Professional Documents

Culture Documents

ICA 4 Key

ICA 4 Key

Uploaded by

Dior Dime0 ratings0% found this document useful (0 votes)

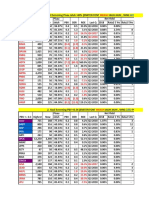

7 views6 pages1. The beta for APPL is 1.222 and for AMZN is 1.299.

2. The expected return for APPL is 2.54% while its beta is higher than the portfolio, so it does not satisfy the higher beta, higher return relationship.

3. The statistics for the equal-weighted portfolio are an expected return of 2.06%, standard deviation of 8.57%, and a beta of 1.261.

4. The best investment based on the highest Sharpe Ratio is APPL.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The beta for APPL is 1.222 and for AMZN is 1.299.

2. The expected return for APPL is 2.54% while its beta is higher than the portfolio, so it does not satisfy the higher beta, higher return relationship.

3. The statistics for the equal-weighted portfolio are an expected return of 2.06%, standard deviation of 8.57%, and a beta of 1.261.

4. The best investment based on the highest Sharpe Ratio is APPL.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views6 pagesICA 4 Key

ICA 4 Key

Uploaded by

Dior Dime1. The beta for APPL is 1.222 and for AMZN is 1.299.

2. The expected return for APPL is 2.54% while its beta is higher than the portfolio, so it does not satisfy the higher beta, higher return relationship.

3. The statistics for the equal-weighted portfolio are an expected return of 2.06%, standard deviation of 8.57%, and a beta of 1.261.

4. The best investment based on the highest Sharpe Ratio is APPL.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 6

In Class Assignment #4

Download historical monthly stock return data for the past 5 years for APPL and AM

Build an equal-weighted portfolio of APPL and AMZN.

Report the following statistics:

1. Beta for APPL

2. Beta for AMZN.

3. Do APPL and AMZN satisfy the usual "higher beta, higher return" relationship?

4. Compute the expected return, standard deviation and beta of the equal-weighte

5. Which of the following investments is "best"? APPL, AMZN or Portfolio?

Bonus:

Can you find weights on APPL and AMZN which produce an even "better" investme

ears for APPL and AMZN, VFINX.

turn" relationship?

of the equal-weighted portfolio.

or Portfolio?

en "better" investment than your answer to number 5?

Analysis of APPL, AMZN, Portfolio

Returns

VINX AMZN APPL VFINX AMZN APPL EQ Portfolio

11/1/2017 226.9248 58.8375 40.77422 0.64% -0.62% -1.17% -0.89%

12/1/2017 228.3869 58.4735 40.29693 6.19% 24.06% -1.06% 11.50%

1/1/2018 242.5312 72.5445 39.86831 -3.70% 4.24% 6.38% 5.31%

2/1/2018 233.5612 75.6225 42.41381 -2.97% -4.30% -5.42% -4.86%

3/1/2018 226.627 72.367 40.11454 0.80% 8.21% -1.50% 3.35%

4/1/2018 228.4311 78.3065 39.51203 2.39% 4.05% 13.08% 8.57%

5/1/2018 233.901 81.481 44.67877 0.16% 4.31% -0.56% 1.87%

6/1/2018 234.2837 84.99 44.42864 4.16% 4.57% 2.80% 3.68%

7/1/2018 244.0353 88.872 45.67189 3.25% 13.24% 19.62% 16.43%

8/1/2018 251.9573 100.6355 54.63395 0.13% -0.48% -0.48% -0.48%

9/1/2018 252.2761 100.15 54.37035 -6.45% -20.22% -3.05% -11.63%

10/1/2018 236.0004 79.9005 52.71328 2.03% 5.77% -18.40% -6.32%

11/1/2018 240.7833 84.5085 43.01168 -9.50% -11.13% -11.36% -11.25%

12/1/2018 217.9044 75.0985 38.12485 8.54% 14.43% 5.52% 9.97%

1/1/2019 236.5192 85.9365 40.22758 3.20% -4.59% 4.03% -0.28%

2/1/2019 244.0891 81.9915 41.84935 1.40% 8.59% 10.17% 9.38%

3/1/2019 247.4955 89.0375 46.10671 4.59% 8.19% 5.64% 6.91%

4/1/2019 258.867 96.326 48.70878 -6.36% -7.86% -12.76% -10.31%

5/1/2019 242.3912 88.7535 42.49488 6.51% 6.68% 13.49% 10.08%

6/1/2019 258.1821 94.6815 48.22628 1.92% -1.42% 7.64% 3.11%

7/1/2019 263.1362 93.339 51.91051 -1.59% -4.85% -2.02% -3.43%

8/1/2019 258.9494 88.8145 50.86275 1.41% -2.27% 7.70% 2.72%

9/1/2019 262.5913 86.7955 54.78112 2.61% 2.35% 11.07% 6.71%

10/1/2019 269.4547 88.833 60.84454 3.62% 1.36% 7.43% 4.40%

11/1/2019 279.2101 90.04 65.36704 2.53% 2.61% 10.21% 6.41%

12/1/2019 286.2866 92.392 72.03988 0.41% 8.71% 5.40% 7.05%

1/1/2020 287.4635 100.436 75.93076 -8.24% -6.22% -11.68% -8.95%

2/1/2020 263.7726 94.1875 67.06222 -12.76% 3.50% -6.76% -1.63%

3/1/2020 230.1271 97.486 62.53192 13.27% 26.89% 15.54% 21.21%

4/1/2020 260.6694 123.7 72.24773 4.76% -1.28% 8.22% 3.47%

5/1/2020 273.0665 122.1185 78.18397 1.48% 12.96% 15.05% 14.00%

6/1/2020 277.115 137.941 89.95004 6.13% 14.71% 16.51% 15.61%

7/1/2020 294.102 158.234 104.8036 7.40% 9.05% 21.44% 15.24%

8/1/2020 315.8711 172.548 127.2714 -4.39% -8.76% -10.09% -9.42%

9/1/2020 301.9941 157.4365 114.4287 -2.28% -3.58% -6.00% -4.79%

10/1/2020 295.1178 151.8075 107.5616 10.94% 4.34% 9.36% 6.85%

11/1/2020 327.3907 158.402 117.63 3.44% 2.81% 11.65% 7.23%

12/1/2020 338.6566 162.8465 131.3335 -0.64% -1.56% -0.55% -1.05%

1/1/2021 336.482 160.31 130.611 2.76% -3.53% -8.11% -5.82%

2/1/2021 345.7606 154.6465 120.0204 4.03% 0.04% 0.88% 0.46%

3/1/2021 359.6982 154.704 121.082 5.66% 12.07% 7.62% 9.84%

4/1/2021 380.0746 173.371 130.3105 0.69% -7.05% -5.21% -6.13%

5/1/2021 382.692 161.1535 123.5204 2.00% 6.74% 10.10% 8.42%

6/1/2021 390.3575 172.008 135.9931 2.68% -3.27% 6.50% 1.61%

7/1/2021 400.8247 166.3795 144.8302 3.03% 4.30% 4.09% 4.20%

8/1/2021 412.9657 173.5395 150.7581 -4.95% -5.35% -6.66% -6.01%

9/1/2021 392.5332 164.252 140.7115 7.31% 2.66% 5.87% 4.26%

10/1/2021 421.2159 168.6215 148.9653 -0.70% 3.99% 10.35% 7.17%

11/1/2021 418.2558 175.3535 164.3789 4.11% -4.93% 7.58% 1.33%

12/1/2021 435.4616 166.717 176.8382 -4.87% -10.28% -1.57% -5.93%

1/1/2022 414.261 149.5735 174.0597 -3.00% 2.67% -5.53% -1.43%

2/1/2022 401.8248 153.563 164.4395 3.38% 6.14% 5.88% 6.01%

3/1/2022 415.4034 162.9975 174.112 -8.45% -23.75% -9.71% -16.73%

4/1/2022 380.2849 124.2815 157.2003 0.17% -3.28% -5.59% -4.43%

5/1/2022 380.9325 120.2095 148.4155 -8.61% -11.65% -8.01% -9.83%

6/1/2022 348.1337 106.21 136.5304 9.61% 27.06% 18.86% 22.96%

7/1/2022 381.6 134.95 162.2846 -4.09% -6.06% -3.26% -4.66%

8/1/2022 365.99 126.77 157.0019 -9.59% -10.86% -11.98% -11.42%

9/1/2022 330.89 113 138.2

10/1/2022 null null null

EQ Portfolio Problem 1. -- Beta for APPL 1.222

Problem 2. -- Beta for AMZN 1.299

Problem 3. -- Higher beta, higher return? Expected Return

APPL

2.54%

Beta

APPL

1.222

Problem 4. -- Portfolio statistics Method 1

Expected Return 2.06%

Standard Devation 8.57%

Beta 1.261

Problem 5. -- Which is the "best" portfolio?

APPL

Sharpe Ratio 0.28

Bonus:

Weight on APPL

0

0.1

0.2

0.3

0.4

0.5

0.6

0.7

0.8

0.9

1

0.006

Expected Return Standard Deviation

AMZN APPL AMZN

1.59% 9.21% 9.73%

Beta

AMZN Cov(APPL, AMZN) 0.005702

1.299

Method 2 Portfolio Weights

2.06% APPL AMZN

8.57% 0.5 0.5

1.261

AMZN Portfolio

0.16 0.24 <--best investment is APPL

Portfolio Ex Portfolio Risk Sharpe Ratio

1.59% 9.73% 0.16

1.68% 9.37% 0.18

1.78% 9.07% 0.20

1.87% 8.83% 0.21

1.97% 8.66% 0.23

2.06% 8.57% 0.24

2.16% 8.55% 0.25

2.25% 8.61% 0.26

2.35% 8.74% 0.27

2.44% 8.94% 0.27

2.54% 9.21% 0.28

You might also like

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Dark Demon - Christine FeehanDocument4 pagesDark Demon - Christine Feehantheresa1970No ratings yet

- T2 Rodriguez Valladares JuniorDocument4 pagesT2 Rodriguez Valladares JuniorRosa AzabacheNo ratings yet

- DCF Modelling - WACC - CompletedDocument6 pagesDCF Modelling - WACC - Completedkukrejanikhil70No ratings yet

- 01-3 Plan Lineal VendedorDocument26 pages01-3 Plan Lineal VendedorJefer AnHe VelezNo ratings yet

- Reporte de RatiosDocument13 pagesReporte de RatiosSebatiaa IbarraNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- Portafolio de Inversiones - Linda Toribio LlanosDocument6 pagesPortafolio de Inversiones - Linda Toribio LlanosLynd Toribio LlanosNo ratings yet

- Session 11 Portfolio OptimizationDocument6 pagesSession 11 Portfolio Optimizationpayal mittalNo ratings yet

- Index ModelDocument1 pageIndex ModelVISHAL PATILNo ratings yet

- Adidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanDocument27 pagesAdidas/Reebok Merger: Collin Shaw Kelly Truesdale Michael Rockette Benedikte Schmidt SaravanansadaiyappanUdipta DasNo ratings yet

- PortfolioModelDocument4 pagesPortfolioModelSem's IndustryNo ratings yet

- Stock Screener203229Document3 pagesStock Screener203229Sde BdrNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- 1-Data For Health FinancingDocument19 pages1-Data For Health FinancingMuhammad Asif Khan KhattakNo ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- CNPF Ratio AnalysisDocument8 pagesCNPF Ratio AnalysisSheena Ann Keh LorenzoNo ratings yet

- BetasDocument10 pagesBetasVilmaCastilloMNo ratings yet

- Practica Sem 7 - Finanzas CoorpDocument9 pagesPractica Sem 7 - Finanzas Coorpabimm2502No ratings yet

- Report On NiftyDocument27 pagesReport On NiftyShashi ShekarNo ratings yet

- DCF Modelling - 12Document24 pagesDCF Modelling - 12sujal KumarNo ratings yet

- Dupont Analysis ModelDocument278 pagesDupont Analysis ModelKartikay GoswamiNo ratings yet

- Caso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALDocument12 pagesCaso Práctico Selección de Instrumentos Bursátiles (Comb y Portaf +3 Activos) FINALMARLEN GUADALUPE MEDINA SERRANONo ratings yet

- C4 - Excel Application SolutionDocument14 pagesC4 - Excel Application SolutionYasmine RhissassiNo ratings yet

- 11 - Ubaid Dhansay-Sapm AssignDocument5 pages11 - Ubaid Dhansay-Sapm Assign077 - Ubaid dhansayNo ratings yet

- The Unidentified Industries - Residency - CaseDocument4 pagesThe Unidentified Industries - Residency - CaseDBNo ratings yet

- Trabajo Aula (Grupo-02) - 18-11-2022Document6 pagesTrabajo Aula (Grupo-02) - 18-11-2022Rosa Lizbeth Chuquiruna ChavezNo ratings yet

- Mercury Athletic Footwear Case (Work Sheet)Document16 pagesMercury Athletic Footwear Case (Work Sheet)Bharat KoiralaNo ratings yet

- SN Date Wipro Kotak Bank TechmahindrDocument7 pagesSN Date Wipro Kotak Bank TechmahindrnavNo ratings yet

- Eval PcareDocument7 pagesEval PcarePKM WRINGINANOMNo ratings yet

- Apuntes 29-Oct-2020Document13 pagesApuntes 29-Oct-2020Gabriel D. Diaz VargasNo ratings yet

- QC 2 Level - Six Sigma - BaruDocument12 pagesQC 2 Level - Six Sigma - BaruHerbanu Haryo PramonoNo ratings yet

- CF Assignment II - Group 3Document8 pagesCF Assignment II - Group 3Rahatul AshafeenNo ratings yet

- Screening Saham 3feb19Document6 pagesScreening Saham 3feb19Muhammad Ramdhan IbadiNo ratings yet

- UntitledDocument9 pagesUntitledFernanda DelgadoNo ratings yet

- BetasDocument7 pagesBetasWendy FernándezNo ratings yet

- Izza InvestmentDocument3 pagesIzza InvestmentizzaNo ratings yet

- Campbell SoupsDocument2 pagesCampbell SoupsBhavesh MotwaniNo ratings yet

- Campbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesDocument2 pagesCampbell Soups Company: Year 11 Year 10 Year 9 Net Sales Costs and ExpensesBhavesh MotwaniNo ratings yet

- Solución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Document6 pagesSolución: Rentabilidad Esperada Volatilidad Coeficiente de Variación Varianza Covarianza Beta 1.98 1.2Yessica MacedaNo ratings yet

- Airthreads Valuation Case Study Excel File PDF FreeDocument18 pagesAirthreads Valuation Case Study Excel File PDF Freegoyalmuskan412No ratings yet

- Anexo 1. Resumen Valorización - Estimaciones BiceDocument1 pageAnexo 1. Resumen Valorización - Estimaciones BiceRicardo CarrilloNo ratings yet

- GB Pp09 Table V 4.1Document25 pagesGB Pp09 Table V 4.1Serchecko JaureguiNo ratings yet

- Tabela de Conversao DPMODocument24 pagesTabela de Conversao DPMONonato BatistaNo ratings yet

- GB-PP09 Table-V 4.1Document25 pagesGB-PP09 Table-V 4.1LuisNo ratings yet

- 3) LabS 03 2023 First Part - RIFATTADocument11 pages3) LabS 03 2023 First Part - RIFATTAgiovanni lazzeriNo ratings yet

- Kingfisher School of Business and Finance: Lucao District, Dagupan City, PangasinanDocument8 pagesKingfisher School of Business and Finance: Lucao District, Dagupan City, Pangasinansecret 12No ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Shivam Khanna BM 019159 FmueDocument10 pagesShivam Khanna BM 019159 FmueBerkshire Hathway coldNo ratings yet

- Stock Screener Database - CROICDocument6 pagesStock Screener Database - CROICJay GalvanNo ratings yet

- AssignmentDocument16 pagesAssignmentMinza JahangirNo ratings yet

- Wusen Js ExcelDocument5 pagesWusen Js ExcelDessiree ChenNo ratings yet

- Table 1. Annual Energy Output Turbine 1 Turbine 2 Turbine 3: FRANCO, Reinier MDocument4 pagesTable 1. Annual Energy Output Turbine 1 Turbine 2 Turbine 3: FRANCO, Reinier MReinier FrancoNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- Big Data Analysis Assig.2Document5 pagesBig Data Analysis Assig.2gerrydenis20No ratings yet

- Determinar WaccDocument5 pagesDeterminar WaccLisbeth CarrascoNo ratings yet

- Ενότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςDocument43 pagesΕνότητα 1.2.2 - Παράδειγμα μοντέλων αποτίμησηςagis.condtNo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- MacroDocument4 pagesMacroLina M Galindo GonzalezNo ratings yet

- Date Adj Close CCR CCR Adj Close CCR CCR CCRDocument17 pagesDate Adj Close CCR CCR Adj Close CCR CCR CCRRanjith KumarNo ratings yet

- Math Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesFrom EverandMath Practice Simplified: Decimals & Percents (Book H): Practicing the Concepts of Decimals and PercentagesRating: 5 out of 5 stars5/5 (3)

- Pre-Class 11Document2 pagesPre-Class 11Dior DimeNo ratings yet

- LWCP 12Document1 pageLWCP 12Dior DimeNo ratings yet

- Redden, Diamond FinalDocument18 pagesRedden, Diamond FinalDior DimeNo ratings yet

- ICA7Document10 pagesICA7Dior DimeNo ratings yet

- ICA5Document1 pageICA5Dior DimeNo ratings yet

- Guru Prasad DubeyDocument2 pagesGuru Prasad DubeyGowtham SivamNo ratings yet

- Answers To Dragnet Abstract 1 & 2 PDFDocument9 pagesAnswers To Dragnet Abstract 1 & 2 PDFokotete evidenceNo ratings yet

- Feed The Birds Pitch PDFDocument795 pagesFeed The Birds Pitch PDFEddie T.100% (1)

- Effects of Complementary Medicine On Nausea and VoDocument10 pagesEffects of Complementary Medicine On Nausea and VoDelviNo ratings yet

- Sleep Hygiene: "Sleep Is The Key To Health, Performance, Safety, and Quality of Life"Document8 pagesSleep Hygiene: "Sleep Is The Key To Health, Performance, Safety, and Quality of Life"Child and Family InstituteNo ratings yet

- Lefty ManualDocument72 pagesLefty ManualInti Llapha100% (2)

- Unilever's Organizational Culture of PerformanceDocument11 pagesUnilever's Organizational Culture of PerformanceHa Nguyen100% (1)

- Morton Feldman, Earle Brown and Heinz-Klaus Metzger DiscussionDocument7 pagesMorton Feldman, Earle Brown and Heinz-Klaus Metzger DiscussionEstefanía SánchezNo ratings yet

- Criteo Vs SteelHouseDocument44 pagesCriteo Vs SteelHouseLaraNo ratings yet

- Positioning StrategiesDocument19 pagesPositioning StrategiesSarvesh MaheshwariNo ratings yet

- BorrokletDocument14 pagesBorrokletHåkon HallenbergNo ratings yet

- Assignment On Business Statistics (SUBMITION DATE 10/12/2013)Document2 pagesAssignment On Business Statistics (SUBMITION DATE 10/12/2013)Negero ArarsoNo ratings yet

- AWWA Alt Disnfec Fro THM RemovalDocument264 pagesAWWA Alt Disnfec Fro THM RemovalsaishankarlNo ratings yet

- Coumadins (Vitamin K Antagonists)Document7 pagesCoumadins (Vitamin K Antagonists)Marvz BulawitNo ratings yet

- UNITED PERFUMES - Distributor Price List Jan 12, 2024 - Web DownloadDocument88 pagesUNITED PERFUMES - Distributor Price List Jan 12, 2024 - Web DownloadMe Dicen RoiNo ratings yet

- Themes of Absurd TheatreDocument5 pagesThemes of Absurd TheatreLuka RomanovNo ratings yet

- INA827 Wide Supply Range, Rail-to-Rail Output Instrumentation Amplifier With A Minimum Gain of 5Document35 pagesINA827 Wide Supply Range, Rail-to-Rail Output Instrumentation Amplifier With A Minimum Gain of 5Sanjeev KumarNo ratings yet

- Rigid Pavement: Postgraduate Studies Highways EngineeringDocument15 pagesRigid Pavement: Postgraduate Studies Highways EngineeringHANAN HUSSNo ratings yet

- Lab Instructions and Answer Key: Configuring and Troubleshooting A Windows Server® 2008 Network InfrastructureDocument297 pagesLab Instructions and Answer Key: Configuring and Troubleshooting A Windows Server® 2008 Network InfrastructureCarlos Ivan Chavez FuentesNo ratings yet

- ME Civil With Construction ManagementDocument42 pagesME Civil With Construction ManagementHitesh KarNo ratings yet

- V A English Final Exam ResultDocument5 pagesV A English Final Exam ResultArdhiyan NugrahantoNo ratings yet

- The Final Appeal To Mankind Nikolai LevashovDocument216 pagesThe Final Appeal To Mankind Nikolai LevashovvickieNo ratings yet

- A. JDocument9 pagesA. JNithin GopalNo ratings yet

- Speak Effortless English Learn Fluent English Grammatically-1Document556 pagesSpeak Effortless English Learn Fluent English Grammatically-1Petre Mihaela Georgiana100% (2)

- Nurse Practitioner Cover LetterDocument4 pagesNurse Practitioner Cover Letterafjwfoffvlnzyy100% (2)

- Method of Milexp MeasurementDocument166 pagesMethod of Milexp MeasurementNasr AliNo ratings yet

- 08 Chapter08 126-138Document13 pages08 Chapter08 126-138api-258749062No ratings yet

- ISA-TR84.00.02-2002 - Part 1Document108 pagesISA-TR84.00.02-2002 - Part 1ЮрийПонNo ratings yet

- Project Report On AmulDocument18 pagesProject Report On AmulKetan Bankar0% (1)