Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

10 viewsSample Tax Computation Rev.1

Sample Tax Computation Rev.1

Uploaded by

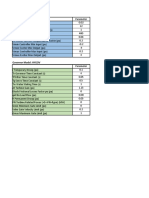

Anthony LacastesantosThis document contains payroll information for an employee's new and old salary. For the new salary, the employee's half month salary is $37,207, bonus payroll is $74,414, and deductions are $2,828.04. The net taxable income is $34,378.96 and total payroll period income is $108,792.96. Tax computations were done for A, B, and C. The final monthly salary for the new salary is $64,284.21. The old salary information is also provided for comparison.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You might also like

- Bus 145 Assignment 2Document18 pagesBus 145 Assignment 2Urvashi AroraNo ratings yet

- Bank Mandiri Yanuaria RanniDocument1 pageBank Mandiri Yanuaria Rannibovan28No ratings yet

- Salary Sep 2019 PDFDocument1 pageSalary Sep 2019 PDFAnonymous eHnCyk7DYNo ratings yet

- 2021 12 December - 71000700Document2 pages2021 12 December - 71000700Pablo BarónNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- New Adjusted Fs TekalignDocument5 pagesNew Adjusted Fs TekalignGali AbamededNo ratings yet

- BEP Computation SheetDocument102 pagesBEP Computation SheetBj AngelesNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- Pay StubDocument1 pagePay Stubnurulamin00023No ratings yet

- Tax Computation: Monthly Reimbursables (Tax Shield)Document2 pagesTax Computation: Monthly Reimbursables (Tax Shield)Harlyn Mae BatalanNo ratings yet

- Abebech G - Medin 2012 1Document19 pagesAbebech G - Medin 2012 1Deresegn NedaNo ratings yet

- Cálculo IndemnizaciónDocument1 pageCálculo IndemnizaciónAmerica HernandezNo ratings yet

- Payslip Month 10Document1 pagePayslip Month 10AmandaNo ratings yet

- RobinpayslipDocument1 pageRobinpayslipscientific entrepreneurNo ratings yet

- Solutions FranchiseDocument18 pagesSolutions FranchiseNicoleNo ratings yet

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyNo ratings yet

- Jan2024 PayslipDocument1 pageJan2024 PayslipTKSVELNo ratings yet

- Egure Grace IzeDocument1 pageEgure Grace IzeuzomaumahiNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- 4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDocument4 pages4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDannah Celiste ParagasNo ratings yet

- 2019 Proposed BudgetDocument91 pages2019 Proposed Budgetcharmaine vegaNo ratings yet

- Cost Distribution-Guards Based On RBV-20Document1 pageCost Distribution-Guards Based On RBV-20jolomenandroNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Cleaning Service - Sepinggan Airport BalikpapanDocument19 pagesCleaning Service - Sepinggan Airport Balikpapanumi rizekiNo ratings yet

- Consolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Document6 pagesConsolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Alicia NhsNo ratings yet

- Full and Final StatementDocument3 pagesFull and Final StatementMaheswari MedapatiNo ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- Quizzer On Withholding of Annual Tax Compensation IncomeDocument5 pagesQuizzer On Withholding of Annual Tax Compensation IncomeRyDNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Simulasi Tax Current PayDocument81 pagesSimulasi Tax Current PayDebiLianaLestariNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Final FNFDocument3 pagesFinal FNFbhagender singhNo ratings yet

- Noel B. Tutor FS 2023Document6 pagesNoel B. Tutor FS 2023rodelryanyanaNo ratings yet

- MAR - 2024 - PaySlip (1) - UnlockedDocument1 pageMAR - 2024 - PaySlip (1) - Unlockednaveen.rawat.10420No ratings yet

- Latihan Hitung PPH 21: Deduction Taxable 125,000Document2 pagesLatihan Hitung PPH 21: Deduction Taxable 125,000Stefani KrisdayantiNo ratings yet

- Nov2023 PayslipDocument1 pageNov2023 PayslipTKSVELNo ratings yet

- LastthreemonthPayslip 11Document7 pagesLastthreemonthPayslip 11delicata.benNo ratings yet

- B1 FormDocument1 pageB1 FormsubishanpriyaNo ratings yet

- Lumpsum Computation Sheet - v2Document43 pagesLumpsum Computation Sheet - v2Bj AngelesNo ratings yet

- 2nd Pay SERVICE STATION Final CommentedDocument62 pages2nd Pay SERVICE STATION Final CommentedajayewondmayeNo ratings yet

- LastthreemonthPayslip 12Document7 pagesLastthreemonthPayslip 12delicata.benNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Provisional FNFDocument3 pagesProvisional FNFrakxnachandran96No ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Ilustration - KitaRekrut Gross Salary Calculation - XLSX - CalculationDocument1 pageIlustration - KitaRekrut Gross Salary Calculation - XLSX - CalculationardifajayaNo ratings yet

- Answer For Payroll ProblemsDocument21 pagesAnswer For Payroll ProblemsAnonymous Lz2qH7No ratings yet

- Statement of Profit and Loss For The Year Ended 31 March 2020Document1 pageStatement of Profit and Loss For The Year Ended 31 March 2020Prathi KarthikNo ratings yet

- Per Returns Vatable Sales Zero Rated Sales Total: CollectionsDocument3 pagesPer Returns Vatable Sales Zero Rated Sales Total: CollectionskingNo ratings yet

- Payslip JULY2023Document1 pagePayslip JULY2023Ghatalia DarshilNo ratings yet

- (In Philippine Pesos) : Se Detendre La Plage IncDocument5 pages(In Philippine Pesos) : Se Detendre La Plage IncJheza Mae PitogoNo ratings yet

- Taj Nepal Pvt. LTD 76 TaxDocument31 pagesTaj Nepal Pvt. LTD 76 TaxSunny DesharNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Balance Sheet: Working Capital ManagementDocument11 pagesBalance Sheet: Working Capital ManagementAnu GraphicsNo ratings yet

- Statement of Receipts (Income) Calendar Year 2007Document10 pagesStatement of Receipts (Income) Calendar Year 2007John Paulo TenorioNo ratings yet

- Day Work Rates From July 2006Document1 pageDay Work Rates From July 2006PaulconroyNo ratings yet

- Estimation of Generator Inertia AvailableDocument8 pagesEstimation of Generator Inertia AvailableAnthony LacastesantosNo ratings yet

- Control System AssignmentDocument5 pagesControl System AssignmentAnthony LacastesantosNo ratings yet

- Introduction To Testing Projects For Modeling and Testing of Steam Turbine and Its Governor 1Document19 pagesIntroduction To Testing Projects For Modeling and Testing of Steam Turbine and Its Governor 1Anthony LacastesantosNo ratings yet

- Training On Dynamic Simulations (PART II) Revjuly18 1Document41 pagesTraining On Dynamic Simulations (PART II) Revjuly18 1Anthony LacastesantosNo ratings yet

- Tasks MonitoringDocument16 pagesTasks MonitoringAnthony LacastesantosNo ratings yet

- OT COMPUTATION - May and June 2023Document4 pagesOT COMPUTATION - May and June 2023Anthony LacastesantosNo ratings yet

- Data ChartDocument3 pagesData ChartAnthony LacastesantosNo ratings yet

- 2022 BreakdownDocument2 pages2022 BreakdownAnthony LacastesantosNo ratings yet

- Generator Dynamic Data (2022 Digsilent Format) Rev.1Document44 pagesGenerator Dynamic Data (2022 Digsilent Format) Rev.1Anthony LacastesantosNo ratings yet

- English Research PaperDocument6 pagesEnglish Research PaperAnthony LacastesantosNo ratings yet

Sample Tax Computation Rev.1

Sample Tax Computation Rev.1

Uploaded by

Anthony Lacastesantos0 ratings0% found this document useful (0 votes)

10 views4 pagesThis document contains payroll information for an employee's new and old salary. For the new salary, the employee's half month salary is $37,207, bonus payroll is $74,414, and deductions are $2,828.04. The net taxable income is $34,378.96 and total payroll period income is $108,792.96. Tax computations were done for A, B, and C. The final monthly salary for the new salary is $64,284.21. The old salary information is also provided for comparison.

Original Description:

Original Title

Sample Tax Computation rev.1

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains payroll information for an employee's new and old salary. For the new salary, the employee's half month salary is $37,207, bonus payroll is $74,414, and deductions are $2,828.04. The net taxable income is $34,378.96 and total payroll period income is $108,792.96. Tax computations were done for A, B, and C. The final monthly salary for the new salary is $64,284.21. The old salary information is also provided for comparison.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

10 views4 pagesSample Tax Computation Rev.1

Sample Tax Computation Rev.1

Uploaded by

Anthony LacastesantosThis document contains payroll information for an employee's new and old salary. For the new salary, the employee's half month salary is $37,207, bonus payroll is $74,414, and deductions are $2,828.04. The net taxable income is $34,378.96 and total payroll period income is $108,792.96. Tax computations were done for A, B, and C. The final monthly salary for the new salary is $64,284.21. The old salary information is also provided for comparison.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 4

New Salary

Half Month Salary 37,207.00

Bonus Payroll (14th Month Pay) 74,414.00

HDMF, PhilH., SSS, MPF 2,828.04

Rice Allowance 2,000.00

Net Taxable Income 34,378.96

Payroll Period Total Taxable Income

108,792.96

(Bonus Payroll+Net Taxable Income)

Computation For A 23,135.69

Computation For B 13,833.94

Computation For C 9,301.75

Final 1st Half Month Salary 29,728.09

Final 2nd Half Month Salary 32,556.13

Final Monthly Salary 64,284.21

Old Salary

Half Month Salary 34,451.00

Bonus Payroll (14th Month Pay) 68,902.00

HDMF, PhilH., SSS, MPF 2,828.04

Rice Allowance 2,000.00

Net Taxable Income 31,622.96

Payroll Period Total Taxable Income

100,524.96

(Bonus Payroll+Net Taxable Income)

Computation For A 21,068.69

Computation For B 12,455.94

Computation For C 8,612.75

Final Half Month Salary 27,316.59

Final 2nd Half Month Salary 30,144.63

Final Monthly Salary 59,461.21

You might also like

- Bus 145 Assignment 2Document18 pagesBus 145 Assignment 2Urvashi AroraNo ratings yet

- Bank Mandiri Yanuaria RanniDocument1 pageBank Mandiri Yanuaria Rannibovan28No ratings yet

- Salary Sep 2019 PDFDocument1 pageSalary Sep 2019 PDFAnonymous eHnCyk7DYNo ratings yet

- 2021 12 December - 71000700Document2 pages2021 12 December - 71000700Pablo BarónNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- New Adjusted Fs TekalignDocument5 pagesNew Adjusted Fs TekalignGali AbamededNo ratings yet

- BEP Computation SheetDocument102 pagesBEP Computation SheetBj AngelesNo ratings yet

- Salary Slip Format For HCLDocument1 pageSalary Slip Format For HCLrajkannamdu100% (1)

- Pay StubDocument1 pagePay Stubnurulamin00023No ratings yet

- Tax Computation: Monthly Reimbursables (Tax Shield)Document2 pagesTax Computation: Monthly Reimbursables (Tax Shield)Harlyn Mae BatalanNo ratings yet

- Abebech G - Medin 2012 1Document19 pagesAbebech G - Medin 2012 1Deresegn NedaNo ratings yet

- Cálculo IndemnizaciónDocument1 pageCálculo IndemnizaciónAmerica HernandezNo ratings yet

- Payslip Month 10Document1 pagePayslip Month 10AmandaNo ratings yet

- RobinpayslipDocument1 pageRobinpayslipscientific entrepreneurNo ratings yet

- Solutions FranchiseDocument18 pagesSolutions FranchiseNicoleNo ratings yet

- Kovai Medical Center and Hospital Limited: PartlcularsDocument2 pagesKovai Medical Center and Hospital Limited: PartlcularsVickyNo ratings yet

- Jan2024 PayslipDocument1 pageJan2024 PayslipTKSVELNo ratings yet

- Egure Grace IzeDocument1 pageEgure Grace IzeuzomaumahiNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- 4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDocument4 pages4.5.1 Case Study AbellaCaparrosPadaoilParagasSinakayDannah Celiste ParagasNo ratings yet

- 2019 Proposed BudgetDocument91 pages2019 Proposed Budgetcharmaine vegaNo ratings yet

- Cost Distribution-Guards Based On RBV-20Document1 pageCost Distribution-Guards Based On RBV-20jolomenandroNo ratings yet

- AKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountDocument1 pageAKINJISE Fatai (SB14243) : Ondo State Government Staff Matters AccountScientist Orioye GabrielNo ratings yet

- Cleaning Service - Sepinggan Airport BalikpapanDocument19 pagesCleaning Service - Sepinggan Airport Balikpapanumi rizekiNo ratings yet

- Consolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Document6 pagesConsolidated Statement of Financial Position: (With Comparative Figures For CY 2016)Alicia NhsNo ratings yet

- Full and Final StatementDocument3 pagesFull and Final StatementMaheswari MedapatiNo ratings yet

- COMPENSATION INCOME EXERCISES AnnualDocument1 pageCOMPENSATION INCOME EXERCISES AnnualJoyce Marie SablayanNo ratings yet

- Quizzer On Withholding of Annual Tax Compensation IncomeDocument5 pagesQuizzer On Withholding of Annual Tax Compensation IncomeRyDNo ratings yet

- SSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077Document29 pagesSSF Not Listed-Monthly Salary Sheet With TDS Calculation 2076-2077samNo ratings yet

- I. Assets: 2018 2019Document7 pagesI. Assets: 2018 2019Kean DeeNo ratings yet

- SalarySlip 8484236Document1 pageSalarySlip 8484236Vikram MaanNo ratings yet

- Simulasi Tax Current PayDocument81 pagesSimulasi Tax Current PayDebiLianaLestariNo ratings yet

- M12 Tax ActivityDocument6 pagesM12 Tax ActivityJanna RodriguezNo ratings yet

- Final FNFDocument3 pagesFinal FNFbhagender singhNo ratings yet

- Noel B. Tutor FS 2023Document6 pagesNoel B. Tutor FS 2023rodelryanyanaNo ratings yet

- MAR - 2024 - PaySlip (1) - UnlockedDocument1 pageMAR - 2024 - PaySlip (1) - Unlockednaveen.rawat.10420No ratings yet

- Latihan Hitung PPH 21: Deduction Taxable 125,000Document2 pagesLatihan Hitung PPH 21: Deduction Taxable 125,000Stefani KrisdayantiNo ratings yet

- Nov2023 PayslipDocument1 pageNov2023 PayslipTKSVELNo ratings yet

- LastthreemonthPayslip 11Document7 pagesLastthreemonthPayslip 11delicata.benNo ratings yet

- B1 FormDocument1 pageB1 FormsubishanpriyaNo ratings yet

- Lumpsum Computation Sheet - v2Document43 pagesLumpsum Computation Sheet - v2Bj AngelesNo ratings yet

- 2nd Pay SERVICE STATION Final CommentedDocument62 pages2nd Pay SERVICE STATION Final CommentedajayewondmayeNo ratings yet

- LastthreemonthPayslip 12Document7 pagesLastthreemonthPayslip 12delicata.benNo ratings yet

- Capital Contribution: Stockholder TINDocument17 pagesCapital Contribution: Stockholder TINEddie ParazoNo ratings yet

- Provisional FNFDocument3 pagesProvisional FNFrakxnachandran96No ratings yet

- Income From Salaries: Rs. Rs. Rs. SCH - NoDocument3 pagesIncome From Salaries: Rs. Rs. Rs. SCH - NoBilalNo ratings yet

- Ilustration - KitaRekrut Gross Salary Calculation - XLSX - CalculationDocument1 pageIlustration - KitaRekrut Gross Salary Calculation - XLSX - CalculationardifajayaNo ratings yet

- Answer For Payroll ProblemsDocument21 pagesAnswer For Payroll ProblemsAnonymous Lz2qH7No ratings yet

- Statement of Profit and Loss For The Year Ended 31 March 2020Document1 pageStatement of Profit and Loss For The Year Ended 31 March 2020Prathi KarthikNo ratings yet

- Per Returns Vatable Sales Zero Rated Sales Total: CollectionsDocument3 pagesPer Returns Vatable Sales Zero Rated Sales Total: CollectionskingNo ratings yet

- Payslip JULY2023Document1 pagePayslip JULY2023Ghatalia DarshilNo ratings yet

- (In Philippine Pesos) : Se Detendre La Plage IncDocument5 pages(In Philippine Pesos) : Se Detendre La Plage IncJheza Mae PitogoNo ratings yet

- Taj Nepal Pvt. LTD 76 TaxDocument31 pagesTaj Nepal Pvt. LTD 76 TaxSunny DesharNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Balance Sheet: Working Capital ManagementDocument11 pagesBalance Sheet: Working Capital ManagementAnu GraphicsNo ratings yet

- Statement of Receipts (Income) Calendar Year 2007Document10 pagesStatement of Receipts (Income) Calendar Year 2007John Paulo TenorioNo ratings yet

- Day Work Rates From July 2006Document1 pageDay Work Rates From July 2006PaulconroyNo ratings yet

- Estimation of Generator Inertia AvailableDocument8 pagesEstimation of Generator Inertia AvailableAnthony LacastesantosNo ratings yet

- Control System AssignmentDocument5 pagesControl System AssignmentAnthony LacastesantosNo ratings yet

- Introduction To Testing Projects For Modeling and Testing of Steam Turbine and Its Governor 1Document19 pagesIntroduction To Testing Projects For Modeling and Testing of Steam Turbine and Its Governor 1Anthony LacastesantosNo ratings yet

- Training On Dynamic Simulations (PART II) Revjuly18 1Document41 pagesTraining On Dynamic Simulations (PART II) Revjuly18 1Anthony LacastesantosNo ratings yet

- Tasks MonitoringDocument16 pagesTasks MonitoringAnthony LacastesantosNo ratings yet

- OT COMPUTATION - May and June 2023Document4 pagesOT COMPUTATION - May and June 2023Anthony LacastesantosNo ratings yet

- Data ChartDocument3 pagesData ChartAnthony LacastesantosNo ratings yet

- 2022 BreakdownDocument2 pages2022 BreakdownAnthony LacastesantosNo ratings yet

- Generator Dynamic Data (2022 Digsilent Format) Rev.1Document44 pagesGenerator Dynamic Data (2022 Digsilent Format) Rev.1Anthony LacastesantosNo ratings yet

- English Research PaperDocument6 pagesEnglish Research PaperAnthony LacastesantosNo ratings yet