Professional Documents

Culture Documents

Commercial Law - Important Exam Info

Commercial Law - Important Exam Info

Uploaded by

Eric Y0 ratings0% found this document useful (0 votes)

15 views11 pagesThe document discusses several topics related to commercial law, including expanding professional liability, director liability, gratuitous promises in contract law, and methods of discharging contracts. It notes that professional liability is expanding due to greater complexity in professions, economic pressures causing more work and potential for error, and more aggressive clients. Director liability has also been expanded through statutes to include duties to various parties like shareholders. Gratuitous promises are generally not enforceable without consideration, but can become binding through methods like nominal consideration or seals. Contracts can be discharged through performance, agreement between parties, frustration making performance impossible, or terms within the contracts themselves.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses several topics related to commercial law, including expanding professional liability, director liability, gratuitous promises in contract law, and methods of discharging contracts. It notes that professional liability is expanding due to greater complexity in professions, economic pressures causing more work and potential for error, and more aggressive clients. Director liability has also been expanded through statutes to include duties to various parties like shareholders. Gratuitous promises are generally not enforceable without consideration, but can become binding through methods like nominal consideration or seals. Contracts can be discharged through performance, agreement between parties, frustration making performance impossible, or terms within the contracts themselves.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

15 views11 pagesCommercial Law - Important Exam Info

Commercial Law - Important Exam Info

Uploaded by

Eric YThe document discusses several topics related to commercial law, including expanding professional liability, director liability, gratuitous promises in contract law, and methods of discharging contracts. It notes that professional liability is expanding due to greater complexity in professions, economic pressures causing more work and potential for error, and more aggressive clients. Director liability has also been expanded through statutes to include duties to various parties like shareholders. Gratuitous promises are generally not enforceable without consideration, but can become binding through methods like nominal consideration or seals. Contracts can be discharged through performance, agreement between parties, frustration making performance impossible, or terms within the contracts themselves.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 11

Commercial Law – Things to Learn First

Why is Professional Liability Expanding

• The practice of professionals is becoming more complex so there is greater chance of making an error

• There is a tendency for professionals to take on more clients and files due to economic pressures,

therefore greater chance of error,

• Instantaneous communication through technology has created an expectation for immediate results so

professionals act more hurriedly and more errors occur

• Clients are more aggressive, sophisticated and litigious,

• Normal rules of negligence law are being applied to professionals and thus professional liability is

expanding due to various court cases. Example, the Donoghue v. Stevenson case established the

neighbour principle (don’t need a contract to have a duty of care with a party) and the Hedley, Byrne v.

Heller case which determined pure economic loss was deemed sufficient to ground a claim of

negligence against a professional. The only harm recognized previously was if it was physical

• The advent of contingency fees has made it easier to retain a lawyer and sue professionals

Director Liability

o Directors are in charge with the management of the corporation and do not have to be shareholders

o Duties of directors are owed to the corporation and not the shareholders

o Potential liabilities of director’s have been expanded beyond what the common law duties are

o New variety of director’s liabilities, most of which are called ‘gatekeeper’ liabilities

§ The attempt to control wrong doing of companies by making the director’s liable through duties

o Liabilities consist of financial and penal nature for directors – this protects the governments revenue

from the corporations

o Some of these duties are owed to a series of individuals depending on the statutes: owed to

shareholders, employees, creditors, etc.

o Examples of potential liabilities:

§ Board of directors not remitting EI, CPP or income taxes

§ Debts that are liable to employees for up to 6 month’s worth

§ Environmental legislation that can give you jail time

§ Supreme court has indicated that directors remain liable even if they quit, during a time of crisis

Contracts – gratuitous promise and how it’s manifested in contract law

o A promise without a returning consideration is gratuitous and not enforceable by laws of contract –

needs to be an exchange made of some sort

o Contracts without consideration (missing element) are void

o If you ask for a good or service and you request, there is an implication that you will pay as you asked

Various Manifestations of the Gratuitous Promise

o Past consideration

§ Is no consideration. Reward for an act previously gratuitously done is not binding

§ Has to be an exchange because a contract is based on an exchange – reciprocity does not make

anything binding

o Existing legal duties and consideration

§ When party A is bound by the existing contractual duty to party B, a later promise by B to pay A

something extra to perform the same obligation is not binding

§ Usual common law contract that established this principle: sailors would be hired to make a

transport trip and then decide later that they want to increase their pay, the captain agrees, but

later only pays them the original amount

• If the sailor promises to do another duty then they would be paid higher

§ Seal: element of consideration has been covered

• Nominal (token) forms of consideration are sufficient for common law. Giving a dollar

or a seal to confirm

• For equity law, substantial considerations. Dollar, peppercorn seal is insufficient. If

seeking an equitable remedy you need a transfer of a substantial consideration

§ Convert a gratuitous contract into an enforceable agreement through one of these methods –

courts do not investigate the consideration, but just the fact that it exists. Equity investigates if

the consideration is substantial

o Rule in Foakes and Beer

§ Ratio of that case is that a creditors gratuitous reduction of debt for a payment is not enforceable

• No consideration was exchanged

• Ex: you’re loaned $1000 but the person needs the money badly so they say make one

payment and ill forgive the final two payments. Then the lender can sue the person

for the money. The person who was lent the money must use some form of nominal

consideration to cover their butt; seal the contract and make payment 1 day early.

It’s not the seal itself that has consideration but that the other party has given up

consideration

o If the creditor takes a gratuitous reduction of payment then he is not able to

collect the remaining balance after

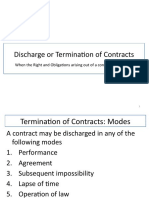

Methods of Discharge

o Discharge by performance – everyone follows the contract, but can also occur over time

§ Tender of performance – one party attempts to perform but the other party refuses, this attempt

to perform is the tender whether it is accepted or rejected by the other party

§ One advantage of the tender, to be alleged of breach of contract – primary reason for tendering

is for evidence, but it is dangerous to tender on your own, you should have solicitors because the

money will be guaranteed to come back

o Discharged by agreement:

§ Waiver – formally discharges both parties, the parties agree between themselves that the

contract doesn’t have to perform, if one person has performed then the waiver is ineffective, it

becomes a gratuitous promise that they fulfill

§ Substituted agreement – new agreement; replaces the first where one of the clauses is that the

first agreement is discharged – also novation: substituted agreement with a new party

• Accord and satisfaction – when a party does not want to perform agreed in the terms

of the contract, they can make an offer of cash payment to buy out their contract and

responsibility

• Option to terminate – the ones offering the contract can buy the parties contract and

essentially get rid of them. It is a term in the contract when initially signed

§ The contract provides for its own dissolution – sometimes parties perceive of the possibility of an

inability or unwillingness to perform in certain situations and they include a term for allowing

those circumstances

• Condition precedent – future or certain event which must either happen or not

before the promisors contractual liability is established

• Condition subsequence – uncertain event that happening of which brings the

promisors contractual liability to an end, one or both or all of the parties have

reserved an out in certain circumstances

o Discharge by frustration – courts excuse persons for failure to perform their contracts in a wide

variety of circumstance where the inability to perform is not their fault. This is called frustration

§ Performance is literally impossible

§ Performance is possible but would have a different meaning than which was conceived at the

time of agreement

§ Results of frustration: contract is discharged and parties are relieved of further performance, any

benefits already exchanged fall where they lie

• Frustrated contracts act: which allows for relocation of the benefits already

exchanged

Contract Law - Certainty in Contract

o Parol Evidence Rule

§ Designed to create certainty in contracts

§ About the ability to enter in or submit something to the fact finder to consider

§ In the context, parol means extrinsic to or outside the written agreement

o Negotiable instruments – means to transfer funds between parties to a transaction without physical

exchange of cash

§ Gives greater certainty to certain types of assignments – people can better depend on negotiable

instruments

o Pharmaceutical society of Great Britain vs boosts cash chemists

§ Stands in the propositions regarding displays in stores and advertisements in the newspaper

§ Came to conclusion for policy reasons rather than logic – too many cases otherwise and would

clog the courts

§ The mere fact that a customer picks up a product from the shelf in this case doesn’t mean they

will buy it

§ It is an offer to buy and there is no sale until the buyers offer to buy is accepted by the

acceptance of the price

§ This was created for certainty and efficiency

o Certainty of an offer

§ Wording cannot be vague or it will be void

§ Sometimes there is an agreement to agree, it is uncertain and makes the contract uncertain

§ Courts are generally inclined to accept interpretations to contracts because they want to fill their

objective content

o Written documents increase certainty

§ Written evidence makes it certain that liars cannot win cases

o Literal meaning approach dictates certainty – liberal creates uncertainty

§ Restricts interpreting to the dictionary meaning, which dictates certainty

Discuss Bankruptcy

• Bankruptcy is a federal statute and has a number of functions

o Sets up a uniform practice to make it as inexpensive as possible

o Sets out methods for reorganizing a debtors business by working out an agreement with the

creditors

o Attempts to provide for an equitable distribution of the debtors assets among the creditors

o Releases the debtor to begin again

• There are 3 differing procedures:

o Proposal: the insolvent individual is trying to make a deal with the debtors: more time, lower

amount of debt, a lower level of interest, or a combination of the three. There are 2 kinds:

§ Consumer: made only by the individual whose debts, not including the debts secured by

mortgage on a principle residence, total less than $75,000. Formal acceptance by the

creditor is only needed under special circumstances, usually under objection. There are

certain benefits of consumer proposal, no termination of leases, acceleration of

installment of payments and the interruption of services by utility. If creditor rejects the

proposal, the individual is automatically considered bankrupt.

§ Commercial: if the creditors reject the proposal the individual or business is bankrupt.

Things you need to have to get bankruptcy: majority of each class of secured creditors,

courts must approve the proposal, proposal is then binding on all the unsecured and

secured creditors who accepted the proposal.

• Place yourself into bankruptcy through an assignment voluntarily. If the creditors put the individual in

bankruptcy, they do so by petitioning the court for a receiving order. If proven bankrupt, orders are put

in the hands of the trustee who will govern the assets and affairs.

o To obtain a receiving order they must prove the debtor has committed an act of bankruptcy in

the last 6 months and that they are due for at least $1,000.

o Acts of bankruptcy: fraudulent transfer of assets/money, fraudulent preferences, absconding of

funds, failure to pay debts as they come due

o Role of the trustee: retain the property/assets that the in debtor has gotten rid of, recover

settlements, distribute assets accordingly

• A way by receiving order, creditors obtain an order by the court placing the debtor into bankruptcy.

Must have committed an act of bankruptcy within the last 60 months. Trustee will sell assets so

creditors can be paid.

What are Secured Transactions? What is Collateral? What are the advantages of secured transactions? What

are some examples? What did the Personal Property Security Act do?

• Secured transactions mean the lender has security. If the debtor doesn’t pay, the lender can sue or seize

an item. Most common secure transactions is mortgages; if the debtor doesn’t make payments the bank

seizes your home by “foreclosing” on you. Security or collateral, is some insurance to the creditor that

the debt owing will be paid or recovered from certain assets of the debtor. Ie. if the debtor does not

pay, the creditor has some ability to seize property to satisfy the liability of the debt beyond the normal

ability to execute on a judgement.

• Collateral – security is dealt with in a separate contract. When you buy a house there is a contract to

purchase the house and a separate contract with the lender for security, ie. the mortgage. The second

contract is referred to as the collateral contract. The object of security, the house, is known as collateral

• Advantages:

o It is more direct, efficient and less expensive than the court system

o In courts, after receiving judgement, you still have the hassle of collecting

o You have priority over general creditors to seize property

o Interest rate is lower for the borrower because there is less risk for the lender

• Examples:

o Conditional sales contract – the transfer of title (ownership) to the buyer is conditional on the

buyer’s completion of a series of scheduled instalment payments.

o Chattel mortgages – title is transferred by a mortgage

o Share hypothecation – used to secure a private share purchase. The physical shares are pledged

and transferred to the lender (often the seller of the business)

o Floating charges – a general mortgage of all assets owned and future assets except those used

in business operations by the borrower

• Personal Property Security Act: emerged to establish a single unified system with common rules for the

following purposes:

o To define a secured party’s remedies against the debtor

o To create one system of registration for all security interests (doesn’t matter what kind of

security interest)

o To define priorities between a secured party and third party purchasers and indeed to define

priorities between all secured parties and general creditors.

What is a Negotiable Instrument? What are 3 types? What 7 elements need to be present for a contract to be a

negotiable instrument?

• Negotiable Instrument: means to transfer funds between parties to a transaction without the immediate

and physical exchange of cash.

• Negotiable instruments create a debtor-creditor relationship and form a contract. First utility is the

replacement for cash so we don’t need wheelbarrows of cash. It also gives greater certainty to certain

types of assignments. Not all financial instruments are negotiable instruments. The rules that govern

negotiability distinguish the NI from others.

• 3 Types:

o Promissory Notes: prepared by the debtor, a written promise to pay

o Cheques

o Bills of Exchange

• Criteria for Negotiability:

o Promise/order must be in writing.

o Obligation must be for money payment(s) (can’t be for 3 dozen carrots).

o Sum of face of instrument must be for a certain fixed sum.

o Promise/order must be unconditional.

o Instrument must be payable at a fixed or determinable time or upon demand.

o The whole instrument (complete sum) must be negotiated (not just part of it).

o The Instrument must be signed by drawer/payer (the debtor).

As discussed in the lectures and textbooks for this course, what are the grounds upon which a contract can be

“impugned?” What is the effect of a contract being impugned and how can these grounds be categorized? Also

discuss how each form of invalid consideration is a manifestation of a gratuitous promise.

• Void – To decide that a contract is void is to say it was never in law formed at all; if it is void there is no

contract. Contracts can be deemed void when:

o Missing an element or uncertainty

o Non est factum (not my doing, illiterate people being misled)

o Mistake of subject matter or identity

o Errors in recording contracts or transcription

• Voidable – Where a misapprehension or misrepresentation would render it unfair if the contract terms

were enforced against him or her. Contracts can be deemed voidable when:

o Misrepresentation – of information

o Duress – illegitimate pressure such as exertion of physical force, threatening physical force or

economic duress

o Undue Influence – The domination of one party over the mind of the other to such a degree as

to deprive the latter of the will to make an independent decision

o Diminished Capacity – vegetative state or being a minor

• Unenforceable

o Requirement of Writing – Some contracts in certain jurisdictions require contracts to be in

writing to be enforceable, such as those types of contracts covered under the Statute of Frauds

(however, this was repealed in MB). Also, the Sale of Goods Act requires written documentation

for the sale of chattels in MB over $50 to prove there is a contract.

o Illegality – the contract is illegal

• A gratuitous promise is a promise made without consideration in return. It is not enforceable by the

laws of contract. There needs to be an exchange made of some sort. There are various manifestations of

the gratuitous promise:

o Past consideration – is no consideration, a promise made to reward for an act previously

gratuitously done is not binding. There has to be an exchange because a contract is based on an

exchange.

o Existing Legal Duties and Consideration – when party A is bound by the existing contractual duty

to party B, a later promise by B to pay A something extra to perform the same obligation, is not

binding. However the common law will recognize the exchange of nominal consideration from A

to B and the promise by B to pay A something extra would be binding; for example, a pepper

corn, small amount of money, or the seal. Equity however requires a transfer of real

consideration and will investigate if the consideration was substantial. Equity does not consider

the seal substantial.

o The rule in Foakes and Beer – the ratio: “a creditor’s gratuitous reduction of debt for a payment

is not enforceable,” because no consideration was exchanged. The borrower will need to use

some form of nominal consideration. This has been replaced by statute.

Discuss how principles of the law of agency relate to and are manifest within the principles of the law of

business organization.

• Agency is a relationship in which one person, known as an agent, is authorized to bring another party for

whom they act, known as a principal, into contractual relations with third parties. In a sole

proprietorship this may be necessary because they cannot do everything on their own. In partnerships,

all partners are both agents and principals of the partnership and thus have fiduciary duties. As a result

one partner can create liabilities that the other partner will be responsible for. In corporations, the

business is considered a separate entity, but they can’t do much by themselves because they are

artificial. So corporations must act through human agents: board of directors. One of the consequences

is that each director is a fiduciary because they are an agent. Agents can create contractual liability for

their principal and usually exist by contract or through estoppel.

• Principles of the law of agency manifest themselves through agency by estoppel in business

organizations. There are two types; apparent authority and holding out. Apparent authority is acquired

from a past manner of transaction business by the principal or from trade custom. Such circumstances

may make it appear to third parties that the agent has authority for the contract at hand, when in fact

they have no expressed authority for the contract at hand.

• There are 3 areas where apparent authority manifests itself in business organizations.

o The effect of publicly filed documents – the public was deemed to have notice of the contents of

filed documents whether they had read them or not, and thus could not rely upon what

otherwise might be the officer’s apparent authority. However this has since been abolished by

statute

o Indoor management rule – a person dealing with a corporation is entitled to assume that its

internal procedural rules have been complied with unless it is apparent that such is not the case.

o Pre-incorporation contract

§ The corporation is bound by the contract and is entitled to the benefits thereof as if the

corporation had been inexistence at the date of the contract and had been a party

thereto, and

§ A person who purported to act in the name of or on behalf of the corporation ceases to

be bound by or entitled to the benefits of the contract.

Mr. Risktaker is thinking about starting a business as a transporter of nuclear waste materials through Canada,

however, he requires advice as to the various types of business organizations that exist and the advantages and

disadvantages of operating a business using each such type of business organizations. Provide that advice to

him keeping in mind that he may have to secure financing of some variety to start the business, and that he is

considering contemplating marriage in the near future and has substantial assets.

• The Sole Proprietorship:

o Advantages – gives you:

§ The ability to make all business decisions

§ The right to all profits

§ The right to deal with all assets without interference

§ It is simple and very inexpensive to set up and dissolve.

• Disadvantages:

o because the sole proprietorship is not a separate legal entity, he would be liable for all the

liabilities of the business and all non-business assets are exposed to creditors of the business

o The business income is added to personal income and the aggregate is taxed at the appropriate

rate.

• Prophylactic actions should be taken in order for Mr. Risktaker to protect himself. A combination of all

possibilities is best:

o Insurance is the best form

o Place investments in creditor proof assets, however the returns tend to be lower

o Make a legitimate business and estate plan to redistribute your property and if desirable transfer

assets to other individuals; it has to be an absolute transfer done well in advance of going into

business. If you transfer the assets to your spouse then in the case of separation the spouse can

be entitled to 50%. As well, you shouldn’t transfer property acquired prior to the marriage or

property acquired through inheritance because these are exempt from division in the marriage

act. Because he has substantial assets, he could achieve some protection through a prenuptial

agreement; it determines the allocation of property and support payments in the event of

divorce.

• Partnership:

o Advantages:

§ All partners may take part in the management of the partnership

§ A partnership is really easy to get into, but it is really tough to get out of or make

transfers of ownership

§ Partnerships also have strong loyalty because they are not allowed to compete with the

partnership. Along with prophylactic actions, a partnership agreement can refine the

terms of the partnership to his satisfaction.

o Disadvantages:

§ Because it is not a separate legal entity the separate assets of each partner are at risk to

satisfy the contractual and other liabilities of the partnership. Each partner is jointly and

separately liable for the liability of the business

§ Because all partners are agents of the partnership, each individual partner can create

liabilities of the partnership. Thus you should only enter into a partnership if you have to

and the partner should have lots of money because they will be able to cover the

liabilities created.

§ Profits are shared amongst partners. Tax advantages have been eliminated.

• Corporation:

o Advantages:

§ Shareholder has limited liability because the corporation is a separate legal entity and is

thus only at risk of losing his investment.

§ It allows for the use of many investors/shareholders as a means of funding.

§ Transfers of ownership are easy and end your relationship.

§ Corporations also have a continuous existence so if someone dies the corporation does

not have to dissolve.

o Disadvantages:

§ Shareholders have no authority to participate in management

§ Costs more to incorporate

§ Loyalty is lower because shareholders can hold shares in competing corporations. You

can change this through the use of a corporation agreement that brings in aspects of the

partnership act.

§ As well, there tend to be disputes due to the separation of ownership and management,

since the two parties have different interests.

§ Directors are considered fiduciaries and thus owe duties to a number of categories of

persons. If they fail to satisfy those duties then they are liable to someone and thus the

liability of directors is expanding and can include their personal assets.

• In deciding which type of organization to use there are numerous criteria Mr. Risktaker should consider:

o Limited liability

o Estate planning

o Tax planning

o Borrowing requirements and relationship of lenders

o Employee ownership

o Flexibility of structure

o Desirability of perpetual existence

o Number of proposed proprietors

o Relationship of proposed proprietors

o Applicable government requirements

o Available government grants

o Costs

You might also like

- Complete Business Law MindmapDocument11 pagesComplete Business Law MindmapJoel Isaiah Koal100% (8)

- Contract Law Crash CourseDocument9 pagesContract Law Crash CourseJane NgNo ratings yet

- Code of Conduct GoogleDocument16 pagesCode of Conduct GooglezubishuNo ratings yet

- Toll Manufacturing ContractDocument4 pagesToll Manufacturing ContractHoward Untalan100% (1)

- RFP - Visa OutsourcingDocument12 pagesRFP - Visa OutsourcingromsbhojakNo ratings yet

- SUPPLY AGREEMENT One Month Payble Elemut MilkDocument2 pagesSUPPLY AGREEMENT One Month Payble Elemut MilkAbel100% (1)

- Business Law Final NotesDocument30 pagesBusiness Law Final NotesMónica DuránNo ratings yet

- Elements of The Law of Contract: DR Graham Melling March 2014Document70 pagesElements of The Law of Contract: DR Graham Melling March 2014kks8070No ratings yet

- Chapter 2 Notes and MortgagesDocument24 pagesChapter 2 Notes and Mortgagesnazmul islamNo ratings yet

- Blaw Week 3 - ConsiderationDocument4 pagesBlaw Week 3 - ConsiderationKenny Ong Kai NengNo ratings yet

- 2 of 2 LAW OF CONTRACT BDocument50 pages2 of 2 LAW OF CONTRACT BNene onetwoNo ratings yet

- DISCHARGE or TERMINATION OF CONTRACTDocument10 pagesDISCHARGE or TERMINATION OF CONTRACTThandie ChirambaNo ratings yet

- Contract Administration - FST HewavitharanaDocument28 pagesContract Administration - FST HewavitharanaTent ParkNo ratings yet

- Tutorial 3 Notes - Consideration and Intention To Create Legal RelationsDocument3 pagesTutorial 3 Notes - Consideration and Intention To Create Legal RelationsAdam 'Fez' Ferris100% (2)

- Intent To Contract: Offer and Acceptance: Contracts OutlineDocument14 pagesIntent To Contract: Offer and Acceptance: Contracts OutlineMickey WilliamsNo ratings yet

- ContractsDocument4 pagesContractsElle BadussyNo ratings yet

- NIDA ArtsLaw StudentNotes 2016Document6 pagesNIDA ArtsLaw StudentNotes 2016Ray PittmanNo ratings yet

- Delivered by Catherine GregoryDocument182 pagesDelivered by Catherine GregoryMir Fida NadeemNo ratings yet

- Consideration and IntentionDocument20 pagesConsideration and IntentionRanyaNo ratings yet

- Rescission IDocument60 pagesRescission Ierica.oreilly59No ratings yet

- 11276discharge of ContractDocument14 pages11276discharge of ContractMUHMMAD ARSALAN 13728No ratings yet

- BU231 - Fall 2012 Final SlidesDocument123 pagesBU231 - Fall 2012 Final SlideskinghopyNo ratings yet

- Module 3Document48 pagesModule 3nirmalatheresaNo ratings yet

- Adrian Fall 1L - Contracts Final OutlineDocument63 pagesAdrian Fall 1L - Contracts Final OutlineJasmine GaoNo ratings yet

- Contract ConceptsDocument4 pagesContract Conceptslwyxmusic KNo ratings yet

- Sales and Lease Law - Midterms - Mama Gie NotesDocument64 pagesSales and Lease Law - Midterms - Mama Gie NotesGieNo ratings yet

- Breach of Contract (Definition) : Legal Binding AgreementDocument20 pagesBreach of Contract (Definition) : Legal Binding AgreementPurwa BanwatNo ratings yet

- CPA REG Notes Chapter 5Document9 pagesCPA REG Notes Chapter 5brisketbackNo ratings yet

- Notes Chapter 5 REGDocument9 pagesNotes Chapter 5 REGcpacfa100% (2)

- CasesDocument7 pagesCasesKomal GuptaNo ratings yet

- Alex Drummond-Contracts Outline-Winter 2020-ShariffDocument107 pagesAlex Drummond-Contracts Outline-Winter 2020-ShariffJjjjmmmmNo ratings yet

- Chapter 9 - Common Contractual TermsDocument17 pagesChapter 9 - Common Contractual TermsComptonNo ratings yet

- Slides - Banking LawDocument44 pagesSlides - Banking LawRentsenjugder NaranchuluunNo ratings yet

- Pob Section 4Document12 pagesPob Section 4Nathefa LayneNo ratings yet

- Oblicon NotesDocument6 pagesOblicon NotesJoy RaguindinNo ratings yet

- Formalities of The Contract: "A Written or Spoken Agreement, That Is Intended To Be Enforceable by Law"Document33 pagesFormalities of The Contract: "A Written or Spoken Agreement, That Is Intended To Be Enforceable by Law"tricia mendozaNo ratings yet

- Frier Contracts Outline 2Document80 pagesFrier Contracts Outline 2oaijfNo ratings yet

- ConsiderationDocument15 pagesConsiderationRanyaNo ratings yet

- Ethics Lecture Notes - Stephanie ForteDocument35 pagesEthics Lecture Notes - Stephanie FortetajhtechzNo ratings yet

- Consideration. Version 2022 23Document8 pagesConsideration. Version 2022 23sakiburrohman11No ratings yet

- Contract Law (Semester 3)Document10 pagesContract Law (Semester 3)ManonScottyNo ratings yet

- Wwek 2Document34 pagesWwek 2repiresNo ratings yet

- Ch1. Law of ContractDocument24 pagesCh1. Law of ContractTaha GargoumNo ratings yet

- Assignment 01: North South UniversityDocument4 pagesAssignment 01: North South UniversityRaj RahmanNo ratings yet

- Contract Law Week 3 ReadingsDocument11 pagesContract Law Week 3 ReadingsCho Jing QinNo ratings yet

- Flowchart - Lecture 4Document2 pagesFlowchart - Lecture 4Mandy DuNo ratings yet

- The Law of ContractDocument19 pagesThe Law of ContractAbdiweli mohamedNo ratings yet

- Indian Contract Act, 1872Document70 pagesIndian Contract Act, 1872migpatel7970No ratings yet

- Formation of K at Common Law Presentation - Okt10Document9 pagesFormation of K at Common Law Presentation - Okt10paschal makonaNo ratings yet

- Redit Ransaction: TranscriptionsDocument75 pagesRedit Ransaction: Transcriptionsjames lebron100% (1)

- C1c. Breach of Contract and Remedies (Latest)Document24 pagesC1c. Breach of Contract and Remedies (Latest)Taha GargoumNo ratings yet

- Chapter 4 - Breach of Contract and TerminationDocument20 pagesChapter 4 - Breach of Contract and TerminationMacdonald PhashaNo ratings yet

- Unit 13 Ending - Termination of ContractsDocument12 pagesUnit 13 Ending - Termination of ContractsGift chipetaNo ratings yet

- Contracts of Guarantee and IndemnityDocument5 pagesContracts of Guarantee and Indemnityomolehalleluyah00No ratings yet

- DetailDocument4 pagesDetail2023000130.mohammadNo ratings yet

- Conclusion 393Document24 pagesConclusion 393Blair ZuoNo ratings yet

- ConsiderationDocument54 pagesConsiderationBrandon WongNo ratings yet

- LAW 711 Contracts I OutlineDocument24 pagesLAW 711 Contracts I Outlinepatel.argNo ratings yet

- Contracts Outline. Bender. Spring 2013Document158 pagesContracts Outline. Bender. Spring 2013Laura CNo ratings yet

- Ab1301 SummaryDocument33 pagesAb1301 SummaryjonathanNo ratings yet

- Contracts, Extinguishing of Obligations, Payment and CompensationDocument44 pagesContracts, Extinguishing of Obligations, Payment and CompensationPaolo ManansalaNo ratings yet

- Consideration CasesDocument8 pagesConsideration CasesHeyy FlowerNo ratings yet

- Absconding Letter Excel Template: Particulars Details Employer DetailsDocument4 pagesAbsconding Letter Excel Template: Particulars Details Employer DetailsCorporate RishiNo ratings yet

- Nature of ContractDocument10 pagesNature of Contractsristi survey groupNo ratings yet

- RFP HCL Uday My E Haat - v2Document7 pagesRFP HCL Uday My E Haat - v2Puri SantoshNo ratings yet

- DOE Order 460dDocument16 pagesDOE Order 460dBryan JonesNo ratings yet

- Landlord Tenant HandbookDocument42 pagesLandlord Tenant HandbookAnthony TriplinNo ratings yet

- Revised Iesco Book of Financial PowersDocument75 pagesRevised Iesco Book of Financial PowersMuhammad IbrarNo ratings yet

- Contract LawDocument5 pagesContract LawSyed Muhammad AhmedNo ratings yet

- Letter of IntentDocument8 pagesLetter of IntentRuwan MadhushankaNo ratings yet

- Natres ReviewerDocument37 pagesNatres ReviewerMark Joseph Reyes100% (6)

- 09 Claims and Disputes ProceduresDocument7 pages09 Claims and Disputes ProceduresFawad SaeedNo ratings yet

- DPWH ContractDocument4 pagesDPWH ContractLance BernardoNo ratings yet

- Specific PerformanceDocument24 pagesSpecific PerformanceSiva NanthaNo ratings yet

- Abbott Piramal AgreementDocument88 pagesAbbott Piramal AgreementHemanth NandigalaNo ratings yet

- (Vol 4) The Book of History. A History of All Nations From The Earliest Times To The Present, With Over 8,000 IllustrationsDocument1,316 pages(Vol 4) The Book of History. A History of All Nations From The Earliest Times To The Present, With Over 8,000 IllustrationsAnonymous mnyCjzP5No ratings yet

- Sales Contract - Junk IronDocument6 pagesSales Contract - Junk IronThư Nguyễn Thị LệNo ratings yet

- Harman Adobe Flash Evaluation License Agreement 2020.10.23Document10 pagesHarman Adobe Flash Evaluation License Agreement 2020.10.23Francisco MacielNo ratings yet

- Midterm Examination: Automatically Fail The Subject.)Document3 pagesMidterm Examination: Automatically Fail The Subject.)Mia Domadalug-AbdullahNo ratings yet

- 02 MS Waterproofing WORKSDocument10 pages02 MS Waterproofing WORKSNhel G. Pascual67% (3)

- Babcock Vs Jackson Full TextDocument10 pagesBabcock Vs Jackson Full TextSyElfredGNo ratings yet

- Voluntary Separation Agreement - SampleDocument4 pagesVoluntary Separation Agreement - Sampleabdul_salahi100% (1)

- Zamboanga V PlagataDocument2 pagesZamboanga V PlagataNikki Estores Gonzales100% (2)

- Escrow Agreement With InterestDocument5 pagesEscrow Agreement With InterestpaulmercadoNo ratings yet

- Appraisal of Challenges Confronting Recognition and Enforcement of Arbitral Awards in Nigeria.Document10 pagesAppraisal of Challenges Confronting Recognition and Enforcement of Arbitral Awards in Nigeria.KIU PUBLICATION AND EXTENSIONNo ratings yet

- Checklist of Eligibility Requirements: - DATEDocument1 pageChecklist of Eligibility Requirements: - DATELouiegiNo ratings yet

- Petitioner vs. vs. Respondents Nitorreda Law Office Pacatang & Pacatang Law OfficesDocument8 pagesPetitioner vs. vs. Respondents Nitorreda Law Office Pacatang & Pacatang Law OfficesApa MendozaNo ratings yet

- Law As A Public Good: The Economics AnarchyDocument19 pagesLaw As A Public Good: The Economics AnarchydecenteredlifeNo ratings yet