Professional Documents

Culture Documents

Jawaban CH 5 - TM 11

Jawaban CH 5 - TM 11

Uploaded by

ahmad shinigami0 ratings0% found this document useful (0 votes)

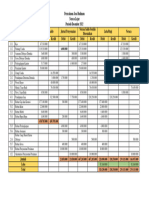

15 views3 pagesThe document is a trial balance worksheet for Starz Department Store for the year ended December 31, 2014. It includes account balances from the trial balance and adjustments, resulting in adjusted balances for the income statement and balance sheet. It shows account titles, debit amounts, credit amounts, income statement accounts, and balance sheet accounts. It also includes an income statement and statement of financial position for Starz Department Store with account categories and amounts.

Original Description:

Original Title

Jawaban CH 5_TM 11

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is a trial balance worksheet for Starz Department Store for the year ended December 31, 2014. It includes account balances from the trial balance and adjustments, resulting in adjusted balances for the income statement and balance sheet. It shows account titles, debit amounts, credit amounts, income statement accounts, and balance sheet accounts. It also includes an income statement and statement of financial position for Starz Department Store with account categories and amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

15 views3 pagesJawaban CH 5 - TM 11

Jawaban CH 5 - TM 11

Uploaded by

ahmad shinigamiThe document is a trial balance worksheet for Starz Department Store for the year ended December 31, 2014. It includes account balances from the trial balance and adjustments, resulting in adjusted balances for the income statement and balance sheet. It shows account titles, debit amounts, credit amounts, income statement accounts, and balance sheet accounts. It also includes an income statement and statement of financial position for Starz Department Store with account categories and amounts.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 3

Name: Date:

Instructor: Course:

Accounting Principles, Ninth Edition by Weygandt, Kieso, and Kimmel

Solving Accounting Principles Problems Using Microsoft Excel for Windows by Rex A Schildhouse

P5-8A The trial balance of Terry Manning Fashion Center contained the following accounts at December 31, the end of the company's fiscal year:

STARZ DEPARTMENT STORE

Worksheet

For the Year Ended December 31, 2014

Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet

Account titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr.

Cash $23,800 23,800 23,800 0

Accounts Receivable 50,300 50,300 50,300 0

Inventory 75,000 75,000 75,000 0

Prepaid Insurance 9,600 7,200 2,400 2,400 0

Buildings 290,000 290,000 290,000 0

Equipment 110,000 110,000 110,000 0

Accumulated Depr - Buildings 42,100 10,400 52,500 0 52,500

Accumulated Depr - Equip $29,600 13,300 42,900 0 42,900

Accounts Payable 79,300 1,000 80,300 0 80,300

Mortagage Payable 80,000 80,000 0 80,000

Property Taxes Payable 4,800 4,800 0 4,800

Sales Commissions Payable 4,300 4,300 0 4,300

Interest Payable 5,600 5,600 0 5,600

Share Capital-Ordinary 112,000 112,000 0 112,000

Retained earnings 64,600 64,600 64,600 0

Dividends 24,000 24,000 24,000 0

Sales Revenue 724,000 724,000 0 724,000

Sales Returns and Allowance 8,000 8,000 8,000 0

Interest Revenue 4,000 4,000 0 4,000

Cost of Goods Sold 412,700 412,700 412,700 0

Utilities Expense 11,000 1,000 12,000 12,000 0

Insurance Expense 7,200 7,200 7,200 0

Interest Expense 3,000 5,600 8,600 8,600 0

Property Tax Expense 4,800 4,800 4,800 0

Salaries and Wages Expense 108,000 108,000 108,000 0

Sales Commissions Expense 10,200 4,300 14,500 14,500 0

Depreciation Expense 23,700 23,700 23,700 0

Totals $1,200,200 $1,071,000 $46,600 $46,600 $1,239,600 $1,110,400 599,500 728,000 640,100 382,400

Net Income 128,500 (257,700)

Totals $728,000 $728,000 $382,400 $382,400

Key: (a) Supplies used, (b) Depreciation expense (c) Accrued interest payable, (d) Adjustment of inventory.

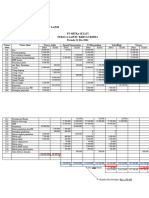

STARZ DEPARTMENT STORE STARZ DEPARTMENT STORE

Income Statement Statement of Financial Position

FileName: 680719513.xls, Tab: CH 5_TM 11, Page 1 of 3, 07/24/2023, 13:47:23

Name: Date:

Instructor: Course:

For the Year Ended December 31, 2014 December 31, 2014

Sales Revenues Assets

Sales Revenue $724,000 Current assets

Sales Returns and Allowances 8,000 Cash $23,800

Net Sales 716,000 Accounts Receivable $50,300

Cost of Goods Sold 412,700 Inventory $75,000

Gross Profit 303,300 Prepaid Insurance $2,400

Operating Expenses Total Current Assets $151,500

Utilities Expense 12,000 Property, plant, and equipment

Insurance Expense 7,200 Buildings $290,000

Property Tax Expense 4,800 Equipment $110,000

Salaries and Wages Expense 108,000 Accumulated Depr - Buildings 52,500

Sales Commissions Expense 14,500 Accumulated Depr - Equip 42,900 304,600 304,600

Depreciation Expense 23,700 Total assets $456,100

Liabilities and Owner’s Equity

Total selling expenses 170,200 Current liabilities

Loss from Operations 133,100 Accounts Payable $80,300

Other expenses and losses Mortagage Payable $16,000

Interest Revenue 4,000 Property Taxes Payable 4,800

Interest Expense 8,600 Sales Commissions Payable 108,000

Net income (Net loss) $128,500 Interest Payable 14,500

Total Current Liabilities 223,600

STARZ DEPARTMENT STORE

Retained Earning Statement Long-term liabilities

For the Year Ended December 31, 2014 Mortgage Payable 64,000

Retained earnings, Dec 1, 2014 $64,600 Total Liabilities 287,600

Net Loss $128,500

Dividends 24,000 152,500 Equity

Retained earnings, December 31, 2014 ($87,900) Share Capital-Ordinary 4,800

FileName: 680719513.xls, Tab: CH 5_TM 11, Page 2 of 3, 07/24/2023, 13:47:23

Name: Date:

Instructor: Course:

Retained earnings, December 31, 2014 (87,900)

Total Equity ($83,100)

Total Liabilities and Equity $204,500

(c) Journalize the adjusting entries.

Dec-31 Insurance Expense 7,200

Prepaid Insurance 7,200

Dec-31 Depreciation Expense 23,700

Accumulated Depr - Buildings 10,400

Accumulated Depr - Equip 13,300

Dec-31 Utilities Expense 1,000 (d) Journalize the closing entries.

Account Payable 1,000

Dec-31 Sales Revenue 724,000

Dec-31 Property Tax Expense 4,800 Income Summary 724,000

Property Taxes Payable 4,800

Dec-31 Income Summary 8,000

Dec-31 Sales Commissions Expense 4,300 Sales Returns and Allowances 8,000

Sales Commissions Payable 4,300

Dec-31 Interest Expense 5,600

Interest Payable 5,600

Dec-31 Income Summary 178,800

(e) Prepare a post-closing trial balance. Utilities Expense 12,000

STARZ DEPARTMENT STORE Insurance Expense 7,200

Post-Closing Trial Balance Property Tax Expense 4,800

For the Year Ended December 31, 2014 Salaries and Wages Expense 108,000

Debit Credit Sales Commissions Expense 14,500

Cash $23,800 Depreciation Expense 23,700

Accounts Receivable $50,300 Interest Expense 8,600

Inventory $75,000

Prepaid Insurance $2,400 Dec-31 Income Summary 128,500

Buildings 290,000 Retained Earnings 128,500

Equipment 110,000

Accumulated Depr - Buildings 52,500 Dec-31 Retained Earnings 24,000

Accumulated Depr - Equip 42,900 Dividends 24,000

Accounts Payable 80,300

Mortagage Payable 16,000

Property Taxes Payable 4,800

Sales Commissions Payable 108,000

Interest Payable 14,500

Share Capital-Ordinary 4,800

Retained earnings 87,900

$775,100 $188,100

FileName: 680719513.xls, Tab: CH 5_TM 11, Page 3 of 3, 07/24/2023, 13:47:23

You might also like

- Case Write Up 1Document4 pagesCase Write Up 1E learningNo ratings yet

- Bohol Pension House 1Document7 pagesBohol Pension House 1Chloe Cataluna86% (7)

- Christine Sousa BagsDocument8 pagesChristine Sousa BagsKaila Clarisse Cortez100% (5)

- FDNACCT C35A Group Project Group 3Document21 pagesFDNACCT C35A Group Project Group 3cNo ratings yet

- Acctg Problem 7Document4 pagesAcctg Problem 7Salvie Perez Utana57% (14)

- C TB1200 90 Sample QuestionsDocument5 pagesC TB1200 90 Sample QuestionsSébastien MichelNo ratings yet

- Assignment Managing A Successful ProjectDocument24 pagesAssignment Managing A Successful ProjectJustina Lc67% (3)

- Jawaban P5-5aDocument2 pagesJawaban P5-5arezky100% (1)

- Dzaky Farhansyah - V1620034 - E5-19 - P5-8A - P5-7ADocument15 pagesDzaky Farhansyah - V1620034 - E5-19 - P5-8A - P5-7ADzaky FarhansyahNo ratings yet

- Joyk-Excel 2 3 1Document4 pagesJoyk-Excel 2 3 1api-664350584No ratings yet

- Neraca LajurDocument1 pageNeraca LajurPutri HandayaniNo ratings yet

- BA 205 AnswerDocument5 pagesBA 205 AnswerAnhar Polo CanacanNo ratings yet

- ULOa Let's Analyze Week 8 9Document4 pagesULOa Let's Analyze Week 8 9emem resuentoNo ratings yet

- Sample Woksheet For Service ConcernDocument1 pageSample Woksheet For Service ConcernEzekiel LapitanNo ratings yet

- Drew SicatDocument1 pageDrew SicatShaine Cabualan SeroyNo ratings yet

- Rosalie Balhag CleanersDocument1 pageRosalie Balhag CleanersDominique Abrajano100% (1)

- Edgar Detoya WorksheetDocument2 pagesEdgar Detoya WorksheetNeilan Jay FloresNo ratings yet

- Accounting 1 (Chapter 9)Document3 pagesAccounting 1 (Chapter 9)CPAREVIEW100% (2)

- Solution To Exercise Set Chapter 3-4Document22 pagesSolution To Exercise Set Chapter 3-4Pham Le Tram Anh (K16HCM)No ratings yet

- Solution To Exercise Set Chapter 3 4Document22 pagesSolution To Exercise Set Chapter 3 4jennibonilla19No ratings yet

- FdnacctDocument20 pagesFdnacctvitobautistaNo ratings yet

- WorksheetDocument4 pagesWorksheetHumaira NomanNo ratings yet

- Acctg 153aDocument6 pagesAcctg 153aCHESTER JAN BOSONGNo ratings yet

- Ily Abella Surveyors - WorksheetDocument2 pagesIly Abella Surveyors - WorksheetNeilan Jay FloresNo ratings yet

- mgt101 Questions With AnswersDocument11 pagesmgt101 Questions With AnswersKinza LaiqatNo ratings yet

- Dellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditDocument6 pagesDellosa Cleaners Adjusting Entry For The Year Ended September 30, 2022. Accounts Debit CreditJaira AsuncionNo ratings yet

- 7 SynthesisDocument5 pages7 SynthesisCristine Jane Granaderos OppusNo ratings yet

- WS MerchDocument5 pagesWS Merchjeonlei02No ratings yet

- Ke Toan Quoc Te 1 Chap 4Document10 pagesKe Toan Quoc Te 1 Chap 4Xuân QuỳnhNo ratings yet

- BSBFIN401 Assessment 3Document6 pagesBSBFIN401 Assessment 3Kitpipoj PornnongsaenNo ratings yet

- Mekidelawit Tamrat MBAO9550.14B 2Document23 pagesMekidelawit Tamrat MBAO9550.14B 2mkdiNo ratings yet

- Kertas Kerja A-1Document1 pageKertas Kerja A-1PrasetyoNo ratings yet

- EKO4 Marsya As - 12ipa3 - 16Document4 pagesEKO4 Marsya As - 12ipa3 - 16Marsya AlyssaNo ratings yet

- Bsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyDocument7 pagesBsa Midterm Non Graded Exercises Worksheet and Financial Statements Preparation Answer KeyGarp BarrocaNo ratings yet

- Untitled Spreadsheet - Sheet1Document1 pageUntitled Spreadsheet - Sheet1gnssgtld7No ratings yet

- Problem 6 - 3: Chapter 6 - AA2 (2014 Edition)Document4 pagesProblem 6 - 3: Chapter 6 - AA2 (2014 Edition)Izzy BNo ratings yet

- Karkits Corporation Excel Copy PasteDocument2 pagesKarkits Corporation Excel Copy PasteCoke Aidenry SaludoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Clenneth CompanyDocument21 pagesClenneth CompanyRich ann belle AuditorNo ratings yet

- Book 1Document4 pagesBook 1monteNo ratings yet

- 17 - Accounting For Incomplete Records (Single Entry)Document7 pages17 - Accounting For Incomplete Records (Single Entry)KAMAL POKHRELNo ratings yet

- Finacc 8-3Document5 pagesFinacc 8-3FakerPlaymakerNo ratings yet

- Zabala Auto Supply Worksheet JANUARY 31, 2021 Unadjusted Trial Balance DebitDocument24 pagesZabala Auto Supply Worksheet JANUARY 31, 2021 Unadjusted Trial Balance DebitIphegenia DipoNo ratings yet

- Exercise 8-7 Page 319Document3 pagesExercise 8-7 Page 319Dianne Jane LirayNo ratings yet

- Neraca Saldo (Klasik) : Lita - PT Mitra AbadiDocument1 pageNeraca Saldo (Klasik) : Lita - PT Mitra AbadiReny Em-HaNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- J. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Document2 pagesJ. P. Peralta Computer Clinic Worksheet For The Month Ended December 31, 2020Minjin lesner ManalansanNo ratings yet

- Homework P4 4ADocument8 pagesHomework P4 4AFrizky Triputra CahyahanaNo ratings yet

- TK 1 Int Acc Adjusting JournalDocument3 pagesTK 1 Int Acc Adjusting JournalliaNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Midterm 1217Document7 pagesMidterm 1217Iphegenia DipoNo ratings yet

- Accounting - Trial BalanceDocument1 pageAccounting - Trial Balancefranchesca.dejesus.educNo ratings yet

- Mahmudin Saepullah - Assignment 5BDocument10 pagesMahmudin Saepullah - Assignment 5BRomi Prabowo De jongNo ratings yet

- AccountsDocument4 pagesAccountsVencint LaranNo ratings yet

- Trial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditDocument2 pagesTrial Balance Adjustments Profit or Loss Financial Position Account Titles Debit Credit Debit Credit Debit Credit Debit CreditVencint LaranNo ratings yet

- Chapter 8Document6 pagesChapter 8SabNo ratings yet

- MGT 101Document13 pagesMGT 101MuzzamilNo ratings yet

- KJA SabrinaDocument1 pageKJA SabrinaKha ShynTaNo ratings yet

- Chapter 6Document10 pagesChapter 6SabNo ratings yet

- Form Kosong-1Document12 pagesForm Kosong-1Toold 75No ratings yet

- J.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2007: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Federal Inland Revenue Service and Taxation Reforms in Democratic NigeriaFrom EverandFederal Inland Revenue Service and Taxation Reforms in Democratic NigeriaIfueko Omoigui OkauruNo ratings yet

- ACCT 220-Corporate Financial Reporting-I-Samia AliDocument9 pagesACCT 220-Corporate Financial Reporting-I-Samia Alinetflix accountNo ratings yet

- A Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019Document36 pagesA Guide To Global Citizenship THE 2019 Cbi Index: Special Report August/September 2019ArunNo ratings yet

- OD328840748510716100Document1 pageOD328840748510716100AkashNo ratings yet

- Coaching Centre Liscensing & RegistrationsDocument3 pagesCoaching Centre Liscensing & RegistrationsshadabchistiNo ratings yet

- An Organizational Study of Pragathi Gramin Bank & Survey On Customer SatisfactionDocument15 pagesAn Organizational Study of Pragathi Gramin Bank & Survey On Customer SatisfactionSatveer SinghNo ratings yet

- CRC Ace Mas First PBDocument10 pagesCRC Ace Mas First PBJohn Philip Castro100% (2)

- Neo Checklist For Credit InvestigatorDocument2 pagesNeo Checklist For Credit Investigatorjandy salazarNo ratings yet

- Annexure 1Document4 pagesAnnexure 1Jalaj JainNo ratings yet

- Mi Report FinalDocument74 pagesMi Report FinalArittraKar100% (1)

- Adam Halpert - ResumeDocument1 pageAdam Halpert - ResumeAdam HalpertNo ratings yet

- ValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04Document4 pagesValueResearchFundcard AxisFocused25Fund DirectPlan 2019mar04ChittaNo ratings yet

- Marketing Plan - SiantechDocument47 pagesMarketing Plan - SiantechAhmed NasrNo ratings yet

- InvoiceDocument1 pageInvoiceshiv kumarNo ratings yet

- Effect of Price Instability On Economic Growth.Document18 pagesEffect of Price Instability On Economic Growth.smarthoney86100% (2)

- Tugas Manajemen Stratejik "Competitive Advantage at Starbucks"Document10 pagesTugas Manajemen Stratejik "Competitive Advantage at Starbucks"Baiq Deria Ayuning FatikaNo ratings yet

- Cost of Capital NotesDocument6 pagesCost of Capital NotesAmy100% (1)

- Unit Four Tactical Decision MakingDocument21 pagesUnit Four Tactical Decision MakingDzukanji SimfukweNo ratings yet

- Answer To The Question No: 4.17: Summary InputDocument1 pageAnswer To The Question No: 4.17: Summary Inputtjarnob13No ratings yet

- Agricultural Economics Thesis PDFDocument8 pagesAgricultural Economics Thesis PDFbsr3rf42100% (2)

- Review Questions - OVWL 2023Document8 pagesReview Questions - OVWL 2023zitkonkuteNo ratings yet

- Muhammad Shamim Ahmed 30062016Document9 pagesMuhammad Shamim Ahmed 30062016MuhammadShamimAhmedNo ratings yet

- CBMEC 1 BSOA Lesson 1 Introduction To Production and Operations ManagementDocument7 pagesCBMEC 1 BSOA Lesson 1 Introduction To Production and Operations ManagementPeach DefsoulNo ratings yet

- 304 Ope Som-Mcq-2019Document7 pages304 Ope Som-Mcq-2019Prafull P KulkarniNo ratings yet

- Godrej Industries LimitedDocument17 pagesGodrej Industries LimitedsurajlalkushwahaNo ratings yet

- Maryam JabeenDocument47 pagesMaryam JabeenMaryam JabeenNo ratings yet

- Statemant HSBCDocument1 pageStatemant HSBCVera DedkovskaNo ratings yet

- Chapter 1 - DDocument26 pagesChapter 1 - DSujani MaarasingheNo ratings yet