Professional Documents

Culture Documents

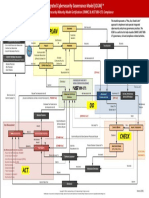

Akl - Mind Map - CH 15

Akl - Mind Map - CH 15

Uploaded by

chrystalia magdalenaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Akl - Mind Map - CH 15

Akl - Mind Map - CH 15

Uploaded by

chrystalia magdalenaCopyright:

Available Formats

- REPORTABLE SEGMENT REVENUE TO

- ENGAGES IN BUSINESS ACTIVITES CONSOLIDATED REVENUE

- OPERATING RESULTS ARE - REPORTABLE SEGMENT PROFIT & LOSS TO

KELOMPOK: REVIEWED BY CHIEF OPERATING CONSOLIDATED INCOME BEFORE TAXES

33209075 / CHRYSTALIA DECISION MAKER - REPORTABEL SEGMENT ASSETS TO

- DISCRETE FINANCIAL

A COMPONENT OF CONSOLIDAED ASSETS

36209009 / MERLYN LIESTIANI

INFORMATION IS AVAILABLE BUSINESS - IF OTHER SIGNIFICANT INFO IS DICLOSED, - PRODUCTS AND SERVICES

39209093 / STANLEY - GEOGRAPHIC INFORMATION

ENTERPRISE RECONSILE THE SEGMENT AMOUNTS WITH

CONSOLIDATED AMOUNTS FOR EACH ITEM - MAJOR CUSTOMERS

ADDITIONAL

- PRODUCTS AND SERVICES OPERATING - INVENTORY MARKET DECLINES NOT

- PRODUCTION PROCESSES DISCLOSURES REQUIRED TO BE RECORED IF THE

SEGMENT WITH SIMILAR SEGMENTS RECONCILIATION (EXPLAIN

- CLASSES AND CUSTOMERS DECLINE IS TEMPORARY

- DISTRIBUTION SYSTEM ECONOMIC CHARACTERISTIC BOUT DIFFERENCES AMOUNT) - VARIANCES UNDER A STANDARD

- REGULATORY ENVIRONMENT IF MAY BE COMBINED ACCOUNTING FOR COST SYSTEM THAT ARE EXPECTED TO

APPLICABLE INTERIM PERIODS BE ABSORBED BY YEAR END

ENTERPRISE WIDE

COMBINING ENTERPRISE WIDE

REPORTABLE DISCLOSURES

SEGMENTS DISCLOSURES PRODUCT COST

OPERATING

- COMBINED INCLUDES “ALL SEGMENTS MODIFICATIONS - ANNUAL EXPENSES MAY BE

OTHER” CATEGORY ALLOCATED, SUCH AS PROPERTY

- COMBINES REVENUE MAYBE > TAXES OR MAJOR ANNUAL REPAIRS

CONSOLIDATED REVENUE INTERIM - INCOME TAXES FROM CONTINUING

10% ASSET TEST

FINANCIAL OPERATIONS ARE USE AN ESTIMATED

CH 15 REPORTING EFFECTIVE ANNUAL TAX RATE

SEGMENT AND INTERIM OTHER INTERIM

10% PROFIT OR REPORTABLE THRESOLD TEST FINANCIAL REPORTING MODIFICATIONS

- THE COMBINED REPORTED LOSS TEST SEGMENTS

PROFIT OF ALL SEGMENTS

REPORTING PROFITS - BASIC AND DILUTED EPS

- THE ABSOLUTE VALUE OF THE - NET INCOME AND COMPERHENSIVE

COMBINED REPORTED LOOSES OF TEST FOR INCOME

10 % REVENUE INTERIM PERIODE INTERIM PERIODE

ALL SEGMENTS REPORTING ADDITIONAL - SALES OR GRASS REVENUES

LOOSES TEST INCOME TAXES DISCLOSURES - PROVISION FOR TAXES

SEGMENTS

SEGMENTS

DISCLOSURES SEC INTERIM

FINANCIAL

75% EXTERNAL - QUARTER 1, 2, 3, AND ANNUAL

- COMBINE INCLUDES “ALL OTHER” DISCLOSURE REPORTS

CATEGORY REVENUE TEST

REPORTABLE - QUARTERLY REQUIREMENTS SIMILAR

- USE THE SAME SEGMENTS IN TO ANNUAL

IDENTIFIABLE ASSETS SEGMENT - COMPARATIVE INFORMATION:*

- GENERAL CORPORATE ASSETS DISCLOSURES OTHER INTERIM

- COMBINE ASSETS OF SEGMENTS - EXCLUDE INTERSEGMENT

MAY BE LESS THAN TOTAL

DISCLOSURES

REVENUES

CORPORATE ASSETS - ADD OTHER SEGMENTS UNTIL

75% TEST IS MET *COMPARATIVE INFORMATION:

- SEGMENTS ARE TYPICALLY - SEGMENT INFORMATION 1. CURRENT QUARTER VS PRIOR YEAR

AGGREGATED DISCLOSURES ARE REDUCTED FOR QUARTER

- PROFIT OR LOSS

INTERIM REPORTING 2. QUARTERLY AND YTD FOR CURRENT

- TOTAL ASSETS

- CERTAIN INFORMATION ABOUT AND PRIOR YEAR

- REVENUE FROM EXTERNAL CUST

DEFINED BENEFIT PENSION PLANS

- INTEREST INCOME & EXPENSE

- INFORMATION ABOUT IMPAIRMENTS

- DEPR. & AMOR. EXPENSE

- INCOME TAX EXPENSE OR BENEFIT

You might also like

- Engineering Economy 9Th Edition Leland T Blank Full ChapterDocument67 pagesEngineering Economy 9Th Edition Leland T Blank Full Chaptereleanor.gamble412100% (10)

- X (Bss-Oss) BSS - Oss Portfolio Success Why ComarchDocument76 pagesX (Bss-Oss) BSS - Oss Portfolio Success Why Comarchzulhelmy photo100% (2)

- ComplianceForge Integrated Cybersecurity Governance ModelDocument1 pageComplianceForge Integrated Cybersecurity Governance ModelbsrpropNo ratings yet

- OB ProjectDocument38 pagesOB ProjectAli KumaylNo ratings yet

- Project RevisedDocument1 pageProject RevisedMD Ayub AlamNo ratings yet

- An Ram AnDocument27 pagesAn Ram Anapi-3705877No ratings yet

- Canva Banco-1Document1 pageCanva Banco-1Diego Flores YagaNo ratings yet

- Export ActivityDocument1 pageExport ActivityERIKA RUBI GONZALEZ HERNANDEZNo ratings yet

- PrivatizationDocument2 pagesPrivatizationAINNUR MYSARA ABDUL HALIMNo ratings yet

- Future Landscape and RoadmapDocument17 pagesFuture Landscape and RoadmapMARIA SELES TELES SOUSANo ratings yet

- Discover The Awesome Power of JD Edwards OrchestratorDocument38 pagesDiscover The Awesome Power of JD Edwards OrchestratorkcmkcmNo ratings yet

- Lean Self AssessmentDocument1 pageLean Self Assessmentmh70100% (1)

- CBM-SCM N Link of Import - ExportDocument15 pagesCBM-SCM N Link of Import - ExportAsfand375yar KhanNo ratings yet

- openSAP s4h23 All SlidesDocument106 pagesopenSAP s4h23 All SlidesRaman GuptaNo ratings yet

- Unit 1: Vision and Customer Value: Implementing SAP S/4HANA Cloud With SAP Central Business ConfigurationDocument8 pagesUnit 1: Vision and Customer Value: Implementing SAP S/4HANA Cloud With SAP Central Business ConfigurationMaheshkumar ChandeNo ratings yet

- Integrated Cybersecurity Governance Model - CMMC VersionDocument1 pageIntegrated Cybersecurity Governance Model - CMMC VersionwenapoNo ratings yet

- Two FlowsDocument2 pagesTwo FlowsfarooqjunaidNo ratings yet

- Financial Indicators (eSRE)Document2 pagesFinancial Indicators (eSRE)Florence ParcareyNo ratings yet

- Summary of Hydraulic Calculation: Area ProtectedDocument10 pagesSummary of Hydraulic Calculation: Area ProtectedsalesNo ratings yet

- Cfas 7Document1 pageCfas 7Kate Cyrene PerezNo ratings yet

- Employee Performance Appraisal Section A - Identifying Information Employee Name: Ernesto Ii P. Saldivar Job Title & DeptDocument4 pagesEmployee Performance Appraisal Section A - Identifying Information Employee Name: Ernesto Ii P. Saldivar Job Title & DeptAnn SaldivarNo ratings yet

- Management 2Document7 pagesManagement 2elena rossiNo ratings yet

- Concept MapDocument1 pageConcept Mapsharm mendezNo ratings yet

- General TakafulDocument86 pagesGeneral TakafulAbdulrahman SharifNo ratings yet

- Advisor FinTech Landscape July 03 2023Document1 pageAdvisor FinTech Landscape July 03 2023Willian SavioNo ratings yet

- National Income Rough TuesdayDocument6 pagesNational Income Rough TuesdayNavneet KaurNo ratings yet

- UEM Sustainability ReportDocument136 pagesUEM Sustainability ReportEncik LaLaNo ratings yet

- Setting Up of A Garment Industry: Submitted byDocument86 pagesSetting Up of A Garment Industry: Submitted bypriyalNo ratings yet

- PDF Microeconomics An Intuitive Approach With Calculus Thomas Nechyba Ebook Full ChapterDocument53 pagesPDF Microeconomics An Intuitive Approach With Calculus Thomas Nechyba Ebook Full Chapterrodney.mccown591100% (4)

- Transportation ZoneDocument1 pageTransportation ZonetarlesubbaNo ratings yet

- Problem-Solution-Finding-Matrix - JonDocument1 pageProblem-Solution-Finding-Matrix - JonLinorē Nonoy TaypinNo ratings yet

- Problem Solution Finding Matrix JonDocument1 pageProblem Solution Finding Matrix JonLinorē Nonoy TaypinNo ratings yet

- Supplier Data Sheet - FILLED UPDocument3 pagesSupplier Data Sheet - FILLED UPTech MarineasiaNo ratings yet

- Project Submission of Internal Atkt Oct 2022Document18 pagesProject Submission of Internal Atkt Oct 2022vinit tandelNo ratings yet

- EA3 LogisticDocument4 pagesEA3 LogisticAlba LopezNo ratings yet

- Explain The First Step Inside This RectangleDocument1 pageExplain The First Step Inside This RectangleClint Bryan VirayNo ratings yet

- Process From EBOM To SimulationDocument12 pagesProcess From EBOM To SimulationFajar SurasnoNo ratings yet

- Pulse ProfileDocument28 pagesPulse ProfileahmedNo ratings yet

- Bubble Diagram Draft 1Document1 pageBubble Diagram Draft 1Eric NjunuNo ratings yet

- Can You Account On It?Document1 pageCan You Account On It?Eryka FloresNo ratings yet

- ADSD-S Allocation Process Flowchart - Nov2010Document3 pagesADSD-S Allocation Process Flowchart - Nov2010enjoythedocsNo ratings yet

- Islamic InsuranceDocument14 pagesIslamic InsuranceMuhammad Salim Ullah Khan100% (1)

- Ude Desh Ka Aam Naagrik: Significance Key FeaturesDocument1 pageUde Desh Ka Aam Naagrik: Significance Key FeaturesRajat KalyaniaNo ratings yet

- Ricardo Vargas HumphreysDocument6 pagesRicardo Vargas HumphreysAnxo X. FerreirósNo ratings yet

- SIPOC - EjemploDocument1 pageSIPOC - EjemploHugo JuarezNo ratings yet

- Service Blueprint MOSDocument2 pagesService Blueprint MOSJITHA JOHNNY 22No ratings yet

- Engineering Asset Management: Company Vision & Mission, Management Requirement, and PoliciesDocument1 pageEngineering Asset Management: Company Vision & Mission, Management Requirement, and PoliciesesutjiadiNo ratings yet

- #Customer Need?: Beyond Technics, Ethic and Legitimacy, What Moral?Document3 pages#Customer Need?: Beyond Technics, Ethic and Legitimacy, What Moral?Sang VothanhNo ratings yet

- Acabar DTRDocument49 pagesAcabar DTRPRINCE CHRISTIAN B. RIMANDONo ratings yet

- COFFEEDAY 18062022215703 Discl Reg31 COFFEEDAY 18062022Document1 pageCOFFEEDAY 18062022215703 Discl Reg31 COFFEEDAY 18062022Swarup JadhavNo ratings yet

- CMDB Service Now ArchitectureDocument35 pagesCMDB Service Now ArchitectureSandipNo ratings yet

- SL 9 (Chart Book)Document60 pagesSL 9 (Chart Book)varuniNo ratings yet

- Chart Book (Edition 10)Document56 pagesChart Book (Edition 10)Yash RaiNo ratings yet

- SLCM Chart BookDocument62 pagesSLCM Chart BookNirvana Technicals100% (1)

- 544173924Document14 pages544173924JOHN NUÑEZ MARALITNo ratings yet

- Org Structure 12feb2024Document2 pagesOrg Structure 12feb2024Jonathan LarozaNo ratings yet

- Aspects Register-CA3913-Rev-2Document23 pagesAspects Register-CA3913-Rev-2Mohamed RizwanNo ratings yet

- NumbersDocument1 pageNumbersthecynicaleconomistNo ratings yet

- Struktur Organisasi PT Urip Gumulya: DirectorDocument1 pageStruktur Organisasi PT Urip Gumulya: DirectorKarinafNo ratings yet

- Doing Business 2016: Measuring Regulatory Quality and EfficiencyFrom EverandDoing Business 2016: Measuring Regulatory Quality and EfficiencyNo ratings yet

- Zuellig Pharma Corporation v. Alice SibalDocument2 pagesZuellig Pharma Corporation v. Alice SibalElaine Belle OgayonNo ratings yet

- 3 The Balance of Payments: Chapter ObjectivesDocument12 pages3 The Balance of Payments: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- SI2112 - Information System Control and Audit: O4 - Tools and Techniques Used in Auditing ITDocument39 pagesSI2112 - Information System Control and Audit: O4 - Tools and Techniques Used in Auditing ITCynthia Herlina LeonardoNo ratings yet

- Syllabus For Product Management Fundamentals Course DescriptionDocument3 pagesSyllabus For Product Management Fundamentals Course DescriptionArihant SuranaNo ratings yet

- Backend Team - PAN IndiaDocument6 pagesBackend Team - PAN IndiaDIVYANSHU SHEKHARNo ratings yet

- Medical Store Rs. 4.64 MillionDocument17 pagesMedical Store Rs. 4.64 MillionMohtashim SolankiNo ratings yet

- Akash Jha-Resume.Document3 pagesAkash Jha-Resume.Ravi JhaNo ratings yet

- Thesis Statement For Life InsuranceDocument8 pagesThesis Statement For Life Insurancednnsgccc100% (2)

- Market Research and AnalysisDocument6 pagesMarket Research and AnalysishasanulfiqryNo ratings yet

- Project Risk Management v0.3Document50 pagesProject Risk Management v0.3rishwaNo ratings yet

- F7 - C2 & C3A PPE & Borrowing Cost AnsDocument53 pagesF7 - C2 & C3A PPE & Borrowing Cost AnsK59 Vo Doan Hoang AnhNo ratings yet

- Aspect Layered Architecture Domain-Driven Design (DDD) Vertical Slice Architecture Clean ArchitectureDocument3 pagesAspect Layered Architecture Domain-Driven Design (DDD) Vertical Slice Architecture Clean ArchitectureLamiyə CəfərovaNo ratings yet

- A Study On Impact of Startup Ecosystem On Student Innovations Bhavin U. Pandya Krupa MehtaDocument10 pagesA Study On Impact of Startup Ecosystem On Student Innovations Bhavin U. Pandya Krupa MehtaDiwya Bharathi V I MBANo ratings yet

- Blue Ocean Stretegy AssignmentDocument4 pagesBlue Ocean Stretegy AssignmentMBA 8th Batch At MUSOMNo ratings yet

- Business Plan (Fish Farming)Document9 pagesBusiness Plan (Fish Farming)ceo solaNo ratings yet

- CV Jenny HillemannDocument1 pageCV Jenny HillemannzahidNo ratings yet

- FUSION - FS - Personnel Administration - E - HR1 - 004 - Custom object-IT0001 V1 0Document11 pagesFUSION - FS - Personnel Administration - E - HR1 - 004 - Custom object-IT0001 V1 0kavitasreeNo ratings yet

- BS Chennai 09-04-2024Document15 pagesBS Chennai 09-04-2024mjason1No ratings yet

- Customer SatisfactionDocument79 pagesCustomer SatisfactionNana DespiteNo ratings yet

- Gates 2GT Pulley 20TDocument1 pageGates 2GT Pulley 20TSofien SellamiNo ratings yet

- Depreciation Account (Motor Vehicle)Document2 pagesDepreciation Account (Motor Vehicle)BELLA CYNTHIA LESMANA WONGSONo ratings yet

- 1902 Learning Config WorkbookDocument331 pages1902 Learning Config WorkbookAravind AlavantharNo ratings yet

- 01 Task Performance 1 - SBADocument6 pages01 Task Performance 1 - SBAPrincess AletreNo ratings yet

- Evaluating A Company's External EnvironmentDocument47 pagesEvaluating A Company's External EnvironmentHong JunNo ratings yet

- Cuh 1001a 1.0 - 1 PDFDocument2 pagesCuh 1001a 1.0 - 1 PDFAnton DwiNo ratings yet

- Nonprofit VsDocument3 pagesNonprofit VsRoschelle MiguelNo ratings yet

- Vision: Innovative Assessment SystemDocument3 pagesVision: Innovative Assessment SystemSachin YadavNo ratings yet

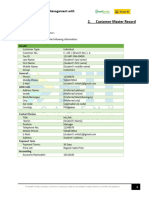

- Customer Master Record: Smartbooks Operations Management With Analytics Workbook Exercise 2.1Document8 pagesCustomer Master Record: Smartbooks Operations Management With Analytics Workbook Exercise 2.1jennicaashley.chua.engNo ratings yet