Professional Documents

Culture Documents

FMP (2nd) May2016

FMP (2nd) May2016

Uploaded by

Vandana AhujaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FMP (2nd) May2016

FMP (2nd) May2016

Uploaded by

Vandana AhujaCopyright:

Available Formats

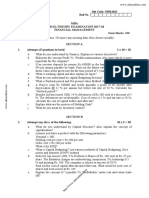

Master of Commerce 2th Semester

Paper-M.C.-203 : Financial Management and Policy

(Same for USOL Candidates)

Time : Three Hours Maximum Marks :80

Note. Attempt any five questions in all, selecting at least one quesion from each Unit. All questions carry

equal marks.

UNIT-I

1. In what ways in the wealth maximization objective superior to the profit maximization objective?

Explain.

2. What is future value? How future value of single cash flow and future value of any annuity is

calculated ?

UNIT-11

3. Capital and countries itd, is considering two projects, only one of which can be accepted. The data

in respect of these two are given as below:

Project I Project II

Outlay 10,000 50,000

NET INFLOWS

Year! 5,000 10,000

II 5,000 15,000

III 3,000 25,000

IV

V

o m2,000

1,500

25,000

21,000

.r c

Calculate:

(i) The excess present value at 10% and

(ii) The internal rate of return.

4.

p e

Suggest which project should be selected by the firm ?

m

Explain briefly the following methods of capital budgeting bringing out the advantages and

disadvantages of each :

a o

(i)

(ii) p

Pay back period method

r

Accounting rate of return method

.r c

5.

b

capital of the firm.

p e

Define the concept of cost of capital. State how would you determine the weighted average cost of

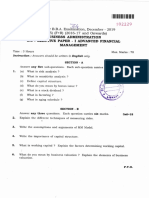

UNIT-III

6. The capital structure of ABC Ltd, consists of

p aan equity share capital of

b r

Rs. 10,00,000 (Shares of Rs. 10 per value) and Rs. 10,00,000 of 20% debentures. Sales

increased by 25% from 2,00,000 units to 2,50,000 units, the selling price in Rs. 10 per unit,

variable costs amount of Rs. 6 per unit and fixed expenses amount to Rs. 2,50,000. Income tax

rate is assumed to be 50%. You are required to calculate the following:

(i) The percentage increase in earnings per share

(ii) The degree of financial leverage at Rs. 2,00,000 units and Rs. 2,50,000 units.

(iii) The degree of operating leverage at Rs. 2,00,000 units and Rs. 2,50,000 units.

7. Give a critical appraisal of the traditional approach and the ModiglianiMillers approach to the

problem of capital structure.

8. What do you mean by capit al gearing ? What is its significance ? Discuss the effects of high and

low gearing on the financial position of the company during various phases of trade cycle.

UNIT-IV

9. Discuss the irrelevance approach of Dividend given by Modigiliani and Miller.

10. Discuss the Walter's Approach of divided. How is it different from Gordon's approach ?

You might also like

- Hospitals' EmailsDocument8 pagesHospitals' EmailsAkil eswarNo ratings yet

- WBS For Wedding ProjectDocument1 pageWBS For Wedding ProjectKhushboo Katyayan50% (2)

- Activity Based Costing - Case StudyDocument8 pagesActivity Based Costing - Case StudyViksit Choudhary100% (1)

- Leadership Development at Goldman SachsDocument2 pagesLeadership Development at Goldman SachsCyril Scaria50% (4)

- Department of The Interior and Local GovernmentDocument2 pagesDepartment of The Interior and Local GovernmentCess AyomaNo ratings yet

- Mefa Question BankDocument6 pagesMefa Question BankShaik ZubayrNo ratings yet

- MBG-206 2019-20 - 1Document4 pagesMBG-206 2019-20 - 1senthil.jpin8830No ratings yet

- Bangalore University Previous Year Question Paper AFM 2020Document3 pagesBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNo ratings yet

- Fourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementDocument4 pagesFourth Semester 5 Year B.B.A. LL.B. Examination, June/July 2014 Financial ManagementsimranNo ratings yet

- Bangalore University Previous Year Question Paper AFM 2022Document4 pagesBangalore University Previous Year Question Paper AFM 2022Ramakrishna NagarajaNo ratings yet

- FM (2nd) May2018Document2 pagesFM (2nd) May2018JohnNo ratings yet

- R17-Eee-Cse-Mefa QP 2Document2 pagesR17-Eee-Cse-Mefa QP 2kisnamohanNo ratings yet

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- FM (4th) May2019Document2 pagesFM (4th) May2019DISHU GUPTANo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoDocument3 pagesTime: 3 Hours Total Marks: 100: Printed Pages:03 Sub Code: KMB 204/KMT 204 Paper Id: 270244 Roll NoHimanshuNo ratings yet

- FM Assignment 6Document2 pagesFM Assignment 6Vundi RohitNo ratings yet

- Loursl: - (L) : (Semester-II)Document4 pagesLoursl: - (L) : (Semester-II)Riya AgrawalNo ratings yet

- MEFA Most Important QuestionsDocument15 pagesMEFA Most Important Questionsapi-26548538100% (5)

- 15A52301 Managerial Economics & Financial AnalysisDocument2 pages15A52301 Managerial Economics & Financial AnalysisGeorgekutty FrancisNo ratings yet

- FM Assignment 4Document3 pagesFM Assignment 4Vundi RohitNo ratings yet

- MBG-206 2019-20Document4 pagesMBG-206 2019-20senthil.jpin8830No ratings yet

- Finanacial ManagementDocument35 pagesFinanacial Managementpineb14317No ratings yet

- Time: 3 Hours Max. Marks: 100 Note: Be Precise in Your Answer. in Case of Numerical Problem Assume Data Wherever Not ProvidedDocument2 pagesTime: 3 Hours Max. Marks: 100 Note: Be Precise in Your Answer. in Case of Numerical Problem Assume Data Wherever Not ProvidedPrashant SharmaNo ratings yet

- Relax Pharma QuestionDocument3 pagesRelax Pharma QuestionTushar Ballabh0% (1)

- 2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Document3 pages2018 March B.com 4th Sem SH College Autonomous March Accounting For Managerial Decision Question Paper Goodwill Tuition Centre Thevara 9846710963 9567902805Rainy GoodwillNo ratings yet

- Exercise On CVP - CB PDFDocument3 pagesExercise On CVP - CB PDFqwertNo ratings yet

- Time: 3 Hours Total Marks: 100: Printed Pages: 02 Sub Code: NMBA024 Paper Id: 270224 Roll NoDocument2 pagesTime: 3 Hours Total Marks: 100: Printed Pages: 02 Sub Code: NMBA024 Paper Id: 270224 Roll NoPrashant SharmaNo ratings yet

- FM Assignment 5Document2 pagesFM Assignment 5Vundi RohitNo ratings yet

- Accounting AndFinancial Management 2015-16Document4 pagesAccounting AndFinancial Management 2015-16Ashish AgarwalNo ratings yet

- Assignment: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemeDocument2 pagesAssignment: Approximately of 400 Words. Each Question Is Followed by Evaluation SchemePuja KumariNo ratings yet

- Docslide - Us Assignment 2 55844503ab61cDocument4 pagesDocslide - Us Assignment 2 55844503ab61cAhmedNo ratings yet

- Merged File - QP, Answers & Notes - CompressedDocument176 pagesMerged File - QP, Answers & Notes - CompressedMEGHA VNo ratings yet

- 69 Elective1 Advance Financial Managemen Repeaters 2014 15 OnwardsDocument3 pages69 Elective1 Advance Financial Managemen Repeaters 2014 15 Onwardspremium info2222No ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- BM-228 - FINAL Bca 3d Semm Model PapperDocument2 pagesBM-228 - FINAL Bca 3d Semm Model Papperfajal ansariNo ratings yet

- FAA Sem (1) 2020Document2 pagesFAA Sem (1) 2020daskarinakiranNo ratings yet

- MBA108CDocument2 pagesMBA108CRohit TushirNo ratings yet

- FM Assignment 2Document3 pagesFM Assignment 2NOEL ThomasNo ratings yet

- 72 Elective 1 Advance Financial Management Repeaters Prior To 2014 15Document4 pages72 Elective 1 Advance Financial Management Repeaters Prior To 2014 15premium info2222No ratings yet

- Accounting For Management: Instruction To CandidatesDocument2 pagesAccounting For Management: Instruction To CandidatesvikramvsuNo ratings yet

- MEFA Important Questions JWFILESDocument14 pagesMEFA Important Questions JWFILESEshwar TejaNo ratings yet

- Mba Ii Sem. Prelim Exam SUBJECT: Financial Management: Roll NoDocument4 pagesMba Ii Sem. Prelim Exam SUBJECT: Financial Management: Roll NoAkash raiNo ratings yet

- Ba 4202 FM Important QuestionsDocument6 pagesBa 4202 FM Important QuestionsRishi vardhiniNo ratings yet

- Exercise - FIN5100 MoF Exercise On Capital Budgeting 070524Document3 pagesExercise - FIN5100 MoF Exercise On Capital Budgeting 070524Izzah IzzatiNo ratings yet

- BBM 410 Final FM EXAMDocument4 pagesBBM 410 Final FM EXAMcyrusNo ratings yet

- ADL 13 Ver2+Document9 pagesADL 13 Ver2+DistPub eLearning Solution100% (1)

- Bangalore University Previous Year Question Paper AFM 2019Document3 pagesBangalore University Previous Year Question Paper AFM 2019Ramakrishna NagarajaNo ratings yet

- Management Accounting: Instructions To CandidatesDocument3 pagesManagement Accounting: Instructions To CandidatessumanNo ratings yet

- Financial Management: Instruction To CandidatesDocument2 pagesFinancial Management: Instruction To CandidatesRishi MitraNo ratings yet

- 6 Semester MGU Cost Accounting 2016 March Question PaperDocument4 pages6 Semester MGU Cost Accounting 2016 March Question PaperRainy GoodwillNo ratings yet

- Instructions To CandidatesDocument3 pagesInstructions To CandidatesSchoTestNo ratings yet

- Management Accounting Exam S2 2022Document6 pagesManagement Accounting Exam S2 2022bonaventure chipetaNo ratings yet

- BCOE - 143 E DoneDocument4 pagesBCOE - 143 E DoneAmit YadavNo ratings yet

- mba-2-sem FMCF KMBN-204 2021-22 (1)Document2 pagesmba-2-sem FMCF KMBN-204 2021-22 (1)8 अमित पाठकNo ratings yet

- 310 Management Accounting May 2021Document4 pages310 Management Accounting May 2021abc1No ratings yet

- Week4 QuestionpaperDocument8 pagesWeek4 QuestionpaperSouth KoreaNo ratings yet

- 260 - MCO-7 - ENG D18 - CompressedDocument2 pages260 - MCO-7 - ENG D18 - CompressedTushar SharmaNo ratings yet

- Finance For ProcurementDocument3 pagesFinance For ProcurementAlex MuhweziNo ratings yet

- An 979 MBA Sem II Financial Management14Document4 pagesAn 979 MBA Sem II Financial Management14Riya AgrawalNo ratings yet

- 32 Financial Management 44 Sep Oct 2022Document3 pages32 Financial Management 44 Sep Oct 2022sathyachandana7No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Private Debt: Yield, Safety and the Emergence of Alternative LendingFrom EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingNo ratings yet

- The Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesFrom EverandThe Micro Cap Investor: Strategies for Making Big Returns in Small CompaniesNo ratings yet

- ConclusionDocument27 pagesConclusionVandana AhujaNo ratings yet

- Sample of Form 2 (Niva Bupa)Document2 pagesSample of Form 2 (Niva Bupa)Vandana AhujaNo ratings yet

- Final DeepikaDocument55 pagesFinal DeepikaVandana AhujaNo ratings yet

- Standing Instruction Form Through IndusInd Bank Account-2Document1 pageStanding Instruction Form Through IndusInd Bank Account-2Vandana AhujaNo ratings yet

- DEP 38.80.30.32-Gen Inspection, Maintenance, Repair and Remanufacture of Hoisting Equipment (Endorsement of ISO 13534)Document7 pagesDEP 38.80.30.32-Gen Inspection, Maintenance, Repair and Remanufacture of Hoisting Equipment (Endorsement of ISO 13534)Sd MahmoodNo ratings yet

- Kuenzle V CIRDocument10 pagesKuenzle V CIRRean Raphaelle GonzalesNo ratings yet

- Money and The Nation State PDFDocument468 pagesMoney and The Nation State PDFsayuj83No ratings yet

- Question Paper - Mock AristoDocument33 pagesQuestion Paper - Mock AristoTONI POOH100% (1)

- 2nd Quarter Periodical Test in TLE - Industrial ArtsDocument21 pages2nd Quarter Periodical Test in TLE - Industrial ArtsNyle NerNo ratings yet

- HolcimLogistic Content CS5 FA 1358Document95 pagesHolcimLogistic Content CS5 FA 1358Novianta KuswandiNo ratings yet

- B-8-Shop House Patte'NeDocument19 pagesB-8-Shop House Patte'NeNural faridziNo ratings yet

- Title:: MTP 36203 (Accounting For Manufacturing)Document17 pagesTitle:: MTP 36203 (Accounting For Manufacturing)Che Rosnor Che HaronNo ratings yet

- Visual Surveillance Within The EU General Data Protection Regulation: A Technology PerspectiveDocument114 pagesVisual Surveillance Within The EU General Data Protection Regulation: A Technology PerspectiveMUHAMMAD ADAM LUQMAN MOHAMMAD ISMAILNo ratings yet

- UTT Application & Programme Info 2020Document37 pagesUTT Application & Programme Info 2020Ariey MaQueenNo ratings yet

- Microservice ArchitectureDocument22 pagesMicroservice ArchitecturenamNo ratings yet

- It8758e BXGDocument1 pageIt8758e BXGmaxgersonNo ratings yet

- HPPT Product Brochure 2020Document15 pagesHPPT Product Brochure 2020Manish JhaNo ratings yet

- ExxonMobil PD-5340Document2 pagesExxonMobil PD-5340蔡佾呈No ratings yet

- Sad ProjectDocument48 pagesSad Projectsamidabala2No ratings yet

- Ch3 - Batch - Exercises and SolutionDocument9 pagesCh3 - Batch - Exercises and Solution黃群睿No ratings yet

- Managing Public Money: July 2013 With Annexes Revised As at March 2018Document61 pagesManaging Public Money: July 2013 With Annexes Revised As at March 2018librekaNo ratings yet

- Three Project Managers With Distinctly Different RolesDocument12 pagesThree Project Managers With Distinctly Different RolesAmber KhalilNo ratings yet

- Solution Manual For A First Course in Differential Equations With Modeling Applications 10th EditionDocument23 pagesSolution Manual For A First Course in Differential Equations With Modeling Applications 10th Editiondisbenchcrang9xds100% (45)

- Final Ko Ni Final 1234Document53 pagesFinal Ko Ni Final 1234Prajwol TamangNo ratings yet

- Ids PDFDocument397 pagesIds PDFMinh Ngô HảiNo ratings yet

- IIFBM at 12 23Document13 pagesIIFBM at 12 23r.phaniKrishna krishnaNo ratings yet

- Ahmed Mohamed Badawy 70J (Literature Review)Document4 pagesAhmed Mohamed Badawy 70J (Literature Review)Ahmed BadawyNo ratings yet

- Chapter 1 - Introduction To LogisiticsDocument31 pagesChapter 1 - Introduction To LogisiticsLê Nguyễn Thảo ChiNo ratings yet

- IVF Store BrandsDocument5 pagesIVF Store BrandsNasraldeen MohamedNo ratings yet