Professional Documents

Culture Documents

SKM Egg Products Export (India) Limited

SKM Egg Products Export (India) Limited

Uploaded by

mohanthakralOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SKM Egg Products Export (India) Limited

SKM Egg Products Export (India) Limited

Uploaded by

mohanthakralCopyright:

Available Formats

Press Release

SKM Egg Products Export (India) Limited

July 02, 2021

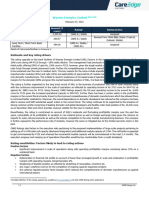

Ratings

Amount

Facilities/Instruments Ratings1 Rating Action

(Rs. crore)

CARE BBB+; Stable Revised from CARE

2.57

Long -term Bank Facilities (Triple B Plus; Outlook: BBB; Stable (Triple B;

(Reduced from 3.33)

Stable) Outlook: Stable)

CARE BBB+; Stable / Revised from CARE

Long-term / Short-term Bank CARE A2 BBB; Stable / CARE A3

36.00

Facilities (Triple B Plus; Outlook: (Triple B; Outlook:

Stable/ A Two) Stable / A Three)

CARE A2 Revised from CARE A3

Short-term Bank Facilities 49.00

(A Two) (A Three)

87.57

(Rs. Eighty seven

Total Bank Facilities

crore and fifty-seven

lakhs only)

Details of facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The revision in the ratings assigned to the bank facilities of SKM Egg Products Export (India) Limited (SKML)

factors in the efforts of the company in securing its supply chain of eggs by way of leasing a farm which would

provide for almost 85% of its egg breaking capacity at a lower cost . Moreover, this helps the company take

advantage of the price volatility in eggs by way of direct sale of eggs or conversion to powder thereby bringing a

more stability in the profitability margins. These efforts have yielded significant benefits for the company in Fy21

on its profitability.

The ratings continue to take into account the long operational track record of SKML for more than two decades

in the egg powder business, dominant share among the Indian egg powder exporters, strategically located

manufacturing facilities with adherence to high-quality standards, diversified product offerings with a well-

established distribution network comfortable capital structure, healthy coverage indicators and adequate

liquidity position.,

The ratings are, however, constrained by SKML’s geographical & client concentration risk, susceptibility of

profitability to international egg powder prices & foreign exchange fluctuations. The ratings also factor in the

susceptibility of the industry to the outbreaks of bird flu and other diseases.

Rating Sensitivities

Positive Factors

Improvement in PBILDT margins upwards of 15% on consistent basis.

Negative Factors

Stretching of operating cycle or deterioration in liquidity indicators.

Any large debt-funded capex leading to deterioration in capital structure with overall gearing above the

range of 0.60-0.80x.

Detailed description of the key rating drivers

Key Rating Strengths

Experienced promoters & long operational track record for more than two decades:

Mr SKM Maeilanandhan, promoter of the SKM group, has vast experience of nearly four decades in the poultry

and related industries. Mr Maeilanandhan is assisted by his son, Mr Shree Shivkumar with nearly 25 years of

1

Complete definitions of the ratings assigned are available at www.careratings.com and in other CARE

publications.

1 CARE Ratings Limited

Press Release

experience in the industry. SKML has a long track record of operations for over two decades in manufacturing

and export of egg powder.

Integrated and strategically located manufacturing facility with adherence to high quality standards

The operations of SKML are integrated with the company having its own poultry farm to meet its raw material

requirements as well as its own feed manufacturing unit to cater to its poultry farm. All the poultry farms

including the company’s own farm are strategically located in proximity from the company’s manufacturing unit

(30-40 km radius) thereby providing easier access to the raw material and ensuring lesser breakage of eggs

during transit. The entire operations of the company from egg-breaking process up to production and packing

of the final egg powder is automated to maintain high level of quality standards.

Largest exporter of egg powder from India backed by diversified product offerings and established distribution

network

SKML is the largest exporter of egg powder from India and accounts for almost 60-65% of the overall export of

Egg Yolk and Albumin egg powder from India in FY21. The company has a diversified range of products including

egg yolk powder, egg albumin, bakery mix, liquid egg etc. SKML has its subsidiary in Netherland (contributing

around 5-10% of revenue) and sales to other markets are channelized through third party distributors/agents.

Product sales mix in export division as a percentage of total sales in FY21 consists of egg yolk powder around

47%, egg albumen powder around 31%, whole egg powder around 18% and the rest by liquid egg.

Improvement in profitability margins with inhouse raw material sourcing and increased presence in domestic

market

SKM is into manufacture of egg derivative products with the raw material, egg forming almost 75-80% of the

production cost. The company had been sourcing its requirement of eggs partly from its own farm and balance

from the market. While the egg prices are volatile depending upon the economics of the Indian market, the end

product prices depend mostly on the international demand supply scenario. Thus, with limited control on the

end product prices rendering the profit margins volatile in the past few years, the company resorted to backward

integration by means of setting up a leased poultry farm in Q4FY20. The price of eggs sourced from own/leased

farms are lower than the market prices and ensures control over the supply chain. This also enables the company

to convert to egg powder when prices are low and stock inventory as the powder have a shelf life of 1.5 years.

Further at times when egg prices are unfavorable for conversion and stocking, the company engages in direct

sales of eggs sourced from its farms in the domestic market which has led to an increased presence in domestic

market. SKML’s domestic income share in sales revenue increased to 34% in FY21 (PY 24%). A combination of

these efforts, along with favourable product prices have resulted in sharp improvement in profitability margins

for FY21 and the efforts in backward integration with the leased farms is expected to help the company sustain

higher margins than in the past.

Comfortable gearing and coverage indicators

The company’s capital structure remains comfortable with overall gearing at 0.70x as on March 31, 2021, against

at 0.80x as on March 31, 2020. The interest coverage ratio remained comfortable at 11.83x (PY 4.73x) in FY21,

Total Debt/ GCA also stood comfortable at 2.05 years (PY 4.03 yrs) as on March 31, 2021.

Key Rating Weaknesses

Geographically concentrated revenue

SKML’s top five customers account for 56% (PY: 62%) of its total sales during FY21 and majority of sales are

contributed by Japan (36% in FY21) followed by Russia and Netherlands. SKML’s higher concentration on

Japanese and European markets exposes the company to any change in consumption pattern in these markets

and entry of alternate products. To improve geographical presence and customer base, SKML has been adding

new customers in other geographies as well as focusing on domestic market for the sale of its liquid products

and frozen Egg albumen.

Exposure to foreign exchange risk

More than 60% of revenue of SKML is generated in foreign currency while the raw material is procured locally

barring certain consumables. SKML enters forward contracts for about 70% of its receivables for one year,

however for the rest of the exposure, the company is exposed to foreign currency fluctuations.

2 CARE Ratings Limited

Press Release

Vulnerability of the industry’s performance to outbreaks of flu and other diseases

A ban on exports due to bird flu could lead to products being piled up leading to an excess supply situation

thereby causing a sharp fall in the end-product prices. Such scenario is expected to have an impact on the

company’s revenues as well as profitability. However, the high level of safety standards like high temperature

pasteurization and high-quality processing at the company’s units reduces any major impact on the company’s

revenues during such outbreaks.

Prospects

India is the 5th largest producer of eggs in the world with annual egg production of 56 billion eggs. Egg prices

are sensitive to market dynamics and controlled by NECC (National Egg Co-ordination Committee), while prices

of egg powder depend on international market demand. It is, however, noteworthy that with the diversification

in geography and sourcing of majority raw material from own farms, SKML is in control of the raw material cost

to a considerable extent. However, movement of egg powder prices in the international market impact SKML’s

performance. Going forward, sustainability of demand for egg powder in its export markets and the ability of

the company to keep its raw material sourcing strategies intact would be crucial for its prospects.

Liquidity- Adequate

The liquidity of the company is adequate with sufficient cushion in accruals against low debt repayment

obligations of Rs 3.42 crore for FY22. However, the operations of SKML are working capital intensive in nature

due to its nature of business and its requirement to maintain high inventory for export orders and diversified

product profile. The operating cycle stood elongated at 141 days in FY21. The average working capital utilization

for the past 12 months period ended May 2021 stood at 85%. The company had unencumbered cash and bank

balance of Rs 10.44 Crores and liquid investments of Rs 15.30 crore as on March 31, 2021. Going forward,

SKMPL’s liquidity is expected to remain comfortable on the back of healthy cash accruals.

Analytical approach: Standalone

Applicable Criteria

CARE’s Policy on Default Recognition

CARE’s Criteria on assigning Outlook and credit watch to Credit Ratings

Financial ratios –Non-Financial Sector

CARE's methodology for manufacturing companies

Criteria for Short-term Instruments

Liquidity Analysis of Non-Financial Sector Entities

About the Company

SKML, promoted in 1995 by Mr SKM Maeilanandhan (Chairman), is a Joint Sector Undertaking along-with Tamil

Nadu Industrial Development Corporation Limited (TIDCO). SKML is a listed entity and as on March 31, 2021, the

promoters hold 47.51% stake, TIDCO holds 7.58% stake and the rest is held by institutions & general public.

SKML is engaged in the manufacture and sale of egg powder and liquid egg with varieties of blends used in

various segments of the food industry and in the health sector. As on March 31, 2021, the company had an

installed capacity to break 1.80 million eggs per day to produce 7,500 MT of egg powder annually at its unit in

Erode.

Brief Financials (Rs. crore) FY20 (A) FY21 (A)

Total operating income 293.04 258.44

PBILDT 28.23 44.43

PAT 5.28 15.67

Overall gearing (times) 0.80 0.70

Interest coverage (times) 4.73 11.83

A: Audited;

Status of non-cooperation with previous CRA: Not Applicable

Any other information:

Not Applicable

Rating History for last three years: Please refer Annexure-2

3 CARE Ratings Limited

Press Release

Covenants of Rated Instrument: Detailed explanation of covenants of the rated instrument is given in Annexure-

3

Complexity level of various instruments rated for this company: Annexure 4

Annexure-1: Details of Instruments/Facilities

Size of the Rating assigned

Name of the Date of Coupon Maturity

Issue along with Rating

Instrument Issuance Rate Date

(Rs. crore) Outlook

CARE BBB+; Stable /

Fund-based - LT/ ST-Packing

- - - 36.00 CARE A2

Credit in Foreign Currency

Fund-based - ST-Foreign Bill CARE A2

- - - 39.00

Discounting

September CARE BBB+; Stable

Fund-based - LT-Term Loan - - 2.57

2023

Non-fund-based - ST-Credit CARE A2

- - - 10.00

Exposure Limit

Annexure-2: Rating History of last three years

Current Ratings Rating history

Name of the Date(s) & Date(s) & Date(s) &

Sr. Type Rating Date(s) &

Instrument/Bank Amount Rating(s) Rating(s) Rating(s)

No. Rating(s)

Facilities Outstanding assigned assigned assigned

assigned in

(Rs. crore) in 2021- in 2020- in 2018-

2019-2020

2022 2021 2019

1)CARE BBB;

1)CARE Stable / CARE 1)CARE

CARE

BBB; A3 BBB;

Fund-based - LT/ BBB+;

Stable / (02-Mar-20) Stable /

ST-Packing Credit Stable

1. LT/ST 36.00 - CARE A3 2)CARE BBB; CARE A3

in Foreign / CARE

(01-Sep- Stable / CARE (05-Oct-

Currency A2

20) A3 18)

(31-Jul-19)

1)CARE 1)CARE A3 1)CARE

Fund-based - ST- CARE A3 (02-Mar-20) A3

2. Foreign Bill ST 39.00 A2 - (01-Sep- 2)CARE A3 (05-Oct-

Discounting 20) (31-Jul-19) 18)

1)CARE

1)Withdrawn A3

Non-fund-based -

3. ST - - - - (31-Jul-19) (05-Oct-

ST-Letter of credit

18)

1)CARE

Non-fund-based - 1)Withdrawn A3

4. ST-Bank ST - - - - (31-Jul-19) (05-Oct-

Guarantees 18)

CARE 1)CARE 1)CARE BBB; 1)CARE

Fund-based - LT-

5. LT 2.57 BBB+; - BBB; Stable BBB;

Term Loan

Stable Stable (02-Mar-20) Stable

4 CARE Ratings Limited

Press Release

(01-Sep- 2)CARE BBB; (05-Oct-

20) Stable 18)

(31-Jul-19)

1)CARE

Non-fund-based - CARE A3 1)CARE A3

6. ST-Credit Exposure ST 10.00 A2 - (01-Sep- (02-Mar-20) -

Limit 20)

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities: Not Applicable

Annexure 4: Complexity level of various instruments rated for this company

Sr.

Name of the Instrument Complexity Level

No.

1. Fund-based - LT-Term Loan Simple

Fund-based - LT/ ST-Packing Credit in Foreign

2. Simple

Currency

3. Fund-based - ST-Foreign Bill Discounting Simple

4. Non-fund-based - ST-Credit Exposure Limit Simple

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of

complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careratings.com

for any clarifications.

Contact us

Media Contact

Name: Mradul Mishra

Contact no. – +91-22-6837 4424

Email ID – mradul.mishra@careratings.com

Analyst Contact

Name - Ms. Swathi Subramanian

Contact no.- 94442 34834

Email ID- swathi.subramanian@careratings.com

Relationship Contact

Name: Mr. V. Pradeep Kumar

Contact no. : 98407 54521

Email ID : pradeep.kumar@careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the

leading credit rating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI)

and also recognized as an External Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE

Ratings is proud of its rightful place in the Indian capital market built around investor confidence. CARE Ratings

provides the entire spectrum of credit rating that helps the corporates to raise capital for their various

requirements and assists the investors to form an informed investment decision based on the credit risk and

their own risk-return expectations. Our rating and grading service offerings leverage our domain and analytical

expertise backed by the methodologies congruent with the international best practices.

5 CARE Ratings Limited

Press Release

Disclaimer

CARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument

and are not recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy,

sell or hold any security. CARE’s ratings do not convey suitability or price for the investor. CARE’s ratings do

not constitute an audit on the rated entity. CARE has based its ratings/outlooks on information obtained from

sources believed by it to be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy

or completeness of any information and is not responsible for any errors or omissions or for the results

obtained from the use of such information. Most entities whose bank facilities/instruments are rated by CARE

have paid a credit rating fee, based on the amount and type of bank facilities/instruments. CARE or its

subsidiaries/associates may also have other commercial transactions with the entity. In case of

partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on the capital

deployed by the partners/proprietor and the financial strength of the firm at present. The rating/outlook may

undergo change in case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor

in addition to the financial performance and other relevant factors. CARE is not responsible for any errors and

states that it has no financial liability whatsoever to the users of CARE’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which

may involve acceleration of payments in case of rating downgrades. However, if any such clauses are

introduced and if triggered, the ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careratings.com

6 CARE Ratings Limited

You might also like

- Completing The Accounting Cycle: Chapter 4Document34 pagesCompleting The Accounting Cycle: Chapter 4Dương Thái NgọcNo ratings yet

- Emerging Markets Currency Guide - Credit SwissDocument26 pagesEmerging Markets Currency Guide - Credit Swissrandomwalker2No ratings yet

- Keventer Agro LimitedDocument4 pagesKeventer Agro LimitedYasser SayedNo ratings yet

- Gujarat Themis Biosyn LimitedDocument5 pagesGujarat Themis Biosyn LimitedAshwani KesharwaniNo ratings yet

- Waaree Energies LimitedDocument6 pagesWaaree Energies LimitedHasik JainNo ratings yet

- Venkateshwara Hatcheries Private Limited-01-08-2020Document5 pagesVenkateshwara Hatcheries Private Limited-01-08-2020Deepti JajooNo ratings yet

- Anmol Feeds Private LimitedDocument7 pagesAnmol Feeds Private Limitedahana.p23No ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- K.P.R. Sugar Mill LimitedDocument7 pagesK.P.R. Sugar Mill LimitedKarthikeyan RK SwamyNo ratings yet

- Saraf Chemicals Private LimitedDocument6 pagesSaraf Chemicals Private LimitedCedric KerkettaNo ratings yet

- Divis Laboratories LimitedDocument7 pagesDivis Laboratories Limiteddivygupta198No ratings yet

- Aarti Industries - Company Update - 170921Document19 pagesAarti Industries - Company Update - 170921darshanmaldeNo ratings yet

- Press Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Tarsons Products Private Limited: Details of Instruments/facilities in Annexure-1hussainNo ratings yet

- Wockhardt LimitedDocument8 pagesWockhardt LimitedKumar SatyakamNo ratings yet

- Bharat Gears LimitedDocument7 pagesBharat Gears LimitedjagadeeshNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Abdos Credit Rating CARE 2020Document5 pagesAbdos Credit Rating CARE 2020Puneet367No ratings yet

- Shilchar Technologies LimitedDocument5 pagesShilchar Technologies Limitedjaikumar608jainNo ratings yet

- Suguna Foods Private Limited ReportDocument8 pagesSuguna Foods Private Limited ReportSHRAYANS NAHATANo ratings yet

- Technico Industries LimitedDocument4 pagesTechnico Industries Limitedshankarravi8975No ratings yet

- 3F Industries LimitedDocument5 pages3F Industries LimitedData CentrumNo ratings yet

- Bhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREDocument4 pagesBhagwati Lacto Vegetarian Exports Private Limited-Jan 2020 CAREPuneet367No ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Gujarat State Fertilizers & Chemicals LimitedDocument6 pagesGujarat State Fertilizers & Chemicals LimitedGopal PatelNo ratings yet

- Bharat Forge LimitedDocument7 pagesBharat Forge LimitedjagadeeshNo ratings yet

- Anthem Biosciences-R-21052018Document7 pagesAnthem Biosciences-R-21052018swarnaNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Press Release Aries Agro Limited: Ratings Facilities Amount (Rs. Crore) Rating Rating Action - Total Facilities 175.05Document4 pagesPress Release Aries Agro Limited: Ratings Facilities Amount (Rs. Crore) Rating Rating Action - Total Facilities 175.05Yogi173No ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07!02!2019Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07!02!2019Technical dostNo ratings yet

- Care Rating Sterling - Addlife - India - Private - LimitedDocument6 pagesCare Rating Sterling - Addlife - India - Private - Limitedrahul.tibrewalNo ratings yet

- IOL Chemicals and Pharmaceuticals Limited-07-07-2020Document4 pagesIOL Chemicals and Pharmaceuticals Limited-07-07-2020Jeet SinghNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Prabhat Dairy - R-13022019Document8 pagesPrabhat Dairy - R-13022019RahulNo ratings yet

- Chelsea Mills LLPDocument5 pagesChelsea Mills LLProhitmahto18158920No ratings yet

- 2020-08, Ambit Insights - Laurus LabsDocument19 pages2020-08, Ambit Insights - Laurus LabsKarthikNo ratings yet

- ICICI Securities Tarsons Re Initiating CoverageDocument14 pagesICICI Securities Tarsons Re Initiating CoverageGaurav ChandnaNo ratings yet

- PR Chennai Rice 24june22Document8 pagesPR Chennai Rice 24june22RaviNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Sumitomo Chemicals India LTD: Emerging MNC Proxy in Indian CPC Growth StoryDocument28 pagesSumitomo Chemicals India LTD: Emerging MNC Proxy in Indian CPC Growth StorySasidhar ThamilNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Suven Pharmaceuticals Topline Declines FocusingDocument4 pagesSuven Pharmaceuticals Topline Declines FocusingKoushik SircarNo ratings yet

- Godrej Agrovet Limited: Branded Player in High Growth SegmentsDocument10 pagesGodrej Agrovet Limited: Branded Player in High Growth SegmentsVaibhav SinghNo ratings yet

- Oriental Rubber Industries Pvt. LTDDocument7 pagesOriental Rubber Industries Pvt. LTDPriya VijiNo ratings yet

- Big Bags International PVT LTDDocument7 pagesBig Bags International PVT LTDnayabrasul208No ratings yet

- Britannia Industries LTD PDFDocument8 pagesBritannia Industries LTD PDFYugandhara HolkarNo ratings yet

- Valiant Organic BP Wealth 280122Document19 pagesValiant Organic BP Wealth 280122Grim ReaperNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Britannia Industries: Steady Performance in Tough EnvironmentDocument6 pagesBritannia Industries: Steady Performance in Tough EnvironmentdarshanmadeNo ratings yet

- Drools Pet Food Private LimitedDocument7 pagesDrools Pet Food Private LimitedramlamacadNo ratings yet

- 202407140711_Garware_Hi-Tech_Films_LimitedDocument7 pages202407140711_Garware_Hi-Tech_Films_LimitedDharam GamiNo ratings yet

- CRISIL Equity Research Detailed ReportDocument28 pagesCRISIL Equity Research Detailed ReportAamir FatahyabNo ratings yet

- AVT McCormick-R-26032018Document7 pagesAVT McCormick-R-26032018Siddharth DamaniNo ratings yet

- Devyani Food Industries LimitedDocument7 pagesDevyani Food Industries LimitedRahulNo ratings yet

- S. Jogani Exports Private LimitedDocument6 pagesS. Jogani Exports Private Limitedarc14consultantNo ratings yet

- Dishman PharmaDocument8 pagesDishman Pharmaapi-234474152No ratings yet

- To, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentDocument24 pagesTo, Listing/Complianpce Department Phiroze Jeejeebhoy Towers, Dalal Street, Mumbai - 400 001. Listing/Compliance DepartmentrohitnagrajNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Ginni Filaments Limited-09!07!2020Document4 pagesGinni Filaments Limited-09!07!2020Saurabh AgarwalNo ratings yet

- Akar Auto Industries LimitedDocument5 pagesAkar Auto Industries Limitedkrushna.maneNo ratings yet

- A Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessFrom EverandA Study of the Supply Chain and Financial Parameters of a Small Manufacturing BusinessNo ratings yet

- Circular Flow of IncomeDocument19 pagesCircular Flow of IncomemohanthakralNo ratings yet

- UntitledDocument1 pageUntitledmohanthakralNo ratings yet

- Research Paper MacroeconomicsDocument1 pageResearch Paper MacroeconomicsmohanthakralNo ratings yet

- Paytm Postpaid Sanction Cum T&C LetterDocument6 pagesPaytm Postpaid Sanction Cum T&C LettermohanthakralNo ratings yet

- Unit V Game Theory (Graphical Method)Document6 pagesUnit V Game Theory (Graphical Method)mohanthakralNo ratings yet

- A211 MC4 MFRS108 Mfrs110-StudentDocument6 pagesA211 MC4 MFRS108 Mfrs110-StudentGui Xue ChingNo ratings yet

- Short Cases: Business Process ReengineeringDocument9 pagesShort Cases: Business Process ReengineeringNOSHEEN MEHFOOZNo ratings yet

- Chapter 10 Goods Market Is LMDocument6 pagesChapter 10 Goods Market Is LMmulengaadamson00No ratings yet

- Cash FlowsDocument4 pagesCash FlowsJb De GuzmanNo ratings yet

- Batteries Company, Oil and Gas Company, Manufacturing Company DUBAIDocument28 pagesBatteries Company, Oil and Gas Company, Manufacturing Company DUBAIPacific HRNo ratings yet

- Financial Management AssignmentDocument4 pagesFinancial Management AssignmentTwaha R. KabandikaNo ratings yet

- Kingspan - Systems and Solutions Guide - Brochure - MEATCA - 062021 - ENDocument168 pagesKingspan - Systems and Solutions Guide - Brochure - MEATCA - 062021 - ENColince FeukouoNo ratings yet

- Brick Manufacturing ProcessDocument17 pagesBrick Manufacturing Processprahladagarwal100% (3)

- Modern History USA 1919-1941 NotesDocument13 pagesModern History USA 1919-1941 NotesOliver Al-MasriNo ratings yet

- Fiarlocks LTD: Invoice and Packing ListDocument1 pageFiarlocks LTD: Invoice and Packing ListDeelaka DheeraratneNo ratings yet

- Cost Benefit Analysis Is Done To Determine How WellDocument5 pagesCost Benefit Analysis Is Done To Determine How WellShaikh JahirNo ratings yet

- John Njenga GathuraDocument2 pagesJohn Njenga GathuraJohn NjengaNo ratings yet

- Indian Economic and Political History: Rajesh Bhattacharya Email: Virtual Lounge: TBADocument14 pagesIndian Economic and Political History: Rajesh Bhattacharya Email: Virtual Lounge: TBANaunihal KumarNo ratings yet

- ESG Data Free Trial - RefinitivDocument4 pagesESG Data Free Trial - RefinitivgodkabetaNo ratings yet

- Bureau of CostumsDocument4 pagesBureau of CostumsJomari BauzonNo ratings yet

- The Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersDocument4 pagesThe Composable Commerce Cheat Sheet: How To Sell The Commerce Solution of Your Dreams To Your Business PeersSaurabh PantNo ratings yet

- ACCOUNTING3Document3 pagesACCOUNTING3Cj SernaNo ratings yet

- Data Tiket Dan Hotel Share H-1Document4 pagesData Tiket Dan Hotel Share H-1Ahmad NursalimNo ratings yet

- English E-Paper Editorial 15 - 5Document34 pagesEnglish E-Paper Editorial 15 - 5Radha PaliwalNo ratings yet

- Effects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Document82 pagesEffects of Cash Management Practice On Financial Performance of Las Pinas Florita Trading 2Rubie Grace ManaigNo ratings yet

- Invoice: PTCL STN: PTCL NTNDocument1 pageInvoice: PTCL STN: PTCL NTNAmal EmaanNo ratings yet

- Saln CherryDocument3 pagesSaln CherryMARISSA MAMARILNo ratings yet

- Kartika Ayuningtyas: EducationDocument1 pageKartika Ayuningtyas: EducationNur Imron CahyadiNo ratings yet

- Types of IndustriesDocument29 pagesTypes of IndustriesMilton MosquitoNo ratings yet

- Accounting Information System - Chapter 4 ExpenditureDocument71 pagesAccounting Information System - Chapter 4 ExpenditureMelisa May Ocampo AmpiloquioNo ratings yet

- Review Questions: Chart of AccountsDocument4 pagesReview Questions: Chart of AccountsHasan NajiNo ratings yet

- Tyre Industry in IndiaDocument11 pagesTyre Industry in IndiaAlok ChowdhuryNo ratings yet

- Indian Textile IndustryDocument4 pagesIndian Textile IndustryAyush BhatnagarNo ratings yet