Professional Documents

Culture Documents

TX 201

TX 201

Uploaded by

Pau SantosOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TX 201

TX 201

Uploaded by

Pau SantosCopyright:

Available Formats

TX-201 TAXATION OF INDIVIDUALS, TRUST AND ESTATES

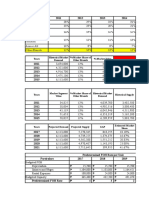

1. A husband and wife, resident citizens, with one (1) qualified dependent child, had the following income

and expenses for the year 2022. The husband waived the additional exemption in favor of his wife. The

husband waived the additional exemption in favor of his wife.

Salary of the husband, net of P50,000 withholding tax 450,000

Salary of the wife, gross of P60,00 withholding tax 600,000

Gross professional income, husband, gross of 15% withholding tax 1,500,000

Cost of services, husband 500,000

Expenses, practice of profession 300,000

Gross sales, wife 800,000

Cost of sales, wife’s business 300,000

Business expenses, wife 100,000

Gross rental income, lease of common property (Gross receipts, P1,000,000) 700,000

Expenses, leased common property 200,000

Gross business income, Singapore (gross sales, P800,000) 600,000

Business expenses, Singapore 150,000

Compute for the taxable income, income tax due, and income tax payable of the husband and the wife

using:

a) Itemized deductions.

b) Optional standard deductions.

c) 8% preferential income tax.

2. A is employed in XYZ Corporation, She receives the following for the current year:

Statutory minimum wage, inclusive of the 13th month pay 175,000

Overtime pay 40,000

Night-shift differential 25,000

Commission from the same employer 20,000

Gross income from trading business 300,000

Total 560,000

Compute for the following:

a) Exempt amount

b) Taxable income

3. Mr. CSO, works for G.O.D., Inc. He is not engaged in business nor has any other source of income other

than his employment. For 2022, Mr. SO earned a total taxable compensation income of P1,060,000.00.

How much is his income tax liability?

4. Ms. EBQ operates a convenience store while she offers bookkeeping services to her clients. In 2022, her

gross sales amounted to P800,000.00, in addition to her receipts from bookkeeping services of

P300,000.00. She already signified her intention to be taxed at 8% income tax rate in her 1st quarter

return. How much is the income tax liability for the year?

Taxation of Individuals, Trusts and Estates | Page 1 of 4

5. Ms. EBQ above, failed to signify her intention to be taxed at 8% income tax rate on gross sales in her 1st

Quarter Income Tax Return, and she incurred cost of sales and operating expenses amounting to

P600,000.00 and P200,000.00, respectively, or a total of P800,000.00. How much is the income tax due?

6. Ms. MRU operates a convenience store while she offers bookkeeping services to her clients. In 2022, her

gross sales amounted to P1,800,000.00, in addition to her gross receipts from bookkeeping services of

P400,000.00. Her recorded cost of goods sold and operating expenses were P1,325,000.00 and

P320,000.00, respectively.

Questions:

a) How much is Ms. MRU’s taxable income and income tax due if she opted to avail of the OSD?

b) How much is the business tax, if any?

c) Can she avail of the 8% option if she does not opt to use OSD?

d) How much is the business tax if she avails of the 8% option?

e) How much is her income tax liability if she signifies her intention to be taxed at 8%income tax

rate in her 1st Quarter return?

7. In 2022, Mr. MAG, a Financial Comptroller of JAB Company, earned annual compensation of

P1,500,000.00, inclusive of 13th month and other benefits in the amount of P120,000.00 but net of

mandatory contributions to SSS, HDMF, and PHIC. Aside from employment income, he owns a

convenience store, with gross sales of P2,400,000. His cost of sales and operating expenses are

P1,000,000.00 and P600,000.00, respectively, and with non-operating income of P100,000.00.

Questions:

a) How much is his tax due for 2022 if he opted to be taxed at eight percent(8%)income tax rate of

his gross sales for his income from business?

b) How much is his income tax due for 2022 if he did not opt for the eight percent (8%) income tax

based on gross sales/receipts and other non-operating income?

c) How much is the percentage tax 2022 if he did not opt for the eight percent (8%) income tax

based on gross sales/receipts and other non-operating income?

8. On December 1, 2022, Juanito Cruz created a trust for his son Alberto and appointed Danilo Paz as the

trustee. On December 26, 2022, another trust was created by Juanito for the benefit of the same son,

Alberto, single. Juancho Garcia was appointed as the trustee. The following data pertain to the two

trusts:

Danilo Juancho

Gross income 500,000 600,000

Expenses 100,000 300,000

Income distributed to Alberto, gross of 15% withholding tax 50,000 100,000

Compute the tax due from:

a) From each trust

b) The consolidated income

c) Each trust after share in the consolidated income tax

d) The beneficiary

9. Mr. Sixto Cruz IV, a rich businessman, established on December 2021 a trust for the benefit of his son

Sixto Cruz V, 18 years old, single. He transferred to the trust two (2) income producing properties with

the following gross rentals:

Taxation of Individuals, Trusts and Estates | Page 2 of 4

Vacant lot leased for P600,000 annually, gross of withholding tax

Office building with monthly rental income of P25,000, gross of withholding tax

The appointed trustee was Mr. Osmundo de la Cruz. During the year 2022, ordinary trust expenses

amounted to P350,000 and income distributed to the beneficiary amounted to P150,000. The beneficiary

has gross sales from his trading business amounting to P500,000 and business expenses totaling

P100,000.

Compute the taxable net income of the:

a) Trust using optional standard deductions

b) Beneficiary using itemized deductions

10. Mr. JMLH signified her intention to be taxed at 8% income tax rate on gross sales in her 1st Quarter

Income Tax Return. However, her gross sales during the taxable year has exceeded the VAT threshold.

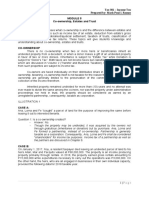

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

Total Sales 500,000 500,000 2,000,000 3,000,000*

Cost of Sales 300,000 300,000 1,200,000 1,200,000

Operating Expenses 120,000 120,000 480,000 720,000

*Assuming sales were earned equally throughout the quarter

Questions:

a) Compute the quarterly income tax payable and show the due date

b) Compute the income tax due when the final or adjusted return is filed and show the due date

c) Compute the percentage tax, if any.

d) Compute the VAT, if any.

11. Compute the withholding tax using the table on the next page.

a) An employee receiving daily compensation in the amount of P2,500, net of mandatory

contributions.

b) An employee receiving weekly compensation in the of P9,500, net of mandatory contributions.

c) An employee receiving semi-monthly compensation in the amount of P15,500, net of mandatory

contributions.

d) An employee receiving monthly compensation in the amount of P170,500, with supplemental

income of P5,000, net of mandatory contributions.

Taxation of Individuals, Trusts and Estates | Page 3 of 4

***

Taxation of Individuals, Trusts and Estates | Page 4 of 4

You might also like

- TAXDocument10 pagesTAXJeana Segumalian100% (3)

- Taxation First Preboard 93 - QuestionnaireDocument16 pagesTaxation First Preboard 93 - QuestionnaireAmeroden AbdullahNo ratings yet

- SW05Document7 pagesSW05Nadi HoodNo ratings yet

- Cash and Cash EquivalentsDocument9 pagesCash and Cash EquivalentsPau Santos76% (29)

- Fiji Income Tax Cases 2006-9Document123 pagesFiji Income Tax Cases 2006-9Sara Raj67% (3)

- Tax Summative 2Document14 pagesTax Summative 2Von Andrei MedinaNo ratings yet

- Tax On Individuals Quiz - ProblemsDocument3 pagesTax On Individuals Quiz - ProblemsJP Mirafuentes100% (1)

- Assignment No. 2: Part 1: Determination of Income Tax Due/PayableDocument4 pagesAssignment No. 2: Part 1: Determination of Income Tax Due/PayableKenneth Pimentel100% (1)

- Tax1 Q Chapter-11 12 13 With-AnswerDocument2 pagesTax1 Q Chapter-11 12 13 With-AnswerPrincess Edelyn CastorNo ratings yet

- Financial Distress Situation of Listed Malaysian Shipping CompaniesDocument14 pagesFinancial Distress Situation of Listed Malaysian Shipping CompaniesPau SantosNo ratings yet

- Bar Examination Questionnaire For Taxation LawDocument27 pagesBar Examination Questionnaire For Taxation LawMaris Angelica AyuyaoNo ratings yet

- Income Tax - Individuals With SolutionsDocument5 pagesIncome Tax - Individuals With SolutionsRandom VidsNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Income Tax Finals Sample Questions Final ExamDocument19 pagesIncome Tax Finals Sample Questions Final ExamAnie P. Martinez0% (1)

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- Prevalidation TaxDocument5 pagesPrevalidation TaxJon Dumagil Inocentes, CPANo ratings yet

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDocument5 pagesACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- SOL QUIZ RIT II and IIIDocument68 pagesSOL QUIZ RIT II and IIIouia iooNo ratings yet

- Deductions From Gross IncomeDocument10 pagesDeductions From Gross IncomewezaNo ratings yet

- Ea - TaxDocument8 pagesEa - TaxKc SevillaNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- IAET TaxationDocument2 pagesIAET TaxationRandy Manzano100% (1)

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDocument4 pages06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNo ratings yet

- Taxation 8-Preferential Taxation: Pre-TestDocument4 pagesTaxation 8-Preferential Taxation: Pre-TestCharles Decripito Flores100% (1)

- Partnership, Co-Ownership, JVDocument2 pagesPartnership, Co-Ownership, JVjanellemoralestNo ratings yet

- Statement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheDocument7 pagesStatement 2: Associations and Mutual Fund Companies, For Income Tax Purposes, Are Excluded in TheEdward Glenn Bagui0% (1)

- Income Taxation 1Document4 pagesIncome Taxation 1nicole bancoroNo ratings yet

- Quiz Week 2 No AnswerDocument10 pagesQuiz Week 2 No AnswerKatherine EderosasNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Required: Compute The Taxable Rental Income and Tax Liability AssumeDocument2 pagesRequired: Compute The Taxable Rental Income and Tax Liability AssumeTilahun GirmaNo ratings yet

- Template - QE - BLT For Incoming 4th YrDocument12 pagesTemplate - QE - BLT For Incoming 4th YrJykx SiaoNo ratings yet

- MASTERY TAXATION October-2019 PDFDocument12 pagesMASTERY TAXATION October-2019 PDFJuvelyn Gregorio100% (1)

- KF Eliminations For RMYCDocument8 pagesKF Eliminations For RMYCFranz Josef De GuzmanNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Intax-Activity 1Document1 pageIntax-Activity 1Venus PalmencoNo ratings yet

- Yellow - Not Sure, Green - CorrectDocument7 pagesYellow - Not Sure, Green - CorrectIsaiah John Domenic M. CantaneroNo ratings yet

- Basic Principles of TaxationDocument18 pagesBasic Principles of TaxationAlexandra Nicole IsaacNo ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- Tax On Corp. Sample ProblemsDocument2 pagesTax On Corp. Sample ProblemsWenjunNo ratings yet

- Review MaterialsDocument3 pagesReview MaterialsAngie S. Rosales100% (1)

- SW03Document11 pagesSW03Nadi HoodNo ratings yet

- PRe Departmental ReviwersDocument7 pagesPRe Departmental ReviwersCañon, Lorenz GeneNo ratings yet

- Individual Taxation Assignment 2 - 1868900521Document2 pagesIndividual Taxation Assignment 2 - 1868900521Jaylyn BacolonNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- 4.2 Assignment - Principles To Accounting Period and MethodsDocument7 pages4.2 Assignment - Principles To Accounting Period and MethodsRoselyn LumbaoNo ratings yet

- Tax 003Document5 pagesTax 003Kyrah Angelica DionglayNo ratings yet

- FUNDALES BTAX MidtermsDocument4 pagesFUNDALES BTAX MidtermsE. RobertNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- Synthesis - Problem Solving QuizDocument3 pagesSynthesis - Problem Solving QuizEren CuestaNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Problem Solving (3 Points Each) .: Father Saturnino Urios UniversityDocument3 pagesProblem Solving (3 Points Each) .: Father Saturnino Urios UniversityErykaNo ratings yet

- Tax 1 Bsais Quiz4 Theories W AnsDocument6 pagesTax 1 Bsais Quiz4 Theories W AnsCyrss BaldemosNo ratings yet

- BTAXREV Week 4 ACT185 Preferential Taxation 2Document16 pagesBTAXREV Week 4 ACT185 Preferential Taxation 2gatotkaNo ratings yet

- Straight Problems Income Tax Bsa2Document2 pagesStraight Problems Income Tax Bsa2dimpy dNo ratings yet

- Lecture NotesDocument4 pagesLecture NotesVinDiesel Balag-eyNo ratings yet

- Income Taxation - Class Standing - Docx-2Document1 pageIncome Taxation - Class Standing - Docx-2Shannon ElizaldeNo ratings yet

- 20th Regional Mid Year Convention Cup 6 Easy RoundDocument18 pages20th Regional Mid Year Convention Cup 6 Easy RoundSophia De GuzmanNo ratings yet

- Illustrative Examples - Accounting For Income TaxDocument3 pagesIllustrative Examples - Accounting For Income Taxr3rvpaudit.nfjpia2324supaccNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- TX 101Document7 pagesTX 101Pau SantosNo ratings yet

- Applied Auditing Audit of Receivables Problem 1: QuestionsDocument9 pagesApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNo ratings yet

- Data FeasibDocument13 pagesData FeasibPau SantosNo ratings yet

- Sample 1Document1 pageSample 1Pau SantosNo ratings yet

- Cpa Lawyer Emilio Aquino Is New Sec CommissionerDocument5 pagesCpa Lawyer Emilio Aquino Is New Sec CommissionerPau SantosNo ratings yet

- Cash and Cash EquivalentDocument5 pagesCash and Cash EquivalentPau SantosNo ratings yet

- Quantitative MethodsDocument19 pagesQuantitative MethodsSerena Van der WoodsenNo ratings yet

- Values, Attitudes & Job Satisfaction: Human Behavior in Organization MWF/3:00 PM - 4:00 PM/RM 244Document15 pagesValues, Attitudes & Job Satisfaction: Human Behavior in Organization MWF/3:00 PM - 4:00 PM/RM 244Pau SantosNo ratings yet

- Accounting Information SystemDocument23 pagesAccounting Information SystemPau SantosNo ratings yet

- At (3) - Auditor'S Responsibility: Employee Fraud. It Involves The Theft of AnDocument1 pageAt (3) - Auditor'S Responsibility: Employee Fraud. It Involves The Theft of AnPau SantosNo ratings yet

- The Professional StandardsDocument1 pageThe Professional StandardsPau SantosNo ratings yet

- Joint Reso PageantDocument3 pagesJoint Reso PageantPau SantosNo ratings yet

- Rust-Free in An Ease: Name of The CompanyDocument3 pagesRust-Free in An Ease: Name of The CompanyPau SantosNo ratings yet

- Constitution and by Laws JPIA 2015Document8 pagesConstitution and by Laws JPIA 2015Pau SantosNo ratings yet

- Joint Reso Basketball VolleyballDocument3 pagesJoint Reso Basketball VolleyballPau SantosNo ratings yet

- Valuing Continuous-Installment Options: Discussion Paper Series A: No. 2007-184Document23 pagesValuing Continuous-Installment Options: Discussion Paper Series A: No. 2007-184Pau SantosNo ratings yet

- 14th NCR JpialympicsDocument30 pages14th NCR JpialympicsPau SantosNo ratings yet

- Characteristics and Principles of Art: Santos, Pauline MDocument13 pagesCharacteristics and Principles of Art: Santos, Pauline MPau SantosNo ratings yet

- 14th NCR JpialympicsDocument30 pages14th NCR JpialympicsPau SantosNo ratings yet

- CBAA VolleyballDocument1 pageCBAA VolleyballPau SantosNo ratings yet

- NYCIntlProgramsAppForm - LastName, FirstNameDocument3 pagesNYCIntlProgramsAppForm - LastName, FirstNamePau SantosNo ratings yet

- College of Business Administration and Accountancy I. Company ProfileDocument8 pagesCollege of Business Administration and Accountancy I. Company ProfilePau SantosNo ratings yet

- Inventory ReviewerDocument7 pagesInventory ReviewerPau Santos100% (5)

- Angeline Marinas 8 Grade, St. AlbericDocument4 pagesAngeline Marinas 8 Grade, St. AlbericPau SantosNo ratings yet

- NITAFAN V COMMISIONER OF INTERNAL REVENUE - LegMeth CCDocument2 pagesNITAFAN V COMMISIONER OF INTERNAL REVENUE - LegMeth CCPaul BelosoNo ratings yet

- Accord Tax Ruling Entre Abbott Laboratories Et Le Luxembourg - 2009Document78 pagesAccord Tax Ruling Entre Abbott Laboratories Et Le Luxembourg - 2009JulieMangematinNo ratings yet

- Personal Bar Exam Preparation OutlineDocument9 pagesPersonal Bar Exam Preparation OutlineRholen LumanlanNo ratings yet

- Account Research WorkDocument55 pagesAccount Research WorkJayeoba Roseline OlawanleNo ratings yet

- ITAD BIR RULING NO. 026-18, March 5, 2018Document10 pagesITAD BIR RULING NO. 026-18, March 5, 2018Kriszan ManiponNo ratings yet

- Summary of PMK 66-2023Document3 pagesSummary of PMK 66-2023ana fithratunnisaNo ratings yet

- Jay Mariz C. Ramirez Juan Dela Cruz: 1. Exempt de Minimis Benefits: P124,500Document3 pagesJay Mariz C. Ramirez Juan Dela Cruz: 1. Exempt de Minimis Benefits: P124,500Jay Mariz C. RamirezNo ratings yet

- CH 2Document71 pagesCH 2Adilene AcostaNo ratings yet

- Income Tax Calculator - FY 2011-12 (FINAL)Document16 pagesIncome Tax Calculator - FY 2011-12 (FINAL)hamzabashamNo ratings yet

- CIR Vs Baier-NickelDocument4 pagesCIR Vs Baier-NickelJohnde MartinezNo ratings yet

- (2023) 147 Taxmann - Com 449 (Nagpur - Trib.) (07-10-2022) Krushi Vibhag Karmchari Vrund Sahakari Pat Sanstha Maryadit vs. Income-Tax OfficerDocument6 pages(2023) 147 Taxmann - Com 449 (Nagpur - Trib.) (07-10-2022) Krushi Vibhag Karmchari Vrund Sahakari Pat Sanstha Maryadit vs. Income-Tax OfficerJai ModiNo ratings yet

- Gross Income & DeductionsDocument10 pagesGross Income & DeductionscathyydumpNo ratings yet

- House Bill 2526Document17 pagesHouse Bill 2526Kristofer PlonaNo ratings yet

- Module 5 Co Ownership Estates and TrustsDocument10 pagesModule 5 Co Ownership Estates and TrustsChryshelle Anne Marie LontokNo ratings yet

- 00, Chah Tali Wala Mouza Nagni Post Office Jhambhi Wahin, Basti Nagni, Lodhran Kahror Pakka Shahid IqbalDocument3 pages00, Chah Tali Wala Mouza Nagni Post Office Jhambhi Wahin, Basti Nagni, Lodhran Kahror Pakka Shahid IqbalBahawalpur 24/7No ratings yet

- CSM 157 PROGRAMMING-Week6 2Document13 pagesCSM 157 PROGRAMMING-Week6 2Michelle AnorchieNo ratings yet

- True or FalseDocument4 pagesTrue or FalseRhona Basong100% (1)

- Tax Reforms in Pakistan Historic and Critical ViewDocument299 pagesTax Reforms in Pakistan Historic and Critical ViewJąhąnząib Khąn KąkąrNo ratings yet

- Sutlej Cotton Mills Ltd. v. CITDocument18 pagesSutlej Cotton Mills Ltd. v. CITSaksham ShrivastavNo ratings yet

- Bir Ruling No. Ot-007-202Document4 pagesBir Ruling No. Ot-007-202Ren Mar CruzNo ratings yet

- TAX (2017) Bar QDocument6 pagesTAX (2017) Bar Qkhan lebronNo ratings yet

- Taxation Law NotesDocument15 pagesTaxation Law NotesKuracha LoftNo ratings yet

- Sjahss 96 240-249Document10 pagesSjahss 96 240-249Mahamood FaisalNo ratings yet

- Question Paper Code: X10841Document4 pagesQuestion Paper Code: X10841Emma WatsonNo ratings yet

- Duty Tax 04Document23 pagesDuty Tax 04hassan arshadNo ratings yet

- 05 Bir - SMRDocument1 page05 Bir - SMRMelany Trazo Calvez-EvangelistaNo ratings yet

- TaxationDocument82 pagesTaxationRiah M. De ChavezNo ratings yet

- How To Save Income Tax On Income From Salary For IndividualsDocument12 pagesHow To Save Income Tax On Income From Salary For IndividualsIndiranNo ratings yet