Professional Documents

Culture Documents

Companies (Winding Up and Miscellaneous Provisions) Ordinance

Companies (Winding Up and Miscellaneous Provisions) Ordinance

Uploaded by

Steve0 ratings0% found this document useful (0 votes)

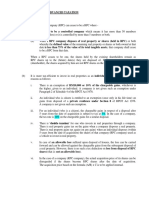

4 views2 pagesThis document discusses provisions related to floating charges and companies that go into liquidation. It defines key terms like floating charge, associate, and connected person. It also outlines rules for determining the validity and value of a floating charge created on a company's assets if the company goes into liquidation. Specifically, it states that a floating charge created in favor of a connected person within 2 years of liquidation will be invalid except for amounts paid in consideration. For other persons, the time frame is 12 months prior to liquidation.

Original Description:

Annotated ORDINANCE of Hong Kong

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses provisions related to floating charges and companies that go into liquidation. It defines key terms like floating charge, associate, and connected person. It also outlines rules for determining the validity and value of a floating charge created on a company's assets if the company goes into liquidation. Specifically, it states that a floating charge created in favor of a connected person within 2 years of liquidation will be invalid except for amounts paid in consideration. For other persons, the time frame is 12 months prior to liquidation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views2 pagesCompanies (Winding Up and Miscellaneous Provisions) Ordinance

Companies (Winding Up and Miscellaneous Provisions) Ordinance

Uploaded by

SteveThis document discusses provisions related to floating charges and companies that go into liquidation. It defines key terms like floating charge, associate, and connected person. It also outlines rules for determining the validity and value of a floating charge created on a company's assets if the company goes into liquidation. Specifically, it states that a floating charge created in favor of a connected person within 2 years of liquidation will be invalid except for amounts paid in consideration. For other persons, the time frame is 12 months prior to liquidation.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Cap.

32 Companies (Winding Up and 01/10/2022

Miscellaneous Provisions)

Ordinance

265A. Interpretation of Subdivision 2

(1) For the purposes of this Subdivision, the question of whether a

person is an associate of another person is to be determined in

accordance with sections 265B and 265C.

(2) In sections 265B and 265C, a provision that a person is an

associate of another person means that they are associates of

each other.

(3) For the purposes of this Subdivision, a person is connected

with a company if that person is—

(a) an associate of a director or shadow director of the

company; or

(b) an associate of the company.

(4) For the purposes of this Subdivision, a company goes into

liquidation when—

(a) the company passes a resolution for voluntary winding

up;

(b) a winding-up statement is delivered to the Registrar for

registration under section 228A for the company; or

(c) (if the company has not gone into liquidation because of

paragraph (a) or (b)) the court makes a winding-up order

in respect of the company.

(5) A note located in the text of this Subdivision is provided for

information only and has no legislative effect.

(Added 14 of 2016 s. 88)

267. Effect of floating charge

(1) This section applies in relation to a company if the company

goes into liquidation.

(2) If the company creates a floating charge on its undertaking or

property at a relevant time (within the meaning of section

267A), the charge is invalid except to the extent of the amount

specified in subsection (3).

(3) The amount is the aggregate of—

(a) the value of so much of the consideration for the creation

of the charge that consists of—

(i) money paid to the company at the same time as, or

after, the creation of the charge;

(ii) money paid at the direction of the company at the

same time as, or after, the creation of the charge; or

(iii) property or services supplied to the company at the

same time as, or after, the creation of the charge;

and

(b) the amount of any interest that is payable on the amount

mentioned in paragraph (a)(i), (ii) or (iii) pursuant to the

charge or consideration agreement, at—

(i) the rate specified in the charge or consideration

agreement; or

(ii) the rate of 12% per annum,

whichever is the lesser.

(4) For the purposes of subsection (3)(a)(iii), the value of any

property or services supplied as consideration for a floating

charge is the amount in money which, at the time they were

supplied, could reasonably have been expected to be obtained

—

(a) for supplying the property or services in the ordinary

course of business; and

(b) on the same terms (apart from the consideration) as those

on which they were supplied to the company.

(5) In this section—

consideration agreement (代價協議)—

(a) in relation to the value mentioned in subsection (3)(a)(i),

means the agreement pursuant to which the money was

paid to the company;

(b) in relation to the value mentioned in subsection (3)(a)(ii),

means the agreement pursuant to which the money was

paid at the direction of the company; or

(c) in relation to the value mentioned in subsection (3)(a)

(iii), means the agreement pursuant to which the property

or services were supplied to the company;

floating charge (浮動押記) means a charge which, when created,

was a floating charge.

(Replaced 14 of 2016 s. 91)

267A. Relevant time under section 267

(1) For a floating charge created in favour of a person who is

connected with the company, the time at which the charge is

created is a relevant time for the purposes of section 267(2) if

it is created at a time in the period of 2 years ending with the

day on which the winding up of the company commences.

(2) For a floating charge created in favour of any person other

than a person connected with the company, the time at which

the charge is created is a relevant time for the purposes of

section 267(2) if—

(a) it is created at a time in the period of 12 months ending

with the day on which the winding up of the company

commences; and

(b) the company—

(i) is unable to pay its debts (within the meaning of

section 178) at that time; or

(ii) becomes unable to pay its debts (within the

meaning of section 178) in consequence of the

transaction under which the charge is created.

Note—

1. For the time at which a winding up by the court commences, see

section 184.

2. For the time at which a voluntary winding up commences, see

sections 209B(a)(i), 228A(5)(a) and 230.

(Added 14 of 2016 s. 92)

You might also like

- Advance Subscription AgreementDocument11 pagesAdvance Subscription AgreementAllen Villanueva Bautista100% (3)

- TheFinanceBill 2023Document159 pagesTheFinanceBill 2023ondalafrederickNo ratings yet

- IBC Amendment Final May 2019Document19 pagesIBC Amendment Final May 2019saikrupaNo ratings yet

- TheFinanceAct No.4of2023Document60 pagesTheFinanceAct No.4of2023newme 7No ratings yet

- Reg Vol LiqDocument54 pagesReg Vol LiqArvind kumar SaxenaNo ratings yet

- ITax Regulations GN78 of 1996Document94 pagesITax Regulations GN78 of 1996Akash TeeluckNo ratings yet

- Chapter 4 (B)Document6 pagesChapter 4 (B)LEARN FROM MENo ratings yet

- Companies (Amendment) Act 2017Document114 pagesCompanies (Amendment) Act 2017Hansi ZhaiNo ratings yet

- Building and Construction Industry Security of PaDocument36 pagesBuilding and Construction Industry Security of PaTin ZawNo ratings yet

- Solved Scanner Paper-4 Company Law 2010 - June (1) (A)Document8 pagesSolved Scanner Paper-4 Company Law 2010 - June (1) (A)Shailja ShuklaNo ratings yet

- Consideration For Shares. - (1) The Board of A Company May Issue Authorised Shares OnlyDocument4 pagesConsideration For Shares. - (1) The Board of A Company May Issue Authorised Shares OnlyCraig CremenNo ratings yet

- Gala - Business 35D and 28 (Iv)Document5 pagesGala - Business 35D and 28 (Iv)Priyank GalaNo ratings yet

- Definition of INCOME Under Income Tax (Section 2 (24) )Document7 pagesDefinition of INCOME Under Income Tax (Section 2 (24) )deepak sharmaNo ratings yet

- Tab 1 - Companies Act 2016 S.228 PDFDocument5 pagesTab 1 - Companies Act 2016 S.228 PDFHaikal AdninNo ratings yet

- Bangladesh Income Tax Ordinance, 1984 PDFDocument310 pagesBangladesh Income Tax Ordinance, 1984 PDFParmeet NainNo ratings yet

- IBBI-Voluntary-LiquidationDocument40 pagesIBBI-Voluntary-LiquidationopparasharNo ratings yet

- IBBI Voluntary LiquidationDocument40 pagesIBBI Voluntary LiquidationopparasharNo ratings yet

- 6.charges 2Document12 pages6.charges 2Sach SahuNo ratings yet

- Bir Ruling No. Ot-338-2022Document6 pagesBir Ruling No. Ot-338-2022Alyssa Marie MartinezNo ratings yet

- Income Tax (Amendment) Act No. 15 of 2019Document10 pagesIncome Tax (Amendment) Act No. 15 of 2019Chimuka MukonkaNo ratings yet

- Commentary For Fin Act 21-Sec9bDocument13 pagesCommentary For Fin Act 21-Sec9bVedaprakash ManavalanNo ratings yet

- Income Tax Ordinance 1984 (FA 2017)Document305 pagesIncome Tax Ordinance 1984 (FA 2017)Akash79No ratings yet

- Amendment Notes For CA (Intermediate) Nov. 2022 ExamsDocument5 pagesAmendment Notes For CA (Intermediate) Nov. 2022 Examssnehadagarsd19No ratings yet

- Eco Law Case Study Amendment List Nov 2022Document3 pagesEco Law Case Study Amendment List Nov 2022Sonia ShahNo ratings yet

- Approving-Employee-Retention AgreementDocument10 pagesApproving-Employee-Retention AgreementSankaty LightNo ratings yet

- The Insolvency and Bankruptcy Code (Amendment) BILL, 2021: S Introduced IN OK AbhaDocument24 pagesThe Insolvency and Bankruptcy Code (Amendment) BILL, 2021: S Introduced IN OK AbhaSathyapersonal KopalleNo ratings yet

- Part 26A Companies ADocument27 pagesPart 26A Companies AYasiru WannigamaNo ratings yet

- Para. Act No. 3 of 2011Document3 pagesPara. Act No. 3 of 2011Craig CremenNo ratings yet

- Ca Inter / Ipcc Law: Amendments For Nov 2018 For NEW & OLD Syllabus BothDocument10 pagesCa Inter / Ipcc Law: Amendments For Nov 2018 For NEW & OLD Syllabus BothRitikaNo ratings yet

- IBC Part IIDocument55 pagesIBC Part IISadab RaeenNo ratings yet

- Finance Bill 2024Document135 pagesFinance Bill 2024Sleepi HollowNo ratings yet

- Issuance of Convertible Debt Securities Through Right Offer Regulations 2022Document5 pagesIssuance of Convertible Debt Securities Through Right Offer Regulations 2022dua nadeemNo ratings yet

- New ActDocument21 pagesNew ActamitNo ratings yet

- 3-Registred Valuer - Legal FrameworkDocument57 pages3-Registred Valuer - Legal Frameworkusne902No ratings yet

- Law S2 AnswersDocument7 pagesLaw S2 Answerskomalchandwani.dnlNo ratings yet

- Exhibit 10.1 - Joint Venture AgreementDocument19 pagesExhibit 10.1 - Joint Venture AgreementGRAFERNo ratings yet

- Liquidation of Companies PDFDocument8 pagesLiquidation of Companies PDFTippanna GodiNo ratings yet

- Part 3 - 58 of 1962 Income Tax Act - 2021.03.01 - To DateDocument254 pagesPart 3 - 58 of 1962 Income Tax Act - 2021.03.01 - To DateCedric PoolNo ratings yet

- The Companies (General Provisions and Forms) Rules, 1985 (As Amended Upto 30.5.16)Document28 pagesThe Companies (General Provisions and Forms) Rules, 1985 (As Amended Upto 30.5.16)Syed HunainNo ratings yet

- Lecture Synopsis-2 For Overall Discussion On Principles of TaxationDocument8 pagesLecture Synopsis-2 For Overall Discussion On Principles of TaxationProgga MehnazNo ratings yet

- Tax Aspects of DemergerDocument8 pagesTax Aspects of DemergerHEMASHEKHARNo ratings yet

- Corporate & Other Laws Supplementary For May 2023 Attempt: CA Harsh GuptaDocument4 pagesCorporate & Other Laws Supplementary For May 2023 Attempt: CA Harsh GuptaPremNo ratings yet

- Finance Bill 2018Document36 pagesFinance Bill 2018Iddi KassiNo ratings yet

- MOSS CLG Constitution Draft 2 December 2016Document32 pagesMOSS CLG Constitution Draft 2 December 2016SammyNo ratings yet

- Insolvency and Bankruptcy Code (Amendment) Act, 2018Document6 pagesInsolvency and Bankruptcy Code (Amendment) Act, 2018Bhawna PalNo ratings yet

- Company Law SectionsDocument4 pagesCompany Law SectionsnbaghrechaNo ratings yet

- CAF 4 Autumn 2023Document7 pagesCAF 4 Autumn 2023Rafay ShahidNo ratings yet

- Amendments To Section 42 RegulationsDocument20 pagesAmendments To Section 42 RegulationsrabiaNo ratings yet

- Expanded Affiliate GrouDocument3 pagesExpanded Affiliate GrouVani VenugopalNo ratings yet

- RevisionDocument335 pagesRevisionnagababuNo ratings yet

- Co Law SupplementDocument20 pagesCo Law SupplementRajiv DsoujaNo ratings yet

- Combination Regulations 17012008Document82 pagesCombination Regulations 17012008Kamal BhanushaliNo ratings yet

- 4 Liquidation of CompanyDocument32 pages4 Liquidation of CompanyKrrish KelwaniNo ratings yet

- p13 Dec 2023 Sol - MergedDocument13 pagesp13 Dec 2023 Sol - Merged18kumari.nNo ratings yet

- The Income Tax Act No. 16 of 2017Document8 pagesThe Income Tax Act No. 16 of 2017cholaNo ratings yet

- (As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Document3 pages(As Per 117 (3) (A) For All SR, MGT-14 Is Required.)Pranzali GuptaNo ratings yet

- CRG Directors Part 2Document23 pagesCRG Directors Part 2maiztulshahirahNo ratings yet

- BBFT3024 T3 Ans 4a, B, C RPGT - RPCDocument2 pagesBBFT3024 T3 Ans 4a, B, C RPGT - RPCsomethingNo ratings yet

- Income Tax (Amendment) Bill, 2024Document18 pagesIncome Tax (Amendment) Bill, 2024RebeccaNo ratings yet