Professional Documents

Culture Documents

Chart Pattern 2023 13 07 08 40 56

Chart Pattern 2023 13 07 08 40 56

Uploaded by

CURIOUS KICK0 ratings0% found this document useful (0 votes)

35 views50 pagesThe document discusses a bearish engulfing pattern, which is a technical chart pattern signaling lower future prices. It consists of an initial up candlestick followed by a larger down candlestick that eclipses the up candle. This shows sellers overtaking buyers and pushing the price down more aggressively than the previous uptick. For the pattern to be significant, the candles should be substantially sized relative to surrounding prices and the down candle's body must fully engulf the body of the up candle.

Original Description:

Trading

Original Title

chart-pattern-2023-13-07-08-40-56 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses a bearish engulfing pattern, which is a technical chart pattern signaling lower future prices. It consists of an initial up candlestick followed by a larger down candlestick that eclipses the up candle. This shows sellers overtaking buyers and pushing the price down more aggressively than the previous uptick. For the pattern to be significant, the candles should be substantially sized relative to surrounding prices and the down candle's body must fully engulf the body of the up candle.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

35 views50 pagesChart Pattern 2023 13 07 08 40 56

Chart Pattern 2023 13 07 08 40 56

Uploaded by

CURIOUS KICKThe document discusses a bearish engulfing pattern, which is a technical chart pattern signaling lower future prices. It consists of an initial up candlestick followed by a larger down candlestick that eclipses the up candle. This shows sellers overtaking buyers and pushing the price down more aggressively than the previous uptick. For the pattern to be significant, the candles should be substantially sized relative to surrounding prices and the down candle's body must fully engulf the body of the up candle.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 50

You Tube Channel @StockLover143

You Tube Channel @StockLover143

You Tube Channel @StockLover143

You Tube Channel @StockLover143

You Tube Channel

@StockLover143

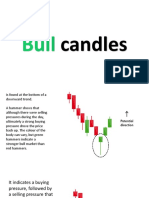

A bearish engulfing pattern is a technical chart pattern that signals lower prices to

come. The pattern consists of an up (white or green) candlestick followed by a

large down (black or red) candlestick that eclipses or "engulfs" the smaller up

candle. The pattern can be important because it shows sellers have overtaken

the buyers and are pushing the price more aggressively down (down candle)

than the buyers were able to push it up (up candle).

1. A bearish engulfing pattern can occur anywhere, but it is more significant if it

occurs after a price advance. This could be an uptrend or a pullback to the

upside with a larger downtrend.

2.Ideally, both candles are of substantial size relative to the price bars around

them. Two very small bars may create an engulfing pattern, but it is far less

significant than if both candles are large.

3. The real body—the difference between the open and close price—of the

candlesticks is what matters. The real body of the down candle must engulf the

up candle.

The pattern has far less significance in choppy markets.

You Tube Channel @StockLover

You Tube Channel @StockLover

You Tube Channel @StockLover

You Tube Channel @StockLover

You Tube Channel @StockLover

You Tube Channel @StockLover143

You Tube Channel @StockLover143

You Tube Channel @StockLover143

You Tube Channel @StockLover143

You might also like

- Forexbee Co Candlestick Patterns Dictionary PDFDocument20 pagesForexbee Co Candlestick Patterns Dictionary PDFDaffy JackNo ratings yet

- CandleStick Patterns ListDocument23 pagesCandleStick Patterns ListZaid Ahmed50% (2)

- How To Read A Candlestick Chart: Reading Candlestick Charts - Talking PointsDocument90 pagesHow To Read A Candlestick Chart: Reading Candlestick Charts - Talking PointsVeljko KerčevićNo ratings yet

- Candle TypesDocument19 pagesCandle TypesMarcel ProustNo ratings yet

- Harmonic Forex Patterns Cheat SheetDocument2 pagesHarmonic Forex Patterns Cheat SheetAklchanNo ratings yet

- Support & Resistance Strategy GuideDocument5 pagesSupport & Resistance Strategy GuideChristopher McManusNo ratings yet

- Candlestick Chart PatternsDocument9 pagesCandlestick Chart Patternssmitha100% (1)

- Candlestick Success Rate 60 PercentDocument12 pagesCandlestick Success Rate 60 PercentClipper52aNo ratings yet

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Bullish Reversal Candlestick PatternsDocument42 pagesBullish Reversal Candlestick PatternsMaham BaqaiNo ratings yet

- Technical AnalysisDocument32 pagesTechnical AnalysisDhikshit ShettyNo ratings yet

- The Art of CandlesticksDocument23 pagesThe Art of Candlesticksilhan100% (2)

- Note 1 of A LotDocument18 pagesNote 1 of A Lotgo brrNo ratings yet

- Basic of Chart Reading and CandlestickDocument10 pagesBasic of Chart Reading and CandlestickRobin WadhwaNo ratings yet

- Price Action Cheatsheet PDFDocument19 pagesPrice Action Cheatsheet PDFcRi SocietyNo ratings yet

- An Introduction To Japanese Candlestick ChartingDocument14 pagesAn Introduction To Japanese Candlestick ChartingRomelu MartialNo ratings yet

- Forex Candlestick Ambush Trade .Document31 pagesForex Candlestick Ambush Trade .Malik SaraikiNo ratings yet

- Hammer CandlestickDocument4 pagesHammer Candlesticklaba primeNo ratings yet

- Bullish Hammer: Reversal Candlestick Pattern: HammerDocument23 pagesBullish Hammer: Reversal Candlestick Pattern: HammerCinaru Cosmin100% (1)

- Supply and Demand TacticsDocument7 pagesSupply and Demand TacticsFesto ShaneNo ratings yet

- Understanding Major Candlestick Patterns in ForexDocument9 pagesUnderstanding Major Candlestick Patterns in Forexsibandaclemence768No ratings yet

- Candlestick Pattern @the - Bullish - TraderDocument29 pagesCandlestick Pattern @the - Bullish - Tradermursal.naqshbandi.mnNo ratings yet

- CandlesticksDocument5 pagesCandlesticksE McDonaldNo ratings yet

- Ten Lessons From My Book: "The Ultimate Guide To Candlestick Chart Patterns" A ThreadDocument11 pagesTen Lessons From My Book: "The Ultimate Guide To Candlestick Chart Patterns" A ThreadAmine AmineNo ratings yet

- Breakout Trading Strategies Quick GuideDocument10 pagesBreakout Trading Strategies Quick GuideKiran KrishnaNo ratings yet

- Doji Candlestick PatternDocument28 pagesDoji Candlestick PatternNadeesha GunathilakaNo ratings yet

- Candlestick PatternDocument6 pagesCandlestick PatternGajanan HegdeNo ratings yet

- Technical AnalysisDocument39 pagesTechnical AnalysisharishNo ratings yet

- Venue FL & N Line 23MY IncrementalDocument4 pagesVenue FL & N Line 23MY IncrementalManish GadeNo ratings yet

- Types of CandlesticksDocument3 pagesTypes of CandlesticksN SAMPATH100% (1)

- Technical AnalysisDocument43 pagesTechnical AnalysisAhsan Iqbal100% (1)

- Bearish Stop LossDocument3 pagesBearish Stop LossSyam Sundar ReddyNo ratings yet

- Candlestick PatternsDocument12 pagesCandlestick PatternsRaja JhaNo ratings yet

- Candlestickv2 3Document1 pageCandlestickv2 3Shahril ZainuddinNo ratings yet

- FVG PDFDocument4 pagesFVG PDFRadu MihaiNo ratings yet

- 4.1 6.4. Using Elliot To Stoploss and Scale in StrategyDocument6 pages4.1 6.4. Using Elliot To Stoploss and Scale in StrategyJardel QuefaceNo ratings yet

- Charts Patterns For PrintoutDocument6 pagesCharts Patterns For PrintoutHarshaaal100% (1)

- Candle Stick (1) : Course 1. Forex Basic Knowledge Course - From Zero To IntermediateDocument11 pagesCandle Stick (1) : Course 1. Forex Basic Knowledge Course - From Zero To IntermediateN36087016吳建德No ratings yet

- Candlestick Cheat SheetDocument14 pagesCandlestick Cheat SheetgabrielNo ratings yet

- Candlesticks Types and PatternsDocument26 pagesCandlesticks Types and PatternsKiran Sathe Ks100% (1)

- Galaxy Waves First ChipterDocument37 pagesGalaxy Waves First ChipterEisa IshaqzaiNo ratings yet

- Trading (Basic)Document7 pagesTrading (Basic)gurjar harshNo ratings yet

- Andrew Lockwood: Trading Cheat SheetDocument20 pagesAndrew Lockwood: Trading Cheat Sheetmansur adam muhammad100% (1)

- Daytrading 2 PDF FreeDocument214 pagesDaytrading 2 PDF FreeMirco Nardi100% (1)

- AdenDocument13 pagesAdenAhmed AdenNo ratings yet

- Candlestick PatternDocument6 pagesCandlestick Patterntraining division100% (1)

- An Introduction To CandlesticksDocument70 pagesAn Introduction To CandlesticksMohit SinghNo ratings yet

- 7-31-12 Breakout in Gold?Document3 pages7-31-12 Breakout in Gold?The Gold SpeculatorNo ratings yet

- Tweezer TopDocument5 pagesTweezer Topkarthick sudharsanNo ratings yet

- Candlestick ChartDocument15 pagesCandlestick Chartyfhtdbqnm8No ratings yet

- Cheatsheet STFXDocument7 pagesCheatsheet STFXAlhassan AlaminNo ratings yet

- ProfitX CandlesDocument27 pagesProfitX CandlesDickson MakoriNo ratings yet

- Candle Pattern ExplanationDocument87 pagesCandle Pattern Explanationdavidsg01zaNo ratings yet

- The Fixed Range Volume Profile FinalDocument5 pagesThe Fixed Range Volume Profile FinalJean-Pierre Crédo LABANo ratings yet

- CLASS 7 Chart PatternsDocument6 pagesCLASS 7 Chart PatternsUmar HussainiNo ratings yet

- Candlestick PatternsDocument35 pagesCandlestick PatternsArie AseandiNo ratings yet

- TA Secrets #4 - Basic Chart PatternsDocument7 pagesTA Secrets #4 - Basic Chart PatternsBlueNo ratings yet

- Binary Option Trading: Introduction to Binary Option TradingFrom EverandBinary Option Trading: Introduction to Binary Option TradingNo ratings yet

- Candlestick PatternsDocument14 pagesCandlestick Patternsmuse marni100% (3)