Professional Documents

Culture Documents

Lists of Requirements From Taxpayers For20220713-12-Xaao9t

Lists of Requirements From Taxpayers For20220713-12-Xaao9t

Uploaded by

Loren SanapoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lists of Requirements From Taxpayers For20220713-12-Xaao9t

Lists of Requirements From Taxpayers For20220713-12-Xaao9t

Uploaded by

Loren SanapoCopyright:

Available Formats

March 12, 2001

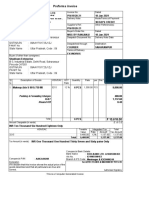

REVENUE MEMORANDUM CIRCULAR NO. 14-01

SUBJECT : Lists of Requirements from Taxpayers for Issuance of Certain

Rulings with Established Precedents Delegated to Regional

Directors and to the Assistant Commissioner, Legal Service

under RMC Nos. 2-2001, 3-2001 and 10-2001

TO : All Internal Revenue Officers and Others Concerned

In order to expedite the issuance of certain rulings with established

precedents delegated to the Regional Directors under RMC No. 3-2001 and

to the Assistant Commissioner, Legal Service under RMC Nos. 2-2001 and

10-2001, the lists of requirements to be submitted by taxpayers are as

follows:

A. Rulings Delegated to the Regional Directors

Under RMC No. 3-2001:

1. TAX EXEMPTION ON SALE OR DISPOSITION OF PRINCIPAL

RESIDENCE UNDER SECTION 24(D)(2) OF THE TAX CODE OF

1997 (RR No. 13-99, AS AMENDED BY RR No. 14-2000)

a) Deed of Absolute Sale;

b) Transfer Certificate of Title (TCT);

c) Tax Declaration (TD);

d) Sworn statement from the Barangay Chairman where the

principal residence is located, that the same has been

the seller's principal residence immediately prior to the

date of sale; if the principal residence is a condominium

unit, the certification shall be issued by the

Administrator of the condominium building;

e) Sworn Declaration of Intent to avail of the exemption

under Section 24(D)(2); and

f) Escrow Agreement between the concerned RDO, the

seller/transferor and the Authorized Agent Bank.

(Revenue Regulations No. 14-2000).

2. TAX EXEMPTION UNDER SECTION 30 OF THE TAX CODE OF 1997

a) Certificate of Registration with the Securities and

Exchange Commission (SEC);

b) Articles of Incorporation which must include the following

provisions:

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

i) that the corporation is non-stock, non-profit;

ii) that the primary purpose for which it was created is one

of those enumerated under Sec. 30 of the Tax Code of

1997;

iii) that no part of the net income shall inure to the benefit

of any its members;

iv) that the trustees do not receive any compensation; and

v) in case of dissolution, assets of the corporation shall be

transferred to similar institution or to the government;

c) By-Laws; and

d) Annual Information Return and Financial Statements for

the last 3 years of operation unless the non-stock, non-

profit corporation is newly incorporated.

3. TAX EXEMPTION OF EDUCATIONAL INSTITUTIONS (non-stock,

non-profit educational corporations [1987 Constitutions])

Same requirements as those requesting tax exemption under

Section 30 of the Tax Code of 1997 and the current Department

of Education, Culture and Sports (DECS), or the Commission on

Higher Education (CHED), or the Technical Education on Skills

Development Authority (TESDA) recognition, as the case may be.

4. TAX EXEMPTION OF COOPERATIVES UNDER RA NO. 6938, AS

AMENDED BY RA NO. 7716 AND RA NO. 8241

a) Articles of Cooperation and By-Laws;

b) Certificate of Registration and certificate of good standing

issued by the Cooperative Development Authority

(CDA);

c) Certificate under oath by the Chairman/President/General

Manager of the Cooperative that it is transacting

business with both members and non-members;

d) Certificate of Confirmation of Registration from CDA (in the

case of Cooperatives transacting business with non

members already existing and previously registered

under PD 175, PD 775 and PD 898, before the creation

of the CDA, the reckoning period for the 10-year period

of exemption is from March 10, 1987;

e) Certification under oath by the

Chairman/President/General Manager of the

Cooperative (if previously registered as above stated),

as to the amount of accumulated reserves and

undivided net savings, and that at least 25% of the net

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

income is returned to the members in the form of

interest and/or patronage refund; acIHDA

f) Latest Financial Statements duly audited by an

independent Certified Public Accountant (CPA); and

g) In the case of non-agricultural, non-electric and non-credit

cooperative, certification that the share capital

contribution of each member does not exceed P

15,000.00.

5. TAX EXEMPTION OF SENIOR CITIZENS UNDER RA NO. 7432

a) Letter request from the senior citizen stating, among

others, that his annual taxable income does not exceed

the poverty level of P60,000.00;

b) Certified true copy of Birth Certificate/Baptismal Certificate

or in the absence thereof, a certificate from the National

Statistics and Census Bureau or an affidavit by two (2)

disinterested credible persons who know personally the

senior citizen or OSCA ID card;

c) If he has a benefactor as defined in Section 2(f) of

Revenue Regulations No. 2-94, Certification as to the

name, address, occupation, office or business address

(office/business) and TIN of his benefactor;

d) If employed, a copy of his withholding tax statement (BIR

Form W-2) for the preceding taxable year; and

e) If self-employed, (i.e., practice of profession, or in business

as single proprietorship) a copy of his income tax return

(ITR) for the preceding taxable year together with the

annual license or permit issued by the city or

municipality where he has his principal place of

business, supported by a copy of his declaration of

sales or income.

6. TAX EXEMPTION OF NHA AND PRIVATE SECTOR PARTICIPATING

IN SOCIALIZED HOUSING, INCLUDING PARTICIPANTS IN

COMMUNITY MORTGAGE PROGRAM UNDER RA NO. 7279, AS

IMPLEMENTED BY REVENUE REGULATIONS NO. 9-93, AS

AMENDED BY RR NO. 11-97

a) Copy of the Deed of Sale;

b) Copy of the Transfer Certificate of Title;

c) Copy of the corresponding Tax Declaration;

d) Photocopy of the receipt of payment of the Documentary

Stamp tax;

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

e) Sworn Statement of taxpayer that the acquired raw land

shall be used for socialized housing project;

f) Approved HLURB Subdivision Preliminary and Location

Clearance of the Subdivision;

g) Certification from HLURB that taxpayer is engaged in

socialized housing;

h) Certification from the HLURB that the sale of the socialized

housing units to qualified beneficiaries shall in no case

exceed the maximum amount of P180,000.00 price

ceiling;

i) Taxpayer Identification Number (TIN) of the seller and

buyer.

7. EXTENSION OF TIME FOR THE FILING OF ESTATE TAX RETURN

UNDER SECTION 90 (C) OF THE TAX CODE OF 1997

a) Death Certificate; and

b) Letter Request from the taxpayer.

AND EXTENSION OF TIME TO PAY ESTATE TAX UNDER SECTION 91

OF THE SAME CODE, BUT WHERE THE FILING OF THE BOND NOT

EXCEEDING DOUBLE THE AMOUNT OF THE TAX IS A NECESSARY

REQUIREMENT.

a) Death Certificate;

b) Court Order, if estate is settled through the court (5 years

extension);

c) Extra judicial settlement of estate (2 years extension); and

d) Letter Request from the taxpayer.

8. EXEMPTION FROM DONOR'S TAX UNDER SECTION 101 OF THE

TAX CODE OF 1997

a) Deed of donation;

b) Donor's Tax Return;

c) If real property, Transfer Certificate of Title & Tax

Declaration; and

d) Certificate of accreditation issued by the Philippine Council

for NGO Certification (PCNC), if the donee is an

accredited NGO under Section 34(H)(2)(c).

9. TAX EXEMPTION OF SEPARATION BENEFITS OF EMPLOYEES FOR

ANY CAUSE BEYOND THEIR CONTROL UNDER SECTION 32(B)

(6)(b) OF THE TAX CODE OF 1997. (IN CASE THE SEPARATION

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

OF THE OFFICIAL OR EMPLOYEE FROM THE SERVICE OF THE

EMPLOYER IS DUE TO SICKNESS OR OTHER PHYSICAL

DISABILITY AND THE CONTINUOUS EMPLOYMENT AND

PERFORMANCE OF HIS REGULAR DUTIES WOULD ENDANGER

HIS PHYSICAL WELL-BEING, A MEDICAL REPORT TO THIS

EFFECT, ISSUED BY A GOVERNMENT HOSPITAL LOCATED

WITHIN THE JURISDICTION OF THE REVENUE REGION, MUST

BE SUBMITTED BY THE TAXPAYER BEFORE THE RULING SHALL

BE ISSUED)

a) Sworn Affidavit to be executed by the Employer's

physician and the head of Office/Entity, attesting to the

fact that the retiring/separated official or employee is

suffering from a serious illness that would effect the

performance of his duties and would endanger his life,

if he would continue working; and

b) A certification to be issued by a government physician

located within the jurisdiction of the Revenue Region

concerned confirming the findings of the employer's

physician.

10. TAX TREATMENT OF THE TRANSFER TO THE CONDOMINIUM

CORPORATION OF THE COMMON AREAS OF A CONDOMINIUM

UNDER RA NO. 4726, OTHERWISE KNOWN AS "THE

CONDOMINIUM ACT"

a) Deed of Conveyance/Assignment;

b) Master Deed and Declaration of Restriction;

c) Secretary's Certificate; and

d) TCT and TD of the parcel of land subject of the Deed of

Conveyance/Assignment.

11. USE OF LOOSE-LEAF INVOICES/RECEIPTS AND BOOKS OF

ACCOUNTS (MANUAL)

a) Letter request from the taxpayer.

12. REQUEST FOR CHANGE OF ACCOUNTING PERIOD (EXCEPT

CHANGE OF ACCOUNTING METHOD) UNDER SECTION 46 OF

THE TAX CODE OF 1997

a) Letter request from the taxpayer.

13. EXEMPTION FROM INCOME TAX AND, CONSEQUENTLY, FROM

WITHHOLDING TAX OF "DE MINIMIS BENEFITS" AS DEFINED

AND DISCUSSED IN RR NO. 2-98, RR NO. 3-98, RR NO. 8-

2000, and RR NO. 10-2000, INCLUDING: (1) Exemption from

the "withholding tax on wages" of monetized ten (10)-day

vacation leave credit for employees of private entities; and

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

(2) Exemption from the "withholding tax on wages" of

monetized leave credits of government employees;

a) Letter request from the taxpayer.

B. Rulings Delegated to the Assistant Commissioner, Legal Service

Under RMC No. 2-2001:

1. VAT EXEMPTION CERTIFICATE FOR EMBASSIES ISSUED ON THE

BASIS OF RECIPROCITY AS CONFIRMED BY THE OFFICE OF

THE PROTOCOL, DEPARTMENT OF FOREIGN AFFAIRS

a) Note Verbale by the requesting Embassy to the

Department of Foreign Affairs (DFA) informing the latter

of the Embassy's intention to apply for the issuance of a

VAT Exemption Certificate/s for the Embassy and/or its

Diplomats;

b) Endorsement/recommendation by the DFA Office of

Protocol; and TDcAaH

c) A precedent BIR Ruling exempting the Embassy and its

personnel from the payment of value added tax.

2. CERTIFICATE OF TAX EXEMPTION FOR ASIAN DEVELOPMENT

BANK AND OTHER INTERNATIONAL ORGANIZATIONS BASED

ON INTERNATIONAL AGREEMENT

a) Letter of application of the qualified ADB Staff member

(professional or higher level);

b) Pro forma invoice showing the car's price and tax

components separately;

c) Recommendation by the Asian Development Bank;

d) Recommendation by the Department of Foreign Affairs;

and

e) Recommendation by the Department of Finance.

3. CERTIFICATE OF RESIDENCY ISSUED IN ACCORDANCE WITH THE

PROVISIONS OF TAX TREATIES BETWEEN THE PHILIPPINES

AND OTHER COUNTRIES

a) For Individuals — Tax Identification No. (TIN) and/or latest

income tax/information return or passport or Embassy's

Certification as to residency; and

b) For Corporations — Securities and Exchange Commission

(SEC) Registration and BIR Registration (Note: Original

should be presented).

4. CERTIFICATION OF REGISTRATION AS QUALIFIED DONEE

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

INSTITUTION IN ACCORDANCE WITH THE PROVISION OF

REVENUE REGULATION NO. 13-98 DATED JANUARY 1, 1999

a) Accreditation from the Philippine Council for NGO Certification

(PCNC) 4/F MSCB Bldg., 4718 Eduque Street, Makati City, Tel.

No. 895-6169.

Under RMC No. 10-2001:

1. DENIAL OF CLAIM FOR INFORMER'S REWARD UNDER SECTION

282 OF THE TAX CODE OF 1997

a) Letter request of informer claiming for his reward

enclosing his affidavit, if any, including his supporting

documents; and

b) Docket of case forwarded by the Tax Fraud Division

recommending disapproval of the claim.

2. ISSUANCE OF DISBURSEMENT VOUCHER FOR THE INFORMER'S

REWARD DULY APPROVED THE SECRETARY OF FINANCE

a) Whole docket of the case, together with the indorsement,

signed by all the members of the Committee on

Reward, duly approved by the Secretary of Finance;

b) Certification from the Revenue Accounting Division of the

actual remittance; and

c) Certification from Revenue District Office where the

informer is registered that he/she has no outstanding

tax liability.

3. ISSUANCE OF TAX CREDIT CERTIFICATE OR DISBURSEMENT

VOUCHER FOR TAX REFUND IN COMPLIANCE WITH THE

DECISION OF THE SUPREME COURT, COURT OF APPEALS AND

COURT OF TAX APPEALS WHICH HAS BECOME FINAL AND

EXECUTORY

a) Writ of Execution issued by the Court; and

b) (Internal: Certifications from the Collection Service/Division

that taxpayer has no outstanding tax liability).

4. REQUEST FOR TAX EXEMPTION OF REASONABLE PRIVATE

BENEFIT PLAN

a) Actual Valuation Report;

b) Duly accomplished BIR Form No. 17.60;

c) Copy of the Retirement Plan;

d) Trust Agreement; and IDaCcS

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

e) Letter request for tax exemption.

5. REQUEST FOR CONFIRMATION THAT THE "REASONABLE PRIVATE

BENEFIT PLAN" IS STILL TAX EXEMPT DESPITE AMENDMENTS

TO ITS PROVISIONS

a) Copy of the Amendments to the provisions of the

Retirement Plan; and

b) Letter request confirming its tax exempt status.

6. REQUEST FOR RENEWAL OF CONFIRMATION OF TAX EXEMPT

STATUS OF A "REASONABLE PRIVATE BENEFIT PLAN"

a) Certified true copy of the previously approved Private

Benefit Plan; and

b) Letter request for renewal of confirmation of its tax

exempt status.

7. REQUEST FOR RULINGS ON TOPICS COVERED BY REVENUE

MEMORANDUM CIRCULAR NO. 3-2001 OF TAXPAYERS

FALLING WITHIN THE JURISDICTION OF THE NATIONAL OFFICE

a) Same list of requirements as those requesting tax

exemption under RMC 3-2001.

C. All the above-mentioned rulings to be issued by the Regional

Directors or the Assistant Commissioner, Legal Service, should state the

particular precedent ruling number signed by the Commissioner, including

the date when it was issued.

All internal revenue officers and others concerned are requested to

give this Circular as wide a publicity as possible.

(SGD.) RENE G. BAÑEZ

Commissioner of Internal Revenue

CD Technologies Asia, Inc. © 2022 cdasiaonline.com

You might also like

- Chapter 1 Cost Accounting Information For Decision MakingDocument5 pagesChapter 1 Cost Accounting Information For Decision MakingLorren K GonzalesNo ratings yet

- 8 Figure Funnel BlueprintDocument25 pages8 Figure Funnel Blueprintoscar thano100% (2)

- 14-2001 - Requirements For Tax ExemptionDocument7 pages14-2001 - Requirements For Tax ExemptionArjam B. BonsucanNo ratings yet

- Tax Theory PDFDocument44 pagesTax Theory PDFReazul IslamNo ratings yet

- Registration of Corporations Stock Corporation Basic RequirementsDocument27 pagesRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNo ratings yet

- DMCIHI - 021 Declaration of Cash Dividends - Final - April 4Document13 pagesDMCIHI - 021 Declaration of Cash Dividends - Final - April 4counsellorsNo ratings yet

- Address: of The of The Employee 2021-2022Document3 pagesAddress: of The of The Employee 2021-2022Dipak PArmarNo ratings yet

- RR 1996Document57 pagesRR 1996Maisie Rose VilladolidNo ratings yet

- Amendment Notes For CA (Intermediate) Nov. 2022 ExamsDocument5 pagesAmendment Notes For CA (Intermediate) Nov. 2022 Examssnehadagarsd19No ratings yet

- Eco Law Case Study Amendment List Nov 2022Document3 pagesEco Law Case Study Amendment List Nov 2022Sonia ShahNo ratings yet

- Bir Ruling Da C 296 727 09Document3 pagesBir Ruling Da C 296 727 09doraemoanNo ratings yet

- IBBI (CIRP) Regulation, 2016 Amended Upto 16-09-2022Document92 pagesIBBI (CIRP) Regulation, 2016 Amended Upto 16-09-2022rajni agarwalNo ratings yet

- Ty Tax Project (Final)Document14 pagesTy Tax Project (Final)raj_s_harmaNo ratings yet

- Frame Work For SSEDocument4 pagesFrame Work For SSEchetdinNo ratings yet

- Circulars/Notifications: Legal UpdateDocument9 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- Tax Canonical DoctrinesDocument20 pagesTax Canonical DoctrinesJay Indestructible HerreroNo ratings yet

- Form For Application For Grant of Licence To Be A Certifying AuthorityDocument19 pagesForm For Application For Grant of Licence To Be A Certifying AuthorityAppy Gowda GNo ratings yet

- Form CHG-1-16032017 Signe Cfil CDocument6 pagesForm CHG-1-16032017 Signe Cfil CsunjuNo ratings yet

- Memo Tax Exemption InstructionsDocument8 pagesMemo Tax Exemption InstructionsMakiling PeakNo ratings yet

- Eoi Amnesty of Fines and Penalties - Aff63417Document2 pagesEoi Amnesty of Fines and Penalties - Aff63417Leo Barraca IIINo ratings yet

- Tax Canonical DoctrinesDocument19 pagesTax Canonical DoctrinesCessy Ciar KimNo ratings yet

- SEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezDocument3 pagesSEC Opinion (November 16, 1982) Atty. Leonen R. GutierrezAlyssa Marie MartinezNo ratings yet

- Revenue Memorandum Circular No. 13-85: SubjectDocument4 pagesRevenue Memorandum Circular No. 13-85: SubjectAemie JordanNo ratings yet

- 2008-BIR Ruling (DA - C-182 559-08)Document8 pages2008-BIR Ruling (DA - C-182 559-08)Jay MirandaNo ratings yet

- MOSS CLG Constitution Draft 2 December 2016Document32 pagesMOSS CLG Constitution Draft 2 December 2016SammyNo ratings yet

- Statement of Single Largest Completed ContractDocument4 pagesStatement of Single Largest Completed ContractMelvanne Nuesca TamboboyNo ratings yet

- Bir Ruling No. Ot-042-2022Document6 pagesBir Ruling No. Ot-042-2022Ren Mar CruzNo ratings yet

- Revenue Regulations On Retirement Benefit Plans PDFDocument15 pagesRevenue Regulations On Retirement Benefit Plans PDFJadeNo ratings yet

- CIRP RegulationDocument90 pagesCIRP RegulationShivangi SinghNo ratings yet

- 18-154 SR 001Document28 pages18-154 SR 001beechezparisNo ratings yet

- Licensing Requirements For Emoney Issuers-Aug 2015Document3 pagesLicensing Requirements For Emoney Issuers-Aug 2015FestusOwusu-AcheampongNo ratings yet

- Revenue Memorandum Order No. 01-00Document3 pagesRevenue Memorandum Order No. 01-00Alea MalabananNo ratings yet

- Form No. Chg-1: English Hindi Form LanguageDocument7 pagesForm No. Chg-1: English Hindi Form LanguageKunal ObhraiNo ratings yet

- Eoi Amnesty of Fines and Penalties - Aff63417Document2 pagesEoi Amnesty of Fines and Penalties - Aff63417Anna Cecilia DonezaNo ratings yet

- AnnexC2 Checklist of Documentary RequirementsDocument3 pagesAnnexC2 Checklist of Documentary RequirementsJerome MansibangNo ratings yet

- Refund in GSTDocument6 pagesRefund in GSTNilesh SoniNo ratings yet

- Xiii Xvi ReviewerDocument38 pagesXiii Xvi Reviewerjuna luz latigayNo ratings yet

- XIII-XVI ReviewerDocument53 pagesXIII-XVI Reviewerjuna luz latigayNo ratings yet

- Tenant AdvisoryDocument1 pageTenant AdvisoryJanetNo ratings yet

- GR 163653 (Filinvest V CIR)Document38 pagesGR 163653 (Filinvest V CIR)ergiesonaNo ratings yet

- 2019 08 05 12 06 16 916 - Aahca2537l - 2020Document4 pages2019 08 05 12 06 16 916 - Aahca2537l - 2020MithileshNo ratings yet

- BIR Rulings (2017 - 2018)Document2,631 pagesBIR Rulings (2017 - 2018)Jerwin DaveNo ratings yet

- Tds On Dividend 24062022Document6 pagesTds On Dividend 24062022thimothiNo ratings yet

- CIRP RegulationsDocument82 pagesCIRP RegulationsUmang ShirodariyaNo ratings yet

- CIR Vs AichiDocument24 pagesCIR Vs AichiElaine GuayNo ratings yet

- Decatur Small Business Grant ProgramDocument4 pagesDecatur Small Business Grant ProgramZachary HansenNo ratings yet

- Circulars/Notifications: Legal UpdateDocument13 pagesCirculars/Notifications: Legal UpdateAnupam BaliNo ratings yet

- 14 CIR v. Aichi Forging Company of Asia Inc.Document24 pages14 CIR v. Aichi Forging Company of Asia Inc.Anonymous 8liWSgmINo ratings yet

- BIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Document3 pagesBIR Ruling No. 039-97 Dated 03april1997 (STT, No Transfer of Beneficial Ownership)Hailin QuintosNo ratings yet

- TAX-304 (VAT Compliance Requirements)Document5 pagesTAX-304 (VAT Compliance Requirements)Edith DalidaNo ratings yet

- VREIT - Board Resolutions - Div Dec - 15apr24 - PSEDocument14 pagesVREIT - Board Resolutions - Div Dec - 15apr24 - PSEcounsellorsNo ratings yet

- (AMENDED UPTO 30.09.2021) : 1 TH TH 2 RDDocument79 pages(AMENDED UPTO 30.09.2021) : 1 TH TH 2 RDShudhanshu Pratap SinghNo ratings yet

- Petitioner vs. vs. Respondent: First DivisionDocument6 pagesPetitioner vs. vs. Respondent: First DivisionPolo MartinezNo ratings yet

- Cirp Reg 180923Document98 pagesCirp Reg 180923RANJANNS7138No ratings yet

- Taxation Barangay Micro Business Enterprises (Bmbes) : Lecture NotesDocument1 pageTaxation Barangay Micro Business Enterprises (Bmbes) : Lecture NotesBryan Christian MaragragNo ratings yet

- IBC, As On 15.02.2024 (Act)Document100 pagesIBC, As On 15.02.2024 (Act)Mohd ZakariaNo ratings yet

- CIRP RegulationsDocument100 pagesCIRP Regulationssoumikighosh10No ratings yet

- Commissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Document13 pagesCommissioner of Internal Revenue vs. Systems Technology Institute, Inc., 833 SCRA 285, July 26, 2017Wallaze EbdaoNo ratings yet

- Fsa DraftDocument8 pagesFsa Drafteve25lyn08No ratings yet

- Form MGT 14 27092017 SignedDocument3 pagesForm MGT 14 27092017 SignedVitta VarunNo ratings yet

- National TaxDocument106 pagesNational TaxAra Mae LizondraNo ratings yet

- Dof Opinion: CD Technologies Asia, Inc. © 2021Document2 pagesDof Opinion: CD Technologies Asia, Inc. © 2021Loren SanapoNo ratings yet

- UntitledDocument10 pagesUntitledLoren SanapoNo ratings yet

- 218880-2018-Revenue Office Tax Exemption Manual TESLite20221008-12-1h3k0fuDocument71 pages218880-2018-Revenue Office Tax Exemption Manual TESLite20221008-12-1h3k0fuLoren SanapoNo ratings yet

- HB 02014Document12 pagesHB 02014Loren SanapoNo ratings yet

- HB 00259Document48 pagesHB 00259Loren SanapoNo ratings yet

- C.T.a. EB Case No. 1883 (C.T.a. AC No. 173) - Province of Pangasinan v. Team Sual Corp. - 236817-2019-Province - of - Pangasinan - v. - Team - Sual - Corp.Document15 pagesC.T.a. EB Case No. 1883 (C.T.a. AC No. 173) - Province of Pangasinan v. Team Sual Corp. - 236817-2019-Province - of - Pangasinan - v. - Team - Sual - Corp.Loren SanapoNo ratings yet

- Business Separation GuidelinesDocument25 pagesBusiness Separation GuidelinesLoren SanapoNo ratings yet

- 141115-1972-Davao Light Power Co. Inc. v. Commissioner20210505-11-146967nDocument6 pages141115-1972-Davao Light Power Co. Inc. v. Commissioner20210505-11-146967nLoren SanapoNo ratings yet

- 2021 Suwa - Shipyard - Machineries - Corp.20211108 12 MkhgioDocument4 pages2021 Suwa - Shipyard - Machineries - Corp.20211108 12 MkhgioLoren SanapoNo ratings yet

- 259697-2019-Power Sector Assets Liabilities Management20220413-11-1j9trrDocument4 pages259697-2019-Power Sector Assets Liabilities Management20220413-11-1j9trrLoren SanapoNo ratings yet

- 51106-2015-Makati v. Trans-Asia Power Generation Corp.20210505-12-14orvnrDocument3 pages51106-2015-Makati v. Trans-Asia Power Generation Corp.20210505-12-14orvnrLoren SanapoNo ratings yet

- 40581-2015-National Power Corp. v. Tenorio20210505-13-3tjqjhDocument17 pages40581-2015-National Power Corp. v. Tenorio20210505-13-3tjqjhLoren SanapoNo ratings yet

- Jao No 2008 1Document28 pagesJao No 2008 1Loren SanapoNo ratings yet

- SEC Opinion - Mr. Fernando C. Santico - 178279-1991-Mr. - Fernando - C. - Santico20210623-11-9s3w53Document2 pagesSEC Opinion - Mr. Fernando C. Santico - 178279-1991-Mr. - Fernando - C. - Santico20210623-11-9s3w53Loren SanapoNo ratings yet

- For+Posting+Notice+0948 2022+ORDER+ +ERC+Case+No.+2019 081+RC+ (Consolidated+With+DO) + (HVB+SGD)Document56 pagesFor+Posting+Notice+0948 2022+ORDER+ +ERC+Case+No.+2019 081+RC+ (Consolidated+With+DO) + (HVB+SGD)Loren SanapoNo ratings yet

- dc2021 06 0014Document11 pagesdc2021 06 0014Loren SanapoNo ratings yet

- dc2021 09 0029Document65 pagesdc2021 09 0029Loren SanapoNo ratings yet

- DC - 2015 06 0007Document15 pagesDC - 2015 06 0007Loren SanapoNo ratings yet

- The Philippine Acetylene Co.: BIR RULING NO. 159-59Document1 pageThe Philippine Acetylene Co.: BIR RULING NO. 159-59Loren SanapoNo ratings yet

- SEC Opinion - Atty. Victor Africa - 177678-1986-Atty. - Victor - Africa20210424-12-1kjtmauDocument5 pagesSEC Opinion - Atty. Victor Africa - 177678-1986-Atty. - Victor - Africa20210424-12-1kjtmauLoren SanapoNo ratings yet

- Trans-Philippines Investment CorporationDocument2 pagesTrans-Philippines Investment CorporationLoren SanapoNo ratings yet

- Asedillo Ramos AssociatesDocument2 pagesAsedillo Ramos AssociatesLoren SanapoNo ratings yet

- Sycip Salazar Hernandez GatmaitanDocument3 pagesSycip Salazar Hernandez GatmaitanLoren SanapoNo ratings yet

- Annual Report 2013Document44 pagesAnnual Report 2013Loren SanapoNo ratings yet

- Spa - LorenDocument3 pagesSpa - LorenLoren SanapoNo ratings yet

- The Marketing Communication Strategies of Street Vendors in Dar Es Salaam TanzaniaDocument13 pagesThe Marketing Communication Strategies of Street Vendors in Dar Es Salaam Tanzaniaswayam jariwalaNo ratings yet

- Infiniti BenefitsDocument11 pagesInfiniti Benefitssu maiyahNo ratings yet

- Taxation Law-IDocument18 pagesTaxation Law-IMahamaya GautamiNo ratings yet

- CitibankDocument12 pagesCitibankshubhamNo ratings yet

- 3 CRM Final Project - AmazonDocument11 pages3 CRM Final Project - Amazonmanmeet kaurNo ratings yet

- The MK3 EVAC+CHAIR Emergency Evacuation SystemDocument4 pagesThe MK3 EVAC+CHAIR Emergency Evacuation SystemevacchairNo ratings yet

- Cambridge O Level: Commerce 7100/12Document16 pagesCambridge O Level: Commerce 7100/12Malik MuneebNo ratings yet

- Bear Spread Payoff Strategy CalculationDocument3 pagesBear Spread Payoff Strategy CalculationMukund KumarNo ratings yet

- Sample Dissertation Project ManagementDocument4 pagesSample Dissertation Project ManagementOnlinePaperWriterCanada100% (1)

- Daizee CoolingDocument2 pagesDaizee CoolingPriya ShindeNo ratings yet

- WACC and Depreciation MethodsDocument18 pagesWACC and Depreciation Methodsrovelyn CabicoNo ratings yet

- Chai Point - FICO OnboardingDocument10 pagesChai Point - FICO OnboardingabhishekswarajyaNo ratings yet

- Corp. Governance Framework (HSBC)Document13 pagesCorp. Governance Framework (HSBC)edoolawNo ratings yet

- Wilmar SR 2016 FinalDocument82 pagesWilmar SR 2016 FinalJoseph LeoNo ratings yet

- Integrated Logistics Is A Unique Business Management Process That Governs The Flow ofDocument13 pagesIntegrated Logistics Is A Unique Business Management Process That Governs The Flow ofMukesh SinghNo ratings yet

- Finedge Bionic Advisory For A Digital IndiaDocument18 pagesFinedge Bionic Advisory For A Digital IndiaShankaran RamanNo ratings yet

- Detailed Programme - 19 Global MSME Business Summit 2022Document5 pagesDetailed Programme - 19 Global MSME Business Summit 2022Arvind KumarNo ratings yet

- International Corporate Finance 11 Edition: by Jeff MaduraDocument32 pagesInternational Corporate Finance 11 Edition: by Jeff MaduraDun DunNo ratings yet

- Idea and OpportunityDocument11 pagesIdea and OpportunityAdil BeshayiNo ratings yet

- 1Document23 pages1Hanggara CahyadiNo ratings yet

- Quantitative Analysis Forl Decision MakingDocument4 pagesQuantitative Analysis Forl Decision MakingYG DENo ratings yet

- Rep 1906075805Document1,183 pagesRep 1906075805Iman SheikhNo ratings yet

- Shubham PIDocument1 pageShubham PIVarsha JiNo ratings yet

- Industrial Management PresentationDocument3 pagesIndustrial Management Presentationsotaw0% (1)

- Chapter 6 - Global Information Systems and Market ResearchDocument27 pagesChapter 6 - Global Information Systems and Market Researchaqiilah subrotoNo ratings yet

- ICAEW - Chapter 6 - Control Accounts Errors and Suspense AccountsDocument21 pagesICAEW - Chapter 6 - Control Accounts Errors and Suspense Accountsvothituongnhi7703No ratings yet

- The Challenges and Prospects of The Manufacturing Sector of Nigerian EconomyDocument17 pagesThe Challenges and Prospects of The Manufacturing Sector of Nigerian EconomyZamri AhmadNo ratings yet

- Math SBADocument28 pagesMath SBATiana ThomasNo ratings yet