Professional Documents

Culture Documents

Financial Accounting and Reporting

Financial Accounting and Reporting

Uploaded by

Vipul 663Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Accounting and Reporting

Financial Accounting and Reporting

Uploaded by

Vipul 663Copyright:

Available Formats

Financial Accounting and

Reporting

Question -1

Public Company

A public company—also called a publicly traded company—is a corporation whose

shareholders have a claim to part of the company's assets and profits. Through the

free trade of shares of stock on stock exchanges or over-the-counter (OTC) markets,

ownership of a public company is distributed among general public shareholders.

Examples, Reliance, LIC, Tata Motors, Tata Chemicals

Private Company

A private company is a firm held under private ownership. Private companies may

issue stock and have shareholders, but their shares do not trade on public

exchanges and are not issued through an initial public offering (IPO).

Partnership/ Limited Liability Partnership

A partnership has two or more parties as co-owners, and each owner is a partner.

Individuals, corporations, partnerships, or other types of entities can be partners.

Income and loss of the partnership “flows through” to the partners and they

recognize it based on their agreed upon percentage interest in the business. In

general, a partnership is not a taxpaying entity. Instead, each partner takes a

proportionate share of the entity’s taxable income and pays tax according to that

partner’s individual or corporate rate.

A limited-liability partnership is one in which a wayward partner cannot create a large

liability for the other partners. In LLPs, each partner is liable for partnership debts

only up to the extent

of his or her investment in the partnership, plus his or her proportionate share of the

liabilities.

Each LLP, however, must have one general partner with unlimited liability for all

partnership

debts.

Financial Accounting and Reporting 1

Proprietorship/ One Person Company

A proprietorship has a single owner, called the proprietor. Proprietorships tend to be

small retail stores or individual providers of professional services—physicians,

attorneys, software programmers, or accountants. Legally, the business is the

proprietor, and the proprietor is personally liable for all the business’s debts.

Question -2

Question -3

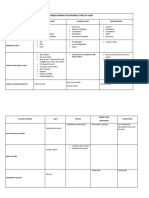

Managerial

Basis Financial Accounting Cost Accounting

Accounting

Record Transections Ascertainment, To assist the

& determine financial Allocation, management in

Objects

position & Profit and Accumulation and decision making and

Loss accounting for cost. policy formulation

Concerned with both Deals with projection

Concerned with

Nature past and present of data for the further

historical data

records. use

Certain Principle

No set principle are

Principle Followed Governed by GAAP followed for recording

followed in it.

cost.

Uses both qualitative

Qualitative aspect Only qualitative

Data Used and quantitative

are not recorded. aspect are recorded.

aspects.

Examples

Financial Accounting is used for Creditors, Shareholders, Tax Authorities and other

external purposes, like Balance sheet, Profit and loss statement, Cash Flow

statement while Management and cost accounting used for managerial decision

making, Managerial Performance and Planning Evolutions.

Question - 4

Financial Accounting and Reporting 2

Modern economies rely on cross-border transactions and the free flow of

international capital. More than a third of all financial transactions occur across

borders, and that number is expected to grow.

Investors seek diversification and investment opportunities across the world, while

companies raise capital, undertake transactions or have international operations and

subsidiaries in multiple countries.

In the past, such cross-border activities were complicated by different countries

maintaining their own sets of national accounting standards. This patchwork of

accounting requirements often added cost, complexity and ultimately risk both to

companies preparing financial statements and investors and others using those

financial statements to make economic decisions.

Applying national accounting standards meant amounts reported in financial

statements might be calculated on a different basis. Unpicking this complexity

involved studying the minutiae of national accounting standards, because even a

small difference in requirements could have a major impact on a company’s reported

financial performance and financial position—for example, a company may

recognize profits under one set of national accounting standards and losses under

another.

Benefits

IFRS Accounting Standards bring transparency by enhancing the international

comparability and quality of financial information, enabling investors and other

market participants to make informed economic decisions.

IFRS Accounting Standards strengthen accountability by reducing the information

gap between the providers of capital and the people to whom they have entrusted

their money. Our Standards provide information that is needed to hold management

to account. As a source of globally comparable information, IFRS Accounting

Standards are also of vital importance to regulators around the world.

And IFRS Accounting Standards contribute to economic efficiency by helping

investors to identify opportunities and risks across the world, thus improving capital

allocation. For businesses, the use of a single, trusted accounting language lowers

the cost of capital and reduces international reporting costs.

Example

For example, If company wants to publish its balance sheet, Profit and loss

statement, etc. to the public and if there is in particular nation standards then

Financial Accounting and Reporting 3

sometimes it can book profit in one country while in other it can be loss. To remove

this type of complications IFRS can help to standardize its accounting statements.

Question - 5

Inventory is a tangible resource that is hold for resale in normal course of operation.

Inventory intended for resale. A car which is Mfg. by company is the inventory for

them, while the person who purchases is asset for him. So the inventory is intended

to sale is the current asset because it is going to sell after sometime.

Current Asset

The current assets meaning is easy to define. These are resources that you can turn

into cash or cash equivalents. It should proceed within a short period of time. In this

way, the current assets support paying the ongoing costs of companies immediately.

For Example,

Cash

Inventory

Prepaid Expenses

Accounts Receivables

Non- Current Asset

Non-current assets, also famous as long-term investments, are the next resources

that the companies owe. A non-current asset is hard to liquidate in comparison to the

current assets.

For Example,

Property, Plant, Equipment

Land

Trademarks

Long Term investment

Question - 6

Financial Accounting and Reporting 4

Double entry system of book-keeping has emerged in the process of evolution of

various accounting techniques. It is the only scientific system of accounting.

According to it, every transaction has two-fold aspects–debit and credit and both the

aspects are to be recorded in the books of accounts.

Advantages of Double Entry System

1. By the use of this system the accuracy of the accounting work can be

established, through

the device of the trial balance.

2. The profit earned or loss suffered during a period can be ascertained together

with details.

3. The financial position of the firm or the institution concerned can be ascertained

at the end

of each period, through preparation of the balance sheet.

4. The system permits accounts to be kept in as much details as necessary and,

therefore affords

significant information for the purposes of control etc.

5. Result of one year may be compared with those of previous years and reasons

for the change

may be ascertained.

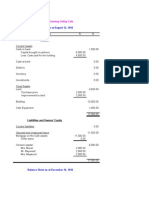

Example

Consider ABD company Transection basis of double entry system

Schedule No. Property Asset Equity Liability

Transfer of

50000Rs to ABS

1 50000 50000

bank account as

owners equity

Rent of a

2 (10000) (10000)

Building

Purchase of

3 (20000) (20000)

Product X

Loan from Bank

4 80000 80000

B

Financial Accounting and Reporting 5

Schedule No. Property Asset Equity Liability

Purchase of

5 Product X on 30000 30000

credit

Sale of Product

6 10000 10000

X

Rules of Debit and Credit

Inventory

Inventory is a tangible resource that is hold for resale in normal course of operation.

Financial Accounting and Reporting 6

Types Of Inventory

Perpetual Inventory System

Updates the inventory system each time inventory brought or sold.

Periodic Inventory System

Updates inventory system only at the end of accounting period.

Inventory Costing System

Specific Identification

First in First Out (FIFO)

Last in First Out (LIFO)

Weighted Average Method

Types Of Accounts

Financial Accounting and Reporting 7

Accrual Basis Accounting and Cash basis

Accounting

Accrual accounting records the impact of business transactions and events on an

entity’s assets and liabilities over the period in which they occur, even if the resulting

cash receipts or payments occur in a past or future period. For example, when a

business performs a service, makes a sale, or incurs an expense, the accountant

records the transaction even if it receives or pays no cash at the time of the

transaction.

Cash-basis accounting records only cash transactions—cash receipts and cash

payments. Cash receipts are treated as revenues, and cash payments are handled

as expenses. Profits are earned when cash receipts are greater than cash

payments, and similarly, losses are incurred when cash receipts are less than cash

payments.

To illustrate the difference between the two bases of accounting, consider the

following example. Richemont sells inventory produced at the cost of €500 to a

customer for €800 on account. The customer promises to pay in 60 days’ time.

Accrual accounting would recognize the €800 as income because making the sale

increases Richemont’s wealth and Richemont now has the right to some future

economic benefits (in the form of receivables, an asset). The eventual payment is

merely an exchange of one asset (receivable) for another (cash) and has no impact

on Richemont’s income. Cash accounting, on the other hand, will not record a sale

as there was no exchange of cash at the time of the sale. Only when cash is

received (60 days later) will cash basis accounting record the transaction.

The Matching Concept

The matching concept is used to explain the relationship between expenses and

revenues. The Conceptual Framework states that expenses are recognized in

the Income Statement on the basis of a direct association between the costs

incurred and the earning of specific items of income.

This process is commonly referred to as the “matching of costs with revenues.”

Unlike assets, expenses offer no future benefits to the company. Matching

includes two steps:

1. Identify decreases in assets or increases in liabilities that result in a reduction in

equity (excluding transactions with owners) during the period. These are

Financial Accounting and Reporting 8

expenses.

2. Measure these expenses, and subtract expenses from revenues to compute

profit or loss.

Financial Accounting and Reporting 9

You might also like

- Summary: Financial Intelligence: Review and Analysis of Berman and Knight's BookFrom EverandSummary: Financial Intelligence: Review and Analysis of Berman and Knight's BookNo ratings yet

- Test Bank For Financial Management Theory Practice 14th Edition by Eugene F Brigham Michael C Ehrhardt SampleDocument70 pagesTest Bank For Financial Management Theory Practice 14th Edition by Eugene F Brigham Michael C Ehrhardt SampleDiệp Phạm HồngNo ratings yet

- Basic Accounting Notes (Finale)Document33 pagesBasic Accounting Notes (Finale)Chreann Rachel100% (4)

- BAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryDocument111 pagesBAC 813 - Financial Accounting Premium Notes - Elab Notes LibraryWachirajaneNo ratings yet

- Audit Program - Fixed AssetsDocument11 pagesAudit Program - Fixed Assetshamza dosani100% (3)

- External Users: Not Directly Involved. These Are Secondary Users of Financial Information Who Are PartiesDocument8 pagesExternal Users: Not Directly Involved. These Are Secondary Users of Financial Information Who Are PartiesAizel AlindoyNo ratings yet

- Test & Interview MCQs Book For All Audit & Accounts JobsDocument95 pagesTest & Interview MCQs Book For All Audit & Accounts JobsNaeem0719No ratings yet

- CH 3Document44 pagesCH 3alfi100% (1)

- Equity Research Interview QuestionsDocument9 pagesEquity Research Interview QuestionsAnonymous mRv3JMB8LwNo ratings yet

- Smokey Valley CafeDocument3 pagesSmokey Valley CafeSreenath SukumaranNo ratings yet

- Acct-1 Chap-1-1Document11 pagesAcct-1 Chap-1-1Natnael GetahunNo ratings yet

- FoA I Chapter OneDocument11 pagesFoA I Chapter OneyeshiwasdagnewNo ratings yet

- 01.1 Introduction For AccountingDocument21 pages01.1 Introduction For AccountingSaneejNo ratings yet

- BBAW2103 Topic 1Document30 pagesBBAW2103 Topic 1MOHD SYUKRI BIN ABDUL WAHAB STUDENTNo ratings yet

- Bcom QbankDocument13 pagesBcom QbankIshaNo ratings yet

- Week 1 - Introduction To AccountingDocument34 pagesWeek 1 - Introduction To AccountingAidon StanleyNo ratings yet

- Financial AccountingDocument51 pagesFinancial AccountingScribdTranslationsNo ratings yet

- Notes - Unit-1Document13 pagesNotes - Unit-1happy lifeNo ratings yet

- Accounting:: Information For Decision MakingDocument29 pagesAccounting:: Information For Decision MakingKhursheed Ahmad KhanNo ratings yet

- CAPE Accounting Unit 1 Module 1 The Nature and Scope of AccountingDocument11 pagesCAPE Accounting Unit 1 Module 1 The Nature and Scope of AccountingRhea Lee Ross100% (1)

- 1.1 Nature and Purpose of AccountsDocument12 pages1.1 Nature and Purpose of AccountsJustin MarshallNo ratings yet

- Muh213U-Accounting I: Chapter 1: Accounting and Business EnvironmentDocument21 pagesMuh213U-Accounting I: Chapter 1: Accounting and Business EnvironmentÖmer Faruk AYDINNo ratings yet

- Basic ConceptsDocument5 pagesBasic ConceptsAgatha ApolinarioNo ratings yet

- 1.2 Financial and Management AccountingDocument55 pages1.2 Financial and Management Accountingteshome100% (2)

- Reviewer For CHAPTER 1 - Introduction To AccountingDocument5 pagesReviewer For CHAPTER 1 - Introduction To AccountingPatrick John AvilaNo ratings yet

- Week 1 - Introduction To AccountingDocument34 pagesWeek 1 - Introduction To AccountingAidon StanleyNo ratings yet

- Financial Accounting For Managers Unit 1 Mba Sem 1Document13 pagesFinancial Accounting For Managers Unit 1 Mba Sem 1Mohit TripathiNo ratings yet

- Accounting Concepts and PrinciplesDocument5 pagesAccounting Concepts and PrinciplesAlex EiyzNo ratings yet

- 1.1 IntroductionDocument11 pages1.1 IntroductionKISAKYE MOSESNo ratings yet

- Objectives of Financial ReportingDocument20 pagesObjectives of Financial ReportingchayNo ratings yet

- CH 01Document6 pagesCH 01Kanbiro OrkaidoNo ratings yet

- Accounting in ActionDocument31 pagesAccounting in ActionTasim IshraqueNo ratings yet

- Unit - I Meaning and Nature of Financial AccountingDocument26 pagesUnit - I Meaning and Nature of Financial Accountingaadi1988No ratings yet

- CHAPTER 1 and 2 Overview and Concepts in AccountingDocument15 pagesCHAPTER 1 and 2 Overview and Concepts in AccountingVin FajardoNo ratings yet

- Chapter 1 Intro To AccoutingDocument32 pagesChapter 1 Intro To Accoutingprincekelvin09No ratings yet

- Unit ThreeDocument5 pagesUnit ThreeTIZITAW MASRESHA100% (1)

- Ais P1Document55 pagesAis P1cali cdNo ratings yet

- Accounting As An Information SystemDocument14 pagesAccounting As An Information SystemAimee SagastumeNo ratings yet

- BAM 1 - Fundamentals of AccountingDocument33 pagesBAM 1 - Fundamentals of AccountingimheziiyyNo ratings yet

- Bản Sao CHAPTER 1-INTRODUCTION ACCOUNTINGDocument28 pagesBản Sao CHAPTER 1-INTRODUCTION ACCOUNTINGHảo HuỳnhNo ratings yet

- Accounting FOR ManagementDocument63 pagesAccounting FOR ManagementAnonymous 1ClGHbiT0JNo ratings yet

- Lecture Notes OnDocument36 pagesLecture Notes OnNaresh GuduruNo ratings yet

- Elements of Financial StatementDocument33 pagesElements of Financial StatementKertik Singh100% (1)

- The Nature and Scope of Financial AccountingDocument6 pagesThe Nature and Scope of Financial AccountingShannoyia D'Neila ClarkeNo ratings yet

- The Other Face of Managerial AccountingDocument20 pagesThe Other Face of Managerial AccountingModar AlzaiemNo ratings yet

- Solution Manual For Financial Accounting An Integrated Approach 5th Edition by TrotmanDocument21 pagesSolution Manual For Financial Accounting An Integrated Approach 5th Edition by Trotmana540142314No ratings yet

- Fundamental of Accounting: Chapter 1-2Document31 pagesFundamental of Accounting: Chapter 1-2Renshey Cordova MacasNo ratings yet

- Chapter 5 Principls and ConceptsDocument10 pagesChapter 5 Principls and ConceptsawlachewNo ratings yet

- Midterm Exam (Reviewer)Document84 pagesMidterm Exam (Reviewer)Mj PamintuanNo ratings yet

- Chapter One: Accounting Practice and PrinciplesDocument16 pagesChapter One: Accounting Practice and PrinciplesTesfamlak MulatuNo ratings yet

- Week 2 Questions AnswersDocument2 pagesWeek 2 Questions Answers啵啵贊贊No ratings yet

- Meaning of AccountingDocument50 pagesMeaning of AccountingAyushi KhareNo ratings yet

- AA015 Topic 2 2023 - 2024Document73 pagesAA015 Topic 2 2023 - 2024m8fk6bmndxNo ratings yet

- Accounting For Managers: Module - 1Document31 pagesAccounting For Managers: Module - 1Madhu RakshaNo ratings yet

- Conceptual FoundationDocument20 pagesConceptual FoundationSuman Samal MagarNo ratings yet

- Chapter 1 (1) NowteyDocument8 pagesChapter 1 (1) NowteyAkkamaNo ratings yet

- Cost and Management Accounting I Chapter I: Fundamentals of Cost AccountingDocument19 pagesCost and Management Accounting I Chapter I: Fundamentals of Cost AccountingFear Part 2No ratings yet

- 489 - Assignment 01 Front Sheet - Fall2020Document11 pages489 - Assignment 01 Front Sheet - Fall2020Bảo NhưNo ratings yet

- B203B-Week 4 - (Accounting-1)Document11 pagesB203B-Week 4 - (Accounting-1)ahmed helmyNo ratings yet

- Module 1: Introduction (5 Hours) : Financial Reporting, Statements and AnalysisDocument21 pagesModule 1: Introduction (5 Hours) : Financial Reporting, Statements and Analysisshahid sjNo ratings yet

- FOA - UNIT II - Introduction To Accounting-1Document8 pagesFOA - UNIT II - Introduction To Accounting-1SALENE WHYTENo ratings yet

- Financial Accounting For Bhu B.com Entrance TestDocument55 pagesFinancial Accounting For Bhu B.com Entrance TestfiscusNo ratings yet

- Chapter 1Document4 pagesChapter 1Aklil TeganewNo ratings yet

- Essentials of Financial Accounting - 1st SEMDocument10 pagesEssentials of Financial Accounting - 1st SEMParichay PalNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Mbination 0 Consolidated FSDocument28 pagesMbination 0 Consolidated FSShe Rae Palma100% (2)

- Interim AcquisitionsDocument13 pagesInterim AcquisitionsValerie Verity MarondedzeNo ratings yet

- Exam (3) ASDocument6 pagesExam (3) ASUsama AslamNo ratings yet

- FIN 310 - Chapter 2 Questions - AnswersDocument7 pagesFIN 310 - Chapter 2 Questions - AnswersKelby BahrNo ratings yet

- Week 4Document4 pagesWeek 4Mariadelaida Uribe De PlazaNo ratings yet

- DIFERENSIAL SederhanaDocument57 pagesDIFERENSIAL SederhanaLagaSuksesUasbn100% (1)

- Managerial Accounting - Chapter 3 - Job Order CostingDocument30 pagesManagerial Accounting - Chapter 3 - Job Order Costingfarhan izharuddinNo ratings yet

- Financial Statement - Contoh Soal - 311221Document126 pagesFinancial Statement - Contoh Soal - 311221Rophinta ViolytaNo ratings yet

- AC551 Midterm November 2013Document10 pagesAC551 Midterm November 2013Natasha DeclanNo ratings yet

- Comparison Among The Different Types of AuditDocument2 pagesComparison Among The Different Types of AuditNicole RochaNo ratings yet

- Wey IFRS 5e SM Ch13 CustomDocument54 pagesWey IFRS 5e SM Ch13 Customa0989889530No ratings yet

- Week 6 Module 5 Analysis and Interpretation of Financial StatementsDocument31 pagesWeek 6 Module 5 Analysis and Interpretation of Financial StatementsZed Mercy86% (14)

- AFAR FPB With AnswerDocument20 pagesAFAR FPB With AnswerJana Trina LibatiqueNo ratings yet

- UNI 20171127080809034827 1175449 uniROC PrepaidDocument6 pagesUNI 20171127080809034827 1175449 uniROC PrepaidSiew Meng WongNo ratings yet

- Buenaflor Quiz1Document5 pagesBuenaflor Quiz1Bhea Irish Joy BuenaflorNo ratings yet

- Introduction To Course and To Accrual AccountingDocument39 pagesIntroduction To Course and To Accrual AccountingKevin IleNo ratings yet

- Assignment 6 SolutionsDocument4 pagesAssignment 6 SolutionsjoanNo ratings yet

- Banamex 2015Document144 pagesBanamex 2015Arpita KapoorNo ratings yet

- Further Practice On Interim Test (Soln)Document4 pagesFurther Practice On Interim Test (Soln)Lê ĐạtNo ratings yet

- VCM NotesDocument4 pagesVCM NotesMendoza, Kristine Joyce M.No ratings yet

- Home and Branch Accounting General ProceduresDocument30 pagesHome and Branch Accounting General ProceduresCleah WaskinNo ratings yet

- HNI 2009 Summary Annual ReportDocument16 pagesHNI 2009 Summary Annual Reportnurul_azizah01No ratings yet

- HAC Intro To FInancial Management QuestionPaperDocument6 pagesHAC Intro To FInancial Management QuestionPaperfortune maviyaNo ratings yet

- Accounting 202Document8 pagesAccounting 202Gortex MeNo ratings yet

- Financial Accounting Notes 1&2Document62 pagesFinancial Accounting Notes 1&2bevinjNo ratings yet