Professional Documents

Culture Documents

Financial Accounting 2B Tutorials - 013048

Financial Accounting 2B Tutorials - 013048

Uploaded by

Pinias ShefikaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting 2B Tutorials - 013048

Financial Accounting 2B Tutorials - 013048

Uploaded by

Pinias ShefikaCopyright:

Available Formats

MyNotes@2021

Consolidation books

FINANCIAL ACCOUBNTING 2B

5.1 INTRAGROUP TRANSACTIONS

Three types of intragroup sales

• Sales of inventories

• Sales of non-depreciable property

• Sales of depreciable property, plant and equipment

Intragroup balances

5.2 Elimination of intragroup balances

IFRS 10.B86(c) all intragroup assets, liabilities, equity, income and expenses

relating to transactions between entities of the group must be eliminated

on consolidation

Intragroup loans

Let say the parent offers a loan to the subsidiary

(DR) Loan from parent (S)(SFP) xxx

(CR) Loan to subsidiary (P)(SFP) xxx

Elimination of intragroup balances

Interest on loan to subsidiary

(DR) Interest income (P)(P/L) xxx

(CR) Interest expenses (S)(P/L) xxx

Elimination of intragroup interest (100,000x8%x12/12)

other transaction incurred between entities

(DR) Other income xxx

(CR) other expenses xxx

Elimination of intragroup rent

5.4 Bank overdrafts guarantees

On consolidation, the bank overdraft of one entity in the group should only

be set off against the favorable bank balance of another entity in the

group, if both entities have their accounts at the same bank and when all

of the following three conditions have been met:

PINIAS LUKIIKO HAMATA SHEFIKA i

MyNotes@2021

• lf both entities have bank accounts at the same financial institution;

• lf the bank itself would set off the two accounts against each other

in terms of an agreement between the two entities concerned and

the bank; and

• lf the group has the intention to settle the amounts on a net basis.

It is clear that the set off of bank accounts within a group does not

constitute intragroup transactions and requires special treatment.

THE DIRECT METHOD OF PREPARINT CONSOLIDATED FINANCIAL STATEMENTS

5.5 The direct method

The following are the abridged statements of financial position, statements

of profit or loss and other comprehensive income and statements of

changes in equity of P Ltd and the partially-owned subsidiary, S Ltd:

STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER 20.8

P LTD S LTD

ASSETS

PPE 80 000 150 000

Investment in S Ltd: 64 000 shares at fair value 120 000 -

(cost price: 90 000)

Investment in S ltd: Loan 50 000 -

Inventories 65 000 55 000

Trade receivables 55 000 35 000

Bank 30 000 -

Total assets 400 000 240 000

Equity and Liabilities

Share capital (100 000/80 000 shares) 100 000 80 000

Retained earnings 125 000 90 000

Mark to market reserve 30 000 -

Long-term borrowings 75 000 -

Loan from P ltd - 50 000

Trade and other payables 70 000 10 000

Bank overdraft - 10 000

Total equipment and liabilities 400 000 240 000

EXTRACT FROM THE STATEMENT OF PROFIT OR LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE YEAR ENDED 31 DECEMBER 20.8

P Ltd S Ltd

Profit 90 000 100 000

Dividends received from S Ltd 32 000 -

Profit before tax 122 000 100 000

Income Tax (36 000) (30 000)

Profit for the year 86 000 70 000

PINIAS LUKIIKO HAMATA SHEFIKA ii

MyNotes@2021

Other comprehensive income for the year

Items that cannot reclassified to profit or loss

Mark to market reserve 5 000 -

Comprehensive income for the year 5 000 -

Total comprehensive income 91 000 70 000

EXTRACT FROM THE STATEMENT OF CHANGES IN EQUITY FOR THE YEAR

ENDED 31 DECEMBER 20.8

Mark to Retained earnings

market

reserve

P Ltd P Ltd S Ltd

Balance as at 1 Janualy 20.8 25 000 75 000 60 000

Change in equity for 20.8

Total comprehensive income for

the year

Profit for the year - 86 000 70 000

Other comprehensive income 5 000 - -

Dividents - (36 000) (40 000)

Balance at 31 December 20.8 30 000 125 000 90 000

On the 1 January 20.5, the date on which P Ltd acquired interest in S Ltd,

the equity of S Ltd was as follows:

Share capital…………………………………….N$80 000

Retained earnings……………………………..N$45 000

P ltd elect to measure the non-controlling interest in an acquiree at their

proportionate share of the acquiree’s identifiable net assets at acquisition

date.

P Ltd Classified equity in S Ltd under ifrs 9, and recognise fair value

adjustment in a mark-to-market reserve.

Ignore tax implications.

SOLUTION

ANALYSIS OF OWNER’S EQUITY OF S LTD

TOTAL P LTD 80% NCI,20%

AT SINCE

AT ACQUISITION (2/01/20.8)

Share capital 80 000 64 000 16 000

PINIAS LUKIIKO HAMATA SHEFIKA iii

MyNotes@2021

Retained earnings 45 000 36 000 9 000

125 000 100 000 25 000

Gain from a bargain purchase (10 000) (10 000) -

Consideration plus NCI 115 000 90 000 25 000

ii) since acquisition

To begging of current year:

Retained earnings (60000- 15 000 12 000 3 000

45000) 28 000

Current year:

Profit for the year, and 70 000 56 000 14 000

Dividend (40 000) (32 000) (8 000)

160 000 36 000 34 000

debit credit

J1 Mark to market reserve-beg. Of year (P)(SCE) 25 000

Mark to market reserve (P)(OCI) 5 000

Investment in S (P)(SFP) 30 000

Reversal of fair value adjustment

J2 Loan from P Ltd (S)(SFP) 50 000

Investment in S Ltd:Loan (P)(SFP) 50 000

Elimination of intragroup loan

J3 Share capital (S)(SCE) 80 000

Retained earnings (S)(SCE) 45 000

Bargain purchase(SCE) 10 000

Investment in S Ltd (P)(SFP) 90 000

Non-controlling interest (SFP) 25 000

Elimination of owner’s equity at acquisition

J4 Retained earnings-Begg. Of the year (S)(SCE) 3000

Non-controling interest 3000

Recognition of non-controlling interest’s portion of

retained earning since acquisition to the beg. Of

current year.

J5 Non controling interest (P/L) 14 000

Non controlling interest (SFP) 14 000

Recognition of non-controlling interest in profit for

the year

J6 Divident received (P)(P/L) 32 000

Non controlling interest (SFP) 8 000

Dividend paid (S)(SCE) 40 000

Eliminating intragroup dividend and recognition of

non-controlling interests in the dividend.

PINIAS LUKIIKO HAMATA SHEFIKA iv

MyNotes@2021

PINIAS LUKIIKO HAMATA SHEFIKA v

MyNotes@2021

INTRAGROUP TRANSACTIONS

A group is regarded as one single entity, one cannot trade with oneself!!!

5.6 Intragroup sales of trading inventories and other assets

1. one reason for combine is synergies within the group

unrealised profits from intragroup transaction should be eliminated

first

Trading inventories

5.7 Unrealised profit in closing inventory

Revenue (seller)(P/L) 100 000

Cost of sales (Buyer)(P/L) 100 000

Elimination of intragroup sales

Cost of sales (SellER)(P/L) 10 000

Inventories (BUYER)(SFP) 10 000

Elimination of unrealised profit in closing

Inventories.

EXAMPLE 5.2 (CONSOLIDATION.PDF)

PINIAS LUKIIKO HAMATA SHEFIKA vi

MyNotes@2021

UNREALISED PROFIT ON OPENING INVENTORIES

EXAMPLE 5.3 (CONSOLIDATION.PDF)

Let’s assume that S ltd purchase all its inventory from P ltd at cost plus

33.1/3%. The inventories on hand in the records of S ltd were as follows:

31 december 20.7………………N$20 000

31 December 20.8………………N$25 000

Total sales of inventories from P Ltd to S Ltd were as follows:

20.7………………..N$50 000

20.8………………..N$80 000

Tax ignored!

Solutions

31/12/2017

(DR) Revenue (P)(P/L) 50,000

(CR) Cost of sales (S)(P/L) 50,000

Elimination of group sales

(DR) CoGS (P)(P/L) 5,000

(CR) Inventories (S)(SFP) 5,000

Elimination of unrealised profit in closing

Inventories of S Ltd.

31/12/2018

(DR) Retained earnings- beginning of the year (P)(SCE)….5,000

(CR) COGS (P)(P/L)………………………………………………………5,000

Retained earnings adjustments

DR. revenue (P)(P/L)………………………………………………...80,000

CR. Cost of Goods Sold (S)(P/L)……………………………………..80,000

Elimination of group sales

DR. Cost of goods sold (P)(P/l)…………………………………..6,250

CR. Inventories (S)(SFP)…………………………………………………6,250

PINIAS LUKIIKO HAMATA SHEFIKA vii

MyNotes@2021

Elimination of unrealised profit.

5.9 intragroup profit in inventories at acquisition date

Not part and parcel of the group.

5.10 losses on intragroup inventories

Added back to the value of inventory, unless NRV fall lower.

5.11 Inventories written down to NRV

As per the prescription of IAS 2 inventories should be valued at the lower of

and net realisable value. What need to be done in the case the carrying

amount of assets held for need to be written down to net realisable value

▪ if the amount to be wriiten down to NRV is equal or more than the

amount of unrealised profit contained in group selling price of closing

inventory, then the carrying amount is less than or equal the cost

price of inventory (excluding profit). No further adjustment.

▪ If the write-down to net realisable value is less than intragroup

unrealised profit, the difference between the NRV and Cost price

(Exclusive of markup) be eliminated.

Explanatory example

The subsidiary sells inventory to the parent at cost plus 25%. The closin

inventory in the records of the parent at 30 September 2021 are N$125,000.

On the same date the parent write down its inventory to a NRV equivalent

of N$99,999.99. ignore tax.

DR. Cost of sales (loss on inventory write

down/impairement)………….N$25,000

CR. Inventories (SFP)……………………………………………………………….N$25,000

Inventory write down to net realisable value in terms of IAS2.

HERE THE NRV OF N$25,000.01 IS GREATER THAN THE UNREALISED PROFIT OF

N$25,000. NO PRO FORMA JOURNAL WILL BE APPROPRIATE.

if we assume that the parent does write down inventory to NRV in their

book, and it is now apparent that the NRV is N$95,000, we have to

eliminate unrealised profit first and then write down to NRV.

DR. cost of sales (S)(P/L)…………………………………N$ 25,000

PINIAS LUKIIKO HAMATA SHEFIKA viii

MyNotes@2021

CR. Inventories (P)(SFP)…………………………………………..N$25,000

Elimination of unrealised profit included in closing inventories

AND

DR. Cost of sale……………………………………………N$5,000

CR. Inventories (P)(P/L)…………………………………………..N$5,000

Inventory write down to NRV as per IAS2

5.12 Unrealised profit elimination and allocation of income tax

5.13 Allocation of tax and elimination of unrealised profit included in

closing inventories.

Example 5.5

S Ltd sold inventories for the first time to to its parent, P Ltd during

the reporting period ended 28 February 20.8, at a profit markup of

25% on cost price. On 28 february 20.8 inventories to the amount of

N$100,000 were still at hand. The company’s tax rate is 28%. Total

sales for the period was N$200,000.

Journal 1

Revenue (S)(P/L)…………………………………200,000

Cost of sales (P)(P/L)…………………………………..200,000

Elimination of intraroup sales

Journal 2

Cost of sales (S)(P/L)……………………………20,000

Inventories (P)(SoFP)…………………………………20,000

Elimination of unrealised profit on closing inventory

Journal 3

Deffered tax (S)(SoFP)…………………………..5,600

Income tax expenses……………………………….5,600

Recognition of deffered tax in unrealised profit

Elimination of income tax and elimination of unrealised profit in

opening and closing inventory.

In addition to example 5.5, lets assume at 28 february 20.9 the closing

inventory of P Ltd is N$150,000, acquired at the same cost plus

markup as of 20.8.

Sales for the period is N$300,000. Again assume a company tax rate of

28%.

PINIAS LUKIIKO HAMATA SHEFIKA ix

MyNotes@2021

SOLUTION

Assume FIFO cost formula was applicable.

Journal 1

DR. Retained earnings- beginning of the year…………….14,400

DR. Deffered tax (S)(SFP)…………………………………….5,600

CR. Cost of sales…………………………………………………..20,000

Retained earnings adjustment

Journal 2

Dr. income tax expenses (S)(P/L)…………………………….5,600

CR. Deffered tax (S)(SoFP)………………………………………..5,600

Tax implication on realisation of unrealised profit on opening

inventory

Journal 3

Revenue (S)(P/L)……………………………………………………300,000

Cost of good sold (P)(P/L)………………………………………………..300,000

Elimination of intragroup sales

Journal 4

Cost of goods sold (S)(P/L)…………………………………………30,000

Inventories (P)(SoFP)…………………………………………………….30,000

Elimination of unrealised profit on closing inventories

Journal 5

Dr. deffered tax (S)(SoFP)…………………………………..8,400

Cr. Income tax expenses (S)(P/L)……………………………...8,400

Adjustment of deffered tax on 30,000 unrealised profit @28%

Allocation of income tax in respect of fair value adjustments on

financial asset at fair value through OCI.

On 2 January 20.17 P Ltd acquired an 80% interest in S Ltd at R8 000.

P Ltd classifies the investment in terms of IFRS 9 in its separate

financial statements and recognises fair value adjustments in a

mark-to-market reserve (other comprehensive income). On 31

December 20.17 the fair value of the investment in S Ltd was R9 500.

On 31 December 20.18 the fair value of the investment in S Ltd was

R10 000. Assume a company tax rate of 28% and that 66,6% of the

capital gain is subject to capital gains tax.

DR CR

Mark to market reserve -begg. Of year

(P)(SCE) 1 220

(1500x(100-28%x66.66%) 280

Deffered tax (P)(SoFP) (1500x66.66%x28%) 1 500

Investment in S Ltd (P)(SoFP) (9,500-8000)

PINIAS LUKIIKO HAMATA SHEFIKA x

MyNotes@2021

Reversal of fair value adjustment on

investment in S ltd at beginning of reporting 500

period. 500

Mark to market reserve (P)(OCI) (10,000-9,500)

Investment in S Ltd (P)(SoFP) 93

Revesal of fair value adjustment during the 93

year

Deffered tax (P)(SoFP) (500x66.66%x28%)

Income tax expenses (P)(OCI)

Deffered tax effect on reversed fair value

adjustment

Property, plant and equipment held by entities in the group 5.15 Disclosure of

the carrying amount of property, plant and equipment in the consolidated

statement of financial position.

5.16 Property, plant and equipment acquired from other entities in the group

~ depreciable assets

~non deprewciable assets

Intragroup gain on non-depreciable PPE

Should any entity within the group sell asset to another at a gain, the full

intragroup gain should be eliminated as long as the asset is held in the

group.

This gain will be realised when the asset is sold to outside entities. Non

depreciable assets gain are subject to capital gain tax implications but not

income tax implication

P Ltd sold a property (which initially cost N$100,000) to S Ltd, a wholly-

owned subsidiary for N$150,000 on 2 January 20.7. S Ltd sold the property

at N$250,000 on 30 June 20.8 to a third party. P ltd’s financial year runs

January to December.

31 december 20.7

DR. Other Income (P)(P/L) 50,000

CR. PPE (S)(SoFP) 50,000

PINIAS LUKIIKO HAMATA SHEFIKA xi

MyNotes@2021

Elimination of unrealised intragroup gain included on PPE of S LTD

31 December 20.8

DR. retained earnings- Beginning of the year (P)(SCE)

50,000

CR. PPE (S)(SoFP)

50,000

Adjusting retained earnings at the beginning of the year to be in

agreement with consolidated retained earnings at 31 Dec 20.7

5.18 Intragroup gain on depreciable PPE.

Example 5.10: sale of PPE to a partially owned subsidiary

At 31 december 20.8, the end of the reporting period, P Ltd holds an interest

of 80% in S Ltd. On 2 January 20.18, P Ltd sold certain equipment which

originally cost R10 000 to S Ltd for R15 000. S Ltd recognises depreciation

on this equipment on a straight-line basis at a rate of 20% per annum.

<<SOLUTIONS>>

Elimination of intragroup gain

Other Income (Gain on Sale of Equipment)(P)(P/L) 5,000

Equipment (S)(SoFP) 5,000

Elimination of intragroup gain on Equipment to S Ltd

THIS GAIN IS REALISED THROUGH DEPRECIATION WHEN THE DEPLETED

PORTION OF FUTURE ECONOMIC BENEFIT IS TO BE WRITTEN OF!!!

DR. Accumulated depreciation (S)(SoFP) 1,000

CR. Depreciation (other expenses)(P)(P/L) 1,000

Recognition of the portion of unrealised intragroup gain realised

by depreciation

ADJUSTMENT OF RETAINED EARNINGS AT THE BEGINNING OF THE YEAR

DR. Retained earning-beginning of the year (P)(SCE) 4,000

DR. Accumulated depreciation (S)(SoFP) 1,000

PINIAS LUKIIKO HAMATA SHEFIKA xii

MyNotes@2021

CR. Equipment (S)(SoFP) 5,000

Adjusting retained earnings at the beginning of the year

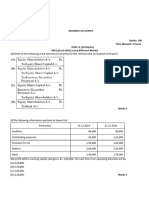

EXAMPLE 5.13: ALLOCATION OF INCOME TAX AND INTRAGROUP TRANSACTIONS

P Ltd acquired a 70% interest in S Ltd on 1 January 20.15 for R24 500, when

the retained earnings of the latter amounted to R25 000. P Ltd was of the

opinion that the assets of S Ltd were shown at fair values at this date. The

following are the abridged financial statements of the two entities at 31

December 20.18:

PINIAS LUKIIKO HAMATA SHEFIKA xiii

MyNotes@2021

S Ltd, a manufacturer of plants, sold a plant with a manufacturing cost of

R6 000 to P Ltd for R10 000 on 1 January 20.17. P Ltd recognises

depreciation on the plant on the straight-line basis at a rate of 20% per

annum.

P Ltd sells trading inventories to S Ltd at a profit mark-up of 25% on cost.

The following figures relate to these intragroup inventories transactions:

Intragroup inventories included in the inventories of S Ltd (also inventories

in the records of P Ltd):

At 1 January 20.18 N$6,000

At 31 December 20.18 N$5,000

Sales of inventories by P Ltd to S Ltd during 20.18 amounted to R10 000. l

It may be assumed that the inventories on hand at 1 January 20.18 were

sold during 20.7.

Assume a company tax rate of 28% and that 66,6% of a capital gain is

subject to capital gains tax. .

P Ltd classified the equity investment in S Ltd under IFRS 9 in its separate

financial statements and recognised fair value adjustments in a mark-to-

market reserve (other comprehensive income).

P Ltd elected to measure any non-controlling interests in an acquiree as its

proportional share of the acquiree’s identifiable net assets at acquisition

date. Assume that the identifiable assets acquired and the liabilities

assumed at acquisition date are shown at their acquisition-date fair

values, as determined in terms of IFRS 3.

Required: Prepare the extract from the consolidated books of P Ltd Group

for the year ended December 20.8.

Show your workings

PINIAS LUKIIKO HAMATA SHEFIKA xiv

MyNotes@2021

PRO-FORMA CONSOLIDATED JOURNALS

ANALYSIS OF OWNER’S EQUITY OF S LTD

P LTD 70% NCI

TOTAL AT SINCE 30%

At Acquisition (01/01/20.5

Share capital 10,000 7,000 3000

Retained Earnings 25,000 17,500 7500

PINIAS LUKIIKO HAMATA SHEFIKA xv

MyNotes@2021

35,000 24,500 10,500

Purchase difference - - -

Consideration and NCI 35,000 24 500 10,500

ii) Since acquisition

to beginning of current year-

retained earnings (10,000-2 304 (J4)) 7,696 5,388 2,308

current year: 12,808

Profit for the year ( 3,600+800(J5)- 4,176 2,923 1,253

224(J6)) 46,872 8,311 14,061

PINIAS LUKIIKO HAMATA SHEFIKA xvi

MyNotes@2021

PINIAS LUKIIKO HAMATA SHEFIKA xvii

MyNotes@2021

COMMENTS:

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

PINIAS LUKIIKO HAMATA SHEFIKA xviii

MyNotes@2021

_________________________________________________________________________

_________________________________________________________________________

_________________________________________________________________________

___________________________.

--------------------------END OF CHAPTER 5------------------------------

------------------------------------------

PINIAS LUKIIKO HAMATA SHEFIKA xix

You might also like

- ACCN 304 Revision QuestionsDocument11 pagesACCN 304 Revision Questionskelvinmunashenyamutumba100% (1)

- Dividend and BondsDocument3 pagesDividend and BondsJanuary Ann Bete100% (1)

- Teori Akuntansi Case 6.1Document9 pagesTeori Akuntansi Case 6.1Tessa Nurul QolbiNo ratings yet

- Dr. Adukia Valuation 09032018Document366 pagesDr. Adukia Valuation 09032018Venkat Deepak SarmaNo ratings yet

- Unit 1 - QuestionsDocument4 pagesUnit 1 - QuestionsMohanNo ratings yet

- Akuntansi Keuangan Lanjutan - Baker (10 E)Document1,086 pagesAkuntansi Keuangan Lanjutan - Baker (10 E)Nabila Nur IzzaNo ratings yet

- Learning Unit 5 Consolidation of A Partly Owned Subsidiary AfterDocument20 pagesLearning Unit 5 Consolidation of A Partly Owned Subsidiary AfterThulani NdlovuNo ratings yet

- Master Question (Foreign) SOFP SOCIDocument2 pagesMaster Question (Foreign) SOFP SOCIShaheryar ShahidNo ratings yet

- Chapter Four Problem P4-8 Part B Adjusted Without VoiceDocument13 pagesChapter Four Problem P4-8 Part B Adjusted Without Voicehassan nassereddineNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- Consolidation After Acquisition Date - Equity Analysis MethodDocument3 pagesConsolidation After Acquisition Date - Equity Analysis MethodPetrinaNo ratings yet

- Learning Unit 8 - Treatments of Dividends During ConsolidationDocument41 pagesLearning Unit 8 - Treatments of Dividends During ConsolidationThulani NdlovuNo ratings yet

- Consolidation 10Document5 pagesConsolidation 10Muhasina MuzyNo ratings yet

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- Advanced AccountingDocument10 pagesAdvanced AccountingLhyn Cantal CalicaNo ratings yet

- PRBA003 Week 10 Tutorialsolutions 10 EdDocument29 pagesPRBA003 Week 10 Tutorialsolutions 10 EdWang ChoiNo ratings yet

- Chapter 5 L5 Depreciable AssetsDocument46 pagesChapter 5 L5 Depreciable AssetsRemofilwe MannafelaNo ratings yet

- Financial Statement Analysis - AssignmentDocument6 pagesFinancial Statement Analysis - AssignmentJennifer JosephNo ratings yet

- Accounting 22 2016Document10 pagesAccounting 22 2016Thulani NdlovuNo ratings yet

- Bacc204-Financial Accounting Iii Assignment 1Document4 pagesBacc204-Financial Accounting Iii Assignment 1Tawanda Tatenda HerbertNo ratings yet

- Nature of Consolidated StatementsDocument8 pagesNature of Consolidated StatementsRoldan Arca PagaposNo ratings yet

- IAS 28 AssociatesDocument7 pagesIAS 28 AssociatesRumbidzai Mapanzure100% (1)

- I1.2-Financial Reporting QPDocument8 pagesI1.2-Financial Reporting QPConstantin NdahimanaNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- Chapter+3+Consolidation+at+aquisition+date+ PART+2Document16 pagesChapter+3+Consolidation+at+aquisition+date+ PART+2Christi ClarkNo ratings yet

- Ac208 2019 11Document6 pagesAc208 2019 11brian mgabi100% (1)

- Groups With AssociatesDocument5 pagesGroups With AssociatesTawanda Tatenda HerbertNo ratings yet

- ACC 401-2023 GA 2-EvenDocument3 pagesACC 401-2023 GA 2-EvenOhene Asare PogastyNo ratings yet

- Unit 5-Group Statements L Cons at Acquisition Date (2024)Document12 pagesUnit 5-Group Statements L Cons at Acquisition Date (2024)jamileethomNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- FRFSA Previous Year Questions 2020-2023Document29 pagesFRFSA Previous Year Questions 2020-2023Sibam BanikNo ratings yet

- Principles of Consolidated Financial Statements Test Your Understanding 1Document17 pagesPrinciples of Consolidated Financial Statements Test Your Understanding 1sandeep gyawaliNo ratings yet

- Question 6 Chic Homes LTD GroupDocument5 pagesQuestion 6 Chic Homes LTD GroupsavagewolfieNo ratings yet

- Learning Unit 9 Treatment of Preference Shares During ConsolidationDocument57 pagesLearning Unit 9 Treatment of Preference Shares During ConsolidationThulani NdlovuNo ratings yet

- 1c213fc3-9b8d-4f8f-b0d2-5c9cd38b9fb3Document3 pages1c213fc3-9b8d-4f8f-b0d2-5c9cd38b9fb3mtarawneh941No ratings yet

- Far210.statement of Cash FlowDocument8 pagesFar210.statement of Cash FlowElsie AnnNo ratings yet

- ABC and XYZ - QuestionDocument2 pagesABC and XYZ - QuestionMohammad El HajjNo ratings yet

- Revision Pack QuestionsDocument12 pagesRevision Pack QuestionsAmmaarah PatelNo ratings yet

- Cfas Ias 1 Presentation of FS For StudentsDocument15 pagesCfas Ias 1 Presentation of FS For StudentsFreya GeslaniNo ratings yet

- Preparation & Analysis of Cash Flow StatementsDocument27 pagesPreparation & Analysis of Cash Flow StatementsAniket PanchalNo ratings yet

- Accountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsDocument5 pagesAccountancy Review: Detailed Reconciliation of Opening and Closing Retained EarningsEricha MutiaNo ratings yet

- Corporate Reporting - ND2020 - Suggested - Answers - Review by SBDocument13 pagesCorporate Reporting - ND2020 - Suggested - Answers - Review by SBTamanna KinnoreNo ratings yet

- CU-2020_B._Com._(Honours)_Financial_Reporting_&_Financial_Statement_Semester-VI_Paper-DSE-6.1A_QPDocument4 pagesCU-2020_B._Com._(Honours)_Financial_Reporting_&_Financial_Statement_Semester-VI_Paper-DSE-6.1A_QPprs26621No ratings yet

- Advanced Accounting 2DDocument5 pagesAdvanced Accounting 2DHarusiNo ratings yet

- Sheldon LTD Group Comprehensive Worked ExampleDocument2 pagesSheldon LTD Group Comprehensive Worked Exampledea.shafa29No ratings yet

- Chapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsDocument45 pagesChapter 9 Intercompany Bond Holdings and Miscellaneous Topics-Consolidated Financial StatementsAchmad RizalNo ratings yet

- Ratio ExercisesDocument23 pagesRatio ExercisesPhumzile MpanzaNo ratings yet

- RATIO QuestionsDocument5 pagesRATIO QuestionsikkaNo ratings yet

- Acct320 LQ5V2Document4 pagesAcct320 LQ5V2laibaNo ratings yet

- Lesson 3. CONSOLIDATED FINANCIAL STATEMENTSDocument5 pagesLesson 3. CONSOLIDATED FINANCIAL STATEMENTSangelinelucastoquero548No ratings yet

- AFR 2 End of Semester Examination 2022-2023Document10 pagesAFR 2 End of Semester Examination 2022-2023Sebastian MlingwaNo ratings yet

- Big Company LimitedDocument6 pagesBig Company LimitedFariha MaharinNo ratings yet

- Revision QN On Ratio AnalysisDocument3 pagesRevision QN On Ratio Analysisamosoundo59No ratings yet

- BuscomDocument5 pagesBuscomdmangiginNo ratings yet

- Question 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireDocument5 pagesQuestion 3 - Financial-Reporting - Question 3 - Sankofa & KaakyireLaud ListowellNo ratings yet

- Coneptual Frameworks and Accounting Standards Probs and TheoriesDocument17 pagesConeptual Frameworks and Accounting Standards Probs and TheoriesIris MnemosyneNo ratings yet

- Exercise 2 Statement of Financial PositionDocument8 pagesExercise 2 Statement of Financial Positionjumawaymichaeljeffrey65No ratings yet

- Adv Level Corporate Reporting (CR)Document24 pagesAdv Level Corporate Reporting (CR)FarhadNo ratings yet

- d15 Hybrid F7 Q PDFDocument7 pagesd15 Hybrid F7 Q PDFBrew BubbyNo ratings yet

- Equity Method (First Year of Acquisition)Document3 pagesEquity Method (First Year of Acquisition)Angel Chane OstrazNo ratings yet

- Business Combination Accounted For Under The Equity MethodDocument4 pagesBusiness Combination Accounted For Under The Equity MethodMixx MineNo ratings yet

- Consolidation Q71Document5 pagesConsolidation Q71IbraheemsadeekNo ratings yet

- T1 Ias12Document1 pageT1 Ias12Pinias ShefikaNo ratings yet

- Financial Management TutorialsDocument25 pagesFinancial Management TutorialsPinias ShefikaNo ratings yet

- Aba3691 2015 07 SupDocument4 pagesAba3691 2015 07 SupPinias ShefikaNo ratings yet

- Cost of Capital ExercisesDocument5 pagesCost of Capital ExercisesPinias ShefikaNo ratings yet

- Valuations TutorialsDocument11 pagesValuations TutorialsPinias ShefikaNo ratings yet

- Aba3691 2015 06 NorDocument5 pagesAba3691 2015 06 NorPinias ShefikaNo ratings yet

- Aba3632 2012 01 SopDocument5 pagesAba3632 2012 01 SopPinias ShefikaNo ratings yet

- Ias 12 QDocument2 pagesIas 12 QPinias ShefikaNo ratings yet

- Cafe3752 2013 11 NorDocument7 pagesCafe3752 2013 11 NorPinias ShefikaNo ratings yet

- Intermediate Accounting Vol 2 Canadian 3Rd Edition Lo Fisher 0133865959 9780133865950 Solution Manual Full Chapter PDFDocument20 pagesIntermediate Accounting Vol 2 Canadian 3Rd Edition Lo Fisher 0133865959 9780133865950 Solution Manual Full Chapter PDFdaniel.walters996100% (20)

- 6th Sessiom - Audit of Investment STUDENTDocument17 pages6th Sessiom - Audit of Investment STUDENTNIMOTHI LASENo ratings yet

- PWC Guide To Accounting For Derivative Instruments and Hedging ActivitiesDocument594 pagesPWC Guide To Accounting For Derivative Instruments and Hedging Activitieshui7411100% (2)

- InventoriesDocument7 pagesInventoriesAl-Sinbad BercasioNo ratings yet

- NCAHFSDocument1 pageNCAHFSPatricia San PabloNo ratings yet

- EY Market Updates On The Impact of IFRS 17 and IFRS 9Document31 pagesEY Market Updates On The Impact of IFRS 17 and IFRS 9ZidnaQoulanTsaqilaNo ratings yet

- Chapter 2 - Basic Accounting ConceptsDocument32 pagesChapter 2 - Basic Accounting ConceptsNIK NUR ALISHA NABILA BT SHAARINo ratings yet

- Accounting For Receivables: Learning ObjectivesDocument63 pagesAccounting For Receivables: Learning ObjectivesBayaderNo ratings yet

- Test Bank For Advanced Accounting 12th EditionDocument36 pagesTest Bank For Advanced Accounting 12th Editionacetize.maleyl.hprj100% (54)

- VALIX - Chapter 6Document14 pagesVALIX - Chapter 6glenn langcuyanNo ratings yet

- W07 Teori-Akuntansi-7-Godfrey Asset VIDEO PDFDocument33 pagesW07 Teori-Akuntansi-7-Godfrey Asset VIDEO PDFRazafinandrasanaNo ratings yet

- IAS 16 Part 2 Revaluation of PPE IAS 16-1Document10 pagesIAS 16 Part 2 Revaluation of PPE IAS 16-1makhanyaNo ratings yet

- CH 17Document24 pagesCH 17Cs CsNo ratings yet

- Ifrs 16 LeasesDocument21 pagesIfrs 16 LeasesUmar Naseer100% (1)

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- WRD Finman 13e - Se PPT - CH 13Document27 pagesWRD Finman 13e - Se PPT - CH 13Bill JonNo ratings yet

- IFRS 16 - Sale and LeasebackDocument2 pagesIFRS 16 - Sale and LeasebackAireyNo ratings yet

- Investment in Associate SBEDocument1 pageInvestment in Associate SBEemman neriNo ratings yet

- Chapter 6 Cfas ReviewerDocument2 pagesChapter 6 Cfas ReviewerBabeEbab AndreiNo ratings yet

- Lilis-Wahidah The Disclosure of Sugar Cane Farmer Profit On Auction ProcessDocument7 pagesLilis-Wahidah The Disclosure of Sugar Cane Farmer Profit On Auction ProcessUlfaNo ratings yet

- IntAcc II Module Investment PropertyDocument9 pagesIntAcc II Module Investment PropertyPamela Ledesma SusonNo ratings yet

- 02 Doing Business in The Philippines 2007 PDFDocument37 pages02 Doing Business in The Philippines 2007 PDFJan Erl Angelo RosalNo ratings yet

- AFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFDocument156 pagesAFAR MCQ On BUSINESS COMBINATIONS CONSOLIDATION PDFJamille Rose PagulayanNo ratings yet

- CH 12Document50 pagesCH 12drealbevo100% (2)

- Adv Accounts - Question - PaperDocument11 pagesAdv Accounts - Question - Papernavyabearad2715No ratings yet

- BCTA UJ Question PaperDocument14 pagesBCTA UJ Question PaperFresh LoverzzNo ratings yet

- 2 Jurnal Internasional (2019) PDFDocument9 pages2 Jurnal Internasional (2019) PDFDwi KrisnawatiNo ratings yet