Professional Documents

Culture Documents

CBSE Class 12 Accountancy Question Paper 2014 With Solutions

CBSE Class 12 Accountancy Question Paper 2014 With Solutions

Uploaded by

Ravi AgrawalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CBSE Class 12 Accountancy Question Paper 2014 With Solutions

CBSE Class 12 Accountancy Question Paper 2014 With Solutions

Uploaded by

Ravi AgrawalCopyright:

Available Formats

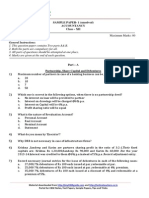

CBSE Class 12

Accountancy

Previous Year Question Paper 2014

Series: OSR Code no. 67/1

● Please check that this question paper contains 24 printed pages.

● Code number given on the right hand side of the question paper should

be written on the title page of the answer-book by the candidate.

● Please check that this question paper contains 25 questions.

● Please write down the Serial Number of the question before

attempting it.

● 15 minutes of time has been allotted to read this question paper. The

question paper will be distributed at 10.15 a.m. From 10.15 a.m. to

10.30 a.m., The students will read the question paper only and will not

write any answer on the answer-book during this period.

ACCOUNTANCY

Time Allowed: 3 hours Maximum Marks: 80

General Instructions :

I. This question paper contains three parts A, B and C.

II. Part A is compulsory for all candidates.

III. Candidates can attempt only one part of the remaining parts B and C.

Class XII Accountancy www.vedantu.com 1

IV. All parts of the questions should be attempted at one.

PART - A

Accounting for Partnership Firms and Companies

1. X, Y and Z were partners sharing profits in the ratio of ½, 3/10 and ⅕ . X

retired from the firm. Calculate the gaining ratio of the remaining partners.

1 Mark

Ans: Gaining ratio = New profit sharing ratio – Old profit sharing ratio

3 3 3

Y’s gain = − =

5 10 10

2 2 2

Z’s gain = − =

5 10 10

Gaining ratio = 3:2

2. State the rights acquired by a newly admitted partner. 1 Mark

Ans: The rights acquired by a newly admitted partners are :-

1. The Right to Be Informed

2. The Right to Access Books

3. Profit-Sharing Rights

3. Distinguish between ‘Dissolution of partnership’ and ‘Dissolution of

partnership firm’ on the basis of Court’s intervention. 1 Mark

Class XII Accountancy www.vedantu.com 2

Ans: The difference between ‘Dissolution of partnership’ and ‘Dissolution of

partnership firm’ on the basis of Court’s intervention is:

DISSOLUTION OF DISSOLUTION OF

BASIS

PARTNERSHIP PARTNERSHIP FIRM

Court intervention Court doesn’t intervene A firm can be dissolved

because partnership is by court order.

dissolved by mutual

agreement

4. Give the meaning of ‘Reconstitution of a partnership firm’. 1 Mark

Ans: Reconstitution of the partnership firm refers to any change to the current

agreement. As a result, the previous agreement expires, and a new agreement is

drafted based on the changed relationship and composition of the partnership firm's

members.

5. D Ltd. invited applications for issuing 10,00,000 equity shares of ₹ 10 each.

The public applied for 8,55,000 shares. Can the company proceed for the

allotment of shares ? Give reason in support of your answer. 1 Mark

Ans: Allotment of shares can’t take place because the minimum subscription

required for allotment of shares, which is 90 percent of the total number of shares

available for subscription, here ₹ 9,00,000 has not been obtained.

6. A Ltd. forfeited 100 equity shares of ₹ 10 each issued at a premium of 20%

for the non-payment of final call of ₹ 5 including premium. State the maximum

amount of discount at which these shares can be re-issued. 1 Mark

Ans: The amount received(or paid by) the shareholder is the maximum amount of

discount that can be granted at the time of reissue. At the moment of the final call,

Class XII Accountancy www.vedantu.com 3

Rs 5 is made, which includes the premium amount as well. As a result, the

shareholder will receive Rs. 7.

7. What is meant by issue of debentures as collateral security ? 1 Mark

Ans: When a corporation secures a loan or overdraft from a bank or financial

institution, a collateral security is a secondary or extra security in addition to the

principal security. The term "Debentures issued as a Collateral Security" refers

to when a corporation issues its own debentures to a lender in addition to other assets

already pledged.

8. Hemant and Nishant were partners in a firm sharing profits in the ratio of

3:2. Their capitals were ₹ 1,60,000 and ₹ 1,00,000 respectively. They admitted

Somesh on 1st April, 2013 as a new partner for 1/5 share in the future profits.

Somesh brought ₹ 1,20,000 as his capital. Calculate the value of goodwill of the

firm and record necessary journal entries for the above transactions on

Somesh’s admission. 3 Marks

Ans: Calculation of Profit sharing Ratio:

Hemant: Naresh

Old Ratio = 3:2

1

Somesh Share =

5

Let the total share of the firm =1

1 4

Remaining share of the firm = 1 − =

5 5

3 4 12

Hemant 's New Share = × =

5 5 25

Class XII Accountancy www.vedantu.com 4

2 4 8

Naresh's New Share = × =

5 5 25

12 8 1

New profit Sharing Ratio = : :

25 25 5

12:8:5

Sacrificing Ratio = old Ratio - New Ratio

3 12 3

Hemant's Sacrifice = − =

5 25 25

2 8 2

Naresh's Sacrifice = − =

5 25 25

Sacrificing Ratio= 3 : 2

Calculation of Somesh's share of Goodwill:

Total Capitalised Value of Firm = Capital brought in by Somesh x Reciprocal of his

share

firm 1,20,000

Total capital of the= = × 5 6,00,000

⇒Combined capital of Hemant, Nishant and Somesh=1,60,000+1,00,000+1,20,000

=₹3,80,000

⇒Goodwill of the firm = Total capital-Combined capital of partners

⇒ 6,00,000-3,80,000=₹2,20,000

1

= 2,20,000 ×

Hence; Somesh’s share of goodwill

5

=₹44,000

Journal Entries

Class XII Accountancy www.vedantu.com 5

for the year ending….

Date Particulars L.F Dr. (₹ ) Cr. (₹ )

i. Bank A/c Dr. 1,20,000

To Somesh’s Capital A/c 1,20,000

(Being capital brought in bank)

ii. Somesh’s capital A/c Dr. 44,000

To Hemant’s Capital A/c 26,400

To Nishant’s Capital A/c 17,600

(Somesh’s share of goodwill credited to Hemant

and Nishant)

9. Tata Ltd. issued 5,000, 10% Debentures of ₹ 100 each on 1st April, 2012. The

issue was fully subscribed. According to the terms of issue, interest on

debentures is payable half-yearly on 30th September and 31st March and tax

deducted at source is 10%.

Pass the necessary journal entries related to the debenture interest for the half-

yearly ending on 31st March, 2013 and transfer of interest on debentures to

Statement of Profit and Loss. 3 Marks

Ans: In the books of Tata Ltd

Journal Entries

for the year ending…..

Date Particulars L.F Dr.(₹ ) Cr.(₹ )

30th Sep Interest on debentures A/c Dr. 25,000

2012 To Debentures holders A/c 22,500

To Income tax payable A/c 2,500

(Being interest due for 6 months &

TDS)

Class XII Accountancy www.vedantu.com 6

30th Sep Debenture holders A/c Dr. 22,500

2012 To Bank A/c 22,500

(Being interest paid)

30th Sep Income Tax Payable Dr. 2,500

2012 To Bank A/c 2,500

(TDS deposited with Income Tax

authorities)

31st Interest on debentures A/c Dr. 25,000

March To Debentures holders A/c 22,500

2013 To Income tax payable A/c 2,500

(Being interest due for 6 months &

TDS)

31st Debenture holders A/c Dr. 22,500

March To Bank A/c 22,500

2013 (Being interest paid)

31st Income Tax Payable Dr. 2,500

March To Bank A/c 2,500

2013 (TDS deposited with Income Tax

authorities)

31st Statement of Profit & Loss Dr. 50,000

March To Interest on Debentures A/c 50,000

2013 (Being interest transferred)

Calculation of interest on debenture :

10 6

:- Interest on debenture

= 5,00,000 × ×

100 100

=25,000

10. Pass necessary journal entries in the following cases :

Class XII Accountancy www.vedantu.com 7

(i) Sunrise Ltd. converted 500, 9% debentures of ₹ 100 each issued at a discount

of 10% into equity shares of ₹ 100 each issued at a premium of 25%.

(ii) Britannia Ltd. redeemed 3,000, 12% debentures of ₹ 100 each which were

issued at a discount of ₹ 10 per debenture by converting them into equity shares

of ₹ 100 each, ₹ 90 paid up. 3 Marks

Ans: (I) In the books of Sunrise Ltd.

Journal Entries

For the year ending…...

Date Particulars L.F Dr.(₹ ) Cr.(₹ )

i. 9% Debenture A/c Dr. 50,000

To Discount on issue of Debentures 5,000

To Debenture holder A/c 45,000

(Being 500, 9% debentures issued at

discount due for redemption)

ii. Debenture holder A/c Dr. 45,000

To Equity Share Capital A/c 36,000

To Securities Premium A/c 9,000

(Amount due to debenture holder on

conversion by issue equity shares at

premium)

(II) In the books of Britannia Ltd.

Journal Entries

for the year ending…..

Date Particulars L.F Dr.(₹ ) Cr.(₹ )

Class XII Accountancy www.vedantu.com 8

i. 12% Debenture A/c Dr. 3,00,000

To Discount on issue of Debentures 30,000

To Debentures holder A/c 2,70,000

(Being 3,000, 12% debentures issued

on discount due for redemption)

ii. Debenture holder A/c Dr. 3,00,000

To Equity Share Capital A/c 3,00,000

(Being 2,700 shares issued at

discount of Rs 90 fully paid up. )

11. Singh and Gupta decided to start a partnership firm to manufacture low

cost jute bags as plastic bags were creating many environmental problems.

They contributed capitals of ₹ 1,00,000 and ₹ 50,000 on 1st April, 2012 for this.

Singh expressed his willingness to admit Shakti as a partner without capital,

who is specially abled but a very creative and intelligent friend of his. Gupta

agreed to this. The terms of partnership were as follows:

(i) Singh, Gupta and Shakti will share profits in the ratio of 2 : 2 : 1.

(ii) Interest on capital will be provided @ 6% p.a.

Due to shortage of capital, Singh contributed ₹ 25,000 on 30th September, 2012

and Gupta contributed ₹ 10,000 on 1st January, 2013 as additional capital. The

profit of the firm for the year ended 31st March, 2013 was ₹ 1,68,900.

4 Marks

(a) Identify any two values which the firm wants to communicate to the society.

Ans: Highlighted values include: (Any two)

I. Talent recognition

II. Environmental concern

III. Assisting, caring, and sharing with particularly abled Individual

Class XII Accountancy www.vedantu.com 9

(b) Prepare Profit and Loss Appropriation Account for the year

ending 31st March, 2013.

Ans: Profit and Loss Appropriation A/c

For the year ended March 31, 2013

Amount Amount

Particulars Particulars

(₹ ) (₹ )

To Interest on Capital: By Profit and Loss A/c 1,68,900

Singh’s Capital A/c 6,750

Gupta’s Capital’s A/c 3,150

To profit transferred to:

Singh’s Capital A/c 63,600

Gupta’s Capital A/c 63,600

Shakti’s Capital A/c 31,800 1,59,000

1,68,900 1,68,900

Working Notes :

6 6 6

= 1,00,000 ×

Interest on Singh’s Capital + 25,000 × ×

100 100 12

= 6,750

6 6 3

Interest on Gupta’s Capital= 50,000 × + 10,000 × ×

100 100 12

= 3,150

12. Monika, Sonika and Mansha were partners in a firm sharing profit in the

ratio of 2 : 2 : 1 respectively. On 31st March, 2013 their Balance Sheet was as

under :

Balance Sheet as on 31st March, 2013

Class XII Accountancy www.vedantu.com 10

Amount Amount

Liabilities Assets

(₹) (₹)

Capitals : Fixed Assets 3,60,000

Monika 1,80,000 Stock 60,000

Sonika 1,50,000 Debtors 1,20,000

Mansha 90,000 4,20,000 Cash 2,70,000

Reserve Fund 1,50,000

Creditors 2,40,000

8,10,000 8,10,000

Sonika died on 30th June, 2013. It was agreed between her executor and the

remaining partners that

(a) Goodwill of the firm be valued at 3 years’ purchase of average profits for

the last four years. The average profits were ₹ 2,00,000.

(b) Interest on capital be provided at 12% p.a.

(c) Her share in the profits upto the date of death will be calculated on the basis

of average profits for the last four years.

Prepare Sonika’s Capital Account as on 30th June, 2013. 4 Marks

Ans: Dr. Sonika’s Capital A/c Cr.

Amount Amount

Particulars Particulars

(₹) (₹)

To Sonika’s executor 4,74,500 By Balance b/d 1,50,000

A/c By Reserve fund 60,000

By Monika’s Capital a/c

(G/w) 1,60,000

By Mansha’s Capital

A/c (G/w) 80,000

By P/L Suspense A/c

Class XII Accountancy www.vedantu.com 11

(Share of Profit) 20,000

By Interest on Capital 4,500

4,74,500 4,74,500

Working notes:-

WN-1: Calculation of Gaining Ratio of Monika and Mansha:

Monika : Sonika: Mansha

Old Ratio = 2: 2: 1

New Ratio of Monika and Mansha = 2: 1

Gaining Ratio = New Ratio - old Ratio

2 2 4

Monika’s gain = − =

3 5 15

1 1 2

Mansha’s gain = − =

3 5 15

Gaining ratio = 2:1

WN-2: Calculation of Sonika’s share of goodwill :

Goodwill of the firm = Average Profit x Number of year's purchase

Goodwill of the firm = 2,00,000×3

=6,00,000

2

= 6,00,000 ×

The share of Goodwill of Sonika's

5

=2,40,000

Class XII Accountancy www.vedantu.com 12

2

Monika Will

= give 2,40,000 ×

3

=1,60,000

1

Mansha will

= give 2,40,000 ×

3

=80,000

WN 3: Calculation of Profit share of Sonika :

Profit for the year = 2,00,000

3 2

= 2,00,000 × ×

Sonika's share of Profit

2 5

=20,000

WN-4: Sonika's share of Reserve fund:

2

Fund 150000 ×

A share of Reserve=

5

=60,000

12

WN-5: Interest on capital

= 1,50,000 × 12 ×

100

=₹4,500

13. On 1st April, 2012, Vishwas Ltd. was formed with an authorised capital of

₹ 10,00,000 divided into 1,00,000 equity shares of ₹ 10 each. The company issued

prospectus inviting applications for 90,000 equity shares.The company received

applications for 85,000 equity shares. During the first year, ₹ 8 per share were

called. Ram holding 1,000 shares and Shyam holding 2,000 shares did not pay

the first call of ₹ 2 per share. Shyam’s shares were forfeited after the first call

Class XII Accountancy www.vedantu.com 13

and later on 1,500 of the forfeited shares were re-issued at ₹ 6 per share, ₹ 8

called up. Show the following :

(a) Share Capital in the Balance Sheet of the company as per revised Schedule

VI Part I of the Companies Act, 1956

(b) Also prepare ‘Notes to Accounts’ for the same. 4 Marks

Ans: Balance Sheet of Vishwas Ltd.

As at ..........................

Current Year Previous Year

Particulars Note No.

(₹) (₹)

Equity & Liabilities

Shareholder’s funds :

a) Share Capital 1 6,77,000

Notes to Accounts :

Amount

Particulars

(₹)

(1) Share Capital

Authorised Capital :

1,00,000 equity shares of Rs 10 each 10,00,000

Issued Capital :

90,000 equity shares of Rs 10 each 9,00,000

Subscribed but not fully paid capital :

84,500 shares of Rs 10 each, Rs 8 called up 6,76,000

Less: Calls in arrears (2,000)

Add: Share forfeiture A/c 3,000 6,77,000

Class XII Accountancy www.vedantu.com 14

14. Pass necessary journal entries for the following transactions in the books

of Gopal Ltd:

(i) Purchased furniture for ₹ 2,50,000 from M/s Furniture Mart.The payment

to M/s Furniture Mart was made by issuing equity shares of ₹ 10 each at a

premium of 25%.

(ii) Purchased a running business from Aman Ltd. for a sum of ₹ 15,00,000.

The payment of ₹ 12,00,000 was made by issue of fully paid equity shares of ₹

10 each and balance by a bank Draft. The assets and liabilities consisted of the

following :

Plant ₹ 3,50,000; Stock ₹ 4,50,000; Land and Building ₹ 6,00,000; Sundry

Creditors ₹ 1,00,000. 4 Marks

Ans: Journal entries in books

of Gopal Ltd for the year ended…...

Date Particulars L.F Dr. (₹) Cr. (₹)

(i) Furniture A/c Dr. 2,50,000

To M/s Furniture Mart 2,50,000

(Being furniture purchased from

M/s Furniture Mart)

M/s Furniture Mart A/c Dr. 2,50,000

To Equity Share Capital A/c 2,00,000

To Securities Premium A/c 50,000

(Being shares issued at premium

as purchase consideration)

(ii) Plant A/c Dr. 3,50,000

Stock A/c Dr. 4,50,000

Land & Building A/c Dr. 6,00,000

Goodwill A/c Dr. 2,00,000

To Sundry Creditors A/c 1,00,000

Class XII Accountancy www.vedantu.com 15

To Aman Ltd 15,00,000

(Being business purchased from

Aman Ltd)

Aman Ltd Dr. 15,00,000

To Equity Share Capital A/c 12,00,000

To Bank A/c 3,00,000

(Being shares issued and balance

is paid by bank draft)

15. Seema, Tanuja and Tripti were partners in a firm trading in garments.

They were sharing profits in the ratio of 5 : 3 : 2. Their capitals on 1st April,

2012 were ₹ 3,00,000, ₹ 4,00,000 and ₹ 8,00,000 respectively. After the flood in

Uttarakhand, all partners decided to help the flood victims personally.

For this Seema withdrew ₹ 20,000 from the firm on 15th September, 2012.

Tanuja instead of withdrawing cash from the firm took garments amounting to

₹ 24,000 from the firm and distributed those to the flood victims. On the other

hand, Tripti withdrew ₹ 2,00,000 from her capital on 1st January, 2013 and

provided a mobile medical van in the flood affected area.

The partnership deed provides for charging interest on drawings @ 6% p.a.

After the final accounts were prepared it was discovered that interest on

drawings had not been charged. Give the necessary adjusting journal entry and

show the working notes clearly. Also state any two values which the partners

wanted to communicate to the society. 6 Marks

Ans: Journal entries

for the year ended…..

Date Particulars L.F Dr.(₹) Cr.(₹)

i. Tripti’s Capital A/c Dr 2,114

To Tanuja’s Capital A/c 1,565

To Seema’s Capital A/c 549

Class XII Accountancy www.vedantu.com 16

(Being adjustment entry passed for Interest on

drawings)

Working notes :

Calculation of interest on drawing :

6 6.5

= 20,000 ×

Interest in Seema’s drawing ×

100 12

=650

6 6.5

Interest in Tanuja,s drawing= 24,000 × ×

100 12

= 780

6 6.5

= 2,00,000 ×

Interest in Tripti’s drawing ×

100 12

=3,000

Seema Tanuja Tripti Total

Particulars

(₹) (₹) (₹) (₹)

Interest on drawings 650 780 3,000 4,430

(Dr)

Profit (Cr.) 2,215 1,329 886 4,430

Net effect 1,565(Cr) 549(Dr.) 2,114(Cr.) ---

Values involved:

1. Duty towards nation

2. Upliftment of victims

Class XII Accountancy www.vedantu.com 17

16. Hanif and Jubed were partners in a firm sharing profits in the ratio of their

capitals. On 31st March, 2013 their Balance Sheet was as follows :

Balance Sheet of Hanif and Jubed as on 31st March, 2013

Amount Amount

Liabilities Assets

(₹) (₹)

Creditors 1,50,000 Bank 2,00,000

Workmen’s Compensation 3,00,000 Debtors 3,40,000

Fund Stock 1,50,000

General Reserve 75,000 Furniture 4,60,000

Hanif ’s Current Account 25,000 Machinery 8,20,000

Capitals :

Hanif 10,00,000 Jubed’s 80,000

Jubed 5,00,000 15,00,000 Current

Account

20,50,000 20,50,000

On the above date the firm was dissolved.

(i) Debtors were realised at a discount of 5%. 50% of the stock was taken over

by Hanif at 10% less than the book value. Remaining stock was sold for ₹

65,000.

(ii) Furniture was taken over by Jubed for ₹ 1,35,000. Machinery was sold as

scrap for ₹ 74,000.

(iii) Creditors were paid in full.

(iv) Expenses on realisation ₹ 8,000 were paid by Hanif.

Prepare a Realisation Account. 6 Marks

Ans: Dr. Realisation A/c Cr.

Particulars Amount Particulars Amount

Class XII Accountancy www.vedantu.com 18

To Debtors 3,40,000 By Creditors 1,50,000

To Stock 1,50,000 By Bank A/c

To Furniture 4,60,000 Stock 65,000

To Machinery 8,20,000 Machinery 74,000

To Bank A/c -Creditors 1,50,000 Debtors 3,23,000 4,62,000

To Hanif’s Capital A/c 8,000 By Hanif’s Capital A/c 67,500

(Realisation Expenses) (Stock)

By Jubed’s Capital A/c 1,35,000

(Furniture)

By loss transferred to

Hanif’s Capital

A/c 7,42,333

Jubed’s Capital

A/c 3,71,167 11,13,500

19,28,000 19,28,000

Working notes :

5

1. Amount realized on Debtors =Rs.3,40,000- ×3,40,000

100

⇨Rs. 3,23,000

5

2. Amount realized on Stock =Rs.1,35,000 ( 90% of 1,50,000 ) - ×1,35,000

100

⇨Rs. 67,500

17. X Ltd. invited applications for issuing 75,000 equity shares of ₹ 10 each at

a premium of ₹ 5 per share. The amount was payable as follows :

On application and allotment – ₹ 9 per share (including premium)

Class XII Accountancy www.vedantu.com 19

On the first and final call – the balance amount.

Applications for 3,00,000 shares were received. Applications for 2,00,000 shares

were rejected and money refunded. Shares were allotted on pro-rata basis to

the remaining applicants. The first and final call was made. The amount was

duly received except on 1,500 shares applied by Ravi. His shares were forfeited.

The forfeited shares were re-issued at a discount of ₹ 4 per share.

Pass necessary journal entries for the above transactions in the books of X Ltd.

Or

Y Ltd. invited applications for issuing 80,000 equity shares of ₹ 10 each at a

discount of 10%. The amount was payable as follows:

On application and allotment – ₹ 6 per share

On first and final call – the balance amount.

Applications for 2,00,000 shares were received. Applications for 40,000 shares

were rejected and money refunded. Shares were allotted on pro-rata basis to

the remaining applicants. The first and final call was made. All money was

received except on 1,600 shares applied by Rohan. His shares were forfeited.

The forfeited shares were re-issued at the maximum discount permissible under

the law.

Pass necessary journal entries for the above transactions in the books of Y Ltd.

8 Marks

Ans: Journal Entries in the books of X Ltd

for the year ended…….

Date Particulars L.F Dr. Cr.

i. Bank A/c Dr. 27,00,000

To Share Application and Allotment A/c 27,00,000

Class XII Accountancy www.vedantu.com 20

(Being share application on 3,00,000 shares

@ Rs. 9 per share including premium of Rs.5

each)

ii. Share Application and Allotment A/c Dr. 27,00,000

To Share Capital A/c 3,00,000

To Securities Premium A/c 3,75,000

To Bank A/c 18,00,000

To Share First and Final Call A/c 2,25,000

(Being share application of 75,000 shares

transferred to share capital, share application

and allotment on 2,00,000 share refunded

and rest is adjusted to share first and final

call)

iii. Share First and Final Call A/c Dr. 4,50,000

To Share Capital A/c 4,50,000

(Being share first and final Call due on

75,000 shares of Rs 6 each)

iv. Bank A/c Dr. 2,21,625

To Share First and Final Call A/c 2,21,625

(Being share first and final call received)

v. Share Capital A/c Dr. 11,250

To Share Forfeiture A/c 7,875

To Share First and Final Call A/c 3,375

(Being 1,125 share were forfeited for non-

payment of share first and final of Rs 6 each)

vi. Bank A/c Dr. 6,750

Share Forfeiture A/c Dr. 4,500

To share capital A/c 11,250

(Being 1,125 share were reissued at a

discount of Rs 4 per share)

Class XII Accountancy www.vedantu.com 21

vii. Share Forfeiture A/c Dr. 3,375

To Capital Reserve A/c 3,375

(Being share forfeiture transferred to capital

reserve)

Working Notes:

1,500

= 75,000 ×

Ravi applied for 1,500 shares, allotted

1,00,000

=1125 shares

Share Application and Allotment received on 1,500 Shares of Rs 9 each

(including premium of Rs 5 each) = Rs 13,500

Shares Allotted (1,125 × 9) = Rs 10,125

Excess Application and Allotment money received = Rs 3,375

Share First and Final Call due on 1,125 shares of Rs 6 each = Rs 6,750

Excess Application and Allotment money received = Rs 3,375

Share First and Final Call not received = Rs. 3,375 (6250-3,375)

Therefore, Share First and final

Call received =Rs. 2,21,625(4,50,000-2,25,000-3,375)

Or

Journal Entries in the books of Y Ltd

for the year ended…….

Date Particulars L.f Dr. Cr.

Class XII Accountancy www.vedantu.com 22

i. Bank A/c Dr. 12,00,000

To Share application and allotment A/c 12,00,000

(Being share application and allotment

received on 2,00,000 of Rs 6 each

including the discount of Rs 1 each )

ii. Share Application and Allotment 12,00,000

A/c Dr.

Discount on Issue A/c Dr. 80,000

To Share Capital A/C 5,60,000

To Bank A/c 2,40,000

To Share First and Final Call A/c 4,80,000

(Being share application of 80,000 shares

transferred to share capital, share

application and allotment on 40,000

shares refunded and rest is adjusted to

share first and final call)

iii. Share First and Final Call A/c Dr. 2,40,000

To Share Capital A/c 2,40,000

(Being share first and final call due on

80,000 shares of Rs 3 each)

Working Note:

Those who applied for 1,60,000 shares, allotted = 80,000 Shares

1,600

= 80,000 ×

Rohan applied for 1,600 shares, allotted

1,60,000

=800 shares

Share Application and Allotment received on 1,600 shares of Rs 6 each (including

the

Class XII Accountancy www.vedantu.com 23

discount of Re 1 each) = Rs 9,600

Shares Allotted (800×6)=Rs. 4,800

Excess Application and Allotment money received = Rs 4,800

Share First and Final Call due on 800 shares of its 3 each = Rs 2,400

Excess Application and Allotment money received = Rs 4,800

Since, Rohan has already paid an excess of Its 4,800 at the time of application and

allotment, which is greater than the amount payable at the time of share final call.

Thus, forfeiture is not possible in this case.

18. Shikhar and Rohit were partners in a firm sharing profits in the ratio of 7

: 3. On 1st April, 2013 they admitted Kavi as a new partner for 1/4 share in

profits of the firm. Kavi brought ₹ 4,30,000 as his capital and ₹ 25,000 for his

share of goodwill premium. The Balance Sheet of Shikhar and Rohit as on 1st

April, 2013 was as follows :

Balance Sheet of Shikhar and Rohit as on 1st April, 2013

Amount Amount

Liabilities Assets

(₹) (₹)

Capitals : Land and Building 3,50,000

Shikhar 8,00,000 Machinery 4,50,000

Rohit 3,50,000 11,50,000 Debtors 2,20,000

General Reserve 1,00,000 Less:

Workmen’s Compensation 1,00,000 Provision (20,000) 2,00,000

Fund Stock 3,50,000

Creditors 1,50,000 Cash 1,50,000

15,00,000 15,00,000

It was agreed that

Class XII Accountancy www.vedantu.com 24

(i) the value of Land and Building will be appreciated by 20%.

(ii) the value of Machinery will be depreciated by 10%.

(iii) the liabilities of Workmen’s Compensation Fund was determined at

₹ 50,000.

(iv) capitals of Shikhar and Rohit will be adjusted on the basis of Kavi’s

capital and actual cash to be brought in or to be paid off as the case may

be.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance

Sheet of the new firm.

Or

L, M and N were partners in a firm sharing profits in the ratio of 2 : 1 : 1. On

1st April, 2013 their Balance Sheet was as follows :

Balance Sheet of L, M and N as on 1st April, 2013

Amount Amount

Liabilities Assets

(₹) (₹)

Capitals : Land 8,00,000

L 6,00,000 Building 6,00,000

M 4,80,000 Furniture 2,40,000

N 4,80,000 15,60,000 Debtors 4,00,000

Less:

General Reserve 4,40,000 Provision (20,000)

Workmen’ Compensation 3,60,000 3,80,000

Fund Stock

Creditors 2,40,000 Cash 4,40,000

1,40,000

26,00,000 26,00,000

On the above date N retired.

Class XII Accountancy www.vedantu.com 25

The following were agreed :

(i) Goodwill of the firm was valued at ₹ 6,00,000.

(ii) Land was to be appreciated by 40% and Building was to be depreciated

by ₹ 1,00,000

(iii) Furniture was to be depreciated by ₹ 30,000.

(iv) The liabilities for Workmen’s Compensation Fund was determined at

₹ 1,60,000.

(v) Amount payable to N was transferred to his loan account.

(vi) Capitals of L and M were to be adjusted in their new profit sharing ratio

and for this purpose current accounts of the partners will be opened.

Prepare Revaluation Account, Partners’ Capital Accounts and theBalance

Sheet of the new firm. 8 Marks

Ans: Dr. Revaluation A/c Cr.

Particulars Amount Particulars Amount

To Machinery A/c 45,000 By Land and Building 70,000

To profit transferred to:

Shikhar’s capital

A/c 17,500

Rohit’s Capital A/c 7,500 25,000

70,000 70,000

Dr. Partner’s Capital A/c Cr.

Particulars Shikhar Rohit Kavi Particulars Shikhar Rohit Kavi

(₹) (₹) (₹) (₹) (₹) (₹)

Class XII Accountancy www.vedantu.com 26

To Cash 37,000 23,000 By Balance b/d 8,00,000 3,50,000

A/c By Cash A/c 4,30,000

By Premium 17,500 7,500

To Balance 9,03,000 3,87,000 4,30,000 for goodwill

c/d A/c

By General 70,000 30,000

reserve A/c

By Workmen

compensation 35,000 15,000

Fund A/c

By Revaluation

A/c (Profit) 17,500 7,500

9,40,000 4,10,000 4,30,000 9,40,000 4,10,000 4,30,000

Balance Sheet of Shikhar, Rohit & Kavi

as at 1st April 2013

Amount Amount

Liabilities Assets

(₹) (₹)

Creditors 1,50,000 Cash in Hand 5,45,000

Workmen Compensation 50,000 Stock 3,50,000

Claim Machinery 4,50,000

Capital: Less: Depreciation 4,05,000

Shikhar – 9,03,000 @10% 45,000

Rohit – 3,87,000 Land & Building 4,20,000

Kavi – 4,30,000 17,20,000 Debtors 2,20,000

Less provision 20,000 2,00,000

19,20,000 19,20,000

Working Note:

Class XII Accountancy www.vedantu.com 27

New Ratio: Old share- Sacrificing share

Let the profit of the firm = 1

1

Kavi’s share =

4

1 3

Remaining share =1 − =

4 4

3 7 21

Shikhar’s Share = × =

4 10 40

3 7 21

Rohit’s Share = × =

4 10 40

1 10 21

Kavi’s Share = × =

4 10 40

New ratio = 21:9:10

Calculation of Profit Sharing Ratio

Old Ratio of Shikhar and Rohit is given as 3:2

th

1

Kavi’s share after his admission as new partner = = of profit

4

Total share of the firm = 1

1 3

Remaining share =1 − =

4 4

New Ratio will be calculated as:

3 7 21

Shikhar’s new ratio = × =

4 10 40

Class XII Accountancy www.vedantu.com 28

3 3 9

Rohit’s new share = × =

10 4 40

21 9 1

New ratio between Shikhar, Rohit and Kavi will be = : :

40 40 4

=21:9:1

Sacrificing ratio = old ratio – new ratio

7 21

Shikar’s sacrifice

= −

10 40

28 − 21

=

40

7

=

40

3 9

Rohit’s sacrifice

= −

10 40

12 − 9

=

40

3

=

40

Sacrificing ratio = 7:3

Calculation of Goodwill amount:

Goodwill amount will be calculated as:

7

Shikhar’s goodwill

= 25,000 ×

10

Class XII Accountancy www.vedantu.com 29

=17,500

3

Rohit’s goodwill

= 25,000 ×

10

=7,500

Calculation of Workmen’s compensation fund:

7

share 50,000 ×

Shikhar’s=

10

=35,000

3

Rohit’s=

share 50,000 ×

10

=15,000

General Reserve Distribution:

7

Shikhar 1,00,000 ×

=

10

=70,000

3

Rohit 1,00,000 ×

=

10

=30,000

Adjustment of Capital:

Kavi’s capital = 4,30,000

Total capital of the firm= 4,30,000×=17,20,000

Class XII Accountancy www.vedantu.com 30

21

Shikhar’s

= capital 17,20,000 ×

40

= 9,03,000

9

Rohit’s

= capital 17,20,000 ×

40

= 3,87,000

Kavi’s Capital = 4,30,000

Or

Revaluation A/c

Dr. Cr.

Particulars Amount Particulars Amount

To Building A/c 1,00,000 By Land A/c 3,20,000

To furniture A/c 30,000

To profit transferred to

L’s capital A/c 95,000

M’s Capital A/c 47,500

N’s Capital A/c 47,500 1,90,000

3,20,000 3,20,000

Dr. Partner’s Capital A/c Cr.

Particular L M N Particulars L M N

s (₹) (₹) (₹) (₹) (₹) (₹)

To N’s 1,00,000 50,000 By Balance 6,00,000 4,80,000 4,80,000

Capital b/d

A/c By L’s

To N’s 8,37,500 Capital A/c 1,00,000

Class XII Accountancy www.vedantu.com 31

loan A/c (g/w)

To M’s 1,20,000 By M’s 1,10,000 50,000

current Capital A/c

A/c (g/w) 2,20,000 1,10,000

To 10,35,000 5,17,500 By General

Balance Reserve A/c

c/d By

50,000

WorkmenC 1,00,000 50,000

ompensatio

n Fund A/c

By 95,000 47,500

revaluation 47,500

A/c (profit)

By L’s 1,20,000

current A/c

11,35,000 6,87,000 6,87,000 11,35,000 6,87,000 6,87,000

Balance sheet of L and M

As at 1st April, 2013

Amount Amount

Liabilities Assets

(₹) (₹)

Capitals: Land 11,20,000

L 10,35,000 Building 5,00,000

M 5,17,500 15,52,000 Furniture 2,10,000

N’s Loan A/c 8,37,500 Debtors 4,00,000

Workmen compensation 1,60,000 Less: provision 20,000 3,80,000

claim Stock 4,40,000

Creditors 2,40,000 Cash 1,40,000

M’s current A/c 1,20,000 L’s current A/c 1,20,000

29,10,000 29,10,000

Working Notes:

Class XII Accountancy www.vedantu.com 32

Old ratio = 2:1:1

New Ratio = 2:1

Remaining capital= 9,15,000+6,37,500

= 15,52,500 (in 2:1)

L’s capital = 10,35,000

M’s Capital = 5,17,500

PART - B

Financial Statements Analysis

19. What is meant by ‘Cash Flow Statement’ ? 1 Mark

Ans: A cash flow statement is a document that shows the inflows and outflows of

money for operating, Investing & financial activities. It is one of the three primary

financial statements used by firms, together with the balance sheet and income

statement.

20. Why is separate disclosure of cash flow from investing activities important

while preparing Cash Flow Statement ? 1 Mark

Ans: Cash flows from investing activities should be disclosed separately since they

show which investments have been made for resources in order to generate future

income and cash flows.

21. State any one objective of financial statements analysis. 1 Mark

Ans: Objective of Financial Statements Analysis are :

Class XII Accountancy www.vedantu.com 33

(i) To figure out how much money you can make or how profitable

you are.

(ii) To achieve the correct and true financial position

22. Under which sub-headings will the following items be placed in the

Balance Sheet of a company as per revised Schedule VI Part I of the

Companies Act, 1956 : 1 Mark

(i) Capital Reserves

(ii) Bonds

(iii) Loans repayable on demand

(iv) Vehicles

(v) Goodwill

(vi) Loose tools

Ans: Statement showing the sub-headings Balance sheet for above items:

Items Subheadings

Capital reserve Reserve and surplus

Long term borrowings Bonds

Loans Repayable on demand Short term loan & Advance

Vehicles Fixed Assets- Tangible assets

Goodwill Fixed Assets-Intangible assets

Loose tools Inventories

Class XII Accountancy www.vedantu.com 34

23. From the following Statement of Profit and Loss of Fenox Ltd. for the year

ended 31st March, 2013, prepare a Comparative Statement of Profit and Loss

: 3 Marks

Note No. 2012 – 13 2011 – 12

Particulars

(₹) (₹)

Revenue from operations 8,00,000 6,00,000

Other Incomes 1,00,000 50,000

Expenses 5,00,000 4,00,000

Rate of income tax was 40%.

Ans: Comparative Statement of Profit & Loss

For the years ended 31st March 2012 and 2013

Particulars Note 2011-12 2012-13 Absolute Change In

No. Change Percentage

Revenue from 6,00,000 8,00,000 2,00,000 33.33%

Operations

Add: other income 50,000 1,00,000 50,000 100%

Total Revenues 6,50,000 9,00,000 2,50,000 38.46%

Less: Expenses (4,00,000) (5,00,000) (1,00,000) 25%

Profit before Tax 2,50,000 4,00,000 1,50,000 60%

Less: Tax @ 40% (1,00,000) (1,60,000) (60,000) 60%

Profit after tax 1,50,000 2,40,000 90,000 60%

Class XII Accountancy www.vedantu.com 35

24. (a) The quick ratio of a company is 1.5 : 1. State with reason which of the

following transactions would (i) increase; (ii) decrease or (iii) not change the

ratio:

1. Paid rent ₹ 3,000 in advance.

2. Trade receivables included a debtor Shri Ashok who paid his entire

amount due ₹ 9,700.

(b) From the following information compute ‘Proprietary Ratio’ :

Long Term Borrowings 2,00,000

Long Term Provisions 1,00,000

Current Liabilities 50,000

Non-Current Assets 3,60,000

Current Assets 90,000

4 Marks

Ans: (a) (1) Decrease

Reason: If current liabilities remain unchanged, liquid assets will fall.

(2) There has been no change in the ratio.

Reason: There has been an increase in cash and a decrease in debtors,

but there has been no change in liquid assets.

Shareholders' funds

(b) Proprietary ratio =

Total assets

1,00,000

=

4,50,000

Class XII Accountancy www.vedantu.com 36

= 22 :1 or 22%

Calculation of Shareholder’s Fund and Total Assets

(Shareholder funds = Current assets + Non Current assets – Long term)

Borrowings – Long term provisions – Current liabilities

=90,000+3,60,000-2,00,000-1,00,000-50,000=1,00,000

Total Assets = Non current assets + current Assets

=90,000+3,60,000

=4,50,000

25. Prepare a Cash Flow Statement on the basis of the information given in

the Balance Sheet of Simco Ltd. as at 31.3.2013 and 31.3.2012 : 6 Marks

S.N Particulars Note 31.3.2013 31.3.2012

No. (₹) (₹)

Class XII Accountancy www.vedantu.com 37

I – Equity and Liabilities :

1. Shareholder’s Funds :

(a) Share Capital 2,00,000 1,50,000

(b) Reserves and Surplus 90,000 75,000

2. Non-Current Liabilities :

Long Term Borrowings 87,500 87,500

3. Current Liabilities :

Trade Payables 10,000 76,000

Total 3,87,500 3,88,500

II – Assets :

1. Non-Current Assets :

(a) Fixed Assets :

(i) Tangible Assets 1,87,500 1,40,000

(b) Non-Current Investments 1,05,500 1,02,500

Current Assets :

2. (a) Current Investments

(Marketable) 12,500 33,500

(b) Inventories 4,000 5,500

(c) Trade Receivables 9,500 23,000

(d) Cash and Cash Equivalents 68,500 84,000

Total 3,87,500 3,88,500

Notes to Accounts Note 1

2013 2012

Particulars (₹) (₹)

Reserves and Surplus

Surplus (Balance in Statement of Profit & Loss) 90,000 75,000

Ans: Cash flow statement

For the year ended 31st March 2013 as per AS-3 (Revised)

Class XII Accountancy www.vedantu.com 38

Details Amount

Particulars

(₹) (₹)

(A) Cash Flows from Operating Activities:

Net Profit before tax & extraordinary items 15,000

Add: Decrease in trade receivables 13,500

Decrease in inventories 1,500

Less: Decrease in trade payables (66,000)

Cash used in Operating Activities (36,000) (36,000)

(B) Cash flows from Investing Activities :

Purchase of fixed tangible assets (47,500)

Purchase of non current investments (3,000)

Cash used in investing activities (50,500) (50,500)

(C) Cash flows from Financing Activities:

Issue of share capital 50,000

Cash from financing activities 50,000

Net decrease in cash & cash equivalents (36,500)

Add: Opening balance of cash & cash equivalents 1,17,500

Closing Balance of cash & cash equivalents 81,000

PART - C

Computerised Accounting

19. What is meant by ‘data’ as a component of Computerised Accounting

System ? 1 Mark

Ans: The smallest identified item of data in the information system is called a 'data'

or a 'data element.' These are facts that can include numbers, language, and other

elements.

20. What is a relational database ? 1 Mark

Ans: A relational database is a type of database that stores and allows access to data

elements that are connected. The relational model, a simple and obvious means of

representing data in tables, is the foundation of relational databases. Each row in a

Class XII Accountancy www.vedantu.com 39

table in a relational database is a record with a unique ID called the key. The

attributes of the data are stored in the table's columns.

21. What is requirement analysis ? 1 Mark

Ans: The process of identifying the expectations of users for an application that is

to be built or upgraded is known as requirements analysis. It includes all of the tasks

that are carried out in order to determine the demands of various stakeholders.

22. Explain any two advantages and one limitation of Computerised Accounting

System. 3 Marks

Ans: Benefits of Using a Computerized Accounting System (Any two)

1. Production of reports and information in a timely and desirable way.

2. Maintaining accurate records.

3. Assures that the system is under effective management.

4. Accounting data processing efficiency.

Limitations (any one):

1. Technology's faster obsolescence needs investment in a shorter time frame.

2. Due to power outages, data may be lost or corrupted.

3. Data is vulnerable to hackers.

4. Reports that aren't programmed or specified can't be generated.

23. What is meant by data validation ? Give two examples when a cell will give

error if the values are not meeting the conditions. 4 Marks

Class XII Accountancy www.vedantu.com 40

Ans: Whether you're collecting data in the field, analysing data, or preparing to

deliver data to stakeholders, data validation is a crucial aspect of any data handling

process. If your data isn't accurate from the start, your outcomes will most likely be

inaccurate as well. As a result, data must be verified and validated before being used.

The tasks performed through data validation are :

a) Using a formula to set limits: Only those entries will be permitted that have true

values according to the formula.

b)Avoiding the creation of duplicate entries.

c)Determining the figure range

The following are some examples of data validation errors:

1. Someone gives a task to a member of the team whose name isn't on the list of

acceptable values.

2. Someone creates a task but forgets to fill in an essential information, such as

the task type.

24. Differentiate between ‘Desktop database’ and ‘Server database’ on any

four basis. 4 Marks

Ans: The difference between ‘Desktop database’ and ‘Server database’ are as

follows:

Basis Desktop Database Server Database

1. Application Single user Multiple Users

2. Additional Not present Present

Provision for

reliability

3. Cost Less Costly Costly

Class XII Accountancy www.vedantu.com 41

4. Flexibility Not present Present

regarding choice of

performance front

end application.

5. Example MS Access ORACLE, SQL

6. Suitability Small office, home office Large Organisation

25. Calculate the formulae from the following information on Excel for

computing the amounts of :

(a) Travelling Allowance, Basic Pay upto ₹ 18,000 at 10% and above it at 15%.

(b) Loan Payable, Basic Pay upto ₹ 18,000 at 20% and 25% above that.

(c) Net Salary, adding Travelling Allowance and deducting Loan Payable from

Basic Pay. 6 Marks

Ans: a) Travelling allowance = IF(B1>18000,0.15×B1, 0.1×B1)

b) Loan payable = IF(B1>18000, 0.25×B1, 0.2×B1)

c) Net salary = SUM(B1, C1-D1)

Class XII Accountancy www.vedantu.com 42

You might also like

- ICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFDocument427 pagesICAEW Professional Level Financial Accounting & Reporting Question & Answer Bank March 2016 To March 2020 PDFOptimal Management Solution100% (5)

- Corporate Finance for CFA level 1: CFA level 1, #1From EverandCorporate Finance for CFA level 1: CFA level 1, #1Rating: 3.5 out of 5 stars3.5/5 (3)

- Conversion of Partnership Firm Into CompanyDocument8 pagesConversion of Partnership Firm Into CompanyAthulya MDNo ratings yet

- Midlands State University Faculty of CommerceDocument9 pagesMidlands State University Faculty of CommerceOscar MakonoNo ratings yet

- Quiz 1.04 Investment in Associate/Derivatives Submissions: Standalone AssignmentDocument13 pagesQuiz 1.04 Investment in Associate/Derivatives Submissions: Standalone AssignmentJohn Lexter MacalberNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2016Document42 pagesCBSE Class 12 Accountancy Question Paper 2016Ravi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2012 With SolutionsDocument38 pagesCBSE Class 12 Accountancy Question Paper 2012 With SolutionsRavi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2015 With SolutionsDocument50 pagesCBSE Class 12 Accountancy Question Paper 2015 With SolutionsRavi AgrawalNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2017Document34 pagesCBSE Class 12 Accountancy Question Paper 2017gajendra kumarNo ratings yet

- CBSE Class 12 Accountancy Question Paper 2018Document39 pagesCBSE Class 12 Accountancy Question Paper 2018vaishnavi coolNo ratings yet

- ABT - BK Question Bank22-23Document8 pagesABT - BK Question Bank22-23shrikantNo ratings yet

- XII Holiday HW 2024-25Document83 pagesXII Holiday HW 2024-25shipra bataviaNo ratings yet

- Class Xii Summer Holiday Homework All MergedDocument97 pagesClass Xii Summer Holiday Homework All MergedRevathi KalyanasundaramNo ratings yet

- Ii Puc Mid Term QPDocument3 pagesIi Puc Mid Term QPSuhail AhmedNo ratings yet

- CBSE Class 12 Accountancy Question Paper & Solutions 2015 Delhi SchemeDocument39 pagesCBSE Class 12 Accountancy Question Paper & Solutions 2015 Delhi SchemeSuman PaswanNo ratings yet

- Sample Paper 3Document16 pagesSample Paper 3TrostingNo ratings yet

- ULTIMATE Sample Paper 3Document22 pagesULTIMATE Sample Paper 3Vansh RanaNo ratings yet

- Typology of QuestionsDocument15 pagesTypology of QuestionsMageswaran PitchaiahNo ratings yet

- XII ACC 1st Online Pre-Board Exam QP 2020-21Document11 pagesXII ACC 1st Online Pre-Board Exam QP 2020-21Melvin CristoNo ratings yet

- Click Here To Check Out The Solution of Class 12 Accountancy Volume 1 Chapter 1 From TS GrewalDocument59 pagesClick Here To Check Out The Solution of Class 12 Accountancy Volume 1 Chapter 1 From TS GrewalTUHIN SUBHARA PATOWARYNo ratings yet

- Partnership AccountsDocument26 pagesPartnership Accountsoneunique.1unqNo ratings yet

- XII - Accountancy U.T - 1 Set 1Document4 pagesXII - Accountancy U.T - 1 Set 1tanu1304262No ratings yet

- Accountancy QP 3 (A) 2023Document5 pagesAccountancy QP 3 (A) 2023mohammedsubhan6651No ratings yet

- Studymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1Document19 pagesStudymate Solutions To CBSE Board Examination 2018-2019: Series: BVM/1SukhmnNo ratings yet

- II PU Accountancy QPDocument13 pagesII PU Accountancy QPLokesh RaoNo ratings yet

- II Pu Acc 23 Dis Pre QprsDocument92 pagesII Pu Acc 23 Dis Pre QprskrupithkNo ratings yet

- Paper For Term-1 2020-21 For Accountancy Xii PDFDocument11 pagesPaper For Term-1 2020-21 For Accountancy Xii PDFPrashil AgrawalNo ratings yet

- Bcom 3 Sem Corporate Accounting 1 19102078 Oct 2019Document5 pagesBcom 3 Sem Corporate Accounting 1 19102078 Oct 2019xyxx1221No ratings yet

- Retiremnet of A Partner - Ashiq MohammedDocument22 pagesRetiremnet of A Partner - Ashiq MohammedAshiq MohammedNo ratings yet

- Class XII Accountancy Paper For Half Yearly PDFDocument13 pagesClass XII Accountancy Paper For Half Yearly PDFJoshi DrcpNo ratings yet

- 1458118002cbse Pariksha Accountancy I For 17 March ExamDocument11 pages1458118002cbse Pariksha Accountancy I For 17 March ExamMerlin KNo ratings yet

- Dr. Vinod Kumar: Contact DetailDocument2 pagesDr. Vinod Kumar: Contact Detailyokesh ashokNo ratings yet

- CBSE Class 12 Accountancy Sample Paper 2019 Solved PDFDocument26 pagesCBSE Class 12 Accountancy Sample Paper 2019 Solved PDFMihir KhandelwalNo ratings yet

- Worksheet Accounts Ut 1 RefrenceDocument10 pagesWorksheet Accounts Ut 1 Refrencemayankkochar216No ratings yet

- Kerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)Document30 pagesKerala Sahodaya CME Acc (055) QP & MS Set 1 (23-24)SIBINo ratings yet

- 01 Sample PaperDocument24 pages01 Sample Papergaming loverNo ratings yet

- 03 QP - Prelims - 2021-22 - XII - AccountsDocument5 pages03 QP - Prelims - 2021-22 - XII - AccountsSharvari PatilNo ratings yet

- SAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDocument5 pagesSAMPLE PAPER-4 (Solved) Accountancy Class - XII: General InstructionsDeepakPhalkeNo ratings yet

- 11 Sample PaperDocument40 pages11 Sample Papergaming loverNo ratings yet

- Hsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletedDocument8 pagesHsslive-march-2023-qn-SY-549 (Accounts With AFS) - Pages-DeletednadidawaunionthekkekadNo ratings yet

- Change in Profit Sharing Ratio QuestionsDocument3 pagesChange in Profit Sharing Ratio QuestionsTechnology worldNo ratings yet

- Delhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Document3 pagesDelhi Public School, Hyderabad Competency Enhancer Date-07.06.2021 Class: XII Time: 1 HR Subject: Accountancy Marks: 30Lekhana WesleyNo ratings yet

- Aidcom Financial Accounting AnalysisDocument17 pagesAidcom Financial Accounting AnalysisAjmal K HussainNo ratings yet

- Cbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Document6 pagesCbse Class XII Accountancy Sample Paper 1: Time:3 Hrs Max. Marks: 80Sukhman DhillonNo ratings yet

- St. Lawrence Convent, Sr. Sec, School Class XII (2021-2022) Accounts UT-1 Time - 1hr 30mins Maximum Marks 40 General InstructionsDocument3 pagesSt. Lawrence Convent, Sr. Sec, School Class XII (2021-2022) Accounts UT-1 Time - 1hr 30mins Maximum Marks 40 General Instructionsshahnawaz alamNo ratings yet

- Solution Class 12 - Accountancy Full Paper Accounts: For Admission Contact 1 / 16Document16 pagesSolution Class 12 - Accountancy Full Paper Accounts: For Admission Contact 1 / 16Shaindra SinghNo ratings yet

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocument3 pagesGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916No ratings yet

- Account 12th ClassDocument4 pagesAccount 12th ClassMandeep KaurNo ratings yet

- Holiday Homework Accountancy Class 12Document15 pagesHoliday Homework Accountancy Class 12Sambhav GargNo ratings yet

- Test-chapter-1-Accountancy 12Document5 pagesTest-chapter-1-Accountancy 12Umesh JaiswalNo ratings yet

- CBSE Class 12 Accountancy Sample Paper 2018Document19 pagesCBSE Class 12 Accountancy Sample Paper 2018Mitesh SethiNo ratings yet

- bcom-CORPORATE ACCOUNTING I - JAN 23Document5 pagesbcom-CORPORATE ACCOUNTING I - JAN 23xyxx1221No ratings yet

- Most Imp Questions Fundamentals To Admission - 240319 - 232457Document5 pagesMost Imp Questions Fundamentals To Admission - 240319 - 232457Qwe assdNo ratings yet

- Model Examination Feb 2010-2011: Computerised AccountingDocument3 pagesModel Examination Feb 2010-2011: Computerised Accountingsharathk916No ratings yet

- Group Assignment - March 2020Document10 pagesGroup Assignment - March 2020Dylan Rabin PereiraNo ratings yet

- ACCOUNTANCY Question Paper 2022 (67-1-1) Set - 1Document6 pagesACCOUNTANCY Question Paper 2022 (67-1-1) Set - 1Manogya GondelaNo ratings yet

- QP CODE: 23106190: Reg No: NameDocument5 pagesQP CODE: 23106190: Reg No: NameabhijathasanthoshNo ratings yet

- Time Allowed: 3 Hours Maximum Marks: 80 General InstructionsDocument32 pagesTime Allowed: 3 Hours Maximum Marks: 80 General InstructionsRohit MatoliyaNo ratings yet

- Class 12 - Quarterly Examination Q FINALDocument11 pagesClass 12 - Quarterly Examination Q FINALsubbuNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- Weekly Test of AccountsDocument6 pagesWeekly Test of AccountsAMIN BUHARI ABDUL KHADER100% (1)

- RTP Nov 15Document46 pagesRTP Nov 15Aaquib ShahiNo ratings yet

- Class-12th Ch-4 Addmission NotesDocument3 pagesClass-12th Ch-4 Addmission NotesSjft6hd FfNo ratings yet

- Quizz Topic 2 - Ias 1Document7 pagesQuizz Topic 2 - Ias 1Ngân QuếNo ratings yet

- CMA Part 2 External Financial ReportingDocument990 pagesCMA Part 2 External Financial Reportingfrances75% (8)

- Tugas 2 - AKL 1Document2 pagesTugas 2 - AKL 1Geroro D'PhoenixNo ratings yet

- Accounting Methods For GoodwillDocument4 pagesAccounting Methods For GoodwillaskmeeNo ratings yet

- Goodwill P 700,000: Multiple Choices - ComputationalDocument14 pagesGoodwill P 700,000: Multiple Choices - ComputationalLove FreddyNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAljur Salameda50% (2)

- Revision Notes Group Accounts PDFDocument11 pagesRevision Notes Group Accounts PDFEhsanulNo ratings yet

- 34 95067Document30 pages34 95067Abdelmadjid djibrineNo ratings yet

- SBR Mock 1 Sep 23 TGDocument7 pagesSBR Mock 1 Sep 23 TGAkshita BhartiyaNo ratings yet

- Session 6 Assets Part 2 - Intangilbe and Investments (Marked Up)Document38 pagesSession 6 Assets Part 2 - Intangilbe and Investments (Marked Up)Kothari InvestmentsNo ratings yet

- Intercorporate Acquisitions and Investments in Other EntitiesDocument31 pagesIntercorporate Acquisitions and Investments in Other EntitiesSayed Farrukh AhmedNo ratings yet

- C 20 MM 3 4 SemDocument81 pagesC 20 MM 3 4 Semsoma rajNo ratings yet

- Globe TelecomDocument8 pagesGlobe TelecomLesterAntoniDeGuzmanNo ratings yet

- Chinese English Translation of Accounting SubjectsDocument89 pagesChinese English Translation of Accounting SubjectsdanielNo ratings yet

- Tham KhaoDocument17 pagesTham KhaoTram NguyenNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- Financial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder Test BankDocument16 pagesFinancial Accounting Theory and Analysis Text and Cases 11th Edition Schroeder Test BankJordanChristianqryox100% (17)

- Answers To Intangible AssetsDocument5 pagesAnswers To Intangible AssetsSoorya SubramaniamNo ratings yet

- Analyzing Investing Activities Chapter 5Document29 pagesAnalyzing Investing Activities Chapter 5Agathos Kurapaq0% (1)

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Afar BuscombDocument22 pagesAfar BuscombMo Mindalano MandanganNo ratings yet

- Accounting For Business Combination - Practice ExamDocument6 pagesAccounting For Business Combination - Practice ExamZYRENE HERNANDEZNo ratings yet

- Business Combination Stock AcquisitionDocument2 pagesBusiness Combination Stock AcquisitionMark Joseph OlinoNo ratings yet

- Theory of MergersDocument37 pagesTheory of MergersJoyal JosephNo ratings yet

- June 2008 Ms 6002Document19 pagesJune 2008 Ms 6002Shifana ARNo ratings yet

- Notes Forming Part of Financial StatementsDocument58 pagesNotes Forming Part of Financial StatementsAndrew StarkNo ratings yet