Professional Documents

Culture Documents

Computation 22-23

Computation 22-23

Uploaded by

Ruloans Vaishali0 ratings0% found this document useful (0 votes)

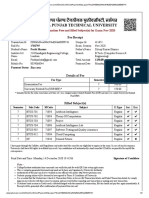

73 views2 pages1. This document contains the income tax return of Kelash Chand Mittal for the assessment year 2022-2023.

2. According to the return, Kelash Chand Mittal has total income of Rs. 510,700 which includes income from business/profession of Rs. 510,600 and other income of Rs. 2,020.

3. The total tax payable is Rs. 12,626 and after deducting TDS of Rs. 17,620, there is a refund due of Rs. 4,994.

Original Description:

Original Title

COMPUTATION 22-23

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. This document contains the income tax return of Kelash Chand Mittal for the assessment year 2022-2023.

2. According to the return, Kelash Chand Mittal has total income of Rs. 510,700 which includes income from business/profession of Rs. 510,600 and other income of Rs. 2,020.

3. The total tax payable is Rs. 12,626 and after deducting TDS of Rs. 17,620, there is a refund due of Rs. 4,994.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

73 views2 pagesComputation 22-23

Computation 22-23

Uploaded by

Ruloans Vaishali1. This document contains the income tax return of Kelash Chand Mittal for the assessment year 2022-2023.

2. According to the return, Kelash Chand Mittal has total income of Rs. 510,700 which includes income from business/profession of Rs. 510,600 and other income of Rs. 2,020.

3. The total tax payable is Rs. 12,626 and after deducting TDS of Rs. 17,620, there is a refund due of Rs. 4,994.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Name of Assessee KELASH CHAND MITTAL

Father's Name LAXMI NARAYAN

Address PANJAB COLONY,NAKA CHUNGI KE SAMNE,SALPURA

ROAD,CHHIPABAROD,BARAN,RAJASTHAN,325221

E-Mail consultancy.agc@gmail.com

Status Individual Assessment Year 2022-2023

Ward Year Ended 31.3.2022

PAN CINPM6572Q Date of Birth 01/01/1953

Residential Status Resident Gender Male

Particular of Business

Filing Status Original

Return Filed On 19/01/2023 Acknowledgement No.: 926254070190123

Last Year Return Filed On 31/03/2022 Acknowledgement No.: 524780170310322

Last Year Return Filed u/s Normal

Aadhaar No: 248319742651 Passport No.:

Bank Name Bank of baroda, , A/C NO:35400200000298 ,Type: ,IFSC: BARB0CHHIPA

Tele: Mob:8947005058

Computation of Total Income [As per Normal Provisions]

Caution

1. 26AS not imported

2. AIS report not imported

3. TIS summary not imported

Income from Business or Profession (Chapter IV D) 510600

Profit as per Profit and Loss a/c 510600

Total 510600

Income from Other Sources (Chapter IV F) 2020

Interest From Saving Bank A/c 1920

Misc. Income 100

2020

Gross Total Income 512620

Less: Deductions (Chapter VI-A)

u/s 80TTB (Interest From Saving Bank Account & FDR.) 1920

1920

Total Income 510700

Round off u/s 288 A 510700

Adjusted total income (ATI) is not more than Rs. 20 lakh hence AMT not applicable.

Tax Due (Exemption Limit Rs. 300000) 12140

Health & Education Cess (HEC) @ 4.00% 486

12626

T.D.S./T.C.S 17620

-4994

NAME OF ASSESSEE : KELASH CHAND MITTAL A.Y. 2022-2023 PAN : CINPM6572Q Code :244

Fee for default in furnishing return of income u/s 5000

234F

6

Round off u/s 288B 10

Deposit u/s 140A 10

Tax Payable 0

Tax calculation on Normal income of Rs 510700/-

Exemption Limit :300000

Tax on (500000 -300000) = 200000 @5% = 10000

Tax on 500001 to 510700 = 10700 @20% = 2140

Total Tax = 12140

T.D.S./ T.C.S. From

Non-Salary(as per Annexure) 17620

Prepaid taxes (Advance tax and Self assessment tax)

Sr.No. BSR Code Date Challan No Bank Name & Branch Amount

1 . 10

Total 10

Bank Account Detail

S. No. Bank Address Account No MICR NO IFSC Code Type

1 Bank of baroda 35400200000298 BARB0CHHIPA (Primary)

2 Hdfc bank 50200039525770 HDFC0004709

Details of T.D.S. on Non-Salary

S.No Name of the Deductor Tax deduction Amount Paid/credited Total Tax Amount out of (5)

A/C No. of the deducted claimed for this year

deductor

1 MUMH03189E 0 17620 17620

TOTAL 0 17620 17620

Head wise Summary on Income and TDS thereon

Head Section Amount As per Location of Income for TDS

Paid/Credited As Computation Comparison

per 26AS

NA 17620

Total 17620

Signature

(KELASH CHAND MITTAL)

Date-27.02.2023

CompuTax : 244 [KELASH CHAND MITTAL]

CA Akshit Bansal

Page 2

You might also like

- PIMCO COF IV Marketing Deck - Israel - 03232023 - 5732Document64 pagesPIMCO COF IV Marketing Deck - Israel - 03232023 - 5732moshe2mosheNo ratings yet

- Completing The Accounting Cycle: Chapter 4Document34 pagesCompleting The Accounting Cycle: Chapter 4Dương Thái NgọcNo ratings yet

- MR Harpreet Singh Punjab India 9592923392Document1 pageMR Harpreet Singh Punjab India 9592923392Neno MiqavaNo ratings yet

- Entrepreneurial Process 1Document38 pagesEntrepreneurial Process 1Marc Andrei MacatugalNo ratings yet

- Vipin Manohar Agarwal Computetion Ay-2022-23Document2 pagesVipin Manohar Agarwal Computetion Ay-2022-23giyanendersingh1No ratings yet

- Computation of Total Income Income From Other Sources (Chapter IV F) 392007Document2 pagesComputation of Total Income Income From Other Sources (Chapter IV F) 392007vipin agarwal0% (1)

- PDF 816776770290723Document1 pagePDF 816776770290723Sunita SinghNo ratings yet

- FD CertificateDocument1 pageFD CertificateBishnu SatpathyNo ratings yet

- RBL BankDocument17 pagesRBL BankorekishNo ratings yet

- Sacred Earth Renewal LicenseDocument6 pagesSacred Earth Renewal LicenseAnu RadhaNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceravi_seth_9No ratings yet

- Lotus Manpower Consultants Services Pvt. LTD.: Payslip For The Month of April 2019Document1 pageLotus Manpower Consultants Services Pvt. LTD.: Payslip For The Month of April 2019Jayanta Kumar SwainNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal AdviceTuhin ChakrabortyNo ratings yet

- Deposit Confirmation/Renewal AdviceDocument1 pageDeposit Confirmation/Renewal Advicekunal singhNo ratings yet

- Gmail - PSG PDFDocument1 pageGmail - PSG PDFJehangir Allam100% (2)

- Financial Certificate Sadhu Chitti Tarun Raj-1Document2 pagesFinancial Certificate Sadhu Chitti Tarun Raj-1syedibrahim.aliasad786No ratings yet

- ITR-3 Computation of TaxDocument25 pagesITR-3 Computation of TaxsharathNo ratings yet

- Appointment LetterDocument3 pagesAppointment Letterpoonam shuklaNo ratings yet

- D JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219Document2 pagesD JavaApps EMAIL-SERVERv1 (1) .1 Temp 111116095854219amardeepjassal85No ratings yet

- Vikky Kumar Asset Composition: Folio: 7842012793Document4 pagesVikky Kumar Asset Composition: Folio: 7842012793etezaziqbal287No ratings yet

- T12604121120044450 SoadDocument4 pagesT12604121120044450 Soadnitu kumariNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Sample Bank StatementDocument9 pagesSample Bank Statementemma adeoyeNo ratings yet

- ., I.K.Gujral Punjab Technical UniversityDocument2 pages., I.K.Gujral Punjab Technical UniversityParth SharmaNo ratings yet

- Teacher Appointment Letter 3Document1 pageTeacher Appointment Letter 3Wajid AliNo ratings yet

- Jitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Document4 pagesJitendra Raghuwanshi - ATCS Offer Letter - 7th February 2020Sonam BhardwajNo ratings yet

- Teamlease Services LimitedDocument1 pageTeamlease Services LimitedMimin khsNo ratings yet

- COMPANY REGISTRATION - CompressedDocument2 pagesCOMPANY REGISTRATION - CompressedPunjab SinghNo ratings yet

- Offer Letter SampleDocument2 pagesOffer Letter Sampleyevadimata vinakuNo ratings yet

- UdyogAadharRegistrationCertificate PDFDocument1 pageUdyogAadharRegistrationCertificate PDFRajit KumarNo ratings yet

- Insurance Smart Sampoorna RakshaDocument10 pagesInsurance Smart Sampoorna RakshaArpit ShahNo ratings yet

- PaySlip July 2022Document1 pagePaySlip July 2022Kaushal YadavNo ratings yet

- Acknowledgement Slip: Fixed DepositDocument1 pageAcknowledgement Slip: Fixed DepositAneesh BangiaNo ratings yet

- RetailAccountStatement 638177701684443330Document2 pagesRetailAccountStatement 638177701684443330ankiankita SounNo ratings yet

- Home & Hill Affairs Department Pay Slip Government of West BengalDocument1 pageHome & Hill Affairs Department Pay Slip Government of West BengalP GhosalNo ratings yet

- Itr 20-21Document1 pageItr 20-21Rohit kandpalNo ratings yet

- VK TradersDocument16 pagesVK TradersMOHAN ChandNo ratings yet

- Bank StatementDocument5 pagesBank StatementAshwani KumarNo ratings yet

- Sanction LetterDocument1 pageSanction LetterSandeep YadagiriNo ratings yet

- Archana V Offfer LetterDocument10 pagesArchana V Offfer LetterKetsyNo ratings yet

- More Ghost Stories of Shimla Hill by Minakhshi ChaudhryDocument13 pagesMore Ghost Stories of Shimla Hill by Minakhshi ChaudhryPuneet SapoliaNo ratings yet

- ZHR RVPN 111500Document69 pagesZHR RVPN 111500vinodk33506No ratings yet

- Patanjali YogDocument1 pagePatanjali Yoggaurav_potnisNo ratings yet

- Ad12459992 26112018095403 PDFDocument1 pageAd12459992 26112018095403 PDFAKSNo ratings yet

- Vamsi Krishna Velaga - ITDocument1 pageVamsi Krishna Velaga - ITvamsiNo ratings yet

- HDFC PayslipDocument2 pagesHDFC PayslipRohit KumarNo ratings yet

- Ca Report 28-07-2023 - 230728 - 173955Document7 pagesCa Report 28-07-2023 - 230728 - 173955Sahib SandhuNo ratings yet

- NEERALDocument4 pagesNEERALSimran MehraNo ratings yet

- GST Certificate - Pandurang SambhudasDocument3 pagesGST Certificate - Pandurang SambhudasPandurang sambhudasNo ratings yet

- IQJxjk EFTy Ua 5 G KTDocument8 pagesIQJxjk EFTy Ua 5 G KTAbhishek KeshariNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancegaurav kumarNo ratings yet

- Print - Udyam Registration CertificateDocument1 pagePrint - Udyam Registration CertificateSandeep KumarNo ratings yet

- PaySlip636676825338004033 PDFDocument1 pagePaySlip636676825338004033 PDFRAVINDER YADAVNo ratings yet

- Pno GV IMm 07 I 35 T 65Document4 pagesPno GV IMm 07 I 35 T 65rahulbhardhwaj0001No ratings yet

- Balance SheetDocument6 pagesBalance SheetBARMER BARMENo ratings yet

- Anamita Basu Human Resources: For Any Query Pls - ContactDocument1 pageAnamita Basu Human Resources: For Any Query Pls - Contactkushlesh jamuarNo ratings yet

- Statement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Document4 pagesStatement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Raghu Veer100% (2)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGagan Sales Agencies SunamNo ratings yet

- Offer Letter - Sathish Basham - Officer - 12-Sep-2023Document3 pagesOffer Letter - Sathish Basham - Officer - 12-Sep-2023Manikanth ChowdaryNo ratings yet

- Acct Statement XX7643 18112022Document8 pagesAcct Statement XX7643 18112022abhinav pratap mauryaNo ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument1 pageNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedUpendra MandalaNo ratings yet

- Comput 2024-25 AnkitDocument3 pagesComput 2024-25 AnkitPriyanshu tripathiNo ratings yet

- Computation Anita SareeDocument3 pagesComputation Anita SareeSURYAKANT PATHAKNo ratings yet

- Itr 22-23Document1 pageItr 22-23Ruloans VaishaliNo ratings yet

- Coi 22-23Document2 pagesCoi 22-23Ruloans VaishaliNo ratings yet

- Itr 23-24Document1 pageItr 23-24Ruloans VaishaliNo ratings yet

- Coi 21-22Document2 pagesCoi 21-22Ruloans VaishaliNo ratings yet

- Hey Bhanwar,: Here Is Your Credit Report For Jul '23Document31 pagesHey Bhanwar,: Here Is Your Credit Report For Jul '23Ruloans VaishaliNo ratings yet

- Mis NovemberDocument4 pagesMis NovemberRuloans VaishaliNo ratings yet

- Print - Udyam Registration CertificateDocument5 pagesPrint - Udyam Registration CertificateRuloans VaishaliNo ratings yet

- 3CB MinDocument17 pages3CB MinRuloans VaishaliNo ratings yet

- Rent Agreement Shop Sector 17 - MinDocument4 pagesRent Agreement Shop Sector 17 - MinRuloans VaishaliNo ratings yet

- IOCL Data 575Document52 pagesIOCL Data 575Ruloans VaishaliNo ratings yet

- Detail Sheet Choudhary Transport CompanyDocument1 pageDetail Sheet Choudhary Transport CompanyRuloans VaishaliNo ratings yet

- PP On Fuel StationDocument20 pagesPP On Fuel StationGurraacha Abbayyaa100% (2)

- Chapter 1 Introduction Corporate GovernanceDocument14 pagesChapter 1 Introduction Corporate GovernanceHM.No ratings yet

- Internship Report On SME Banking of Jamuna Bank Limited: Submitted ToDocument68 pagesInternship Report On SME Banking of Jamuna Bank Limited: Submitted ToMahmud HossainNo ratings yet

- ANSWER KEY (Mid-Term Quiz 1)Document1 pageANSWER KEY (Mid-Term Quiz 1)JoyluxxiNo ratings yet

- (Download PDF) International Trade Finance A Pragmatic Approach Tarsem Bhogal Online Ebook All Chapter PDFDocument42 pages(Download PDF) International Trade Finance A Pragmatic Approach Tarsem Bhogal Online Ebook All Chapter PDFcharlie.pigg926100% (8)

- LAS - Q1W1 - Intro To Accounting1Document4 pagesLAS - Q1W1 - Intro To Accounting1marissa casareno almueteNo ratings yet

- Strategic Analysis ShivamDocument27 pagesStrategic Analysis ShivamMadanKarkiNo ratings yet

- All About IOCL New PDFDocument3 pagesAll About IOCL New PDFAshishNo ratings yet

- Land Line Tariff Plans: ALTTC, GhaziabadDocument66 pagesLand Line Tariff Plans: ALTTC, GhaziabadRajesh KumarNo ratings yet

- Section 7 of Court Fee ActDocument15 pagesSection 7 of Court Fee Actzenab tayyab 86No ratings yet

- CetaDocument36 pagesCetaTudor SimionovNo ratings yet

- Production FunctionDocument33 pagesProduction FunctionRence MarcoNo ratings yet

- Small Business Loans: A Practical Guide To Business CreditDocument15 pagesSmall Business Loans: A Practical Guide To Business CreditwilllNo ratings yet

- Insights Mind Maps: Golden Quadrilateral ProjectDocument2 pagesInsights Mind Maps: Golden Quadrilateral Projectashish kumarNo ratings yet

- Dimla Selene S Assignment On Aggregate PlanningDocument3 pagesDimla Selene S Assignment On Aggregate PlanningJhaister Ashley LayugNo ratings yet

- Quiz - M1 M2Document12 pagesQuiz - M1 M2Jenz Crisha PazNo ratings yet

- Pricing Strategies: Marketing Starter: Chapter 11Document28 pagesPricing Strategies: Marketing Starter: Chapter 11muazNo ratings yet

- Jammu & Kashmir State Electricity Regulatory Commission: Tariff OrderDocument108 pagesJammu & Kashmir State Electricity Regulatory Commission: Tariff OrderBilal AhmadNo ratings yet

- A Review of Dynamic Capabilities, Innovation Capabilities, Entrepreneurial Capabilities and Their ConsequencesDocument10 pagesA Review of Dynamic Capabilities, Innovation Capabilities, Entrepreneurial Capabilities and Their ConsequencessukorotoNo ratings yet

- Types of IndustriesDocument29 pagesTypes of IndustriesMilton MosquitoNo ratings yet

- Inventory Management FinalDocument32 pagesInventory Management Finaljessa rodene franciscoNo ratings yet

- TTC Package 3D2N Istanbul Bursa Winter 2023Document1 pageTTC Package 3D2N Istanbul Bursa Winter 2023Meiryza AstutiNo ratings yet

- INDRAJIT SURVE (Resume R-2-2022)Document3 pagesINDRAJIT SURVE (Resume R-2-2022)sri projectssNo ratings yet

- The Role of Supplier Base Rationalisation in Operational Performance in The Retail Sector in ZimbabweDocument10 pagesThe Role of Supplier Base Rationalisation in Operational Performance in The Retail Sector in ZimbabweJorge Alejandro Patron ChicanaNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- Liberty Insurance Berhad (16688-K) Customer Service Tollfree: 1-300-888-990Document5 pagesLiberty Insurance Berhad (16688-K) Customer Service Tollfree: 1-300-888-990Abdul Hady Abu BakarNo ratings yet

- Realme 7 (Mist Blue, 128 GB) : Keep This Invoice and Manufacturer Box For Warranty PurposesDocument1 pageRealme 7 (Mist Blue, 128 GB) : Keep This Invoice and Manufacturer Box For Warranty PurposesBishal KhatriNo ratings yet