Professional Documents

Culture Documents

P5 8

P5 8

Uploaded by

laurentinus fikaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P5 8

P5 8

Uploaded by

laurentinus fikaCopyright:

Available Formats

1.

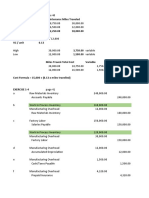

) Income Statement

Digital Tunes Inc.

Income Statement

For The Month Ending December 31, 2010

Sales 13,600,000

Less cost of goods sold 3,187,500

Gross profit 10,412,500

Less commercial expenses:

Marketing expense 1,700,000

Media Campaign expense 4,000,000

Shipping expense 212,500

Administrative Expense 1,200,000 7,112,500

Income from operations 3,300,000

Less provision for income tax -

Net Income 3,300,000

# Perhitungan Sales

= 850.000 x $16

= $13.600.000

# Perhitungan COGS

Jumlah Terjual Pengali Total

Direct Labor 850,000 0.25 212,500

Direct Material 850,000 3.00 2,550,000

FOH Applied 1,200 354.17 425,000

COGS 3,187,500

Shipping Expense = 850.000 x 0,25 FOH Applied/ Unit = 850.000/ 2.400

= 212,500 = 354.167

2.) a. Balance Work In Process

Jumlah WIP Pengali Total

Direct Labor - 0.00 -

Direct Material 25,000 3.00 75,000

FOH Applied 1,200 10.42 12,500

Balance WIP 87,500

FOH Applied/ Unit = 25.000/ 2.400

= 354.167

2.) a. Balance Finished Goods

Jumlah Finishe Pengali Total

Direct Labor 150,000 0.25 37,500

Direct Material 150,000 3.00 450,000

FOH Applied 1,200 62.50 75,000

Balance Finished Goods 562,500

FOH Applied/ Unit = 150.000/ 2.400

= 62.5

Transaksi Keterangan Akun Debit Kredit

a. Materials 115,020

Account Payable 115,020

c. Work In Process 78,000

Payroll 78,000

Job 101 (2.500 x 8 = 20.000)

Job 102 (4.000 x 10 = 40.000)

Job 103 (3.000 x 6 = 18.000)

FOH 12,000

Payroll 12,000

Marketing & Salaries Expense 20,000

Payroll 20,000

d. Work In Process 108,175

Materials 108,175

FOH 7,520

Materials 7,520

e. Work In Process 42,750

FOH Applied 42,750

f. Finished Goods 190,350

Work In Process 190,350

Account Receivable 255,000

Sales 255,000

Cost of Goods Sold 190,350

Finished Goods 190,350

h. Marketing & Administrative Expense 15,000

Cash 15,000

FOH 24,680

Cash 24,680

i. Account Payable 85,000

Cash 85,000

j. Cost of Goods Sold 1,450

FOH Applied 1,450

WIP Job 101 WIP Job 102

Debit Kredit Debit Kredit

Saldo Awal 5,500 88,350 Finished Goods Saldo Awal 2,000 102,000 Finished Goods

DM 51,600 DM 42,000

DL 20,000 DL 40,000

FOH Applied 11,250 FOH Applied 18,000

Total Cost 88,350 88,350 Total Cost 102,000 102,000

Saldo Akhir - - Saldo Akhir - -

WIP Job 103

Debit Kredit

Saldo Awal -

DM 14,575

DL 18,000

FOH Applied 13,500

Total Cost 46,075 -

Saldo Akhir 46,075 -

Jackson Company

Cost of Goods Manufactured Statement

For The Month Ending Januari 31, 20XX

Direct Materials

Materials inventory, beginning 22,000

Purchases of raw materials 115,020

Material available for use 137,020

Less: Materials inventory, ending 21,325

Indirect Material used 7,520 28,845

Direct Material Consumed 108,175

Direct Labor 78,000

Factory Overhead

Payroll 12,000

Indirect Materials 7,520

Depreciation 2,000

Misc. FOH 22,680 44,200

Total Manufacturing Cost 230,375

Add WIP beginning 7,500

Less WIP ending - 46,075

COGM (Cost of Goods Manufactured) 191,800

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Financial Management Midtem ExamDocument4 pagesFinancial Management Midtem Examzavria100% (1)

- 01 Expedition Audit L1Document46 pages01 Expedition Audit L1MateoLagardoNo ratings yet

- Chapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyDocument4 pagesChapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyCertified Public AccountantNo ratings yet

- Chapter 5Document12 pagesChapter 5?????0% (1)

- FinAcc3 Chap4Document9 pagesFinAcc3 Chap4Iyah AmranNo ratings yet

- Answers in Exercise For Partnership FormationDocument9 pagesAnswers in Exercise For Partnership FormationAllen Gonzaga100% (2)

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Panganiban, Mary Grace S. OMGT 3101Document12 pagesPanganiban, Mary Grace S. OMGT 3101Mary Grace PanganibanNo ratings yet

- MAKSI - UI - LatihanKuis - Okt 2019Document8 pagesMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Income Statement Under Job Order and Activity-Based CostingDocument10 pagesIncome Statement Under Job Order and Activity-Based CostingSadhna MaharjanNo ratings yet

- 1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Document14 pages1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Shien Angel Delos ReyesNo ratings yet

- DG8C3UQW6Document16 pagesDG8C3UQW6gumbanaleahfateNo ratings yet

- M4 Answer Key 1 Nad 3Document11 pagesM4 Answer Key 1 Nad 3JOSCEL SYJONGTIANNo ratings yet

- Cost Accounting Chapter 3Document5 pagesCost Accounting Chapter 3Jenefer DianoNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- Chapter 4 - Ia3Document10 pagesChapter 4 - Ia3Xynith Nicole RamosNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Bài tập kế toán quản trị chương 4Document12 pagesBài tập kế toán quản trị chương 4Liêm PhanNo ratings yet

- Toaz - Info Chapter 5 2019 Problem 1 Alexis Company PRDocument3 pagesToaz - Info Chapter 5 2019 Problem 1 Alexis Company PRAngela Ruedas33% (3)

- Cost AccountingDocument3 pagesCost AccountingRajibNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- Assignment 1Document4 pagesAssignment 1Richmond KudoziaNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- Cost Accounting Adc Bcom Part 2 Solved Past Paper 2016Document8 pagesCost Accounting Adc Bcom Part 2 Solved Past Paper 2016Imran JuttNo ratings yet

- Advanced Accounting - Answers and Solutions: Problem 1. DDocument4 pagesAdvanced Accounting - Answers and Solutions: Problem 1. DDaniel HunksNo ratings yet

- Corp AccountsDocument8 pagesCorp AccountsShreyNo ratings yet

- Midterm Exam FALL SOLUTION Feb 27Document10 pagesMidterm Exam FALL SOLUTION Feb 27rawanelayusNo ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- 07 Reconciliation FTDocument7 pages07 Reconciliation FTnsm2zmvnbbNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Jawaban Perhitungan Dan Akumulasi BiayaDocument7 pagesJawaban Perhitungan Dan Akumulasi BiayaEka OematanNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Lan Services Incorporated Income Statement For The Year Ended December 31,2020Document5 pagesLan Services Incorporated Income Statement For The Year Ended December 31,2020Jasmine ActaNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- Additional Practice Exam Solution Updated Nov 19Document7 pagesAdditional Practice Exam Solution Updated Nov 19Shaunny BravoNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Cost Accounting AnswersDocument10 pagesCost Accounting AnswersHaris KhanNo ratings yet

- Chapter 7, Cost AccountingDocument2 pagesChapter 7, Cost AccountingApril Joy ObedozaNo ratings yet

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersJolina MostalesNo ratings yet

- Midterm Review QuestionsDocument6 pagesMidterm Review QuestionsnamiyuartsNo ratings yet

- 1.3.1. Problems - Hoba - General Transactions IllustrationDocument15 pages1.3.1. Problems - Hoba - General Transactions IllustrationJane DizonNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Business Combination Problem 1 Upto 9Document8 pagesBusiness Combination Problem 1 Upto 9jhun nhixNo ratings yet

- Solutions To Problems AFAR2 Chapter 13Document18 pagesSolutions To Problems AFAR2 Chapter 13Jane DizonNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Business Genetics: Understanding 21st Century Corporations using xBMLFrom EverandBusiness Genetics: Understanding 21st Century Corporations using xBMLNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- LAtihan CH 18Document19 pagesLAtihan CH 18laurentinus fikaNo ratings yet

- Tugas Managerial AccountinDocument3 pagesTugas Managerial Accountinlaurentinus fikaNo ratings yet

- Classifying CostDocument8 pagesClassifying Costlaurentinus fikaNo ratings yet

- Statement COGSDocument2 pagesStatement COGSlaurentinus fikaNo ratings yet

- Latihan CH 19Document12 pagesLatihan CH 19laurentinus fikaNo ratings yet

- Latihan CH 20 Process Costing Pengakun IIDocument2 pagesLatihan CH 20 Process Costing Pengakun IIlaurentinus fikaNo ratings yet

- BUSS 102 AssignmentDocument11 pagesBUSS 102 AssignmentDr. Mohammad Noor AlamNo ratings yet

- Ind As 16Document27 pagesInd As 16Dinesh TokasNo ratings yet

- CH 22Document79 pagesCH 22Hasan AzmiNo ratings yet

- Revision CVPDocument18 pagesRevision CVPMostafa MahmoudNo ratings yet

- CFO Controller VP Finance in Tulsa OK Resume Victoria DeBoefDocument2 pagesCFO Controller VP Finance in Tulsa OK Resume Victoria DeBoefVictoriaDeBoefNo ratings yet

- MPERS Article - A Comparative Analysis of PERS MPERS and MFRS FrameworksDocument59 pagesMPERS Article - A Comparative Analysis of PERS MPERS and MFRS FrameworksHaron BadrulNo ratings yet

- ResultsDocument16 pagesResultsURVASHINo ratings yet

- Bad Debts and Provision For Doubtful DebtsDocument13 pagesBad Debts and Provision For Doubtful DebtsbillNo ratings yet

- Internal Audit NC ReportDocument2 pagesInternal Audit NC ReportCQMS 5S DivisionNo ratings yet

- Chapter 9 Plant Assets, Natural Resources, and Intangible AssetsDocument65 pagesChapter 9 Plant Assets, Natural Resources, and Intangible Assetssaba gul rehmat100% (1)

- Akuntansi Keuangan 2: Pertemuan 1Document72 pagesAkuntansi Keuangan 2: Pertemuan 1Ananda SalsabilaNo ratings yet

- Exercise 7Document3 pagesExercise 7JM Delos SantosNo ratings yet

- Solution Manual For Mcgraw Hills Taxation of Individuals and Business Entities 2019 Edition 10th by SpilkerDocument34 pagesSolution Manual For Mcgraw Hills Taxation of Individuals and Business Entities 2019 Edition 10th by Spilkerlynneromerot0b58f100% (14)

- Nxcum Share Price) + (R X Price) N +R)Document4 pagesNxcum Share Price) + (R X Price) N +R)WinniferTeohNo ratings yet

- Accounting Equations PaDocument24 pagesAccounting Equations PaAisyah Ayu SaputriNo ratings yet

- Financial Forecasting Planning 1226943025978198 9Document20 pagesFinancial Forecasting Planning 1226943025978198 9Surya PratapNo ratings yet

- #01 Accounting ProcessDocument3 pages#01 Accounting ProcessZaaavnn VannnnnNo ratings yet

- Batik Malaysia Gallery Budgeted Income StatementDocument6 pagesBatik Malaysia Gallery Budgeted Income StatementkiwiweeNo ratings yet

- FR Global Assurance Ifrs Compared French Gaap Overview - Sept19Document87 pagesFR Global Assurance Ifrs Compared French Gaap Overview - Sept19Fauad NureddinNo ratings yet

- The Cotton Corporation of India LTD - 121202284133105Document20 pagesThe Cotton Corporation of India LTD - 121202284133105CAAniketGangwalNo ratings yet

- November 2021Document30 pagesNovember 2021Oni SegunNo ratings yet

- FI-CO Reports SAP Materials, Documents, TutorialsDocument5 pagesFI-CO Reports SAP Materials, Documents, Tutorialscasst346No ratings yet

- Notes Topic 3Document4 pagesNotes Topic 3Fatin Nur DiniNo ratings yet

- Problems 3 - Cash and Cash Equivalents PDFDocument17 pagesProblems 3 - Cash and Cash Equivalents PDFEliyah JhonsonNo ratings yet

- Test Bank For Advanced Accounting 12th Edition Fischer Tayler and Cheng 1305084853 9781305084858Document49 pagesTest Bank For Advanced Accounting 12th Edition Fischer Tayler and Cheng 1305084853 9781305084858jamesNo ratings yet

- Careers HRD 20240131 Posts of Bank Examiners On Contract eDocument1 pageCareers HRD 20240131 Posts of Bank Examiners On Contract emihirluck2441No ratings yet

- Development CostsDocument3 pagesDevelopment CostsAmanda EstherNo ratings yet

- 03 AddDocument13 pages03 AddHà My NguyễnNo ratings yet