Professional Documents

Culture Documents

17 18 Saleem

17 18 Saleem

Uploaded by

balaji xeroxCopyright:

Available Formats

You might also like

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKunda MalleshNo ratings yet

- Chapter 1 - Individuals and GovernmentDocument26 pagesChapter 1 - Individuals and Governmentwatts1100% (7)

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- 2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFDocument1 page2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFLEo GEnji KhunnuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- 2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - ItrvDocument1 page2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - Itrvdibyan dasNo ratings yet

- 2019-09-12 - XXXPB6273X - ItrvDocument1 page2019-09-12 - XXXPB6273X - ItrvDeb Kumar BhaumikNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formsriram tennetiNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- 2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFDocument1 page2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFVarun MgNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFDocument1 page2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSAI MOHANNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRahul KashyapNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- 2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFDocument1 page2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFpramodNo ratings yet

- Ack 18-19Document1 pageAck 18-19tax solutionsNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Itr VDocument1 pageItr VAbhishek Kumar GuptaNo ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- .Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVDocument1 page.Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVUday RayapudiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- 2018 09 22 18 57 49 873 - 1537622869873 - XXXPD8645X - Acknowledgement PDFDocument1 page2018 09 22 18 57 49 873 - 1537622869873 - XXXPD8645X - Acknowledgement PDFshouvik mitraNo ratings yet

- Itr-V Aghpy0583f 2013-14 741874350050813Document1 pageItr-V Aghpy0583f 2013-14 741874350050813Jatin YadavNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKushal MalhotraNo ratings yet

- Itr 18-19Document1 pageItr 18-19aarushi singhNo ratings yet

- 2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFDocument1 page2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFKunal PaulNo ratings yet

- CONCLUSIONDocument1 pageCONCLUSIONbalaji xeroxNo ratings yet

- 2 AbstractDocument3 pages2 Abstractbalaji xeroxNo ratings yet

- Remote Monitoring & Control of Industrial Parameters Using EWSDocument16 pagesRemote Monitoring & Control of Industrial Parameters Using EWSbalaji xeroxNo ratings yet

- Hotel Report 3Document17 pagesHotel Report 3balaji xeroxNo ratings yet

- Surg PGDocument1 pageSurg PGbalaji xeroxNo ratings yet

- Santoshi Patil Pattan 11Document60 pagesSantoshi Patil Pattan 11balaji xeroxNo ratings yet

- Pranay ReportDocument15 pagesPranay Reportbalaji xeroxNo ratings yet

- Report 11Document19 pagesReport 11balaji xeroxNo ratings yet

- Anil 2Document29 pagesAnil 2balaji xeroxNo ratings yet

- 20 July English TestDocument4 pages20 July English Testbalaji xeroxNo ratings yet

- Physiochemical Charecterization and Evaluation of PHDocument6 pagesPhysiochemical Charecterization and Evaluation of PHbalaji xeroxNo ratings yet

- Rahman Seminar 12Document17 pagesRahman Seminar 12balaji xeroxNo ratings yet

- H.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102Document22 pagesH.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102balaji xeroxNo ratings yet

- Buda Variation5-5-23Document48 pagesBuda Variation5-5-23balaji xeroxNo ratings yet

- A in Police Custody SaysDocument5 pagesA in Police Custody Saysbalaji xeroxNo ratings yet

- English 1st LessonDocument16 pagesEnglish 1st Lessonbalaji xeroxNo ratings yet

- Thesis Sewage Water TreatmentDocument31 pagesThesis Sewage Water Treatmentbalaji xeroxNo ratings yet

- English 2nd LessonDocument19 pagesEnglish 2nd Lessonbalaji xeroxNo ratings yet

- II Module EITDocument32 pagesII Module EITbalaji xeroxNo ratings yet

- English 2nd LessonDocument19 pagesEnglish 2nd Lessonbalaji xeroxNo ratings yet

- On The Insert TabDocument1 pageOn The Insert Tabbalaji xeroxNo ratings yet

- Presentation 1Document4 pagesPresentation 1balaji xeroxNo ratings yet

- English 1st LessonDocument16 pagesEnglish 1st Lessonbalaji xeroxNo ratings yet

- Document Traffic SignalDocument32 pagesDocument Traffic Signalbalaji xeroxNo ratings yet

- H.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102Document4 pagesH.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102balaji xeroxNo ratings yet

- Pampapathi Diposit Scheme of Suko BankDocument56 pagesPampapathi Diposit Scheme of Suko Bankbalaji xeroxNo ratings yet

- A Seminar On "Industrial Internship" BY Ashish Biradar (3PD20EPE02) Under The Guidance of Dr. M.S. AspalliDocument27 pagesA Seminar On "Industrial Internship" BY Ashish Biradar (3PD20EPE02) Under The Guidance of Dr. M.S. Aspallibalaji xeroxNo ratings yet

- Robot Garbage Collector Using Wireless CommunicationDocument15 pagesRobot Garbage Collector Using Wireless Communicationbalaji xeroxNo ratings yet

- "Tours and Travel Agency": Bachelor of Computer ApplicationsDocument4 pages"Tours and Travel Agency": Bachelor of Computer Applicationsbalaji xeroxNo ratings yet

- CSC TEC Exam Question Answer Key 2021Document17 pagesCSC TEC Exam Question Answer Key 2021balaji xerox100% (1)

- House No.D-9, Block N, North Nazimabad, Karachi Central North Nazimabad Town Imran Bashir CHDocument2 pagesHouse No.D-9, Block N, North Nazimabad, Karachi Central North Nazimabad Town Imran Bashir CHMIRZA AKHTAR ALINo ratings yet

- Foreign Tax Credit - Worked Example From IRASDocument1 pageForeign Tax Credit - Worked Example From IRASItorin DigitalNo ratings yet

- Pandemic DeadlinesDocument19 pagesPandemic DeadlinesChristine Joyce TaluaNo ratings yet

- Mgt111 Final Term Short NotesDocument44 pagesMgt111 Final Term Short NotesAb DulNo ratings yet

- DoccDocument1 pageDoccsonalikaNo ratings yet

- Direct Taxes in BangladeshDocument33 pagesDirect Taxes in Bangladeshaspire5572wxmi100% (6)

- Corporations - An: Kristie DewaldDocument38 pagesCorporations - An: Kristie DewaldJenniferNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument25 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxSonu KumarNo ratings yet

- Applied Maths ProjectDocument16 pagesApplied Maths ProjectLB ψNo ratings yet

- Bir FormsDocument25 pagesBir FormsAngel Mae ToreniadoNo ratings yet

- Application Economics of Public PolicyDocument13 pagesApplication Economics of Public Policyfilipa barbosaNo ratings yet

- Fiscal Policy - Wikipedia, The Free EncyclopediaDocument4 pagesFiscal Policy - Wikipedia, The Free EncyclopediaFiroz KhanNo ratings yet

- 2017 PWC-europe PDFDocument715 pages2017 PWC-europe PDFaammNo ratings yet

- Tutorial 1-Partnership-QuestionDocument2 pagesTutorial 1-Partnership-QuestionChan YingNo ratings yet

- Income Taxation Laws Principles and ApplDocument61 pagesIncome Taxation Laws Principles and ApplCherrie Arianne Fhaye NarajaNo ratings yet

- Resolution No. 11 BIRDocument2 pagesResolution No. 11 BIRAngelo FelicildaNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)DupanNo ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Corporate Financial Reporting: Income TaxDocument30 pagesCorporate Financial Reporting: Income TaxadeshlNo ratings yet

- Babulia Sales-8406Document1 pageBabulia Sales-8406NI KONo ratings yet

- TaxesDocument3 pagesTaxesMercy NamboNo ratings yet

- Tax Form-22.Document27 pagesTax Form-22.Masroor RasoolNo ratings yet

- P 63Document1 pageP 63penelopegerhardNo ratings yet

- Advanced Public Finance & Taxation: Ethiopian Civil Service University College of Finance, Management and DevelopmentDocument28 pagesAdvanced Public Finance & Taxation: Ethiopian Civil Service University College of Finance, Management and DevelopmentWagner Adugna100% (4)

- Paycheck 12.21 PDFDocument1 pagePaycheck 12.21 PDFJared RoseNo ratings yet

- MyGlamm Invoice 1682780534-39Document1 pageMyGlamm Invoice 1682780534-39Prince BaraiyaNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- Taxation. Textbook. Chapter 1 2 3Document88 pagesTaxation. Textbook. Chapter 1 2 3Phương Anh NguyễnNo ratings yet

17 18 Saleem

17 18 Saleem

Uploaded by

balaji xeroxOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

17 18 Saleem

17 18 Saleem

Uploaded by

balaji xeroxCopyright:

Available Formats

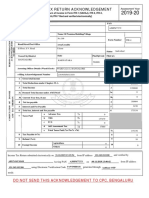

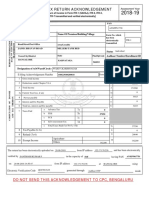

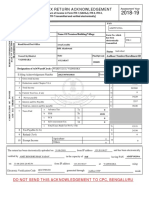

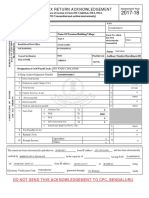

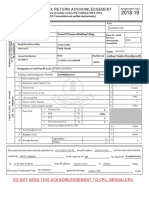

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2017-18

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

MOHAMMED SALIM

PERSONAL INFORMATION AND THE

CTQPS0681C

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-1

TRANSMISSION

PLOT NO.61 PATEL COLONY

electronically

transmitted

Road/Street/Post Office Area/Locality

MSK MILL RING ROAD GULBARGA Individual

Status

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

KALABURAGI

KARNATAKA 585103 XXXX XXXX 9282

Designation of AO (Ward / Circle) WARD 1& TPS, GULBARGA Original or Revised ORIGINAL

E-filing Acknowledgement Number 400141620170218 Date(DD-MM-YYYY) 17-02-2018

1 Gross Total Income 1 320437

2 Deductions under Chapter-VI-A 2 45526

3 Total Income 3 274910

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4

AND TAX THEREON

4 Net Tax Payable 0

5 Interest Payable 5 0

6 Total Tax and Interest Payable 6 0

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 2500

c TCS 7c 0

d Self Assessment Tax 7d 0

e Total Taxes Paid (7a+7b+7c +7d) 7e 2500

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 2500

10 Exempt Income Agriculture

10

Others 0 0

VERIFICATION

I, MOHAMMED SALIM son/ daughter of MIYASAB INAMDAR , holding Permanent Account Number CTQPS0681C

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2017-18. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 17-02-2018 Place KALABURAGI

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 117.222.96.69

Date

Seal and signature of CTQPS0681C01400141620170218F35F47F0A686B0AA10064F461B72E7E8DFA640A0

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address saleem.md14@gmail.com

You might also like

- TAX 1201 Answers Deductions From Gross IncomeDocument6 pagesTAX 1201 Answers Deductions From Gross IncomeCarlo Agravante100% (1)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKunda MalleshNo ratings yet

- Chapter 1 - Individuals and GovernmentDocument26 pagesChapter 1 - Individuals and Governmentwatts1100% (7)

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Itr-V Atipc3056f 2012-13 661170550180713Document1 pageItr-V Atipc3056f 2012-13 661170550180713Gst IndiaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageLingesh MaharajanNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- 2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFDocument1 page2018 12 18 14 20 55 960 - 1545123055960 - XXXPS8841X - Acknowledgement PDFLEo GEnji KhunnuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- 2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - ItrvDocument1 page2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - Itrvdibyan dasNo ratings yet

- 2019-09-12 - XXXPB6273X - ItrvDocument1 page2019-09-12 - XXXPB6273X - ItrvDeb Kumar BhaumikNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBibhu Datta SenapatiNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formsriram tennetiNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr 19-20 PDFDocument1 pageItr 19-20 PDFAnonymous fM5CtB8Qm7No ratings yet

- 2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFDocument1 page2018 08 31 08 56 38 421 - 1535685998421 - XXXPR9465X - Acknowledgement PDFVarun MgNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageBimal Kumar MaityNo ratings yet

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- Aman Jain Itr (A.y.2017-18)Document1 pageAman Jain Itr (A.y.2017-18)ramanNo ratings yet

- 2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFDocument1 page2019 12 20 11 04 21 881 - 1576820061881 - XXXPJ2291X - Acknowledgement PDFArjunJaiNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)shalabhNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageZa HidNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSAI MOHANNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageRahul KashyapNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- 2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFDocument1 page2019 07 22 21 53 18 209 - 1563812598209 - XXXPR7908X - Itrv PDFpramodNo ratings yet

- Ack 18-19Document1 pageAck 18-19tax solutionsNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Itr VDocument1 pageItr VAbhishek Kumar GuptaNo ratings yet

- 2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFDocument1 page2019 08 20 21 00 05 439 - 1566315005439 - XXXPB0009X - Acknowledgement PDFMurali KrishnaNo ratings yet

- .Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVDocument1 page.Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVUday RayapudiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDhanu goswamiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- 2018 09 22 18 57 49 873 - 1537622869873 - XXXPD8645X - Acknowledgement PDFDocument1 page2018 09 22 18 57 49 873 - 1537622869873 - XXXPD8645X - Acknowledgement PDFshouvik mitraNo ratings yet

- Itr-V Aghpy0583f 2013-14 741874350050813Document1 pageItr-V Aghpy0583f 2013-14 741874350050813Jatin YadavNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruKushal MalhotraNo ratings yet

- Itr 18-19Document1 pageItr 18-19aarushi singhNo ratings yet

- 2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFDocument1 page2019 11 01 21 37 31 963 - 1572624451963 - XXXPP7803X - Acknowledgement PDFKunal PaulNo ratings yet

- CONCLUSIONDocument1 pageCONCLUSIONbalaji xeroxNo ratings yet

- 2 AbstractDocument3 pages2 Abstractbalaji xeroxNo ratings yet

- Remote Monitoring & Control of Industrial Parameters Using EWSDocument16 pagesRemote Monitoring & Control of Industrial Parameters Using EWSbalaji xeroxNo ratings yet

- Hotel Report 3Document17 pagesHotel Report 3balaji xeroxNo ratings yet

- Surg PGDocument1 pageSurg PGbalaji xeroxNo ratings yet

- Santoshi Patil Pattan 11Document60 pagesSantoshi Patil Pattan 11balaji xeroxNo ratings yet

- Pranay ReportDocument15 pagesPranay Reportbalaji xeroxNo ratings yet

- Report 11Document19 pagesReport 11balaji xeroxNo ratings yet

- Anil 2Document29 pagesAnil 2balaji xeroxNo ratings yet

- 20 July English TestDocument4 pages20 July English Testbalaji xeroxNo ratings yet

- Physiochemical Charecterization and Evaluation of PHDocument6 pagesPhysiochemical Charecterization and Evaluation of PHbalaji xeroxNo ratings yet

- Rahman Seminar 12Document17 pagesRahman Seminar 12balaji xeroxNo ratings yet

- H.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102Document22 pagesH.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102balaji xeroxNo ratings yet

- Buda Variation5-5-23Document48 pagesBuda Variation5-5-23balaji xeroxNo ratings yet

- A in Police Custody SaysDocument5 pagesA in Police Custody Saysbalaji xeroxNo ratings yet

- English 1st LessonDocument16 pagesEnglish 1st Lessonbalaji xeroxNo ratings yet

- Thesis Sewage Water TreatmentDocument31 pagesThesis Sewage Water Treatmentbalaji xeroxNo ratings yet

- English 2nd LessonDocument19 pagesEnglish 2nd Lessonbalaji xeroxNo ratings yet

- II Module EITDocument32 pagesII Module EITbalaji xeroxNo ratings yet

- English 2nd LessonDocument19 pagesEnglish 2nd Lessonbalaji xeroxNo ratings yet

- On The Insert TabDocument1 pageOn The Insert Tabbalaji xeroxNo ratings yet

- Presentation 1Document4 pagesPresentation 1balaji xeroxNo ratings yet

- English 1st LessonDocument16 pagesEnglish 1st Lessonbalaji xeroxNo ratings yet

- Document Traffic SignalDocument32 pagesDocument Traffic Signalbalaji xeroxNo ratings yet

- H.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102Document4 pagesH.K.E Society's Poojya Doddappa Appa College of Engineering KALABURAGI - 585102balaji xeroxNo ratings yet

- Pampapathi Diposit Scheme of Suko BankDocument56 pagesPampapathi Diposit Scheme of Suko Bankbalaji xeroxNo ratings yet

- A Seminar On "Industrial Internship" BY Ashish Biradar (3PD20EPE02) Under The Guidance of Dr. M.S. AspalliDocument27 pagesA Seminar On "Industrial Internship" BY Ashish Biradar (3PD20EPE02) Under The Guidance of Dr. M.S. Aspallibalaji xeroxNo ratings yet

- Robot Garbage Collector Using Wireless CommunicationDocument15 pagesRobot Garbage Collector Using Wireless Communicationbalaji xeroxNo ratings yet

- "Tours and Travel Agency": Bachelor of Computer ApplicationsDocument4 pages"Tours and Travel Agency": Bachelor of Computer Applicationsbalaji xeroxNo ratings yet

- CSC TEC Exam Question Answer Key 2021Document17 pagesCSC TEC Exam Question Answer Key 2021balaji xerox100% (1)

- House No.D-9, Block N, North Nazimabad, Karachi Central North Nazimabad Town Imran Bashir CHDocument2 pagesHouse No.D-9, Block N, North Nazimabad, Karachi Central North Nazimabad Town Imran Bashir CHMIRZA AKHTAR ALINo ratings yet

- Foreign Tax Credit - Worked Example From IRASDocument1 pageForeign Tax Credit - Worked Example From IRASItorin DigitalNo ratings yet

- Pandemic DeadlinesDocument19 pagesPandemic DeadlinesChristine Joyce TaluaNo ratings yet

- Mgt111 Final Term Short NotesDocument44 pagesMgt111 Final Term Short NotesAb DulNo ratings yet

- DoccDocument1 pageDoccsonalikaNo ratings yet

- Direct Taxes in BangladeshDocument33 pagesDirect Taxes in Bangladeshaspire5572wxmi100% (6)

- Corporations - An: Kristie DewaldDocument38 pagesCorporations - An: Kristie DewaldJenniferNo ratings yet

- Chapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxDocument25 pagesChapter 1 MCQs On Income Tax Rates and Basic Concept of Income TaxSonu KumarNo ratings yet

- Applied Maths ProjectDocument16 pagesApplied Maths ProjectLB ψNo ratings yet

- Bir FormsDocument25 pagesBir FormsAngel Mae ToreniadoNo ratings yet

- Application Economics of Public PolicyDocument13 pagesApplication Economics of Public Policyfilipa barbosaNo ratings yet

- Fiscal Policy - Wikipedia, The Free EncyclopediaDocument4 pagesFiscal Policy - Wikipedia, The Free EncyclopediaFiroz KhanNo ratings yet

- 2017 PWC-europe PDFDocument715 pages2017 PWC-europe PDFaammNo ratings yet

- Tutorial 1-Partnership-QuestionDocument2 pagesTutorial 1-Partnership-QuestionChan YingNo ratings yet

- Income Taxation Laws Principles and ApplDocument61 pagesIncome Taxation Laws Principles and ApplCherrie Arianne Fhaye NarajaNo ratings yet

- Resolution No. 11 BIRDocument2 pagesResolution No. 11 BIRAngelo FelicildaNo ratings yet

- W-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)Document1 pageW-8BEN: Certificate of Foreign Status of Beneficial Owner For United States Tax Withholding and Reporting (Individuals)DupanNo ratings yet

- New Income Tax Return BIR Form 1700 - November 2011 RevisedDocument4 pagesNew Income Tax Return BIR Form 1700 - November 2011 RevisedBusinessTips.Ph100% (2)

- Corporate Financial Reporting: Income TaxDocument30 pagesCorporate Financial Reporting: Income TaxadeshlNo ratings yet

- Babulia Sales-8406Document1 pageBabulia Sales-8406NI KONo ratings yet

- TaxesDocument3 pagesTaxesMercy NamboNo ratings yet

- Tax Form-22.Document27 pagesTax Form-22.Masroor RasoolNo ratings yet

- P 63Document1 pageP 63penelopegerhardNo ratings yet

- Advanced Public Finance & Taxation: Ethiopian Civil Service University College of Finance, Management and DevelopmentDocument28 pagesAdvanced Public Finance & Taxation: Ethiopian Civil Service University College of Finance, Management and DevelopmentWagner Adugna100% (4)

- Paycheck 12.21 PDFDocument1 pagePaycheck 12.21 PDFJared RoseNo ratings yet

- MyGlamm Invoice 1682780534-39Document1 pageMyGlamm Invoice 1682780534-39Prince BaraiyaNo ratings yet

- B5952260 - Rahma Ali - Roble - P45 - 2324Document4 pagesB5952260 - Rahma Ali - Roble - P45 - 2324rahmaroble71No ratings yet

- Taxation. Textbook. Chapter 1 2 3Document88 pagesTaxation. Textbook. Chapter 1 2 3Phương Anh NguyễnNo ratings yet