Professional Documents

Culture Documents

Basf Buy Emkay 06.10.17

Basf Buy Emkay 06.10.17

Uploaded by

Harshal PatilOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basf Buy Emkay 06.10.17

Basf Buy Emkay 06.10.17

Uploaded by

Harshal PatilCopyright:

Available Formats

BASF India Ltd

India Equity Research | Others

October 5, 2017

Initiating Coverage Emkay

Your success is our success

©

Refer to important disclosures at the end of this report

CMP Target Price

Benefits of capex surface; turnaround to Rs 1,466

as of (October 5, 2017)

Rs 2,212

12 months

sustain Rating Upside

BUY 51%

Change in Estimates

BASF India Ltd (BASF India), a part of BASF SE, the largest chemicals company in the

EPS Chg FY18E/FY19E (%) NA

world, is well positioned to deliver solid performance on revenue and profitability front,

backed by ramp-up in new capacity utilization and consolidation of niche businesses. Target Price change (%) NA

Target Period (Months) 12

Thirteen new product launches in Agrochemicals, and localization of many niche

Previous Reco NA

products in Construction, Coatings, Plastics and Care products are likely to boost high-

Emkay vs Consensus

margin Manufacturing revenue and reduce dependence on low-margin Trading business.

EPS Estimates

Initial pay-offs from recent changes are visible in FY17 results with 7%/155% yoy FY18E FY19E

sales/EBITDA growth. Settlement of technical issues and enhanced capacity utilization

Emkay 25.4 60.1

should lead to CAGR of 13.6%/39.1% in revenue/EBITDA during FY17-20E.

Consensus - -

BASF India is poised to demonstrate strong recovery in net profit (Rs4bn in FY20E v/s - Mean Consensus TP (12M) Rs 1,025

Rs141mn in FY17) and return ratios (RoCE: 21.8% in FY20E v/s 4.2% in FY17) going Stock Details

ahead. We initiate BUY with a TP of Rs2,212 with a 51% upside potential.

Bloomberg Code BASF IN

Face Value (Rs) 10

Dahej plant to spur revenue growth: The Dahej plant has stabilized in the last 2 years.

BASF India has also resolved product level technical issues besides obtaining key Shares outstanding (mn) 43

customer approvals after successful audits. In the next 3 years, based on product wise 52 Week H/L 1,812 / 989

plant capacities, the Dahej plant can add c.Rs28bn to total revenue. M Cap (Rs bn/USD bn) 63 / 0.98

Promising non-Dahej outlook: Non-Dahej operation is expect to deliver revenue CAGR Daily Avg Volume (nos.) 18,505

of 7.3% over the next 3 years due to 13 new product launches in Agrochemicals covering Daily Avg Turnover (US$ mn) 0.4

larger crops portfolio (Rice, Corn, Soya, Grapes & Apple) whereas earlier it was largely

Shareholding Pattern Jun '17

focusing on Soya crop. Additionally, demand dynamics of Automotive Coating &

Promoters 73.3%

Construction segments are also looking favorable.

FIIs 3.0%

Dahej plant replicates BASF’s successful Ludwigshafen model: Ludwigshafen is the

DIIs 6.8%

world’s largest integrated chemical complex of BASF SE. The Dahej plant is the largest

Public and Others 16.8%

investment made by BASF in India, which replicates 58% of product basket of

Ludwigshafen site like MDI splitter (Asia’s first) and Sulfation plant (India’s first). Price Performance

Formidable R&D synergies: The combination of a strong R&D support from the German (%) 1M 3M 6M 12M

parent & strategic India research hub to catalyze innovative products in domestic market. Absolute (1) (15) 9 20

Efforts to reduce import reliance: The Dahej facility is developed as a chemical Rel. to Nifty (1) (16) 4 8

complex to reduce imports of intermediate products. Relative price chart

1800 Rs % 40

Valuation & Outlook: Rising revenue from manufacturing and new product launches in

1640 28

Agrochemicals are likely to drive revenue growth & margins. We estimate a CAGR of

13.6%/39.1% in revenue/EBITDA over FY17-20E. We initiate BUY with TP of Rs2,212 1480 16

(14.4x FY20 EV/EBITDA). 1320 4

1160 -8

Financial Snapshot (Standalone)

1000 -20

Oct-16 Dec-16 Feb-17 Apr-17 Jun-17 Aug-17 Oct-17

(Rs mn) FY16 FY17 FY18E FY19E FY20E

BASF India Ltd. (LHS) Rel to Nifty (RHS)

Net Sales 47,492 50,798 56,290 63,602 74,497 Source: Bloomberg

EBITDA 1,058 2,697 4,099 5,662 7,257

This report is solely produced by Emkay Global. The

EBITDA Margin (%) 2.2 5.3 7.3 8.9 9.7 following person(s) are responsible for the

production of the recommendation:

APAT (2,025) (141) 1,100 2,602 3,991

EPS (Rs) (46.8) (3.3) 25.4 60.1 92.2 Amar Mourya

EPS (% chg) 0.0 0.0 0.0 136.5 53.4 amar.mourya@emkayglobal.com

+91-022-66242425

ROE (%) (17.8) (1.3) 9.6 20.6 26.6

P/E (x) (31.3) (449.5) 57.7 24.4 15.9 Rohit Sinha

rohit.sinha@emkayglobal.com

EV/EBITDA (x) 73.4 28.7 18.4 13.2 10.1

022-266121306

P/BV (x) 5.7 5.8 5.4 4.7 3.8

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer

to the last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Snapshot

Unfolding tailwinds set the stage for historically high margins to reemerge

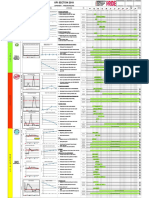

Exhibit 1: EBITDA Margin Trend (%)

13.1

12.4 Amalgamated loss making business: Dahej technical issues are behind also seen uptick in

11.6 11.6 BASF Construction Chemicals (India), BASF capacity utilization and contributed Rs10bn t o revenue with

Coatings (India) & BASF Polyurethanes India ~50% capacity utilization

9.7

9.2 Dahej plant has the potential to add Rs28 bn at peak

8.9

capacity utilization level, which we are expecting by 2020

7.3

6.2 6.2 Dahej facility is positioned to replaced bulk of low margin

5.9 6.0

trading business Polyurethanes [BASF Polyurethane s

5.3

India] and Dispersions [BASF Coatings/ Construction]

with local manufacturing

Largest investment made to manufacture 2.8

Polyurethanes, Construction, and Coatings 2.2 Current changes will lead to higher manufacturing business

chemicals locally, but plant was down due to to 79% (v/s 67% in FY17) of the total revenue by 2020.

technical issues These recent changes could lead to historic high margins.

FY6 FY7 FY8 FY9 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research

Gravitating towards a sustainable turnaround

Dahej Chemical complex has the potential to add 55% to the current revenue

Plans 13 new product launches in high-margin Agrochemicals segment, largely

manufactured locally

Backward integration of Construction & Coating division likely to propel margins

Indigenization of care-chemical feedstock by introduction of first sulfation plant in India

First MDI Splitter cracker in South Asia installed by BASF India. The potential market size

of this product is Rs3.8-5.8bn and BASF India already commands strong market share,

which will be replaced by manufactured MDI Splitter (v/s Traded MDI Splitter)

Valuation compelling

We are comparing BASF India with listed MNC chemical names like Bayer Crop Science and

Akzo Nobel India, which are trading in the range of 18-20x EV/EBITDA. We are valuing BASF

India at 14.4x FY20E EV/EBITDA and arrive at a TP of Rs2,212 per share, which implies a

sizable 46% upside from the current market price.

Exhibit 2: Asia-Pacific EBIT margin trend (%) Exhibit 3: Peer Valuation

31.2x

9% 28.3x

23.2x 23.8x

23.1x

19.8x 18.2x 18.0x

5%

13.0x

4%

Akzo Nobel India Ltd BASF India Ltd Bayer Cropscience

Ltd

2014 2015 2016 FY 17 FY 18E FY 19E

Source: Company, Emkay Research Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 2

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

A. Manufacturing SBU: Seeing improvement in revenue

BASF India’s business is broadly divided into 3 SBUs - Manufacturing, Trading and Services

while the horizontal bifurcation is in terms of 5 key areas - Performance Products, Functional

Material & Solutions, Agriculture Solutions and Others. The key industry in which BASF operates

in India is illustrated below.

As can be seen from the below table, Manufacturing remains the largest SBU for BASF India.

Additionally, this remains the most profitable among the 3 SBUs. The German parent is aiming

for ~75% local production of products it sells in Asia Pacific by 2020. In Asia Pacific, BASF SE

intends to grow profitably with a sales target of US$30bn by 2020.

In order to achieve the 2020 revenue target, BASF SE has announced investment of US$12bn,

c.9,000 new jobs and annual savings of US$2bn. Further, c.25% of BASF SE’s global R&D will

be conducted in Asia Pacific by 2020, to develop innovative solutions that address the region’s

challenges.

The Asian region is one of the fastest growing geographies for BASF SE. Higher GDP growth

and rising income levels are likely to keep up the momentum and the region is expected to

expand at a CAGR of c.6% during 2016-20. The Asian region reported US$14.4bn revenue in

2016, contributing 20% to BASF SE’s overall revenue. Revenue is expected to reach c.US$30bn

by 2020, forming 25% of the total BASF SE revenue. BASF SE’s revenue from India stood at

US$0.79bn in FY17. However, India is likely to outperform the Asian region with growth rate in

mid-teens. The key trigger for BASF India’s growth would be back-ended capex of Rs16.0bn and

sharper focus on R&D investments.

Exhibit 4: BASF India Business Model

Manufacturing Trading Service Total

As % of SBU's Revenue As % of total revenue

Performance Dispersion: 9% |Rs2.9bn

Pigments: 9% | Rs 1.3 bn Performance Products:

Products Care Prod: 3% | Rs 0.9bn ------------No------------

Others: 54% | Rs 7.9 bn 39% | Rs.19.7 bn

Others: 20% | Rs6.7 bn

Eng. Plastic: 14% |Rs4.6bn Functional Material &

Functional Auto. Coatings: 9%|Rs3.2bn

Material & Construction: 4% | Rs1.5bn

PU: 17% | Rs 2.4 bn ------------No------------ Solutions:

PU: 25% | Rs8.4bn 40% | Rs.20.3 bn

Agriculture Agriculture

Herbicides: 17% |Rs5.7bn

Solutions Fungicides: 6% | Rs 0.9 bn ------------No------------ Solutions:

13% | Rs.6.6bn

Chemicals Chemicals:

------------No------------ ------------No------------ Monomers: 15% | Rs 2.1 bn

4% | Rs.2.1bn

Others Technical: 47% | Rs 0.9 bn Others:

------------No------------ ------------No------------

Others: 53% | Rs 1.0bn 4% | Rs.1.9bn

As % of total revenue

67% 29% 4% 100%

(Rs34.2 bn) (Rs14.6 bn) (Rs19.6 bn) (Rs50.8 bn)

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 3

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Exhibit 5: BASF Asia Pacific 2020 Sales Target

($ Bn) 2016 2017E 2018E 2019E 2020E CAGR

World Chemical Production ($ Bn) 3715 3856 4003 4155 4312 3.8%

Asia Pacific Chemical Production ($ Bn) 1997 2111 2231 2359 2493 5.7%

BASF Asia Pacific Revenue ($ Bn) 14.4 17.3 20.8 24.9 29.9 20.0%

As % of Asia Pacific 0.7% 0.8% 0.9% 1.1% 1.2%

EBIT ($ Bn) 1.1 1.5 1.8 2.1 2.5 23.2%

EBIT Margin % 9% 10% 10% 10% 10%

BASF Region-Wise Revenue Mix ($ Bn) 2016 2017E 2018E 2019E 2020E CAGR

China 7.1 8.7 10.8 13.3 16.5 23.6%

South Asia (India/Pakistan/Bangladesh/Sri Lanka) 1.6 1.8 2.1 2.4 2.7 14.6%

South East Asia 2.2 2.5 2.9 3.3 3.8 15.4%

Japan 1.9 2.1 2.3 2.6 2.9 11.7%

South Korea 1.3 1.4 1.5 1.7 1.8 8.5%

ANZ 0.4 0.5 0.6 0.7 0.9 20.0%

Others 0.0 0.2 0.5 0.8 1.2 0.0%

Total 14.4 17.3 20.8 24.9 29.9 20.0%

Source: Company, Emkay Research

Exhibit 6: Global Chemical Production ($ Trillion ) Exhibit 7: Asia Pacific Chemical Production ($ Trillion)

Source: Company, Emkay Research Source: Company, Emkay Research

Exhibit 8: BASF Asia Pacific Revenue Mix (%) Exhibit 9: BASF India Revenue Mix (%)

Others

2% Agricultural

Functional Solution…

Materials &

Solutions…

Performanc

Chemi… e Products

41%

Source: Company, Emkay Research Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 4

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

A.1 BASF India at an inflection point; Dahej plant to spur revenue

growth

Post the commencement of Dahej operations in FY15, BASF India’s gross block increased to

Rs18.7bn (v/s Rs9.0bn in FY14). However, revenue growth acceleration was not in tandem with

gross block due to technical issues. As a result, manufacturing revenue-to-fixed asset ratio

declined to 1.5x in FY15 from 3.0x in FY14. But, the Dahej plant has stabilized in the last 2 years

and technical issues have also been resolved. Over the next 3 years, based on product wise

plant capacities, Dahej can add ~Rs28.4bn to Manufacturing revenue (See Table Below).

Exhibit 10: Manufacturing Revenue-to-Gross Block Exhibit 11: Manufacturing Revenue Trend

3.6x 60,000

3.5x

3.4x 50,000

3.0x 40,000

30,000

2.4x

2.1x 20,000

2.0x 10,000

1.5x

1.7x

1.6x 0

FY15 FY16 FY17 FY18e FY19e FY20e

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18e FY19e FY20e Manf. Rev: Dahej Manf. Rev: Non-Dahej

Source: Company, Emkay Research Source: Company, Emkay Research

In FY17, the company’s Manufacturing revenue increased by 11.5% yoy to Rs34.2bn (v/s

Rs30.6bn in FY16), driven by enhanced plant utilization. On a full year basis, the Dahej plant’s

revenue jumped 66.7% yoy to Rs10bn (v/s Rs6.0bn in FY16) and contributed 29.2% to the

Manufacturing business revenue. The Dahej plant’s contribution to the overall Manufacturing

revenue could further increase to 51.0% in FY20E.

Exhibit 12: FY17 – Dahej Plant Revenue Mix Exhibit 13: FY20E – Dahej Plant Revenue Mix

Cellasto TPU Polyols

2% 1% 2% Dispersions Cellasto TPU Polyols

MDI Splitter 6%

9% 6% 1%

2%

MDI Splitter

Surfactants 1%

17% Dispersions

21%

Surfactants

PU

29%

PU 36%

67%

Source: Company, Emkay Research Source: Company, Emkay Research

Exhibit 14: FY17 – Manf. Rev: Dahej v/s Non-Dahej Exhibit 15: FY20 – Manf. Rev: Dahej v/s Non-Dahej

Manf. Rev:

Dahej Manf. Rev:

29% Non-Dahej

Manf. Rev: 48% Manf. Rev:

Non-Dahej Dahej

71% 52%

Source: Company, Emkay Research Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 5

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

The overall Manufacturing revenue is expected to deliver revenue CAGR of 16.8% yoy during

FY17-20E on the back of the expected uptick in the Dahej plant utilization. Additionally, the

overall Manufacturing revenue contribution to the total topline will increase from 67% in FY17 to

77% in FY20E. In our view, enhanced Manufacturing revenue contribution will be a key trigger

for overall EBITDA expansion going forward. In FY17, the total EBITDA increased by 155% yoy

to Rs2.7bn (v/s Rs1.1bn in FY16).

Exhibit 16: Manufacturing Revenue (as % of total revenue) Exhibit 17: Overall EBITDA Margin Trend (%)

75% 78%

71% 9.9

65% 67% 8.9

61%

7.3

5.3

2.8

2.2

FY15 FY16 FY17 FY18e FY19e FY20e FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research Source: Company, Emkay Research

Why Dahej plant is so crucial for BASF India?

The Dahej plant is the biggest investment (c.Rs10bn/US$180mn) made by BASF in India. The

strengthening of the production platform in India is part of BASF SE’s investment plans for the

Asia-Pacific region, where the German parent aspires to invest more than US$12bn (Rs778bn)

between 2013 and 2020. The plant is located at Dahej Petroleum, Chemicals and

Petrochemicals Investment Region (PCPIR). With this new facility, BASF India will significantly

increase its competitiveness in the Indian market.

The Dahej plant is divided into 4 key products: (1) Integrated Polyurethane (PU) Complex,

(2) Surfactants, (3) Polymeric Dispersion and (4) Automotive Engine Coolants Fluid. There

are 11 plants, which are divided into below mentioned product lines.

Exhibit 18: BASF - Dahej Plant Manufacturing Set-up

BASF

Dahej, Plant

Products Manufactured

Integrated Polyurethane (PU) Automotive Engines

Surfactants Polymeric Dispersion

Complex (Coolant Fluid)

- Polyols - Sulfation Products - Super Concentrate Coolants - Acronals

- MDI Splitter - Low/High Temperature Reaction - Concentrate Coolants - Styronals

- PU Systems - Ready to Use Coolants - Basoplasts

- Cellasto

- TPU

Source: Company, Emkay Research

Integrated Polyurethane (PU) Complex: The Dahej plant is fully backward integrated, with

production facilities for precursors, such as Polyetherols and Polyesterols, and an MDI

(Methylene Diphenyl Diisocyanate) splitter - the first of its kind in South Asia - for processing

crude MDI. BASF India's Polyurethane plant has the capability to produce proprietary Elastollan

Thermoplastic Polyurethane (TPU), Elastocool, Elastopor, Elastogran, and Cellasto Microcellular

Polyurethane components.

TPU: Used for combination of elasticity and robustness.

Elastocool: To fill the vacuum with new refrigeration concepts.

Elastopor: Rigid foam system largely used by construction industry.

Elastogran: Structural TPU used for foot support for the feet.

Cellasto Microcellular: Used by auto industry for NVH (noise, vibration and harshness)

reduction parts like Jounce Bumper, Bump Stop and Top Mount.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 6

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

The addressable market for Polyurethane in India is c.Rs108bn with volume growth in the range

of 7-8%. BASF India has an advantage due to its integrated production facilities for Polyetherols,

Polyesterols and MDI Splitter, which is a feedstock for PU Systems. Typically, one metric tonne

of Polyurethane Foam needs 616kg of MDI and 386kg of Polyol, with 54kg of Pentane acting as

a blowing agent. The largest demand in India is demonstrated for Rigid Polyurethane followed

by Slabstock, Shoe Sole, Flxmolded, Case and TPU.

The dynamics of MDI Splitter business is also very strong and BASF India is the only producer

in the country. The market size (Rs3.8-5.8bn) is huge and BAFS India commands a strong

market share in this space. The key reason behind putting up the MDI Splitter plant was to

replace imports from BASF Korea with domestic production. However, due to some technical

issues at the Dahej plant, BASF India was not able to produce as per the clients’ specifications.

The management indicated that major technical issues are behind and seamless production is

possible over the medium term. The actual revenue potential from this unit at peak capacity

would be ~Rs14.3bn with c.15-16% EBITDA margin.

Exhibit 19: PU Demand Mix (%) India Exhibit 20: Huntsman MDI Splitter/PU EBITDA Margin Trend

TPU 16% 16%

CASE 1%

15% 15% 15%

5% 14%

SLABSTOCK

27% 11%

SHOE SOLES

9%

20%

RIGIDS

30%

FLXMOLDED

17% 2010 2011 2012 2013 2014 2015 2016 2017

Source: Company, Emkay Research Source: Company, Emkay Research

Exhibit 21: Global Players in MDI Space

12

Huntsman

Degree of Differentiation

10

Top 5 MDI BASF

8

Producers = 90%

Covestro

6

DOW

4

2 Wanhua

0 Crude MDI Capacity Size

0 200000 400000 600000 800000 1000000 1200000

Source: Company, Emkay Research

Surfactants: BASF India’s Dahej plant will produce a wide variety of Surfactants that are used

in Home Care and Personal Care. The company has core competencies in Alkoxylation and

Nonionic chemistries. The Dahej site integrates India’s first Sulphation plant to produce

Surfactants for Home Care and Personal Care. These Surfactants will also add value to

formulation technology applications, including Agrochemicals, Textiles and Emulsion

Polymerisation.

Surfactants for Home Care and Personal Care are manufactured using either natural or synthetic

ingredients. In India as well as in the developed countries, there is a gradual shift in consumers’

preferences for natural ingredients-based FMCG products. The Dahej site is certified by

Roundtable on Sustainable Palm Oil (RSPO) to produce sustainable oil palm products. This is a

positive for companies like BASF India, which mainly focuses on natural ingredients-based

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 7

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Surfactants for Home Care and Personal Care products. The key raw materials for production of

Surfactants are Oleo-chemicals (fatty alcohols & fatty acids), Ethylene Oxide, Phenol etc.

The overall industry size of the Indian Surfactants market is c.US$3,748mn (Rs243bn) and it is

estimated to grow at 13% annually. However, the personal care surfactants market is estimated

at c.US$547mn (Rs36bn), which is largely dominated by Galaxy Surfactants and BASF. The

actual revenue potential from this unit at peak capacity would be ~Rs7.2bn with EBITDA

margin of c.8-10%.

Exhibit 22: Types of Surfactants

Surfactants Types Characteristics Uses

Anionic Surfactants

BASF Portfolio

- Fatty alcohol ethersulfates Shampoos, toothpastes, body wash formulations,

High foam and dirt removal properties

- Fatty alcohol sulfates laundry detergents and dishwashing products

- Linear alkylbenzene sulfonates

- Oleic acid sulfonates

Nonionic surfactants

BASF Portfolio

- Alcohol ethoxylates

- Alkyl polyglucosides

- Amine ethoxylates

- Aminopolyol

Cosmetics, personal care like shampoos, bath & shower

- Resins precursors and additives

products, home care products like liquid detergents

- Emulsifiers and Solubilizers

- Foam suppressors

- Low-foaming nonionic surfactants

- Special Surfactants

- Agro blends

-Unsaturated alcohol ethoxylates

Cationic surfactants Helps in conditioning due to substantively to hair and

Hair conditioners and fabric softeners

- Betaines antimicrobial properties

Amphoteric surfactants

Dermatological properties and reduces skin irritation Personal care and household cleaning products

- Betaines

Surface active preparations Preformulated and is a mixture of various surfactants Shampoo, body wash, syndet and transparent soap bars

Source: Company, Emkay Research

Polymeric Dispersion: The Polymer Dispersions plant, which complements BASF India's

existing dispersions facility in Mangalore (largest plant in India), produces BASF's proprietary

Acronal and Styrofan products for Architectural Coatings, Adhesives and Construction Materials;

Styronal and Basonal for Paper Coating, and Basoplast for Sizing. The plant will cater to North

and West Indian markets.

Acronal: This is a water-based acrylic and styrene acrylic dispersions, which are used as

binders in high quality Architectural Coatings, Adhesives, Construction and Fiber Bonding

applications. Acronal redispersable powders act as co-binders in dry mix mortars and

improve their properties in a wide range of construction applications. Under the Acronal

brand, BASF India offers a comprehensive range of Acrylate Dispersions and Acrylate

Dispersion Powders, which are used for the production and formulation of Paints,

Adhesives, Sealants, Construction Materials & Fiber Bonding materials as well as in the

Paper industry.

Basoplast: This is the BASF brand name for a range of sizing agents. Sizing agents allow

control of paper absorbency. Basoplast is a well-established range of sizing agents used

in the manufacture of Printing & Writing papers, Paperboards, Newsprint and Paperboard

grades. Basoplast range of surface sizing agents provide excellent control of paper product

absorbency.

Styronal: This is the BASF brand name for a range of synthetic binders based on styrene

and butadiene copolymers used in the manufacture of Coated Paper and Coated Board.

Styronal latex binder is used for all Coated Paper and Board segments. Styronal is a well-

established range of synthetic binders based on styrene-butadiene copolymers that can be

used for all Paper and Board segments.

Styrofan: This is a water-based styrene butadiene dispersion. Styrofan dispersions are

used in the construction industry for fiber bonding applications, cementations as well as

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 8

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

ready-to-use construction materials and adhesives. Styrofan is a water-based styrene

butadiene dispersion. BASF offers different product grades with specific properties.

Styrofan gives elasticity, besides resistance from water and solvent. This binder makes

nonwovens more resistant and durable. This product offers excellent process ability and by

adding specific BASF additives one can easily adjust viscosity, foam-ability or wetting

properties as per the needs.

Basonal: This offers new potential for improvement with top performance in obtaining

individual properties and balance on other properties. BASF India supplies a range of

aqueous dispersions of copolymers of acrylonitrile, butadiene, butyl acrylate and styrene

under the Basonal trademark. Additionally, BASF India has recently developed and

launched its novel 3-in-1 Basonal Food Contact Board product line, which is tailor-made for

the specific requirements in food contact materials.

The actual revenue potential from this unit at peak capacity would be ~Rs6.0bn with

EBITDA margin of c.15-16%.

Exhibit 23: Polymeric Dispersion Product Portfolio

Polymeric Dispersion Acronal Styrofan Styronal Basonal Basoplast

Fiber bonding Architectural Coatings Packaging & Print Packaging & Print Packaging & Print

Adhesives Auto & Transportation Coatings Pulp & Paper Pulp & Paper Pulp & Paper

Applications

Construction Industrial coatings

Architectural Coatings

Paper

Industry Size (Rs mn) Rs 12.9 bn Rs 27.3 bn

Source: Company, Emkay Research

Automotive Engines (Coolant Fluid): BASF India’s key brand Glysantin, the original engine

coolant, offers proven triple protection against corrosion, overheating and frost. Products from

the Glysantin series have the official approvals from most manufacturers in the automotive

industry. These approvals are the result of superior quality and comprehensive technical know-

how. The actual revenue potential from this unit at peak capacity would be ~Rs1.3bn with

EBITDA margin of c.17-18%.

Exhibit 24: Coolant Fluid Application Industry

AUTOMOTIVE ENGINES (COOLANT FLUID)

Machines, Instruments

Combustion turbines and engines

Combustion

Coolant

Coolant (Turbines)

Vehicles

APPLICATIONS

Motor vehicles

Cooling System

Cooling water tanks

Corrosion (Vehicles)

Cylinder head covers

Expansion tanks

Heat exchangers

Thermostats

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017 | 9

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Exhibit 25: Dahej Plant - SBU Wise Revenue Potential (Rs mn) Exhibit 26: Dahej Plant - SBU Wise EBITDA Potential (Rs mn)

28,775

3,752

1,305

183

6,003

720

780

7,204

14,264

2,068

PU Surfactants Polymeric Auto Collent Total PU Surfactants Polymeric Auto Collent Total

Dispersion Dispersion

Source: Company, Emkay Research Source: Company, Emkay Research

What is the outlook for Non-Dahej manufacturing revenue?

In FY17, Non-Dahej Manufacturing revenue contributed ~48% (Rs24.2bn) to the total topline.

We expect revenue CAGR of 8.7% in this vertical over the next 3 years. The major positive

should be seen on the EBIT margin front due to new product launches in Agrochemicals and

favorable demand scenario in Automotive and Construction sectors. The key revenue

contributors to Non-Dahej Manufacturing business are Agrochemicals, Automotive Coatings,

Admixture System, PU, Care Products and Pigments. However, the details of all sub-segments

are not disclosed by the company.

Agrochemicals: BASF India has received approval for 11 new crop protection products from

the Central Insecticide Board, including strategic key active ingredient registrations such as

Fluxapyroxad, Metrafenone, Bentazone and Boscalid. The new products will help BASF India

service a much larger base of farmers, in particular India’s strategic rice market. BASF India’s

launch of 2 new fungicides [SELTIMA™ and ADEXAR™] and one selective herbicide

[BASAGRAN™] in Rice should bode well for driving Agrochemicals revenue, given that India has

the largest cultivated area of rice in the world at nearly 43 million hectares. In addition, 13 label

expansions have also been approved, which allow existing Agrochemicals to be used for certain

other crops. The new products like TYNZER™ in corn, XELORA™ and OPERA™ in soybean,

ACRISIO™ and MERIVON™ in specialty crops like grapes have already seen increased sales.

Many training and marketing programs have also been launched to make these products familiar

to the farmers.

Automotive Coatings: The Automotive Coatings business comprises coatings for Passenger

Cars, Commercial Vehicles and Two Wheelers. In FY17, the Automotive Coatings business grew

at an average rate. Demonetization had a dampening effect on this business from Dec.2016 to

Feb.2017. Going forward, in view of the GST implementation the Automotive industry is expected

to do well. The company is focusing on developing new products besides enhancing supply to

existing accounts and acquisition of new customers.

Construction & Admixture System: The Construction Chemicals business supplies chemical

solutions to the construction industry. The Admixture Systems segment in the Construction

Chemicals division caters to customers from the ready-mix, precast, site mix, underground

construction and the cement producing industries. This segment was affected in FY17 due to

delays in the execution of infrastructure projects, liquidity concerns and increased price pressure

from domestic as well as overseas competition. During the year, a new Admixture plant was

commissioned at Kharagpur, West Bengal, which produces the entire range of admixtures and

accelerators, and caters to the demand of customers in East India and Bhutan. The segment

offers a wide range of products & solutions such as Industrial Floorings, Grouting and Anchoring

Systems, Concrete Repair & Protection Materials, Crack Repair & Injection Resins, Joint

Sealants, Tiling Products, Waterproofing Membranes, Exterior Insulation and Facade Systems.

KPMG estimates that India’s urban population will grow from 420mn in 2015 to 583mn in 2030,

which is expected to drive demand for affordable mass housing and durable infrastructure

projects.

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 10

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Exhibit 27: Total Manufacturing Revenue Trend (Rs Mn) Exhibit 28: Non-Dahej Manufacturing Revenue Trend (Rs Mn)

58,512 29,938

28,243

26,830 25,911

47,423 24,694 24,216

39,911

34,216

28,830 30,694

FY15 FY16 FY17 FY18e FY19e FY20e FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research Source: Company, Emkay Research

A.2 Dahej Chemical Complex: Micro replica of BASF, Ludwigshafen

BASF, Ludwigshafen, Germany site is the world’s largest integrated chemical complex with an

area of approximately 10sq. km. This is BASF SE’s headquarters, where production facilities,

energy flow and logistics are networked together intelligently. This integration leads to efficient

value-adding chains from basic chemicals to highly sophisticated products. The backbone of the

Ludwigshafen production is a dense network of c.200 production plants that are connected to

each other by over 2,850 kilometers of pipelines and more than 230 kilometers of rail track. At

BASF SE’s Ludwigshafen site, c.8,000 products are manufactured with a total volume of 8.5

million metric tonne per year from just a few raw materials, such as Naphtha, Rock Salt and

Sulfur. This site also serves as a technology hub and the center of corporate research.

Exhibit 29: BASF, Ludwigshafen Product Manufacturing (v/s Dahej, Plant Product)

Segments Products Manufactured

Chemicals Petrochemicals Monomers Intermediates

Dispersions & Performance

Performance Products Care Chemicals Nutrition & Health

Pigments Chemicals

Functional Materials & Construction Performance

Catalysts Coatings

Solutions Chemicals Materials

Crop

Agricultural Solutions

Protection

Oil & Gas

Source: Company, Emkay Research

Dahej has total production capacity of 0.547mn metric tonne (~6% of BASF, Ludwigshafen Site)

per year. The plant has total plot area of 0.234Sq.Km. (v/s 10 Sq.Km at BASF, Ludwigshafen Site).

Water requirement for the Dahej facility is 4600KLD while waste water generation will be 1352KLD.

BASF India has invested Rs4.5bn for various utilities like boiler, thermic fluid heater, cooling tower,

brine plant, chilling plant, DM plant, air compressor, DG set etc. The Dahej chemical complex is the

biggest investment (c.Rs10bn) made by BASF SE in India. The strengthening of production base

in India is part of the German parent’s investment plans for the Asia Pacific region, where BASF

SE aspires to invest more than US$12bn between 2013 and 2020. BASF SE aims to increase local

production to 75% of total sales. With domestic production of feedstock increasing in India, foreign

imports are likely to reduce in the long term, a key catalyst for margin expansion. BASF SE aims

to increase Asia Pacific revenue to US$30bn in 2020E from US$14bn in 2016.

Exhibit: Dahej, Plant Capex Highest in the history of BASF India (Rs mn)

9674

1618

959 1024 1009 1026

FY12 FY13 FY14 FY15 FY16 FY17

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 11

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Power, emission data corroborate Dahej production ramp-up

Overall production volume of BASF India increased in CY16, as all the manufacturing plants at

Dahej became fully operational. The production volume is not disclosed by BASF India. However,

seeing the power consumption and emission data, we can connect the dots from the

management commentary about the potential increase in production and revenue numbers.

Exhibit 30: Fuel Consumption (MWh) - Central Power Plant & Boilers Exhibit 31: Greenhouse gas emissions (MT CO2 Equivalents)

92855 84515

86064

68554

78198

73078

2014 2015 2016 2014 2015 2016

Source: Company, Emkay Research Source: Company, Emkay Research

As a result, we are of the view that BASF India has huge potential to deliver strong revenue and

significant improvement in margin going forward, in-line with the Asia Pacific region.

Exhibit 32: Emissions to water (Nitrogen MT) Exhibit 33: Asia-Pacific EBIT margin improvement (%)

1.6 9%

1.3

5%

0.8

4%

2014 2015 2016 2014 2015 2016

Source: Company, Emkay Research Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 12

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

B. Trading SBU: Declining Contribution

Low-margin trading business should see a declining trend

BASF India’s Trading business comprises Herbicides, Pigments, Polyurethane, Fungicides,

Monomers and Petrochemical Intermediates. In FY17, the Trading business contributed 29% to

the total revenue. In the last 5 years, this segment has delivered 3.6% revenue CAGR with

average EBIT margin of ~3.5%. We expect a gradual decline in the Trading business over the

next 3 years given that BASF India is focusing more on the indigenous production and has

already invested ~Rs16.0bn in the Manufacturing business.

Exhibit 34: SBU Wise Revenue Mix (%) Exhibit 35: SBU Wise EBIT Margin

Services

4% 24.0%

Trading

29% 4.5%

Manufacturing

67% -0.4%

Trading Manufacturing Services

Source: Company, Emkay Research Source: Company, Emkay Research

Why trading business?

BASF India’s business model is largely divided into 3 parts - Manufacturing, Trading and

Services. Trading is generally pursued to launch and increase the market share of new products;

once it reaches a certain size, the product is manufactured locally. In FY17, Agriculture segment

contributed 16% to the total topline followed by Monomer (15%), Polyurethane (16%), Pigments

(9%) and others (44%).

Exhibit 36: Trading SBU Revenue Mix (%)

Herbicides

16%

Pigments

Others 9%

44%

Polyurethane

Monomer 16%

15%

Source: Company, Emkay Research

We expect Trading business to clock a revenue CAGR of -1.4% over the next 3 years (FY17-

20E), with average EBIT margin of 2.7%. In FY20E, the Trading business revenue contribution

to the total revenue is likely to decline to 19% from 29% in FY17. The major de-growth in revenue

is likely to come from Polyurethane (-30% CAGR), and Fungicides (-5% CAGR) over the next 3

years.

Exhibit 37: Services SBU Revenue Trend (Rs Mn) Exhibit 38: Services SBU EBIT Tend (Rs Mn)

1,970 500 470

1,957 1,957 1,957 1,957

1,960 369

400 350

1,950

297

1,940 300 266

1,930

1,917 200

1,920

1,910

100

1,900

1,890 -

2016 2017 2018E 2019E 2020E 2016 2017 2018E 2019E 2020E

Source: Company, Emkay Research Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 13

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

C. Service SBU: Expect Muted Show

BASF India’s Services business includes various types of technical assistance, which is offered

to customers along with the products. This segment has demonstrated 2.7% revenue CAGR

over the last 5 years. In FY17, this SBU contributed 3.9% to the total topline with 24% EBIT

margin. In the next 3 years, we expect muted revenue show from the Services business, with

average EBIT margin of 15.8%. As per our estimate, the Services business revenue contribution

will reduce to 2.6% in FY20.

Exhibit 39: Services Business Revenue Trend (Rs Mn) Exhibit 40: Services Business EBIT Trend (Rs Mn)

470

1,967 1,967 1,967

1,957 369 357

303

272

1,917

2016 2017 2018E 2019E 2020E 2016 2017 2018E 2019E 2020E

Source: Company, Emkay Research Source: Company, Emkay Research

Exhibit 41: Manufacturing Revenue Mix (%) Exhibit 42: Trading Revenue Mix (%)

Herbicides Herbicides Pigments

17% 6% 9%

Others

44% Polyurethan

e

16%

Polyurethan Others

e 59%

25%

Fungicides

Admixture Auto. OEM 10%

Systems Coatings

4% 10%

Source: Company, Emkay Research Source: C006Fmpany, Emkay Research

Exhibit 43: Services Revenue Mix (%)

Technical/Service charges

46%

Indent Commission

54%

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 14

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

D. Strong parentage to aid in new product launches

Being an innovator, BASF SE invests heavily in R&D. The company plans c.25% of global R&D

to be conducted in Asia Pacific by 2020, to not only develop innovative solutions but also to

address the region’s challenges. In keeping with this strategic thinking, BASF SE has made its

biggest R&D investment in South Asia at a new innovation campus in Mumbai, India. The project

will involve a total expected investment of up to €50mn from BASF Group. In FY17, the company

had 12 production sites and different offices, as well as 2 R&D centers, located in Mumbai and

Mangalore. With this, the Indian entity is also engaged in R&D, primarily focusing on customized

solutions to domestic customers with annual spending of Rs72.68mn in FY17, which is c.0.14%

of total revenue. We believe that the strong R&D support from the German parent will help BASF

India to introduce newer products in the domestic market.

Exhibit 44: India’s Production Site/R&D Centers

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 15

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

E. Substantial capex to reduce reliance on imports

The commencement of Dahej site will help BASF India to cater to the demand of fast-growing

segments like Personal Care, Adhesives, Appliances, Paper and Coatings etc. Additionally, the

Dahej facility is developed as a chemical complex to reduce reliance on imports by BASF India

to cater to the domestic market (import of raw materials formed ~78% of total requirement in

FY17). The parent also targets ~75% local production of the products it sells in Asia Pacific by

2020. Given that the petrochemicals capacities and feedstock availability are increasing in Asia,

we could see significant decline in the overall raw material imports of BASF India going forward.

Further, the government’s initiatives to become self-sufficient in basic chemicals will further move

the needle in terms of reduction of raw material imports.

Exhibit 45: Large Capex (Rs Mn)

9674

1449 1521 1618

959 1024 1009 1026

473 321 256

FY07 FY08 FY09 FY10 FY11 FY12 FY13 FY14 FY15 FY16 FY17

Source: Company, Emkay Research

Exhibit 46: Import (as % of the total RM Cost)

78.1% 78.1%

69.6% 71.8%

55.4% 55.8%

51.0%

FY11 FY12 FY13 FY14 FY15 FY16 FY17

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 16

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

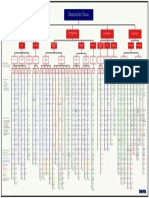

Company Background

BASF India is a subsidiary of BASF SE, the world’s largest chemicals company with global

revenue of over €57.5bn. BASF India caters to an array of customers with products like Polymers,

Tanning Agents, Leather Chemicals & Auxiliaries, Crop Protection Chemicals, Textile

Chemicals, Dispersions, Specialty Chemicals, Performance Plastics, Automotive & Coil

Coatings, Construction Chemicals, Polystyrenes etc. In FY11, the company merged 3 BASF

entities (BASF Construction Chemicals India Pvt Ltd, BASF Coatings India Ltd and BASF

Polyurethanes India Ltd with BASF India, and separately acquired Cognis Specialty Chemicals

Pvt. Ltd. However, the company’s profitability suffered significantly post this major consolidation

exercise, as many of these businesses were low-margin or loss-making due to lower volumes

and lack of manufacturing base in India. The expansion of the chemical complex at Dahej will

broadly indigenize the base chemicals for many sectors like Construction, Coatings and PU. As

a result, we are of the view that improvement in margin will be huge over the next 3 years followed

by revenue growth.

Exhibit 47: Key Management Personnel

Name Position

Dr. Raman Ramachandran Chairman & Managing Director

Mr. Narendranath Baliga Vice President- Finance & Corporate Processes

Mr. Rajesh Naik Director, Manufacturing

Mr. R. A. Shah Director

Mr. Pradip P. Shah Director

Mr. R.R. Nair Director

Mr. Arun Bewoor Director

Dr. Andrea Frenzel President, South & East Asia, ASEAN, and Australia/New Zealand

President, Performance Materials Division, BASF Belgium Coordination

Mr. Raimar Jahn

Centre

Source: Company, Emkay Research

Exhibit 48: Management Personnel

Performance Functional Material Agriculture

Chemicals Others

Product & Solution Solution

Tanning Agents Catalysts Agrochemicals Monomers Technical

Leather Chemicals Coatings which are Intermediates Service

Textile Chemicals Construction seasonal in Petrochemicals Charges

Dispersion Chemicals Chemicals nature.

Styropor Dependent

Speciality crop -Soya.

Polyurethanes

Chemicals:-

-Additives

System

-Water Treatment Engineering

-Home Care Plastics.

-Febric Care

Fine Chemicals

-Food

-Pharmaceuticals

-Animal Feed

-Cosmetic Industries

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 17

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Exhibit 49: Consolidation and acquisition strengthened BASF India portfolio

BASF and New

York based

Chatterjee group

form a strategic

alliance to

produce and BASF India

BASF acquires market merges 3 group

the coil coatings polystyrene in entities in India -

business from India. BASF takes BASF Coatings

Hydro Coatings up majority in the BASF SE (India) Pvt. Ltd.,

Worldwide and BASF acquires Ciba

partnership and BASF

Hydro Coatings Polyurethane Holding AG and

Pushpa Polymers Construction

BASF AG India ltd. is s India Ltd is begins

Pvt. Ltd is Chemicals (India)

acquires remamed as formed as a integration of

renamed BASF Pvt. Ltd. and

majority BASF Coatings 100% local Ciba

Styrene Pvt. ltd. BASF

holding subsidiary of entities around

BASF India Polyurethanes

(50.00104%

) in BASF

1995 1998 2000 2001 2005 2006 2008 2010 2011 2012

Automotive Cynamid

coating business Agro Ltd is With the global BASF AG The merger of BASF SE Expan

is acquired from merged with acquisition of acquires USA Ciba India, acquires Polyst

Dr. Beck & co. BASF India construction based Diamond Dye- Cognis (EPS)

and printing inds pursuant to chemicals Engelhard Chem and Holding part of

business is BASF's business of Corporation Ciba GmbH Plastic

acquired from worldwide Degussa AG by and Research worldwide of the

JBA Printing acquistion of BASF AG, its its Indian unit India) including its Comp

Indian unit is re-named Private Ltd Indian unit under

renamed BASF Cognis name

Construction India.

Source: Company, Emkay Research

Exhibit48: ….Consolidation and acquisition strengthened BASF India portfolio

Sold BASF's

BASF India global industrial

merges 3 group The greenfield BASF India coatings

chemical plant signed a MoU business to BASF SE, has

entities in India - signed

BASF Coatings at Dahej with Wurth India AkzoNobel, Sold

Petroleum, Pvt. Ltd to Photoinitiator agreement to

(India) Pvt. Ltd., BASF SE, acquire Solvay's

BASF Chemicals and transfer its business to IGM

announced and consider integrated

Construction Petrochemicals Import and

setting up of a global polyamide

Chemicals (India) Investment distribution

new global Restructuring of business

Pvt. Ltd. and Region in business of

business unit BASF's Plant globally for EUR

BASF Gujarat Glasurit, an

combining all its Biotechnology 1.6 bn.

Polyurethanes commence automotive

pigment (Expected to

commercial refinish paint

2010 2011 2012 2014 2015 2016 2017

BASF India Transfered the BASF has entered

merger of BASF SE Expandable

inaugurated the textile chemicals into crop

a India, acquires Polystyrene

new Agricultural business of the protection

mond Dye- Cognis (EPS), forming

Research Company to market for Rice in

m and Holding part of the

Station in Pune Archroma India

a GmbH Plastics Division India with its two

(cost ~Rs 64 Pvt Ltd.

earch worldwide of the products i.e.

Company is sold cr), will focus on Seltima and

a) including its

under the brand undertaking

ate Ltd Indian unit Adexar.

name Styropor in global research

Cognis

India. in the area of

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 18

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Financial Performance

Exhibit 50: Revenue Growth Trend (Reaching to the historical higher levels)

30%

24% 24%

25% 22%

20% 19%

17%

15%

15% 13% 12% 12% 13%

11%

10% 7%

6%

5%

1%

0%

FY18E

FY07

FY08

FY09

FY10

FY12

FY13

FY14

FY15

FY16

FY17

FY19E

FY19E

FY11*

Source: Company, Emkay Research

Exhibit 51: EBITDA Margin Trend (Margin to reach historical higher levels)

14.0 13.1

12.4

11.6 11.6

12.0

9.2 9.7

10.0 8.9

8.0 7.3

5.9 5.9 6.4 6.4

6.0 5.3

4.0 2.8

2.2

2.0

-

FY14

FY06

FY07

FY08

FY09

FY10

FY11

FY12

FY13

FY15

FY16

FY17

FY18E

FY19E

FY20E

Source: Company, Emkay Research

Exhibit 52: Sales/Fixed-Asset Turnover Ratio (x)

4.3x

3.9x 3.9x

3.5x

3.1x

2.8x 2.9x

2.5x

2.2x 2.3x

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research

Exhibit 53: RoCE Trend (%) Exhibit 54: RoE Trend (%)

21.79

24.2

16.79 19.3

12.21 12.72 12.04 11.6

10.00 10.0 9.2 9.4 9.3

8.74

4.23

-0.34 -2.7 -1.3

-2.33 -5.8

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18eFY19eFY20e FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18eFY19eFY20e

Source: Company, Emkay Research Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 19

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Exhibit 55: Net Debt/Equity Exhibit 56: Cash Balance (Rs Mn)

1.3x

1.2x

1.1x 1948

0.9x

0.8x 1513 1482

0.7x 1277

0.5x

0.3x

0.2x 339 251

0.1x 185 156 151

32

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18eFY19eFY20e FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18eFY19eFY20e

Source: Company, Emkay Research Source: Company, Emkay Research

Exhibit 57: Cash Conversion Cycle (Days)

67

64

54

49 50 49 46

41

38 38

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research

Exhibit 58: RoIC (%)

19.3

15.3

10.2

8.9 8.5 8.1

5.3

4.0

-0.4

-2.3

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research

Exhibit 59: Dividend Yield (%)

1.49 1.49

0.47

0.27

0.16

0.04 0.05 0.03 0.07

0.01

FY11 FY12 FY13 FY14 FY15 FY16 FY17 FY18e FY19e FY20e

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 20

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Valuation

In FY17, BASF India posted a 7% jump in revenue at Rs50.79bn (v/s Rs47.49bn). However,

demonstrated 310 BPS YoY expansion in EBITDA margin to 5.3% (v/s 2.2% in FY16). EBITDA

profit jumped by 155% yoy to Rs2.69bn. The higher depreciation and interest costs, resulted in

net loss of Rs141mn in FY17. The last few years have been affected by the addition of new

capacity, consolidation of loss making business and subdued demand.

We believe that the recent capex has started reaping a rich harvest and the company will be able

to comfortably report 13.6% CAGR in revenue to Rs74.49bn over FY17-20E. The company’s

Agrochemicals division has suffered from single crop dependence and lack of rich product

basket. The recent launch of thirteen new products in rice, corn, soya, grapes and apple is likely

to bode well on revenue growth and margin. Additionally, the company key concern - low Dahej

plant utilization level also seen the uptick with rise in profitability. The major negatives begin to

reverse in 2017. Going forward the growth momentum is expected to accelerate from its new

facility at Dahej, which can potentially add c.Rs2.8bn in revenue during next three years.

Additionally, the economies of scale and operational efficiency will help BASF India to expand

margins.

We estimate margin expansion from 5.3% in FY17 to 7.3% in FY18E and further to 8.9%/9.7%

in FY19/20E. Consequently, the net loss of FY17 is expected to turn into a profit in FY18 at

Rs1.1bn, and thereafter will exhibit exponential growth. We estimate a CAGR of 13.6% in

revenue and 39.1% in operating profit. This growth is backed by robust growth in Agricultural

Solutions, Performance Chemicals and Functional Solutions businesses along with margin

expansion. We initiate BUY with TP of Rs2,212 (14.4x FY20 EV/EBITDA) with a 51% upside

potential.

Exhibit 60: Peer Valuation (EV/EBITDA)

35.0x 31.2x

30.0x 28.3x

23.2x 23.1x 23.8x

25.0x

19.8x

20.0x 18.2x 18.0x

15.0x 13.0x

10.0x

5.0x

0.0x

Akzo Nobel India Ltd BASF India Ltd Bayer Cropscience Ltd

FY 17 FY 18E FY 19E

Source: Company, Emkay Research

Exhibit 61: Peer Valuation (RoCE)

35% 33%

30%

30% 26% 27%

24%

25%

20% 17% 16%

15%

10%

10%

4%

5%

0%

Akzo Nobel India Ltd BASF India Ltd Bayer Cropscience Ltd

FY 17 FY 18E FY 19E

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 21

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Key Financials (Standalone)

Income Statement

Y/E Mar (Rs mn) FY16 FY17 FY18E FY19E FY20E

Net Sales 47,492 50,798 56,290 63,602 74,497

Expenditure 46,434 48,101 52,190 57,939 67,240

EBITDA 1,058 2,697 4,099 5,662 7,257

Depreciation 1,631 1,690 1,657 1,492 1,490

EBIT (573) 1,007 2,443 4,170 5,767

Other Income 29 285 20 156 121

Interest expenses 1,481 1,416 1,340 1,324 1,193

PBT (2,025) (125) 1,123 3,002 4,695

Tax 0 17 22 400 704

Extraordinary Items 1,721 0 0 0 0

Minority Int./Income from Assoc. 0 0 0 0 0

Reported Net Income (304) (141) 1,100 2,602 3,991

Adjusted PAT (2,025) (141) 1,100 2,602 3,991

Balance Sheet

Y/E Mar (Rs mn) FY16 FY17 FY18E FY19E FY20E

Equity share capital 433 433 433 433 433

Reserves & surplus 10,727 10,590 11,387 13,037 16,075

Net worth 11,160 11,023 11,820 13,469 16,508

Minority Interest 0 0 0 0 0

Loan Funds 14,209 14,121 13,871 12,621 11,221

Net deferred tax liability 0 0 0 0 0

Total Liabilities 25,369 25,144 25,692 26,091 27,730

Net block 12,889 12,224 10,291 10,599 10,909

Investment 2,038 2,141 2,141 2,141 2,141

Current Assets 22,288 24,112 27,863 29,894 34,113

Cash & bank balance 32 251 1,948 1,513 1,482

Other Current Assets 0 0 0 0 0

Current liabilities & Provision 12,397 13,662 14,932 16,872 19,762

Net current assets 9,891 10,451 12,931 13,023 14,351

Misc. exp 0 0 0 0 0

Total Assets 25,369 25,144 25,692 26,091 27,730

Cash Flow

Y/E Mar (Rs mn) FY16 FY17 FY18E FY19E FY20E

PBT (Ex-Other income) (NI+Dep) (2,054) (410) 1,103 2,846 4,574

Other Non-Cash items 0 0 0 0 0

Chg in working cap 2,222 (340) (784) (526) (1,359)

Operating Cashflow 1,550 1,849 1,873 3,568 4,121

Capital expenditure (1,009) (1,026) (1,700) (1,800) (1,800)

Free Cash Flow 542 823 173 1,768 2,321

Investments 0 0 0 0 0

Other Investing Cash Flow 880 119 1,977 0 0

Investing Cashflow (129) (906) 277 (1,800) (1,800)

Equity Capital Raised 0 0 0 0 0

Loans Taken / (Repaid) (4,508) (87) (250) (1,250) (1,400)

Dividend paid (incl tax) (17) (43) (303) (952) (952)

Other Financing Cash Flow 3,340 824 1,440 1,324 1,193

Financing Cashflow (2,666) (723) (453) (2,202) (2,352)

Net chg in cash (1,245) 219 1,697 (434) (31)

Opening cash position 1,277 32 251 1,948 1,513

Closing cash position 32 251 1,948 1,513 1,482

Source: Company, Emkay Research

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 22

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Key Ratios

Profitability (%) FY16 FY17 FY18E FY19E FY20E

EBITDA Margin 2.2 5.3 7.3 8.9 9.7

EBIT Margin (1.2) 2.0 4.3 6.6 7.7

Effective Tax Rate 0.0 (13.3) 2.0 13.3 15.0

Net Margin (4.3) (0.3) 2.0 4.1 5.4

ROCE (2.0) 5.1 9.7 16.7 21.9

ROE (17.8) (1.3) 9.6 20.6 26.6

RoIC (2.4) 4.5 11.2 19.2 25.1

Per Share Data (Rs) FY16 FY17 FY18E FY19E FY20E

EPS (46.8) (3.3) 25.4 60.1 92.2

CEPS (9.1) 35.8 63.7 94.6 126.6

BVPS 257.8 254.6 273.0 311.1 381.3

DPS 0.4 1.0 7.0 22.0 22.0

Valuations (x) FY16 FY17 FY18E FY19E FY20E

PER (31.3) (449.5) 57.7 24.4 15.9

P/CEPS (164.8) 41.9 23.6 15.9 11.8

P/BV 5.7 5.8 5.4 4.7 3.8

EV / Sales 1.6 1.5 1.3 1.2 1.0

EV / EBITDA 73.4 28.7 18.4 13.2 10.1

Dividend Yield (%) 0.0 0.1 0.5 1.5 1.5

Gearing Ratio (x) FY16 FY17 FY18E FY19E FY20E

Net Debt/ Equity 1.3 1.3 1.0 0.8 0.6

Net Debt/EBIDTA 13.4 5.1 2.9 2.0 1.3

Working Cap Cycle (days) 75.8 73.3 71.2 66.0 63.0

Growth (%) FY16 FY17 FY18E FY19E FY20E

Revenue 0.9 7.0 10.8 13.0 17.1

EBITDA (20.5) 155.0 52.0 38.1 28.2

EBIT 0.0 0.0 142.6 70.7 38.3

PAT 0.0 0.0 0.0 136.5 53.4

Quarterly (Rs mn) Q1FY17 Q2FY17 Q3FY17 Q4FY17 Q1FY18

Revenue 13,949 12,919 11,225 12,753 15,101

EBITDA 776 526 155 1,217 700

EBITDA Margin (%) 5.6 4.1 1.4 9.5 4.6

PAT 115 (194) (461) 451 (30)

EPS (Rs) 2.7 (4.5) (10.9) 9.5 (0.7)

Source: Company, Emkay Research

Shareholding Pattern (%) Jun-16 Sep-16 Dec-16 Mar-17 Jun-17

Promoters 73.3 73.3 73.3 73.3 73.3

FIIs 1.3 2.0 2.3 2.8 3.0

DIIs 7.3 7.2 7.1 6.9 6.8

Public and Others 18.0 17.5 17.3 16.9 16.8

Source: Capitaline

Emkay Research is also available on www.emkayglobal.com, Bloomberg EMKAY<GO>, Reuters and DOWJONES. DBS Bank Ltd, DBS Vickers Securities (Singapore) Pte Ltd,its respective connected and associated corporations and affiliates are the distributors of the research reports, please refer to the

last page of the report on Restrictions on Distribution. In Singapore, this research report or research analyses may only be distributed to Institutional Investors,Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore

ED: HEMANT MARADIA SA: DHANANJAY SINHA October 5, 2017| 23

BASF India Ltd (BASF IN) India Equity Research | Initiating Coverage

Emkay Rating Distribution

BUY Expected total return (%) (Stock price appreciation and dividend yield) of over 25% within the next 12-18 months.

ACCUMULATE Expected total return (%) (Stock price appreciation and dividend yield) of over 10% within the next 12-18 months.

HOLD Expected total return (%) (Stock price appreciation and dividend yield) of upto 10% within the next 12-18 months.

REDUCE Expected total return (%) (Stock price depreciation) of upto (-) 10% within the next 12-18 months.

SELL The stock is believed to underperform the broad market indices or its related universe within the next 12-18 months.

Completed Date:

Dissemination Date:

Sources for all charts and tables are Emkay Research unless otherwise specified.

GENERAL DISCLOSURE/DISCLAIMER BY EMKAY GLOBAL FINANCIAL SERVICES LIMITED (EGFSL):

Emkay Global Financial Services Limited (CIN-L67120MH1995PLC084899) and its affiliates are a full-service, brokerage, investment banking, investment

management and financing group. Emkay Global Financial Services Limited (EGFSL) along with its affiliates are participants in virtually all securities trading

markets in India. EGFSL was established in 1995 and is one of India's leading brokerage and distribution house. EGFSL is a corporate trading member of

Bombay Stock Exchange Limited (BSE), National Stock Exchange of India Limited (NSE), MCX Stock Exchange Limited (MCX-SX). EGFSL along with its

subsidiaries offers the most comprehensive avenues for investments and is engaged in the businesses including stock broking (Institutional and retail),

merchant banking, commodity broking, depository participant, portfolio management, insurance broking and services rendered in connection with

distribution of primary market issues and financial products like mutual funds, fixed deposits. Details of associates are available on our website i.e.

www.emkayglobal.com

EGFSL is registered as Research Analyst with SEBI bearing registration Number INH000000354 as per SEBI (Research Analysts) Regulations, 2014.

EGFSL hereby declares that it has not defaulted with any stock exchange nor its activities were suspended by any stock exchange with whom it is registered

in last five years, except that NSE had disabled EGFSL from trading on October 05, October 08 and October 09, 2012 for a manifest error resulting into a

bonafide erroneous trade on October 05, 2012. However, SEBI and Stock Exchanges have conducted the routine inspection and based on their

observations have issued advice letters or levied minor penalty on EGFSL for certain operational deviations in ordinary/routine course of business. EGFSL

has not been debarred from doing business by any Stock Exchange / SEBI or any other authorities; nor has its certificate of registration been cancelled

by SEBI at any point of time.

EGFSL offers research services to clients as well as prospects. The analyst for this report certifies that all of the views expressed in this report accurately

reflect his or her personal views about the subject company or companies and its or their securities, and no part of his or her compensation was, is or will

be, directly or indirectly related to specific recommendations or views expressed in this report.

Other disclosures by Emkay Global Financial Services Limited (Research Entity) and its Research Analyst under SEBI (Research Analyst) Regulations,

2014 with reference to the subject company(s) covered in this report

EGFSL and/or its affiliates may seek investment banking or other business from the company or companies that are the subject of this material. Our

salespeople, traders, and other professionals may provide oral or written market commentary or trading strategies to our clients that reflect opinions that

are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that may be

inconsistent with the recommendations expressed herein. In reviewing these materials, you should be aware that any or all of the foregoing, among other

things, may give rise to real or potential conflicts of interest including but not limited to those stated herein. Additionally, other important information

regarding our relationships with the company or companies that are the subject of this material is provided herein. This report is not directed to, or intended

for distribution to or use by, any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction where such

distribution, publication, availability or use would be contrary to law or regulation or which would subject EGFSL or its group companies to any registration