Professional Documents

Culture Documents

Solution 14.7

Solution 14.7

Uploaded by

DRACCOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution 14.7

Solution 14.7

Uploaded by

DRACCCopyright:

Available Formats

QUESTION 14.

Suggested solution

(a)

GENERAL JOURNAL

Particulars Debit Credit

R R

Normal income tax expense – (P&L) 35 000

Income tax payable (Creditor - SARS) – (SFP) 35 000

(Provision for normal income tax expense for the current year.)

Profit and loss account– (P&L) 35 000

Normal income tax expense– (P&L) 35 000

(Closing journal entry)

Profit and loss account– (P&L) 65 000

Retained earnings– (SFP) 65 000

(Closing journal entry)

Preference dividend– (SFP) 7 000

Ordinary dividend– (SFP) 6 000

Dividends payable (Creditors) – (SFP) 13 000

(Provision for preference and ordinary dividends on date declared.)

Retained earnings– (SFP) 13 000

Preference dividend– (SFP) 7 000

Ordinary dividend– (SFP) 6 000

(Closing journal entries)

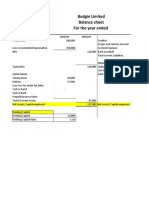

(b)

Retained earnings

Particulars Amount Particulars Amount

Preference dividend 7 000 Balance b/d 55 000

Ordinary dividend 6 000 Profit after tax 65 000

(Transferred from profit and loss

Balance c/f 107 000 account)

120 000 120 000

Balance b/d 107 000

Note:

The preference dividend will be declared before the ordinary dividend. Because the

preference shares are cumulative, the dividend will be calculated as follows:

20 000 x 10c x 3½ years (1 Jan 20x2 – 30 Jun 20x5) = R7 000

You might also like

- Packer and ScottDocument2 pagesPacker and ScottKiri chrisNo ratings yet

- Exercise 3 - Group Accounts - SolutionDocument5 pagesExercise 3 - Group Accounts - SolutionAnh TramNo ratings yet

- Assignment 1: AP1-5A CL SI CL NCA CA SI SCF SI SC CA NCLDocument10 pagesAssignment 1: AP1-5A CL SI CL NCA CA SI SCF SI SC CA NCLAsad MahmoodNo ratings yet

- Solution 14.4Document2 pagesSolution 14.4DRACCNo ratings yet

- MODULE 19 - Group Statements - Chapter 5 (Class Question 2 - SS)Document5 pagesMODULE 19 - Group Statements - Chapter 5 (Class Question 2 - SS)Zwivhuya MaimelaNo ratings yet

- Suggested Solutions To Group Discussion 11 March 2023Document7 pagesSuggested Solutions To Group Discussion 11 March 2023Akudzwe CharlesNo ratings yet

- Session 2 - Exempt Income and DeductionsDocument23 pagesSession 2 - Exempt Income and DeductionsLesediNo ratings yet

- Bab 7 - Kel 8Document13 pagesBab 7 - Kel 8betmenNo ratings yet

- Unit 12-Question 12-A Sol (2023)Document3 pagesUnit 12-Question 12-A Sol (2023)shirleygebenga020829No ratings yet

- Solution Tax667 - Jun 2016-1Document8 pagesSolution Tax667 - Jun 2016-1Zahiratul QamarinaNo ratings yet

- Solution 14.8Document1 pageSolution 14.8DRACCNo ratings yet

- Financial Accounting 2B Tutorials - 013048Document19 pagesFinancial Accounting 2B Tutorials - 013048Pinias ShefikaNo ratings yet

- Ratio Analysis For CADocument7 pagesRatio Analysis For CAShahid MahmudNo ratings yet

- Ratio Analysis - Advanced QuestionsDocument5 pagesRatio Analysis - Advanced Questionsrobinkapoor100% (2)

- Consolidation Q76Document4 pagesConsolidation Q76johny SahaNo ratings yet

- Individual Chargeable Income (Section 4a To 4d) Tax Computation FormatDocument1 pageIndividual Chargeable Income (Section 4a To 4d) Tax Computation FormatHaananth SubramaniamNo ratings yet

- Adobe Scan Jan 30, 2023Document6 pagesAdobe Scan Jan 30, 2023Karan RajakNo ratings yet

- Financial Reporting - IAS 28 - Associates NotesDocument9 pagesFinancial Reporting - IAS 28 - Associates Notesjaimeturpin12No ratings yet

- Gross Working CapitalDocument14 pagesGross Working Capitalfizza amjadNo ratings yet

- SOLUTION TO SCHEDULE 3gDocument4 pagesSOLUTION TO SCHEDULE 3gKrushna Omprakash MundadaNo ratings yet

- Lecture 2 - Chapter 14Document34 pagesLecture 2 - Chapter 14sknatey221No ratings yet

- South-Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manual 1Document36 pagesSouth-Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19th Edition Raabe Solutions Manual 1briancrosbyqfakzcndys100% (39)

- South Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19Th Edition Raabe Solutions Manual Full Chapter PDFDocument35 pagesSouth Western Federal Taxation 2016 Essentials of Taxation Individuals and Business Entities 19Th Edition Raabe Solutions Manual Full Chapter PDFfred.henderson352100% (18)

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Ratio Excercise 2Document1 pageRatio Excercise 2Marwan AqrabNo ratings yet

- T10 Ans 3Document2 pagesT10 Ans 3PUI TUNG CHONGNo ratings yet

- Sem6 RatioAnalysisLecture 6 JuhiJaiswal 19apr2020Document8 pagesSem6 RatioAnalysisLecture 6 JuhiJaiswal 19apr2020Hanabusa Kawaii IdouNo ratings yet

- South-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadDocument17 pagesSouth-Western Federal Taxation 2017 Essentials of Taxation Individuals and Business Entities 20th Edition Raabe Solutions Manual DownloadGregory Brown100% (21)

- Chapter 16 Advanced Accounting Solution ManualDocument94 pagesChapter 16 Advanced Accounting Solution ManualVanessa DozonNo ratings yet

- Al-Fadl 1 Limited Financial Statement For The Year End July 2023Document2 pagesAl-Fadl 1 Limited Financial Statement For The Year End July 2023SkymoonNo ratings yet

- HW On Statement of Changes in EquityDocument2 pagesHW On Statement of Changes in EquityCharles TuazonNo ratings yet

- MGAD65 Midterm Review Take-UpDocument4 pagesMGAD65 Midterm Review Take-Upavaxuan0329No ratings yet

- Abc FR264Document1 pageAbc FR264Krishna 11No ratings yet

- Topic 2 - Assets, Equities and LiabilitiesDocument29 pagesTopic 2 - Assets, Equities and Liabilitiesahmadamsyar083No ratings yet

- KZN 2020 June P1 Memo 2Document7 pagesKZN 2020 June P1 Memo 2shandren19No ratings yet

- Govacc Finals DrillsDocument8 pagesGovacc Finals DrillsVon Andrei Medina100% (1)

- Ilustrasi Cash Flow Pertemuan Ke 5 11-10-2022Document6 pagesIlustrasi Cash Flow Pertemuan Ke 5 11-10-2022nur sayNo ratings yet

- Chapter 16 Advanced Accounting Solution ManualDocument119 pagesChapter 16 Advanced Accounting Solution ManualAsuncion BarquerosNo ratings yet

- Accounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusDocument18 pagesAccounting IAS (Malaysia) Model Answers Series 2 2007 Old SyllabusAung Zaw HtweNo ratings yet

- Close LTDDocument5 pagesClose LTDXianFa WongNo ratings yet

- Sloved Questions Financial AnalysisDocument12 pagesSloved Questions Financial AnalysisMurad KhanNo ratings yet

- Financial Statement ExerciseDocument7 pagesFinancial Statement ExerciseĐạt PhạmNo ratings yet

- What Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Document12 pagesWhat Are The Advantages To A Business of Being Formed As A Company? What Are The Disadvantages?Nguyễn HoàngNo ratings yet

- CH - 04 SolutionDocument3 pagesCH - 04 SolutionSaifur R. SabbirNo ratings yet

- Cash Flow Tutorial - Muhammad Azizi Bin HairulanuarDocument1 pageCash Flow Tutorial - Muhammad Azizi Bin Hairulanuarwhynotnana1919No ratings yet

- Financial Management MidtermDocument4 pagesFinancial Management MidtermGrace Sinoy BastanteNo ratings yet

- Capital Reorganization QuestionsDocument20 pagesCapital Reorganization QuestionsProf. OBESENo ratings yet

- Cost and Equity MethodDocument11 pagesCost and Equity MethoddmangiginNo ratings yet

- AFM Assignment Question 4Document6 pagesAFM Assignment Question 4AyazNo ratings yet

- Solution Cash FlowDocument7 pagesSolution Cash FlowritamNo ratings yet

- Tutorial QuestionsDocument2 pagesTutorial QuestionsNishika KaranNo ratings yet

- Master Question (Foreign) SOFP SOCIDocument2 pagesMaster Question (Foreign) SOFP SOCIShaheryar ShahidNo ratings yet

- Ca Final SFM (New Scheme) Dawn 2022 - Equity ValuationDocument55 pagesCa Final SFM (New Scheme) Dawn 2022 - Equity Valuationanand kachwaNo ratings yet

- FR AS ScannerDocument144 pagesFR AS ScannerPooja GuptaNo ratings yet

- 13 Chapter 6.2 - LeverageDocument12 pages13 Chapter 6.2 - Leverageatishayjjj123No ratings yet

- Question 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Document6 pagesQuestion 7 - Financial-Reporting-Nov-2020 - Kingdom & Paradise-Question 1Laud ListowellNo ratings yet

- BusinessCombi (Chapter 6)Document5 pagesBusinessCombi (Chapter 6)richmond naragNo ratings yet

- Quiz 1 FIN 440 2Document2 pagesQuiz 1 FIN 440 2Anowarul IslamNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet