Professional Documents

Culture Documents

2019 Membership Info - Global

2019 Membership Info - Global

Uploaded by

huihudsonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2019 Membership Info - Global

2019 Membership Info - Global

Uploaded by

huihudsonCopyright:

Available Formats

Membership Information

for the

2019 Million Dollar Round Table

Based on 2018 production

Million Dollar Round Table

325 West Touhy Avenue, Park Ridge, Illinois USA Phone: +847.692.6378 | Fax: +1 847.518.8921 |

Email: membership@mdrt.org

PLEASE NOTE

Please note the following changes to previous versions of this document. Please

discard any copies of this document that do not have the mark of Global – 12/10/2018

at the foot of each page.

The name of the product categories has been modified to Risk-Protection

Products and Other Products. See page 4.

Dues requirements for each level of membership have been updated. See page 6.

The MDRT Annual Meeting date and location were updated. See page 10.

The MDRT Global Conference date and location were updated. See page 10.

The MDRT EDGE Meeting date and location were updated. See page 10.

The Top of the Table Meeting date and location were updated. See page 10.

Table of Contents

Page

I. Production Requirements ------------------------------------------------------------------- 3

II. Eligibility ------------------------------------------------------------------------------------------ 4

III. Reporting ----------------------------------------------------------------------------------------- 5

IV. Additional Requirements -------------------------------------------------------------------- 6

V. Clarifications ------------------------------------------------------------------------------------- 7

VI. Illustrations -------------------------------------------------------------------------------------- 9

VII. Meetings ----------------------------------------------------------------------------------------- 10

VIII. Commission/Premium Production Requirements By Country ------------------ 11

IX. Income Production Requirements By Country --------------------------------------- 13

Apply for 2019 membership online at https://My.mdrt.org/OnlineMembershipApplication.aspx.

Page 2 Global – 12/10/2018

MEMBERSHIP INFORMATION FOR THE

2019 MILLION DOLLAR ROUND TABLE

I. PRODUCTION REQUIREMENTS Top of the Table

1. Production Methods Commission & Premium Method

Membership in the 2019 Round Table will be based on the A minimum of USD 576,000 of eligible commissions paid

following production methods: (See page 4 for products) or USD 1,152,000 of eligible paid premium. At least USD

Commission/Fee Method 48,000 of commission or USD 96,000 of premium (50

A minimum of USD 96,000 of eligible commissions paid is percent of the entry-level MDRT requirement) must come

required. Of this total, a minimum of USD 48,000 of paid from products listed in the Risk-Protection category before

commissions (50 percent of the requirement) must come an applicant can use any credit from policies listed under

from products listed in the Risk-Protection category. the Other Products category.

Premium Method Income Method

A minimum of USD 192,000 of eligible paid premium A minimum of USD 996,000 of eligible annual gross income

is required. Of this total, a minimum of USD 96,000 of is required. The applicant must meet the minimums of USD

premium (50 percent of the requirement) must come 48,000 in new business and USD 48,000 in risk-protection

from products listed in the Risk-Protection category. business.

Income Qualification Method Top of the Table Waivers

A minimum of USD 166,000 in annual gross income Top of the Table members with a minimum of 10 years of

from the sale of insurance and financial products is Top of the Table membership who do not meet the required

required. A minimum of USD 48,000 must be income minimum production level may apply under the Top of the

from new business generated during the production Table waiver provision, but must submit required Top of the

year. Further, a minimum of USD 48,000 must be Table dues.

derived from income associated with products in the

Risk-Protection category. It is possible that the same

business, for example the sale of new life insurance

policies, could satisfy both requirements.

2. Court of the Table

Commission & Premium Method

A minimum of USD 288,000 of eligible commissions paid or

USD 576,000 of eligible paid premium is required. At least

USD 48,000 of commission or USD 96,000 of premium (50

percent of the entry-level MDRT requirement) must come

from products listed in the Risk-Protection category before an

applicant can use any credit from policies listed under the

Other Products category.

Income Method

A minimum of USD 498,000 of eligible annual gross income is

required. The applicant must meet the minimums of USD

48,000 in new business and USD 48,000 in risk-protection

business.

Please note: Applicants may not combine production credit from the methods above to attain the minimum

requirement. Applicants will be approved only under one method.

The 2019 production requirements for applicants outside the United States are expressed in local

currency. All commission, premium or income credit reported must be converted to U.S. dollars using

the MDRT conversion factor listed at the end of this document.

Page 3 Global – 12/10/2018

3. Eligible Products and Credit

RISK-PROTECTION PRODUCTS

Products from life insurance companies Commission/Fee Credit Premium Credit

Accidental death and dismemberment (individual) 100% of first year commission 100% of first year premium

Critical illness (individual) 100% of first year commission 100% of first year premium

Disability income contracts (individual) 100% of first year commission 100% of first year premium

Life (individual)

Up to annual premium/target premium 100% of first year commission 100% of first year premium

Deposits in excess of annual/target 100% of commission paid 6% of excess premium

premium/top up

Single premium (whole life and investment) 100% of first year commission 6% of first year premium

Short-term endowment rider (max 15 yrs) 100% of first year commission 6% of first year premium

Long-term care (individual) 100% of first year commission 100% of first year premium

Accidental death and dismemberment (group) 100% of first year commission 10% of first year premium

Critical illness (group) 100% of first year commission 10% of first year premium

Disability income contracts (group) 100% of first year commission 10% of first year premium

Life (group) 100% of first year commission 10% of first year premium

Long-term care (group) 100% of first year commission 10% of first year premium

Annuities (individual and group) 100% of all commissions 6% of new money invested

Single premium and/or short-term endowment (max 100% of first year commission 6% of first year premium

15 yrs.)

OTHER PRODUCTS

Products Commission/Fee Credit Premium Credit

Health care (individual) 100% of first year commission 100% of first year premium

Health care (group) 100% of first year commission 10% of first year premium

Mutual funds 100% of all commissions/fee 6% of new money invested

Securities 100% of commission/fee on new 6% of new money invested

money invested

Wrap accounts/asset management accounts 100% of all commissions/fee 6% of new money invested

Financial Planning Fees/Fees for Advice 100% of the net fee 100% of the gross fee

II. ELIGIBILITY

1. Qualification Overview Qualifying And Life Member

First-time applicants for MDRT must use either the An individual becomes a Qualifying and Life (QL) member

commission or premium methods to demonstrate when approved for the 10th year of membership. The year or

qualification for membership. (See chart on page 5.) years during which Provisional Applicant status was/were held

Any individual with prior MDRT membership is eligible to are counted. Qualifying and Life status is maintained in future

apply using the income qualification method. years by submitting an application each year, including

certifying letter(s) demonstrating qualifying production or by

2. MDRT Status Designations attesting to having met current minimum production levels,

Each MDRT status designation is granted for one year only. All and by paying the required dues.

members must apply every year to continue their affiliation with Life Member

MDRT. After Qualifying and Life membership has been attained,

Qualifying Member Applicants for Life status will declare that they did not meet

An individual who is a first-time applicant becomes a the production requirement, but still wish to continue their

Qualifying (Q) member when his/her application papers are MDRT membership. Life members must annually submit an

approved. Until the 10th year of membership is attained, the application and pay dues.

member will be a Qualifying member.

Page 4 Global – 12/10/2018

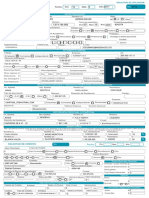

COMMISSION PREMIUM

MDRT COT TOT MDRT COT TOT

Member Risk- Risk- Risk- Member Risk- Risk- Risk-

Type Protection Total Protection Total Protection Total Type Protection Total Protection Total Protection Total

Production $48,000 $96,000 $48,000 $288,000 $48,000 $576,000 Production $96,000 $192,000 $96,000 $576,000 $96,000 $1,152,000

1st-Time 1st-Time

Member Member

Certifying Certifying

Required Required Required Required Required Required

letters letters

Signed by Company Company Company Signed by Company Company Company

2 - 10 Year 2 - 10 Year

Member Member

Certifying Certifying

Required Required Required Required Required Required

letters letters

Signed by Company Company Company Signed by Company Company Company

11+ Year 11+ Year

Member Member

Certifying Certifying

Not Required Required if less Required if less Not Required Required if less Required if less

letters letters

than 10 COT than 10 TOT than 10 COT than 10 TOT

Signed by Not Required Company Company Signed by Not Required Company Company

INCOME

MDRT COT TOT

Member Risk- Risk- Risk-

Type New Business Protection Total New Business Protection Total New Business Protection Total

Production $48,000 $48,000 $166,000 $48,000 $48,000 $498,000 $48,000 $48,000 $996,000

1st-Time

Member

Certifying

Not Eligible Not Eligible Not Eligible

letters

Signed by

2 - 10 Year

Member

Certifying

Required Required Required

letters

Signed by Self-signed Self-signed Self-signed

11+ Year

Member

Certifying

Not Required Required if less than 10 COT Required if less than 10 TOT

letters

Signed by Not Required Self-signed Self-signed

III. REPORTING

1. Verifying Production Income Verification

Commission And Premium Verification Verification of eligible production under the income

First-time applicants must apply using ONLY the qualification method will be accomplished via a certifying

commission or premium methods and supply a certifying letter signed by the applicant. All applications submitted

letter(s) with third party verification. Those applying for under the income method are subject to a random

Qualifying membership (years two through 10) may submit production verification audit at a later date. If selected, the

the customary certifying letters with third party verification individual will need to supply supporting documents, such

for commission or premium or submit a self-signed certifying as commission statements, that verify the amounts claimed.

letter and attach supporting documents for the income Other acceptable supporting documents would be a

qualification method as outlined above. Certifying letters statement of income signed by a representative of the

may be completed by a representative of the company/broker company/broker dealer/brokerage agency, a Certified Public

dealer/brokerage agency, a Certified Public Accountant (or Accountant (or equivalent), or a representative of the

equivalent), or a representative of the applicant's personal applicant’s personal agency/corporation/office. Tax

agency/corporation or office. documents may also be used.

Page 5 Global – 12/10/2018

Simplified Reporting for Qualifying & Life and Life Income certifying letters are self-reported, signed by the

Members applicant. If selected for a production verification audit, the

Once eligibility for Life status has been attained, members individual will need to supply supporting documents to

who have achieved Qualifying and Life or Life status are verify the amounts claimed, such as:

eligible to submit an application each year, including commission statements

certifying letter(s) demonstrating qualifying production or a statement of income signed by a representative of the

by attesting to having met current minimum production company/broker dealer/ brokerage agency, a Certified

levels, and by paying the required dues. Proof of production Public Accountant (or equivalent), or a representative

(i.e. certifying letters or commission/income documents) of the applicant’s personal agency/corporation/office

will not be required beginning in the eleventh year. Tax documents

Applicants for Life status will declare that they did not meet

the production requirement, but still wish to continue their 6. Honor Roll

MDRT membership.

Individuals who have reported at least 15 years of

Qualifying membership shall be designated as members of

2. Court of the Table the “Honor Roll.”

Applicants must continue to submit proof of production via

certifying letter(s) until achieving 10 years of membership

IV. ADDITIONAL REQUIREMENTS

at the higher level. They may declare their eligibility

1. Professional Association Membership Requirement

without certifying letters or income documents when

When applying for MDRT membership, applicants from the

applying for the eleventh year of membership at Court of

countries listed below must be members in good standing of

the Table level.

an association that meets all of the following criteria: (A list

of associations that meet the criteria may be found Web site

3. Top of the Table

at https://www.mdrt.org/membership/requirements/ )

Applicants must continue to submit proof of production via

The association must be an individual membership

certifying letter(s) until achieving 10 years of membership

organization, open to participation without regard to

at the higher level. They may declare their eligibility

company affiliation, one of the focuses of which is insurance

without certifying letters or income documents when

or financial services.

applying for the eleventh year of membership at Top of the

Table level. The association must have been in existence at least two

years and must have 100 or more members.

4. Application Forms The association must be a nonprofit organization.

Applications for 2019 MDRT membership will automatically The association must have a code of ethics and an

be sent in November 2018 to all 2018 and 2017 MDRT effective means of dealing with breaches of its code.

members. Others may request an application by phone, fax or Membership in an association is required of applicants from

through the MDRT Web site at www.mdrt.org . the following countries:

5. Certifying Letters Australia Ireland Philippines

A certifying letter signed by an official from the company an Bahamas Israel Singapore

applicant is using for MDRT qualification is required when Canada Jamaica Thailand

applying under the commission or premium method. Greece Japan Trinidad & Tobago

Otherwise, the application will be considered incomplete and Hong Kong Malaysia United States

membership may be denied. These companies may include

life insurance companies, agencies, brokerage companies, New Zealand

broker/dealers, banks or mutual fund companies. Also

acceptable would be a certifying letter completed by a 2. Annual Membership Dues: USD 550

representative of the company/broker dealer/brokerage Required dues, completed application and other required

agency, a Certified Public Accountant (or equivalent), or a forms must be postmarked on or before March 1, 2019.

representative of the applicant's personal Applications postmarked after March 1 will be considered

agency/corporation or office. only if accompanied by an additional fee of USD 200.

A Certified Public Accountant (CPA) or the equivalent may

sign certifying letters for financial planning fees/fees for 3. Court of the Table Dues: USD 50

advice that are paid directly to the producer when applying In addition to remitting regular MDRT dues, a Court of the

under the commission or premium method. Table applicant must remit the required Court of the Table

Brokerage companies are defined as third party wholesalers dues.

of insurance and investment products that are provided to

agents on behalf of insurance and investment companies. 4. Top of the Table Dues: USD 550

Should an applicant be an official of a brokerage company, In addition to remitting regular MDRT membership dues, a

the product provider who pays the commissions must sign Top of the Table applicant must remit the required Top of the

the certifying letter unless applying under the income Table dues. Top of the Table membership dues includes Court

qualification method. of the Table dues.

Page 6 Global – 12/10/2018

5. Life, Reduced Dues: USD 185 If commissions are paid as earned, a policy effective in 2017

Life members who meet all four of the criteria below are may result in production credit for 2018. The policy must be

eligible to pay a reduced dues amount. Those eligible for in force on December 31, 2017 but is not required to be in

reduced dues are not required to be members of a professional force as of December 31, 2018.

association. Commission credit for pensions is based on the product used

a Life or a Qualifying & Life member, and to fund the pension (life insurance, annuities, mutual funds,

applying as a Life member, and etc.) which determines whether it receives Risk-Protection or

65 years of age by December 31, 2018 and Other Products credit.

have either 25 years of membership OR 20 years of Commissions that are part of a deferred compensation

membership with production program may be claimed up front for MDRT credit, provided

that they are not claimed again in later years.

Online payment options are now available. For more Life insurance policies that exceed the annual premium or

information, please refer to your 2019 Membership application. target premium are eligible for credit. First year commission

credit may be given Risk-Protection category for the

6. Disability Waiver commission paid on the amount up to the annual/target

Life members who have been declared totally disabled for six premium. If the annual/target premium is exceeded,

consecutive months during 2018 may petition for a waiver of (sometimes referred to as a “top up”) commission credit may

payment of dues for the 2019 Table. A disability petition be given in the Risk-Protection category for the commission

form and doctor’s statement must be submitted by March 1, paid on the amount that exceeded the annual/target premium.

2019, with the membership application. Each petition will be Override commissions, training allowances, bonuses and

judged on its own merit. Those approved for the disability other sales or expense allowances do not qualify under the

waiver are not required to be members of a professional commission/premium method.

association. Fees paid for the placement of a product are eligible for

credit toward the commission requirement, as are asset

7. Former Life Member Options management fees for mutual funds and wrap/asset

Former Life and Qualifying & Life members who wish to management accounts. The type of product placed

rejoin MDRT have two options: determines the type of credit the product receives (Risk-

Option One: They may choose not to pay back dues for the Protection or Other).

years missed and submit the current minimum production Financial Planning Fees/Fees for Advice are eligible for

and current membership dues with their application. Their Other Products credit for the net fee paid to the agent/advisor.

member status will revert to Qualifying and they must again Fees must be documented by certifying letter signed by a

fulfill the requirements to attain Life or Qualifying & Life company official, a broker dealer official, or a Certified

status, which includes accumulating an additional 9 years of Public Accountant (or equivalent) for qualifying members.

Qualifying membership. Group health insurance commissions are eligible in the first

Option Two: They may retain Life or Qualifying & Life year of the policy only. Additions to the group policy in

member status by paying back dues for the number of years subsequent years are not eligible for credit.

missed, not to exceed a maximum of five years, and by Single premium and/or short-term endowment commissions

meeting the then current requirements for Life membership. are only eligible in the first year of the policy. Short-term

The maximum number of years for which back dues may be endowment riders (max 15 years) to life insurance policies

required will be reduced to three years if the member submits are eligible for 100 percent of first-year commissions in the

qualifying production for the current year. The amount of Risk-Protection category.

back dues will be based upon the current dues at the time of Long-term endowment commissions are only eligible in the

reinstatement. Please note: Payment of back dues does not first year of the policy. Long-term endowment riders (16 or

provide credit for member year(s) missed. more years) to life insurance policies are eligible for 100

percent of first-year commissions in the Risk-Protection

V. CLARIFICATIONS category.

1. Eligible Commissions, Fees

Production credit (for commissions) will be based on eligible

commissions received during 2018. Credit may include either

earned or advanced (annualized) commissions or both. Advanced

(annualized) or earned commissions must be paid to the applicant

For additional information, contact:

in 2018 to be eligible for MDRT credit. Please note:

Million Dollar Round Table

Commissions paid on a levelized basis may be reported using

Member Services Department

the present value of up to the first five years' commission

325 West Touhy Avenue

discounted at 10 percent per year, not to exceed 55 percent of

Park Ridge, IL 60068 USA

first-year premium.

Phone: +1 847.692.6378

Annualized commissions may be reported for credit if paid,

Fax: +1 847.518.8921

but any chargeback of annualized commissions in a

Web site: https://www.mdrt.org

subsequent production year will result in a reduction of that

E-mail: membership@mdrt.org

year's production credit.

Page 7 Global – 12/10/2018

2. Eligible Premium Income considered INELIGIBLE for MDRT credit

Production credit (for premium) will be based on eligible includes:

premium paid or new money invested during 2018. Please note: Training bonuses/allowances

If commissions are paid as earned, premium credit should be Sales/expense allowances

given only for the amount of premium actually received Overrides derived from the production of others.

during the production year. Non-cash compensation, such as incentive trips

If commissions are annualized, the premium credit should Income from property and casualty insurance and

also be annualized. Any chargeback of annualized general insurance (fire, home, auto, etc.)

commissions should also result in a reduction of that year's Income from the sale of mortgages.

premium credit. Life settlements

A policy that becomes effective in 2017 may result in Money market accounts

production credit for the amount of premium paid or new

money invested during 2018. 4. Credit for Coverage Written on the Applicant, Spouse

Life insurance policies that exceed the annual premium or or Dependents

target premium are eligible for credit. First year premium Any business written on the applicant, applicant’s spouse

credit may be given in the Risk-Protection category up to or dependents may not exceed a maximum of 5 percent

the amount of the annual/target premium. If the of the current year's MDRT production requirement

annual/target premium is exceeded, (sometimes referred to (USD 4,800 eligible commissions or USD 9,600 of

as a “top up”) premium credit may be given in the Risk- eligible premium or USD 8,300 of eligible income) if any

Protection category for 6 percent of the amount that of the premiums are paid, directly or indirectly, by the

exceeded the annual/target premium. applicant or spouse.

Financial Planning Fees/Fees for Advice are eligible for

Other Products credit for the gross fee paid to the company, 5. Replacements

broker dealer or individual agent/advisor. Fees must be Credit for individual life insurance policies may be

documented by certifying letter signed by a company claimed only for the amount of first-year commissions or

official, a broker dealer official, or a Certified Public premium on the new policy that exceeds the first-year

Accountant (or equivalent) for qualifying members. commissions or premium for the policy being replaced. If

Group health insurance premium is eligible for credit in the the amount is not known, then the amount of

first year of the policy only. Additions to the group policy in commissions being replaced shall be calculated by

subsequent years are not eligible for credit. multiplying the current commission times the appropriate

Single premium and/or short-term endowment premium is premium for the policy being replaced. Premium credit

only eligible in the first year of the policy. Short-term can be determined by subtracting the replaced premium

endowment riders (max 15 years) to life insurance policies from the new premium.

are eligible for 6 percent of first year premium credit. Conversion of a permanent product to a permanent

Long-term endowment premium is only eligible in the first product is to be treated as a replacement for MDRT

year of the policy. Long-term endowment riders (16 or more purposes. This applies only to replacement of individual

years) to life insurance policies are eligible for 100 percent life insurance policies.

of first-year premium credit in the Risk-Protection category.

Premium credit for pensions is based on the product used to 6. Definitions And Interpretations

fund the pension (life insurance, annuities, mutual funds, Business Paid for and Underwritten

etc.) which determines whether it receives Risk-Protection Business to be credited shall be paid for during the MDRT

or Other Products credit. qualification period (January 1 through December 31).

Business shall be considered to have been paid for as of the

3. Eligible Income date when the coverage first became fully effective with

Production credit is based on annual gross income paid during home office approval from the standpoint of payment of the

2018. Please note: claim (regardless of company practice or the distance

See chart on page 4 for eligible products. between home and field office). However, no credit shall be

Under this model, income is defined as first-year, trail and allowed until the home office has finally accepted the

renewal commissions, as well as fees for product premium and also until the first-year commissions have been

placement, asset management fees and fees for advice. paid or credited to the agent's account without any right

Other production-based compensation, such as salaries and reserved to the insurance company to recover same, except in

production-based bonuses, are also eligible for credit. case of recall under the contestable provisions of the contract.

Income contributed as part of a deferred compensation plan On joint, partnership, corporate and/or brokerage business,

is eligible for credit. Credit should be taken during the MDRT credit shall be given for only that portion of the

production year when the deferred income was earned. business on which the applicant has been compensated, either

Override commissions are eligible only for personal by first-year commission or the equivalent.

production. Health Insurance

Includes policies that relate to the health of the body. Dental,

vision, etc., are eligible for credit. See page 4 for specifics.

Page 8 Global – 12/10/2018

6. Definitions and Interpretations (Cont’d) In Force Requirement

Policy and Case Definitions Credited business shall include only business which has not

A policy shall be defined as an individual contract covering been terminated on or before the last day of the MDRT

one or more lives as contrasted with a group policy, a qualification period (December 31) except for business

pension, profit sharing trust or a salary savings plan. Under a terminated by death or term conversion.

qualified pension or profit sharing trust or a salary savings Securities

plan, each individual policy shall count as one (1) policy for Includes stocks, bonds or other equities. See page 4 for

the purpose of computing total eligible policies. For purposes specifics.

of production, an employer-sponsored group life plan,

franchise life plan and group annuity plan and mutual fund

transaction with one (1) investor shall be considered one (1)

case regardless of the number of lives or funds involved.

VI. ILLUSTRATIONS

Clarification of Risk-Protection and Clarification of Income Qualification

Other Products Credit

A minimum of USD 166,000 in annual gross income

At least one-half (50 percent) of the production from the sale of insurance and financial products is

requirement must come from products listed in the required.

Risk-Protection category. (See section I, 4) A minimum of USD 48,000 must be income from

This serves as a threshold that must be crossed new business generated during the production year.

before an applicant can use any credit from the Further, a minimum of USD 48,000 must be derived

Other Products category. from income associated with Risk-Protection

Once crossing the threshold, applicants may use all Products.

of the credits from Other Products category to meet It is possible that the same business, for example the

the MDRT requirement. sale of new life insurance policies, could satisfy both

The 2019 commission requirement for is USD requirements. (See Example 2 below.)

96,000. To qualify, the applicant must submit a

minimum of USD 48,000 in commission from ELIGIBLE for MDRT membership

products listed in the Risk-Protection category. Example 1

Applicant annual gross income 166,000

Example 1 – Eligible for MDRT membership Applicant total new business 48,000

Applicant total Risk-Protection 48,000 Applicant total Risk-Protection Products 48,000

Applicant total Other Products 100,000

Total MDRT commission credit 148,000 Example 2

Applicant annual gross income 166,000

Example 2 – NOT eligible for MDRT membership Applicant total new business from

Applicant total Risk-Protection 47,999 Risk-Protection Products * 48,000

Applicant total Other Products 100,000 *Satisfies both new business and risk-protection products minimums.

Total MDRT commission credit 47,999

NOT Eligible for MDRT membership

Example 3

Please note: Applicant annual gross income 166,000

The 50 percent threshold applies regardless of whether Applicant total new business 47,999

commission or premium is used to qualify for Applicant total Risk-Protection Products 48,000

membership.

Example 4

Applicant annual gross income 166,000

Applicant total new business 48,000

Applicant total Risk-Protection Products 47,999

Page 9 Global – 12/10/2018

MDRT Meetings - Mark Your Calendars!

MDRT Annual Meeting*

9 – 12 June 2019

Miami Beach, Florida, USA

MDRT Global Conference*

1 – 4 September 2019

Sydney, Australia

Top of the Table Annual Meeting*

25 – 28 September 2019

Austin, Texas, USA

MDRT EDGE Meeting*

21 – 23 October 2019

New York City, New York, USA

*Attendance at the MDRT Annual Meeting, MDRT Global

Conference, Top of the Table Annual Meeting and

MDRT EDGE Meeting are open to approved members of

the 2019 Table and requires payment of separate

registration fees.

Visit www.mdrt.org or contact MDRT at +1 847.692.6378 or email to meetings@mdrt.org

for meeting information or for exhibitor and sponsorship opportunities.

Page 10 Global – 12/10/2018

COMMISSION AND PREMIUM PRODUCTION REQUIREMENTS FOR MEMBERSHIP

IN THE 2019 MILLION DOLLAR ROUND TABLE

Based on 2018 Production, Expressed in Local Currency

Production credit must be reported in U.S. dollars on Certifying Letters

(Local currency divided by the conversion/standardization factor = MDRT requirement in U.S. dollars)

Production requirements are set independently for each country. Conversion/standardization factors have no relationship to

currency exchange rates and are used only to standardize MDRT processing.

(For a complete list of country requirements, see the MDRT web site at https://www.mdrt.org/membership/requirements/ .)

MDRT COT TOT Commission MDRT COT TOT Premium

Country Commission Commission Commission Conv Factor Premium Premium Premium Conv Factor

Angola 53,700 161,100 322,200 0.5593 107,400 322,200 644,400 0.5593

Anguilla 106,500 319,500 639,000 1.1093 213,000 639,000 1,278,000 1.1093

Antigua 160,600 481,800 963,600 1.6729 321,200 963,600 1,927,200 1.6729

Argentina 222,200 666,600 1,333,200 2.3145 444,400 1,333,200 2,666,400 2.3145

Armenia 16,500,800 49,502,400 99,004,800 171.8833 33,001,600 99,004,800 198,009,600 171.8833

Aruba 121,000 363,000 726,000 1.2604 242,000 726,000 1,452,000 1.2604

Australia 135,600 406,800 813,600 1.4125 271,200 813,600 1,627,200 1.4125

Azerbaijan 24,300 72,900 145,800 0.2531 48,600 145,800 291,600 0.2531

Bahamas 80,200 240,600 481,200 0.8354 160,400 481,200 962,400 0.8354

Bahrain 23,000 69,000 138,000 0.2395 46,000 138,000 276,000 0.2395

Bangladesh 2,140,900 6,422,700 12,845,400 22.3010 4,281,800 12,845,400 25,690,800 22.3010

Barbados 125,400 376,200 752,400 1.3062 250,800 752,400 1,504,800 1.306200

Belarus 140,059,400 420,178,200 840,356,400 1,458.9520 280,118,800 840,356,400 1,680,712,800 1458.9520

Belgium 78,800 236,400 472,800 0.8208 157,600 472,800 945,600 0.8208

Belize 95,200 285,600 571,200 0.9916 190,400 571,200 1,142,400 0.9916

Bermuda 145,000 435,000 870,000 1.5104 290,000 870,000 1,740,000 1.5104

Bolivia 240,400 721,200 1,442,400 2.5041 480,800 1,442,400 2,884,800 2.5041

Bosnia-Herzegovina 67,400 202,200 404,400 0.7020 134,800 404,400 808,800 0.7020

Botswana 254,300 762,900 1,525,800 2.6489 508,600 1,525,800 3,051,600 2.6489

Brazil 181,700 545,100 1,090,200 1.8927 545,100 1,635,300 3,270,600 2.8390

British Virgin Islands 96,000 288,000 576,000 1.0000 192,000 576,000 1,152,000 1.0000

Brunei 59,800 179,400 358,800 0.6229 179,400 538,200 1,076,400 0.9343

Bulgaria 61,000 183,000 366,000 0.6354 122,000 366,000 732,000 0.6354

Cambodia 74,884,900 224,654,700 449,309,400 780.0510 299,539,600 898,618,800 1,797,237,600 1560.1020

Canada 116,200 348,600 697,200 1.2104 232,400 697,200 1,394,400 1.2104

Cayman Islands 65,500 196,500 393,000 0.6822 131,000 393,000 786,000 0.6822

Channel Islands 66,600 199,800 399,600 0.6937 133,200 399,600 799,200 0.6937

Chile 31,824,000 95,472,000 190,944,000 331.5000 63,648,000 190,944,000 381,888,000 331.5000

Colombia 84,255,300 252,765,900 505,531,800 877.6593 168,510,600 505,531,800 1,011,063,600 877.6593

Costa Rica 26,812,000 80,436,000 160,872,000 279.2916 53,624,000 160,872,000 321,744,000 279.2916

Croatia 344,200 1,032,600 2,065,200 3.5854 688,400 2,065,200 4,130,400 3.5854

Curacao 72,400 217,200 434,400 0.7541 144,800 434,400 868,800 0.7541

Cyprus 40,400 121,200 242,400 0.4208 80,800 242,400 484,800 0.4208

Czech Republic 1,259,900 3,779,700 7,559,400 13.1239 2,519,800 7,559,400 15,118,800 13.1239

Denmark 699,100 2,097,300 4,194,600 7.2822 1,398,200 4,194,600 8,389,200 7.2822

Dominica 128,100 384,300 768,600 1.3343 256,200 768,600 1,537,200 1.3343

Dominican Republic 1,284,800 3,854,400 7,708,800 13.3833 2,569,600 7,708,800 15,417,600 13.3833

Ecuador 44,900 134,700 269,400 0.4677 89,800 269,400 538,800 0.4677

Egypt 138,100 414,300 828,600 1.4385 414,300 1,242,900 2,485,800 2.1578

El Salvador 46,400 139,200 278,400 0.4833 92,800 278,400 556,800 0.4833

Estonia 50,300 150,900 301,800 0.5239 100,600 301,800 603,600 0.5239

Fiji 76,000 228,000 456,000 0.7916 152,000 456,000 912,000 0.7916

France 78,600 235,800 471,600 0.8187 157,200 471,600 943,200 0.8187

Georgia 68,800 206,400 412,800 0.7166 137,600 412,800 825,600 0.7166

Germany 75,200 225,600 451,200 0.7833 150,400 451,200 902,400 0.7833

Ghana 60,400 181,200 362,400 0.6291 120,800 362,400 724,800 0.6291

Gibraltar 54,900 164,700 329,400 0.5718 109,800 329,400 658,800 0.5718

Greece 57,500 172,500 345,000 0.5989 115,000 345,000 690,000 0.5989

Grenada 170,700 512,100 1,024,200 1.7781 341,400 1,024,200 2,048,400 1.7781

Guatemala 340,000 1,020,000 2,040,000 3.5416 680,000 2,040,000 4,080,000 3.5416

Guyana 8,812,500 26,437,500 52,875,000 91.7968 17,625,000 52,875,000 105,750,000 91.7968

Honduras 875,800 2,627,400 5,254,800 9.1229 1,751,600 5,254,800 10,509,600 9.1229

Hong Kong SAR 528,300 1,584,900 3,169,800 5.5031 2,113,200 6,339,600 12,679,200 11.0062

Hungary 12,265,800 36,797,400 73,594,800 127.7687 24,531,600 73,594,800 147,189,600 127.7687

India 934,400 2,803,200 5,606,400 9.7333 3,737,600 11,212,800 22,425,600 19.4666

Indonesia 276,280,500 828,841,500 1,657,683,000 2,877.9218 552,561,000 1,657,683,000 3,315,366,000 2877.9218

Ireland 79,900 239,700 479,400 0.8322 159,800 479,400 958,800 0.8322

Isle of Man 66,600 199,800 399,600 0.6937 133,200 399,600 799,200 0.6937

Israel 340,500 1,021,500 2,043,000 3.5468 681,000 2,043,000 4,086,000 3.5468

Italy 71,400 214,200 428,400 0.7437 142,800 428,400 856,800 0.7437

Jamaica West Indies 4,170,300 12,510,900 25,021,800 43.4406 8,340,600 25,021,800 50,043,600 43.4406

Page 11 Global – 12/10/2018

MDRT COT TOT Commission MDRT TOT Premium

Country Commission Commission Commission Conv Factor Premium COT Premium Premium Conv Factor

Japan 10,880,000 32,640,000 65,280,000 113.3333 32,640,000 97,920,000 195,840,000 170.0000

Jordan 23,200 69,600 139,200 0.2416 46,400 139,200 278,400 0.2416

Kazakhstan 5,097,900 15,293,700 30,587,400 53.1031 10,195,800 30,587,400 61,174,800 53.1031

Kenya 3,119,200 9,357,600 18,715,200 32.4916 6,238,400 18,715,200 37,430,400 32.4916

Kuwait 24,800 74,400 148,800 0.2583 49,600 148,800 297,600 0.2583

Latvia 34,300 102,900 205,800 0.3572 68,600 205,800 411,600 0.3572

Lebanon 112,330,600 336,991,800 673,983,600 1,170.1104 224,661,200 673,983,600 1,347,967,200 1170.1104

Lithuania 116,100 348,300 696,600 1.2093 232,200 696,600 1,393,200 1.2093

Luxembourg 85,600 256,800 513,600 0.8916 171,200 513,600 1,027,200 0.8916

Macau 386,900 1,160,700 2,321,400 4.0302 1,547,600 4,642,800 9,285,600 8.0604

Macedonia 1,760,100 5,280,300 10,560,600 18.3343 3,520,200 10,560,600 21,121,200 18.3343

Malaysia 145,400 436,200 872,400 1.5145 436,200 1,308,600 2,617,200 2.2718

Malta 25,300 75,900 151,800 0.2635 50,600 151,800 303,600 0.2635

Mauritius 1,464,600 4,393,800 8,787,600 15.2562 2,929,200 8,787,600 17,575,200 15.2562

Mexico 713,800 2,141,400 4,282,800 7.4354 1,427,600 4,282,800 8,565,600 7.4354

Montenegro 5,900 17,700 35,400 0.0614 11,800 35,400 70,800 0.0614

Montserrat 74,200 222,600 445,200 0.7729 148,400 445,200 890,400 0.7729

Mozambique 1,475,800 4,427,400 8,854,800 15.3729 2,951,600 8,854,800 17,709,600 15.3729

Myanmar 23,977,600 71,932,800 143,865,600 249.7666 47,955,200 143,865,600 287,731,200 249.7666

Namibia 431,400 1,294,200 2,588,400 4.4937 862,800 2,588,400 5,176,800 4.4937

Nepal 1,342,500 4,027,500 8,055,000 13.9843 4,027,500 12,082,500 24,165,000 20.9765

Netherlands 78,600 235,800 471,600 0.8187 157,200 471,600 943,200 0.8187

New Zealand 140,300 420,900 841,800 1.4614 280,600 841,800 1,683,600 1.4614

Nicaragua 948,800 2,846,400 5,692,800 9.8833 1,897,600 5,692,800 11,385,600 9.8833

Nigeria 5,660,300 16,980,900 33,961,800 58.9614 11,320,600 33,961,800 67,923,600 58.9614

Norway 838,700 2,516,100 5,032,200 8.7364 1,677,400 5,032,200 10,064,400 8.7364

Oman 16,600 49,800 99,600 0.1729 33,200 99,600 199,200 0.1729

P.R. China 201,900 605,700 1,211,400 2.1031 605,700 1,817,100 3,634,200 3.1546

Pakistan 1,676,700 5,030,100 10,060,200 17.4656 3,353,400 10,060,200 20,120,400 17.4656

Panama 49,600 148,800 297,600 0.5166 99,200 297,600 595,200 0.5166

Peru 138,100 414,300 828,600 1.4385 276,200 828,600 1,657,200 1.4385

Philippines 1,301,800 3,905,400 7,810,800 13.5604 2,603,600 7,810,800 15,621,600 13.5604

Poland 172,300 516,900 1,033,800 1.7947 344,600 1,033,800 2,067,600 1.7947

Portugal 58,100 174,300 348,600 0.6052 174,300 522,900 1,045,800 0.9078

Qatar 206,100 618,300 1,236,600 2.1468 412,200 1,236,600 2,473,200 2.1468

Republic of Korea 75,274,000 225,822,000 451,644,000 784.1041 188,185,000 564,555,000 1,129,110,000 980.1302

Romania 137,600 412,800 825,600 1.4333 275,200 825,600 1,651,200 1.4333

Russia 1,263,700 3,791,100 7,582,200 13.1635 3,159,302 9,477,905 18,955,810 16.4546

Saudi Arabia 240,400 721,200 1,442,400 2.5041 480,800 1,442,400 2,884,800 2.5041

Serbia 2,986,400 8,959,200 17,918,400 31.1083 5,972,800 17,918,400 35,836,800 31.1083

Singapore 115,800 347,400 694,800 1.2062 347,400 1,042,200 2,084,400 1.8093

Slovakia 50,800 152,400 304,800 0.5291 101,600 304,800 609,600 0.5291

Slovenia 64,400 193,200 386,400 0.6708 128,800 386,400 772,800 0.6708

South Africa 286,600 859,800 1,719,600 2.9854 573,200 1,719,600 3,439,200 2.9854

Spain 66,400 199,200 398,400 0.6916 132,800 398,400 796,800 0.6916

Sri Lanka 2,655,200 7,965,600 15,931,200 27.6583 5,310,400 15,931,200 31,862,400 27.6583

St Kitts and Nevis 165,400 496,200 992,400 1.7229 330,800 992,400 1,984,800 1.7229

St Lucia 171,000 513,000 1,026,000 1.7812 342,000 1,026,000 2,052,000 1.7812

St Maarten 72,400 217,200 434,400 0.7541 144,800 434,400 868,800 0.7541

St Vincent 158,500 475,500 951,000 1.6510 317,000 951,000 1,902,000 1.6510

Suriname 17,054,300 51,162,900 102,325,800 177.6489 34,108,600 102,325,800 204,651,600 177.6489

Sweden 877,700 2,633,100 5,266,200 9.1427 1,755,400 5,266,200 10,532,400 9.1427

Switzerland 123,500 370,500 741,000 1.2864 247,000 741,000 1,482,000 1.2864

Taiwan R.O.C. 1,739,900 5,219,700 10,439,400 18.1239 3,479,800 10,439,400 20,878,800 18.1239

Tanzania 60,106,300 180,318,900 360,637,800 626.1072 47,955,200 360,637,800 721,275,600 249.7666

Thailand 1,114,300 3,342,900 6,685,800 11.6072 2,228,600 6,685,800 13,371,600 11.6072

Tonga 127,800 383,400 766,800 1.3312 255,600 766,800 1,533,600 1.3312

Trinidad & Tobago 379,600 1,138,800 2,277,600 3.9541 759,200 2,277,600 4,555,200 3.9541

Turkey 77,800 233,400 466,800 0.8104 155,600 466,800 933,600 0.8104

Turks & Caicos 105,600 316,800 633,600 1.1000 211,200 633,600 1,267,200 1.1000

Uganda 100,105,600 300,316,800 600,633,600 1042.7666 200,211,200 600,633,600 1,201,267,200 1042.7666

UK 60,700 182,100 364,200 0.6322 121,400 364,200 728,400 0.6322

Ukraine 220,100 660,300 1,320,600 2.2927 440,200 1,320,600 2,641,200 2.2927

United Arab Emirates 282,700 848,100 1,696,200 2.9447 565,400 1,696,200 3,392,400 2.9447

United States 96,000 288,000 576,000 1.0000 192,000 576,000 1,152,000 1.0000

Uruguay 1,205,900 3,617,700 7,235,400 12.5614 2,411,800 7,235,400 14,470,800 12.5614

Venezuela 109,726,600 329,179,800 658,359,600 1,142.9854 219,453,200 658,359,600 1,316,719,200 1142.9854

Vietnam 339,234,600 1,017,703,800 2,035,407,600 3,533.6937 678,469,200 2,035,407,600 4,070,815,200 3533.6937

Zambia 224,700 674,100 1,348,200 2.3406 449,400 1,348,200 2,696,400 2.3406

Zimbabwe 1,374,700 4,124,100 8,248,200 14.3197 2,749,400 8,248,200 16,496,400 14.3197

Page 12 Global – 12/10/2018

INCOME PRODUCTION REQUIREMENTS FOR MEMBERSHIP

IN THE 2019 MILLION DOLLAR ROUND TABLE

Based on 2018 Production, Expressed in Local Currency

Production credit must be reported in U.S. dollars on certifying letters Production requirements are set independently for each country. Conversion (Conv) factors have

no relationship to currency exchange rates and are used only to standardize MDRT processing. (Local currency divided by the income conversion = U.S .MDRT

requirement) Qualification under this method is based on a requirement of USD 166,000 in annual gross income from insurance and financial products. A minimum of

USD 48,000 must be income from new business generated during the production year. Further, a minimum of USD 48,000 must be derived from income associated

with Risk-Protection Products. (For a complete list of country requirements, see the MDRT website at https://www.mdrt.org/membership/requirements/ .)

Country MDRT Income COT Income TOT Income Income Conv Factor

Angola 92,900 278,700 557,400 0.5596

Anguilla 184,200 552,600 1,105,200 1.1096

Antigua 277,800 833,400 1,666,800 1.6734

Argentina 384,400 1,153,200 2,306,400 2.3156

Armenia 28,546,400 85,639,200 171,278,400 171.9662

Aruba 209,300 627,900 1,255,800 1.2608

Australia 234,600 703,800 1,407,600 1.4132

Azerbaijan 42,000 126,000 252,000 0.2530

Bahamas 138,700 416,100 832,200 0.8355

Bahrain 39,800 119,400 238,800 0.2397

Bangladesh 3,703,800 11,111,400 22,222,800 22.3120

Barbados 216,900 650,700 1,301,400 1.3066

Belarus 242,302,800 726,908,400 1,453,816,800 1459.6554

Belgium 136,300 408,900 817,800 0.8210

Belize 164,700 494,100 988,200 0.9921

Bermuda 250,900 752,700 1,505,400 1.5114

Bolivia 415,900 1,247,700 2,495,400 2.5054

Bosnia-Herzegovina 116,600 349,800 699,600 0.7024

Botswana 439,900 1,319,700 2,639,400 2.6500

Brazil 314,300 942,900 1,885,800 1.8933

British Virgin Islands 166,100 498,300 996,600 1.0006

Brunei 103,500 310,500 621,000 0.6234

Bulgaria 105,500 316,500 633,000 0.6355

Cambodia 129,550,900 388,652,700 777,305,400 780.4271

Canada 201,000 603,000 1,206,000 1.2108

Cayman Islands 113,300 339,900 679,800 0.6825

Channel Islands 115,200 345,600 691,200 0.6939

Chile 55,055,500 165,166,500 330,333,000 331.6596

Colombia 145,761,700 437,285,100 874,570,200 878.0825

Costa Rica 46,384,800 139,154,400 278,308,800 279.4265

Croatia 595,500 1,786,500 3,573,000 3.5873

Curacao 125,300 375,900 751,800 0.7548

Cyprus 69,900 209,700 419,400 0.4210

Czech Republic 2,179,600 6,538,800 13,077,600 13.1301

Denmark 1,208,900 3,626,700 7,253,400 7.2825

Dominica 221,600 664,800 1,329,600 1.3349

Dominican Republic 2,222,700 6,668,100 13,336,200 13.3897

Ecuador 77,700 233,100 466,200 0.4680

Egypt 238,900 716,700 1,433,400 1.4391

El Salvador 80,300 240,900 481,800 0.4837

Estonia 87,000 261,000 522,000 0.5240

Fiji 131,500 394,500 789,000 0.7921

France 136,000 408,000 816,000 0.8192

Georgia 119,000 357,000 714,000 0.7168

Germany 130,100 390,300 780,600 0.7837

Ghana 104,500 313,500 627,000 0.6295

Gibraltar 95,000 285,000 570,000 0.5722

Greece 99,500 298,500 597,000 0.5993

Grenada 295,300 885,900 1,771,800 1.7789

Guatemala 588,200 1,764,600 3,529,200 3.5433

Guyana 15,245,600 45,736,800 91,473,600 91.8409

Honduras 1,515,100 4,545,300 9,090,600 9.1271

Hong Kong SAR 914,000 2,742,000 5,484,000 5.5060

Hungary 21,219,800 63,659,400 127,318,800 127.8301

India 1,616,500 4,849,500 9,699,000 9.7379

Indonesia 477,965,300 1,433,895,900 2,867,791,800 2879.3090

Ireland 138,200 414,600 829,200 0.8325

Isle of Man 115,200 345,600 691,200 0.6939

Israel 589,100 1,767,300 3,534,600 3.5487

Italy 123,500 370,500 741,000 0.7439

Jamaica West Indies 7,214,600 21,643,800 43,287,600 43.4614

Japan 18,822,400 56,467,200 112,934,400 113.3879

Page 13 Global – 12/10/2018

Country MDRT Income COT Income TOT Income Income Conv Factor

Jordan 40,100 120,300 240,600 0.2415

Kazakhstan 8,819,400 26,458,200 52,916,400 53.1289

Kenya 5,396,200 16,188,600 32,377,200 32.5072

Kuwait 42,900 128,700 257,400 0.2584

Latvia 59,300 177,900 355,800 0.3572

Lebanon 194,331,900 582,995,700 1,165,991,400 1170.6740

Lithuania 200,900 602,700 1,205,400 1.2102

Luxembourg 148,100 444,300 888,600 0.8921

Macau 669,300 2,007,900 4,015,800 4.0319

Macedonia 3,045,000 9,135,000 18,270,000 18.3433

Malaysia 251,500 754,500 1,509,000 1.5150

Malta 43,800 131,400 262,800 0.2638

Mauritius 2,533,800 7,601,400 15,202,800 15.2638

Mexico 1,234,900 3,704,700 7,409,400 7.4391

Montenegro 10,200 30,600 61,200 0.0614

Montserrat 128,400 385,200 770,400 0.7734

Mozambique 2,553,100 7,659,300 15,318,600 15.3801

Myanmar 41,461,300 124,383,900 248,767,800 249.7668

Namibia 746,300 2,238,900 4,477,800 4.4957

Nepal 2,322,500 6,967,500 13,935,000 13.9909

Netherlands 136,000 408,000 816,000 0.8192

New Zealand 242,700 728,100 1,456,200 1.4620

Nicaragua 1,641,400 4,924,200 9,848,400 9.8879

Nigeria 9,792,300 29,376,900 58,753,800 58.9897

Norway 1,451,000 4,353,000 8,706,000 8.7409

Oman 28,700 86,100 172,200 0.1728

P.R. China 349,300 1,047,900 2,095,800 2.1042

Pakistan 2,900,700 8,702,100 17,404,200 17.4740

Panama 85,800 257,400 514,800 0.5168

Peru 238,900 716,700 1,433,400 1.4391

Philippines 2,252,100 6,756,300 13,512,600 13.5668

Poland 298,100 894,300 1,788,600 1.7957

Portugal 100,500 301,500 603,000 0.6054

Qatar 356,600 1,069,800 2,139,600 2.1481

Republic of Korea 130,224,000 390,672,000 781,344,000 784.4819

Romania 238,000 714,000 1,428,000 1.4337

Russia 2,186,200 6,558,600 13,117,200 13.1698

Saudi Arabia 415,900 1,247,700 2,495,400 2.5054

Serbia 5,166,500 15,499,500 30,999,000 31.1234

Singapore 200,300 600,900 1,201,800 1.2066

Slovakia 87,900 263,700 527,400 0.5295

Slovenia 111,400 334,200 668,400 0.6710

South Africa 495,800 1,487,400 2,974,800 2.9867

Spain 114,900 344,700 689,400 0.6921

Sri Lanka 4,593,500 13,780,500 27,561,000 27.6716

St Kitts and Nevis 286,100 858,300 1,716,600 1.7234

St Lucia 295,800 887,400 1,774,800 1.7819

St Maarten 125,300 375,900 751,800 0.7548

St Vincent 274,200 822,600 1,645,200 1.6518

Suriname 29,503,900 88,511,700 177,023,400 177.7343

Sweden 1,518,400 4,555,200 9,110,400 9.1469

Switzerland 213,700 641,100 1,282,200 1.2873

Taiwan R.O.C. 3,010,000 9,030,000 18,060,000 18.1325

Tanzania 103,933,800 311,801,400 623,602,800 626.1072

Thailand 1,927,700 5,783,100 11,566,200 11.6126

Tonga 221,100 663,300 1,326,600 1.3319

Trinidad & Tobago 656,700 1,970,100 3,940,200 3.9560

Turkey 134,600 403,800 807,600 0.8108

Turks & Caicos 182,700 548,100 1,096,200 1.1006

Uganda 173,099,200 519,297,600 1,038,595,200 1042.7662

UK 105,000 315,000 630,000 0.6325

Ukraine 380,800 1,142,400 2,284,800 2.2939

United Arab Emirates 489,100 1,467,300 2,934,600 2.9463

United States 166,000 498,000 996,000 1.0000

Uruguay 2,086,200 6,258,600 12,517,200 12.5674

Venezuela 189,827,000 569,481,000 1,138,962,000 1143.5361

Vietnam 586,875,900 1,760,627,700 3,521,255,400 3535.3969

Zambia 388,700 1,166,100 2,332,200 2.3415

Zimbabwe 2,378,200 7,134,600 14,269,200 14.3265

Page 14 Global – 12/10/2018

You might also like

- Ch.20 SolDocument43 pagesCh.20 Solkokmunwai717No ratings yet

- MDRT 2017 Membership InfoDocument14 pagesMDRT 2017 Membership InfoJayson Solomon50% (2)

- Pru LifeDocument20 pagesPru LifeJaboh LabohNo ratings yet

- Requirement Membership ApplicationDocument7 pagesRequirement Membership ApplicationkezNo ratings yet

- CIPM Exam Pass Question - Insurance - Pensions MGTDocument7 pagesCIPM Exam Pass Question - Insurance - Pensions MGTVictory M. DankardNo ratings yet

- CompensationDocument75 pagesCompensationflorin251No ratings yet

- Termination of Employment PolicyDocument9 pagesTermination of Employment PolicyKirubakaran ShanmugamNo ratings yet

- 2020 Membership Info - Global (8!5!2019)Document16 pages2020 Membership Info - Global (8!5!2019)Jenefer AntoNo ratings yet

- 2024 Membership Info - GlobalDocument16 pages2024 Membership Info - GlobalhuihudsonNo ratings yet

- 2025 Membership Info Global - ENGLISH (11!01!2023)Document16 pages2025 Membership Info Global - ENGLISH (11!01!2023)ravi.rnrfreedomNo ratings yet

- 2024 Membership Info Non-Core - ENGLISH (11-3-2022)Document16 pages2024 Membership Info Non-Core - ENGLISH (11-3-2022)neotheuniverseNo ratings yet

- 2025 Membership Info Non-Core - ENGLISH (11-01-2023)Document16 pages2025 Membership Info Non-Core - ENGLISH (11-01-2023)neotheuniverseNo ratings yet

- Chapter # 3: Functioning of SLICDocument9 pagesChapter # 3: Functioning of SLICraul_0189No ratings yet

- Tata AIA Life Diamond Savings PlanDocument4 pagesTata AIA Life Diamond Savings Plansree db2No ratings yet

- QT Nil P 0281201503151442615Document51 pagesQT Nil P 0281201503151442615Dinesh MuruganNo ratings yet

- Aviva Life Shield Plus1Document8 pagesAviva Life Shield Plus1Anoop NimkandeNo ratings yet

- MM AssignmentDocument16 pagesMM AssignmentRahul ParasharNo ratings yet

- FWAP ULIP Leaflet RevisedDocument16 pagesFWAP ULIP Leaflet Revisedmantoo kumarNo ratings yet

- Brochuredocument OSP 202308030651PM891 PDFDocument23 pagesBrochuredocument OSP 202308030651PM891 PDFhaseebamerNo ratings yet

- Fuel Ventures Scale Up EIS Fund KIDDocument3 pagesFuel Ventures Scale Up EIS Fund KIDctmcmenemyNo ratings yet

- JuanDelaCruz AxeleratorDocument8 pagesJuanDelaCruz AxeleratorOmar Jayson Siao VallejeraNo ratings yet

- Lakshya Plus v1Document10 pagesLakshya Plus v1Mahadevan VenkatesanNo ratings yet

- MoneyWorks Proposal38yoDocument5 pagesMoneyWorks Proposal38yoMorg ActusNo ratings yet

- KFD U39Document3 pagesKFD U39mniarunNo ratings yet

- PDS Boost ProtectActiveDocument4 pagesPDS Boost ProtectActiveAizat HermanNo ratings yet

- Auto Income Tax Calculator Version 5.1 2010-11Document19 pagesAuto Income Tax Calculator Version 5.1 2010-11Bijender Pal ChoudharyNo ratings yet

- Presentation On Householder Insurance PolicyDocument63 pagesPresentation On Householder Insurance Policychhavigupta1689No ratings yet

- Rea T: Protection That Builds Your Wealth For Future GenerationDocument18 pagesRea T: Protection That Builds Your Wealth For Future GenerationDato SNo ratings yet

- PrudentialDocument5 pagesPrudentialManish RaiNo ratings yet

- Aapki Zaroorat - Wealth AccumulationDocument13 pagesAapki Zaroorat - Wealth AccumulationRohitNo ratings yet

- Fulfil The Smaller Joys in Life, Through Regular IncomeDocument8 pagesFulfil The Smaller Joys in Life, Through Regular IncomeSajeed ShaikhNo ratings yet

- Taxation Ce2Document10 pagesTaxation Ce2Ratnesh PalNo ratings yet

- Life Gain Premier BrochureDocument12 pagesLife Gain Premier BrochureNeeralNo ratings yet

- EdelweissTokioLife WealthAccumulation AcceleratedCover WAAC UIN147L003V02Document12 pagesEdelweissTokioLife WealthAccumulation AcceleratedCover WAAC UIN147L003V02avisekgNo ratings yet

- Exide Life Secured Income Insurance RPDocument10 pagesExide Life Secured Income Insurance RPrahul sarmaNo ratings yet

- DT NotesDocument41 pagesDT NotesHariprasad bhatNo ratings yet

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) Formawang naziroolNo ratings yet

- PDS (OTO360) FormDocument2 pagesPDS (OTO360) FormSara AriffNo ratings yet

- Standardized Product: TrainingDocument44 pagesStandardized Product: TrainingHannington KondeNo ratings yet

- A Premier Saver: CWA - PDU - V2 - 2010 - For Training Purposes OnlyDocument30 pagesA Premier Saver: CWA - PDU - V2 - 2010 - For Training Purposes OnlySaladin KamarudinNo ratings yet

- Bima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFDocument7 pagesBima Bachat Plan 175 For Aged 20 All Term 9,12,15 Years Call LIC Agent Anandaraman at 9843146519 PDFMutual Funds Advisor ANANDARAMAN 944-529-6519No ratings yet

- Example:: 1 Pmg/Egtb/Motor/Pds/Eng/Echannel/Direct/2105V2.5Document3 pagesExample:: 1 Pmg/Egtb/Motor/Pds/Eng/Echannel/Direct/2105V2.5aniesNo ratings yet

- Health Invest PrimerDocument16 pagesHealth Invest PrimerArt WadsilangNo ratings yet

- Secure Access 2015Document16 pagesSecure Access 2015api-288656991No ratings yet

- Money Back 20 Years Insurance Policy by Lic: Plan ParametersDocument3 pagesMoney Back 20 Years Insurance Policy by Lic: Plan ParametersTwinkle PahujaNo ratings yet

- How To Make QuotationDocument20 pagesHow To Make QuotationArvin DiNozzoNo ratings yet

- New Pension PlusDocument2 pagesNew Pension Plusrsgk75No ratings yet

- QT Nil P 0281201412122056697Document18 pagesQT Nil P 0281201412122056697Sarath KumarNo ratings yet

- LifeXL PDFDocument6 pagesLifeXL PDFJoydeep Kar0% (1)

- PDSMotor FormDocument3 pagesPDSMotor FormAkoo MeraNo ratings yet

- FWAP LeafletDocument16 pagesFWAP LeafletsatishbhattNo ratings yet

- Insurance Ia 2Document6 pagesInsurance Ia 2Vikrant SinghNo ratings yet

- Variable Life Insurance Proposal: 0PROP.07.4Document4 pagesVariable Life Insurance Proposal: 0PROP.07.4Ahmad Israfil PiliNo ratings yet

- Igreat DamaiDocument18 pagesIgreat Damaiapi-240706460No ratings yet

- HDFC Life Click 2 Invest - Ulip - GJ - IllustrationDocument3 pagesHDFC Life Click 2 Invest - Ulip - GJ - IllustrationYashpal SinghNo ratings yet

- ICICI Pru Pinnacle II RefresherDocument31 pagesICICI Pru Pinnacle II RefresherGaurav AroraNo ratings yet

- SBI Life - Saral Jeevan Bima - BrochureDocument9 pagesSBI Life - Saral Jeevan Bima - BrochureH.O. Rajendra TiwariNo ratings yet

- Gist of LIC's Samridhi Plus (Plan No 804)Document6 pagesGist of LIC's Samridhi Plus (Plan No 804)Avinash KolugadeNo ratings yet

- Flexi Income IncomeDocument7 pagesFlexi Income Incomeharshad malusareNo ratings yet

- Pension Plus v2 Arn Slic Brochure WithdrawnDocument10 pagesPension Plus v2 Arn Slic Brochure WithdrawnNitin MishraNo ratings yet

- Sales-Brochure 802Document18 pagesSales-Brochure 802Rai Nityanand SantoshkumarNo ratings yet

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.From EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.No ratings yet

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineFrom EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineNo ratings yet

- Basic Facts On Employment in MauritiusDocument3 pagesBasic Facts On Employment in MauritiusRaivinNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Superannuation Circular III A 4 The Sole Purpose Test February 2001Document16 pagesSuperannuation Circular III A 4 The Sole Purpose Test February 2001Abdullah TheNo ratings yet

- Parreno Vs COADocument1 pageParreno Vs COAPortia WynonaNo ratings yet

- Quiz 4Document7 pagesQuiz 4Vivienne Rozenn LaytoNo ratings yet

- Reflective PaperDocument8 pagesReflective PapernajlovejonesNo ratings yet

- Retirement Planning Mock Test: Practical Questions: Section 1: 29 Questions (1 Mark Each)Document17 pagesRetirement Planning Mock Test: Practical Questions: Section 1: 29 Questions (1 Mark Each)Ami ShahNo ratings yet

- ch20 11Document40 pagesch20 11Tingting Liu100% (6)

- Application For Disbursement of Holiday Allowance: (Ddmmyy)Document3 pagesApplication For Disbursement of Holiday Allowance: (Ddmmyy)xaste100% (1)

- IFRS - IAS19 - Employee BenefitsDocument16 pagesIFRS - IAS19 - Employee BenefitsPramita RoyNo ratings yet

- 3rd PRC RecommendationsDocument38 pages3rd PRC RecommendationsAnonymous bxAM8jNo ratings yet

- FINAL Wilshire TRSL SFP ResponseDocument129 pagesFINAL Wilshire TRSL SFP ResponseAlexNo ratings yet

- 20132014ProposedBudget Sep19 9pmDocument765 pages20132014ProposedBudget Sep19 9pmChs BlogNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Credito Edwin GuzmanDocument2 pagesCredito Edwin GuzmanCarol Milena Arias MontoyaNo ratings yet

- Retirement Financial Expert Ryan Skinner - A Step Above The RestDocument3 pagesRetirement Financial Expert Ryan Skinner - A Step Above The RestRyan SkinnerNo ratings yet

- Philconsa Vs Enriquez: FactsDocument2 pagesPhilconsa Vs Enriquez: FactsvictorNo ratings yet

- MQ q3 ch01Document46 pagesMQ q3 ch01Lee DickensNo ratings yet

- LLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsDocument133 pagesLLB Subject: Tax Law: Unit 1: Introduction A. DefinitionsTahaNo ratings yet

- Petra Teir 2 FormDocument2 pagesPetra Teir 2 Formd5n8k7mmvyNo ratings yet

- Taxation NotesDocument63 pagesTaxation Notesthushara234465087% (31)

- Confederation For Unity, Recognition and Advancement Ofgovernment Employees (Courage) vs. Commissioner, Bureau of Internal RevenueDocument57 pagesConfederation For Unity, Recognition and Advancement Ofgovernment Employees (Courage) vs. Commissioner, Bureau of Internal RevenueChristopher IgnacioNo ratings yet

- Dronation MoADocument4 pagesDronation MoAVineetha KanchumarthiNo ratings yet

- UKRI Sickness Absence PolicyDocument28 pagesUKRI Sickness Absence PolicyanupkrajakNo ratings yet

- BrochureDocument9 pagesBrochureLamro Triwandes SimatupangNo ratings yet

- Rundown Ep.122 FINAL The Allegory of The Hawk and Serpent Chris Cole 1Document16 pagesRundown Ep.122 FINAL The Allegory of The Hawk and Serpent Chris Cole 1Станислав СкрипниченкоNo ratings yet