228 - 150322Vijaya ChandNo ratings yet

- BPCL FTP 01.03.2022Document1 pageBPCL FTP 01.03.2022Vijaya ChandNo ratings yet

- Par - Ms - 33 - 2018 PDFDocument2 pagesPar - Ms - 33 - 2018 PDFVijaya ChandNo ratings yet

- Par Ms 153 2017Document4 pagesPar Ms 153 2017HRS REGIONAL LAB TANJAVURNo ratings yet

- IEC Download LinkDocument11 pagesIEC Download LinkMultitech InternationalNo ratings yet

- Bcsbi Pictorial BookDocument24 pagesBcsbi Pictorial BookMALAYADRI DUARINo ratings yet

- Electrical Circuit Lab ManualDocument38 pagesElectrical Circuit Lab Manualecessec67% (3)

- Agile TestingDocument5 pagesAgile TestingAman YadavNo ratings yet

- ScheduleDocument2 pagesScheduleJen NevalgaNo ratings yet

- PLC - HMI Lab #4 22W1Document2 pagesPLC - HMI Lab #4 22W1crazyjmprNo ratings yet

- PR m1Document15 pagesPR m1Jazmyn BulusanNo ratings yet

- Working Capital Management: Summer Training Project Report ONDocument102 pagesWorking Capital Management: Summer Training Project Report ONSHASHANKNo ratings yet

- 03 - Literature ReviewDocument9 pages03 - Literature ReviewKhant Wai YanNo ratings yet

- Pre-Lab: Microscopes II: Plant Cells and OsmosisDocument2 pagesPre-Lab: Microscopes II: Plant Cells and Osmosisapi-234540318No ratings yet

- Multi-Component FTIR Emission Monitoring System: Abb Measurement & Analytics - Data SheetDocument16 pagesMulti-Component FTIR Emission Monitoring System: Abb Measurement & Analytics - Data SheetRonaldo JuniorNo ratings yet

- Chapter 3 InternetDocument33 pagesChapter 3 InternetJeanette LynnNo ratings yet

- Western Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterDocument4 pagesWestern Mindanao State University College of Engineering-College Student Council Acknowledgement Form and Waiver of Fees For 1 SemesterMaria Julia DenustaNo ratings yet

- Sebp7383 05 00 Allcd - 9Document837 pagesSebp7383 05 00 Allcd - 9Roland Culla100% (1)

- Steffes 5100 Tech Data SheetDocument4 pagesSteffes 5100 Tech Data SheetcringsredNo ratings yet

- Georgina Smith - Resume 1Document3 pagesGeorgina Smith - Resume 1api-559062488No ratings yet

- Reading Test 1: Questions 1-5 Refer To The Following ArticleDocument14 pagesReading Test 1: Questions 1-5 Refer To The Following ArticletrucNo ratings yet

- Chapter 6Document18 pagesChapter 6Lydelle Mae CabaltejaNo ratings yet

- Binary Vapor Liquid Equilibrium (Vle) Calculator PDFDocument11 pagesBinary Vapor Liquid Equilibrium (Vle) Calculator PDFSalman ZafarNo ratings yet

- YCT Heat Transfer NEET JEE Questions PracticeDocument81 pagesYCT Heat Transfer NEET JEE Questions Practicedrsantanuchakraborty91No ratings yet

- 38 Parasrampuria Synthetics LTD 20 Sot 248Document5 pages38 Parasrampuria Synthetics LTD 20 Sot 248Chanakya ReddyNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument13 pagesSummary of Current Charges (RS) : Talk To Us SMSBrandon FloresNo ratings yet

- Tera Spin PK-1500 Series PK-1600 40 Weighting Arms Jul-2018Document14 pagesTera Spin PK-1500 Series PK-1600 40 Weighting Arms Jul-2018deepakNo ratings yet

- 'Beware of Being Burgoyned.': Marching Toward Monmouth, Delaware River To Freehold, 18 To 27 June 1778Document35 pages'Beware of Being Burgoyned.': Marching Toward Monmouth, Delaware River To Freehold, 18 To 27 June 1778John U. Rees100% (1)

- Piping Stress AnalysisDocument10 pagesPiping Stress AnalysisM Alim Ur Rahman100% (1)

- The-Impact-On-Load-balancing-In-Cloud-Computing 2020Document5 pagesThe-Impact-On-Load-balancing-In-Cloud-Computing 2020Nikola JovanovicNo ratings yet

- 8DIO Claire Oboe Virtuoso ManualDocument10 pages8DIO Claire Oboe Virtuoso ManualNiskaNo ratings yet

- Vol-37 Let's Eat! MagazineDocument80 pagesVol-37 Let's Eat! MagazineLetseatmagNo ratings yet

- Form Service A40gDocument1 pageForm Service A40gBrando ImanuelNo ratings yet