Professional Documents

Culture Documents

Publikasi - PT Dwi Guna Laksana TBK 18042022 01052023

Publikasi - PT Dwi Guna Laksana TBK 18042022 01052023

Uploaded by

Imam M DarwisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Publikasi - PT Dwi Guna Laksana TBK 18042022 01052023

Publikasi - PT Dwi Guna Laksana TBK 18042022 01052023

Uploaded by

Imam M DarwisCopyright:

Available Formats

Press Release

KREDIT RATING INDONESIA April 28, 2022

PT Dwi Guna Laksana Tbk

Corporate rating irA-/Stable “Obligor with irA rating has a high level of certainty to

honor its financial obligations, but it can be affected by

Rated Issues adverse changes in business and economic

conditions, relative to Obligor with a higher rating."

Rating Period The minus sign (-) indicates that the rating is still

higher than the rating category below, although it is

April 18, 2022 – May 1, 2023

closer to the lower rating than it is to the higher rating

category.

Rating History

February 2022 irA-/Stable

July 2020 irBBB+/Stable

Kredit Rating Indonesia assigns ‘irA-‘ corporate rating to PT Dwi Guna Laksana Tbk

Kredit Rating Indonesia (KRI) assigns a Corporate Rating ‘irA- ‘ with ‘Stable’ outlook for PT Dwi Guna

Laksana Tbk (DWGL or the Company). The rating reflects DWGL’s increasing revenue with high

likelihood of its steadiness going forward, better operating management, and healthier capital structure.

The rating is limited by its number of customer base.

DWGL’s revenue has increased from previously IDR1.72 Tn in 2019 to IDR2.24 Tn in 2021, or

increasing by 14.1% CAGR. We expect the Company’s revenue to sustain in mid-term as the Company

has received contracts from new customers for more than three years. We also see a better operating

management as the Company has successfully suppressed its expenses when facing COVID-19 in

2020 and 2021. For at least another year, we expect the high base profitability margin to continue as

the benchmark coal price (HBA) is expected to stay above USD70/ton. The Company also has posted

a healthier capital structure as its total equities has turned positive in late 2021.

However, the rating is constrained by the Company’s limited number of customer-based since three of

its major customers contributed to 96.83% of DWGL’s revenue in 2021.

As of December 31, 2021, the Company’s shareholders were Hawthorn-Capital Investment Pte., Ltd

(51.54%), PT Asuransi Simas Jiwa – Simas Equity Fund 2 (7.18%), PT Dian Ciptamas Agung (9.37%),

and public (31.91%)

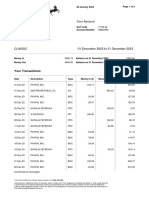

DWGL Financial Results Highlights

Dec 2021 Dec 2020 Dec 2019 Dec 2018

As of/For the year ended

(Unaudited) (Audited) (Audited) (Audited)

Total Assets (IDR, bn) 1,245.7 703.7 863.9 1,603.6

Total Adjusted Debt (IDR, bn) 354.3 280.6 323.1 441.5

Total Adjusted Equity (IDR, bn) 136.4 (52.6) (46.5) (38.1)

Total Sales (IDR, bn) 2,297.6 1,568.5 1,724.2 1,439.6

Net Income After MI (IDR, bn) 94.2 35.6 (21.7) (31.3)

EBIT Margin (%) 5.4 9.2 0.7 1.6

Return on Permanent Capital (%) 34.2 N.R N.R N.R

Adjusted Debt /Adj. Equity (x) 2.6 N.R N.R N.R

EBITDA/Total Adjusted Debt (x) 0.4 0.5 0.0 0.0

EBITDA/IFCCI (x) 3.5 3.8 0.2 0.3

FFO/Total Adjusted Debt (x) 23.9 0.1 (0.1) (0.2)

USD Exchange Rate (IDR/USD) 14,572 14,104 13,901 14,481

Analysts : Achmad Kurniawan Sudjatmiko (Achmad.sudjatmiko@kreditratingindonesia.com)

Furqon Abrory Samara (Furqon.samara@kreditratingindonesia.com)

Dwi Guna Laksana Tbk

Press Release

KREDIT RATING INDONESIA April 28, 2022

DISCLAIMER

PT Kredit Rating Indonesia (KRI) does not represent or warrant or guarantee the accuracy, completeness, timeliness or availability of the contents of this report or publication. KRI does not perform an audit

and does not undertake due diligence or independent verification of any information used as the basis of and presented in this report or publication. Although the information upon which KRI rating report are

based, and any other contents provide in this rating report is obtained by KRI from sources which KRI believers to be reliable.

KRI will be held harmless against any responsibility arising from its use, its partial use, or its lack of use, in combination with other products or used solely, nor can it be held responsible for the result of its

use or lack of its use in any investment or other kind of financial decision making on which this report or publication is based. The issuance of a solicited or unsolicited rating report does not supply financial,

legal, tax or investment consultancy. The rating report is not an opinion as to the value of securities, therefore KRI is not responsible for any credit, loan or investment decision, damages or other losses

resulting from the reliance upon or use of this report.

In no event shall KRI be held liable for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses including but not limited

to lost profits and opportunity costs in connection with any use of the contents of this rating report or publication.

Credit analyses, including ratings, and statements in this report or publication are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold

or sell any securities or to make any investment decision. Therefore, this report may not reflect any event or circumstances which occur after the date of this report.

KRI also assumes no obligation to update the content following publication in any form. KRI does not act as fiduciary or an investment advisor. KRI keeps the activities of its analytical units separate from its

business units to preserve independence and objectivity of its analytical process and products. As a result, certain units of KRI may have information that is not available to other units. KRI has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process. KRI may receive compensation for its ratings and other analytical

work, normally from issuers of securities. KRI reserves the right to disseminate its opinions and analyses. KRI’s public ratings and analyses are made available on its website,

http://www.kreditratingindonesia.com (free of charge) and through other subscription based services, and may be distributed through other means, including via KRI publications and third party redistributors.

Information in KRI’s website and its use fall under the restrictions and disclaimer stated above. No part of KRI’s website, the content of this report, may be reproduced or transmitted by any means, electronic

or non-electronic whether in full or in part, will be subjected to written approval from KRI.

Dwi Guna Laksana Tbk

You might also like

- Budgeting CS - Budget or BustDocument9 pagesBudgeting CS - Budget or BustHLeigh Nietes-Gabutan20% (5)

- Foundations of Risk ManagementDocument173 pagesFoundations of Risk ManagementIdriss Armel Kougoum95% (19)

- Kredit Rating Indonesia: Press ReleaseDocument2 pagesKredit Rating Indonesia: Press ReleaseTri Nanda Christo MarthinusNo ratings yet

- Kredit Rating Indonesia: Press ReleaseDocument2 pagesKredit Rating Indonesia: Press ReleaseTri Nanda Christo MarthinusNo ratings yet

- PT Pan Pacific Investama (PPI) : Press Release Kredit Rating IndonesiaDocument2 pagesPT Pan Pacific Investama (PPI) : Press Release Kredit Rating IndonesiaTri Nanda Christo MarthinusNo ratings yet

- PT Asuransi Simas Jiwa (Asj) : Press Release Kredit Rating IndonesiaDocument2 pagesPT Asuransi Simas Jiwa (Asj) : Press Release Kredit Rating IndonesiaTri Nanda Christo MarthinusNo ratings yet

- PT AB Sinar Mas Multifinance (ABSM) : Kredit Rating IndonesiaDocument2 pagesPT AB Sinar Mas Multifinance (ABSM) : Kredit Rating IndonesiaTri Nanda Christo MarthinusNo ratings yet

- 2022 12 14 MedcDocument2 pages2022 12 14 MedcfirmanNo ratings yet

- PT Bank Syariah Indonesia TBK: Tugas 1Document4 pagesPT Bank Syariah Indonesia TBK: Tugas 1Atin FirnandaNo ratings yet

- 2022 12 01 JSMRDocument2 pages2022 12 01 JSMRfirmanNo ratings yet

- Publikasi - PT Hasjrat Multifinance 20082019 01092020Document1 pagePublikasi - PT Hasjrat Multifinance 20082019 01092020Imam M DarwisNo ratings yet

- Press Release Bank KB Bukopin 2022 - PefindoDocument4 pagesPress Release Bank KB Bukopin 2022 - PefindoIra PujiNo ratings yet

- 2022 10 20 BRPTDocument2 pages2022 10 20 BRPTfirmanNo ratings yet

- 2022 10 18 PNMPDocument2 pages2022 10 18 PNMPfirmanNo ratings yet

- 2022 11 30 BPDBDocument2 pages2022 11 30 BPDBfirmanNo ratings yet

- 2022 12 15 MegaDocument2 pages2022 12 15 MegafirmanNo ratings yet

- Aria CR Jun21Document5 pagesAria CR Jun21swamih.knightfrankNo ratings yet

- 2022 12 27 BvicDocument2 pages2022 12 27 BvicfirmanNo ratings yet

- PT Bank Central Asia TBK: Credit Profile Financial HighlightsDocument1 pagePT Bank Central Asia TBK: Credit Profile Financial HighlightsAz CheNo ratings yet

- 2022 11 22 BJTMDocument2 pages2022 11 22 BJTMfirmanNo ratings yet

- PT Bank Bukopin TBK: June 11, 2020Document2 pagesPT Bank Bukopin TBK: June 11, 2020Az CheNo ratings yet

- PT Bank Pembangunan Daerah Sumatera Selatan Dan Bangka BelitungDocument2 pagesPT Bank Pembangunan Daerah Sumatera Selatan Dan Bangka BelitungAz CheNo ratings yet

- 2022 12 05 BniiDocument2 pages2022 12 05 BniifirmanNo ratings yet

- 2022 10 18 InkpDocument2 pages2022 10 18 InkpfirmanNo ratings yet

- ICRA - Stock Update - 070322Document10 pagesICRA - Stock Update - 070322arunNo ratings yet

- PR Sheetal Coolproducts 4jul23Document5 pagesPR Sheetal Coolproducts 4jul23jay.futuretecNo ratings yet

- Aria CR Jul22Document5 pagesAria CR Jul22swamih.knightfrankNo ratings yet

- 2022 11 29 SufiDocument2 pages2022 11 29 SufifirmanNo ratings yet

- IJNRD2207081Document11 pagesIJNRD2207081RIZWAN SHAIKNo ratings yet

- PT Bank Rakyat Indonesia (Persero) TBK: March 13, 2018Document1 pagePT Bank Rakyat Indonesia (Persero) TBK: March 13, 2018Wisnu Pramana PutraNo ratings yet

- Grainger's Strong Fourth-Quarter Performance Leads To StrongDocument26 pagesGrainger's Strong Fourth-Quarter Performance Leads To StrongburmanikgpNo ratings yet

- Franklin Resources, Inc.: Stock Report - March 12, 2022 - NYSE Symbol: BEN - BEN Is in The S&P 500Document9 pagesFranklin Resources, Inc.: Stock Report - March 12, 2022 - NYSE Symbol: BEN - BEN Is in The S&P 500apdusp2No ratings yet

- Grainger's Strong Fourth-Quarter Performance Leads To Strong2Document26 pagesGrainger's Strong Fourth-Quarter Performance Leads To Strong2burmanikgpNo ratings yet

- Aria CR Dec 19Document4 pagesAria CR Dec 19swamih.knightfrankNo ratings yet

- Kogta Financial India LimitedDocument5 pagesKogta Financial India LimitedofficeloginpurposeNo ratings yet

- PT Rekayasa Industri: Credit Profile Financial HighlightsDocument2 pagesPT Rekayasa Industri: Credit Profile Financial HighlightsFebrianto ChNo ratings yet

- Sanghi Jewellers PVT - R - 20102020Document7 pagesSanghi Jewellers PVT - R - 20102020DarshanNo ratings yet

- Savaria Quarterly Report 2022 Q1Document33 pagesSavaria Quarterly Report 2022 Q1Marcela CairoliNo ratings yet

- PEFINDO Press Releases (PEFINDOPR)Document2 pagesPEFINDO Press Releases (PEFINDOPR)dio dioNo ratings yet

- Terrier Security Services (India) Private LimitedDocument7 pagesTerrier Security Services (India) Private Limitedgcgary87No ratings yet

- Dialog Finance Annual Report 2022Document180 pagesDialog Finance Annual Report 2022Batticaloa BuildingsNo ratings yet

- Fundcard: SBI Magnum Income FundDocument4 pagesFundcard: SBI Magnum Income FundPhani VemuriNo ratings yet

- PT Nippon Indosari Corpindo TBK: Credit Profile Financial HighlightsDocument2 pagesPT Nippon Indosari Corpindo TBK: Credit Profile Financial HighlightsRaymond Sabater Jr.No ratings yet

- PT Perusahaan Pengelola Aset (Persero) : Credit Profile Financial HighlightsDocument2 pagesPT Perusahaan Pengelola Aset (Persero) : Credit Profile Financial HighlightsMiftakhul FalahNo ratings yet

- Effect - of.Liquidity,.Leverage,,Profitability, And, Firm Size, On, Corporate - Sukuk RatingDocument7 pagesEffect - of.Liquidity,.Leverage,,Profitability, And, Firm Size, On, Corporate - Sukuk RatingInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Document Service V2Document6 pagesDocument Service V2UTSAV DUBEYNo ratings yet

- PT Pos Indonesia (Persero) : Press ReleaseDocument2 pagesPT Pos Indonesia (Persero) : Press ReleaseKaa BilNo ratings yet

- Fundcard: Baroda Pioneer Treasury Advantage Fund - Direct PlanDocument4 pagesFundcard: Baroda Pioneer Treasury Advantage Fund - Direct Planravinandan_pNo ratings yet

- Vibracoustic India Private LimitedDocument6 pagesVibracoustic India Private LimitedBithal PrasadNo ratings yet

- ValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Document4 pagesValueResearchFundcard BarodaPioneerShortTermBondFund DirectPlan 2017may16Achint KumarNo ratings yet

- ValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Document4 pagesValueResearchFundcard RelianceIncomeFund DirectPlan 2019jun15Phani VemuriNo ratings yet

- Global BuildconDocument6 pagesGlobal Buildconprasad.patilNo ratings yet

- Vivriti Capital Private Limited PDFDocument9 pagesVivriti Capital Private Limited PDFIb SulochanaNo ratings yet

- 2022 10 18 IsatDocument2 pages2022 10 18 IsatfirmanNo ratings yet

- NagaCorp 2022 Interim Results PresentationDocument16 pagesNagaCorp 2022 Interim Results PresentationJonathan ChoiNo ratings yet

- Bank Jago: Execution On Track TP Raised 14% To IDR20,250Document5 pagesBank Jago: Execution On Track TP Raised 14% To IDR20,250Tasya AngelineNo ratings yet

- 2022 12 14 TyroDocument2 pages2022 12 14 TyrofirmanNo ratings yet

- March 2023 - Performance Analysis PDFDocument48 pagesMarch 2023 - Performance Analysis PDFsrpatra143sNo ratings yet

- Crisil GR&A - Bank - Bank of America NADocument9 pagesCrisil GR&A - Bank - Bank of America NANguyễn Bùi Phương DungNo ratings yet

- Jupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFDocument4 pagesJupiter Global Emerging Markets Corporate Bond Factsheet-GB-Retail-LU1551064923-En-GB PDFeldime06No ratings yet

- ViewFile PDFDocument2 pagesViewFile PDFNikole MontezNo ratings yet

- Couple Stung by 100,000 Secret' LoanDocument3 pagesCouple Stung by 100,000 Secret' LoanSimply Debt SolutionsNo ratings yet

- Soal Quiz AdvanceDocument18 pagesSoal Quiz AdvanceAditya Agung SatrioNo ratings yet

- 06-Soler & Wind Energy 25L-FDocument17 pages06-Soler & Wind Energy 25L-FAshutosh PradhanNo ratings yet

- Practice Set 1Document4 pagesPractice Set 1Shiela Mae BautistaNo ratings yet

- 9708 w03 QP 3Document12 pages9708 w03 QP 3michael hengNo ratings yet

- Econ 10.5 PDFDocument3 pagesEcon 10.5 PDFpeter wongNo ratings yet

- Fundamental Analysis BooksDocument17 pagesFundamental Analysis BooksSanjivaniNo ratings yet

- 10 ExamplesDocument8 pages10 ExamplespmlprasadNo ratings yet

- Discussion Problems: FAR.2925-Derivatives and Hedge Accounting OCTOBER 2020Document12 pagesDiscussion Problems: FAR.2925-Derivatives and Hedge Accounting OCTOBER 2020Edmark LuspeNo ratings yet

- Revised Poripatra (DPP Format)Document81 pagesRevised Poripatra (DPP Format)gazi sharif100% (7)

- GenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Document10 pagesGenMath11 Q2 Mod9 Basic-Concepts-of-Loans Version2Angelica ZipaganNo ratings yet

- Roll's Critique Is A Famous Analysis of The Validity of Empirical Tests of TheDocument1 pageRoll's Critique Is A Famous Analysis of The Validity of Empirical Tests of TheRaman RandhawaNo ratings yet

- CitiDocument2 pagesCitiPink HayleeNo ratings yet

- Chapter 3 - IA and Corporate Governance STDTDocument23 pagesChapter 3 - IA and Corporate Governance STDTNor Syahra AjinimNo ratings yet

- ReportHistory 48173905Document46 pagesReportHistory 48173905Dhanush AsapuNo ratings yet

- Dean Robert Blair GibsonDocument2 pagesDean Robert Blair GibsonKabanNo ratings yet

- Year 2009 2010 2011 2012 2013 Price Earnings Per Share PE RatioDocument2 pagesYear 2009 2010 2011 2012 2013 Price Earnings Per Share PE RatiohelloNo ratings yet

- Quiz: Corporate Liquidation Final Term: Problem 1Document3 pagesQuiz: Corporate Liquidation Final Term: Problem 1Eel GiNo ratings yet

- Theory in Action 6.2 Dan 5.2Document2 pagesTheory in Action 6.2 Dan 5.2zahra zhafiraNo ratings yet

- Cost EstimationDocument46 pagesCost EstimationMohammad Reza AnghaeiNo ratings yet

- Gen Tech FileDocument73 pagesGen Tech Filethe kingfishNo ratings yet

- Tech ProDocument574 pagesTech ProMurali KrishnaNo ratings yet

- TATA Motor Ratio AnalysisDocument32 pagesTATA Motor Ratio AnalysisBilal Mujadadi67% (3)

- Summary of IAS 40Document2 pagesSummary of IAS 40Zes ONo ratings yet

- Application Summary FormDocument2 pagesApplication Summary Formjqm printingNo ratings yet

- Financial Ratio Analyses and Their Implications To ManagementDocument46 pagesFinancial Ratio Analyses and Their Implications To ManagementPrinsesa EsguerraNo ratings yet

- Chap021newDocument36 pagesChap021newNguyễn Cẩm HươngNo ratings yet