Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

1 viewsGST Challan

GST Challan

Uploaded by

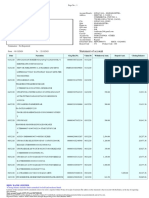

ANJANA SINGH CHAUHANThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies the reason for payment as "Any other payment". It lists the tax amounts to be paid under different heads - CGST, IGST, CESS, SGST - totaling to Rs. 195514. The mode of payment can be via e-payment, over the counter or NEFT/RTGS. Fields are provided for depositor details like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, taxpayer name, bank details, payment reference number etc.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Documen - Tips 10kdata3Document446 pagesDocumen - Tips 10kdata3onlinedata50% (2)

- List of Cement Plants in India PDFDocument6 pagesList of Cement Plants in India PDFAnonymous 9pKSMxb8100% (1)

- GST Challan PDFDocument1 pageGST Challan PDFAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanGaurav AgarwalNo ratings yet

- GST ChallanDocument1 pageGST ChallanAnkit DalsaniyaNo ratings yet

- GST ChallanDocument1 pageGST Challanvlogwithfun06No ratings yet

- GST ChallanDocument1 pageGST ChallanHMSNo ratings yet

- GST ChallanDocument1 pageGST ChallanHMSNo ratings yet

- GAYATRI INC GST-CHALLAN (7)Document1 pageGAYATRI INC GST-CHALLAN (7)gayatripackaging9No ratings yet

- GST ChallanDocument1 pageGST Challansachinkumar.rkcjNo ratings yet

- GST ChallanDocument1 pageGST Challannagesh abbaramainaNo ratings yet

- GST ChallanDocument1 pageGST ChallanWilfred DsouzaNo ratings yet

- GST ChallanDocument1 pageGST Challanaman sainNo ratings yet

- GST ChallanDocument1 pageGST Challansachinkumar.rkcjNo ratings yet

- Star Whizz - MArch ChallanDocument1 pageStar Whizz - MArch ChallanAmit PrabhuNo ratings yet

- Gst-Challan - 2024-01-06T171130.219Document1 pageGst-Challan - 2024-01-06T171130.219asafintax.consultingNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish VishnoiNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish GuptaNo ratings yet

- GST#CHALLANDocument1 pageGST#CHALLANravilakra lakraNo ratings yet

- Gst-Challan (13) MeDocument1 pageGst-Challan (13) Meacpandey.lawfirmNo ratings yet

- GST ChallanDocument1 pageGST ChallanArisina BanerjeeNo ratings yet

- GST ChallanDocument1 pageGST ChallanAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanFlish AcademyNo ratings yet

- GST Challan (RCM)Document1 pageGST Challan (RCM)sachinkumar.rkcjNo ratings yet

- GST CHALLAN Delta April 21Document1 pageGST CHALLAN Delta April 21pawan kanojiaNo ratings yet

- GST CHALLAN Delta April 21Document1 pageGST CHALLAN Delta April 21pawan kanojiaNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST Challantaxsachin16No ratings yet

- GST ChallanDocument1 pageGST ChallanTushar RaneNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- GST ChallanDocument1 pageGST Challanrajender kumarNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST ChallanSumit PanchalNo ratings yet

- Get HandsDocument1 pageGet HandsGaurav kumarNo ratings yet

- UntitledDocument1 pageUntitledvishalmahale15No ratings yet

- GST ChallanDocument1 pageGST Challandurgpalsingh2023No ratings yet

- GST CHALLAnDocument1 pageGST CHALLAnVibhav AnasaneNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- 2657 0 0 0 0 2657 SGST (0006)Document1 page2657 0 0 0 0 2657 SGST (0006)Bhvunesh AshaliyaNo ratings yet

- GST ChallanDocument1 pageGST Challanproject worksNo ratings yet

- GST ChallanDocument2 pagesGST ChallanHmingsanga HauhnarNo ratings yet

- GST ChallanDocument1 pageGST ChallanTushar Prakash ChaudhariNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- GST ChallanDocument1 pageGST ChallanTushar Prakash ChaudhariNo ratings yet

- GST ChallanDocument1 pageGST ChallanRakesh ZanwarNo ratings yet

- Gupta Trading Co. Gst-Challan Payment-1Document1 pageGupta Trading Co. Gst-Challan Payment-1Pradeep G NairNo ratings yet

- 5577 0 0 0 0 5577 SGST (0006)Document2 pages5577 0 0 0 0 5577 SGST (0006)Virender AryaNo ratings yet

- GST-CHALLAN (2)Document1 pageGST-CHALLAN (2)aliahmad.090No ratings yet

- Gst-Challan (4) - 120008Document1 pageGst-Challan (4) - 120008ShivanshNo ratings yet

- GST Challan Revised Mangalore Bio July. 21Document2 pagesGST Challan Revised Mangalore Bio July. 21AHAMMAD BASHEERNo ratings yet

- GST ChallanDocument1 pageGST Challansarah IsharatNo ratings yet

- GST ChallanDocument1 pageGST ChallanVineet KhuranaNo ratings yet

- GST ChallanDocument1 pageGST Challandurgpalsingh2023No ratings yet

- GST ChallanDocument1 pageGST ChallanSanjayThakkarNo ratings yet

- 8695 0 0 150 0 8845 SGST (0006)Document2 pages8695 0 0 150 0 8845 SGST (0006)061-vineet jainNo ratings yet

- GST ChallanDocument2 pagesGST ChallanCaRaghavendraRaghuNo ratings yet

- GST Challan Receipt 6Document1 pageGST Challan Receipt 6jenishjeba90No ratings yet

- KGHHDocument1 pageKGHHNadeem ManzoorNo ratings yet

- Indian Manufacturing Industry Technology Status and ProspectsDocument47 pagesIndian Manufacturing Industry Technology Status and ProspectsJust_Jobless100% (1)

- South Companies DataDocument51 pagesSouth Companies DataIOD EventsNo ratings yet

- Exclusive Interview With SteelGuru - Com, MR Jayant Acharya Director Sales & Marketing of JSW SteelDocument4 pagesExclusive Interview With SteelGuru - Com, MR Jayant Acharya Director Sales & Marketing of JSW SteeljtpmlNo ratings yet

- Fy 21-22 - 110034Document33 pagesFy 21-22 - 110034The Words Can Speak Rudra SharmaNo ratings yet

- NiftyDocument14 pagesNiftyAnshuman GuptaNo ratings yet

- Task StatusDocument80 pagesTask StatusAmit KumarNo ratings yet

- Annexure 1A - Major CityDocument415 pagesAnnexure 1A - Major CitygurshaaNo ratings yet

- Do MSTC JPR 23-24 2012Document3 pagesDo MSTC JPR 23-24 2012vikas agrawalNo ratings yet

- Acct Statement - XX9928 - 22122021Document49 pagesAcct Statement - XX9928 - 22122021viveknaikNo ratings yet

- Transactions List ITFOX TECHNOLOGIES LLP 024005003462Document4 pagesTransactions List ITFOX TECHNOLOGIES LLP 024005003462Arushi SinghNo ratings yet

- 34 Socio Economic Review EnglishDocument234 pages34 Socio Economic Review EnglishjarikhatriNo ratings yet

- GRT Store AddressDocument14 pagesGRT Store AddressyaminiraviNo ratings yet

- BO - Code BO - Name BO - Add BO - Pin Div - Code Div - NameDocument20 pagesBO - Code BO - Name BO - Add BO - Pin Div - Code Div - NameSuvashreePradhan100% (1)

- Is China Threat To India?Document38 pagesIs China Threat To India?abdul hameed100% (2)

- MSME Infographic November 2021Document1 pageMSME Infographic November 2021RITIK RAJNo ratings yet

- Baec-102 Ec-02Document8 pagesBaec-102 Ec-02Ashutosh palNo ratings yet

- Office Space On LeaseDocument11 pagesOffice Space On Leaseanarang2523No ratings yet

- 17 Stock Portfolio Bse NseDocument81 pages17 Stock Portfolio Bse Nsechintandesai20083112No ratings yet

- Competitive Performance of Micro, Small and Medium Enterprises in IndiaDocument20 pagesCompetitive Performance of Micro, Small and Medium Enterprises in IndiaKamal JoshiNo ratings yet

- Nse 20150106Document33 pagesNse 20150106Dhawan SandeepNo ratings yet

- Cbjesscq 42Document4 pagesCbjesscq 42vanditNo ratings yet

- Apy ChartDocument1 pageApy ChartpraveenaNo ratings yet

- Changes in The Marketing Strategies of Automobile Sector Due To RecessionDocument102 pagesChanges in The Marketing Strategies of Automobile Sector Due To RecessionVivek SinghNo ratings yet

- Aircel: From Wikipedia, The Free EncyclopediaDocument4 pagesAircel: From Wikipedia, The Free EncyclopediasrikantmehtaNo ratings yet

- Impact of Globalization On Indian EconomyDocument16 pagesImpact of Globalization On Indian EconomyRajendra M.InamdarNo ratings yet

- YASH Banking ReportDocument37 pagesYASH Banking ReportYashNo ratings yet

- S No Name of The Company Regional OfficeDocument39 pagesS No Name of The Company Regional OfficeNo nameNo ratings yet

GST Challan

GST Challan

Uploaded by

ANJANA SINGH CHAUHAN0 ratings0% found this document useful (0 votes)

1 views1 pageThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies the reason for payment as "Any other payment". It lists the tax amounts to be paid under different heads - CGST, IGST, CESS, SGST - totaling to Rs. 195514. The mode of payment can be via e-payment, over the counter or NEFT/RTGS. Fields are provided for depositor details like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, taxpayer name, bank details, payment reference number etc.

Original Description:

Original Title

GST-CHALLAN (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies the reason for payment as "Any other payment". It lists the tax amounts to be paid under different heads - CGST, IGST, CESS, SGST - totaling to Rs. 195514. The mode of payment can be via e-payment, over the counter or NEFT/RTGS. Fields are provided for depositor details like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, taxpayer name, bank details, payment reference number etc.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

1 views1 pageGST Challan

GST Challan

Uploaded by

ANJANA SINGH CHAUHANThis document is a payment challan form for depositing goods and services tax. It provides details of the taxpayer including their GSTIN and contact information. The challan specifies the reason for payment as "Any other payment". It lists the tax amounts to be paid under different heads - CGST, IGST, CESS, SGST - totaling to Rs. 195514. The mode of payment can be via e-payment, over the counter or NEFT/RTGS. Fields are provided for depositor details like name, designation, signature and date. The form also has sections to capture paid challan information like GSTIN, taxpayer name, bank details, payment reference number etc.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Form GST PMT –06 Payment Challan

(See Rule 87(2) )

Challan for deposit of goods and services tax

CPIN: 23070900290785 Challan Generated on : 17/07/2023 17:11:57 Expiry Date : 01/08/2023

Details of Taxpayer

GSTIN: 09AQPPY1536N1ZV E-mail Id: hXXXXXXXXXXXX@XXXXXXXom Mobile No.: 8XXXXX4150

Name(Legal): PRATAP YADAV Address : XXXXXXXXXX Uttar Pradesh,209801

Reason For Challan

Reason: Any other payment

Details of Deposit (All Amount in Rs.)

Government Major Head Minor Head

Tax Interest Penalty Fee Others Total

CGST(0005) 97757 - - - - 97757

Government

IGST(0008) - - - - - -

Of India

CESS(0009) - - - - - -

Sub-Total 97757 0 0 0 0 97757

Uttar Pradesh SGST(0006) 97757 - - - - 97757

Total Amount 195514

Total Amount (in words) Rupees One Lakhs Ninety-Five Thousand Five hundred Fourteen Only

Mode of Payment

E-Payment Over the Counter(OTC) NEFT / RTGS

Particulars of depositor

Name

Designation/Status(Manager,partner etc)

Signature

Date

Paid Challan Information

GSTIN

Taxpayer Name

Name of the Bank

Amount

Bank Reference No.(BRN)/UTR

CIN

Payment Date

Bank Ack No.

(For Cheque / DD deposited at Bank’s counter)

You might also like

- Documen - Tips 10kdata3Document446 pagesDocumen - Tips 10kdata3onlinedata50% (2)

- List of Cement Plants in India PDFDocument6 pagesList of Cement Plants in India PDFAnonymous 9pKSMxb8100% (1)

- GST Challan PDFDocument1 pageGST Challan PDFAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanGaurav AgarwalNo ratings yet

- GST ChallanDocument1 pageGST ChallanAnkit DalsaniyaNo ratings yet

- GST ChallanDocument1 pageGST Challanvlogwithfun06No ratings yet

- GST ChallanDocument1 pageGST ChallanHMSNo ratings yet

- GST ChallanDocument1 pageGST ChallanHMSNo ratings yet

- GAYATRI INC GST-CHALLAN (7)Document1 pageGAYATRI INC GST-CHALLAN (7)gayatripackaging9No ratings yet

- GST ChallanDocument1 pageGST Challansachinkumar.rkcjNo ratings yet

- GST ChallanDocument1 pageGST Challannagesh abbaramainaNo ratings yet

- GST ChallanDocument1 pageGST ChallanWilfred DsouzaNo ratings yet

- GST ChallanDocument1 pageGST Challanaman sainNo ratings yet

- GST ChallanDocument1 pageGST Challansachinkumar.rkcjNo ratings yet

- Star Whizz - MArch ChallanDocument1 pageStar Whizz - MArch ChallanAmit PrabhuNo ratings yet

- Gst-Challan - 2024-01-06T171130.219Document1 pageGst-Challan - 2024-01-06T171130.219asafintax.consultingNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish VishnoiNo ratings yet

- GST ChallanDocument1 pageGST ChallanAshish GuptaNo ratings yet

- GST#CHALLANDocument1 pageGST#CHALLANravilakra lakraNo ratings yet

- Gst-Challan (13) MeDocument1 pageGst-Challan (13) Meacpandey.lawfirmNo ratings yet

- GST ChallanDocument1 pageGST ChallanArisina BanerjeeNo ratings yet

- GST ChallanDocument1 pageGST ChallanAjayGuptaNo ratings yet

- GST ChallanDocument1 pageGST ChallanFlish AcademyNo ratings yet

- GST Challan (RCM)Document1 pageGST Challan (RCM)sachinkumar.rkcjNo ratings yet

- GST CHALLAN Delta April 21Document1 pageGST CHALLAN Delta April 21pawan kanojiaNo ratings yet

- GST CHALLAN Delta April 21Document1 pageGST CHALLAN Delta April 21pawan kanojiaNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST Challantaxsachin16No ratings yet

- GST ChallanDocument1 pageGST ChallanTushar RaneNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- GST ChallanDocument1 pageGST Challanrajender kumarNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST ChallanSumit PanchalNo ratings yet

- Get HandsDocument1 pageGet HandsGaurav kumarNo ratings yet

- UntitledDocument1 pageUntitledvishalmahale15No ratings yet

- GST ChallanDocument1 pageGST Challandurgpalsingh2023No ratings yet

- GST CHALLAnDocument1 pageGST CHALLAnVibhav AnasaneNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST ChallanANJANA SINGH CHAUHANNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- 2657 0 0 0 0 2657 SGST (0006)Document1 page2657 0 0 0 0 2657 SGST (0006)Bhvunesh AshaliyaNo ratings yet

- GST ChallanDocument1 pageGST Challanproject worksNo ratings yet

- GST ChallanDocument2 pagesGST ChallanHmingsanga HauhnarNo ratings yet

- GST ChallanDocument1 pageGST ChallanTushar Prakash ChaudhariNo ratings yet

- GST ChallanDocument1 pageGST Challanvk6541803No ratings yet

- GST ChallanDocument1 pageGST ChallanTushar Prakash ChaudhariNo ratings yet

- GST ChallanDocument1 pageGST ChallanRakesh ZanwarNo ratings yet

- Gupta Trading Co. Gst-Challan Payment-1Document1 pageGupta Trading Co. Gst-Challan Payment-1Pradeep G NairNo ratings yet

- 5577 0 0 0 0 5577 SGST (0006)Document2 pages5577 0 0 0 0 5577 SGST (0006)Virender AryaNo ratings yet

- GST-CHALLAN (2)Document1 pageGST-CHALLAN (2)aliahmad.090No ratings yet

- Gst-Challan (4) - 120008Document1 pageGst-Challan (4) - 120008ShivanshNo ratings yet

- GST Challan Revised Mangalore Bio July. 21Document2 pagesGST Challan Revised Mangalore Bio July. 21AHAMMAD BASHEERNo ratings yet

- GST ChallanDocument1 pageGST Challansarah IsharatNo ratings yet

- GST ChallanDocument1 pageGST ChallanVineet KhuranaNo ratings yet

- GST ChallanDocument1 pageGST Challandurgpalsingh2023No ratings yet

- GST ChallanDocument1 pageGST ChallanSanjayThakkarNo ratings yet

- 8695 0 0 150 0 8845 SGST (0006)Document2 pages8695 0 0 150 0 8845 SGST (0006)061-vineet jainNo ratings yet

- GST ChallanDocument2 pagesGST ChallanCaRaghavendraRaghuNo ratings yet

- GST Challan Receipt 6Document1 pageGST Challan Receipt 6jenishjeba90No ratings yet

- KGHHDocument1 pageKGHHNadeem ManzoorNo ratings yet

- Indian Manufacturing Industry Technology Status and ProspectsDocument47 pagesIndian Manufacturing Industry Technology Status and ProspectsJust_Jobless100% (1)

- South Companies DataDocument51 pagesSouth Companies DataIOD EventsNo ratings yet

- Exclusive Interview With SteelGuru - Com, MR Jayant Acharya Director Sales & Marketing of JSW SteelDocument4 pagesExclusive Interview With SteelGuru - Com, MR Jayant Acharya Director Sales & Marketing of JSW SteeljtpmlNo ratings yet

- Fy 21-22 - 110034Document33 pagesFy 21-22 - 110034The Words Can Speak Rudra SharmaNo ratings yet

- NiftyDocument14 pagesNiftyAnshuman GuptaNo ratings yet

- Task StatusDocument80 pagesTask StatusAmit KumarNo ratings yet

- Annexure 1A - Major CityDocument415 pagesAnnexure 1A - Major CitygurshaaNo ratings yet

- Do MSTC JPR 23-24 2012Document3 pagesDo MSTC JPR 23-24 2012vikas agrawalNo ratings yet

- Acct Statement - XX9928 - 22122021Document49 pagesAcct Statement - XX9928 - 22122021viveknaikNo ratings yet

- Transactions List ITFOX TECHNOLOGIES LLP 024005003462Document4 pagesTransactions List ITFOX TECHNOLOGIES LLP 024005003462Arushi SinghNo ratings yet

- 34 Socio Economic Review EnglishDocument234 pages34 Socio Economic Review EnglishjarikhatriNo ratings yet

- GRT Store AddressDocument14 pagesGRT Store AddressyaminiraviNo ratings yet

- BO - Code BO - Name BO - Add BO - Pin Div - Code Div - NameDocument20 pagesBO - Code BO - Name BO - Add BO - Pin Div - Code Div - NameSuvashreePradhan100% (1)

- Is China Threat To India?Document38 pagesIs China Threat To India?abdul hameed100% (2)

- MSME Infographic November 2021Document1 pageMSME Infographic November 2021RITIK RAJNo ratings yet

- Baec-102 Ec-02Document8 pagesBaec-102 Ec-02Ashutosh palNo ratings yet

- Office Space On LeaseDocument11 pagesOffice Space On Leaseanarang2523No ratings yet

- 17 Stock Portfolio Bse NseDocument81 pages17 Stock Portfolio Bse Nsechintandesai20083112No ratings yet

- Competitive Performance of Micro, Small and Medium Enterprises in IndiaDocument20 pagesCompetitive Performance of Micro, Small and Medium Enterprises in IndiaKamal JoshiNo ratings yet

- Nse 20150106Document33 pagesNse 20150106Dhawan SandeepNo ratings yet

- Cbjesscq 42Document4 pagesCbjesscq 42vanditNo ratings yet

- Apy ChartDocument1 pageApy ChartpraveenaNo ratings yet

- Changes in The Marketing Strategies of Automobile Sector Due To RecessionDocument102 pagesChanges in The Marketing Strategies of Automobile Sector Due To RecessionVivek SinghNo ratings yet

- Aircel: From Wikipedia, The Free EncyclopediaDocument4 pagesAircel: From Wikipedia, The Free EncyclopediasrikantmehtaNo ratings yet

- Impact of Globalization On Indian EconomyDocument16 pagesImpact of Globalization On Indian EconomyRajendra M.InamdarNo ratings yet

- YASH Banking ReportDocument37 pagesYASH Banking ReportYashNo ratings yet

- S No Name of The Company Regional OfficeDocument39 pagesS No Name of The Company Regional OfficeNo nameNo ratings yet