Professional Documents

Culture Documents

Charts of Accounts of Eagle Wheels Auto Solutions For QB

Charts of Accounts of Eagle Wheels Auto Solutions For QB

Uploaded by

Muhammad UsmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Charts of Accounts of Eagle Wheels Auto Solutions For QB

Charts of Accounts of Eagle Wheels Auto Solutions For QB

Uploaded by

Muhammad UsmanCopyright:

Available Formats

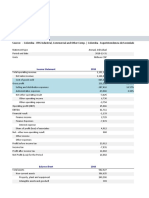

Eagle Wheels Automotive Solutions

Statement of Charts of Accounts

Account Number Account Name Account Type

Assets

1010 Cash on Hand Bank/Cash Account

1020 Checking Account Bank/Cash Account

1030 Savings Account Bank/Cash Account

1040 Accounts Receivable Accounts Receivable

1050 Inventory Other Current Asset

1060 Prepaid Expenses Other Current Asset

1070 Fixed Assets Fixed Asset

Liabilities

2010 Accounts Payable Accounts Payable

2020 Credit Card Payable Credit Card

2030 Loans Payable Loan

2040 Accrued Expenses Other Current Liability

2050 Taxes Payable Other Current Liability

Equity

3010 Owner's Equity Equity

3020 Retained Earnings Equity

Income

4010 Car/Vehicle Repair Services Service/Sales

4020 Car/Vehicle Washing Services Service/Sales

4030 Parts Sales Product/Service

4040 Miscellaneous Income Other Income

Cost of Goods Sold

5010 Cost of Parts Cost of Goods Sold

5020 Direct Labor Cost of Goods Sold

Expenses

6010 Advertising and Marketing Advertising/Marketing

6020 Rent or Lease Rent/Lease

6030 Utilities Utilities

6040 Insurance Insurance

6050 Office Supplies Office Expense

6060 Vehicle Expenses Auto Expense

6070 Repairs and Maintenance Repairs/Maintenance

6080 Professional Services Professional Fees

6090 Salaries and Wages Payroll Expense

6100 Employee Benefits Payroll Expense

6110 Training and Education Professional Development

6120 Travel and Entertainment Travel/Entertainment

6130 Depreciation and Amortization Depreciation

6140 Taxes and Licenses Taxes/Licenses

Opening Opening

Detail Type Tax Rate Balance Balance Date

Cash & Cash Equal

Cash & Cash Equal

Cash & Cash Equal

Receivables

Stock in business

Adv payments agt Exp

Machines, Building, Furniture, Computer and

other Fixed Assets of Business

Payables of Business

Payables of Business

Payables of Business

Payables of business which are stil not paid

Govt. Taxes Paybale

Capital

Accumulated Profit account

Income from Car repair Service

Income from car wash service

Selling of Auto Parts

Other Income

Purchased Cost of Auto Parts

Direct Labour charges

Ads & Marketing Exp

Rent Exp

Utilities Exp

Insurance Exp

Office Supplies Exp

Vedicle running Exp

R/M Exp related to the Business

Professional and Legal Services

Salaries of employees

Benefits given to Employees

Professional Development Exp related to

business

Travelling and Entertainment Exp of the Business

Depreciation of fixed assets and Amortization of

Non tangiable assets

Taxes and Licenses fee Exp

Account Number Account Name Acount Type

1000 Cash in Hand Bank

1001 Cash in Hand -HO Bank

1002 Cash in Hand - SHOP Bank

1003 Cash in Hand - WELLS FARGO Bank

1020 WELLS FARGO Bank USA Bank

1021 Paypal Bank

1040 Investments Current Asset

1060 Accounts Receivable Accounts Receivable

1100 Allowance for Bad Debts Allowance for Bad Debts

1199 Grants Receivable Grants Receivable

1200 Advances Current Asset

1250 Prepayments Current Asset

1251 Advance to Employees Current Asset

1252 Prepaid Expenses Current Asset

1300 Other Sundry Assets Current Asset

1380 Inventory Inventory

1400 Land Fixed Asset

1500 Buildings Fixed Asset

1550 Furniture and Fixtures Fixed Asset

1580 Equipment Fixed Asset

1600 Vehicles Fixed Asset

1650 Patents, TradeMarks and Copyrights Fixed Asset

1700 Other Fixed Assets Fixed Asset

2000 Accounts Payable Liability

2100 Accrued payroll Liability

2110 Accrued payroll taxes Liability

2115 Accrued Employee Benefits Liability

2150 Grants & allocations payable Liability

2200 Deferred Revenue Liability

2300 Accrued Expenses Liability

2400 Unearned/deferred revenue Liability

2420 Deferred contract revenue Liability

2500 Advances Liability

2570 Line of credit Liability

2590 Other Current Liabilities Liability

2600 Long Term Loans Liability

2620 Bonds payable Liability

2640 Mortgages payable Liability

2690 Other Long Term Liabilities Liability

3000 Restricted net assets Equity

3100 Board-designated net assets Equity

3130 Retained Earnings Equity

3150 Restricted Funds Equity

4000 Donations and Grants - Individuals Income

4050 Donations and Grants - Government Income

4100 Donations and Grants - Foundations Income

4150 Donations and Grants - Corporate Income

4200 Fundraising and Events Income

4300 Gifts in kind - Goods Income

4340 Gifts in kind - Services Income

4350 Memberships Fees Income

4400 Programs Income

4500 Interest Income Income

4600 Other Income Income

5000 Payroll and Wages Expense

5010 Payroll Taxes Expense

5100 Rent Expense Expense

5110 Utilities Expense Expense

5120 Repair and Maintenance Expense Expense

5140 Travel Expense Expense

5141 Airfare Expense Expense

5142 Lodging Expense Expense

5143 Ground Transportation Expense Expense

5144 Meals and Entertainment Expense Expense

5145 Other Traveling Expense Expense

5150 Transportation Expense Expense

5151 Vehicle Expenses Expense

5152 Public Transportation Expense Expense

5153 Ride-Sharing Services Expense

5154 Tolls and Parking Expenses Expense

5155 Other Transportation Expenses Expense

5160 Advertising Expense Expense

5161 Online Advertising Expense Expense

5162 Print Advertising Expense Expense

5163 Other Advertising Expense Expense

5180 Printing and Stationary Expense Expense

5200 Program and Events Expense Expense

5201 Venue Rental Expense Expense

5202 Entertainment Expense Expense

5203 Speakers or Performers Fees Expense

5204 Supplies and Materials Expense Expense

5205 Other Program and Event Expenses Expense

5220 Education and Awareness Expense

5221 Training and Workshops Expense

5222 Community Outreach Expense

5223 Educational Materials Expense

5224 Advertising and Promotion Expense

5225 Other Education and Awareness Expense

5240 Software Expense Expense

5241 Operating Systems and Utilities Expense

5242 Productivity and Collaboration Expense

5443 Accounting and Financial Software Expense

5444 Customer Relationship Management Expense

5555 Other Software Expenses Expense

5260 Professional and Legal Fee Expense

5261 Legal Services Expense

5262 Other Professional and Legal Fees Expense

5280 Bank Fee Expense

5281 Account Maintenance Fees Expense

5282 Transaction Fees Expense

5283 Merchant Services Fees Expense

5284 Overdraft and Insufficient Funds Fees Expense

5285 Other Bank Fees Expense

5300 Fundraising Expense Expense

5301 Event Expenses Expense

5302 Marketing and Advertising Expenses Expense

5303 Donor Management Expenses Expense

5304 Professional Services Expenses Expense

5305 Other Fundraising Expenses Expense

5330 Accounting and Auditing Fees Expense

5331 Accounting and Bookkeeping Expense

5332 Tax Preparation Expense

5333 Audit Fees Expense

5334 Consulting Services Expense

5340 Telephone and Internet Expense Expense

5341 Landline Phone Expenses Expense

5342 Mobile Phone Expenses Expense

5343 Internet Expenses Expense

5444 Other Telecommunications Expenses Expense

5350 Postage and Shipping Expense

5351 Postal Mail Expense

5352 Courier and Shipping Services Expense

5353 Packaging Supplies Expense

5354 Freight and Transportation Expense

5355 Other Postage and Shipping Expenses Expense

5360 Property Taxes Expense

5361 Real Estate Taxes Expense

5362 Personal Property Taxes Expense

5263 Other Property Tax Expenses Expense

5370 epreciation Expense Expense

5371 Building Depreciation Expense

5372 Equipment Depreciation Expense

5373 Furniture and Fixtures Depreciation Expense

5374 Vehicle Depreciation Expense

5390 Amortization Expense Expense

5395 Bad Debts Expense Expense

5400 Entertainment Expense Expense

5401 Client/Donor Entertainment Expense

5402 Staff Entertainment Expense

5403 Board Member Entertainment Expense

5415 nterest Expense Expense

5416 Bank Loan Interest Expense

5417 Credit Card Interest Expense

5418 Other Interest Expenses Expense

5420 Insurance Expense Expense

5421 Liability Insurance Expense

5422 Property Insurance Expense

5423 Workers' Compensation Insurance Expense

5424 Health and Life Insurance Expense

5425 Cash in Safe Insurance Expense

5426 Cash in Transit Insurance Expense

5427 Burglary Insurance Expense

5428 Terrorism Insurance Expense

5429 Other Insurance Expenses Expense

5430 Staff Training and Development Expense

5431 Orientation and Onboarding Expense

5432 Professional Development Expense

5433 Leadership Development Expense

5434 Diversity, Equity, and Inclusion (DEI) Training Expense

5435 Other Training and Development Expense

5440 Currency Exchange Losses Expense

5441 Foreign Currency Transaction Losses Expense

5442 Hedging Losses Expense

5450 Other Expenses Expense

Detail Type

Checking

Checking

Checking

Checking

Checking

Online Payment

Investment

Accounts Receivable

Allowance for Bad Debts

Grants Receivable

Other Current Asset

Other Current Asset

Other Current Asset

Other Current Asset

Other Asset

Inventory Asset

Land

Building

Furniture and Fixtures

Equipment

Vehicles

Intangible Asset

Other Fixed Asset

Accounts Payable

Accrued Payroll

Payroll Taxes Payable

Other Accrued Expenses

Accounts Payable

Deferred Revenue

Accrued Expenses

Unearned Revenue

Deferred Revenue

Other Current Liabilities

Line of Credit

Other Current Liabilities

Long Term Loans

Bonds Payable

Mortgages Payable

Other Long Term Liabilities

Non-Profit Equity

Non-Profit Equity

Non-Profit Equity

Non-Profit Equity

Donations

Donations

Donations

Donations

Fundraising Events

Donations In-Kind

Donations In-Kind

Memberships

Programs

Interest Income

Other Income

Salary and wages

Payroll taxes

Rent Expense

Utilities Expense

Maintenance and repairs

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Travel and entertainment

Advertising and promotion

Advertising and promotion

Advertising and promotion

Advertising and promotion

Office Expenses

Event Expenses

Event Expenses

Event Expenses

Event Expenses

Event Expenses

Event Expenses

Education and Awareness

Education and Awareness

Education and Awareness

Education and Awareness

Education and Awareness

Education and Awareness

Software Expense

Software Expense

Software Expense

Software Expense

Software Expense

Software Expense

Legal Fee

Legal Fee

Legal Fee

Bank Charges

Bank Charges

Bank Charges

Bank Charges

Bank Charges

Bank Charges

Fundraising Expense

Fundraising Expense

Fundraising Expense

Fundraising Expense

Fundraising Expense

Fundraising Expense

Professional Fees

Professional Fees

Professional Fees

Professional Fees

Professional Fees

Telephone and Internet Expense

Telephone and Internet Expense

Telephone and Internet Expense

Telephone and Internet Expense

Telephone and Internet Expense

Postage and Shipping Expense

Postage and Shipping Expense

Postage and Shipping Expense

Postage and Shipping Expense

Postage and Shipping Expense

Postage and Shipping Expense

Tax - Property

Tax - Property

Tax - Property

Tax - Property

Depreciation Expense

Building Depreciation

Equipment Depreciation

Furniture and Fixtures Depreciation

Vehicle Depreciation

Amortization

Bad Debts

General Expense

General Expense

General Expense

General Expense

Interest Expense

Interest Expense

Interest Expense

Interest Expense

Insurance Expense

Insurance Expense

Insurance Expense

Insurance Expense

Insurance Expense

Other Insurance

Other Insurance

Other Insurance

Other Insurance

Other Insurance

General and Administrative Expenses

General and Administrative Expenses

General and Administrative Expenses

General and Administrative Expenses

General and Administrative Expenses

General and Administrative Expenses

Currency Exchange Losses

Currency Exchange Losses

Currency Exchange Losses

Other Expenses

Description

Cash on hand in local currency

Cash on hand in USD

Cash on hand in pound

Cash on hand in US dollars at Wells Fargo bank

Checking account at WELLS FARGO Bank USA

Paypal account for online transactions

Investment in stocks, bonds or other securities

Amounts owed to the organization for goods or services sold on credit

Reserve for estimated losses from uncollectible accounts

Amounts receivable from grant-making organizations

Advances made to employees or vendors

Payments made in advance for goods or services

Advances made to employees for business expenses

Expenses paid in advance

Other miscellaneous assets

Value of goods held for sale or distribution

Cost of land owned by the organization

Cost of buildings owned by the organization

Cost of furniture and fixtures owned by the organization

Cost of equipment owned by the organization

Cost of vehicles owned by the organization

Cost of intangible assets such as patents, trademarks, and copyrights

Other miscellaneous fixed assets

Amounts owed to vendors or suppliers for goods or services purchased on credit.

Wages earned by employees but not yet paid as of the end of the accounting period.

Taxes that are withheld from employees' paychecks but have not yet been remitted to the government.

Amounts owed for employee benefits, such as vacation time or health insurance, that have been earned but not yet paid as of the end of t

Amounts owed to grantors or funding agencies for grants or allocations received.

Revenue that has been received in advance but has not yet been earned.

Amounts owed for expenses that have been incurred but not yet paid as of the end of the accounting period.

Revenue that has been received but has not yet been earned.

Revenue from contracts that has been received in advance but has not yet been earned.

Amounts owed for advances received from customers or other entities.

Amounts borrowed under a line of credit agreement.

Other amounts owed that are expected to be paid within one year.

Amounts owed for loans that have a repayment term of more than one year.

Amounts owed for bonds that have been issued by the organization.

Amounts owed for mortgages on property owned by the organization.

Other amounts owed that are not expected to be paid within one year.

Assets with donor restrictions

Assets designated by the Board for specific purposes

Accumulated net income or loss

Assets with restrictions on their use, other than board or donor restrictions.

Contributions from individuals, including cash, checks, and credit card donations

Grants and contributions received from government agencies, including federal, state, and local governments

Grants and contributions received from private foundations and other grant-making organizations

Contributions from corporations and other businesses, including cash, checks, and in-kind contributions

Income generated from fundraising events, including ticket sales, auctions, and raffles

Non-cash donations of goods or property, such as donated inventory, supplies, or equipment

Non-cash donations of services, such as pro-bono legal or consulting services

Revenue generated from membership fees, subscriptions, and dues

Income generated from program services, such as fees for services or classes offered by the organization

Interest income earned on savings, investments, and other interest-bearing accounts

Other types of income, such as rental income or income from unrelated business activities

Payments to employees for services rendered

Taxes withheld from employee paychecks and employer taxes

Rental payments for office space or other facilities

Electricity, gas, water, and other utilities

Cost of repairs and maintenance of equipment or property

Costs associated with business travel and entertainment

Cost of airfare for business travel

Cost of lodging for business travel

Cost of ground transportation for business travel

Cost of meals and entertainment related to business travel

Other expenses related to business travel

Cost of transportation not related to business travel

Cost of owning and operating company-owned vehicles

Cost of public transportation for business purposes

Cost of ride-sharing services for business purposes

Cost of tolls and parking fees for business purposes

Other transportation expenses not covered by other accounts

Cost of advertising the company's products or services

Cost of online advertising for the company

Cost of print advertising for the company

Other advertising expenses not covered by other accounts

Expense related to printing and stationary.

Expense related to events and programs.

Expense related to rental of venues for events.

Expense related to entertainment provided at events.

Expense related to fees paid to speakers or performers at events.

Expense related to supplies and materials used at events.

Other expenses related to events and programs.

Expenses related to education and awareness initiatives

Expenses related to staff or volunteer training and workshops

Expenses related to outreach efforts to the community

Expenses related to materials used in educational programs or events

Expenses related to advertising and promotion of the organization or its events and programs

Other expenses related to education and awareness initiatives

Expenses related to purchasing or licensing software

Expenses related to purchasing or licensing operating systems and utility software

Expenses related to purchasing or licensing productivity and collaboration software

Expenses related to purchasing or licensing accounting and financial software

Expenses related to purchasing or licensing customer relationship management (CRM) software

Other expenses related to purchasing or licensing software

Expenses incurred for professional and legal services

Expenses incurred for legal services

Expenses incurred for other professional and legal fees

Fees charged by the bank for various services

Fees charged for maintaining the bank account

Fees charged for transactions made through the bank account

Fees charged for merchant services

Fees charged for overdrafts or insufficient funds in the bank account

Other fees charged by the bank for various services

A general account for all fundraising expenses.

Expenses related to fundraising events.

Expenses related to advertising and marketing for fundraising.

Expenses related to managing donors and fundraising campaigns.

Expenses related to hiring professional services for fundraising.

Other fundraising expenses not covered by other sub-accounts.

Fees paid for accounting and auditing

Fees paid for bookkeeping and accounting

Fees paid for tax preparation services

Fees paid for auditing services

Fees paid for consulting services

Expenses incurred for telephone and internet services.

Expenses incurred for landline phone services.

Expenses incurred for mobile phone services.

Expenses incurred for internet services.

Other expenses incurred for telecommunications services.

Includes all expenses related to mailing and shipping

Expenses related to postage and mailing services

Expenses related to shipping and courier services

Expenses related to packaging materials and supplies

Expenses related to transportation and freight

Other miscellaneous postage and shipping expenses

Taxes assessed on real or personal property

Taxes assessed on real estate property

Taxes assessed on personal property

Other taxes assessed on property

Expense incurred from the depreciation of assets

Depreciation expense for buildings

Depreciation expense for equipment

Depreciation expense for furniture and fixtures

Depreciation expense for vehicles

The expense incurred from the process of spreading the cost of an intangible asset over its useful life.

The expense incurred from writing off accounts receivable that are unlikely to be collected due to customers' inability or unwillingness to p

A general category for all entertainment expenses

Expenses related to entertaining clients or donors

Expenses related to entertaining staff members

Expenses related to entertaining board members

Total interest expense paid during a period.

Interest paid on bank loans.

Interest paid on credit card balances.

Interest paid on other types of loans or financing.

Expense for various insurance policies

Expense for liability insurance policy

Expense for property insurance policy

Expense for workers' compensation insurance

Expense for health insurance policy

Expense for insurance on cash in safe

Expense for insurance on cash in transit

Expense for burglary insurance policy

Expense for terrorism insurance policy

Expense for other insurance policies

Expenses incurred for training and development of staff

Expenses incurred for the orientation and onboarding of new staff

Expenses incurred for professional development of staff

Expenses incurred for leadership development of staff

Expenses incurred for DEI training of staff

Other expenses incurred for training and development of staff

The amount of loss incurred due to fluctuations in currency exchange rates.

The amount of loss incurred due to foreign currency transactions at unfavorable exchange rates.

The amount of loss incurred due to hedging activities to manage foreign currency risks.

Miscellaneous expenses not covered in other accounts

You might also like

- Chase Bank Feb 2023Document4 pagesChase Bank Feb 2023Muhammad Usman50% (6)

- Dec-23 UpdatedDocument10 pagesDec-23 UpdatedMuhammad UsmanNo ratings yet

- Bano Qabil Past Papers 00001Document8 pagesBano Qabil Past Papers 00001Muhammad Usman100% (4)

- Oil Gas Accounting 101Document29 pagesOil Gas Accounting 101Dharmendra Pandey100% (2)

- Chart of Accounts For Petroleum Exploration Company - Accounting-Financial-TDocument6 pagesChart of Accounts For Petroleum Exploration Company - Accounting-Financial-TJohnLAsia100% (1)

- R Dalberg Operates Dalberg S Tours The Company Has The FollowingDocument1 pageR Dalberg Operates Dalberg S Tours The Company Has The Followingtrilocksp SinghNo ratings yet

- Chart of AccountsDocument4 pagesChart of Accountsjyllstuart100% (3)

- Chart of Accounts For Dilley and CompanyDocument9 pagesChart of Accounts For Dilley and CompanyCharitycharityNo ratings yet

- Overview of Oil and Gas Accounting & PSC Accounting: Budi HartonoDocument47 pagesOverview of Oil and Gas Accounting & PSC Accounting: Budi HartonoHariNugrohoNo ratings yet

- Trade Finance Proposal-Buyers CreditDocument8 pagesTrade Finance Proposal-Buyers Creditneeraj9696cNo ratings yet

- Financial Accounting Chapter 3Document5 pagesFinancial Accounting Chapter 3NiraniyaNo ratings yet

- The Chart of Accounts For Companies PDFDocument14 pagesThe Chart of Accounts For Companies PDFEmir Ademovic100% (1)

- Sample Chart of AccountsDocument5 pagesSample Chart of AccountssnsdyurijjangNo ratings yet

- Balance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet SectionDocument5 pagesBalance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet SectionmakahiyaNo ratings yet

- Icann Chart of Accounts 02aug02Document3 pagesIcann Chart of Accounts 02aug02Namikaze MinatoNo ratings yet

- Illustration Sample Chart of AccountsDocument3 pagesIllustration Sample Chart of AccountsJulie R. UgsodNo ratings yet

- Audit Module 1 - Trial Balance Account MappingDocument6 pagesAudit Module 1 - Trial Balance Account MappingGaurav KumarNo ratings yet

- Sample Chart of AccountsDocument12 pagesSample Chart of AccountsjeffryNo ratings yet

- Chart of AccountDocument5 pagesChart of Accountsana82966534100% (1)

- Descriptive Chart of Accounts Model TemplateDocument17 pagesDescriptive Chart of Accounts Model Templateयशोधन कुलकर्णीNo ratings yet

- Construction Company COADocument10 pagesConstruction Company COAappiah ernestNo ratings yet

- XL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Document686 pagesXL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Satria ArliandiNo ratings yet

- Overview of Oil Gas Accounting 1233735951675198 3Document47 pagesOverview of Oil Gas Accounting 1233735951675198 3Aren BennetNo ratings yet

- Sample Chart of Accounts: Account Name Code Financial Statement Group NormallyDocument2 pagesSample Chart of Accounts: Account Name Code Financial Statement Group NormallyQamar ShahzadNo ratings yet

- Deferred Tax Silvia IFRSBoxDocument10 pagesDeferred Tax Silvia IFRSBoxteddy matendawafaNo ratings yet

- Account CodesDocument35 pagesAccount CodesKarenNo ratings yet

- Chart of Accounts: Current AssetsDocument8 pagesChart of Accounts: Current Assetsgalatid4u100% (1)

- Buy Vs Lease Car CalculatorDocument1 pageBuy Vs Lease Car CalculatorLCNo ratings yet

- The Application of Ifrs Oil and Gas PDFDocument18 pagesThe Application of Ifrs Oil and Gas PDFSahilJainNo ratings yet

- Checklist Compliance CertificateDocument7 pagesChecklist Compliance CertificatethulasikNo ratings yet

- Chart of AccountsDocument2 pagesChart of AccountsFiania WatungNo ratings yet

- Chart of AccountsDocument4 pagesChart of AccountsMohammed Aslam100% (2)

- IFS Apps 2004 - 7.5 SP5 Enhancement SummaryDocument91 pagesIFS Apps 2004 - 7.5 SP5 Enhancement SummaryamalkumarNo ratings yet

- Chart of AccountDocument300 pagesChart of AccountyadadNo ratings yet

- SOLAC BOOK (Latest Version)Document152 pagesSOLAC BOOK (Latest Version)NURUL A'TIKAHNo ratings yet

- Quickbooks Guide - Chart of AccountsDocument13 pagesQuickbooks Guide - Chart of Accountsjr7mondo7edoNo ratings yet

- Chart of Accounts: Account Type Income Tax LineDocument4 pagesChart of Accounts: Account Type Income Tax LineNak VanNo ratings yet

- Basic TallyDocument89 pagesBasic TallyAanchal BudhrajNo ratings yet

- Coa Mapping Int enDocument26 pagesCoa Mapping Int enMuhammad Javed IqbalNo ratings yet

- Chart of AccountDocument10 pagesChart of AccountDmitry_11No ratings yet

- Topic 5 Deferred TaxDocument45 pagesTopic 5 Deferred TaxFuchoin Reiko100% (1)

- Adjustment Entries, Income Statement and Balance SheetDocument60 pagesAdjustment Entries, Income Statement and Balance Sheetvaishnavi sharma100% (1)

- 25 Chart of AccountsDocument104 pages25 Chart of AccountsFiania WatungNo ratings yet

- 6int 2011 Jun ADocument7 pages6int 2011 Jun AMuhmmad FahadNo ratings yet

- Nominal CodesDocument3 pagesNominal Codesrohit5000No ratings yet

- Updated - Salary Sheet With Auto Salary Tax Calculator For FY 2075-2076 (Nepali Talim)Document13 pagesUpdated - Salary Sheet With Auto Salary Tax Calculator For FY 2075-2076 (Nepali Talim)samNo ratings yet

- Chart of Account Group - As Per Business BlueprintDocument3 pagesChart of Account Group - As Per Business BlueprintChetan TandelNo ratings yet

- Deloitte Au Audit Chart Accounts 0812Document31 pagesDeloitte Au Audit Chart Accounts 0812Suman Beemisetty100% (1)

- Standard Chart of AccountsDocument4 pagesStandard Chart of AccountsMihai FildanNo ratings yet

- Chart of Accounts and ReportingDocument35 pagesChart of Accounts and ReportingSafiullah KamawalNo ratings yet

- Avidesa Mac Pollo S A (Colombia)Document18 pagesAvidesa Mac Pollo S A (Colombia)Batfori clucksNo ratings yet

- Short Term Car Lease in Europe Travel Booklet 2013Document9 pagesShort Term Car Lease in Europe Travel Booklet 2013adrianberttNo ratings yet

- Oil & Gas Accounting, May 2011Document9 pagesOil & Gas Accounting, May 2011Sunday Oluwole50% (2)

- ISA 315 - MGT AssertionsDocument5 pagesISA 315 - MGT AssertionsAwaisQureshiNo ratings yet

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoNo ratings yet

- Income Tax Calculator in ExcelDocument2 pagesIncome Tax Calculator in Excelkirang gandhi50% (2)

- Projected Balance SheetDocument1 pageProjected Balance Sheetr.jeyashankar9550100% (1)

- Vat Audit Check ListDocument1 pageVat Audit Check Listmehtayash90No ratings yet

- Oil and Gas Tax ReviewDocument12 pagesOil and Gas Tax ReviewOhioCPAsNo ratings yet

- Al Rafay ProfileDocument8 pagesAl Rafay ProfileRana UsmanNo ratings yet

- Property COADocument1 pageProperty COAjahidemam10No ratings yet

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820No ratings yet

- Daftar AkunDocument3 pagesDaftar Akun20. IDA AYU PUTU EVA PRAMESTI DEWINo ratings yet

- PaystubDocument4 pagesPaystubMuhammad UsmanNo ratings yet

- NFC July 2023 UpdatedDocument3 pagesNFC July 2023 UpdatedMuhammad UsmanNo ratings yet

- Insurance CardDocument1 pageInsurance CardMuhammad UsmanNo ratings yet

- The Winning Facebook StrategyDocument57 pagesThe Winning Facebook StrategyMuhammad UsmanNo ratings yet

- PaystubDocument1 pagePaystubMuhammad UsmanNo ratings yet

- Upwork Saved My Life BookDocument160 pagesUpwork Saved My Life BookMuhammad Usman100% (1)

- Setup and Cleanup QuickbookDocument3 pagesSetup and Cleanup QuickbookMuhammad UsmanNo ratings yet

- GK-051 1 Paystub-1Document1 pageGK-051 1 Paystub-1Muhammad UsmanNo ratings yet