Professional Documents

Culture Documents

Earn Revenue

Earn Revenue

Uploaded by

Lea VillapuzCopyright:

Available Formats

You might also like

- How To Write A Financial PlanDocument6 pagesHow To Write A Financial PlanGokul SoodNo ratings yet

- Economic vs. Accounting ProfitDocument2 pagesEconomic vs. Accounting Profitushaikh_usNo ratings yet

- Expenses Are Bills and Other Costs A Business Must Pay in Order For It To Operate and Earn RevenueDocument1 pageExpenses Are Bills and Other Costs A Business Must Pay in Order For It To Operate and Earn RevenueLea VillapuzNo ratings yet

- Business AccountingDocument22 pagesBusiness Accountingkauti0% (1)

- Income Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Document47 pagesIncome Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Jenkins Jose Shirley100% (1)

- 2-Income StatementDocument22 pages2-Income StatementSanz GuéNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- Chapter 8 Income StatementDocument2 pagesChapter 8 Income Statementmarianne raelNo ratings yet

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- FSA Level 1Document31 pagesFSA Level 1Rahul MaheshwariNo ratings yet

- Income StatementDocument36 pagesIncome StatementTiffany VinzonNo ratings yet

- Accounting! What's It All About?: THE Business CycleDocument10 pagesAccounting! What's It All About?: THE Business CycleMarcinNo ratings yet

- 2 Income StatementDocument3 pages2 Income Statementapi-299265916No ratings yet

- Summary Ch4 & Ch5Document10 pagesSummary Ch4 & Ch5beenishyousafNo ratings yet

- Chapter 5 NotesDocument15 pagesChapter 5 NotesNavroopamNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsNitesh KumarNo ratings yet

- Income StatementDocument6 pagesIncome Statementkyrian chimaNo ratings yet

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- Basics of Indeterminate AccountingDocument19 pagesBasics of Indeterminate AccountinghummankhanNo ratings yet

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Financial Plan For BusinessDocument4 pagesFinancial Plan For Businesschandralekhakodavali100% (1)

- Accounting ReportDocument23 pagesAccounting ReportAreeba FatimaNo ratings yet

- Multi Step Income Statement For Merchadising BusinessDocument10 pagesMulti Step Income Statement For Merchadising Businessjesi zamoraNo ratings yet

- CH2 Fabm2Document27 pagesCH2 Fabm2Crisson FermalinoNo ratings yet

- Income Statement - Format - Types - ExampleDocument3 pagesIncome Statement - Format - Types - ExampleIoana DragneNo ratings yet

- Financial Statement Analysis For ValuationDocument5 pagesFinancial Statement Analysis For Valuationsanu sayedNo ratings yet

- What Is The Statement of Comprehensive Income?: EquityDocument4 pagesWhat Is The Statement of Comprehensive Income?: EquityKatherine Canisguin AlvarecoNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisShreya VermaNo ratings yet

- Financial Accounting: Salal Durrani 2020Document12 pagesFinancial Accounting: Salal Durrani 2020Rahat BatoolNo ratings yet

- Profit and LossDocument1 pageProfit and LossammuNo ratings yet

- Equity, Financial Position and Cash FlowsDocument9 pagesEquity, Financial Position and Cash FlowsAbigail Elsa Samita Sitakar 1902113687No ratings yet

- Inc StatmentDocument3 pagesInc StatmentDilawarNo ratings yet

- 5 Inc Statm-BDADocument7 pages5 Inc Statm-BDASyed Hamzah Al-IdrusNo ratings yet

- Term 2 Week 3Document42 pagesTerm 2 Week 3bhavik GuptaNo ratings yet

- Profitability Is The Ability of A Firm To Generate EarningsDocument2 pagesProfitability Is The Ability of A Firm To Generate EarningsJaneNo ratings yet

- Lana Taher (Second Stage) - Profit and Loss AccountDocument8 pagesLana Taher (Second Stage) - Profit and Loss AccountTana AzeezNo ratings yet

- Net Income NI Definition Uses and How To Calculate ItDocument4 pagesNet Income NI Definition Uses and How To Calculate IthieutlbkreportNo ratings yet

- Levy Net Earnings Taxable IncomeDocument4 pagesLevy Net Earnings Taxable Incomeadhi anoragaNo ratings yet

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocument36 pagesLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNo ratings yet

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- Financial Plan PerbisDocument9 pagesFinancial Plan PerbisDamas Pandya JanottamaNo ratings yet

- Key Performance IndicesDocument38 pagesKey Performance IndicesSuryanarayana TataNo ratings yet

- Income Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Document14 pagesIncome Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Dr. Satish Jangra100% (1)

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- Acc. 101-True or False and IdentificationDocument9 pagesAcc. 101-True or False and IdentificationAuroraNo ratings yet

- Writing The Business PlanDocument8 pagesWriting The Business PlanIngrid Yaneth SalamancaNo ratings yet

- CH3 Titman 12eDocument84 pagesCH3 Titman 12elouise carinoNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement AnalysisQueen RielleNo ratings yet

- Financial Statements and Accounting Concepts/PrinciplesDocument18 pagesFinancial Statements and Accounting Concepts/PrinciplesdanterozaNo ratings yet

- Prepare Basic Financial StatementsDocument6 pagesPrepare Basic Financial StatementsMujieh NkengNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- Financial StatementsDocument8 pagesFinancial StatementsbouhaddihayetNo ratings yet

- RoarDocument19 pagesRoarFrank HernandezNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Financial Statements GuideDocument16 pagesFinancial Statements Guidehenaa sssaaaaeeeettNo ratings yet

- V. Basic Interprestation and Use of Financial StatementsDocument12 pagesV. Basic Interprestation and Use of Financial StatementsJHERICA SURELLNo ratings yet

- 33 - Financial Statements: 33.1 Statement of Profit or LossDocument14 pages33 - Financial Statements: 33.1 Statement of Profit or LossRokaia MortadaNo ratings yet

- How To Make A Financial Statement For Small BusinessDocument6 pagesHow To Make A Financial Statement For Small BusinessAaron MushunjeNo ratings yet

Earn Revenue

Earn Revenue

Uploaded by

Lea VillapuzOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Earn Revenue

Earn Revenue

Uploaded by

Lea VillapuzCopyright:

Available Formats

Miscellaneous Expense Costs that are minor and/or non-repetitive ANY Expense Any cost associated

with earning revenue Page | 3 PRINCIPLES OF FINANCIAL ACCOUNTING ACCOUNTING CYCLE - SERVICE -

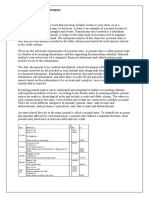

CASH A chart of accounts is a list of all accounts used by a business. Accounts are presented by category

in the following order: (1) Assets, (2) Liabilities, (3) Stockholders’ equity, (4) Revenue, and (5) Expenses.

1.2 NET INCOME—A CRITICAL AMOUNT The difference between the total revenue and total expense

amounts for a particular period (such as a month or year), assuming revenue is higher, is profit. We will

now refer to profit as net income. The following is a key calculation in determining a business’s

operating results in dollars: Revenue - Expenses = Net Income Net income is determined by subtracting

all expenses for a month (or year) from all revenue for that same month (or year). A net loss results if

total expenses for a month (or year) exceed total revenue for the same period of time. Net income is a

result that business people are extremely interested in knowing since it represents the results of a firm’s

operations in a given period of time. 1.3 THE MECHANICS OF THE ACCOUNTIN

You might also like

- How To Write A Financial PlanDocument6 pagesHow To Write A Financial PlanGokul SoodNo ratings yet

- Economic vs. Accounting ProfitDocument2 pagesEconomic vs. Accounting Profitushaikh_usNo ratings yet

- Expenses Are Bills and Other Costs A Business Must Pay in Order For It To Operate and Earn RevenueDocument1 pageExpenses Are Bills and Other Costs A Business Must Pay in Order For It To Operate and Earn RevenueLea VillapuzNo ratings yet

- Business AccountingDocument22 pagesBusiness Accountingkauti0% (1)

- Income Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Document47 pagesIncome Statement: Presented by HARI PRIYA - 102114025 JENKINS-102114026 ARVIND-102114027Jenkins Jose Shirley100% (1)

- 2-Income StatementDocument22 pages2-Income StatementSanz GuéNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- Chapter 8 Income StatementDocument2 pagesChapter 8 Income Statementmarianne raelNo ratings yet

- CFI Team 05072022 - Income StatementDocument8 pagesCFI Team 05072022 - Income StatementDR WONDERS PIBOWEINo ratings yet

- FSA Level 1Document31 pagesFSA Level 1Rahul MaheshwariNo ratings yet

- Income StatementDocument36 pagesIncome StatementTiffany VinzonNo ratings yet

- Accounting! What's It All About?: THE Business CycleDocument10 pagesAccounting! What's It All About?: THE Business CycleMarcinNo ratings yet

- 2 Income StatementDocument3 pages2 Income Statementapi-299265916No ratings yet

- Summary Ch4 & Ch5Document10 pagesSummary Ch4 & Ch5beenishyousafNo ratings yet

- Chapter 5 NotesDocument15 pagesChapter 5 NotesNavroopamNo ratings yet

- Financial StatementsDocument12 pagesFinancial StatementsNitesh KumarNo ratings yet

- Income StatementDocument6 pagesIncome Statementkyrian chimaNo ratings yet

- Income StatementDocument3 pagesIncome StatementMamta LallNo ratings yet

- Basics of Indeterminate AccountingDocument19 pagesBasics of Indeterminate AccountinghummankhanNo ratings yet

- Understanding The Income StatementDocument4 pagesUnderstanding The Income Statementluvujaya100% (1)

- Financial Plan For BusinessDocument4 pagesFinancial Plan For Businesschandralekhakodavali100% (1)

- Accounting ReportDocument23 pagesAccounting ReportAreeba FatimaNo ratings yet

- Multi Step Income Statement For Merchadising BusinessDocument10 pagesMulti Step Income Statement For Merchadising Businessjesi zamoraNo ratings yet

- CH2 Fabm2Document27 pagesCH2 Fabm2Crisson FermalinoNo ratings yet

- Income Statement - Format - Types - ExampleDocument3 pagesIncome Statement - Format - Types - ExampleIoana DragneNo ratings yet

- Financial Statement Analysis For ValuationDocument5 pagesFinancial Statement Analysis For Valuationsanu sayedNo ratings yet

- What Is The Statement of Comprehensive Income?: EquityDocument4 pagesWhat Is The Statement of Comprehensive Income?: EquityKatherine Canisguin AlvarecoNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisShreya VermaNo ratings yet

- Financial Accounting: Salal Durrani 2020Document12 pagesFinancial Accounting: Salal Durrani 2020Rahat BatoolNo ratings yet

- Profit and LossDocument1 pageProfit and LossammuNo ratings yet

- Equity, Financial Position and Cash FlowsDocument9 pagesEquity, Financial Position and Cash FlowsAbigail Elsa Samita Sitakar 1902113687No ratings yet

- Inc StatmentDocument3 pagesInc StatmentDilawarNo ratings yet

- 5 Inc Statm-BDADocument7 pages5 Inc Statm-BDASyed Hamzah Al-IdrusNo ratings yet

- Term 2 Week 3Document42 pagesTerm 2 Week 3bhavik GuptaNo ratings yet

- Profitability Is The Ability of A Firm To Generate EarningsDocument2 pagesProfitability Is The Ability of A Firm To Generate EarningsJaneNo ratings yet

- Lana Taher (Second Stage) - Profit and Loss AccountDocument8 pagesLana Taher (Second Stage) - Profit and Loss AccountTana AzeezNo ratings yet

- Net Income NI Definition Uses and How To Calculate ItDocument4 pagesNet Income NI Definition Uses and How To Calculate IthieutlbkreportNo ratings yet

- Levy Net Earnings Taxable IncomeDocument4 pagesLevy Net Earnings Taxable Incomeadhi anoragaNo ratings yet

- Lecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetDocument36 pagesLecture 2728 Prospective Analysis Process of Projecting Income Statement Balance SheetRahul GautamNo ratings yet

- Financial Accounting & AnalysisDocument5 pagesFinancial Accounting & AnalysisSourav SaraswatNo ratings yet

- Financial Plan PerbisDocument9 pagesFinancial Plan PerbisDamas Pandya JanottamaNo ratings yet

- Key Performance IndicesDocument38 pagesKey Performance IndicesSuryanarayana TataNo ratings yet

- Income Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Document14 pagesIncome Statement: Profit/Loss Account Dr. Satish Jangra (2009A229M)Dr. Satish Jangra100% (1)

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- Acc. 101-True or False and IdentificationDocument9 pagesAcc. 101-True or False and IdentificationAuroraNo ratings yet

- Writing The Business PlanDocument8 pagesWriting The Business PlanIngrid Yaneth SalamancaNo ratings yet

- CH3 Titman 12eDocument84 pagesCH3 Titman 12elouise carinoNo ratings yet

- Financial Statement AnalysisDocument29 pagesFinancial Statement AnalysisQueen RielleNo ratings yet

- Financial Statements and Accounting Concepts/PrinciplesDocument18 pagesFinancial Statements and Accounting Concepts/PrinciplesdanterozaNo ratings yet

- Prepare Basic Financial StatementsDocument6 pagesPrepare Basic Financial StatementsMujieh NkengNo ratings yet

- Income Statement, Its Elements, Usefulness and LimitationsDocument5 pagesIncome Statement, Its Elements, Usefulness and LimitationsDipika tasfannum salamNo ratings yet

- Financial StatementsDocument8 pagesFinancial StatementsbouhaddihayetNo ratings yet

- RoarDocument19 pagesRoarFrank HernandezNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Financial Statements GuideDocument16 pagesFinancial Statements Guidehenaa sssaaaaeeeettNo ratings yet

- V. Basic Interprestation and Use of Financial StatementsDocument12 pagesV. Basic Interprestation and Use of Financial StatementsJHERICA SURELLNo ratings yet

- 33 - Financial Statements: 33.1 Statement of Profit or LossDocument14 pages33 - Financial Statements: 33.1 Statement of Profit or LossRokaia MortadaNo ratings yet

- How To Make A Financial Statement For Small BusinessDocument6 pagesHow To Make A Financial Statement For Small BusinessAaron MushunjeNo ratings yet