Professional Documents

Culture Documents

The Harmonization of Ifrs in Vietnam: The Theme of Land Accounting

The Harmonization of Ifrs in Vietnam: The Theme of Land Accounting

Uploaded by

Anh NguyenOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Harmonization of Ifrs in Vietnam: The Theme of Land Accounting

The Harmonization of Ifrs in Vietnam: The Theme of Land Accounting

Uploaded by

Anh NguyenCopyright:

Available Formats

STUDY EXCHANGE No.

03 (16) - 2022

THE HARMONIZATION OF IFRS IN VIETNAM:

THE THEME OF LAND ACCOUNTING

PhD. Nguyen Thi Hong Van*

Abstract: This paper re-considers the notion of “the harmonization of IFRS” as it has been applied to the

accounting standard harmonization project and its implications for accounting practices that are emerging

in Vietnam. There exist some challenges in the process in Vietnam, in terms of land accounting regulations.

In order to explore this, given the unique legal status of land in Vietnam, we consider how it is classified and

represented in Vietnamese financial reports. This example shows that there are still significant challenges

that need to be overcome in order to implement IFRS in Vietnam and there are still substantial comparability

problems for cross-border users.

• Keywords: IFRS; accounting; land ownership; Vietnam.

Date of receipt: 10th December, 2021 Date of receipt revision: 15th March, 2022

Date of delivery revision: 15th January, 2022 Date of approval: 30th March, 2022

with international practice. We believe that

Tóm tắt: Bài báo đề cập đến quá trình hội tụ theo accounting standards should be flexible enough

IFRS, một số cản trở trong quy định kế toán ở Việt to allow different reporting of these assets

Nam. Một trong những thách thức trong quá trình in different social contexts, yet recognized

áp dụng IFRS ở Việt Nam, đó là những quy định

and presented in the financial statements in a

pháp lý trong luật đất đai, kế toán đối với quyền sử

consistent principles to ensure comparability

dụng đất. Một số đề xuất để hạn chế những thách

thức và nhằm củng cố thông tin trên Báo cáo tài among enterprises in the world.

chính có tính so sánh giữa các quốc gia. From the perspective of corporate accounting,

• Từ khóa: IFRS, kế toán, quyền sử dụng đất, the research team proposes a number of contents

Việt Nam. related to the principle of recording and

presenting financial statement information for

land in Vietnam.

1. Introduction 2. Literature review

Based on the goal of the International Much of the literature that raises the

Financial Reporting Standard - IFRS, issue of harmonization is connected with the

regulations are issued to improve the usefulness, internationalisation of accounting standards.

comparability, and consistency of financial Many researchers supporting harmonisation

reporting information. To achieve those criteria, through international accounting standards

accountants are required to report one economic have referred to ‘accounting uniformity.

situation in different contexts in similar According to Zeff (2007) “there are those

manners. For financial statement information who believe, and many have believed this for

users, comparing the financial statements of a long time, that comparability is promoted,

Vietnamese companies presents a significant or assured, by all companies being required

challenge because of an important class of assets to use the same accounting methods, that is

of the company, land, which has a very different to say, ‘standardisation’ or ‘uniformity’ of

legal status from similar assets in accordance method”. Early researchers (see Wilkinson

* Academy of Finance; email: nguyenhongvan@hvtc.edu.vn

26 Journal of Finance & Accounting Research

No. 03 (16) - 2022 STUDY EXCHANGE

1965, Morgan 1967, Bromwich 1980, Fitzgerald The research shown above has been largely

1981, Dopunik 1987, Goeltz 1991, Wallace descriptive in arguing that international

1990, Schweikart et al. 1996) indicated a differences in reporting and disclosure has been

strong interest in the achievement of greater attributed to the different economic and political

levels of international harmonisation, with environment of each country and has consistently

the eventual goal of achieving uniformity in presented challenges to the globalisation of

accounting practice. Wilkinson (1965) even accounting standards. This prior research has

suggested that “each company presents only not actually provided evidence of the perceived

one set of accounts for all investors, of whatever costs or benefits of harmonisation by concrete

nationality”. Along with the accelerating trend cases or empirical analysis of real data. Further,

of convergence toward International Financial the major weakness of the existing literature, in

Reporting Standards (IFRS) since the late the context of this paper, is that they have not

1990s, one of the primary arguments for IFRS, explained specially the underlying assumption

on the ground of economic rationality, was to of how the definition would influence any

achieve a global accounting uniformity which studies on the topic of global harmonisation of

brought about an open and accountable world accounting standards.

(Lehman 2005). Saravanamuthu (2004) argued 3. Research Methodology

that “the IFRS projects an aura of objectivity by

This paper follows qualitative research.

transcribing complex local reality into universal

Short interviews were carried with 5 specialists

recognisable and acceptable information”.

in the Accounting and Auditing Supervisory

A major assumption of these arguments, as

Department, the results show the challenges of

indicated by the IASB (2008), is that accounting

Land- use rights accounting in terms of VAS and

uniformity leads to comparable financial

Vietnamese financial Regime. Futhermore, past

information across international boundaries.

literature and research findings are used to gather

On the other hand, many have questioned the information on a global perspective. Textbooks,

possibilities of a single regulatory framework journal articles and websites are also used for

that could meet the financial reporting needs collecting information.

of all societies. There have been considerable

Research questions:

counter-arguments that have focused on

environmental factors, such as difference in a. How current situations of accounting

culture (Violet 1983, Riahi- Belkaoui and Picur treatment for Land in Vietnam?

1991, Belkaoui 1983, Taylor-Zarzeski 1996), b. What are challenges for IFRS harmonisation

economic factors (Gray 1988, Chow and Wong in terms of Land- use rights accounting?

1987, Ampofo and Sellani 2005, Chand and

c. What are the solutions for Land- use rights

White 2007) and political systems (Luther 1996,

accounting to aim to IFRS harmonisation?

Chandler 1992, Ahadiat and Stewart 1992, Craig

and Diga 1996). Some of these studies have 4. Findings - Current status of Land

raised issues such as the impact of language; the accounting regulations

historical development of a nation; the different Currently, in Vietnam, there exist accounting

legal systems; the different nature of property treatments for Land-use rights as tables belows:

rights; the size, structure and complexity of the 4.1. Land-use rights is intangible fixed

economy within a nation; the education system; assets or prepaid expenses

the social stabilities; and differences in capital

markets – all of which present challenges to the

development of uniform accounting practices.

Journal of Finance & Accounting Research 27

STUDY EXCHANGE No. 03 (16) - 2022

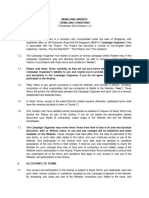

Topic VAS 04 IAS 38 Vietnamese financial Regime Remark

Initial Under Vietnamese law, According to Article 4.2d of Circular 45, In accordance with IFRS, land use

recognition entities and individuals Under IFRS, land use a land use right which is recognized as rights may be classified as finance

are not permitted to rights are considered to be intangible fixed assets comprise: lease or operating lease depending

own land but only land within the scope of IAS 17 + Those granted by the State for which on each circumstance.

use rights. Land use – Leases and are classified land use levy is collected; + In case of operating lease, land

rights are recognized as as finance or operating + Those acquired in a legitimate transfer; lease payment paid for future lease

intangible fixed assets lease as appropriate. + Land rights to use leased land obtained period will be recognized by lessees

or long-term prepaid before the effective date of Land Law in long-term prepaid expenses

expenses in accordance (2003) for which payments have been similarly as according to VAS;

with prevailing made in advance for more than 5 + In case of finance lease, lessees

regulations (VAS04.18). years and supported by land use right will recognize a finance lease asset.

certificate issued by competent authority.

+ Land use rights which are not

recognized as intangible fixed assets

comprise:

+ Land use rights granted by the State

without collecting land use levy.

+ Land lease payment paid one time for

the entire lease term (the land lease date

is after the

effective date of the Land Law 2003 and

therefore certificate of land use right is

not granted).

Subsequent x (VAS04.54) Maximum x (IAS38.88) An entity shall (Article 11.2) Land use rights is amortized x Requirements on range of useful

measurement - useful life of intangible assess whether the useful over the land lease period. Land use lives for intangible fixed assets

Amortisation fixed assets is 20 years. life of an intangible asset rights with indefinite useful life is not of Circular 45 are not consistent

is finite or indefinite and, amortized. with those of IAS 38. IFRS permits

x (VAS 04.57) In some if finite, the length of, or measurement of intangible assets

cases, the useful life of number of production or with indefinite useful life for which

intangible fixed assets similar units constituting, amortization is not required.

may exceed 20 years that useful life. An

upon reliable evidences intangible asset shall be x Similarly to tangible fixed assets,

but must be specified. regarded by the entity VAS permits reassessment of useful

In this case, the as having an indefinite life and amortization method on an

enterprises must: useful life when, based annually basis while under Circular

(a) Depreciate the on an analysis of all of the 45, method of amortization is

intangible fixed assets relevant factors, there is allowed to be changed only once

according to their most no foreseeable limit to during the use of assets.

accurately-estimated the period over which

useful life; and the asset is expected to

(b) Justify the reasons generate net cash inflows

for the estimation for the entity.

of the assets’ useful

life in the financial x (IAS38.107) Intangible

statements. assets with indefinite

useful life are not

x (VAS4.65) Useful amortized.

life and amortization

method must be x (IAS38.109) The events

reassessed at least at and circumstances relevant

the end of every fiscal to the classification of an

year. intangible asset as having

either a finite or indefinite

useful life may change

over time. A change in the

assessment of the useful

life from indefinite to

finite is accounted for as a

change in estimate under

IAS8.

28 Journal of Finance & Accounting Research

No. 03 (16) - 2022 STUDY EXCHANGE

4.2. Land-use rights is investment property

Topic VAS 04 IAS 38 Vietnamese financial Regime Remark

Definition (VAS05.5) Investment (IAS40.5) Investment According to Circular 16, for properties held as a x Under Vietnamese law,

property is property being property is property (land result of foreclose in accordance with Clause 3, entities and individuals

land-use rights or a or or building or part of Article 132 of the Law on Credit Institutions: are legally not allowed to

both, building - or part of building or both) held (by x For properties held for sales or transfer for own land but only land

a building - infrastructure the owner or by the lessee purpose of recovering capital within 3 years, the use rights. Therefore,

held by the owner or by under a finance lease) to credit institutions shall not record the increase in definition of investment

the lessee under a finance earn rental income or for assets and depreciation; property in VAS 05.5 is

lease to earn rentals or capital appreciation, or modified in accordance

for capital appreciation or both, rather than for use in x For properties acquired for use in normal course with this requirement.

both, rather than for use in the production or supply of business, the credit institution shall record the x With respect to the

the production or supply of goods or services or for increase in assets and depreciation them according provisions in Circular

of goods or services or for administrative purposes; or to prevailing regulations. The procurement of such 16, no recognition of

administrative purposes; or sale in the ordinary course assets must comply with the provision of in Clauses properties held as a

sale in the ordinary course of business. 3 and 4, Article 6 of Decree No.93/2017/ND-CP, in result of foreclose may

of business. which the net book value of those assets must not result in understating of

exceed 50% of the charter capital and reserve for enterprises’ assets in their

supplementary financial statements

x For properties acquired for use in normal course

of business, the credit institution shall record the

increase in assets and depreciation them according

to prevailing regulations.

The procurement of such assets must comply with

the provision of in Clauses 3 and 4, Article 6 of

Decree No.93/2017/ND-CP, in which the net book

value of those assets must not exceed 50% of the

charter capital and reserve for supplementary

charter capital.

The authors synthesized

4.3. Advantages and limitations of current regulations on accounting for land use rights in

enterprises

Advantages

The regulations on accounting for land use rights in enterprises have been standardized, creating

favorable conditions for enterprises to determine the value, record and present information on the financial

statements relatively fully.

Limitations

In addition to the above advantages, the regulations on accounting for land use rights at enterprises

also have some limitations that lead to the presentation of information that is not really useful in the

financial statements:

Firstly, for land use rights that are leased by an enterprise and the land rent is paid annually or once

without a land use right certificate but has an irrevocable land lease contract and the enterprise has the

right to control the benefits derived from that land, current Vietnamese accounting regulations do not

guide this type of land use right to be valued, recognized and presented in the financial statements as an

intangible asset, and only instructs that this one-time rental will be gradually amortized to expenses on

Account 242 - prepaid expenses.

Secondly, for land use rights that are intangible fixed assets, the valuation subsequent to initial

recognition follows historical cost model. There is neither guidance in recognition for impairment loss

nor recognition under revaluation model.

Thirdly, in case of the land use right that is assigned by the State to the enterprise without land use

levy, the historical cost of this type of land use right is being guided by Decree 151/2017 to be determined

according to the land price bracket of the People’s Committee of the province or city according to Article

Journal of Finance & Accounting Research 29

STUDY EXCHANGE No. 03 (16) - 2022

100, which is not very reasonable, because in many behalf. Thus, under such a system, property owners

cases the price based on the land price bracket of cannot have full and legal title to the land. Their

the People’s Committee of the province or city rights are limited to the land use rights permitted

does not truly reflect the market price. by law.

Fourthly, the current guidance on amortization Land users usually receive a land use right

of land use rights regarding the amortization certificate which shows the land user’s rights to

period and amortization method according to the property. There are different types of land use

Circular 45/2013/TT-BTC is for tax purpose only. rights, however it is important to note that under

Meanwhile, VAS 04 on intangible fixed assets current regulations people can have indefinite

and VAS 05 on investment properties do not have LURCs. An individual can rent a piece of land

clear instructions for the case of long-term land and pay the rent annually (known as an “annual

use rights without amortization. In this case, the arrangement”) or pay the entire rent in one payment

enterprise needs to test for impairment, and report (known as a “one-time arrangement”).

any impairment loss in the financial statements. More practically, the different legal status

Fifthly, there is a need for more complete of land ownership has a great influence on the

guidance for specific businesses that are assigned assumptions made about asset recognition.

land for preserve afforestation, or forestry According to land ownership law of Vietnam,

enterprises that are assigned land for afforestation the physical form of land cannot be recognized in

and do business on it, or enterprises that produce Vietnamese accounting standards, only land use

and trade in salt, agricultural enterprises that rights can be measured and reported as intangible

produce seeds…For these enterprises, the State assets. This rationale to a certain extent reinforces

neither collects land use fees nor issues land use our assumption that the economic nature of land

right certificate (LURC). Therefore, it is necessary use rights in Vietnam is similar to physical land in

to guide them on how to determine the value western countries. If they are formally different but

and reflect in the accounting books and financial are of the same “economic nature”, the different

statements about the land resources assigned by measurement and presentation in accounting will

the State to enterprises, thereby providing more make it difficult to achieve the “true comparability”

complete and transparent information about the in the current financial statements.

financial resources of the enterprises. Specifically, the difference is as follows: The

Sixthly, the current regulations on accounting IASB defines an asset as “a resource controlled by

have not yet guided enterprises to fully disclose the entity as a result of past events and from which

the land resources that the enterprise is entitled to future economic benefits are expected to flow into

manage and use to bring benefits to the enterprise the entity” (IASB, 2010). Land is measured as

in the financial statements. an asset in the financial statements of companies

5. Discussions when they have control over the land. However,

Vietnamese reporting entities do not control the

5.1. Completing the identification and

land but only hold land use rights. Companies do

recognition of land use rights

not report land in their financial statements but

According to international practice, land is as “land use rights”, which are often classified as

considered a tangible fixed asset while in Vietnam intangible assets in their Statements of financial

it is an intangible fixed asset because it is the right position.

to use. However, land is an asset with a specific

While the underlying economic nature of these

shape, so the classification according to Vietnam’s

two accounts in relation to companies’ businesses

regulations is not suitable with the nature of the

may not be so different, if we shift our focus to

property. On the other hand, a subleased land

the reported financial position and performance

is classified as investment property along with

the issue of comparing financial statements will

the premises on it as a tangible asset leading to

become clearer.

inconsistent classification of property as land in

Vietnam. Under IFRS, intangible assets must be

recognized at cost, just like PPE assets. However,

In Vietnam, land is collectively owned by the

unlike PPE assets, intangible assets cannot then

people and managed by the government on their

30 Journal of Finance & Accounting Research

No. 03 (16) - 2022 STUDY EXCHANGE

be measured to fair value or revalued unless considered as intangible assets at the enterprises.

there is an active market. By their very nature, Meanwhile, land use rights are allocated by the

most intangible assets have no active market State without land use levy, with leased land with

and therefore will not be subject to revaluation one-off rental payment for the entire lease period

(Kimmel et al. 2006). Using the cost model, (land lease period after the effective date of the

after initial recognition, intangible assets are 2003 Land Law and the land use right certificate

recognized at cost less accumulated amortization is not granted), the land rent shall be gradually

and accumulated impairment loss. As mentioned, amortized into business expenses according to

land use rights in Vietnam have a limited term of the number of years of land lease, and shall not be

use. An entity must systematically value an asset recorded as an intangible asset. Thus, all cases of

based on its useful life, resulting in a depreciation prepayment of land rent after the effective date of

expense in the profit or loss account for each the 2003 Land Law must be recorded as prepaid

period. expenses, regardless of whether there is a land

In summary, in order to make the information use right certificate or not. If the land is leased

on the financial statements of the enterprise with annual rental payment, the land rental shall

be comparably informative, the accounting be accounted into business expenses in the period

regulations should consider the recognition of land corresponding to the annual land rental payment.

in the form of land use rights so as to clearly show However, in our opinion, in the case of leasing

the nature of the current transactions related to the land use rights, it is advisable to consider recording

land use rights. and presenting information in accordance with

In our opinion, from the point of view of regulations on leased properties. Meanwhile, land

accounting, relevant accounting standards use rights assigned by the State with land use levy

should clarify and provide specific conditions for or legally transferred are recorded as intangible

determining land use rights or distinguishing land assets. Specifically, enterprises need to consider

use rights from long-term leased land. It cannot the following contents related to land use rights

be implied that land use rights are subject to the eligible for intangible assets:

provisions of other legal documents (land law).

Initial recognition at cost:

In Vietnam, land acquisition is essentially like a

lease, i.e. Vietnamese companies lease land for 50 The historical cost of a fixed asset as a land

years from the State. However, it is not completely use right is determined to be the entire amount

the same as a lease because Vietnamese companies spent to acquire the lawful land use right plus

divide land into two parts: (1) physical land (not (+) expenses for compensation for site clearance,

recorded in accounting); (2) and intangible land leveling, and registration fees (excluding expenses

use rights, but they only recognize the intangible for construction of works on land); or the value of

part of land use rights. The physical part is off the land use rights received as capital contribution.

balance sheet. To make the financial statements Valuation subsequent to initial recognition:

comparable, a consistent treatment of the financial Enterprises choose one of two models:

position and performance is made based on the

+ Cost model:

underlying economic nature of the transaction.

Carrying amount (land use rights)= Initial

5.2. Completing accounting for assigned land

cost - Accumulated amortization – Accumulated

use rights as intangible assets

impairment loss of land use rights (if any)

Regarding the legal status of land use rights,

with (1) land use rights assigned by the State with + Revaluation model:

land use levy or legally transferred and (2) leased Carrying amount (land use rights)= Revaluation

land use rights existing before the effective date of amount of land use rights – Subsequent accumulated

the 2003 Land Law, enterprises have been granted amortization - Accumulated impairment loss of

land use right certificates by competent authorities land use rights (if any)

and have paid land rent for the entire lease period However, using the revaluation model of land-

or for many years, of which the remaining lease use rights assets requires an active market for the

period is at least five years. The above cases are asset.

Journal of Finance & Accounting Research 31

STUDY EXCHANGE No. 03 (16) - 2022

Amortization of land use right assets: government representative the right to use the land

+ If the land use right has a finite useful life: for the lease term (for example, 49 years or 50 years)

calculate amortization and at the same time creates a lease obligation that

+ If the land use right has an indefinite useful represents an obligation to pay annual land rent

life: excluding depreciation, periodically test for for the lease period in the statement of financial

impairment of the asset. position.

5.3. Completing state-leased land use rights The transaction costs to purchase the land will

continue to be capitalized and amortized over the

According to the provisions of Clause 8, Article useful life as the first factor, but will be restored

3 of the 2013 Land Law, the State leases land use at the end of the land use term if the use right is

rights (hereinafter referred to as the State leases renewed with the same entity or individual. In

land) means the State’s decision to grant land use short, the combination of transaction costs and the

rights to the subjects who wish to use the land present value of the annual land rent for the lease

through the lease of land use rights. term will represent the amount capitalized for the

Currently, the law stipulates two cases when land and amortized accordingly.

the State leases land, including: At the lease commencement, the lessee must

- Land rental with one-time payment; recognize in the statement of financial position the

- Land rental with annual payment. land use rights and the obligation to pay the rent.

This was allowed under previous lease The lessee is required to recognize the following

accounting standards with operating leases. items in the comprehensive income statement,

However, under the new accounting treatment except to the extent that other accounting standards

of IFRS 16, finance leases and operating leases require or permit this item to be included in the

should be treated equally, at least, when it comes cost of the asset:

to capitalization of payments to the government for (a) interest expense on the rental obligation

the use of land. The IASB’s IFRS Interpretation (b) amortization on land use rights

Committee found that there are characteristics of a (c) any change in rental payment liability due

lease based on the definition of a lease, that is, “A to a revaluation of the expected rent or expected

lease is an agreement whereby the lessor transfers payments under the term option and the residual

to the lessee an amount or a series of payments value in relation to current or previous period.

for the right to use an asset for an agreed period”

is satisfied. The characteristics identified in this (d) any impairment in the value of land use

standard include: rights.

Property use right: land use right is the right to Initial recognition

use property. At lease commencement, the lessee must

The existence of lessor and lessee: government, identify:

identified as lessor and subject as lessee. (a) The lease liability is initially measured at

One-time or multi-time payment: the payment the present value of the lease payments payable

for the purchase of rights is made directly from over the lease term, discounted at the rate implicit

the organization or individual that is assigned in the lease if that can be readily determined. If

land and pays the annual land rent to the State for that rate cannot be readily determined, the lessee

continued use. shall use their incremental borrowing rate.

Agreement period: there is an agreement (b) the land use right equivalent to the rental

between the State and the entity on the time, liability, plus any initial direct costs incurred by

including the extension plans. the lessee.

Given this analysis, it is therefore correct Valuation subsequent to initial recognition

that the annual land payments include land rent After lease commencement, the lessee must

and therefore should be capitalized under IFRS identify:

16 by creating a new depreciable lease that (a) Liability to pay rent at the amortized price

is characterized by annual land rent paid to a according to the effective interest method

32 Journal of Finance & Accounting Research

No. 03 (16) - 2022 STUDY EXCHANGE

(b) Land use right according to the amortized Circular No. 147/2016/TT-BTC amending some articles of Circular 45;

VAS 03 - Tangible Fixed Assets; IAS 16 - Property, Plant and Equipment;

price VAS 04 - Intangible Fixed Assets; IAS 38 - Intangible Assets; VAS 05 - Investment

Amortization of lease land use rights Property; IAS 40 - Investment Property; IFRS 16 - Leases

Ahadiat, N. & Stewart, B. R. 1992, ‘International geographic segment

The lessee calculates the amortization of the reporting standards, a case for the harmonization of accounting and reporting

land use rights according to the amortized value, practices’, The International Journal of Accounting, Vol. 27, No. 1, pp. 45-56.

Ampofo, A. A. & Sellani, R. J. 2005, ‘Examining the differences between

the lessee must choose a method of analysis and United States generally accepted accounting principles and international

consider the amortization period according to IAS accounting standards: implications for the harmonization of accounting

standards’, Accounting Forum, Vol. 29, No. 2, pp. 219-31.

38. Belkaoui, A. 1983, ‘Economic, political and civil indicators and reporting

Impairment test for land use right: and disclosure adequacy: empirical investigation’, Journal of Accounting and

Public Policy, Vol. 2, No. 3, pp. 207-219.

The lessee must apply the impairment test for Bromwich, M. 1980, ‘The possibility of partial accounting standards’, The

the land use right at each end of the reporting Accounting Review, Vol. 50, No. 2, pp. 288-300.

Chand, P. & White, M. 2007, ‘A critique of the in uence of globalization

period to determine if it is impaired and recognize and convergence of accounting standards in Fiji’, Critical Perspectives on

any impairment loss in accordance with IAS 36. Accounting, Vol. 18, No. 5, pp. 605-622.

Chandler, R. A. 1992, ‘The international harmonization of accounting: in

Disclosure on financial statements: search of in uence’, The International Journal of Accounting, Vol. 27, No. 2, pp.

The lessee must disclose the following items in 222-233.

Chow, C. W. & Wong, B. 1987, ‘Voluntary nancial disclosure by Mexican

the statement of financial position: corporations’, The Accounting Review, Vol. 62, No. 3, pp. 533-541.

(a) lease liabilities, separately from other Craig, R. J. & Diga, J. G. 1996, ‘Financial reporting regulation in ASEAN:

Features and prospects’, The International Journal of Accounting, Vol. 31, No.

financial liabilities; 2, pp. 239-259.

(b) land use rights as if they were assets Dopunik, T. S. 1987, ‘Evidence of international harmonization of nancial

reporting’, The International Journal of Accounting, Vol. 23, No. 1, pp. 12- 27.

The lessee must disclose amortization on Fitzgerald, R. D. 1981, ‘International harmonization of accounting and

the land use rights and interest expense on lease reporting’, The International Journal of Accounting, Vol. 17, No. 1, pp. 21- 32.

Goeltz, R. K. 1991, ‘International accounting harmonization: the impossible

liabilities separately from other amortization and (and uncessary?) dream’, Accounting Horizons, Vol. 5, No. 1, pp. 85-88.

interest expenses, either profit or loss. Gray, S. J. 1988, ‘Towards a theory of cultural in uence on the development

of accounting systems internationally’, Abacus, Vol. 24, No. 1, pp. 1-15.

The lessee must classify cash payments for Kimmel, P., Carlon, S., Loftus, J., Mladenovic, R., Kieso, D. E. & Weygandt,

leases as financing activities in the statement of J. J. 2006, Accounting building business skills, John Wiley & Sons Australia, Ltd,

cash flows and present them separately from other Sydney and Melbourne.

Lehman, G. 2005, ‘A critical perspective on the harmonisation of accounting

financing cash flows. in a globalizing world’, Critical Perspectives on Accounting, Vol. 16, No. 7, pp.

Conclusion 975-92.

Luther, R. G. 1996, ‘The development of accounting regulation in the

The problem of current IFRS harmonisation is extractive industries, an international review’, The International Journal of

Accounting, Vol. 31, No. 1, pp. 67-93.

that we try to create an appearance of “uniformity” Morgan, R. A. 1967, ‘The multinational enterprise and its accounting needs’,

and the appearance of “comparability”. Many The International Journal of Accounting, Vol. 3, No. 1, pp. 21-28.

financial numbers look alike in the accounts, Riahi-Belkaoui, A. & Picur, R. D. 1991, ‘Cultural determinism and the 74

perception of accounting concepts’, The International Journal of Accounting,

but in fact, they may be subject to substantially Vol. 26, No. 1, pp. 118-130.

different treatment. If we are satisfied with the Saravanamuthu, K. 2004, ‘What is measured counts: harmonized corporate

current practices that are achieving comparability reporting and sustainable economic development’, Critical Perspectives on

Accounting, Vol. 15, No. 3, pp. 295-302.

by treating different transactions in different ways, Schweikart, J. A., Gray, S. J. & Salter, S. B. 1996, ‘An interview with Sir

we may be undermining our own objective by bryan Carsberg, Secretary-General of the International Accounting Standards

creating the illusion of similarity. As pointed out Committee’, Accounting Horizons, Vol. 10, No. 1, pp. 110-117.

Taylor-Zarzeski, M. 1996, ‘Spontaneous harmonization effects of culture and

above, there are many solutions to come with market forces on accounting disclosure practices’, Accounting Horizons, Vol. 10,

international convergence and comparability to No. 1, pp. 18-37.

be achieved. We might accept that we can work Violet, W. J. 1983, ‘The development of international accounting standards;

an anthropological perspective’, The International Journal of Accounting, Vol.

towards better comparability but that absolute 18, No. 2, pp. 1-12.

uniformity of reporting practice and disclosure Wallace, R. S. O. 1990, ‘Survival strategies of global organization: the case

of the international accounting standards committee’, Accounting Horizons, Vol.

may be beyond this globalisation effort. 4, No. 2, pp. 1-22.

Wilkinson, T. L. 1965, ‘United States accounting as viewed by accountants of

References: other countries’, The International Journal of Accounting, Vol. 1, No. 1, pp. 3-14.

https://assets.kpmg/content/dam/kpmg/vn/pdf/publication/2021/Investing- Zeff, S. A. 2007, ‘Some obstacles to global nancial reporting comparability

in-Vietnam-Mar2021.pdf and convergence at a high level of quality’, The British Accounting Review, Vol.

Circular No. 45/2013/TT-BTC providing guidance on management, use and 39, No. 4, pp. 290-302.

depreciation of fixed assets (“Circular 45”);

Journal of Finance & Accounting Research 33

You might also like

- Manual de Partes National JWS 340Document10 pagesManual de Partes National JWS 340nds2006sNo ratings yet

- Analysis of Financial Accounting Standards and Their Effects On Financial Reporting and Practices of Modern Business Organizations in Nigeria.Document9 pagesAnalysis of Financial Accounting Standards and Their Effects On Financial Reporting and Practices of Modern Business Organizations in Nigeria.Alexander DeckerNo ratings yet

- ch03 Test ACCT 512 Financial Accounting Theory and IssuesDocument12 pagesch03 Test ACCT 512 Financial Accounting Theory and IssuesSonny MaciasNo ratings yet

- Lessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and ValuationFrom EverandLessons in Corporate Finance: A Case Studies Approach to Financial Tools, Financial Policies, and ValuationNo ratings yet

- 2019 Huntsman General Oilfield Chemical Presentation July 2019Document48 pages2019 Huntsman General Oilfield Chemical Presentation July 2019Cyprien67% (3)

- A Critique of The Influence of Globalization and Convergence of Accounting Standards in FijiDocument18 pagesA Critique of The Influence of Globalization and Convergence of Accounting Standards in FijiGarima SinghNo ratings yet

- Chapter 2 As 10Document11 pagesChapter 2 As 10Nausheen MerchantNo ratings yet

- Convergence of Accounting Standards in The South Pacific Island NationsDocument22 pagesConvergence of Accounting Standards in The South Pacific Island NationsTrishNo ratings yet

- Perceptions of Accounting Professionals Towards International Financial Reporting Standards (IFRS) in Developing Country: Evidence From VietnamDocument22 pagesPerceptions of Accounting Professionals Towards International Financial Reporting Standards (IFRS) in Developing Country: Evidence From VietnamsaharaReporters headlinesNo ratings yet

- International Experiences With Accrual Budgeting in The Public SectorDocument11 pagesInternational Experiences With Accrual Budgeting in The Public SectorAcwin CethinkNo ratings yet

- IFRS Adoption and Capital Markets: Elkana K. KimeliDocument12 pagesIFRS Adoption and Capital Markets: Elkana K. KimeliUbaid DarNo ratings yet

- International Financial Reporting Standards (IFRS) Adoption in Vietnam: If, When and How?Document10 pagesInternational Financial Reporting Standards (IFRS) Adoption in Vietnam: If, When and How?Adi StănescuNo ratings yet

- Financial Reporting Harmonization - Measurement ModelsDocument6 pagesFinancial Reporting Harmonization - Measurement ModelsArnab BaruaNo ratings yet

- An Analysis of The Factors Affecting The Adoption of International Accounting Standards by Developing CountriesDocument14 pagesAn Analysis of The Factors Affecting The Adoption of International Accounting Standards by Developing CountriesPhương VũNo ratings yet

- HabteDocument5 pagesHabteAsfawosen DingamaNo ratings yet

- IfrsDocument11 pagesIfrsabduNo ratings yet

- Convergence and Foreign InvestmentsDocument26 pagesConvergence and Foreign InvestmentsFlorie-May Garcia100% (1)

- Does The IFRS Adoption Promote Emerging Stock Markets Development and PerformanceDocument24 pagesDoes The IFRS Adoption Promote Emerging Stock Markets Development and PerformanceMete EfeNo ratings yet

- (Ifrs) Adoption in VietnamDocument9 pages(Ifrs) Adoption in VietnamDexie Cabañelez ManahanNo ratings yet

- Percieved Challenges of International Financial Reporting Standards (Ifrs) Adoption in NigeriaDocument11 pagesPercieved Challenges of International Financial Reporting Standards (Ifrs) Adoption in NigeriasaharaReporters headlinesNo ratings yet

- The Impact of Company Size, Debt Contracts, and Type of Sector On The Level of Accounting Conservatism: An Empirical Study From BahrainDocument13 pagesThe Impact of Company Size, Debt Contracts, and Type of Sector On The Level of Accounting Conservatism: An Empirical Study From BahrainEmad Fayez GaidNo ratings yet

- 1550701770convergence of Int'l FRDocument5 pages1550701770convergence of Int'l FROluwadara Solomon TellaNo ratings yet

- A Study of Recent Accounting Trends in India's Corporate Sector With Special Reference To International Financial Reporting StandardsDocument9 pagesA Study of Recent Accounting Trends in India's Corporate Sector With Special Reference To International Financial Reporting StandardsManagement Journal for Advanced ResearchNo ratings yet

- Global Financial Reporting Convergence: A Study of The Adoption of International Financial Reporting Standards by The Swedish Accountancy ProfessionDocument21 pagesGlobal Financial Reporting Convergence: A Study of The Adoption of International Financial Reporting Standards by The Swedish Accountancy Professionihda0farhatun0nisakNo ratings yet

- Need For Harmonization of International Accounting StandardsDocument4 pagesNeed For Harmonization of International Accounting StandardsEditor IJTSRDNo ratings yet

- If Rs Exploring Financial Evidence From Listed Companies in The UsDocument27 pagesIf Rs Exploring Financial Evidence From Listed Companies in The UsMariam AlraeesiNo ratings yet

- Kaminski 2011 Diff IASB FASB CFDocument12 pagesKaminski 2011 Diff IASB FASB CFAmy TsmNo ratings yet

- Benefits of and Obstacles To Global Convergence of Accounting StandardsDocument6 pagesBenefits of and Obstacles To Global Convergence of Accounting StandardsAtia IbnatNo ratings yet

- Proses Penyusunan Standar - Group 3 (KU A)Document6 pagesProses Penyusunan Standar - Group 3 (KU A)mutia rasyaNo ratings yet

- Ifrs Compliance and Audit Quality in Developing Countries: The Case of Income Tax Accounting in EgyptDocument20 pagesIfrs Compliance and Audit Quality in Developing Countries: The Case of Income Tax Accounting in EgyptRavinesh PrasadNo ratings yet

- Topic 3 International Convergence of Financial Reporting 2022Document17 pagesTopic 3 International Convergence of Financial Reporting 2022Nguyễn Minh ĐứcNo ratings yet

- OECONOMICA The IASB and FASB Convergence PDFDocument23 pagesOECONOMICA The IASB and FASB Convergence PDFmansoor mahmoodNo ratings yet

- Globalization of Financial Reporting ObsDocument17 pagesGlobalization of Financial Reporting ObsAduot MaditNo ratings yet

- Superior Accounting Report-Rabanal Vargas Joseluis EnriqueDocument8 pagesSuperior Accounting Report-Rabanal Vargas Joseluis EnriquejoseluisrabanalvargasNo ratings yet

- Perceptions Towards International Financial Reporting Standards (IFRS) : The Case of VietnamDocument21 pagesPerceptions Towards International Financial Reporting Standards (IFRS) : The Case of VietnamsaharaReporters headlinesNo ratings yet

- Earning MGTDocument27 pagesEarning MGTanubhaNo ratings yet

- Lectures 7, 8, 9Document6 pagesLectures 7, 8, 9Natalia MatuNo ratings yet

- Financial SystemsDocument27 pagesFinancial SystemsKudakwashe mahachiNo ratings yet

- Financial Accounting Theory and Reporting Practices (BKAF5053)Document13 pagesFinancial Accounting Theory and Reporting Practices (BKAF5053)hajiagwaggo100% (2)

- SSRN Id4356970Document13 pagesSSRN Id4356970Rohit RanaNo ratings yet

- Requirements For Reaching Accounting Harmonization: Research ArticleDocument8 pagesRequirements For Reaching Accounting Harmonization: Research Article*iNo ratings yet

- AS Dita - IfRS As A Guide To Overcome Challenges in International AccountingDocument9 pagesAS Dita - IfRS As A Guide To Overcome Challenges in International AccountingYor AdeNo ratings yet

- CH 11solutionsDocument8 pagesCH 11solutionsVincent Oluoch Odhiambo67% (3)

- E - Content On IFRSDocument20 pagesE - Content On IFRSPranit Satyavan NaikNo ratings yet

- Perceptions of Accounting Professionals Towards IFRS in Developing Country: Evidence From VietnamDocument22 pagesPerceptions of Accounting Professionals Towards IFRS in Developing Country: Evidence From VietnamHong-Duc PhanNo ratings yet

- The Impact of The IAS/IFRS Adoption On The Predictive Quality of Discretionary Accruals: A Comparison Between The French and The British ContextDocument24 pagesThe Impact of The IAS/IFRS Adoption On The Predictive Quality of Discretionary Accruals: A Comparison Between The French and The British ContextAhmadi AliNo ratings yet

- (Sent) Pelaporan Keuangan - Kelompok 7Document40 pages(Sent) Pelaporan Keuangan - Kelompok 7Jofinka SalsabillaNo ratings yet

- The Impact of IFRS AdoptionDocument27 pagesThe Impact of IFRS AdoptionMichelle100% (1)

- Convergence of Accounting Standards: Internationalization of AccountingDocument7 pagesConvergence of Accounting Standards: Internationalization of AccountingAnonymous 0AwqQH1vwNo ratings yet

- Chapter-Five International Accounting (IA) : Rift Valley University, Department of AccountingDocument9 pagesChapter-Five International Accounting (IA) : Rift Valley University, Department of AccountingtemedebereNo ratings yet

- International AccountingDocument4 pagesInternational AccountingCristina Andreea MNo ratings yet

- Business Ethics and Corporate GovernanceDocument6 pagesBusiness Ethics and Corporate GovernanceNaina MehraNo ratings yet

- Chapter 2. Harmonisation of Accounting Regulation and PracticeDocument3 pagesChapter 2. Harmonisation of Accounting Regulation and PracticeSasha KingNo ratings yet

- Gaire Ganesh - Bahadur s0251931Document16 pagesGaire Ganesh - Bahadur s0251931ganyNo ratings yet

- ACFI317 - IFRS Convergence Issues-5Document9 pagesACFI317 - IFRS Convergence Issues-5Matt financeNo ratings yet

- ACSA JournalDocument96 pagesACSA JournalACSA AdminNo ratings yet

- Synthesis - IFRSDocument37 pagesSynthesis - IFRSRoseJeanAbingosaPernito0% (1)

- The Use of Fair Value in IFRSDocument19 pagesThe Use of Fair Value in IFRSahadiano200No ratings yet

- Commercial Dispute Resolution in China: An Annual Review and Preview 2021From EverandCommercial Dispute Resolution in China: An Annual Review and Preview 2021No ratings yet

- Tax Policy and the Economy, Volume 34From EverandTax Policy and the Economy, Volume 34Robert A. MoffittNo ratings yet

- Strengthening Fiscal Decentralization in Nepal’s Transition to FederalismFrom EverandStrengthening Fiscal Decentralization in Nepal’s Transition to FederalismNo ratings yet

- Central Asia and The Caucasus, 2009, Issue 2Document140 pagesCentral Asia and The Caucasus, 2009, Issue 2serik_giNo ratings yet

- Annual Report and Accounts 2020Document382 pagesAnnual Report and Accounts 2020EvgeniyNo ratings yet

- Question BankDocument70 pagesQuestion Bankmohanraokp2279No ratings yet

- Ga State BAR HandbookDocument192 pagesGa State BAR HandbookJohn StarkeyNo ratings yet

- R V Hinks House of Lords 26th October 2006Document25 pagesR V Hinks House of Lords 26th October 2006Eric TittoNo ratings yet

- Offer LetterDocument1 pageOffer Letterahmadkahan5272No ratings yet

- 7th Delhi Leislative Assembly: AC NO. Constituency Candidate S.Sh./Smt./Ms. Address Number Email ID Party NameDocument4 pages7th Delhi Leislative Assembly: AC NO. Constituency Candidate S.Sh./Smt./Ms. Address Number Email ID Party NameRahul Jaat100% (1)

- Criminal Law CasesDocument8 pagesCriminal Law CasesArmstrong BosantogNo ratings yet

- Ticket Delhi To JaipurDocument2 pagesTicket Delhi To JaipurK.r. SolankiNo ratings yet

- 14 VariationDocument12 pages14 VariationWork OfficeNo ratings yet

- End Term Time Table UG PG 1st Year JUNE 2023 EXAMDocument12 pagesEnd Term Time Table UG PG 1st Year JUNE 2023 EXAMkanakvani39No ratings yet

- CS Form No. 212 Personal Data Sheet RevisedDocument4 pagesCS Form No. 212 Personal Data Sheet RevisedMarc GelacioNo ratings yet

- 2023 Ivy League Admissions StatisticsDocument19 pages2023 Ivy League Admissions StatisticspalanitNo ratings yet

- MilnesR DirectorsMemo10Document36 pagesMilnesR DirectorsMemo10Mariem AzzabiNo ratings yet

- Chapter 1 - Nature and Scope of NGASDocument26 pagesChapter 1 - Nature and Scope of NGASJapsNo ratings yet

- DailyNews 13-02-2024Document20 pagesDailyNews 13-02-2024menuralakvindu200411No ratings yet

- Lectut HSS 02 PPT Nisbet Impact of IR & FR - e05O80QDocument17 pagesLectut HSS 02 PPT Nisbet Impact of IR & FR - e05O80QjimgogreatNo ratings yet

- Les Miserables Outline SummaryDocument6 pagesLes Miserables Outline SummaryJohn Clark BermudezNo ratings yet

- Consumer Protection CouncilDocument2 pagesConsumer Protection Councilsadia hashamNo ratings yet

- Sample Leave of Absence LetterDocument1 pageSample Leave of Absence LettermahendranNo ratings yet

- Lecture 2 Nature of Cyber CrimeDocument17 pagesLecture 2 Nature of Cyber CrimemansiNo ratings yet

- The 4 Principles - MIAWDocument13 pagesThe 4 Principles - MIAWfariskhosa69No ratings yet

- United States vs. Del Rosario, 2 Phil., 127, April 15, 1903Document2 pagesUnited States vs. Del Rosario, 2 Phil., 127, April 15, 1903Campbell HezekiahNo ratings yet

- Appoinment of TANOD RESOLUTION AGAAS 2023Document2 pagesAppoinment of TANOD RESOLUTION AGAAS 2023Romnick RefugiaNo ratings yet

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Deed of Sale - Ludivina Baluyut - BlankDocument2 pagesDeed of Sale - Ludivina Baluyut - Blankroyrichard1228No ratings yet

- Terms AirdropDocument19 pagesTerms Airdropaj4642825No ratings yet

- Rule: Motor Vehicle Safety Standards: Occupant Crash Protection— Tire Pressure Monitoring Systems Controls and DisplaysDocument57 pagesRule: Motor Vehicle Safety Standards: Occupant Crash Protection— Tire Pressure Monitoring Systems Controls and DisplaysJustia.comNo ratings yet