Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

18 viewsFinal Exams Fund of Acctg Bus MGT 2023

Final Exams Fund of Acctg Bus MGT 2023

Uploaded by

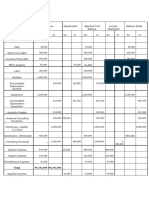

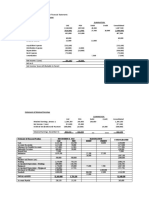

JAN RAY CUISON VISPERASThis document contains the adjusted trial balance, income statement, and balance sheet for Golden Bright Company as of December 31, 2022. The trial balance shows the company has $975,000 in cash, $1.25 million in accounts receivable, and $2.5 million in capital. The income statement reveals the company had $875,000 in service revenue and $105,000 in interest revenue, as well as $235,000 in salaries expense. The balance sheet lists the company's assets including cash, accounts receivable, and equipment, and its liabilities and equity.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- FDNACCT C35A Group Project Group 3Document21 pagesFDNACCT C35A Group Project Group 3cNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Exercise 6 22 Acctba1Document11 pagesExercise 6 22 Acctba1Sophia Santos50% (2)

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- FLE1 PROBLEM Template - 749774773Document4 pagesFLE1 PROBLEM Template - 749774773Claire Anne LeeNo ratings yet

- Book 1Document6 pagesBook 1xbautista124No ratings yet

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Worksheet Quiz ExampleDocument5 pagesWorksheet Quiz ExampleFrenzearl ArmadaNo ratings yet

- Perpetual - Adjusted Trial BalanceDocument1 pagePerpetual - Adjusted Trial BalanceJeon Cyrone CuachonNo ratings yet

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaNo ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- Example WorksheetDocument1 pageExample WorksheetmarkuspriamNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Kevin ConsultantDocument13 pagesKevin ConsultantNaufal MohammadNo ratings yet

- Af Cash FlowDocument1 pageAf Cash FlowHarvey Oli100% (1)

- EX7Document3 pagesEX7dumpanonymouslyNo ratings yet

- ADJUSTINGDocument2 pagesADJUSTINGZup ThanksNo ratings yet

- Fabm 1 ExamDocument2 pagesFabm 1 ExamJasfer Niño100% (1)

- WorksheetDocument37 pagesWorksheetKim FloresNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentRochelle ObadoNo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- Quiz FS MerchandisingDocument3 pagesQuiz FS Merchandisingchey dabestNo ratings yet

- AccountingDocument5 pagesAccountingLycel BelenNo ratings yet

- Book 1Document1 pageBook 1iya RasonableNo ratings yet

- FDNACCT - Group 1 Project - Eri Torsten HardwaresDocument24 pagesFDNACCT - Group 1 Project - Eri Torsten HardwaresLara Ysabelle CappsNo ratings yet

- FAR 2 SledgerDocument6 pagesFAR 2 Sledgerkrystallanedenice.manansalaNo ratings yet

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- Big Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4Document3 pagesBig Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4rida zulquarnainNo ratings yet

- Dot Printing Narioazelleah B.Document12 pagesDot Printing Narioazelleah B.Aizha NarioNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- KhemDocument2 pagesKhemMelonie GalarpeNo ratings yet

- Project OverviewDocument6 pagesProject OverviewWakin PoloNo ratings yet

- Problem Exercises AnswerDocument6 pagesProblem Exercises AnswersaphirejunelNo ratings yet

- IT ActivityDocument5 pagesIT ActivityTine RobisoNo ratings yet

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Document15 pagesEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytNo ratings yet

- Task-1 Master Budget With Profit ProjectionsDocument5 pagesTask-1 Master Budget With Profit ProjectionsbabluanandNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- Unit 3 Tutorial Worksheet (Session 1)Document15 pagesUnit 3 Tutorial Worksheet (Session 1)MingxNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Seatwork 2 Worksheet Income Statemet Changes in Equity and Balance SheetDocument7 pagesSeatwork 2 Worksheet Income Statemet Changes in Equity and Balance Sheetjohn vincent de leonNo ratings yet

- Accounting 1Document7 pagesAccounting 1Nhoriel MacawileNo ratings yet

- #Chapter 4 Asignación (Recovered)Document22 pages#Chapter 4 Asignación (Recovered)adrianasofiagomez14No ratings yet

- Jane Christine SolutionDocument7 pagesJane Christine Solutionckbeom0No ratings yet

- Yeahna Auditing-WPS OfficeDocument4 pagesYeahna Auditing-WPS OfficeDante PagariganNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Quiz Lab AkmDocument20 pagesQuiz Lab AkmAdib PramanaNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- NO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Document6 pagesNO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Rizki Fajar RhamadanNo ratings yet

- Adjusted Trial BalanceDocument1 pageAdjusted Trial BalanceRyan EvaristoNo ratings yet

- Ap A2Document22 pagesAp A2damminhngoc228No ratings yet

- AJEDocument8 pagesAJEAngel Cldn VelayoNo ratings yet

- Comprehensiveproblemset#8Document15 pagesComprehensiveproblemset#8DEO100% (1)

- Chapter 3 Source of Capital - Handout - 404263880Document22 pagesChapter 3 Source of Capital - Handout - 404263880JAN RAY CUISON VISPERASNo ratings yet

- ACCTG1 PrefinalsDocument23 pagesACCTG1 PrefinalsJAN RAY CUISON VISPERAS100% (1)

- Sample Radio CallsDocument7 pagesSample Radio CallsJAN RAY CUISON VISPERASNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJAN RAY CUISON VISPERASNo ratings yet

- Statement of Accounts Group 4 AOM1ADocument1 pageStatement of Accounts Group 4 AOM1AJAN RAY CUISON VISPERASNo ratings yet

- Group 7 Case StudyDocument17 pagesGroup 7 Case StudyJAN RAY CUISON VISPERASNo ratings yet

- Film Review (Jan Ray)Document5 pagesFilm Review (Jan Ray)JAN RAY CUISON VISPERASNo ratings yet

- Academic Paper (Jan Ray)Document2 pagesAcademic Paper (Jan Ray)JAN RAY CUISON VISPERASNo ratings yet

- Activity 1.5 (Jan Ray)Document4 pagesActivity 1.5 (Jan Ray)JAN RAY CUISON VISPERASNo ratings yet

- Final 4 For Theoriees of LearningDocument2 pagesFinal 4 For Theoriees of LearningRose B Unlad67% (6)

- Technical Manual For Design and Construction of Road Tunnels-2010 PDFDocument648 pagesTechnical Manual For Design and Construction of Road Tunnels-2010 PDFAsim Amin100% (1)

- VAL 225 Procedure For Performing Steam in Place SIP Validation SampleDocument14 pagesVAL 225 Procedure For Performing Steam in Place SIP Validation SampleSameh MostafaNo ratings yet

- TOR - Design & Supervision of Windalco-Kirkvine Cold Storage Facility Project - 0Document57 pagesTOR - Design & Supervision of Windalco-Kirkvine Cold Storage Facility Project - 0jawidNo ratings yet

- Pancha Mahabhuta - Five Great Elements: Akash (Ether)Document2 pagesPancha Mahabhuta - Five Great Elements: Akash (Ether)ANU M ANo ratings yet

- Funda Finals ReviewerDocument23 pagesFunda Finals Reviewerchloepaxton030No ratings yet

- Specifications Dimension: (Unit: MM) 55SVH7EDocument1 pageSpecifications Dimension: (Unit: MM) 55SVH7Edervis quinteroNo ratings yet

- MGS & WipDocument2 pagesMGS & WipRoni HadyanNo ratings yet

- Computer Networking A Top Down Approach 7Th Edition PDF Full ChapterDocument41 pagesComputer Networking A Top Down Approach 7Th Edition PDF Full Chapterlawrence.graves202100% (16)

- People CodeDocument44 pagesPeople CodehardanuNo ratings yet

- Brown Spot of RiceDocument16 pagesBrown Spot of Riceuvmahansar16No ratings yet

- Urban Development - 2Document3 pagesUrban Development - 2APSDPS17 OFFICENo ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial Analysisdewanibipin100% (1)

- Anti War Literature Project by Namratha.NDocument32 pagesAnti War Literature Project by Namratha.NSuhas Sai MasettyNo ratings yet

- You As An Entrepreneur: SOFTNET Information Technology Center IncDocument7 pagesYou As An Entrepreneur: SOFTNET Information Technology Center IncVirnadette OlinaresNo ratings yet

- The Effects of Drinking Alcoholic Beverages in The 4 Year Nursing Students of Brent Hospital and Colleges Incorporated School Year 2010 - 2011Document17 pagesThe Effects of Drinking Alcoholic Beverages in The 4 Year Nursing Students of Brent Hospital and Colleges Incorporated School Year 2010 - 2011Chauz Undo100% (2)

- Front Office Food and Beverage ServiceDocument28 pagesFront Office Food and Beverage Servicenajeebkalwar67% (3)

- Cathay Pacific Research PaperDocument4 pagesCathay Pacific Research Paperafeawfxlb100% (1)

- CBSE Class 9 Computers Notes and Assignments - 0 PDFDocument18 pagesCBSE Class 9 Computers Notes and Assignments - 0 PDFPonk ManNo ratings yet

- An Essay On Islamic SchoolsDocument3 pagesAn Essay On Islamic Schoolsibnajami100% (1)

- General Organic ChemistryDocument5 pagesGeneral Organic ChemistryG RNo ratings yet

- Ascento Dental Line Catalog Implanturi Alpha Dent GermaniaDocument82 pagesAscento Dental Line Catalog Implanturi Alpha Dent GermaniaGabriela IconaruNo ratings yet

- Very Very Imp Docs For Nbde/Ndeb 2017: (WWW - Dental-Books - In)Document33 pagesVery Very Imp Docs For Nbde/Ndeb 2017: (WWW - Dental-Books - In)mohanNo ratings yet

- Front End LoadingDocument2 pagesFront End LoadingRyan SykesNo ratings yet

- Pasteurization and Heat Sterilization - 2Document33 pagesPasteurization and Heat Sterilization - 2Taf Du Plessis Ngara50% (2)

- Impact of AIS On OE of AC in Alabang Muntinlupa PROPER 2Document39 pagesImpact of AIS On OE of AC in Alabang Muntinlupa PROPER 2Kyle Baladad50% (2)

- Twisted Pair, Coaxial Cable, Optical FiberDocument34 pagesTwisted Pair, Coaxial Cable, Optical Fiber7t854s6wd2No ratings yet

- Module 3 Parliamentary ProceduresDocument9 pagesModule 3 Parliamentary ProceduresRonJen VlogsNo ratings yet

- 00 Table of Contents NMDocument9 pages00 Table of Contents NMJohn Bofarull GuixNo ratings yet

- Specifications: Shenzhen Sunlord Electronics Co., LTDDocument38 pagesSpecifications: Shenzhen Sunlord Electronics Co., LTDdabajiNo ratings yet

Final Exams Fund of Acctg Bus MGT 2023

Final Exams Fund of Acctg Bus MGT 2023

Uploaded by

JAN RAY CUISON VISPERAS0 ratings0% found this document useful (0 votes)

18 views1 pageThis document contains the adjusted trial balance, income statement, and balance sheet for Golden Bright Company as of December 31, 2022. The trial balance shows the company has $975,000 in cash, $1.25 million in accounts receivable, and $2.5 million in capital. The income statement reveals the company had $875,000 in service revenue and $105,000 in interest revenue, as well as $235,000 in salaries expense. The balance sheet lists the company's assets including cash, accounts receivable, and equipment, and its liabilities and equity.

Original Description:

Original Title

FINAL-EXAMS-FUND-OF-ACCTG-BUS-MGT-2023

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains the adjusted trial balance, income statement, and balance sheet for Golden Bright Company as of December 31, 2022. The trial balance shows the company has $975,000 in cash, $1.25 million in accounts receivable, and $2.5 million in capital. The income statement reveals the company had $875,000 in service revenue and $105,000 in interest revenue, as well as $235,000 in salaries expense. The balance sheet lists the company's assets including cash, accounts receivable, and equipment, and its liabilities and equity.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageFinal Exams Fund of Acctg Bus MGT 2023

Final Exams Fund of Acctg Bus MGT 2023

Uploaded by

JAN RAY CUISON VISPERASThis document contains the adjusted trial balance, income statement, and balance sheet for Golden Bright Company as of December 31, 2022. The trial balance shows the company has $975,000 in cash, $1.25 million in accounts receivable, and $2.5 million in capital. The income statement reveals the company had $875,000 in service revenue and $105,000 in interest revenue, as well as $235,000 in salaries expense. The balance sheet lists the company's assets including cash, accounts receivable, and equipment, and its liabilities and equity.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

Fundamentals of Accounting, Bus Management (Bridging)

Name Jan Ray Visperas Course/Year AOM-A Score .

Below is the adjusted Trial Balance of Golden Bright Company as of December 31, 2022

ADJUSTED TRIAL BALANCE INCOME STATEMENT BALANCE SHEET

DEBIT CREDIT DEBIT CREDIT DEBIT CREDIT

Cash 975,000 975,000

Accounts Receivable 1,250,000 1,250,000

Allowance for Bad Debts 62,500 62,500

Prepaid Rent 75,000 75,000

Office Supplies 45,000 45,000

Furniture and Fixtures 225,000 225,000

Accumulated Depreciation - F & F 45,000 45,000

Office Equipment 1,250,000 1,250,000

Accumulated Depreciation- Of Eq. 250,000 250,000

Accounts Payable 75,000 75,000

Loans Payable 375,000 375,000

Unearned Service Revenue 65,000 65,000

Gold, Capital 2,500,000 2,500,000

Gold, Drawings 75,000 75,000

Service Revenue 875,000 875,000

Interest Revenue 105,000 105,000

Salaries Expense 235,000 235,000

Office Supplies Expense 15,250 15,250

Miscellaneous Expense 15,500 15,500

Rent Expense 25,000 25,000

Utilities Expense 19,250 19,250

Depreciation Expense 147,500 147,500

TOTAL 4,352,500 4,352,500 457,500 980,000 3,895,000 3,372,500

Net Income 522,500 522,500

TOTALS 980,000 980,000 3,895,000 3,895,000

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- FDNACCT C35A Group Project Group 3Document21 pagesFDNACCT C35A Group Project Group 3cNo ratings yet

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- Exercise 6 22 Acctba1Document11 pagesExercise 6 22 Acctba1Sophia Santos50% (2)

- ASPL3 Activity 3-6 DoneDocument7 pagesASPL3 Activity 3-6 DoneConcepcion Family33% (3)

- FLE1 PROBLEM Template - 749774773Document4 pagesFLE1 PROBLEM Template - 749774773Claire Anne LeeNo ratings yet

- Book 1Document6 pagesBook 1xbautista124No ratings yet

- AnswersDocument24 pagesAnswersDeul ErNo ratings yet

- Abm2 Week-5Document12 pagesAbm2 Week-5amorashella5No ratings yet

- Worksheet Quiz ExampleDocument5 pagesWorksheet Quiz ExampleFrenzearl ArmadaNo ratings yet

- Perpetual - Adjusted Trial BalanceDocument1 pagePerpetual - Adjusted Trial BalanceJeon Cyrone CuachonNo ratings yet

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Lab Komputer Akuntansi KeuanganDocument8 pagesLab Komputer Akuntansi KeuanganlistianiNo ratings yet

- MODULE 8 Learning ActivitiesDocument5 pagesMODULE 8 Learning ActivitiesChristian Cyrous AcostaNo ratings yet

- DeceVid Company Final Worksheet PDFDocument1 pageDeceVid Company Final Worksheet PDFAngel Nhova Pepito OmalayNo ratings yet

- Working Paper Part 2Document3 pagesWorking Paper Part 2KEITH JEROME VIERNESNo ratings yet

- Attachment AccountingDocument6 pagesAttachment Accountingtaylor swiftyyyNo ratings yet

- Example WorksheetDocument1 pageExample WorksheetmarkuspriamNo ratings yet

- Act 110 Bonus Activity (Dimalawang)Document10 pagesAct 110 Bonus Activity (Dimalawang)Kilwa DyNo ratings yet

- Kevin ConsultantDocument13 pagesKevin ConsultantNaufal MohammadNo ratings yet

- Af Cash FlowDocument1 pageAf Cash FlowHarvey Oli100% (1)

- EX7Document3 pagesEX7dumpanonymouslyNo ratings yet

- ADJUSTINGDocument2 pagesADJUSTINGZup ThanksNo ratings yet

- Fabm 1 ExamDocument2 pagesFabm 1 ExamJasfer Niño100% (1)

- WorksheetDocument37 pagesWorksheetKim FloresNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentRochelle ObadoNo ratings yet

- Handout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyDocument3 pagesHandout 1 Adjusting Entries Adjusted Trial Balance Financial Statements Answer KeyKris Dela CruzNo ratings yet

- Quiz FS MerchandisingDocument3 pagesQuiz FS Merchandisingchey dabestNo ratings yet

- AccountingDocument5 pagesAccountingLycel BelenNo ratings yet

- Book 1Document1 pageBook 1iya RasonableNo ratings yet

- FDNACCT - Group 1 Project - Eri Torsten HardwaresDocument24 pagesFDNACCT - Group 1 Project - Eri Torsten HardwaresLara Ysabelle CappsNo ratings yet

- FAR 2 SledgerDocument6 pagesFAR 2 Sledgerkrystallanedenice.manansalaNo ratings yet

- Travel Agency RubisomethingDocument12 pagesTravel Agency RubisomethingItsRenz YTNo ratings yet

- Big Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4Document3 pagesBig Red Bicycle Master Budget FY 2011/2012 FY Q1 Q2 Q3 Q4rida zulquarnainNo ratings yet

- Dot Printing Narioazelleah B.Document12 pagesDot Printing Narioazelleah B.Aizha NarioNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- KhemDocument2 pagesKhemMelonie GalarpeNo ratings yet

- Project OverviewDocument6 pagesProject OverviewWakin PoloNo ratings yet

- Problem Exercises AnswerDocument6 pagesProblem Exercises AnswersaphirejunelNo ratings yet

- IT ActivityDocument5 pagesIT ActivityTine RobisoNo ratings yet

- Eg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Document15 pagesEg (Dela Cruz, Juan S. - Adjusting Entries and Recommendation)Peyti PeytNo ratings yet

- Task-1 Master Budget With Profit ProjectionsDocument5 pagesTask-1 Master Budget With Profit ProjectionsbabluanandNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Nelson Daganta CashDocument10 pagesNelson Daganta CashDan RioNo ratings yet

- Unit 3 Tutorial Worksheet (Session 1)Document15 pagesUnit 3 Tutorial Worksheet (Session 1)MingxNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Seatwork 2 Worksheet Income Statemet Changes in Equity and Balance SheetDocument7 pagesSeatwork 2 Worksheet Income Statemet Changes in Equity and Balance Sheetjohn vincent de leonNo ratings yet

- Accounting 1Document7 pagesAccounting 1Nhoriel MacawileNo ratings yet

- #Chapter 4 Asignación (Recovered)Document22 pages#Chapter 4 Asignación (Recovered)adrianasofiagomez14No ratings yet

- Jane Christine SolutionDocument7 pagesJane Christine Solutionckbeom0No ratings yet

- Yeahna Auditing-WPS OfficeDocument4 pagesYeahna Auditing-WPS OfficeDante PagariganNo ratings yet

- UntitledDocument5 pagesUntitledm habiburrahman55No ratings yet

- Quiz Lab AkmDocument20 pagesQuiz Lab AkmAdib PramanaNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- NO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Document6 pagesNO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Rizki Fajar RhamadanNo ratings yet

- Adjusted Trial BalanceDocument1 pageAdjusted Trial BalanceRyan EvaristoNo ratings yet

- Ap A2Document22 pagesAp A2damminhngoc228No ratings yet

- AJEDocument8 pagesAJEAngel Cldn VelayoNo ratings yet

- Comprehensiveproblemset#8Document15 pagesComprehensiveproblemset#8DEO100% (1)

- Chapter 3 Source of Capital - Handout - 404263880Document22 pagesChapter 3 Source of Capital - Handout - 404263880JAN RAY CUISON VISPERASNo ratings yet

- ACCTG1 PrefinalsDocument23 pagesACCTG1 PrefinalsJAN RAY CUISON VISPERAS100% (1)

- Sample Radio CallsDocument7 pagesSample Radio CallsJAN RAY CUISON VISPERASNo ratings yet

- Statement of Cash FlowsDocument10 pagesStatement of Cash FlowsJAN RAY CUISON VISPERASNo ratings yet

- Statement of Accounts Group 4 AOM1ADocument1 pageStatement of Accounts Group 4 AOM1AJAN RAY CUISON VISPERASNo ratings yet

- Group 7 Case StudyDocument17 pagesGroup 7 Case StudyJAN RAY CUISON VISPERASNo ratings yet

- Film Review (Jan Ray)Document5 pagesFilm Review (Jan Ray)JAN RAY CUISON VISPERASNo ratings yet

- Academic Paper (Jan Ray)Document2 pagesAcademic Paper (Jan Ray)JAN RAY CUISON VISPERASNo ratings yet

- Activity 1.5 (Jan Ray)Document4 pagesActivity 1.5 (Jan Ray)JAN RAY CUISON VISPERASNo ratings yet

- Final 4 For Theoriees of LearningDocument2 pagesFinal 4 For Theoriees of LearningRose B Unlad67% (6)

- Technical Manual For Design and Construction of Road Tunnels-2010 PDFDocument648 pagesTechnical Manual For Design and Construction of Road Tunnels-2010 PDFAsim Amin100% (1)

- VAL 225 Procedure For Performing Steam in Place SIP Validation SampleDocument14 pagesVAL 225 Procedure For Performing Steam in Place SIP Validation SampleSameh MostafaNo ratings yet

- TOR - Design & Supervision of Windalco-Kirkvine Cold Storage Facility Project - 0Document57 pagesTOR - Design & Supervision of Windalco-Kirkvine Cold Storage Facility Project - 0jawidNo ratings yet

- Pancha Mahabhuta - Five Great Elements: Akash (Ether)Document2 pagesPancha Mahabhuta - Five Great Elements: Akash (Ether)ANU M ANo ratings yet

- Funda Finals ReviewerDocument23 pagesFunda Finals Reviewerchloepaxton030No ratings yet

- Specifications Dimension: (Unit: MM) 55SVH7EDocument1 pageSpecifications Dimension: (Unit: MM) 55SVH7Edervis quinteroNo ratings yet

- MGS & WipDocument2 pagesMGS & WipRoni HadyanNo ratings yet

- Computer Networking A Top Down Approach 7Th Edition PDF Full ChapterDocument41 pagesComputer Networking A Top Down Approach 7Th Edition PDF Full Chapterlawrence.graves202100% (16)

- People CodeDocument44 pagesPeople CodehardanuNo ratings yet

- Brown Spot of RiceDocument16 pagesBrown Spot of Riceuvmahansar16No ratings yet

- Urban Development - 2Document3 pagesUrban Development - 2APSDPS17 OFFICENo ratings yet

- PZ Financial AnalysisDocument2 pagesPZ Financial Analysisdewanibipin100% (1)

- Anti War Literature Project by Namratha.NDocument32 pagesAnti War Literature Project by Namratha.NSuhas Sai MasettyNo ratings yet

- You As An Entrepreneur: SOFTNET Information Technology Center IncDocument7 pagesYou As An Entrepreneur: SOFTNET Information Technology Center IncVirnadette OlinaresNo ratings yet

- The Effects of Drinking Alcoholic Beverages in The 4 Year Nursing Students of Brent Hospital and Colleges Incorporated School Year 2010 - 2011Document17 pagesThe Effects of Drinking Alcoholic Beverages in The 4 Year Nursing Students of Brent Hospital and Colleges Incorporated School Year 2010 - 2011Chauz Undo100% (2)

- Front Office Food and Beverage ServiceDocument28 pagesFront Office Food and Beverage Servicenajeebkalwar67% (3)

- Cathay Pacific Research PaperDocument4 pagesCathay Pacific Research Paperafeawfxlb100% (1)

- CBSE Class 9 Computers Notes and Assignments - 0 PDFDocument18 pagesCBSE Class 9 Computers Notes and Assignments - 0 PDFPonk ManNo ratings yet

- An Essay On Islamic SchoolsDocument3 pagesAn Essay On Islamic Schoolsibnajami100% (1)

- General Organic ChemistryDocument5 pagesGeneral Organic ChemistryG RNo ratings yet

- Ascento Dental Line Catalog Implanturi Alpha Dent GermaniaDocument82 pagesAscento Dental Line Catalog Implanturi Alpha Dent GermaniaGabriela IconaruNo ratings yet

- Very Very Imp Docs For Nbde/Ndeb 2017: (WWW - Dental-Books - In)Document33 pagesVery Very Imp Docs For Nbde/Ndeb 2017: (WWW - Dental-Books - In)mohanNo ratings yet

- Front End LoadingDocument2 pagesFront End LoadingRyan SykesNo ratings yet

- Pasteurization and Heat Sterilization - 2Document33 pagesPasteurization and Heat Sterilization - 2Taf Du Plessis Ngara50% (2)

- Impact of AIS On OE of AC in Alabang Muntinlupa PROPER 2Document39 pagesImpact of AIS On OE of AC in Alabang Muntinlupa PROPER 2Kyle Baladad50% (2)

- Twisted Pair, Coaxial Cable, Optical FiberDocument34 pagesTwisted Pair, Coaxial Cable, Optical Fiber7t854s6wd2No ratings yet

- Module 3 Parliamentary ProceduresDocument9 pagesModule 3 Parliamentary ProceduresRonJen VlogsNo ratings yet

- 00 Table of Contents NMDocument9 pages00 Table of Contents NMJohn Bofarull GuixNo ratings yet

- Specifications: Shenzhen Sunlord Electronics Co., LTDDocument38 pagesSpecifications: Shenzhen Sunlord Electronics Co., LTDdabajiNo ratings yet