Professional Documents

Culture Documents

Btax302 Lesson4 Valueaddedtax

Btax302 Lesson4 Valueaddedtax

Uploaded by

Jr Reyes PedidaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Btax302 Lesson4 Valueaddedtax

Btax302 Lesson4 Valueaddedtax

Uploaded by

Jr Reyes PedidaCopyright:

Available Formats

40

Lesson 4

Value Added Tax

Lesson Objectives:

At the end of this lesson, the students should be able to:

a. Identify the transactions that are subject and exempt to VAT

b. Define input and output taxes and how to compute for VAT payable

c. Learn how, when, and where to file the VAT returns and the compliance

requirements and attachments needed

d. Apply, practice, solve, analyze, and evaluate problems relating to value

added tax

Learning Module on BTAX302

41

Discussion:

VAT subject transactions

TRANSACTIONS TAX BASE

Sale of goods or properties in the course of trade or business Gross selling price

Sale of services and lease of properties in the course of trade or business Gross receipts

importation Total landed cost

The phrase “in the course of trade or business” means the regular conduct or pursuit of a

commercial or an economic activity including transactions incidental thereto, by any person

regardless of whether or not the person engaged therein is a nonstock, nonprofit private

organization (irrespective of the disposition of its net income and whether or not it sells

exclusively to members or their guests), or government entity.

The rule of regularity, to the contrary notwithstanding, services as defined in the Tax Code in

the Philippines by nonresident foreign persons shall be considered as being rendered in the

course of trade or business.

The term “goods or properties” refers to all tangible and intangible objects which are

capable of pecuniary estimation and shall include, among others:

a. Real properties held primarily for sale to customers or held for lease in the ordinary

course of trade or business

b. The right or privilege to use patent, copyright, design or model, plan, secret formula or

process, goodwill, trademark, trade brand or other like property or right

c. The right or the privilege to use any industrial, commercial, or scientific equipment

d. The right or the privilege to use motion picture films, films, tapes and discs

e. Radio, television, satellite transmission and cable television time

Computation of VAT Payable (excess input tax)

Output tax exceeds input tax at the end of any taxable quarter Output tax xx

Less: input tax xx

VAT Payable xx

Input tax inclusive of input tax carried over from the previous Output tax Xx

quarter exceeds output tax Less: input tax (xx)

Excess input tax xx

Learning Module on BTAX302

42

Computation of The Tax Base and The Applicable Tax Rates

TRANSACTION TAX BASE TAX RATE

Sale of goods The term “gross selling price” means the total amount of money or its 12% or 0%

equivalent which the purchaser pays or is obligated to pay to the seller

in consideration of the sale, barter or exchange of the goods or

properties, excluding the value-added tax. The excise tax, f any, on

such goods or properties shall form part of the gross selling price

In computing the taxable base during the month or quarter, the

following shall be allowed as deductions from gross selling price:

a. Discounts determined ad granted at the time of sale which are

expressly indicated in the invoice, the amount thereof forming

part of the gross sales duly recorded in the books of accounts.

Sales discount indicated un the invoice at the time of sale, the

grant of which is not dependent upon the happening of a

future event, may be excluded from the gross sales within the

same month/ quarter it was given.

b. Sales returns and allowances for which a proper credit or

refund was made during the month or quarter to the buyer for

sales previously recorded as taxable sales

Gross selling price

Gross sales xx

Less: sales returns and allowances xx

Sales discounts xx xx

Net sales xx

Add: excise tax, if any xx

Tax base (excluding VAT) xx

Sale of real properties Installment received xx 12% or 0%

on installment plan Add: interest xx

(initial payments do Penalties for late payment xx xx

not exceed 25% of Tax base xx

the gross selling If FMV is greater than selling price:

price) 𝑎𝑐𝑡𝑢𝑎𝑙 𝑐𝑜𝑙𝑙𝑒𝑐𝑡𝑖𝑜𝑛 (𝑉𝐴𝑇 𝑒𝑥𝑐𝑙𝑢𝑠𝑖𝑣𝑒)

𝑥 𝑓𝑎𝑖𝑟 𝑚𝑎𝑟𝑘𝑒𝑡 𝑣𝑎𝑙𝑢𝑒

𝑎𝑔𝑟𝑒𝑒𝑑 𝑐𝑜𝑛𝑠𝑖𝑑𝑒𝑟𝑎𝑡𝑖𝑜𝑛 (𝑉𝐴𝑇 𝑒𝑥𝑐𝑙𝑢𝑠𝑖𝑣𝑒)

Sale of real properties Selling price stated in the sales documents or fair market value, 12% or 0%

on cash basis or whichever is higher

deferred payment

plan (initial payments

exceed 25% of the

gross selling price)

Sale of services The term “gross receipts” means the total amount of money or its 12% or 0%

equivalent representing the contract price, compensation, service fee,

rental royalty, including the amount charged for materials supplied

with the services and deposits and advanced payments actually or

constructively received during the taxable quarter for the services

performed or to be performed for another person, excluding value-

Learning Module on BTAX302

43

added tax

Gross receipts:

Cash received (actually and constructively) xx

Advance payments for future projects xx

Materials charged with the services xx

Gross receipts (excluding VAT) xx

Note: receivables, although earned, are not included

Gross receipts for For dealer in securities, the term “gross receipts” means gross selling 12% or 0%

dealer in securities price less cost of the securities sold

Gross receipts computed as follows:

Gross selling price xx

Less: acquisition cost of securities sold for the month or quarter xx

Balance xx

Add: other or incidental income xx

Gross receipts (excluding VAT) xx

Gross receipts on the Gross receipts shall refer to the following: 12% or 0%

sale of electricity by a. Total amounts charged by generation companies for the sale

generation, of electricity and related ancillary services

transmission and b. Total amount charged by transmission by any entity including

distribution National Grid Corporation of the Philippines (NGCP) for

companies transmission of electricity and related ancillary services

c. Total amount charged by distribution companies and electric

cooperatives for distribution and supply of electricity and

related electric service. The universal charge passed on and

collected by distribution companies and electric cooperatives

shall be excluded from the computation of the Gross Receipts

Sale of electricity by generation, transmission by any entity including

the National Grid Corporation of the Philippines (NGCP), and

distribution companies including electric cooperatives shall be subject

to 12% VAT on their gross receipts

Gross receipts from Total premiums collected, whether paid in money, notes, credits or any 12% or 0%

nonlife insurance substitute for money

companies

VAT on Importation

When importation Importation begins when the carrying vessel or aircraft enters the jurisdiction of the

begins and deemed Philippines with intention to unlad therein

terminated Importation s deemed terminated upon payment of the duties, taxes and other

charges due upon the articles, or secured to be paid, at a port of entry and the

legal permit for withdrawal shall have been granted, or in case articles are free of

duties, taxes and other charges, until they have legally left the jurisdiction of the

customs

Tax base There shall be levied, assessed and collected on every importation of goods a value-

added tax equivalent to twelve percent (12%) based on the total value used by the

Bureau of Customs in determining tariff and custom duties, plus customs duties,

Learning Module on BTAX302

44

excise taxes, if any, and other charges, such tax to be paid by the importer prior to

the release of such goods from customs custody: Provided, that where the customs

duties are determined on the basis of the quantity or volume of the goods, the

value-added tax shall be based on the landed cost plus excise taxes, if any.

In general where customs duties are based on the value (ad valorem)

Total value (dutiable value-cost, insurance, freight) xx

Add: custom duties xx

Excise tax xx

Other charges prior to release of goods from customs custody xx xx

Tax base xx

In case where customs duties is based on volume or quantity (specific):

Total landed cost xx

Add: excise tax xx

Tax base xx

Tax rate 12%

Output Tax

Meaning Output tax means the value-added tax on sale or lease of taxable goods or

properties or services by any person registered or required to register

Determination of In a sale of goods or properties, the output tax is computed by multiplying the gross

output tax selling price by the regular rate of VAT

Sample Problem:

The following data are taken from the books of a dealer in securities:

Selling price, shares held as inventory P3,000,000

Selling price, shares held as investment 2,000,000

Acquisition cost, shares held as inventory 1,000,000

Acquisition cost, shares held as investment 1,500,000

Other income, shares held as inventory 200,000

The output tax using 12% rate is

selling price, shares held as inventory 3,000,000

acquisition cost, shares held as inventory (1,000,000)

other income, shares held as inventory 200,000

vatable sales 2,200,000

rate 12%

output tax 264,000

A VAT registered contractor has the following selected VAT exclusive data for the month of July 2018:

Collections from contracts completed in June 2018 P500,000

Advances from contracts to be completed in August 2018 300,000

Collections from contracts completed in July 2018, net of 10% retention on billings transferred 198,000

by the payor to the account of the contractor

Materials charged with the services rendered July 2018 100,000

Payments for services rendered by a sub-contractor July 2018 200,000

The gross receipts and output tax for the month of July 2018 are:

Learning Module on BTAX302

45

Collections, June 2018 500,000

advances 300,000

collections, July 2018 (198K/90%) 220,000

materials 100,000

gross receipts 1,120,000

rate 12%

output tax 134,400

Mr. Chris T, Rosales, not VAT registered, imported an article from Japan for his personal use. The invoice value

of the imported article was Y1,000,000 (Y1=P0.35). the following were incurred in connection with the

importation

Insurance P15,000

Freight 10,000

Postage 5,000

Wharfage dues 7,000

Arrastre charges 8,000

Brokerage fees 25,000

Facilitation fee 3,000

The imported article was subject to P50,000 customs duties and to P30,000 excise tax. How much was the VAT

on importation using 12% rate?

Cost 350,000

Insurance 15,000

Freight 10,000

dutiable value 375,000

Customs duties 50,000

excise tax 30,000

other charges (postage, wharfage, arrastre, brokerage) 45,000

tax base 500,000

rate 12%

VAT 60,000

Zero-rated sales are taxable transaction for VAT purposes, but shall not result in any output

tax. However, the input tax on purchases of goods, properties or services, related to such

zero-rated sale, shall be available as tax credit or refund in accordance with the

Regulations.

Zero-Rated Sales of Goods and Properties

a. Export sales of goods

1. The sale and actual shipment of goods from the Philippines to a foreign country, irrespective of

any shipping arrangement that may be agreed upon which may influence or determine the

transfer of ownership of the goods so exported and paid for in acceptable foreign currency or its

equivalent in goods or services, and accounted for in accordance with the rules and regulations

Learning Module on BTAX302

46

of the Bangko Sentral ng Pilipinas (BSP)

2. Sale and delivery of goods to registered enterprises within a separate custom territory provided

under special laws and registered enterprises within tourism enterprise zones as declared by the

Tourism Infrastructure and Enterprise Zone Authority (TIEZA) subject to the provision under Republic

Act No. 9593 or the Tourism Act of 2009.

3. Sale of raw materials or packaging materials to a nonresident buyer for delivery to a resident local

export-oriented enterprise to be used in manufacturing, processing, packing or repacking in the

Philippines of the said buyer’s goods and paid for in acceptable foreign currency and accounted

for in accordance with the rules and regulations of the Bangko Sentral ng Pilipinas (BSP)

4. Sale of raw materials or packaging materials to export-oriented enterprise whose export sales

exceed 70% of the total annual production

5. Those considered export sales under the Omnibus Investment Code of 1987 (E.O.No.226), and

other special laws

6. The sale of goods, supplies, equipment and fuel to persons engaged in international shipping or

international air transport operations provided, that the goods, supplies, equipment and fuel shall

be used for international shipping or air transport operations

b. Sales to persons or entities whose exemption under special laws or international agreements to which

the Philippines is a signatory effectively subjects sales to zero rate

Zero-rated Sales of Goods or Properties which shall be subject to 12% VAT Upon Satisfaction

of Certain Conditions (under the TRAIN)

Items subject to 12% VAT 1. Sale of raw materials or packaging materials to a nonresident buyer for

and no longer be delivery to a resident local export-oriented enterprise to be used in

considered export sales manufacturing, processing, packing or repacking in the Philippines of the

subject to 0% VAT rate said buyer’s goods and paid for in acceptable foreign currency and

accounted for in accordance with the rules and regulations of the

Bangko Sentral ng Pilipinas (BSP)

2. Sale of raw materials or packaging materials to export-oriented

enterprise whose export sales exceed 70% of the total annual production

3. Those considered export sales under the Omnibus Investment Code of

1987 (E.O.No.226), and other special laws

Conditions to be satisfied 1. Successful establishment and implementation of an enhanced VAT

refund system that grants refunds of creditable input tax within 90 days

from the filing of the VAT refund application with the Bureau

To determine the effectivity of item 1, all applications filed from January

1, 2018 shall be processed and must be decided within 90 days from the

filing of the VAT refund application

2. All pending VAT refund claims as of December 31, 2017 shall be fully

paid in cash by December 31, 2019

Considered Export Sales Under Omnibus Investment Code

"Export sales" shall mean the Philippine port F.O.B. value, determined from invoices, bills of lading, inward

letters of credit, landing certificates, and other commercial documents, of exports products exported directly

by a registered export producer or the net selling price of export product sold by a registered export

producer to another export producer, or to an export trader that subsequently exports the same: Provided,

Learning Module on BTAX302

47

That sales of export products to another producer or to an export trader shall only be deemed export sales

when actually exported by the latter, as evidenced by landing certificates or similar commercial documents:

Provided, further, That without actual exportation the following shall be considered constructively exported

for purposes of this provision:

1. sales to bonded manufacturing warehouses of export-oriented manufacturers;

2. sales to export processing zones;

3. sale to enterprises duly registered and accredited with the Subic Bay Metropolitan Authority pursuant

to RA 7227

4. sales to registered export traders operating bonded trading warehouses supplying raw materials used

in the manufacture of export products under guidelines to be set by the Board in consultation with

the Bureau of Internal Revenue and the Bureau of Customs;

5. sales to foreign military bases, diplomatic missions and other agencies and/or instrumentalities

granted tax immunities, of locally manufactured, assembled or repacked products whether paid for

in foreign currency or not: Provided, further, that export sales of registered export trader may include

commission income: and Provided, finally, that exportation of goods on consignment shall not be

deemed export sales until the export products consigned are in fact sold by the consignee.

Sales of locally manufactured or assembled goods for household and personal use to Filipinos abroad and

other non-residents of the Philippines as well as returning Overseas Filipinos under the Internal Export Program

of the government and paid for in convertible foreign currency inwardly remitted through the Philippine

banking systems shall also be considered export sales.

Zero-Rated Sales of Services and Lease of Properties

1. processing, manufacturing or repacking of goods for other persons doing business outside the

Philippines which goods are subsequently exported where the services are paid for in acceptable

foreign currency and accounted for in accordance with the rules and regulations of the Bangko

Sentral ng Pilipinas (BSP)

2. services other than processing, manufacturing or repacking rendered to a person engaged in

business conducted outside the Philippines or to a nonresident person not engaged in business who is

outside the Philippines when the services are performed the consideration for which is paid for in

acceptable foreign currency and accounted for in accordance with the rules and regulations of the

Bangko Sentral ng Pilipinas (BSP)

3. services rendered to persons or entities whose exemption under special laws or international

agreements to which the Philippines is a signatory effectively subjects the supply of such services to

zero percent rate

4. services rendered to persons engaged in international shipping or air transport operations, including

lease of property for use thereof provided, that these services shall be exclusive for international

shipping or air transport operation

5. services performed by subcontractors and/or contractors in processing, converting, or manufacturing

goods for an enterprise whose export sales exceed 70% of the total annual production

6. transport of passengers and cargo by domestic air or sea carriers from the Philippines to a foreign

country

7. sale of power or fuel generated through renewable sources of energy. Provided, however, that zero-

rating shall not extend to the sale of services related to the maintenance or operation of plants

generating said power

8. services rendered to registered enterprises within a separate custom territory provided under special

laws and registered enterprises within tourism enterprise zones as declared by the Tourism

Learning Module on BTAX302

48

Infrastructure and Enterprise Zone Authority (TIEZA) subject to the provision under Republic Act No.

9593 or the Tourism Act of 2009

Zero-rated sales of services and lease of properties which shall be subject to 12% VAT Upon

Satisfaction of Certain Conditions (under the TRAIN)

Items subject to 12% 1. processing, manufacturing or repacking of goods for other persons doing

VAT and no longer be business outside the Philippines which goods are subsequently exported

considered export where the services are paid for in acceptable foreign currency and

sales subject to 0% accounted for in accordance with the rules and regulations of the Bangko

VAT rate Sentral ng Pilipinas (BSP)

2. services performed by subcontractors and/or contractors in processing,

converting, or manufacturing goods for an enterprise whose export sales

exceed 70% of the total annual production

Conditions to be 1. Successful establishment and implementation of an enhanced VAT refund

satisfied system that grants refunds of creditable input tax within 90 days from the

filing of the VAT refund application with the Bureau

To determine the effectivity of item 1, all applications filed from January 1,

2018 shall be processed and must be decided within 90 days from the filing

of the VAT refund application

2. All pending VAT refund claims as of December 31, 2017 shall be fully paid in

cash by December 31, 2019

Effectively Zero-Rated Sales

Sales of goods or property or services to persons or entities who are tax-exempt under international

agreements to which the Philippines is signatory, such as, Asian Development Bank (ADB), International Rice

Research Institute (IRRI), etc., shall be effectively subject to VAT at zero-rate

Deemed Sales Transactions

a. Transfer, use or consumption, not in the course of business, of goods or properties originally intended

for sale or for use in the course of business. Transfer of goods or properties not in the course of business

can take place when VAT-registered person withdraws goods from his business for his personal use;

b. Distribution or transfer to:

o Shareholders or investors as share in the profits of the VAT-registered person; or

o Creditors in payment of debt or obligation

c. Consignment of goods if actual sale is not made within sixty (60) days following the date such goods

were consigned. Consigned goods returned by the consignee within the 60-day period are not

deemed sold;

d. Retirement from or cessation of business, with respect to all goods on hand, whether capital goods,

stock-in-trade, supplies or materials as of the date of such retirement or cessation, whether or not the

business is continued by the new owner or successor. The following circumstances shall, among

others, give rise to transactions "deemed sale";

o Change of ownership of the business. There is a change in the ownership of the business when

a single proprietorship incorporated; or the proprietor of a single proprietorship sells his entire

business

Learning Module on BTAX302

49

o Dissolution of a partnership and creation of a new partnership which takes over the business.

Sale, Transfer, Or Exchange of Imported Goods by Tax-Exempt Persons

a. In the case of goods imported into the Philippines by VAT-exempt persons, entities, or agencies which

are subsequently sold, transferred or exchanged in the Philippines to non-exempt persons or entities,

the latter shall be considered the importers thereof who shall be liable for VAT on such importation

b. The tax due on such importation shall constitute a lien on the goods, superior to all charges or liens,

irrespective of the possessor of said goods

Sample problems

The following information taken from the books of a VAT registered enterprise was provided to you:

Domestic sales of goods P3,000,000

Sales of packaging material to an export-oriented enterprise whose export sales exceed 70% of 2,000,000

the annual production

Local sales of goods to Asian Development Bank 500,000

Consignment of goods (not returned within 60 days following the date of consignment) 200,000

Consignment of goods (returned within 60 days following the date of consignment) 150,000

Goods transferred for the personal use of the owner (cost is P90,000), market value 100,000

Goods transferred to creditor as payment of debt of the enterprise (cost, P100,000), market 90,000

value

Goods transferred to owners as share in the profit of the enterprise, market value 80,000

How much was the total taxable sales and the output VAT using 12% rate?

tax output

rate tax

Domestic sales of goods 3,000,000

12% 360,000

Sales of packaging material to an export-oriented enterprise whose export

2,000,000

sales exceed 70% of the annual production 0% -

Local sales of goods to Asian Development Bank 500,000

0% -

Consignment of goods (not returned within 60 days following the date of

200,000

consignment) 12% 24,000

Goods transferred for the personal use of the owner (cost is P90,000), market

100,000

value 12% 12,000

Goods transferred to creditor as payment of debt of the enterprise (cost,

90,000

P100,000), market value 12% 10,800

Goods transferred to owners as share in the profit of the enterprise, market

80,000

value 12% 9,600

5,970,000 416,400

A VAT registered corporation has the following data taken from the books of accounts for the first calendar

quarter of 2018:

gross sales 5,000,000

Learning Module on BTAX302

50

sales returns and allowances 100,000

sales discount given at the time of sale 400,000

sales discount given to cover prompt payment 200,000

sales allowance to cover roll back in prices 120,000

cost of sales 1,500,000

office equipment purchased January 1,2018 1,100,000

vehicle for land transport imported January 1, 2018 2,500,000

purchase of goods for sale, included in the cost of sales above 300,000

operating expenses (40% with passed-on VAT) 500,000

office supplies purchased (wholly used) 90,000

VAT payments for January and February 40,000

How much is the taxable sales and the output VAT?

gross sales 5,000,000

sales returns and allowances (100,000)

sales discount given at the time of sale (400,000)

taxable sales 4,500,000

rate 12%

output VAT 540,000

VAT-exempt Transactions

It is a sale of goods, properties or service and the use or lease of properties which is not

subject to output tax and whereby the buyer is not allowed any tax credit or input tax

related to such exempt sale.

a. Sale or importation of agricultural and marine food products in their original state, livestock and

poultry of a kind generally used as, or yielding or producing foods for human consumption; and

breeding stock and genetic materials therefore;

b. Sale or importation of fertilizers; seeds, seedlings and fingerlings; fish, prawn, livestock and poultry

feeds, including ingredients, whether locally produced or imported, used in the manufacture of

finished feeds (except specialty feeds for race horses, fighting cocks, aquarium fish, zoo animals and

other animals considered as pets);

c. Importation of personal and household effects belonging to residents of the Philippines returning from

abroad and non-resident citizens coming to resettle in the Philippines; Provided, that such goods are

exempt from custom duties under the Tariff and Customs Code of the Philippines;

d. Importation of professional instruments and implements, tools of trade, occupation or employment,

wearing apparel, domestic animals, and personal and household effects ( except vehicles, vessels,

aircrafts machineries and other similar goods for use in manufacture which are subject to duties, taxes

and other charges) belonging to persons coming to settle in the Philippines or Filipinos or their families

and descendants who are now residents or citizens of other countries, such parties hereinafter

referred to as overseas Filipinos, in quantities and of the class suitable to the profession, rank or

position of the persons importing said items, for their own use and not barter or sale, accompanying

such persons, or arriving within a reasonable time; Provided, That the Bureau of Customs may, upon

the production of satisfactorily evidence that such persons are actually coming to settle in the

Philippines and that the goods are brought from their place of residence, exempt such goods from

Learning Module on BTAX302

51

payment of duties and taxes.

e. Services subject to percentage tax under Title V of the Tax Code, as amended;

f. Services by agricultural contract growers and milling for others of palay into rice, corn into grits, and

sugar cane into raw sugar;

g. Medical, dental, hospital and veterinary services except those rendered by professionals;

h. Educational services rendered by private educational institutions duly accredited by the Department

of Education (DepED), the Commission on Higher Education (CHED) and the Technical Education

and Skills Development Authority (TESDA) and those rendered by the government educational

institutions;

i. Services rendered by individuals pursuant to an employer-employee relationship;

j. Services rendered by regional or area headquarters established in the Philippines by multinational

corporations which act as supervisory, communications and coordinating centers for their affiliates,

subsidiaries or branches in the Asia-Pacific Region and do not earn or derive income from the

Philippines;

k. Transactions which are exempt under international agreements to which the Philippines is a signatory

or under special laws except those granted under P.D. No. 529 - Petroleum Exploration

Concessionaires under the Petroleum Act of 1949;

l. Sales by agricultural cooperatives duly registered and in good standing with the Cooperative

Development Authority (CDA) to their members, as well as of their produce, whether in its original

state or processed form, to non-members, their importation of direct farm inputs, machineries and

equipment, including spare parts thereof, to be used directly and exclusively in the production

and/or processing of their produce;

m. Gross receipts from lending activities by credit or multi-purpose cooperatives duly registered and in

good standing with the Cooperative Development Authority;

n. Sales by non-agricultural, non-electric and non-credit cooperatives duly registered with and in good

standing with CDA; Provided, that the share capital contribution of each member does not exceed

Fifteen Thousand Pesos (P15,000.00) and regardless of the aggregate capital and net surplus ratably

distributed among the members;

o. Export sales by persons who are not VAT-registered;

p. The following sales of real properties:

i. Sale of real properties not primarily held for sale to customers or held for lease in the ordinary

course of trade or business.

ii. Sale of real properties utilized for low-cost housing as defined by RA No. 7279, otherwise known

as the "Urban Development and Housing Act of 1992" and other related laws, such as RA No.

7835 and RA No. 8763;

iii. Sale of real properties utilized for specialized housing as defined under RA No. 7279, and other

related laws, such as RA No. 7835 and RA No. 8763, wherein price ceiling per unit is Php

450,000.00 or as may from time to time be determined by the HUDCC and the NEDA and

other related laws;

iv. Sale of residential lot valued at One Million Five Hundred Thousand Pesos (P1,500,000.00) and

below, or house and lot and other residential dwellings valued at Two Million Five Hundred

Thousand Pesos (P2,500,000.00) and below, as adjusted using latest Consumer Price Index

values. (If two or more adjacent lots are sold or disposed in favor of one buyer, for the

purpose of utilizing the lots as one residential lot, the sale shall be exempt from VAT only if the

aggregate value of the lots do not exceed One Million Five Hundred Thousand Pesos

(P1,500,000.00). Adjacent residential lots, although covered by separate titles and/or

Learning Module on BTAX302

52

separate tax declarations, when sold or disposed to one and the same buyer, whether

covered by one or separate Deed of Conveyance, shall be presumed as a sale of one

residential lot.)

q. Lease of residential units with a monthly rental per unit not exceeding Fifteen Thousand Pesos

(P15,000.00), regardless of the amount of aggregate rentals received by the lessor during the year;

Provided, that not later than January 31, 2009 and every three (3) years thereafter, the amount of

P10,000.00 shall be adjusted to its present value using the Consumer Price Index, as published by the

Philippine Statistics Authority (Formerly known as NSO);

r. Sale, importation, printing or publication of books and any newspaper, magazine, review or bulletin

which appears at regular intervals with fixed prices for subscription and sale and which is not devoted

principally to the publication of paid advertisements;

s. Transport of passengers by international carriers;

t. Sale, importation or lease of passenger or cargo vessels and aircraft, including engine equipment

and spare parts thereof for domestic or international transport operations; Provided, that the

exemption from VAT on the importation and local purchase of passenger and/or cargo vessels shall

be subject to the requirements on restriction on vessel importation and mandatory vessel retirement

program of Maritime Industry Authority (MARINA);

u. Importation of fuel, goods and supplies by persons engaged in international shipping or air transport

operations; Provided, that the said fuel, goods and supplies shall be used exclusively or shall pertain to

the transport of goods and/or passenger from a port in the Philippines directly to a foreign port, or

vice-versa, without docking or stopping at any other port in the Philippines unless the docking or

stopping at any other Philippine port is for the purpose of unloading passengers and/or cargoes that

originated from abroad, or to load passengers and/or cargoes bound for abroad; Provided, further,

that if any portion of such fuel, goods or supplies is used for purposes other than the mentioned in the

paragraph, such portion of fuel, goods and supplies shall be subject to 12% VAT;

v. Services of banks, non-bank financial intermediaries performing quasi-banking functions, and other

non-bank financial intermediaries, such as money changers and pawnshops, subject to percentage

tax under Sections 121 and 122, respectively of the Tax Code; and

w. Sale or lease of goods and services to senior citizens and persons with disabilities, as provided under

Republic Act Nos. 9994 (Expanded Senior Citizens Act of 2010) and 10754 (An Act Expanding the

Benefits and Privileges of Persons with Disability), respectively;

x. Transfer of property in merger or consolidation (pursuant to Section 40(C)(2) of the Tax Code, as

amended);

y. Association dues, membership fees, and other assessments and charges collected on a purely

reimbursement basis by homeowners’ associations and condominium established under Republic Act

No. 9904 (Magna Carta for Homeowners and Homeowner’s Association) and Republic Act No. 4726

(The Condominium Act), respectively;

z. Sale of gold to the Banko Sentral ng Pilipinas (BSP) (previously zero-rated transaction);

aa. Sale of drugs and medicines prescribed for diabetes, high cholesterol, and hypertension (beginning

on January 1, 2019 as determined by the Department of Health); and

bb. Sale or lease of goods or properties or the performance of services other than the transactions

mentioned in the preceding paragraphs, the gross annual sales and/or receipts do not exceed the

amount of Three Million Pesos (Php 3,000,000.00). Note: Self-employed individuals and professionals

availing of the 8% on gross sales and/or receipts and other non-operating income, under Sections 24

(A)(2)(b) and 24 (A)(2)(c)(2) of the NIRC shall also be exempt from the payment of twelve (12%) VAT.

Learning Module on BTAX302

53

Sample problems

Compute the VAT due on the following importations made by different persons:

importation of cows and bulls by a VAT registered company 5,000,000

importation of fighting cocks by a non-VAT registered person 4,000,000

importation of turkey by VAT registered person 3,000,000

importation of race horses by VAT registered person 2,000,000

importation of livestock and poultry feeds by a non-VAT registered person 1,000,000

importation of ingredients to be used in the manufacture of finished fertilizer 500,000

importation of fighting cocks by a non-VAT registered person 4,000,000

importation of race horses by VAT registered person 2,000,000

importation of ingredients to be used in the manufacture of finished fertilizer 500,000

taxable sales 6,500,000

rate 12%

VAT due 780,000

The following information pertains to lease of property for the current year

APARTMENT HOUSE COMMERCIAL BUILDING

case 1 rent per month 15,000 15,000

annual gross receipts 2,500,000 2,500,000

VAT-subject

VAT-Exempt 2,500,000 2,500,000

case 2 rent per month 15,000 15,000

annual gross receipts 3,500,000 3,500,000

VAT-subject 3,500,000 3,500,000

VAT-Exempt

case 3 rent per month 20,000 20,000

annual gross receipts 3,000,000 3,000,000

VAT-subject

VAT-Exempt 3,000,000 3,000,000

case 4 rent per month 20,000 20,000

annual gross receipts 3,500,000 3,500,000

VAT-subject 3,500,000 3,500,000

VAT-Exempt

Based on the following current year information, determine the VAT subject and the VAT exempt amounts

HUSBAND WIFE

case 1 gross receipts, practice of profession 2,500,000 2,000,000

VAT-subject - -

VAT-Exempt 2,500,000 2,000,000

case 2 gross receipts, practice of profession 1,800,000 -

gross receipts, beauty parlor - 1,200,000

Learning Module on BTAX302

54

gross receipts, trucking business 1,500,000 -

gross sales, grocery store - 1,500,000

gross sales, agricultural food products (original state) 1,200,000 -

gross sales, livestock - 1,300,000

total 4,500,000 4,000,000

VAT-subject 3,300,000 -

VAT-Exempt 1,200,000 4,000,000

Mr. Jose Diesto signified his intention to be taxed at 8% income tax in lieu of the graduated income tax rates

and percentage tax under Section 116 in his 1st quarter income tax. However, his gross sales/receipts during

the taxable year have exceeded the VAT threshold as follows:

1st quarter January 250,000.00

February 250,000.00

March 250,000.00

2nd quarter April 250,000.00

May 250,000.00

June 250,000.00

3rd quarter July 250,000.00

August 250,000.00

September 250,000.00

4th quarter October 1,000,000.00

November 1,000,000.00

December 1,000,000.00

total - 5,250,000.00

How much is the percentage tax? P3M x 3% = P90,000

How much is the Value-added tax? P5,250,000 – P3,000,000= P2,250,000 x 12%= P270,000

When shall he update his registration from non-VAT to VAT? November 30

Input Taxes

Meaning of input Input tax is the value-added tax due from or paid by VAT-registered person in the

tax course of his trade or business on importation of goods or local purchase of goods,

properties or services, including lease or use of properties, in the course of his trade or

business. It shall also include the transitional input tax and the presumptive input tax.

Categories of 1.VAT paid on local purchases (passed on by seller) or on importation (passed-on VAT)

creditable or 2.Presumptive input tax

deductible input 3.Transitional input tax

taxes 4.Standard input tax

Persons who can The input tax credit on importation of goods or local purchases of goods, properties or

avail of input tax services by a VAT-registered person shall be creditable:

credit 1.to the importer upon payment of VAT prior to the release of goods from customs

custody

2.to the purchaser of the domestic goods or properties upon consummation of the

sale

3.to the purchaser of services or the lessee or licensee upon payment of the

Learning Module on BTAX302

55

compensation, rental, royalty or fee

Determination of Allowable Input Taxes

Determination input tax carried over from previous period xxx

of creditable input tax deferred on capital goods exceeding P1,000,000 from previous

input tax quarter xxx

transitional input tax xxx

presumptive input tax xxx

others xxx

total xxx

input taxes on current transactions xxx

total available input taxes xxx

less: deductions from input taxes xxx

total allowable input taxes xxx

Deductions a. Input tax claimed as tax credit certificate or refund

from input b. Input tax attributed to VAT-exempt sales

taxes c. Input tax attributed to sales to government

Sources of Creditable Input Taxes (Local Purchases or Importation)

Input tax a. Purchase or importation of goods

evidenced by a 1.for sale

VAT invoice or 2.for conversion into or intended to form part of a finished product for sale,

official receipts by including packaging materials

a VAT-registered 3.for use as supplies in the course of trade or business

person which shall 4.for use as raw materials supplied in the sale of services

be valid for 5 years 5.for use in trade or business for which deduction for depreciation or

from the date of amortization is allowed

permit to use b. Purchase of real properties for which a VAT has actually been paid

c. Purchase of services in which VAT has actually been paid

d. Transactions deemed sale

VAT-registered A VAT-registered person who is also engaged in transactions not subject to VAT shall be

person is also allowed to recognize input tax credit on transactions subject to VAT as follows:

engaged in a. All the input taxes that can be directly attributed to transactions subject to VAT

transactions not may be recognized for input tax credit

subject to VAT b. If any input tax cannot be directly attributed to either a VAT taxable or VAT-

exempt transaction, the input tax shall be pro-rated to the VAT taxable and

VAT-exempt transactions and only the ratable portion pertaining to transactions

subject to VAT may be recognized for input tax credit computed as follows:

VAT Sales/total sales x input taxes

Claims for Input Tax on Depreciable Goods (Under RR16-2005)

Where the aggregate (a) If the estimated useful life of a capital good is five (5) years or more – The

acquisition cost (exclusive input tax shall be spread evenly over a period of sixty (60) months and the

Learning Module on BTAX302

56

of VAT) of depreciable claim for input tax credit will commence in the calendar month when the

capital goods during any capital good is acquired. The total input taxes on purchases or importations of

calendar month exceeds this type of capital goods shall be divided by 60 and the quotient will be the

P1,000,000 amount to be claimed monthly.

(b) If the estimated useful life of a capital good is less than five (5) years – The

input tax shall be spread evenly on a monthly basis by dividing the input tax

by the actual number of months comprising the estimated useful life of the

capital good. The claim for input tax credit shall commence in the calendar

month that the capital goods were acquired.

Where the aggregate the total input tax is creditable against output tax in the month acquired.

acquisition cost (exclusive

of VAT) of depreciable

capital goods during any

calendar month does not

exceed P1,000,000

Amortization allowed until The amortization of the input VAT shall only be allowed until December 31,

December 31,2021 2021 after which taxpayers with unutilized input VAT on capital goods

purchased or imported shall be allowed to apply the same as scheduled until

fully utilized

Meaning of aggregate The aggregate acquisition cost of a depreciable asset in any calendar month

acquisition cost refers to the total price agreed upon for one or more assets acquired and not

on the payments actually made during the calendar month. Thus, an asset

acquired in instalment for an acquisition cost of more than P 1,000,000.00 will

be subject to the amortization of input tax despite the fact that the monthly

payments/installments may not exceed P 1,000,000.00.

Sale or transfer of If the depreciable capital good is sold/transferred within 5 years or prior to the

depreciable good within a exhaustion of the amortizable input tax, the entire unamortized input tax can

period of 5 years or prior to be claimed as input tax credit during the month/quarter when the sale or

the exhaustion of the transfer was made

amortizable input tax

Meaning of capital goods Goods or properties with estimated useful life greater than one (1) year

or properties treated as depreciable assets under Sec. 34(F) of the NIRC; and used directly

or indirectly in the production or sale of taxable goods or services. [Sec. 16, RR

4-2007]

Meaning of construction in CIP is the cost of construction work which is not yet completed. CIP is not

progress depreciated util the asset is places in service. Normally, upon completion, a

CIP is reclassified and the reclassified asset is capitalized and depreciated

Input tax on construction in a. CIP is considered, for purposes of claiming input tax, as a purchase of

progress service, the value of which shall be determined based on the progress

billings

b. Until such time the construction has been completed, it will not qualify

as capital goods as define, in which case, input tax credit on such

transaction can be recognized in the month the payment was made,

provided, that an official receipt of payment has been issued based

on the progress billings

Contract for the sale of In case of contract for the sale of service where only the labor will be supplied

Learning Module on BTAX302

57

service where only the labor by the contractor and materials will be purchased by the contractee from

will be supplied other suppliers, input tax credit on the labor contracted shall still be

recognized on the month the payment was made based on the progress

billings while input tax on the purchase of materials shall be recognized at the

time the materials were purchased

Input tax claimed while the Once the input tax has already been claimed while the construction is in

construction is in progress progress, no additional input tax can be claimed upon completion of the

asset when it has been reclassified as a depreciable capital asset and

depreciated

Rules on allowing input tax a. Purchase of vehicle must be substantiated with official receipts or

credit on vehicles, and other adequate records;

other expenses incurred b. Taxpayer has to prove the direct connection of the motor vehicle to

the business;

c. Only one vehicle for land transport is allowed for the use of an

official/employee with value not exceeding P2.4 million;

d. No depreciation shall be allowed for yachts, helicopters, airplanes

[Sec. 3, RR 12-2012

Presumptive Input Tax

Persons allowed 1.Processors of sardines, mackerel, and milk

presumptive input tax 2.Manufacturers of refined sugar, cooking oil

3.Manufacturers of packed noodle-based instant meals

Rate and basis of four percent (4%) of the gross value in money of their purchases of primary

presumptive input tax agricultural products which are used as inputs to their production

Transitional Input Tax

Situations where transitional a. Taxpayers who became VAT-registered persons upon exceeding the

input tax may be allowed minimum turnover of P3,000,000.00 in any 12-month period

b. Taxpayers who voluntarily register even if their turnover does not

exceed P3,000,000.00 (except franchise grantees of radio and

television broadcasting whose threshold is P10,000,000.00)

Basis of transitional input tax Beginning inventory of goods, materials and supplies (including those that are

VAT-exempt under Sec.109)

Amount of transitional input (2%) of the value of the beginning inventory on hand or actual VAT paid on

tax such, goods, materials and supplies, whichever is higher

The value allowed for income tax purposes on inventories shall be the basis for

the computation of the 2% transitional input tax, including goods that are

exempt from VAT under Sec. 109 of the Tax Code.

Standard Input Tax

Input tax attributable to VAT Input taxes that can be directly attributable to VAT taxable sales of goods and

sales to Government not services to the Government or any of its political subdivisions, instrumentalities

creditable against output or agencies including GOCCs shall not be credited against output taxes

tax on sales to non- arising from sales to non-Government entities

Learning Module on BTAX302

58

Government entities

Government required to The government or any of its political subdivisions, instrumentalities or

withhold agencies, including GOCCs shall deduct and withhold a final VAT due at the

rate of fiver percent (5%) of the gross payment

Beginning January 1, 2021, the VAT withholding system under this Subsection

shall shift from final to a creditable system

The payor or person in control of the payment shall be considered as the

withholding agent

Final withholding VAT The five percent (5%) final withholding VAT rate shall represent the net VAT

represent the net VAT payable of the seller

payable of the seller

Difference between the The remaining seven percent (7%) effectively accounts for the standard input

VAT rate and the VAT for sales of goods or services to government or any of its political

withholding VAT rate subdivisions, instrumentalities or agencies including GOCCs, in lieu of the

accounts for the standard actual input VAT directly attributable or ratably apportioned to such sales

input tax

Should actual input VAT attributable to sale to government exceeds seven

percent (7%) of gross payments, the excess may form part of the seller’s

expense or cost. On the other hand, if actual input VAT attributable to sale to

government is less than seven percent (7%) of gross payment, the difference

must be closed to expense or cost

Withholding VAT

TAX

DESCRIPTION RATE ATC

TYPE

Applicable to Government Withholding Agent Only

WV VAT withholding on Purchase of Goods 5% WV010

WV VAT Withholding on Purchase of Services 5% WV020

Applicable to Both Government and Private Withholding Agents

WV VAT Withholding from non-residents (Government Withholding Agents) 12% WV040

WV VAT Withholding from non-residents (Private Withholding Agents) 12% WV050

VAT Withholding on Purchases of Goods (with waiver of privilege to claim tax credit)

WV 12% WV012

creditable

VAT Withholding on Purchases of Goods (with waiver of privilege to claim input tax credit)

WV 12% WV014

final

VAT Withholding on Purchases of Services (with waiver of privilege to claim input tax credit)

WV 12% WV022

creditable

VAT Withholding on Purchases of Services (with waiver of privilege to claim input tax credit)

WV 12% WV024

final

Remittance of Withholding VAT

Learning Module on BTAX302

59

The VAT withheld shall be remitted within ten (10) days following the end of the month the

withholding was made

Advance Payment Of VAT

Transactions requiring 1.sale of refined sugar

advance payment of 2. sale of flour

VAT 3. transport of naturally grown and planted timber products

4. sale of jewelry, gold and other metallic minerals

Advance payment of The advance payments made by the seller/owner of refined sugar, importer or

VAT allowed as credit miller of wheat/flour and sellers/owners of naturally grown and planted timber

against output tax products shall be allowed as credit against their output tax on the actual gross

selling price of refined sugar/flour/timber products

Advance payments advance payments which remains unutilized at the end of taxpayer’s taxable

may be available for year where the advance payment was made, which is tantamount to excess

issuance of tax credit payment, may, at the option of the owner/seller/taxpayer or

certificate importer/miller/taxpayer, be available for the issuance of TCC upon application

duly filed with the BIR by the seller/owner or importer/miller within two (2) years

from the date of filing of the 4th quarter VAT return of the year such advance

payments were made, or if filed out of time, from the last day prescribed by law

for filing the return

Advance VAT payment Advance VAT payments which have been the subject of an application for the

claimed as TCC cannot issuance of TCC shall not be allowed as carry-over nor credited against the

be carried over output tax of the succeeding quarter/year

Issuance of TCC limited Issuance of TCC shall be limited to the unutilized advance VAT payment and shall

to unutilized advance not include excess input tax

VAT payment

Separate applications Issuance of TCC for input tax attributable to zero-rated sales shall be covered by a

required separate application for TCC following applicable rules

Refund of Input Tax

Input tax on zero-rated A VAT-registered person whose sales of goods, properties or services are zero-

sales of goods or rated or effectively zero-rated may apply for the issuance of a tax credit

property certificate/refund of input tax attributable to such sales. The input tax that may be

subject of the claim shall exclude the portion of input tax that has been applied

against the output tax. The application should be filed within two (2) years after

the close of the taxable quarter when such sales were made

Printing of the word The supreme court has ruled in several cases that the printing of the word “zero-

“zero-rate” required rated” is required to be placed on the VAT invoices or receipts covering zero-

rated sales in order to be entitled to claim for tax credit or refund

Other documents may In another case, failure of the taxpayer to indicate its zero-rated sales in its VAT

be used to prove “zero- returns and in its official receipts is not sufficient reason to deny its claim for tax

rated sale credit or refund when there are other documents from which the court can

determine the veracity if the taxpayer’s claims

Unused input tax of A VAT-registered person whose registration has been cancelled due to retirement

Learning Module on BTAX302

60

person who retired or from or cessation of business, or due to changes in or cessation of status under

ceased business Sec. 106 (C) of the Tax Code may, within two (2) years from the date of

cancellation, apply for the issuance of a tax credit certificate for any unused

input tax which he may use in payment of his other internal revenue taxes;

Provided, however, that he shall be entitled to a refund if he has no internal

revenue tax liabilities against which the tax credit certificate may be utilized.

Period of refund or tax refund or tax credit certificate/refund of input taxes shall be made in proper

credit of input tax cases, the Commissioner of Internal Revenue shall grant a tax credit

certificate/refund for creditable input taxes within ninety (90) days from the date

of submission of complete documents in support of the application

Appeal of full or partial In case of full or partial denial of the claim for tax credit certificate/refund as

denial decided by the Commissioner of Internal Revenue, the taxpayer may appeal to

the Court of Tax Appeals (CTA) within thirty (30) days from the receipt of said

denial, otherwise the decision shall become final. However, if no action on the

claim for tax credit certificate/refund has been taken by the Commissioner of

Internal Revenue after the ninety (90) day shall be punishable under Section 269

of this code

Manner of giving Refunds shall be made upon warrants drawn by the Commissioner of Internal

refunds Revenue or by his authorized representative without the necessity of being

countersigned by the COA Chairman.

Sample Problem

Elirie Corporation, VAT-registered, has the following transactions during the month of January 2018

domestic sales, exclusive of VAT 800,000

importation of goods for sale 240,000

importation of goods for personal use 100,000

purchase of office supplies, exclusive of VAT 20,000

purchase of office equipment, total invoice price (estimated life is 3 years) 1,680,000

purchase of home appliances for the residence of Elirie Corp's President, gross of VAT 17,920

payment of services for store repair, contractor not VAT-registered but issued VAT official

receipt (total invoice amount) 33,600

purchase of services for repainting of store (evidenced by ordinary receipt issued by

contractor) 4,480

purchase of real property to be used as office, VAT not included, purchase price not yet

paid 500,000

purchase of vehicle for land transport and for business use, net of VAT 1,200,000

payment of maintenance expenses for vehicle for land transport, net of VAT 50,000

How much of the VAT on importation can be claimed as input tax credit? P240,000 x 12%= P28,800

(importation of goods for sale)

How much of the input tax on purchase of office equipment can be claimed as input tax credit?

P1,680,000/1.12 x 12%/36= P5,000

Can the passed-on VAT on purchase of vehicle for land transport be claimed as input tax credit? Yes, does

not exceed P2.4M threshold

Can the passed-on VAT by a service contractor who is not VAT registered be claimed as input tax credit? Yes

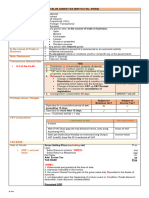

How much is the total allowable input taxes for the month?

Learning Module on BTAX302

61

importation of goods for sale 28,800

purchase of office equipment, total invoice price (estimated life is 3 years) 5,000.00

purchase of vehicle for land transport and for business use, net of VAT(1.2Mx12%/60mos) 2,400

purchase of office supplies, exclusive of VAT 2,400

payment of services for store repair, contractor not VAT-registered but issued VAT official

receipt (total invoice amount) 3,600.00

payment of maintenance expenses for vehicle for land transport, net of VAT 6,000

input taxes 48,200

COMPLIANCE REQUIREMENTS

Invoicing Requirement, Refund of Input Taxes and Others

VAT invoice and VAT A VAT-registered person shall issue: --

Official Receipt (1) A VAT invoice for every sale, barter or exchange of goods or properties; and

(2) A VAT official receipt for every lease of goods or properties, and for every sale,

barter or exchange of services.

Validity of VAT invoice The invoice/receipt shall be valid for 5 years from date of permit to use

and VAT OR

Invoicing requirement The following information shall be indicated in VAT invoice or VAT official receipt:

(1) A statement that the seller is a VAT-registered person, followed by his TIN;

(2) The total amount which the purchaser pays or is obligated to pay to the seller

with the indication that such amount includes the VAT; Provided, That:

(a) The amount of tax shall be shown as a separate item in the invoice or receipt;

(b) If the sale is exempt from VAT, the term “VAT-exempt sale” shall be written or

printed prominently on the invoice or receipt;

(c) If the sale is subject to zero percent (0%) VAT, the term “zero-rated sale” shall be

written or printed prominently on the invoice or receipt;

(d) If the sale involves goods, properties or services some of which are subject to

and some of which are VAT zero-rated or VAT-exempt, the invoice or receipt shall

clearly indicate the break-down of the sale price between its taxable, exempt and

zero-rated components, and the calculation of the VAT on each portion of the

sale shall be shown on the invoice or receipt. The seller has the option to issue

separate invoices or receipts for the taxable, exempt, and zero-rated components

of the sale.

(3) In the case of sales in the amount of one thousand pesos (P1,000.00) or more

where the sale or transfer is made to a VAT-registered person, the name, business

style, if any, address and TIN of the purchaser, customer or client, shall be indicated

in addition to the information required in (1) and (2) of this Section.

Invoicing and Recording Deemed Sale Transactions

Deemed sale transaction Invoicing and recording

Transfer, use or consumption, memorandum entry

not in the course of business

Learning Module on BTAX302

62

Distribution or transfer to an invoice shall be prepared at the time of the occurrence of the

transaction, which should include, all the information prescribed in Sec. 4.113-

Shareholders or investors

1. The data appearing in the invoice shall be duly recorded in the subsidiary

Or to Creditors in payment of

sales journal. The total amount of “deemed sale” shall be included in the

debt or obligation

return to be filed for the month or quarter.

Consignment of goods if Same as in above

actual sale is not made

within sixty (60) days

Retirement from or cessation an inventory shall be prepared and submitted to the RDO who has jurisdiction

of business over the taxpayer’s principal place of business not later than 30 days after

retirement or cessation from business

VAT returns and payment of value-added tax

a. Monthly VAT declaration and payment of VAT

Filing of the declaration and Not later than 20th day following the end of the first 2 months in a quarter

payment of VAT

Taxpayers enrolled with EFPS Group A - 25 days following the end of the month

Group B - 24 days following the end of the month

Group C - 23 days following the end of the month

Group D - 22 days following the end of the month

Group E- 21 days following the end of the month

b. Filing of Quarterly VAT return and Payment of VAT

Filing of quarterly return and Every person liable to pay the value-added tax imposed under this Title shall

payment of value-added tax file a quarterly return of the amount of his gross sales or receipts within twenty-

five (25) days following the close of each taxable quarter prescribed for each

taxpayer: Provided, however, That VAT-registered persons shall pay the

value-added tax on a monthly basis:

beginning January 1, 2023, the filing and payment required under the Tax

Code shall be done within twenty-five (25) days following the close of each

taxable quarter.

Meaning of taxable quarter The term “taxable quarter” shall mean that quarter that is synchronized with

the income tax quarter of the taxpayer (i.e., the calendar quarter or fiscal

quarter)

Quarterly return included the Amounts reflected in the monthly VAT declarations for the first two (2) months

amounts reflected in the of the quarter shall still be included in the quarterly VAT return, which reflects

monthly VAT declarations the cumulative figures for the taxable quarter

Monthly payments to be Payments in the monthly VAT declarations shall be credited in the quarterly

credited in the quarterly VAT VAT return to arrive at the net VAT payable, or excess input tax/overpayment

return as of the end of the quarter

Deductions from the The VAT payable/excess input tax for each taxable quarter shall be reduced

quarterly VAT payable by the total amount of taxes previously paid for the immediately preceding

(excess input tax) two (2) months, and the advance payments/creditable VAT withheld by the

payors for he three months of the quarter

Learning Module on BTAX302

63

Substituted VAT Return

Substituted VAT return 1.in case of sale of goods or services by persons subject to 12% VAT, whose

(payee with Lone Payor) gross sales or receipts have already been subjected to 12% VAT by the lone

payor, the payee(seller) shall no longer be required to file the monthly VAT

declaration and the quarterly returns.

2. the monthly remittance return of VAT withheld duly filed by the withholding

agent-payor serves as the substituted return of the payee (seller) with the

lone payor

Payee with several payors Payees with several payors are still required to file the regular VAT return

reflecting the consolidated total of all taxable transactions for the taxable

period and applying as tax credits the taxes withheld by several payors

Short Period Return

Final return of a person who Any person who retires from business with due notice to the BIR office where

retires from business the taxpayer (head office) is registered or whose VAT registration has been

cancelled shall file a final quarterly return and pay the tax due thereon within

twenty-five (25) days from the end of the month when the business ceases to

operate or when VAT registration has been officially cancelled

Subsequent monthly monthly declarations/quarterly returns are still required to be filed if the results

declarations/quarterly of the winding up of the affairs/business of the taxpayer reveal taxable

returns to be filed after transactions

retirement

Effective date of VAT All persons first registered shall be liable to VAT on the effective date of

registration registration stated in their Certificates of Registration

Initial monthly VAT 1.If the effective date of registration falls on the first or second month of the

declaration or quarterly VAT taxable quarter, initial monthly VAT declaration shall be filed within twenty

return (20) days after the end of the month, and the initial quarterly return shall be

filed on or before the 25th day after the end of the taxable quarter.

2. if the effective date of registration falls on the third month of the taxable

quarter the quarterly returns shall be filed on or before the 25th day of the

month following the end of the taxable quarter, and no monthly VAT

declaration need be filed for the initial quarter.

Payment of VAT on Importation

The VAT on importation shall be paid by the importer prior to the release of such goods from

customs custody

Where to file ang pay VAT

Where to file monthly VAT The monthly VAT declaration and quarterly return shall be filed with, and VAT

declaration and quarterly due thereon paid to, an AAB under the jurisdiction of the Revenue District/BIR

VAT return if payment is Office where the taxpayer (head office of the business establishment) is

involved required to be registered.

In cases where there are no duly accredited agent banks within the

Learning Module on BTAX302

64

municipality or city, the monthly VAT declaration and quarterly VAT return,

shall be filed with and any amount due shall be paid to the RDO, Collection

Agent or duly authorized Treasurer of the Municipality/City where such

taxpayer (head office of the business establishment) is required to be

registered.

Where to file monthly VAT The quarterly VAT return and the monthly VAT declaration, where no

declaration and quarterly payment is involved, shall be filed with the RDO/LTDO/Large Taxpayers

VAT return if no payment is Assistance Division (LTAD), Collection Agent, duly authorized Municipal/City

involved Treasurer of Municipality/City where the taxpayer (head office of the business

establishment) is registered or required to be registered.”

consolidated quarterly VAT Only one consolidated quarterly VAT return or monthly VAT declaration

return or monthly VAT covering the results of operation of the head office as well as the branches

declaration for all lines of business subject to VAT shall be filed by the taxpayer, for every

return period, with the BIR office where said taxpayer is required to be

registered.

Submission of Quarterly Summary List of Sales and Purchases

Persons Required to Submit Persons Required to Submit Summary Lists of Sales. — All persons liable for VAT

Summary Lists of such as manufacturers, wholesalers, service-providers, among others, with

Sales/Purchases quarterly total sales/receipts (net of VAT) exceeding Two Million Five Hundred

Thousand Pesos (P2,500,000.00).

Persons Required to Submit Summary Lists of Purchases. — All persons liable

for VAT such as manufacturers, service-providers, among others, with

quarterly total purchases (net of VAT) exceeding One Million Pesos (P

1,000,000.00).

When to File the Summary on or before the twenty-fifth (25th) day of the month following the close of

Lists of Sales/Purchases the taxable quarter (VAT quarter)-calendar quarter or fiscal quarter

Where to File the Summary The quarterly summary list of sales or purchases, whichever is applicable, shall

Lists of Sales/Purchases be submitted in diskette form to the RDO or LTDO or LTAD having jurisdiction

over the taxpayer

Submission of summary lists of For taxpayers authorized to use computerized accounting system, the above

sales or purchases list shall be submitted through Compact-Disk Recordable (CDR) medium

Suspension of business operations

the Commissioner of Internal Revenue or his duly authorized representative may order suspension or closure

of a business establishment for a period of not less than five (5) days for any of the following violations:

(1) Failure to issue receipts and invoices.

(2) Failure to file VAT return as required under the provisions of Sec. 114 of the Tax Code.

(3) Understatement of taxable sales or receipts by 30% or more of his correct taxable sales or receipt for the

taxable quarter.

(4) Failure of any person to register as required under the provisions of Sec. 236 of the Tax Code.

Learning Module on BTAX302

65

Mandatory Registration under VAT System

Persons required to Any person who, in the course of trade or business, sells, barters or exchanges

mandatorily register goods or properties or engages in the sale or exchange of services shall be

liable to register if:

i. His gross sales or receipts for the past twelve (12) months, other than those

that are exempt under Sec. 109 (A) to (BB) have exceeded Three million pesos

(P3,000,000.00); or

ii. There are reasonable grounds to believe that his gross sales or receipts for

the next twelve (12) months, other than those that are exempt under Sec. 109

(A) to (BB, will exceed Three million pesos (P3,000,000.00)

Optional Registration of VAT-Exempt Persons

Persons allowed optional a. Any person who is VAT exempt under Section 109 (aa) not required to

VAT registration register for VAT may elect to be VAT-registered by registering with the

RDO that has jurisdiction over the head office of that person, and pay

the annual registration fee of P500 for every separate and distinct

establishment or place of business, including facility types where sales

transactions occur, shall be paid upon registration and every year

thereafter on or before the last day of January

Cooperatives, individuals earning purely compensation income,

whether locally or abroad, and overseas workers are not liable to the

registration fee herein imposed

b. Any person who elects to register optionally shall not be entitled to

cancel his registration for the next three (3) years

c. Any person who elected to pay 8% tax on gross sales or receipts shall

not be allowed to avail of this option

d. For purposes of VAT, any person who has registered VAT as a tax type

shall be referred to as a VAT-registered person who shall be assigned

only one TIN

Attachments

Monthly VAT Declarations

BIR Form 2550M - Monthly Value-Added Tax Declaration (February 2007 ENCS)

Documentary Requirements

1. Duly issued Certificate of Creditable VAT Withheld at Source (BIR Form No. 2307), if applicable

2. Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at

Source (SAWT), if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Duly approved Tax Credit Certificate, if applicable

5. Authorization letter, if return is filed by authorized representative.

Quarterly Value-Added Tax Return

BIR Form No. 2550Q - Quarterly Value-Added Tax Return (February 2007 ENCS)

Documentary Requirements

1. Duly issued Certificate of Creditable VAT Withheld at Source (BIR Form 2307), if applicable

Learning Module on BTAX302

66

2. Summary Alphalist of Withholding Agents of Income Payments Subjected to Withholding Tax at

Source (SAWT), if applicable

3. Duly approved Tax Debit Memo, if applicable

4. Duly approved Tax Credit Certificate, if applicable

5. Previously filed return and proof of payment, for amended return

6. Authorization letter, if return is filed by authorized representative

Summary of the Lesson:

The lesson classified the transactions that are subject and exempt to VAT. It also defined

what are input and output taxes and how to compute the VAT payable of a taxpayer. the

lesson also highlighted the filing of VAT returns of a taxpayer and the compliance

requirements as well as the attachments needed. The lesson also focused on illustrating

problems relating to value added tax.

References:

TAMAYO, LIM, CAIGA, MANUEL (2019). VAT-subject Transactions. Taxation. The Review School

of Accountancy

TAMAYO, LIM, CAIGA, MANUEL (2019). VAT-exempt Transactions. Taxation. The Review

School of Accountancy

TAMAYO, LIM, CAIGA, MANUEL (2019). Input Taxes. Taxation. The Review School of

Accountancy

TAMAYO, LIM, CAIGA, MANUEL (2019). Compliance Requirements. Taxation. The Review

School of Accountancy

TABAG, E.D. (2020). Value Added Tax. CPA Reviewer in Taxation with Special Topics and

Properly Filled BIR Forms. EDT Bookshop

Learning Module on BTAX302

You might also like

- Chapter 7: Introduction To Regular Income Tax: 1. General in CoverageDocument19 pagesChapter 7: Introduction To Regular Income Tax: 1. General in CoverageJulie Mae Caling Malit33% (3)

- Valued Added TaxDocument5 pagesValued Added TaxCharles Reginald K. Hwang100% (7)

- RR 9-89Document6 pagesRR 9-89papepipupoNo ratings yet

- TED Talk-Our Dangerous Obsession With Perfectionism Is Getting Worse (Thomas Curran)Document3 pagesTED Talk-Our Dangerous Obsession With Perfectionism Is Getting Worse (Thomas Curran)CARYS BROWN0% (1)

- Final Exam For Comm 440 Political CommunicationDocument4 pagesFinal Exam For Comm 440 Political CommunicationMarcelo Alves Dos Santos JuniorNo ratings yet

- Module 2. Lesson 1. Value Added TaxDocument34 pagesModule 2. Lesson 1. Value Added TaxJoy RubioNo ratings yet

- TX-301 Vat Subject Trans PDFDocument12 pagesTX-301 Vat Subject Trans PDFDea LingaoNo ratings yet

- 03 Vat Subject TransactionsDocument5 pages03 Vat Subject TransactionsJaneLayugCabacungan100% (1)

- Vat - Ransfer & Business Taxation Enrico D. TabagDocument30 pagesVat - Ransfer & Business Taxation Enrico D. TabagJhon baal S. SetNo ratings yet

- 07 Business Tax and VATDocument5 pages07 Business Tax and VATlemvin121003No ratings yet

- VAT Handouts TaxDocument9 pagesVAT Handouts TaxRenmar CruzNo ratings yet

- VAT Part 1Document9 pagesVAT Part 1Sittee Raihana Talicop BansilNo ratings yet

- VAT Output TaxesDocument7 pagesVAT Output TaxesJocelyn Verbo-AyubanNo ratings yet

- Lecture 6 - Value-Added TaxDocument6 pagesLecture 6 - Value-Added TaxVic FabeNo ratings yet

- Bullet Notes 8 - Value Added TaxDocument10 pagesBullet Notes 8 - Value Added TaxFlores Renato Jr. S.No ratings yet

- Lecture 6 - Value-Added TaxDocument7 pagesLecture 6 - Value-Added TaxPiyey LlarenaNo ratings yet

- Lesson 4 BtaxDocument4 pagesLesson 4 Btaxdin matanguihanNo ratings yet

- Value Added TaxesDocument75 pagesValue Added TaxesLEILALYN NICOLAS100% (1)

- Tax 43 - Vat PayableDocument6 pagesTax 43 - Vat PayableFemie AmazonaNo ratings yet