Professional Documents

Culture Documents

Benefit Illustration: UIN: 104N076V16 Page 1 of 3

Benefit Illustration: UIN: 104N076V16 Page 1 of 3

Uploaded by

Viju KCopyright:

Available Formats

You might also like

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- Benefit Illustration: UIN: 104N076V17 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N076V17 Page 1 of 3vipin jainNo ratings yet

- Benefit Illustration: UIN: 104N076V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N076V11 Page 1 of 2Vir ShahNo ratings yet

- Mon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueDocument3 pagesMon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueRamesh SharmaNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Class NotesDocument3 pagesClass NotesMUKESH MEHTANo ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- 70014883867Document4 pages70014883867Manish YadavNo ratings yet

- Benefit Illustration: UIN: 104N116V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V02 Page 1 of 3Ravindar aNo ratings yet

- Illustration Qb22tohnmq5mjDocument3 pagesIllustration Qb22tohnmq5mjMotivational QuotesNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Illustration (13)Document2 pagesIllustration (13)gdrivelink07No ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- HDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Document3 pagesHDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Teja Reddy Telugu YuvathaNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusbabukcdNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusĄńıkęť MâhîñďNo ratings yet

- IllustrationDocument3 pagesIllustrationTarush RastogiNo ratings yet

- Benefit Illustration: Tata AIA Life Insurance Smart Value Income PlanDocument3 pagesBenefit Illustration: Tata AIA Life Insurance Smart Value Income PlanPrakash SinghNo ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- IllustrationDocument2 pagesIllustrationamitkumar.nayek28101989No ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Illustration - 2023-07-12T192907.748Document2 pagesIllustration - 2023-07-12T192907.748abinashsekharmishra1No ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001876111021Document4 pagesE SymbiosysFiles Generated OutputSIPDF 10200001876111021Sankalp SrivastavaNo ratings yet

- HDFC PolicyDocument2 pagesHDFC Policyestrade1112No ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- IllustrationDocument3 pagesIllustrationHar DonNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantagekesk32No ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantageraja reddyNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- IllustrationDocument2 pagesIllustrationashutoshshinde2210No ratings yet

- Illustration - 2023-11-04T171018.610Document2 pagesIllustration - 2023-11-04T171018.610bakavoNo ratings yet

- 70012166554 (2)Document4 pages70012166554 (2)amanmittal08No ratings yet

Benefit Illustration: UIN: 104N076V16 Page 1 of 3

Benefit Illustration: UIN: 104N076V16 Page 1 of 3

Uploaded by

Viju KOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Benefit Illustration: UIN: 104N076V16 Page 1 of 3

Benefit Illustration: UIN: 104N076V16 Page 1 of 3

Uploaded by

Viju KCopyright:

Available Formats

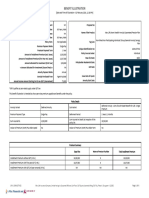

BENEFIT ILLUSTRATION

Name of the First Annuitant: Mr. Proposal No:

Age & Gender: 55 Years, Male Name of the Product: Max Life Guaranteed Lifetime Income Plan

Name of the Second Annuitant, if any: Not Applicable Tag Line: A Non-Linked Non Participating Individual General Annuity Savings Plan

Age & Gender: 60 Years, Male Unique Identification No: 104N076V16

Policy Term: Not Applicable GST Rate (First Year): 4.50%

Premium Payment Mode: Annual GST Rate (Subsequent Year): 2.25%

Premium Payment Term: 5 Max Life State: Kerala

Amount of Installment Premium: `10,45,000 Policyholder Residential State: Kerala

Annuity Payment Frequency: Monthly Issue Date of Quote: 14 July 2023

Annuity Purchased From: Agent Assisted Annuity Start Date: 14 August 2028

Monthly Income Amount Starting On 14-Aug-2028

`30,590

(Guaranteed)

This quote is valid for a period of 10 calendar days from the date of issue. Please ensure that your proposal form is submitted at any of our offices within this duration as annuity rates change frequently.

This benefit illustration is intended to show year-wise premiums payable and benefits under the policy.

Policy Details

Policy Option Deferred Annuity - Joint Life Sum Assured (in Rs.) Not Applicable

Deferment Period, if applicable 5 Years Sum Assured on Death (at inception of the policy) (in Rs.) `10,50,000

Death Benefit Opted Yes Payment Option Limited Pay

Premium Summary

Base Plan Riders Total Installment Premium

Installment Premium without GST (in Rs.) 10,00,000 NA 10,00,000

Installment Premium with first year GST (in Rs.) 10,45,000 NA 10,45,000

Installment Premium with GST 2nd year onwards (in Rs.) 10,22,500 NA 10,22,500

UIN: 104N076V16 Page 1 of 3

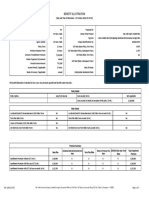

(Amount in Rupees)

Guaranteed Non Guaranteed

Single/ Annualized

Policy Year

Premium Survival Benefits / Loyalty Min Guaranteed Surrender Value Special Surrender Value

Other Benefits, if any Maturity Benefit Death Benefit

Additions

1 10,00,000 0 3,82,380 0 13,82,380 0 0

2 10,00,000 0 7,64,760 0 27,64,760 6,00,000 12,72,589

3 10,00,000 0 11,47,140 0 41,47,140 21,00,000 21,00,000

4 10,00,000 0 15,29,520 0 55,29,520 36,00,000 36,00,000

5 10,00,000 0 19,11,900 0 69,11,900 45,00,000 45,00,000

6 0 3,67,085 19,11,900 0 65,44,815 41,32,915 41,92,329

7 0 3,67,085 19,11,900 0 61,77,730 37,65,830 42,02,257

8 0 3,67,085 19,11,900 0 58,10,646 33,98,746 42,12,684

9 0 3,67,085 19,11,900 0 54,43,561 30,31,661 42,24,403

10 0 3,67,085 19,11,900 0 52,50,000 26,64,576 42,36,782

11 0 3,67,085 19,11,900 0 52,50,000 22,97,491 42,50,078

12 0 3,67,085 19,11,900 0 52,50,000 19,30,406 42,64,194

13 0 3,67,085 19,11,900 0 52,50,000 15,63,322 42,78,887

14 0 3,67,085 19,11,900 0 52,50,000 11,96,237 42,93,487

15 0 3,67,085 19,11,900 0 52,50,000 8,29,152 43,09,253

16 0 3,67,085 19,11,900 0 52,50,000 4,62,067 43,25,013

17 0 3,67,085 19,11,900 0 52,50,000 94,982 43,40,988

18 0 3,67,085 19,11,900 0 52,50,000 0 43,57,436

19 0 3,67,085 19,11,900 0 52,50,000 0 43,74,076

20 0 3,67,085 19,11,900 0 52,50,000 0 43,91,128

21 0 3,67,085 19,11,900 0 52,50,000 0 44,07,740

22 0 3,67,085 19,11,900 0 52,50,000 0 44,24,559

23 0 3,67,085 19,11,900 0 52,50,000 0 44,41,767

24 0 3,67,085 19,11,900 0 52,50,000 0 44,58,902

25 0 3,67,085 19,11,900 0 52,50,000 0 44,75,573

26 0 3,67,085 19,11,900 0 52,50,000 0 44,92,819

27 0 3,67,085 19,11,900 0 52,50,000 0 45,09,600

28 0 3,67,085 19,11,900 0 52,50,000 0 45,26,419

29 0 3,67,085 19,11,900 0 52,50,000 0 45,43,664

UIN: 104N076V16 Page 2 of 3

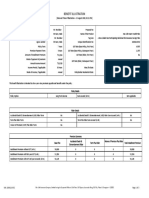

Guaranteed Non Guaranteed

Single/ Annualized

Policy Year

Premium Survival Benefits / Loyalty Min Guaranteed Surrender Value Special Surrender Value

Other Benefits, if any Maturity Benefit Death Benefit

Additions

30 0 3,67,085 19,11,900 0 52,50,000 0 45,60,652

31 0 3,67,085 19,11,900 0 52,50,000 0 45,77,699

32 0 3,67,085 19,11,900 0 52,50,000 0 45,94,903

33 0 3,67,085 19,11,900 0 52,50,000 0 46,12,858

34 0 3,67,085 19,11,900 0 52,50,000 0 46,30,977

35 0 3,67,085 19,11,900 0 52,50,000 0 46,49,418

36 0 3,67,085 19,11,900 0 52,50,000 0 46,69,113

37 0 3,67,085 19,11,900 0 52,50,000 0 46,90,133

38 0 3,67,085 19,11,900 0 52,50,000 0 47,13,068

39 0 3,67,085 19,11,900 0 52,50,000 0 47,37,886

40 0 3,67,085 19,11,900 0 52,50,000 0 47,66,635

41 0 3,67,085 19,11,900 0 52,50,000 0 47,99,117

42 0 3,67,085 19,11,900 0 52,50,000 0 48,37,946

43 0 3,67,085 19,11,900 0 52,50,000 0 48,84,810

44 0 3,67,085 19,11,900 0 52,50,000 0 49,42,375

45 0 3,67,085 19,11,900 0 52,50,000 0 50,16,000

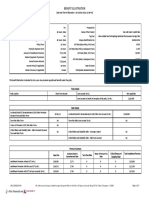

Notes: Annualized Premium excludes underwriting extra premium, frequency loadings on premiums, the premiums paid towards the riders, if any, and Goods and Service Tax. Refer Sales literature for explanation of terms used in

this illustration.

I, ……………………………………………. (name),have explained the premiums, and benefits I, ……………………………………………. (name), having received the information with respect

under the product fully to the prospect / policyholder to the above, have understood the above statement before entering into the contract.

Place:

Date: 7/14/23 Signature / OTP Confirmation Date / Thumb Impression / Date:7/14/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104N076V16 Page 3 of 3

You might also like

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- Benefit Illustration: UIN: 104N076V17 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N076V17 Page 1 of 3vipin jainNo ratings yet

- Benefit Illustration: UIN: 104N076V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N076V11 Page 1 of 2Vir ShahNo ratings yet

- Mon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueDocument3 pagesMon Pay 5pay Deferred 5 With Rop - With Ga & Death Benefit & Surrender ValueRamesh SharmaNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Class NotesDocument3 pagesClass NotesMUKESH MEHTANo ratings yet

- 70015063229Document4 pages70015063229Manish YadavNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- IllustrationDocument2 pagesIllustrationRajnandan shindeNo ratings yet

- 70014913388Document4 pages70014913388Manish YadavNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusScribbydooNo ratings yet

- Benefit Illustration: Of2 UIN: 104N076V11Document2 pagesBenefit Illustration: Of2 UIN: 104N076V11Vir ShahNo ratings yet

- UIN: 104N085V04 Page 1 of 2Document2 pagesUIN: 104N085V04 Page 1 of 2Yashwant ojhaNo ratings yet

- 70014883867Document4 pages70014883867Manish YadavNo ratings yet

- Benefit Illustration: UIN: 104N116V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V02 Page 1 of 3Ravindar aNo ratings yet

- Illustration Qb22tohnmq5mjDocument3 pagesIllustration Qb22tohnmq5mjMotivational QuotesNo ratings yet

- Mrs Richa 8-1-25 10LDocument2 pagesMrs Richa 8-1-25 10LRaju KaliperumalNo ratings yet

- IllustrationDocument2 pagesIllustrationMahesh AgrawalNo ratings yet

- IllustrationDocument2 pagesIllustrationNiranjan LenkaNo ratings yet

- Illustration (13)Document2 pagesIllustration (13)gdrivelink07No ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- HDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Document3 pagesHDFC Life Smart Income Plan-Mon Oct 17 20 - 02 - 31 IST 2022Teja Reddy Telugu YuvathaNo ratings yet

- Guaranteed Return Insurance PlanDocument4 pagesGuaranteed Return Insurance Planprayas03No ratings yet

- Fortune Guarantee PlusDocument3 pagesFortune Guarantee PlusbabukcdNo ratings yet

- Fortune Guarantee PlusDocument4 pagesFortune Guarantee PlusĄńıkęť MâhîñďNo ratings yet

- IllustrationDocument3 pagesIllustrationTarush RastogiNo ratings yet

- Benefit Illustration: Tata AIA Life Insurance Smart Value Income PlanDocument3 pagesBenefit Illustration: Tata AIA Life Insurance Smart Value Income PlanPrakash SinghNo ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- IllustrationDocument2 pagesIllustrationamitkumar.nayek28101989No ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Illustration - 2023-07-12T192907.748Document2 pagesIllustration - 2023-07-12T192907.748abinashsekharmishra1No ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001876111021Document4 pagesE SymbiosysFiles Generated OutputSIPDF 10200001876111021Sankalp SrivastavaNo ratings yet

- HDFC PolicyDocument2 pagesHDFC Policyestrade1112No ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- IllustrationDocument3 pagesIllustrationHar DonNo ratings yet

- Illustration 990Document2 pagesIllustration 990prachididwania13No ratings yet

- DetailsDocument2 pagesDetailsmailshimmerandshineNo ratings yet

- Illustration Qbhlvjke4x8v0Document2 pagesIllustration Qbhlvjke4x8v0Akshay ChaudhryNo ratings yet

- IllustrationDocument2 pagesIllustrationraamshankar11No ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantagekesk32No ratings yet

- Illustration - 2022-08-30T164443.287Document2 pagesIllustration - 2022-08-30T164443.287Soumen BeraNo ratings yet

- Illustration - 2022-07-30T141948.715Document3 pagesIllustration - 2022-07-30T141948.715Soumen BeraNo ratings yet

- Illustration - 2022-12-21T143227.841Document2 pagesIllustration - 2022-12-21T143227.841Ashher UsmaniNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantageraja reddyNo ratings yet

- Benefit Illustration: UIN: 104N137V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N137V02 Page 1 of 4bhavnapal74No ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlussarthakNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- IllustrationDocument2 pagesIllustrationashutoshshinde2210No ratings yet

- Illustration - 2023-11-04T171018.610Document2 pagesIllustration - 2023-11-04T171018.610bakavoNo ratings yet

- 70012166554 (2)Document4 pages70012166554 (2)amanmittal08No ratings yet